Market Overview:

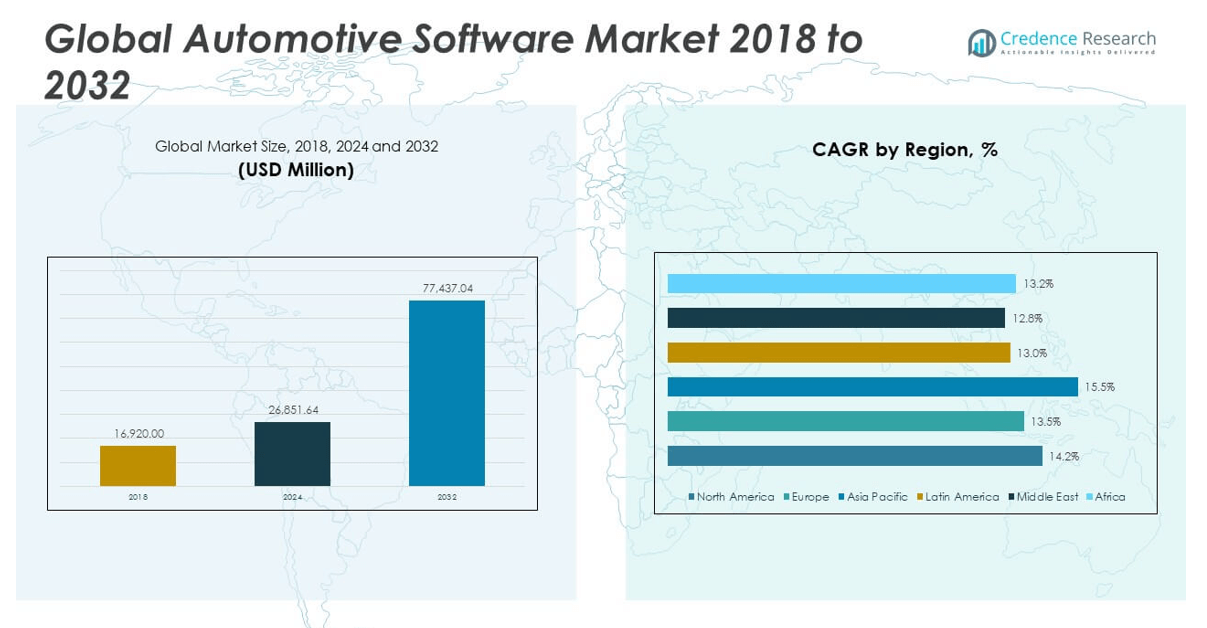

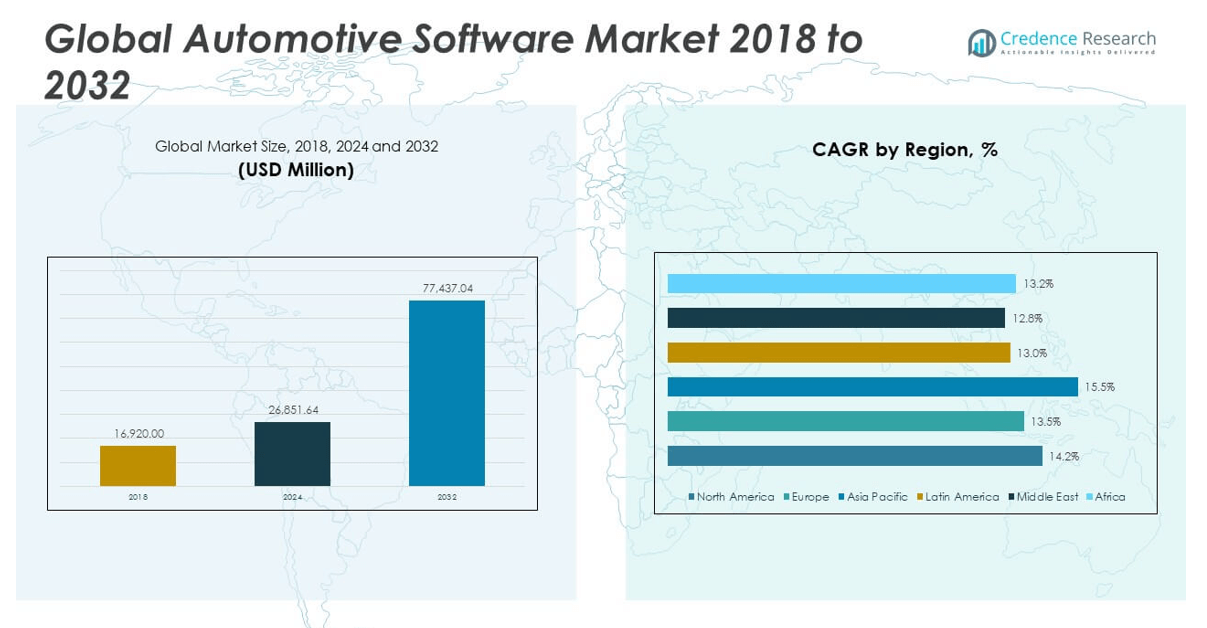

The Automotive Software Market size was valued at USD 16,920.00 million in 2018 to USD 26,851.64 million in 2024 and is anticipated to reach USD 77,437.04 million by 2032, at a CAGR of 14.21% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Software Market Size 2024 |

USD 26,851.64 million |

| Automotive Software Market, CAGR |

14.21% |

| Automotive Software Market Size 2032 |

USD 77,437.04 million |

The automotive software market is experiencing strong growth due to increasing demand for connected and autonomous vehicles. These vehicles rely on sophisticated software systems to support features such as advanced driver-assistance, real-time navigation, and vehicle-to-everything communication. Automakers are shifting toward software-defined vehicle architectures that enable over-the-air updates and enhance the user experience through customizable digital features. Regulatory mandates for safety, emissions, and cybersecurity compliance are further driving the need for reliable and secure software solutions. Additionally, the rising adoption of electric vehicles and the integration of artificial intelligence and machine learning into vehicle operations are prompting manufacturers to develop more advanced and adaptable software platforms. Automakers and Tier 1 suppliers are also investing in proprietary software ecosystems to generate recurring revenue through services, subscriptions, and data-driven functionalities.

North America plays a leading role in the automotive software market, supported by early adoption of advanced driver-assistance technologies, a well-established automotive sector, and regulatory frameworks that promote innovation and safety. Asia-Pacific is witnessing rapid growth, with countries like China, Japan, South Korea, and India investing heavily in automotive digitization, electrification, and embedded software capabilities. The region benefits from a strong manufacturing base and an expanding ecosystem of technology providers. Europe remains a key contributor to market development, with a strong focus on vehicle safety, environmental compliance, and in-vehicle connectivity. Major automotive-producing countries in the region are actively pursuing software-centric strategies to remain competitive in a shifting mobility landscape. South America is gradually advancing in automotive software adoption, driven by digital transformation and growing interest in electric and connected vehicles. In the Middle East and Africa, market development is at an early stage, but there is increasing attention on smart mobility infrastructure and connected vehicle technologies in select countries.

Market Insights:

- The Automotive Software Market is projected to grow from USD 26,851.64 million in 2024 to USD 77,437.04 million by 2032, registering a strong CAGR of 14.21%.

- Over-the-air (OTA) software updates are becoming a standard feature, helping automakers enhance post-sale service, reduce recalls, and deliver new functionalities without physical intervention.

- Automakers are investing in middleware and vehicle operating systems to manage increasing software complexity and ensure faster integration across electric, hybrid, and ICE platforms.

- Cloud-to-edge computing infrastructure is transforming how vehicles process and analyze data, enabling real-time services like traffic updates, predictive maintenance, and personalized infotainment.

- Human-machine interface innovation is reshaping digital cockpits, replacing analog controls with high-resolution displays, voice commands, and gesture recognition for enhanced user experience.

- A shortage of skilled software talent and inconsistent global standards are major challenges, slowing product development and complicating international deployments.

- North America leads market share, while Asia-Pacific shows the fastest growth due to strong investments in EVs and embedded software; Europe remains focused on regulatory compliance and safety.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Integration of Connected and Autonomous Vehicle Technologies

Automotive Software Market growth is being propelled by the rapid adoption of connected and autonomous vehicle technologies. Automakers are embedding sophisticated software systems into vehicles to support navigation, real-time diagnostics, telematics, and over-the-air updates. It enables seamless communication between vehicles, infrastructure, and cloud platforms, creating new functionality across driver assistance, infotainment, and predictive maintenance. Government initiatives encouraging safer and smarter transportation systems are reinforcing this transition. Consumers are demanding vehicles that offer advanced features such as adaptive cruise control, lane-keeping assistance, and self-parking capabilities. Automakers are responding by prioritizing software innovation over mechanical enhancements.

- For example, Tesla’s Full Self-Driving Beta is now processing over 1 billion miles of real-world driving data, enabling continuous improvement in autonomous performance.

Expansion of Software-Defined Vehicle Architectures and Digital Platforms

The shift from hardware-centric to software-defined vehicles is accelerating the demand for automotive software. Vehicles are increasingly built around centralized computing platforms where software determines functionality and performance. It supports continuous improvement through updates, customization of driving modes, and remote troubleshooting. OEMs are moving away from traditional ECU-heavy designs to scalable architectures that reduce complexity and improve efficiency. This transformation is enabling manufacturers to unlock new revenue streams through feature subscriptions and digital services. The Automotive Software Market is being shaped by this fundamental shift in vehicle development and lifecycle management.

Regulatory Mandates and Cybersecurity Requirements Strengthen Software Demand

Strict global regulations on safety, emissions, and cybersecurity are pushing automakers to implement robust and compliant software solutions. Standards such as ISO 26262 for functional safety and WP.29 for cybersecurity require advanced software integration across all vehicle systems. It ensures secure communication, fault detection, and data integrity throughout the vehicle’s operation. Governments are enforcing stricter emissions and safety norms, which demand intelligent software control over engine management, braking systems, and electronic stability programs. Regulatory compliance is no longer optional; it is a prerequisite for market entry in most regions. This regulatory environment is fueling investment in reliable, secure, and updatable automotive software systems.

- For example, the United Nations’ WP.29 regulation, effective in the EU, Japan, and South Korea since July 2022, mandates that all new vehicles implement a Cyber Security Management System (CSMS) and a Software Update Management System (SUMS), covering 69 distinct cyber threats and vulnerabilities

Strategic Investments and Technological Advancements by OEMs and Suppliers

Automakers and Tier 1 suppliers are making significant investments to build in-house software capabilities and form alliances with technology firms. They are developing proprietary platforms and operating systems that offer greater control over vehicle functionality and data. It helps reduce dependency on third-party vendors while improving speed to market. Emerging technologies such as artificial intelligence, machine learning, and real-time analytics are being integrated into vehicle systems to enhance performance and user experience. Companies are also forming joint ventures and acquiring software startups to gain specialized expertise. These strategic moves are fueling the expansion and sophistication of the Automotive Software Market.

Market Trends:

Emergence of In-Vehicle App Ecosystems Shaping Consumer Engagement

Automakers are developing in-vehicle app ecosystems that mirror the experience of smartphones and smart devices. These ecosystems offer navigation, music streaming, weather updates, parking services, and third-party applications through integrated platforms. It allows drivers and passengers to personalize their digital experience and access services on demand. Companies are opening their platforms to external developers to foster innovation and increase consumer engagement. This app-centric model is transforming vehicles into connected digital hubs with expandable features. The Automotive Software Market is evolving to support this ecosystem-driven approach, creating new avenues for service monetization and brand differentiation.

Growing Use of Digital Twins for Software Testing and Vehicle Simulation

Digital twin technology is gaining momentum in automotive design and software testing. By creating a real-time virtual replica of a vehicle or system, engineers can simulate driving conditions, diagnose faults, and validate software functions before deployment. It reduces time-to-market, lowers development costs, and improves system reliability. Automakers are using digital twins to optimize performance, assess updates, and manage vehicle lifecycle data. The Automotive Software Market is leveraging this trend to support agile development processes and continuous improvement strategies. It ensures higher software quality while minimizing risks associated with physical testing.

Expansion of Subscription-Based Software Features and Pay-Per-Use Models

Manufacturers are increasingly turning to subscription-based models to generate recurring revenue from software features. Heated seats, advanced navigation, parking assist, and acceleration boosts are now offered on a pay-per-use or monthly subscription basis. It enables flexibility for consumers while allowing automakers to monetize features that were once bundled at the time of purchase. This shift is altering traditional sales strategies and creating digital revenue streams that extend beyond vehicle delivery. The Automotive Software Market is being reshaped by this service-oriented mindset, encouraging OEMs to focus on feature scalability and backend software infrastructure. Companies are also integrating billing, user authentication, and service management tools into their platforms.

- BMW, for example, offers heated seats and advanced driver assistance features as monthly or yearly subscriptions, with pricing that can range from $18 to $30 per month for specific features.

Increasing Focus on Software Reusability and Modular Development Frameworks

To accelerate time-to-market and reduce engineering costs, automakers are adopting modular software development practices. Software reusability allows companies to deploy the same codebase across multiple vehicle platforms, variants, and generations. It improves efficiency, simplifies updates, and ensures compatibility across hardware configurations. Suppliers and OEMs are investing in toolchains and platforms that support modularity without compromising performance or compliance. The Automotive Software Market is adapting to this trend by supporting common development environments and standardized interfaces. It promotes long-term scalability and aligns with the industry’s push toward sustainable, agile engineering practices.

- For example, Platforms like AUTOSAR (AUTomotive Open System Architecture) provide standardized software layers, enabling code to be reused across different vehicle models and generations without extensive revalidation.

Market Challenges Analysis:

Increasing Software Complexity and Integration Burden Across Vehicle Systems

The rising complexity of vehicle electronics poses a significant challenge to software integration and lifecycle management. Automakers must coordinate numerous software modules—from powertrain control to infotainment—across multiple electronic control units and sensor networks. It requires extensive validation, standardization, and coordination among suppliers, which increases development time and costs. Ensuring seamless operation, real-time responsiveness, and safety compliance across distributed systems adds further strain to engineering teams. The Automotive Software Market must address these integration hurdles while maintaining scalability and reliability in increasingly software-defined vehicles. Failure to manage this complexity can lead to software bugs, update failures, and reduced consumer trust.

Shortage of Skilled Software Talent and Gaps in Industry-Standard Alignment

A critical shortage of automotive software engineers continues to slow innovation and project execution. Demand for expertise in embedded systems, cybersecurity, AI, and real-time operating systems far exceeds current industry capacity. It limits the ability of OEMs and Tier 1 suppliers to scale development or implement advanced features quickly. At the same time, misalignment across global safety, connectivity, and security standards complicates cross-border product deployment. Inconsistent frameworks create inefficiencies in development and hinder collaboration across supply chains. The Automotive Software Market faces mounting pressure to invest in talent development and harmonize compliance standards to sustain growth and product quality.

Market Opportunities:

Expansion of Electric Vehicles Unlocks New Software-Centric Revenue Streams

The growing adoption of electric vehicles presents significant opportunities for software innovation and monetization. EVs rely heavily on software for battery management, energy optimization, and powertrain control. It creates demand for intelligent algorithms that enhance range, performance, and charging efficiency. Automakers can offer subscription-based services, real-time diagnostics, and over-the-air feature upgrades tailored to EV users. The Automotive Software Market stands to benefit from this shift by delivering integrated platforms that support modular design and digital services. Companies investing in EV-specific software tools and platforms can capture long-term value across vehicle lifecycles.

Integration with Smart City Infrastructure and Mobility Ecosystems

The rising integration of vehicles with smart city infrastructure is opening new frontiers for data-driven software applications. Connected cars contribute to traffic management, emissions monitoring, and urban mobility planning through continuous data exchange with external systems. It enables advanced features such as adaptive routing, automated tolling, and dynamic parking solutions. The Automotive Software Market can leverage these developments to build scalable, cloud-connected solutions aligned with future mobility trends. Software providers that align with public and private urban mobility initiatives will gain a competitive edge. This convergence supports broader digital transformation across the transportation sector.

Market Segmentation Analysis:

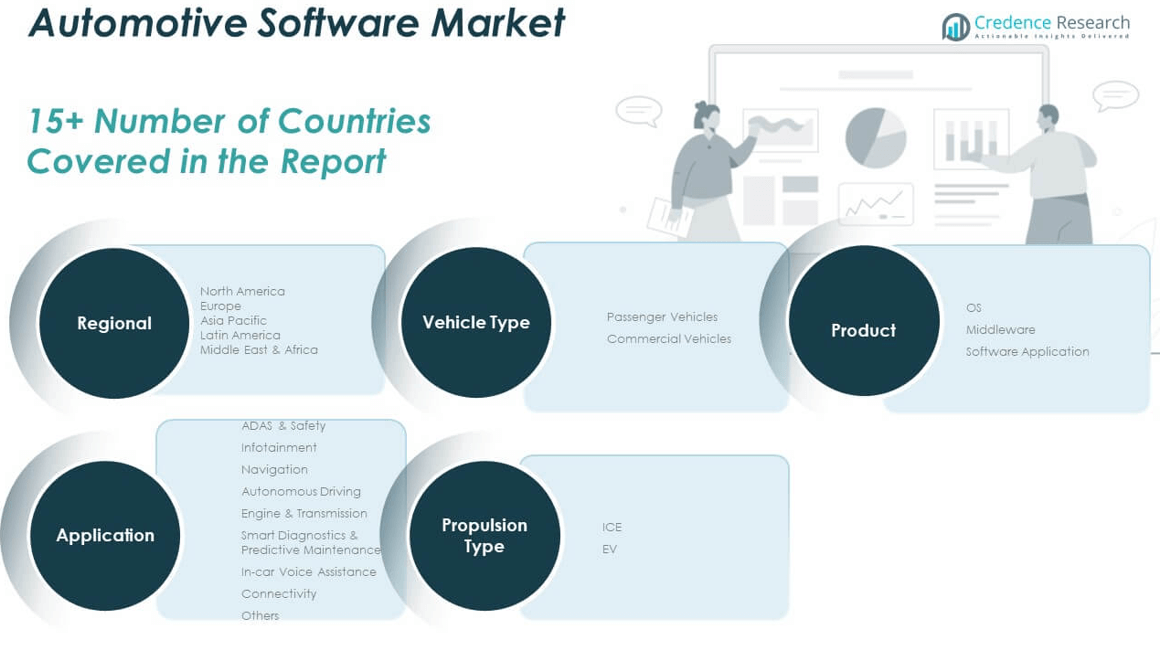

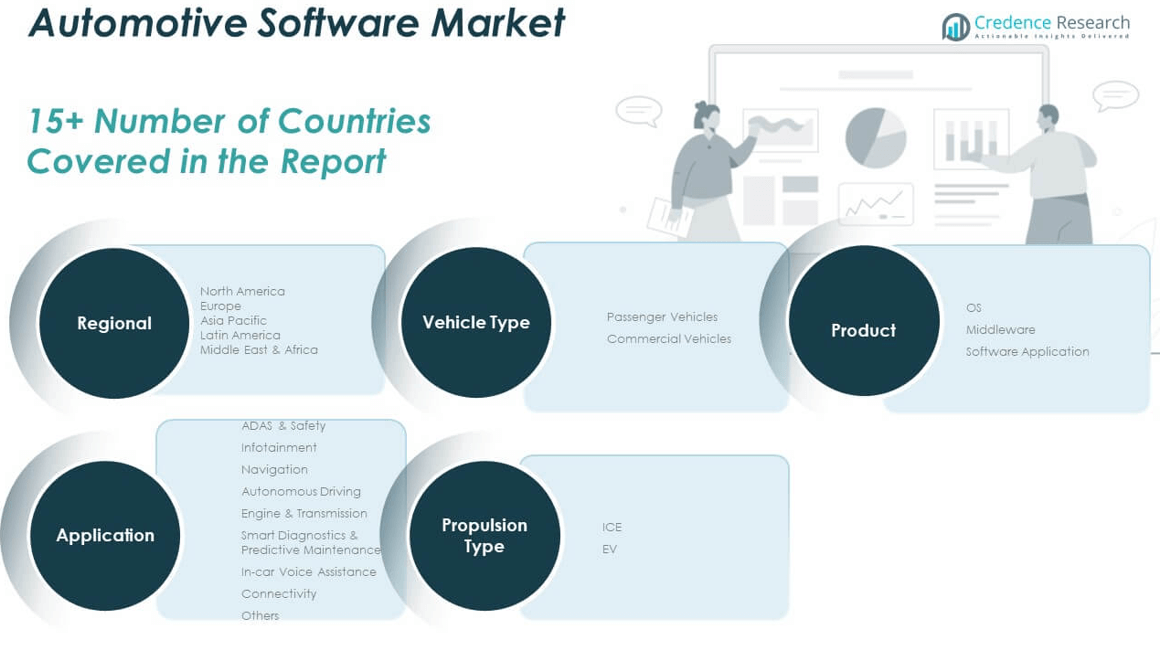

The Automotive Software Market is segmented by vehicle type, application, product, and propulsion type, reflecting its diverse technological landscape.

By vehicle type, passenger vehicles dominate due to rising consumer demand for infotainment, ADAS, and in-car connectivity. Commercial vehicles are gaining traction with growing integration of fleet management, predictive maintenance, and navigation software.

- The 2025 Cadillac Escalade exemplifies the integration of advanced infotainment and ADAS in passenger vehicles. Its 38-inch curved OLED display merges navigation, entertainment, and safety alerts, including augmented reality overlays for turn-by-turn directions.

By application, the market includes ADAS & safety, infotainment, navigation, autonomous driving, engine & transmission, smart diagnostics & predictive maintenance, in-car voice assistance, connectivity, and others. ADAS & safety lead in adoption due to regulatory mandates and increased focus on accident prevention. Infotainment and navigation systems remain central to the user experience, while autonomous driving and predictive diagnostics are rapidly emerging areas.

- For example, Hyundai’s ccNC (connected car Navigation Cockpit) system, featured in the 2025 Ioniq 5, integrates a 12.3-inch touchscreen and digital driver display. It provides seamless navigation, smartphone connectivity, and voice assistance, all updated via OTA software.

By product, the market is categorized into operating systems (OS), middleware, and software applications. Software applications hold the largest share due to their direct role in vehicle functionality and user interface. Middleware and OS segments are expanding with the rise of software-defined vehicle platforms.

By propulsion type, internal combustion engine (ICE) vehicles continue to demand traditional software systems, but electric vehicles (EVs) are accelerating growth. It requires advanced software for battery management, energy efficiency, and real-time system monitoring, reshaping the Automotive Software Market.

Segmentation:

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

By Application

- ADAS & Safety

- Infotainment

- Navigation

- Autonomous Driving

- Engine & Transmission

- Smart Diagnostics & Predictive Maintenance

- In-car Voice Assistance

- Connectivity

- Others

By Product

- OS (Operating Systems)

- Middleware

- Software Application

By Propulsion Type

- ICE (Internal Combustion Engine)

- EV (Electric Vehicles)

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Automotive Software Market size was valued at USD 6,395.76 million in 2018 to USD 10,031.61 million in 2024 and is anticipated to reach USD 28,836.78 million by 2032, at a CAGR of 14.2% during the forecast period. North America holds the largest share of the global market, accounting for 33% in 2024. The region leads due to early adoption of advanced technologies such as ADAS, autonomous driving systems, and over-the-air updates. It benefits from a strong presence of OEMs, tech giants, and Tier 1 suppliers actively investing in proprietary software platforms. Regulatory frameworks related to cybersecurity, emissions, and safety accelerate software innovation across vehicle systems. Rising consumer expectations for digitally integrated vehicles continue to drive demand for user-centric software solutions. The Automotive Software Market in North America remains a mature and competitive space, supported by strong R&D investments and established digital infrastructure.

Europe

The Europe Automotive Software Market size was valued at USD 4,859.42 million in 2018 to USD 7,437.17 million in 2024 and is anticipated to reach USD 20,362.28 million by 2032, at a CAGR of 13.5% during the forecast period. Europe captures a 25% share of the global market, driven by regulatory pressure and a strong automotive manufacturing base. Automakers across Germany, France, and the UK are prioritizing in-vehicle connectivity, functional safety, and software-defined vehicle platforms. It benefits from the region’s focus on environmental standards, requiring intelligent software control over emissions and energy efficiency. The enforcement of UNECE WP.29 and ISO 26262 continues to shape OEM software roadmaps. European companies are actively collaborating with semiconductor and software vendors to accelerate digital transformation. The Automotive Software Market in Europe is expanding through strategic alliances and innovation hubs focused on future mobility.

Asia Pacific

The Asia Pacific Automotive Software Market size was valued at USD 3,925.44 million in 2018 to USD 6,520.81 million in 2024 and is anticipated to reach USD 20,668.78 million by 2032, at a CAGR of 15.5% during the forecast period. Asia Pacific holds the highest growth rate and accounts for 22% of the global market share. Countries such as China, Japan, South Korea, and India are driving expansion through large-scale vehicle production, electrification, and tech-sector integration. It is emerging as a hub for embedded software development, EV platform innovation, and connected vehicle deployment. Government policies supporting electric mobility and digital infrastructure are reinforcing demand for advanced automotive software. Local OEMs are building in-house capabilities to reduce reliance on Western suppliers. The Automotive Software Market in Asia Pacific is well-positioned for rapid growth supported by regional tech ecosystems and evolving consumer expectations.

Latin America

The Latin America Automotive Software Market size was valued at USD 900.14 million in 2018 to USD 1,412.13 million in 2024 and is anticipated to reach USD 3,722.40 million by 2032, at a CAGR of 13.0% during the forecast period. Latin America represents 5% of the global market and is gradually evolving through digital upgrades in vehicle architecture. Brazil and Mexico lead regional demand, with growing adoption of infotainment systems, fleet management software, and emissions-compliant powertrain controls. It is experiencing increased investment from global automakers expanding their footprint in emerging economies. Economic recovery and regulatory modernization are encouraging OEMs to include digital features in their vehicle offerings. The Automotive Software Market in Latin America is gaining traction as consumer preferences shift toward connected and efficient mobility.

Middle East

The Middle East Automotive Software Market size was valued at USD 646.34 million in 2018 to USD 961.11 million in 2024 and is anticipated to reach USD 2,501.64 million by 2032, at a CAGR of 12.8% during the forecast period. The Middle East contributes a modest 3% to the global market but shows increasing potential in urban tech and mobility integration. Gulf nations are investing in smart city infrastructure and EV policies, which foster demand for telematics, navigation, and charging-related software. It is supported by rising consumer interest in digitally enhanced vehicles, particularly among the premium segment. Automotive players are collaborating with software providers to launch localized platforms tailored to climatic and regulatory conditions. The Automotive Software Market in the Middle East is expected to expand steadily as governments push for digital transformation in transport.

Africa

The Africa Automotive Software Market size was valued at USD 192.89 million in 2018 to USD 488.81 million in 2024 and is anticipated to reach USD 1,345.16 million by 2032, at a CAGR of 13.2% during the forecast period. Africa accounts for 2% of the global market and remains at an early stage of development. Countries such as South Africa, Nigeria, and Kenya are witnessing growing interest in digital vehicle diagnostics, fleet tracking, and mobility-as-a-service platforms. It faces infrastructure and affordability challenges but is gaining momentum through mobile-based solutions and public-private transport modernization efforts. OEMs and technology providers see long-term potential in offering scalable, cloud-based software solutions across urban centers. The Automotive Software Market in Africa is set to grow gradually as digital adoption and vehicle connectivity improve.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Amazon Web Services, Inc.

- Aptiv

- BlackBerry Limited

- Continental AG

- Cox Automotive

- Dassault Systèmes

- NVIDIA Corporation

- Robert Bosch GmbH

- Siemens

- Sonatus, Inc.

Competitive Analysis:

The Automotive Software Market is highly competitive, with key players focusing on innovation, strategic partnerships, and platform development to strengthen their market presence. Leading companies such as Bosch, Continental, Aptiv, NVIDIA, and Elektrobit are investing in advanced driver-assistance systems, autonomous driving platforms, and vehicle connectivity solutions. It is shaped by collaborations between automakers and technology firms aiming to accelerate the shift toward software-defined vehicles. Startups and niche providers are also gaining traction by offering specialized software for cybersecurity, fleet management, and AI-driven features. Companies are prioritizing scalable architectures, over-the-air update capabilities, and compliance with global safety standards to differentiate their offerings. The market is witnessing consolidation and joint ventures, especially in areas such as mobility-as-a-service, cloud-based platforms, and electric vehicle software ecosystems. The Automotive Software Market continues to evolve rapidly, driven by technological convergence, rising consumer expectations, and the demand for continuous innovation across the value chain.

Recent Developments:

- In May 2025, BlackBerry’s QNX division launched the QNX Hypervisor 8.0, a major advancement in embedded virtualization technology for automotive applications. This new hypervisor allows multiple operating systems, such as Android, Linux, and QNX, to run simultaneously on a single system-on-chip, enhancing the flexibility and scalability of automotive software platforms.

- In January 2025, Amazon Web Services announced a significant partnership with Valeo to accelerate the development of software-defined vehicles. This collaboration introduced three new cloud-based solutions Valeo Virtualized Hardware Lab, Valeo Cloud Hardware Lab, and Assist XR designed to streamline the development, testing, and validation of automotive software.

- In January 2025, Aptiv revealed its intention to separate its Electrical Distribution Systems (EDS) business, creating two independent companies to better address evolving customer needs and market opportunities. This move follows Aptiv’s acquisition of Wind River, a major software developer, for $4.3 billion in 2024.

- In September 2024, Continental AG announced a major expansion of its product portfolio, introducing new sensors and components for driver assistance systems, including multifunctional cameras and radar sensors. This expansion, set to roll out by mid-2025, supports the growing demand for advanced driver assistance and software-defined vehicle solutions.

Market Concentration & Characteristics:

The Automotive Software Market exhibits moderate to high concentration, with a mix of global technology giants and specialized automotive software firms dominating the competitive landscape. It is characterized by rapid innovation cycles, strong OEM-supplier integration, and increasing reliance on scalable, cloud-enabled platforms. The market favors companies with capabilities in real-time systems, functional safety, and secure connectivity. Barriers to entry remain significant due to stringent regulatory requirements, high R&D costs, and the need for long-term partnerships with automakers. It is evolving from fragmented software stacks toward unified platforms that support modularity and over-the-air updates. Customization, compliance, and continuous development define the operational model across the ecosystem. The Automotive Software Market demands strategic alignment between hardware and software stakeholders to ensure consistent performance, upgradeability, and user-centric design.

Report Coverage:

The research report offers an in-depth analysis based on vehicle type, application, product, and propulsion type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Automakers will prioritize proprietary software platforms to drive digital differentiation and long-term customer engagement.

- Subscription-based models for in-vehicle features will become a mainstream revenue channel across vehicle segments.

- Growth in electric and autonomous vehicles will increase demand for high-performance software integration and real-time analytics.

- Middleware and automotive operating systems will standardize development across models, improving efficiency and scalability.

- Cybersecurity solutions will see rising investment as regulatory frameworks tighten globally.

- Partnerships between OEMs and tech firms will intensify to accelerate the deployment of software-defined vehicle architectures.

- Edge computing and cloud synchronization will enhance vehicle responsiveness and support connected mobility services.

- Over-the-air update infrastructure will expand to cover critical systems beyond infotainment and navigation.

- AI and machine learning will enable advanced driver behavior monitoring, predictive diagnostics, and personalization.

- Emerging markets will contribute significantly to growth through localized software platforms and mobile-based applications.