Market Overview:

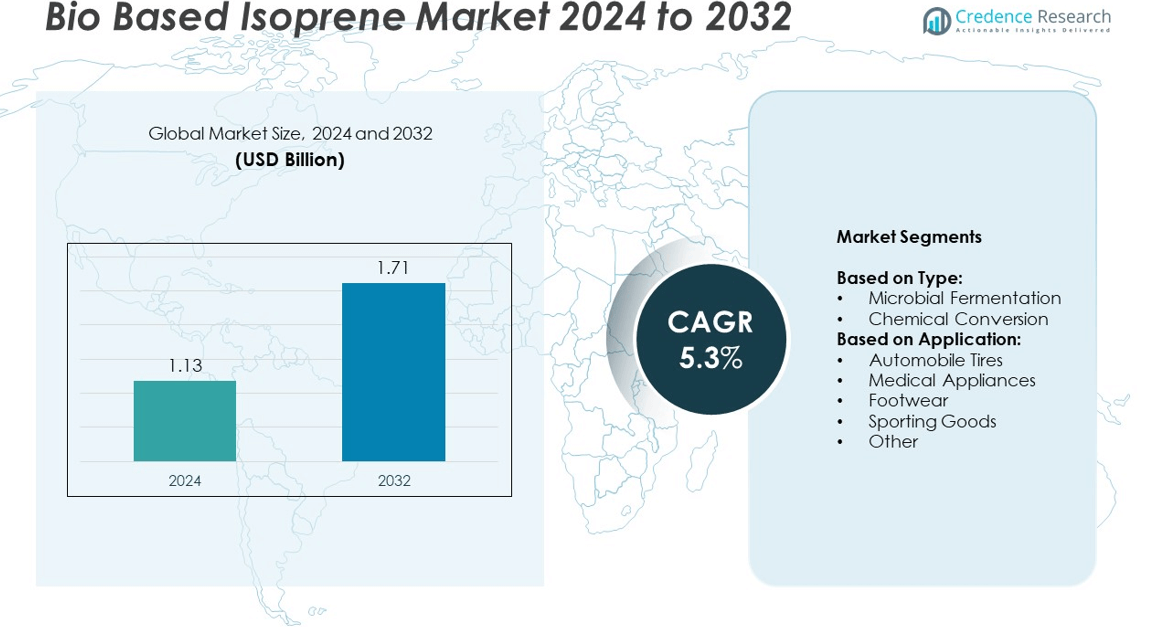

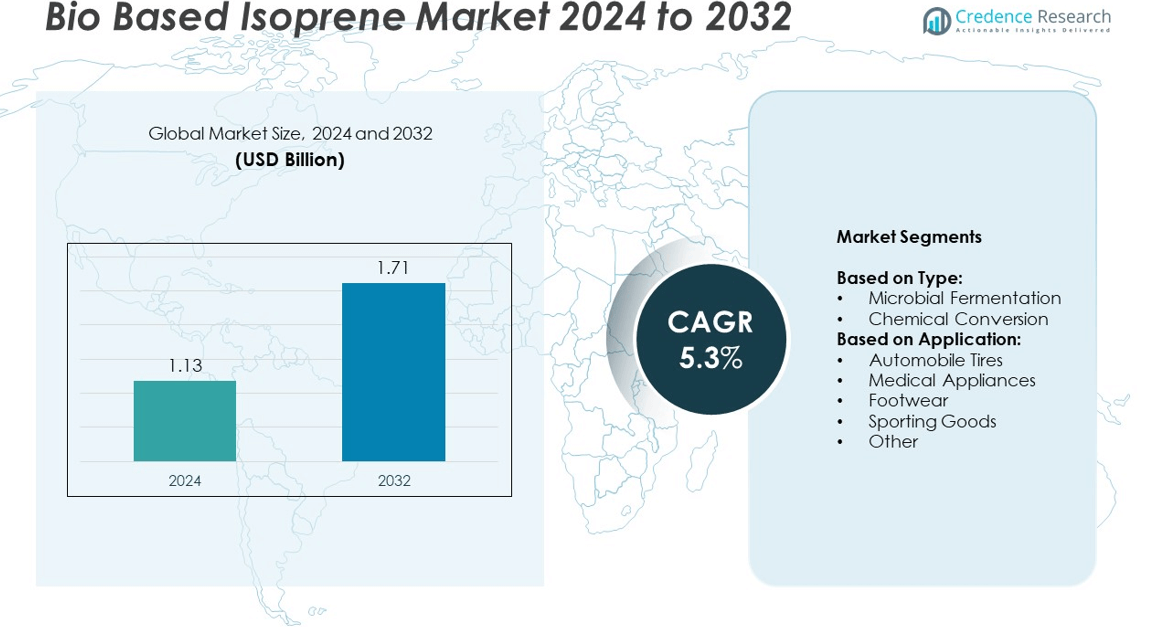

The bio-based isoprene market size was valued at USD 1.13 billion in 2024 and is anticipated to reach USD 1.71 billion by 2032, at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Bio Based Isoprene Market Size 2024 |

USD 1.13 billion |

| Bio Based Isoprene Market, CAGR |

5.3% |

| Bio Based Isoprene Market Size 2032 |

USD 1.71 billion |

The bio-based isoprene market is shaped by key players including Yokohama Rubber Company, Genencor (DuPont), Mitsubishi Chemical Group Corporation, Amyris Inc. (USA), Genomatica, Gevo Inc, Braskem, Ginkgo Bioworks, GlycosBio, and Ajinomoto. These companies focus on advancing microbial fermentation technologies, scaling bio-refinery operations, and forming partnerships with automotive and medical device manufacturers to meet rising demand for sustainable rubber materials. North America leads the market with over 35% share in 2024, supported by strong adoption in tire manufacturing and favorable government incentives. Europe follows closely with nearly 30% share, driven by strict sustainability regulations and active R&D investments.

Market Insights

- The bio-based isoprene market was valued at USD 1.13 billion in 2024 and is projected to reach USD 1.71 billion by 2032, growing at a CAGR of 5.3%.

- Rising demand for sustainable rubber alternatives and regulatory support for renewable chemicals are driving market growth, with microbial fermentation holding over 65% share in 2024.

- Strategic partnerships between tire manufacturers and biotech firms are boosting commercialization, while expanding applications in medical devices and footwear are creating new opportunities.

- The market is competitive, with key players focusing on bio-refinery expansions, technology advancements, and supply chain security to maintain price competitiveness.

- North America leads with over 35% share, followed by Europe at nearly 30% and Asia Pacific with more than 25%, driven by strong automotive and healthcare demand, while Latin America and Middle East & Africa together account for around 10% of the global market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Microbial fermentation dominates the bio-based isoprene market, accounting for over 65% share in 2024. Its leadership is driven by its cost-effectiveness, scalability, and ability to use renewable feedstocks such as sugarcane and corn. Companies leverage advanced metabolic engineering and optimized fermentation processes to increase yield and purity. Rising demand from tire manufacturers and consumer goods industries strengthens the adoption of microbial fermentation technology. Chemical conversion holds the remaining share and finds niche use in regions with abundant biomass availability but remains limited by higher energy requirements and production costs compared to fermentation routes.

- For instance, the engineered Escherichia coli strain YJM25 with a hybrid mevalonate (MVA) pathway produced 6.3 g/L of isoprene after 40 hours in fed-batch fermentation.

By Application

Automobile tires lead the bio-based isoprene market, holding more than 45% share in 2024. Growth is fueled by major tire producers adopting bio-based materials to meet sustainability targets and reduce carbon emissions. Bio-isoprene improves tire elasticity, durability, and rolling resistance, supporting fuel efficiency standards. Medical appliances follow as the second-largest application due to demand for biocompatible materials in gloves, catheters, and tubing. Footwear and sporting goods also contribute steadily, as brands focus on eco-friendly product lines to meet consumer preferences for sustainable materials, further expanding market penetration across these sectors.

- For instance, Partnership with Zeon Corporation, Visolis, a biotechnology company, achieved a 50-fold increase in its bio-isoprene monomer production capacity. The two companies are investigating the feasibility of commercializing bio-isoprene monomers and sustainable aviation fuel (SAF) using Visolis’ proprietary technology. In this collaboration, Visolis is the one that scaled up its production capacity.

Market Overview

Rising Demand for Sustainable Rubber Alternatives

Growing pressure to reduce carbon emissions drives demand for bio-based isoprene as a greener substitute for petroleum-derived isoprene. Major tire manufacturers are investing in renewable feedstock solutions to meet corporate sustainability goals. This shift is encouraged by regulatory frameworks supporting bio-based materials and circular economy initiatives. Increased adoption in automotive and consumer goods sectors ensures long-term demand growth, making this factor one of the most significant drivers shaping the market.

- For instance, the strain YJM25 achieved a ~7% conversion of glucose into isoprene in the high-yield 6.3 g/L fed-batch run.

Advancements in Fermentation Technology

Breakthroughs in metabolic engineering and strain optimization enhance microbial fermentation efficiency, reducing production costs and improving yield. Companies are scaling up pilot projects to commercial production levels, strengthening supply security. Strategic collaborations between chemical producers and biotech firms accelerate technology deployment. These advancements make bio-based isoprene competitive with petrochemical counterparts, driving wider adoption across tire and medical device industries.

- For instance, in lab-scale studies, engineered E. coli using lignocellulosic pretreated biomass produced ~294 mg/L isoprene via SSF (simultaneous saccharification and fermentation), nearly matching yields from pure glucose.

Government Incentives and Green Policies

Supportive regulations and subsidies promote the shift toward bio-based chemicals globally. Programs in North America, Europe, and Asia encourage manufacturers to invest in renewable monomer production facilities. Tax credits and funding for bio-refineries lower entry barriers and reduce capital risk. Such policy-driven initiatives significantly boost market penetration, positioning bio-based isoprene as a preferred material for sustainable product development.

Key Trends & Opportunities

Partnerships Between Tire Manufacturers and Biotech Firms

Collaborations between major tire companies and biotechnology firms are increasing to secure consistent bio-isoprene supply. These partnerships accelerate commercialization through joint R&D efforts and shared infrastructure investments. Such alliances enable early adoption of bio-based tires, giving companies a competitive advantage. This trend also creates opportunities for emerging players to enter niche markets, particularly in specialty tire segments for electric and hybrid vehicles.

- For instance, Goodyear unveiled a demonstration tire in 2023 made with 90 % sustainable materials.

Expansion Beyond Automotive Applications

The market is witnessing rising use of bio-based isoprene in medical devices, footwear, and sporting goods. Brands seek to differentiate products with sustainable materials to meet consumer demand for eco-friendly alternatives. Growth in healthcare applications, particularly biocompatible gloves and tubing, provides a strong opportunity. This diversification reduces reliance on the automotive industry and broadens revenue streams for producers.

- For instance, KAUST (King Abdullah University of Science & Technology) engineered Chlamydomonas reinhardtii to express the Ipomoea batatas isoprene synthase. The best transformants achieved between 50 and 58 mg/L isoprene in sealed vial cultivation over 6 days.

Key Challenges

High Production Costs and Price Competitiveness

Bio-based isoprene production remains costlier than petroleum-based alternatives due to feedstock and processing expenses. Price fluctuations of biomass raw materials and higher capital investment in fermentation infrastructure add to challenges. Without economies of scale, cost parity is difficult to achieve, limiting adoption among price-sensitive manufacturers.

Supply Chain and Feedstock Availability

Availability of sustainable biomass feedstocks is critical for consistent bio-isoprene production. Competition with food crops for raw materials like sugarcane and corn raises sustainability concerns. Disruptions in feedstock supply can lead to production delays and hinder long-term market growth, especially in regions dependent on imports.

Regional Analysis

North America

North America holds over 35% share of the bio-based isoprene market in 2024, driven by strong adoption across the automotive and medical sectors. Leading tire manufacturers in the U.S. invest heavily in sustainable raw materials to meet corporate ESG targets. Government incentives and funding for bio-refineries support local production capacity. The region also benefits from advanced biotechnology research and strong collaborations between chemical producers and universities. Growing demand for eco-friendly medical gloves and tubing further supports market expansion, positioning North America as a key hub for innovation and early commercialization of bio-based isoprene technologies.

Europe

Europe accounts for nearly 30% of the bio-based isoprene market share in 2024, supported by stringent regulations promoting sustainable materials. The EU Green Deal and circular economy initiatives push manufacturers toward renewable feedstocks, creating steady demand. Germany and France lead adoption due to their strong automotive and chemical industries. European tire companies actively collaborate with biotech firms to scale up bio-isoprene production. Consumer preference for eco-friendly products in footwear and sporting goods also strengthens market presence. Investments in research programs and pilot-scale facilities ensure Europe maintains its competitive edge in sustainable chemical innovation and adoption.

Asia Pacific

Asia Pacific captures more than 25% share of the bio-based isoprene market in 2024, driven by rapid industrialization and expanding automotive production in China, Japan, and India. The region benefits from large-scale sugarcane and corn availability, ensuring stable feedstock supply for microbial fermentation processes. Tire manufacturers in Japan and South Korea are actively integrating bio-isoprene into premium product lines. Rising healthcare spending boosts demand for medical devices made from biocompatible materials. Supportive government policies and increasing foreign investments in bio-refineries accelerate production capacity, positioning Asia Pacific as the fastest-growing regional market through the forecast period.

Latin America

Latin America represents around 6% of the global bio-based isoprene market in 2024, with Brazil serving as the primary growth engine. Abundant sugarcane production provides a cost-effective feedstock source for microbial fermentation, attracting investments from global chemical producers. Growing automotive assembly activities and footwear manufacturing in Brazil and Mexico increase consumption of bio-based isoprene. Government initiatives to expand bio-economy projects and export capabilities further boost the region’s market potential. However, limited infrastructure for large-scale production and slower regulatory alignment with global sustainability standards somewhat constrain rapid adoption in smaller Latin American markets.

Middle East & Africa

Middle East & Africa hold close to 4% share of the bio-based isoprene market in 2024, with gradual adoption focused on niche applications. The region’s demand is primarily driven by medical device imports and small-scale automotive manufacturing. Investments in sustainable chemical projects are growing, particularly in the Gulf countries as part of economic diversification plans. Limited local production capacity and feedstock availability remain key barriers, resulting in dependence on imports. Nonetheless, increasing focus on green initiatives and partnerships with international chemical companies are expected to open new growth opportunities in the coming years.

Market Segmentations:

By Type:

- Microbial Fermentation

- Chemical Conversion

By Application:

- Automobile Tires

- Medical Appliances

- Footwear

- Sporting Goods

- Other

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The bio-based isoprene market features key players such as Yokohama Rubber Company, Genencor (DuPont), Mitsubishi Chemical Group Corporation, Amyris Inc. (USA), Genomatica, Inc. (USA), Gevo Inc, Braskem, Ginkgo Bioworks (USA), GlycosBio, and Ajinomoto. These companies focus on scaling production capacity through microbial fermentation and advanced metabolic engineering to meet rising demand from tire, medical, and consumer goods sectors. Strategic collaborations between biotechnology firms and tire manufacturers are driving faster commercialization of bio-isoprene. Several players are expanding bio-refinery operations and securing long-term supply agreements with automotive OEMs to ensure consistent availability. Continuous investment in R&D enhances production efficiency and lowers costs, improving price competitiveness against petroleum-based isoprene. Regional expansion strategies include partnerships with local producers and the development of feedstock supply chains in Asia and Latin America. The competitive environment is marked by innovation-driven growth, with sustainability commitments playing a major role in shaping long-term market positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Yokohama Rubber Company

- Genencor (DuPont)

- Mitsubishi Chemical Group Corporation

- Amyris Inc. (USA)

- Genomatica, Inc. (USA)

- Gevo Inc

- Braskem

- Ginkgo Bioworks (USA)

- GlycosBio

- Ajinomoto

Recent Developments

- In 2025, Zeon and Yokohama Rubber announced plans to install a bench-scale facility at Zeon’s Tokuyama Plant. The facility will convert ethanol from plant-based and other sustainable materials into butadiene and isoprene, starting operation in 2026

- In 2024, Honda Motor adopted DURABIO from Mitsubishi Chemical for motorcycle bodywork and windshields, highlighting the role of bio-based materials in durable engineered products.

- In 2024, Gevo extended its joint development agreement with LG Chem to advance bio-propylene.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for bio-based isoprene will rise with growing focus on sustainable rubber production.

- Microbial fermentation technology will dominate due to higher yield and lower production cost.

- Partnerships between biotech firms and tire manufacturers will expand to secure long-term supply.

- Adoption in medical devices and biocompatible products will see steady growth.

- Asia Pacific will emerge as the fastest-growing market driven by automotive and healthcare demand.

- Companies will invest in bio-refinery capacity expansion to achieve economies of scale.

- Regulatory support and incentives will accelerate commercialization across major regions.

- Product innovations will improve performance and match petrochemical-based isoprene quality.

- Competition will intensify as new entrants and startups join the market.

- Focus on reducing greenhouse gas emissions will keep driving bio-based material adoption.