Market Overview

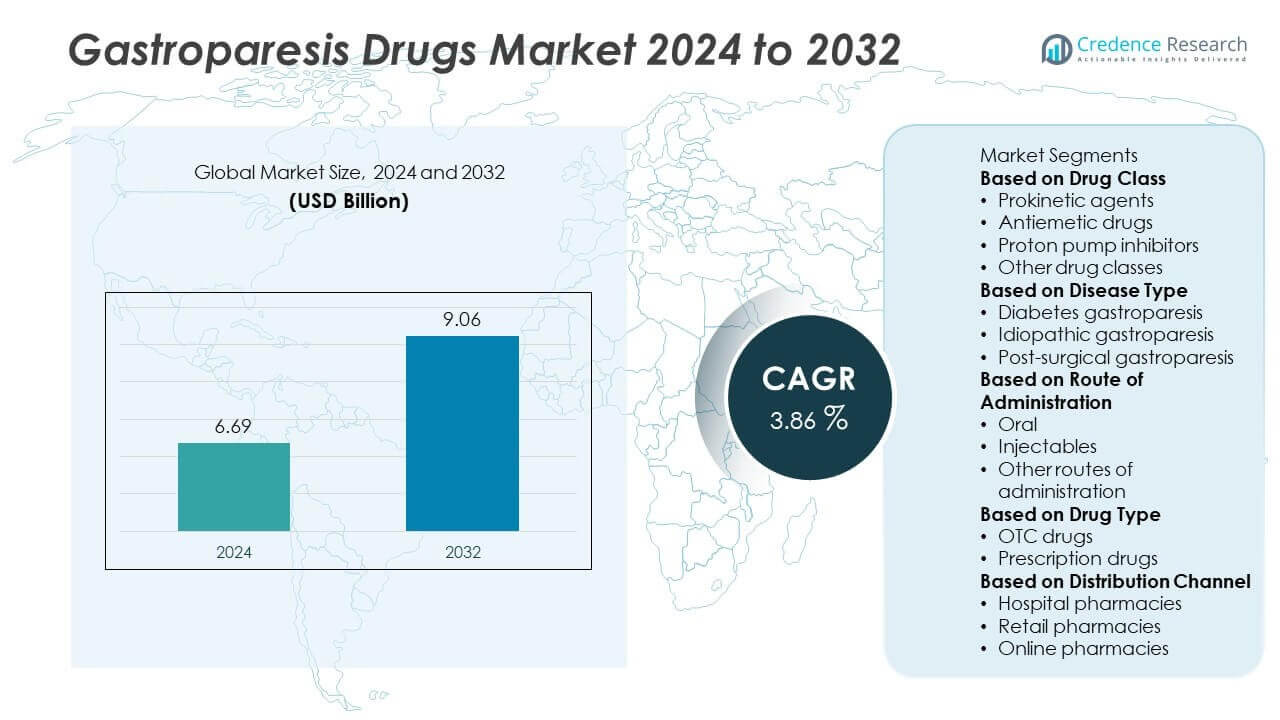

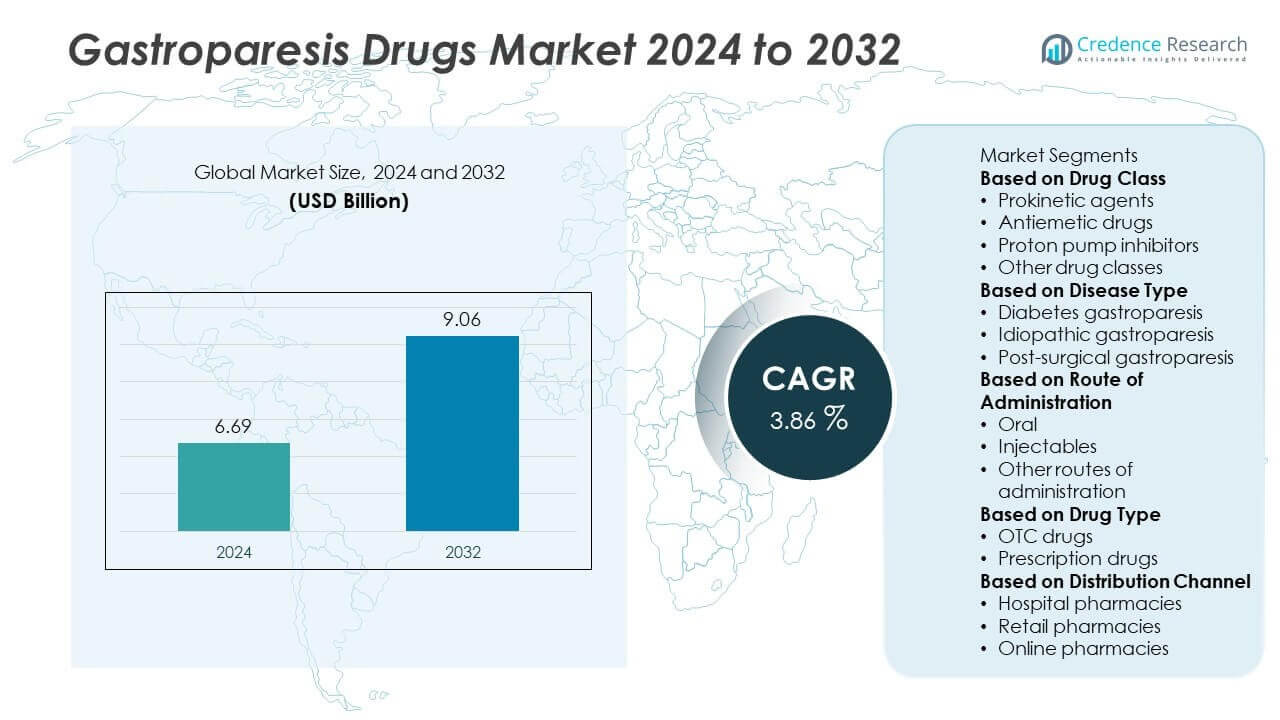

The global Gastroparesis Drugs Market was valued at USD 6.69 billion in 2024 and is projected to reach USD 9.06 billion by 2032, growing at a CAGR of 3.86% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gastroparesis Drugs Market Size 2024 |

USD 6.69 Billion |

| Gastroparesis Drugs Market, CAGR |

3.86% |

| Gastroparesis Drugs Market Size 2032 |

USD 9.06 Billion |

Gastroparesis Drugs Market grows with rising prevalence of diabetes, idiopathic cases, and postsurgical complications driving treatment demand. Improved awareness and diagnostic capabilities increase early detection and expand the treated patient pool. Pharmaceutical companies invest in developing safer prokinetics, motilin agonists, and combination therapies to improve outcomes.

Geographically, the Gastroparesis Drugs Market demonstrates strong growth across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads with advanced healthcare infrastructure, high diagnosis rates, and strong adoption of prokinetic and antiemetic therapies. Europe follows with well-established treatment protocols and increasing focus on diabetic gastroparesis management. Asia-Pacific shows the fastest growth, supported by rising diabetes prevalence, improving healthcare access, and growing awareness of gastrointestinal disorders. Latin America and Middle East & Africa experience gradual growth driven by expanding pharmaceutical distribution and government programs addressing chronic disease care. Key players driving this market include Abbott Laboratories, AbbVie Inc., Pfizer Inc., Takeda Pharmaceutical Inc., and Evoke Pharma, focusing on developing novel drug classes, improved formulations, and targeted therapies that enhance efficacy, safety, and patient compliance while addressing unmet clinical needs in managing gastroparesis symptoms effectively.

Market Insights

- Gastroparesis Drugs Market was valued at USD 6.69 billion in 2024 and is projected to reach USD 9.06 billion by 2032, growing at a CAGR of 3.86%.

- Rising prevalence of diabetes, idiopathic, and postsurgical gastroparesis drives strong demand for prokinetic and antiemetic drugs worldwide.

- Market trends highlight growing focus on motilin agonists, ghrelin-based therapies, sustained-release formulations, and patient-centric treatment approaches.

- Competitive landscape includes Abbott Laboratories, AbbVie Inc., Pfizer Inc., Takeda Pharmaceutical Inc., and Evoke Pharma investing in novel therapies and clinical trials to expand product portfolios.

- Limited availability of FDA-approved drugs and safety concerns related to long-term use of existing treatments act as restraints for market expansion.

- North America leads growth due to high diagnosis rates and strong healthcare infrastructure, while Europe benefits from robust chronic disease management programs.

- Asia-Pacific emerges as the fastest-growing region driven by large diabetic population, improving diagnostic access, and expansion of gastroenterology care facilities in China and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Prevalence of Gastroparesis and Related Disorders

Gastroparesis Drugs Market grows with increasing incidence of diabetes, which is a major cause of gastroparesis. Rising cases of idiopathic and postsurgical gastroparesis further expand patient population worldwide. Hospitals and clinics report growing diagnosis rates due to improved awareness and availability of advanced diagnostic tools. It strengthens demand for drug therapies that manage symptoms like nausea, vomiting, and delayed gastric emptying. Growth in the aging population also contributes to rising prevalence. This expanding patient base creates steady need for effective treatment options.

- For instance, Evoke Pharma’s GIMOTI® nasal spray has demonstrated significant reductions in emergency room visits and hospitalizations compared to oral metoclopramide, as shown in real-world evidence. Specifically, a 2023 study found that GIMOTI patients had a 68% decrease in hospitalizations and a 60% reduction in emergency room visits when compared to those on oral metoclopramide over a six-month period.

Advancements in Drug Development and Novel Therapies

Gastroparesis Drugs Market benefits from ongoing research into prokinetic agents, motilin agonists, and antiemetic drugs. Pharmaceutical companies invest in developing next-generation molecules with improved safety profiles and efficacy. Clinical trials explore innovative formulations that target multiple symptoms and offer sustained relief. It encourages launch of new products that meet unmet clinical needs and improve quality of life for patients. Development of targeted therapies enhances treatment precision. Rising R&D activity supports long-term market growth potential.

- For instance, the procedure known as Gastric Per-Oral Endoscopic Myotomy (G-POEM) has demonstrated a pooled technical success rate of 98.6% and a pooled clinical success rate of 75% at 36 months post-procedure in patients with refractory gastroparesis. This data comes from a systematic review and meta-analysis published in 2023 that included 560 patients across five studies.

Growing Awareness and Diagnosis Rates Among Patients

Gastroparesis Drugs Market sees higher adoption due to education campaigns and improved physician training. Awareness programs by healthcare organizations promote early diagnosis and timely intervention. It leads to a larger treated patient pool and stronger demand for medications. Rising availability of diagnostic tests like gastric emptying studies improves detection rates. Patients actively seek treatment to manage chronic symptoms and improve daily functioning. These factors contribute to consistent demand for drug-based therapies.

Supportive Healthcare Infrastructure and Reimbursement Policies

Gastroparesis Drugs Market gains momentum from expanding healthcare access and favorable reimbursement frameworks. Government initiatives strengthen availability of treatments in developed and emerging regions. Insurance coverage for prokinetic and antiemetic drugs encourages adherence to therapy. It reduces financial burden on patients and promotes sustained drug utilization. Growth in specialty clinics and gastroenterology departments improves patient management. Strong distribution networks ensure timely drug availability, supporting overall market expansion.

Market Trends

Market Trends

Shift Toward Novel Prokinetic and Motilin Agonist Therapies

Gastroparesis Drugs Market shows a clear trend toward development of safer and more effective prokinetic agents. Traditional therapies like metoclopramide face limitations due to safety concerns and black box warnings. Pharmaceutical companies focus on motilin receptor agonists and ghrelin agonists that offer improved gastric motility with fewer side effects. It expands therapeutic options for patients with chronic and severe cases. The trend strengthens pipeline activity and boosts approvals of innovative molecules. Growing investment in clinical research supports steady advancement in treatment choices.

- For instance, Evoke Pharma’s GIMOTI® nasal spray provided statistically significant relief for upper abdominal pain and nausea in a subgroup of women with moderate-to-severe diabetic gastroparesis symptoms, with improvements starting as early as 1 week.

Rising Focus on Combination Therapies and Symptom-Specific Management

Gastroparesis Drugs Market increasingly explores combination drug regimens to address multiple symptoms simultaneously. Pairing prokinetics with antiemetics provides better relief for nausea, vomiting, and delayed gastric emptying. It improves patient compliance and treatment outcomes by reducing symptom recurrence. Demand grows for therapies that offer long-term control with minimal adverse reactions. Pharmaceutical companies develop sustained-release formulations to maintain therapeutic effect over extended periods. This approach supports more comprehensive management of gastroparesis.

- For instance, in a randomized, double-blind, placebo-controlled study, researchers evaluated a metoclopramide nasal spray formulation for women with diabetic gastroparesis. In this study, subjects with moderate-to-severe symptoms at baseline who received metoclopramide nasal spray for 28 days experienced a significant reduction in mean daily nausea and upper abdominal pain scores compared with those on placebo.

Increased Patient-Centric Drug Development and Personalized Treatment

Gastroparesis Drugs Market adopts patient-focused approaches to therapy design and dosing. Personalized medicine strategies consider disease severity, comorbidities, and patient tolerability. It drives innovation in flexible dosing options and targeted drug delivery systems. Companies invest in oral and injectable formulations that improve convenience and adherence. Patient-reported outcome measures guide clinical trial design to ensure better efficacy evaluation. This trend enhances treatment satisfaction and long-term therapy adherence.

Growing Research on Alternative and Non-Pharmacological Approaches

Gastroparesis Drugs Market sees parallel research in non-drug solutions like gastric electrical stimulation and dietary interventions. These approaches complement pharmacological therapy and expand treatment choices. It opens opportunities for drugs designed to work alongside device-based therapies. Nutritional support products and supplements gain interest for symptom relief and improved quality of life. Clinical trials study synergistic effects of combining drugs with lifestyle modifications. This trend broadens the treatment ecosystem and drives holistic management strategies.

Market Challenges Analysis

Limited Efficacy and Safety Concerns of Existing Therapies

Gastroparesis Drugs Market faces challenges due to limited efficacy of currently available drug options. Many patients experience partial relief or recurrence of symptoms despite ongoing therapy. Safety concerns surrounding widely used drugs like metoclopramide create restrictions on long-term use. It limits treatment choices for chronic cases and forces physicians to rotate therapies frequently. Lack of FDA-approved options beyond a few drug classes further constrains effective disease management. These gaps highlight the need for innovative treatments with improved safety and sustained efficacy.

High Development Costs and Regulatory Hurdles

Gastroparesis Drugs Market is impacted by high R&D investment requirements and stringent regulatory pathways. Clinical trials for novel therapies face challenges in recruiting patients and measuring consistent gastric motility outcomes. It leads to delays in approvals and raises development costs for manufacturers. Complex regulatory frameworks slow entry of new drugs into the market. Reimbursement challenges in some regions further limit patient access to advanced treatments. These factors collectively hinder faster innovation and widespread adoption of new therapies.

Market Opportunities

Rising Demand for Novel and Targeted Therapies

Gastroparesis Drugs Market holds strong opportunities with growing demand for safer and more effective treatment options. Pharmaceutical companies focus on developing novel prokinetics, motilin agonists, and ghrelin-based therapies to address unmet clinical needs. It creates room for next-generation drugs with improved tolerability and long-term efficacy. Advancements in drug delivery systems, including sustained-release and injectable formulations, further enhance patient convenience. Expanding research on targeted therapies allows precise treatment for severe and refractory cases. Strong pipeline activity positions the market for significant product launches over the next few years.

Increasing Awareness and Expansion in Emerging Markets

Gastroparesis Drugs Market benefits from rising awareness campaigns and improved diagnostic capabilities worldwide. Healthcare infrastructure in emerging economies strengthens access to gastroenterology services and drug therapies. It drives higher treatment rates and supports consistent demand growth. Government initiatives to expand insurance coverage and reimbursement programs improve patient affordability. Pharmaceutical companies explore partnerships and distribution networks to penetrate untapped regions. These factors create favorable conditions for market expansion and new revenue opportunities.

Market Segmentation Analysis:

By Drug Class

Gastroparesis Drugs Market is segmented into prokinetic agents, antiemetics, and others including antibiotics and neuromodulators. Prokinetic agents dominate due to their ability to enhance gastric motility and improve gastric emptying. Metoclopramide remains the most widely prescribed drug despite safety concerns, while newer motilin receptor agonists and ghrelin agonists are emerging as alternatives. Antiemetics hold significant demand as they help manage nausea and vomiting, two of the most common symptoms of gastroparesis. It supports better symptom relief and improves patient quality of life. The “others” segment includes erythromycin and neuromodulators used in combination therapies. Continuous R&D efforts are focused on developing safer and more effective options across all drug classes.

- For instance, a multicenter placebo-controlled trial found that metoclopramide significantly improved symptoms like nausea, vomiting, and fullness better than a placebo in 40 patients with diabetic gastroparesis after 3 weeks of treatment.

By Disease Type

Gastroparesis Drugs Market by disease type includes diabetic gastroparesis, idiopathic gastroparesis, and postsurgical gastroparesis. Diabetic gastroparesis holds the largest share due to rising global prevalence of diabetes and its strong association with delayed gastric emptying. Idiopathic gastroparesis represents a considerable segment as many cases have no identified underlying cause but still require long-term drug therapy. Postsurgical cases contribute to demand where nerve injury from surgery leads to persistent symptoms. It creates a consistent need for medications to manage chronic cases. Increasing diagnosis rates across all categories drive strong demand for drug therapy and expand the treatment pool.

- For instance, Takeda Pharmaceutical’s Phase 2b trial of trazpiroben (TAK-906) enrolled 242 patients with idiopathic or diabetic gastroparesis across multiple countries and tested 5 mg, 25 mg, and 50 mg doses twice daily over 12 weeks, generating one of the largest randomized datasets in this therapeutic area

By Route of Administration

Gastroparesis Drugs Market is segmented into oral, parenteral, and other routes. Oral drugs dominate due to ease of administration, patient convenience, and lower treatment cost. Parenteral formulations are preferred for severe cases where oral intake is not feasible or where rapid relief is required. It ensures effective symptom control in hospitalized patients or acute episodes. The demand for long-acting injectables and sustained-release formulations is growing to improve adherence. Pharmaceutical companies focus on developing flexible delivery formats to improve patient compliance. Rising innovation in drug delivery technologies supports steady growth in all routes of administration.

Segments:

Based on Drug Class

- Prokinetic agents

- Antiemetic drugs

- Proton pump inhibitors

- Other drug classes

Based on Disease Type

- Diabetes gastroparesis

- Idiopathic gastroparesis

- Post-surgical gastroparesis

Based on Route of Administration

- Oral

- Injectables

- Other routes of administration

Based on Drug Type

- OTC drugs

- Prescription drugs

Based on Distribution Channel

- Hospital pharmacies

- Retail pharmacies

- Online pharmacies

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 38% market share in the Gastroparesis Drugs Market, driven by high prevalence of diabetes and strong diagnosis rates. The United States leads with advanced healthcare infrastructure, availability of gastroenterology specialists, and widespread adoption of prokinetic and antiemetic drugs. Canada contributes with government-backed programs that improve access to treatment and support early diagnosis. It benefits from strong research activity and clinical trials focused on next-generation therapies. Rising awareness among patients and healthcare providers ensures higher treatment rates. Presence of major pharmaceutical companies and strong distribution networks further strengthens market growth in this region.

Europe

Europe holds 27% market share supported by well-established healthcare systems and increasing focus on chronic disease management. Germany, France, and the U.K. lead in adoption of approved drug therapies and novel treatment approaches. Rising prevalence of diabetic gastroparesis drives demand for long-term medication use. It gains momentum from growing geriatric population and better access to diagnostic facilities across major countries. The region also benefits from regulatory support for safe and effective drug launches. Ongoing research partnerships between pharmaceutical companies and academic institutions enhance availability of innovative treatment options.

Asia-Pacific

Asia-Pacific captures 24% market share and represents the fastest-growing regional market. China and India account for significant growth due to large diabetic populations and improving awareness of gastroparesis management. It benefits from expanding healthcare infrastructure, rising income levels, and better access to gastroenterology services. Governments in the region focus on improving diagnosis rates and providing affordable treatment options. Japan and South Korea lead in adoption of advanced drug formulations and clinical research activity. Pharmaceutical companies expand operations and establish partnerships to penetrate rural and semi-urban markets, driving future growth.

Latin America

Latin America represents 6% market share, supported by rising incidence of diabetes and improvements in healthcare access. Brazil dominates with increasing adoption of prokinetics and antiemetics in public and private healthcare systems. Mexico, Argentina, and Chile follow with rising investments in diagnostic capabilities and awareness campaigns. It benefits from expansion of pharmaceutical distribution channels and government programs addressing chronic disease management. Growing demand for affordable therapies creates opportunities for generic drug manufacturers to expand market presence.

Middle East & Africa

Middle East & Africa hold 5% market share with demand driven by growing prevalence of diabetes and lifestyle-related gastrointestinal disorders. Gulf countries such as Saudi Arabia and UAE invest in expanding specialized healthcare facilities and treatment access. South Africa contributes with efforts to improve chronic disease management and patient education. It sees gradual rise in diagnosis rates and adoption of drug therapy for symptom management. International pharmaceutical companies expand distribution networks to strengthen availability of medications across the region. Rising government focus on healthcare modernization supports steady market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Takeda Pharmaceutical, Inc.

- Cipla Ltd.

- Pfizer Inc.

- Evoke Pharma

- Teva Pharmaceutical Inc.

- Bayer AG

- Salix Pharmaceuticals

- Abbott Laboratories

- AbbVie Inc.

- AstraZeneca PLC

Competitive Analysis

Competitive landscape of the Gastroparesis Drugs Market features leading players such as Abbott Laboratories, AbbVie Inc., Pfizer Inc., Takeda Pharmaceutical Inc., AstraZeneca PLC, Bayer AG, Cipla Ltd., Evoke Pharma, Salix Pharmaceuticals, and Teva Pharmaceutical Inc. competing through innovation, drug pipeline expansion, and global market presence. These companies focus on developing novel prokinetics, motilin agonists, and ghrelin-based therapies with improved safety and efficacy profiles. They invest heavily in clinical research and regulatory approvals to address the limitations of current treatments and provide long-term solutions for gastroparesis management. Strategic collaborations with research institutes, licensing agreements, and partnerships strengthen product development capabilities and speed up commercialization. Companies are also working on sustained-release and patient-centric formulations to improve adherence and therapeutic outcomes. Continuous R&D efforts and expansion into emerging markets allow these players to capture untapped demand. Intense competition drives the industry toward safer, more effective, and targeted treatment options.

Recent Developments

- In August 2025, Teva Pharmaceutical Inc. attained FDA approval and launched the first generic version of Saxenda® (liraglutide injection)—a GLP-1 therapy for weight management.

- In August 2025, Evoke Pharma announced the listing of a new U.S. patent for GIMOTI® (metoclopramide) nasal spray in the FDA Orange Book and reported strong real-world results, including significant reductions in emergency room visits and hospitalizations for diabetic gastroparesis patients.

- In June 2025, Salix Pharmaceuticals was involved in ongoing legal defense and competitive pressure regarding its core GI drug, rifaximin (Xifaxan), with recent EPO Boards of Appeal revocations weakening patent protection for hepatic encephalopathy uses.

- In June 2024, Takeda Pharmaceutical granted Cipla Ltd. rights to commercialize vonoprazan (Voltapraz), a novel potassium-competitive acid blocker (PCAB), in India targeting gastrointestinal disorders.

Report Coverage

The research report offers an in-depth analysis based on Drug Class, Disease Type, Route of Administration, Drug Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for safer and more effective prokinetic therapies will continue to rise.

- Development of novel motilin and ghrelin agonists will expand treatment options.

- Combination therapies targeting multiple symptoms will gain wider adoption.

- Sustained-release and long-acting formulations will improve patient adherence.

- Personalized medicine approaches will shape treatment protocols for severe cases.

- Clinical research activity and regulatory approvals will strengthen product pipelines.

- Expansion into emerging markets will create new growth opportunities for drug makers.

- Digital health tools will support symptom tracking and improve disease management.

- Greater awareness campaigns will drive earlier diagnosis and treatment uptake.

- Competition will push companies to focus on safer profiles and superior efficacy.

Market Trends

Market Trends