Market Overview

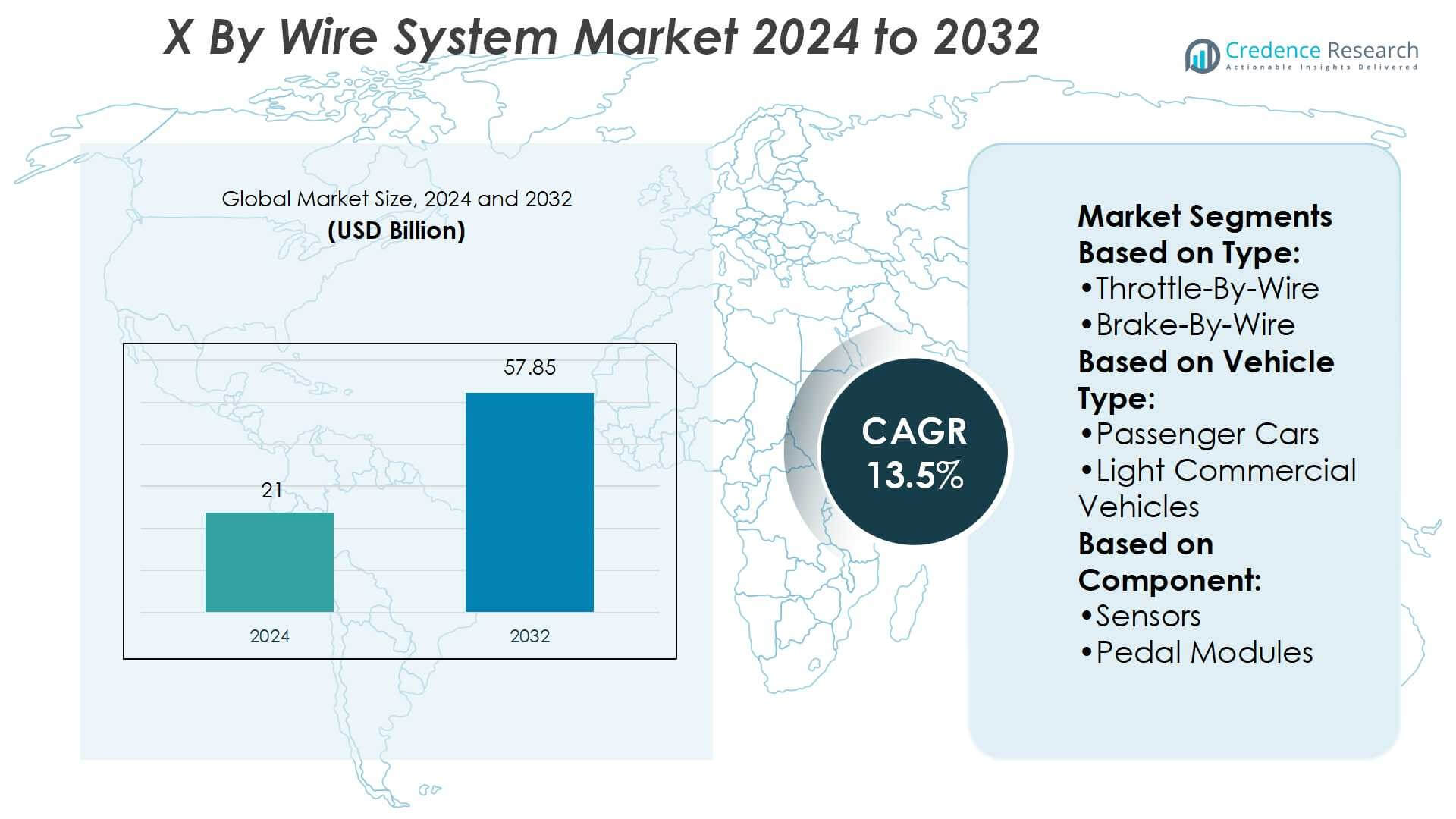

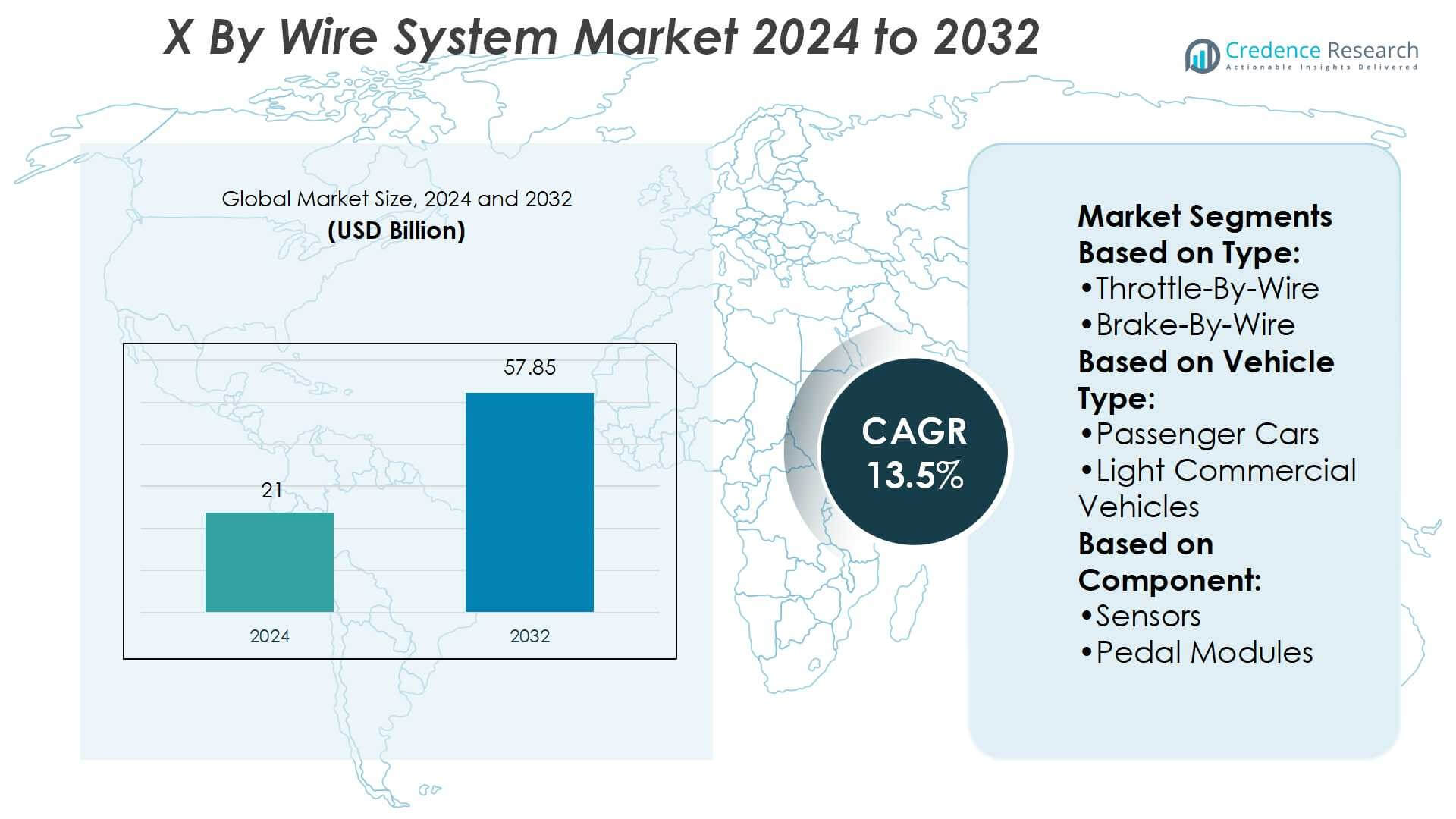

X By Wire System Market size was valued USD 21 billion in 2024 and is anticipated to reach USD 57.85 billion by 2032, at a CAGR of 13.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| X By Wire System Market Size 2024 |

USD 21 Billion |

| X By Wire System Market, CAGR |

13.5% |

| X By Wire System Market Size 2032 |

USD 57.85 Billion |

The X-By-Wire System Market is driven by prominent players such as Waymo LLC, Cruise LLC, Aptiv, NAVYA, Lyft, Inc., Zoox, Inc., Uber Technologies Inc., Tesla, MOIA, and Beijing Xiaoju Technology Co, Ltd., all of which focus on advancing electronic control solutions for electrification and autonomous driving. These companies invest heavily in R&D, partnerships, and fleet integration to strengthen adoption across passenger and commercial vehicles. Asia-Pacific leads the global market with a 34% share, supported by high vehicle production, rapid electrification, and strong regulatory backing, positioning the region as the dominant hub for X-By-Wire system deployment.

Market Insights

- The X By Wire System Market was valued at USD 21 billion in 2024 and is projected to reach USD 57.85 billion by 2032, registering a CAGR of 13.5% during the forecast period.

- Market growth is driven by rising demand for advanced safety systems, electrification, and autonomous driving technologies, with throttle-by-wire and brake-by-wire systems contributing the largest segment share.

- Key trends include integration of X-by-wire systems in electric and hybrid vehicles, alongside increasing partnerships between technology providers and automakers to accelerate deployment and innovation.

- Competitive intensity is high, with leading players such as Waymo LLC, Cruise LLC, Aptiv, NAVYA, Lyft, Zoox, Uber Technologies Inc., Tesla, MOIA, and Beijing Xiaoju Technology Co, Ltd. investing in R&D and fleet integration strategies.

- Asia-Pacific leads the market with a 34% share, supported by large-scale vehicle production and regulatory backing, while North America and Europe show steady adoption driven by premium and autonomous vehicle segments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Throttle-by-wire dominates the X-By-Wire System Market with a 42% share. The segment leads due to widespread adoption in passenger and commercial vehicles for improved fuel efficiency, emission control, and precise throttle response. Rising regulatory pressure on emission standards and the demand for enhanced vehicle performance strengthen its position. Brake-by-wire and steer-by-wire systems are expanding, but their penetration remains slower due to higher system complexity and cost. The continuous development of fail-safe architectures and redundancy in throttle-by-wire systems further supports its dominance.

- For instance, Waymo reported driving over 100 million fully autonomous miles on public roads, complementing its extensive use of simulation, which has logged over 20 billion simulated miles.

By Vehicle Type

Passenger cars hold the largest share in the X-By-Wire System Market at 55%. Growth in this segment stems from consumer demand for advanced safety features, efficient fuel use, and smooth driving experiences. OEMs focus on equipping mid and premium passenger vehicles with throttle-by-wire, brake-by-wire, and steer-by-wire systems to comply with emission and safety norms. Light commercial vehicles and heavy-duty trucks are gradually adopting these systems, driven by fleet efficiency needs. However, the scale of passenger car production keeps this segment at the forefront.

- For instance, Aptiv developed Radar AI/ML and ML Behavior Planner modules, which achieved 99% better classification (pedestrians, bikes, vehicles in all-weather), 80% improvement in object size estimation, and 50% improvement in object positioning over conventional radar-camera systems.

By Component

Sensors and pedal modules dominate the component segment with a 37% share, as they are indispensable in throttle-by-wire and brake-by-wire applications. Their demand is driven by the shift to digital control systems requiring precision and safety. In propulsion, battery-electric vehicles lead with 46% share, fueled by global electrification trends. BEVs integrate X-by-wire systems for optimized energy use, lightweight designs, and regenerative braking efficiency. Hybrid vehicles also adopt these systems, though internal-combustion vehicles rely more on traditional mechanical systems, reinforcing the electrification-driven leadership of BEVs.

Key Growth Drivers

Rising Demand for Advanced Safety and Efficiency

The growing focus on road safety and fuel efficiency drives adoption of X-By-Wire systems. Throttle-by-wire, brake-by-wire, and steer-by-wire replace mechanical linkages with electronic controls, offering faster response times and higher precision. Governments enforce stringent safety regulations, pushing OEMs to integrate these systems. Enhanced control also improves vehicle efficiency by reducing energy losses and optimizing performance. Consumers increasingly prefer vehicles with advanced driver-assistance features, making electronic control systems an essential component. This strong demand establishes X-By-Wire systems as a critical growth driver.

- For instance, Zoox’s robotaxi is built all-electric, with a length of 3,630 mm, height of 1,936 mm, and top speed of 75 mph in either direction. Turning circle is 8.4 meters.

Acceleration of Vehicle Electrification

The rapid shift toward hybrid and battery-electric vehicles significantly boosts demand for X-By-Wire systems. These vehicles require lightweight, electronically controlled architectures to enhance efficiency and maximize range. Brake-by-wire enables regenerative braking, while steer-by-wire reduces weight and mechanical complexity. Global electrification policies, carbon-neutral targets, and subsidies accelerate integration. OEMs prioritize X-By-Wire technologies to optimize electronic propulsion and reduce maintenance needs. With EV production increasing worldwide, the demand for advanced electronic control systems strengthens, positioning electrification as a central driver for market growth.

- For instance, Uber reported more than 230,000 zero-emission vehicle (ZEV) drivers active on its platform in Q1 2025, completing over 105 million tailpipe-emissions-free trips globally. The company also stated that drivers are adopting EVs up to 5 times faster than average motorists in the US, Canada, and Europe.

Technological Advancements and Integration of ADAS

Continuous innovation in sensors, actuators, and ECUs expands the scope of X-By-Wire systems. Advancements enable real-time monitoring, redundancy, and fail-safe mechanisms, addressing safety concerns and enhancing reliability. Integration with ADAS features such as lane-keeping assist, adaptive cruise control, and automated braking relies heavily on X-By-Wire systems. OEMs invest in scalable platforms that combine multiple functions, reducing cost and improving performance. These developments not only meet consumer expectations for intelligent vehicles but also prepare the market for autonomous driving, making technology advancement a strong growth driver.

Key Trends & Opportunities

Integration with Autonomous and Connected Vehicles

The X-By-Wire market benefits from the rapid evolution of autonomous and connected vehicle technologies. These systems eliminate mechanical constraints, enabling flexible design for autonomous platforms. Steer-by-wire and brake-by-wire support over-the-air updates, predictive control, and remote diagnostics. Growing investments in self-driving cars open opportunities for large-scale deployment of fully electronic control systems. Automakers view X-By-Wire as essential for autonomous navigation and enhanced connectivity, ensuring seamless coordination with sensors and vehicle-to-everything (V2X) networks. This trend positions the market for long-term expansion across advanced mobility ecosystems.

- For instance, MOIA its fleet included wheelchair-accessible vehicles, which have provided 42,000 rides for wheelchair users, while severely disabled persons and their companions have taken over 400,000 free rides.

Rising Adoption in Commercial Fleets

Commercial vehicles increasingly adopt X-By-Wire systems to improve efficiency, safety, and fleet management. Brake-by-wire enhances braking precision, while throttle-by-wire optimizes fuel consumption for delivery and logistics fleets. Integration with telematics and fleet monitoring tools allows operators to reduce downtime and maintenance costs. Electrification of buses and trucks further supports adoption, as electronic controls align with sustainability targets. Government incentives for cleaner commercial transportation create new opportunities. Fleet operators seeking operational savings and regulatory compliance continue to drive this adoption trend forward.

- For instance, Xiaoju Charging (a part of DiDi) has built a vast network of charging infrastructure across China, including a significant number of fast-charging piles rated 120 kW or higher. The company continues to expand its network.

Key Challenges

High Development and Implementation Costs

The transition from mechanical to electronic control systems involves significant investment in research, design, and testing. OEMs face high costs for developing redundant systems that meet safety requirements, especially in steer-by-wire and brake-by-wire technologies. Additional expenses arise from ensuring cybersecurity, fail-safe operations, and compliance with global standards. These costs often pass on to consumers, slowing adoption in cost-sensitive markets. Smaller manufacturers find it difficult to compete with established OEMs, creating barriers to widespread adoption of X-By-Wire systems across all vehicle categories.

Reliability and Consumer Acceptance Concerns

Despite technological progress, concerns remain regarding reliability and long-term durability of X-By-Wire systems. Mechanical linkages are perceived as more dependable, while electronic systems require robust backup and redundancy to prevent failures. Consumers remain cautious about complete reliance on software-controlled mechanisms, especially for steering and braking. Any system malfunction poses safety risks, making acceptance slower in traditional markets. Gaining consumer trust requires extensive testing, certification, and real-world performance validation. Building confidence in reliability is a key challenge that must be addressed for broader adoption.

Regional Analysis

North America

North America accounts for 31% share of the X-By-Wire System Market, driven by strong adoption of advanced driver assistance systems and early electrification initiatives. The United States leads the region with high integration of throttle-by-wire and brake-by-wire in premium passenger cars and light commercial vehicles. Regulatory mandates for vehicle safety and emission reductions further strengthen adoption. Canada supports growth through rising EV sales, while Mexico benefits from expanding automotive manufacturing hubs. Strong presence of technology-driven OEMs and suppliers ensures continued innovation, making North America a significant market for X-By-Wire systems.

Europe

Europe holds 28% share of the X-By-Wire System Market, supported by stringent safety and emission regulations. Countries such as Germany, France, and the UK dominate adoption, with strong EV and hybrid vehicle production. Brake-by-wire and steer-by-wire gain traction in luxury and mid-segment passenger vehicles, driven by consumer demand for advanced safety features. EU regulations mandating lower CO₂ emissions push OEMs to adopt lightweight and efficient electronic control systems. Leading European automakers invest heavily in integrating these systems with ADAS and autonomous technologies, solidifying the region’s leadership in technological innovation and regulatory compliance.

Asia-Pacific

Asia-Pacific leads the X-By-Wire System Market with a 34% share, driven by rapid vehicle production in China, Japan, South Korea, and India. Rising demand for passenger cars and accelerating electrification initiatives fuel adoption of throttle-by-wire and brake-by-wire systems. China dominates with large EV production volumes and strong regulatory support for emission reduction. Japan and South Korea emphasize advanced automotive technologies, particularly in hybrid and electric models. India’s expanding automotive industry and growing consumer preference for safety features further boost adoption. Strong supply chain networks and local manufacturing capacity strengthen the region’s dominance.

Latin America

Latin America holds 4% share of the X-By-Wire System Market, with adoption primarily concentrated in Brazil and Mexico. Growing automotive manufacturing bases and gradual electrification initiatives drive regional demand. Passenger cars dominate installations, while light commercial vehicles slowly adopt throttle-by-wire and brake-by-wire systems. Limited consumer purchasing power and high costs of electronic systems restrict wider penetration. However, government initiatives to support cleaner mobility and safety standards create growth opportunities. Rising investments from global OEMs in local assembly plants are expected to accelerate adoption in the medium term, particularly within Brazil’s expanding automotive industry.

Middle East & Africa

The Middle East & Africa represent 3% share of the X-By-Wire System Market, with growth led by the Gulf countries and South Africa. Demand remains modest compared to other regions, but rising preference for premium vehicles with advanced safety features supports adoption. Electrification initiatives in the UAE and Saudi Arabia, along with increasing investment in EV infrastructure, encourage integration of brake-by-wire and throttle-by-wire systems. South Africa’s automotive production base contributes to gradual uptake. Despite challenges from high costs and limited consumer awareness, expanding premium car sales position the region for steady growth in the coming years.

Market Segmentations:

By Type:

- Throttle-By-Wire

- Brake-By-Wire

By Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles

By Component:

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The X-By-Wire System Market is shaped by key players including Waymo LLC, Cruise LLC, Aptiv, NAVYA, Lyft, Inc., Zoox, Inc., Uber Technologies Inc., Tesla, MOIA, and Beijing Xiaoju Technology Co, Ltd. The X-By-Wire System Market is becoming increasingly competitive, with companies focusing on innovation, safety, and integration with next-generation mobility solutions. Advancements in throttle-by-wire, brake-by-wire, and steer-by-wire systems are central to addressing the rising demand for electrification and autonomous driving. Market participants are investing heavily in research and development to enhance reliability, redundancy, and fail-safe designs, ensuring compliance with stringent safety regulations. Strategic collaborations, partnerships, and acquisitions remain common strategies to expand product portfolios and accelerate deployment. The emphasis on aligning with global electrification goals and autonomous vehicle readiness continues to drive competition and market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2025, Mercedes-Benz announced the launch of its new steer-by-wire systems, which will debut in production vehicles in 2026. The system removes the traditional mechanical link between the steering wheel and the wheels, replacing it with a fully electronic setup that enhances safety through redundant architecture.

- In April 2025, Nexteer Automotive launched its advanced Electro-Mechanical Brake system, representing a new step in brake-by-wire technology. The EMB system eliminates traditional hydraulics, offering enhanced safety, comfort, and serviceability while supporting software-defined chassis integration.

- In January 2025, ZF combined Active Safety and Passenger Car Chassis units into a new Chassis Solutions Division while landing a brake-by-wire order covering nearly vehicles from a North American OEM.

- In January 2025, Bosch successfully tested its hydraulic brake-by-wire system on public roads, including extreme conditions during a test journey to the Arctic Circle. The system eliminates the mechanical connection between the pedal and the brakes, replacing it with a fully electronic link designed to improve efficiency and safety.

- In January 2024, REE received its first U.S. certification for a vehicle fully controlled by electronics rather than mechanical connections. The “Powered by REE” P7-C medium-duty electric commercial truck is the first fully steer-by-wire, brake-by-wire and drive-by-wire vehicle certified by the U.S. Federal Motor Vehicle Safety Standards and Environmental Protection Agency.

Report Coverage

The research report offers an in-depth analysis based on Type, Vehicle Type, Component and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see strong growth from wider adoption of electrification and hybrid vehicles.

- Throttle-by-wire and brake-by-wire will remain the most deployed systems across vehicle categories.

- Autonomous driving development will accelerate demand for steer-by-wire and integrated control systems.

- Increasing regulatory focus on safety and emissions will drive mandatory adoption in key regions.

- Passenger cars will continue leading demand, while commercial fleets steadily adopt for efficiency.

- Advancements in sensors, actuators, and ECUs will improve system reliability and cost-effectiveness.

- Asia-Pacific will maintain dominance due to high vehicle production and electrification initiatives.

- Partnerships between OEMs and technology suppliers will expand to enable scalable deployments.

- Cybersecurity and redundancy features will become critical differentiators for market competitiveness.

- The shift toward software-defined vehicles will reinforce integration of X-By-Wire architectures.