Market Overview

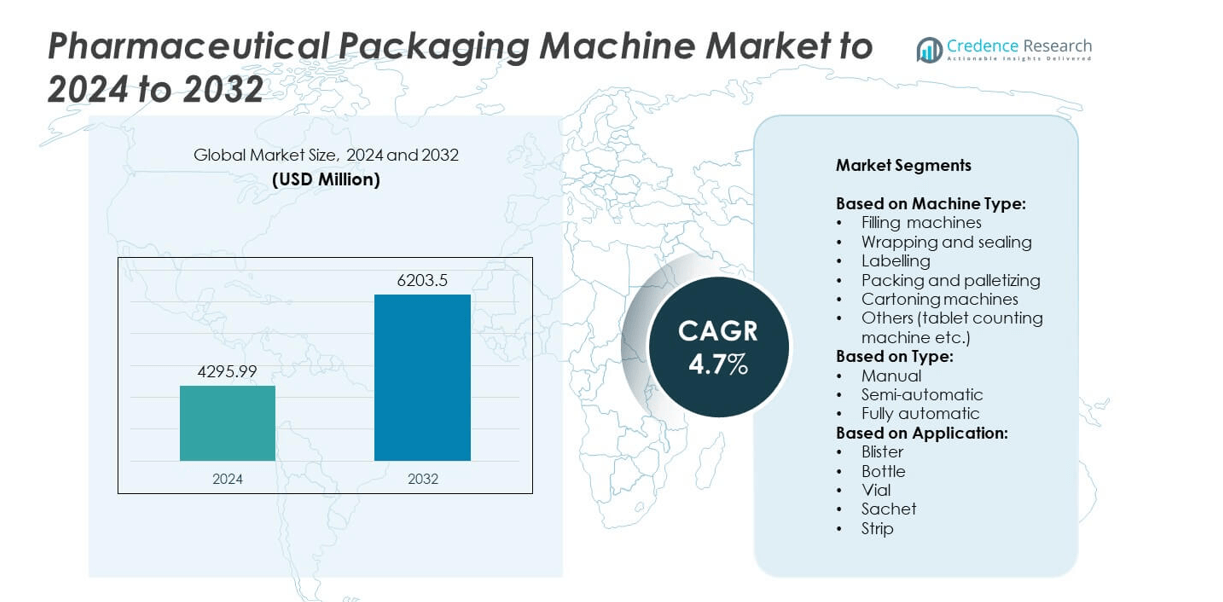

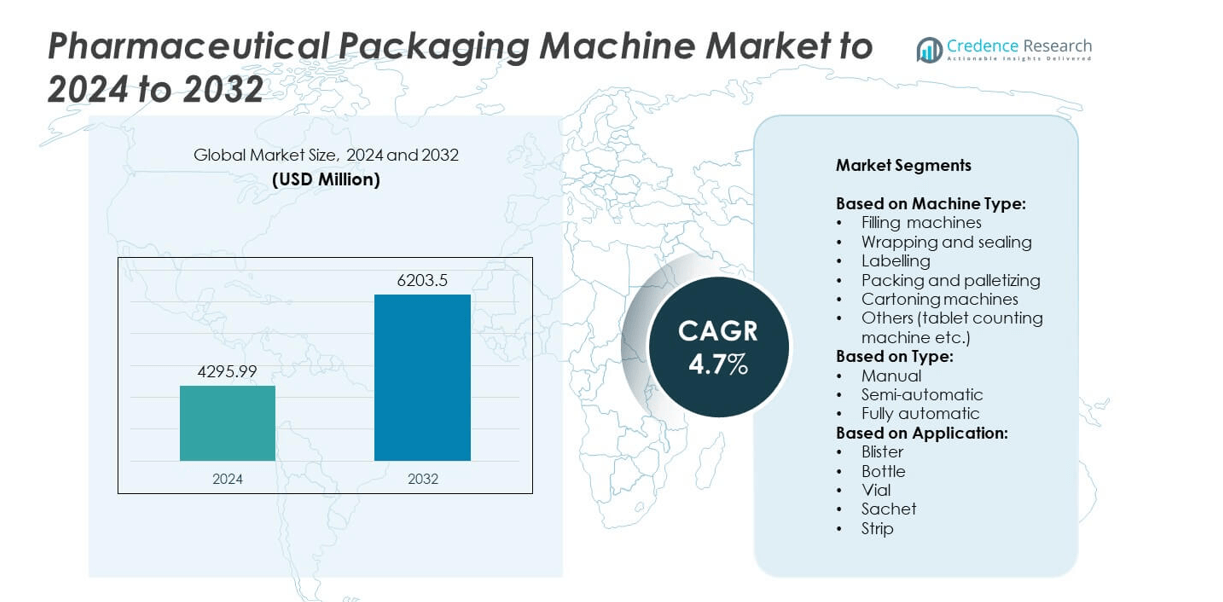

Pharmaceutical Packaging Machine Market size was valued USD 4295.99 Million in 2024 and is anticipated to reach USD 6203.5 Million by 2032, at a CAGR of 4.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pharmaceutical Packaging Machine Market Size 2024 |

USD 4295.99 Million |

| Pharmaceutical Packaging Machine Market, CAGR |

4.7% |

| Pharmaceutical Packaging Machine Market Size 2032 |

USD 6203.5 Million |

The pharmaceutical packaging machine market is driven by key players such as SaintyCo, ULMA Packaging, Korber, Farmadosis, Cama Group, Heino Ilsemann, Uhlmann, TGM – Technomachines, Harro Hofliger, Optel Group, Marchesini Group, Lodha Pharma, Romaco, Syntegon Technology, Bausch+Strobel, IMA Pharma, and Schubert Group. These companies focus on automation, modular machine design, and compliance with global regulatory requirements to meet rising pharmaceutical production needs. North America leads the market with 34% share, supported by advanced manufacturing infrastructure and strong adoption of Industry 4.0-enabled solutions. Europe follows with 28% share, while Asia-Pacific accounts for 25%, driven by rapid growth in domestic production and contract manufacturing services.

Market Insights

- The pharmaceutical packaging machine market was valued at USD 4295.99 Million in 2024 and is projected to reach USD 6203.5 Million by 2032, growing at a CAGR of 4.7%.

- Rising demand for biologics, injectables, and patient-centric packaging formats is a major growth driver, boosting adoption of automated filling, sealing, and labeling machines.

- Key trends include Industry 4.0 integration, IoT-enabled monitoring, and growing use of eco-friendly packaging materials supporting sustainability goals.

- The market is moderately consolidated, with players competing on automation, modular design, and compliance-ready solutions to gain a competitive edge.

- North America leads with 34% share, followed by Europe at 28% and Asia-Pacific at 25%, while filling machines hold the dominant 35% segment share, reflecting strong demand for precision drug packaging systems across regions.\

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Machine Type

Filling machines dominated the pharmaceutical packaging machine market with over 35% share in 2024, driven by high demand for liquid and injectable drug packaging. These machines ensure precise dosing, contamination-free filling, and compliance with stringent regulatory standards like cGMP. Growing biologics and vaccine production further boosts adoption. Wrapping, sealing, and cartoning machines follow, supported by increasing need for tamper-evident and patient-friendly packaging formats. Automation in packing and palletizing enhances production efficiency, reducing labor costs and errors. Rising preference for tablet counting machines in small-batch and personalized medicine production supports steady growth in the “others” category.

- For instance, Syntegon (formerly Bosch Packaging Technology) produces a range of capsule filling machines, including the GKF 720, which has an output of up to 43,500 capsules per hour and is used for small-batch production.

By Type

Fully automatic machines led the market with nearly 60% share in 2024, as pharmaceutical manufacturers adopt high-speed lines to meet large-scale production needs. Automation ensures consistent quality, minimizes human intervention, and complies with regulatory audits. Growing investment in Industry 4.0 and IoT-enabled monitoring systems is accelerating adoption. Semi-automatic machines hold a moderate share, serving mid-scale producers requiring flexibility and lower capital investment. Manual machines remain relevant for small-scale manufacturers and R&D applications, where short runs and frequent product changes demand cost-effective, adaptable solutions without significant infrastructure investments.

- For instance, Romaco’s Macofar LF 200 series includes high-speed liquid filling machines capable of outputting up to 12,000 bottles per hour, used for pharmaceutical and nutraceutical liquids.

By Application

Blister packaging accounted for more than 40% of the market in 2024, supported by its moisture protection, dose accuracy, and patient compliance advantages. Blister machines are widely used for solid oral dosage forms, which dominate pharmaceutical production. Bottle packaging machines are the second-largest segment, driven by rising demand for liquid formulations and nutraceuticals. Vial filling machines are witnessing significant growth with increasing production of biologics, injectables, and vaccines. Sachet and strip packaging machines are gaining traction for single-dose applications and emerging markets, where cost-effective, portable solutions are preferred for consumer convenience and adherence.

Market Overview

Rising Demand for Precision and Compliance

The rising demand for precision and contamination-free drug packaging is a major growth driver. Strict regulatory frameworks such as cGMP and FDA guidelines push manufacturers to adopt advanced, automated filling and sealing machines. Growing biologics and injectable drug production further accelerates demand for highly accurate packaging systems. Companies invest in high-speed, fully automated lines to reduce errors and maintain consistent quality. Expanding vaccine and biosimilar pipelines worldwide also contribute to higher machine adoption, as manufacturers aim to scale production and meet stringent global compliance requirements effectively.

- For instance, Uhlmann Pac-Systeme’s BEC 500 blister lines are used for pharmaceutical solid products and can produce a maximum of 500 blisters per minute.

Automation and Industry 4.0 Adoption

Another key growth driver is the rapid shift toward automation and Industry 4.0 integration in pharmaceutical manufacturing. IoT-enabled packaging machines allow real-time monitoring, predictive maintenance, and process optimization. This shift improves operational efficiency, reduces downtime, and lowers labor dependency. The move toward digitalized production supports traceability and serialization compliance, particularly for regulated markets like the EU and U.S. Growing investments from large pharma companies in automated solutions accelerate this adoption trend globally.

- For instance, Syntegon’s ALF 5000 vial filling machine has a maximum output of 600 vials per minute, and the company has partnered with BioNTech on various projects, including providing equipment for BioNTech’s manufacturing network.

Patient-Centric Packaging Demand

A third key driver is the surge in demand for patient-centric packaging formats that improve compliance and convenience. Blister and prefilled syringe machines are increasingly adopted for their ability to deliver precise dosages and easy-to-use formats. The growing popularity of unit-dose packaging, especially in emerging markets, fuels equipment demand. Additionally, aging populations and chronic disease prevalence drive the need for packaging that supports adherence programs. Machine manufacturers respond by developing flexible, modular systems capable of handling diverse packaging formats efficiently.

Key Trends and Opportunities

Sustainable and Eco-Friendly Packaging

One major trend is the increasing adoption of sustainable and eco-friendly packaging materials. Pharmaceutical companies are seeking machines capable of handling recyclable plastics, biodegradable films, and paper-based blister packs. Machine manufacturers are innovating to accommodate these materials without compromising product safety or barrier properties. This shift aligns with corporate sustainability goals and regulatory pressure to reduce plastic waste. The demand for flexible machines supporting green materials opens opportunities for suppliers offering customizable and energy-efficient solutions tailored to environmentally responsible production.

- For instance, the cost of a high-tech pharmaceutical filling line like the Syntegon ALF 5000 is considered commercially confidential information and depends heavily on specific customer requirements, configuration, and location.

Serialization and Track-and-Trace Compliance

Another significant opportunity lies in the growing demand for serialization and track-and-trace compliance. Global regulations like the U.S. Drug Supply Chain Security Act (DSCSA) and EU Falsified Medicines Directive (FMD) require unique identifiers on pharmaceutical packages. This has driven investments in labeling, coding, and inspection systems integrated within packaging machines. Companies offering end-to-end serialization-ready solutions are well-positioned to capture market share. Adoption of advanced vision inspection and cloud-based data systems creates additional opportunities for solution providers focused on regulatory compliance.

- For instance, Romaco Kilian’s S 710 Prime rotary tablet press has a configuration with 85 press stations and achieves a maximum output of 1,020,000 tablets per hour for mono-layer production.

Key Challenges

High Cost of Advanced Machinery

One major challenge is the high initial investment and maintenance costs of advanced pharmaceutical packaging machines. Small and mid-sized manufacturers often face capital constraints, delaying adoption of fully automated systems. The need for skilled operators and regular machine calibration adds to operational expenses. This can limit penetration in cost-sensitive emerging markets, where manual or semi-automatic machines remain preferred. Suppliers must offer cost-effective financing models and scalable machine options to overcome this barrier and encourage broader adoption across smaller manufacturing facilities.

Complexity of Multiple Packaging Formats

Another key challenge is the complexity of handling multiple packaging formats and frequent product changeovers. Pharmaceutical companies increasingly demand flexibility to package tablets, liquids, injectables, and personalized medicines on the same line. This creates technical challenges related to machine adaptability and line efficiency. Downtime during changeovers can affect productivity and increase costs. Manufacturers must invest in modular machine designs and quick-change tooling to reduce setup times. Addressing these challenges is critical to meeting the growing need for shorter production cycles and diverse product portfolios.

Regional Analysis

North America

North America held the largest share of 34% in the pharmaceutical packaging machine market in 2024, driven by advanced manufacturing infrastructure and strong presence of major pharmaceutical companies. High adoption of automated and Industry 4.0-enabled machines ensures compliance with strict FDA and cGMP regulations. Demand for flexible and patient-centric packaging formats, including blister packs and prefilled syringes, is rising rapidly. Significant investments in biologics and vaccine production further boost demand for high-speed filling and sealing equipment. The region benefits from continuous technological innovation and strong R&D spending, supporting market expansion and encouraging rapid adoption of advanced packaging solutions.

Europe

Europe accounted for 28% of the market share in 2024, supported by stringent regulatory standards such as the EU Falsified Medicines Directive driving serialization and track-and-trace solutions. Strong pharmaceutical production in Germany, Switzerland, and the UK fuels demand for automated and high-precision packaging machines. Sustainability initiatives promote adoption of machines compatible with recyclable and biodegradable packaging materials. Growing investments in biologics and personalized medicine create opportunities for specialized filling, labeling, and cartoning equipment. Rising emphasis on reducing operational costs and improving efficiency accelerates adoption of fully automated packaging lines across contract manufacturing organizations and mid-sized pharmaceutical producers.

Asia-Pacific

Asia-Pacific held 25% market share in 2024 and is projected to witness the fastest growth through 2032. Rising pharmaceutical production in China and India, combined with government support for domestic manufacturing, fuels demand for cost-effective and scalable packaging machines. Growing adoption of contract manufacturing services by global pharmaceutical companies drives equipment installation. Increasing prevalence of chronic diseases and expanding access to healthcare boost demand for blister and bottle packaging solutions. Local manufacturers are upgrading from manual to semi-automatic and fully automated lines, creating significant growth opportunities for machine suppliers focusing on affordable, high-performance packaging equipment.

Latin America

Latin America captured 7% of the market share in 2024, led by growing pharmaceutical production in Brazil and Mexico. The region is seeing rising investments in packaging automation as manufacturers aim to meet global export standards and enhance production efficiency. Demand is increasing for machines that support blister and vial packaging, particularly for generic medicines. Government initiatives promoting local manufacturing and expansion of healthcare infrastructure support market growth. However, capital constraints among small producers encourage adoption of semi-automatic solutions. Partnerships with international equipment suppliers are helping regional players access advanced technology at competitive costs.

Middle East & Africa

The Middle East & Africa region held a 6% share of the market in 2024 and is steadily growing with rising healthcare investments and local pharmaceutical production. Expansion of manufacturing hubs in Saudi Arabia, South Africa, and the UAE is creating demand for advanced packaging solutions. Focus on reducing medicine imports and increasing domestic production encourages installation of filling, sealing, and labeling machines. Demand for cost-efficient and compact machines is significant due to smaller batch production in several countries. International equipment suppliers are entering the region through partnerships to capture emerging opportunities and strengthen their distribution networks.

Market Segmentations:

By Machine Type:

- Filling machines

- Wrapping and sealing

- Labelling

- Packing and palletizing

- Cartoning machines

- Others (tablet counting machine etc.)

By Type:

- Manual

- Semi-automatic

- Fully automatic

By Application:

- Blister

- Bottle

- Vial

- Sachet

- Strip

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The pharmaceutical packaging machine market features prominent players such as SaintyCo, ULMA Packaging, Korber, Farmadosis, Cama Group, Heino Ilsemann, Uhlmann, TGM – Technomachines, Harro Hofliger, Optel Group, Marchesini Group, Lodha Pharma, Romaco, Syntegon Technology, Bausch+Strobel, IMA Pharma, and Schubert Group. The market is highly competitive, with companies focusing on advanced automation, IoT integration, and flexible machine designs to meet diverse packaging needs. Emphasis is placed on developing systems that comply with global regulatory standards and support serialization requirements. Players are investing in modular and energy-efficient solutions to enhance production efficiency while reducing downtime and operational costs. Strategic partnerships, mergers, and global expansions are common to strengthen regional presence and address rising demand from emerging markets. Increasing R&D activities are directed at sustainable and patient-centric packaging solutions, aligning with the industry’s focus on eco-friendly materials and personalized medicine production. Competitive intensity is expected to remain strong throughout the forecast period.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SaintyCo

- ULMA Packaging

- Korber

- Farmadosis

- Cama Group

- Heino Ilsemann

- Uhlmann

- TGM – Technomachines

- Harro Hofliger

- Optel Group

- Marchesini Group

- Lodha Pharma

- Romaco

- Syntegon Technology

- Bausch+Strobel

- IMA Pharma

- Schubert Group

Recent Developments

- In 2024, Syntegon Technology expanded its digital service offerings, including “Synexio”, a data-driven service solution. This enabled real-time monitoring, predictive maintenance, and optimized machine performance, reducing downtime and enhancing overall equipment effectiveness (OEE) for pharmaceutical manufacturers.

- In 2024, IMA Life at CPHI Milan introduced the INJECTA 36, an advanced, high-speed robotic filling solution for sterile product processing, featuring enhanced controls and in-process checks for Ready-To-Use syringes.

- In 2023, Marchesini Group company expanded its specialized lines for aseptic filling and packaging of injectables (vials, syringes, ampoules), incorporating advanced robotics and barrier systems (isolators or RABS – Restricted Access Barrier Systems) to meet stringent regulatory requirements.

Report Coverage

The research report offers an in-depth analysis based on Machine Type, Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for fully automated packaging machines will continue to grow for large-scale production.

- Integration of IoT and Industry 4.0 technologies will enhance real-time monitoring and efficiency.

- Adoption of eco-friendly and recyclable packaging materials will drive machine design innovation.

- Serialization and track-and-trace solutions will remain a priority to meet regulatory compliance.

- Flexible and modular machine designs will gain traction to support multiple packaging formats.

- Rising biologics and vaccine production will boost demand for precision filling and sealing systems.

- Emerging markets will see higher investments in automated and semi-automated packaging solutions.

- Focus on patient-centric and unit-dose packaging will influence equipment development.

- Strategic collaborations and acquisitions will expand global presence of leading equipment suppliers.

- R&D will focus on energy-efficient, sustainable, and digitalized packaging technologies for future growth.