Market Overview

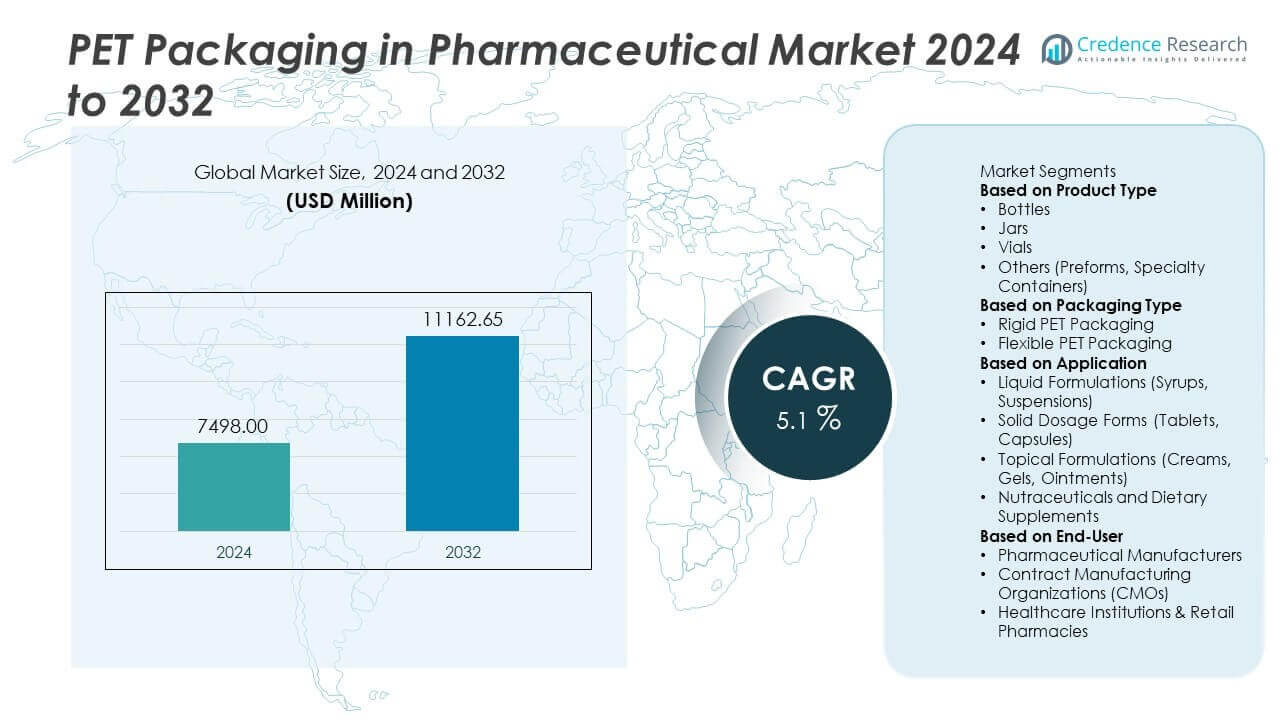

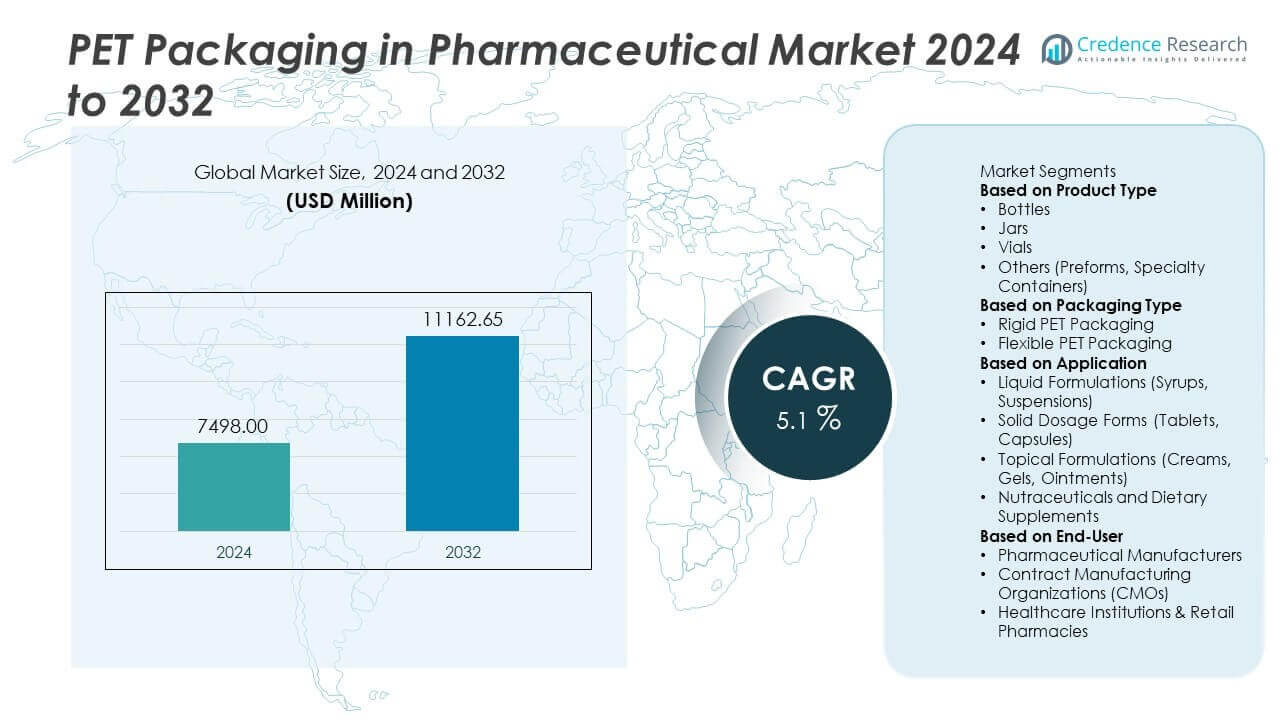

The PET packaging in pharmaceutical market was valued at USD 7,498.00 million in 2024 and is projected to reach USD 11,162.65 million by 2032, growing at a CAGR of 5.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| PET Packaging In Pharmaceutical Market Size 2024 |

USD 7,498.00 Million |

| PET Packaging In Pharmaceutical Market, CAGR |

5.1% |

| PET Packaging In Pharmaceutical Market Size 2032 |

USD 11,162.65 Million |

The PET packaging in pharmaceutical market is driven by leading players such as GOLDMINE POLYMERS INDUSTRIES, Huhtamaki, Amcor, CCL Industries, West Pharmaceutical Services, Kamala Plastics, Gerresheimer, Sonoco, Graham Packaging, and AG Poly Packs Private Limited. These companies focus on producing durable PET bottles, vials, and jars with advanced barrier properties to protect drug stability and ensure compliance with global pharmaceutical standards. North America leads the market with 37% share, supported by strong pharmaceutical production and high adoption of recyclable PET. Europe accounts for 31%, driven by sustainability initiatives and strict EMA compliance, while Asia-Pacific holds 23% and is the fastest-growing region due to expanding generic drug production and rising healthcare spending.

Market Insights

Market Insights

- The PET packaging in pharmaceutical market was valued at USD 7,498.00 million in 2024 and is projected to reach USD 11,162.65 million by 2032, growing at a CAGR of 5.1% during the forecast period.

- Rising demand for lightweight, shatter-resistant, and cost-effective packaging is driving adoption of PET bottles, vials, and jars for syrups, tablets, and nutraceuticals.

- Key trends include increasing use of recyclable PET (rPET), bio-based PET solutions, and adoption of smart packaging with serialization features to enhance traceability and compliance.

- The market is competitive, with players such as Amcor, Gerresheimer, Huhtamaki, and Graham Packaging focusing on capacity expansion, automation, and sustainable packaging innovations.

- North America leads with 37% share, Europe holds 31%, and Asia-Pacific accounts for 23%, while bottles dominate the product segment with over 55% share due to their versatility and superior barrier protection for pharmaceutical applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Bottles dominated the PET packaging in pharmaceutical market in 2024, accounting for over 55% share. Their popularity stems from durability, transparency, and compatibility with liquid and solid formulations, making them ideal for syrups, tablets, and capsules. PET bottles are lightweight, shatter-resistant, and cost-efficient, making them suitable for bulk manufacturing and transport. Jars hold a moderate share, preferred for ointments and topical creams requiring wide-mouth access. Vials and specialty containers are witnessing steady growth, supported by rising demand for small-volume packaging for high-value drugs and personalized medicine applications.

- For instance, Gerresheimer AG produces pharmaceutical PET bottles in a range of sizes, which are part of its broader portfolio of plastic packaging for liquid pharmaceuticals. This includes “edp-branded PET bottles for liquid dosage” that adhere to strict pharmaceutical-grade compliance, with production taking place in modern clean rooms and meeting standards like FDA, GMP, and ISO.

By Packaging Type

Rigid PET packaging led the market with more than 65% share in 2024, supported by its strength, barrier properties, and ability to withstand sterilization. Rigid formats are widely used for pharmaceutical bottles, vials, and jars that require protection against moisture and oxygen. Their recyclability and cost-effectiveness make them the preferred choice for large-scale drug manufacturing. Flexible PET packaging is gaining traction with growing adoption of pouches, blister packs, and sachets for unit-dose applications. This segment is supported by convenience, portability, and patient compliance trends in emerging markets.

- For instance, Amcor plc manufactures a wide range of packaging for the pharmaceutical industry, including high-barrier PET bottles with specialized barrier coatings. Amcor also produces pouches compatible with gamma sterilization for medical products.

By Application

Liquid formulations accounted for over 40% share of PET pharmaceutical packaging in 2024, driven by high demand for cough syrups, suspensions, and oral solutions. PET bottles provide clarity and chemical resistance, ensuring dosage accuracy and product stability. Solid dosage forms, including tablets and capsules, are the second-largest segment, supported by blister packs and high-volume production. Topical formulations and nutraceuticals are growing rapidly as demand rises for dermatology treatments, dietary supplements, and over-the-counter wellness products. Growth in these segments is supported by consumer preference for hygienic, lightweight, and recyclable packaging solutions.

Key Growth Drivers

Rising Demand for Lightweight and Durable Packaging

The pharmaceutical industry is increasingly adopting PET packaging due to its lightweight, shatter-resistant, and cost-effective nature. PET bottles and vials provide excellent protection against moisture and oxygen, preserving drug efficacy. This makes them ideal for syrups, suspensions, tablets, and capsules. The material’s clarity supports easy identification and patient compliance. Growth in large-scale production of generic medicines and over-the-counter (OTC) drugs is further fueling demand for PET packaging as pharmaceutical manufacturers seek scalable, safe, and efficient packaging solutions that meet regulatory and logistical requirements.

- For instance, Indorama Ventures is a major global producer of PET resins for packaging, including pharmaceuticals. The company does use advanced stretch blow molding to create highly resistant PET bottles with precise volume control, and the production rate is plausible for some high-volume applications.

Shift Toward Sustainable and Recyclable Solutions

Growing focus on sustainability is driving adoption of recyclable PET packaging in the pharmaceutical sector. Companies are investing in food-grade recycled PET (rPET) and bio-based PET to reduce environmental impact while maintaining strict regulatory compliance. PET packaging aligns with circular economy goals and extended producer responsibility (EPR) regulations. Lightweight PET formats also reduce transportation emissions, supporting pharmaceutical companies’ carbon reduction targets. This shift toward greener packaging materials is expected to create new opportunities for packaging manufacturers and increase adoption across all dosage forms globally.

- For instance, Amcor is a global leader in producing responsible packaging solutions, including for pharmaceutical applications, and has pledged to increase its use of recycled materials. By fiscal year 2024, Amcor had already purchased 224,000 metric tons of Post-Consumer Recycled (PCR) plastic toward its goals.

Expansion of Pharmaceutical Manufacturing and Distribution

Global growth in pharmaceutical production, particularly in emerging markets, is boosting demand for PET packaging. Expanding manufacturing capacities in India, China, and Southeast Asia are creating large-scale opportunities for bottles, jars, and vials. Rising exports of generic drugs, biologics, and nutraceuticals require packaging that meets international quality and safety standards. PET packaging offers consistent performance across long supply chains, supporting efficient distribution. Increased investment in contract manufacturing organizations (CMOs) is further accelerating demand for PET containers optimized for cost efficiency, regulatory compliance, and extended shelf life.

Key Trends & Opportunities

Adoption of Advanced Barrier Technologies

The market is witnessing a rise in demand for PET packaging with enhanced barrier properties, such as UV protection and moisture resistance. These improvements extend the shelf life of sensitive formulations, including biologics and nutraceuticals. Manufacturers are incorporating coatings and multilayer PET structures to achieve pharmaceutical-grade protection. This trend is creating opportunities for packaging suppliers to differentiate offerings and meet the needs of high-value, stability-sensitive medications. The integration of such technologies is also driving compliance with global pharmaceutical packaging standards.

- For instance, Radhe Containers, an Indian manufacturer producing pharma PET bottles with capacities from 10 ml up to 1000 ml. Their production lines run at 10,000 bottles per day with strict quality control measures ensuring high standards for clarity, sealing, and contamination resistance tailored for liquid medicines and solid formulations.

Integration of Smart Packaging and Digital Labeling

Smart packaging solutions using QR codes, NFC tags, and serialization are gaining momentum in PET pharmaceutical packaging. These technologies improve supply chain transparency, enable anti-counterfeiting measures, and support regulatory compliance for track-and-trace systems. Digital labeling also enhances patient engagement by providing dosage instructions and safety information via mobile devices. This creates opportunities for pharmaceutical companies to strengthen brand trust and ensure product authenticity while meeting regulatory requirements for serialization in major markets like the U.S. and EU.

- For instance, in August 2023, India’s Central Drugs Standard Control Organisation (CDSCO) mandated GS1-compliant QR codes on the packaging of the country’s top 300 pharmaceutical brands to ensure authenticity and end-to-end traceability. Packaging companies like CCL Industries provide the necessary serialization services and digital labels for manufacturers to comply with such regulations.

Key Challenges

Fluctuating Raw Material Prices

The price volatility of PET resin impacts production costs for packaging manufacturers. Rising crude oil prices and supply chain disruptions can increase PET costs, pressuring margins for pharmaceutical companies. This challenge forces manufacturers to explore cost optimization strategies, including lightweighting and using recycled PET content. Balancing affordability with quality and regulatory compliance remains a key concern, particularly for high-volume producers in cost-sensitive markets such as generics and nutraceuticals.

Stringent Regulatory and Quality Standards

PET packaging for pharmaceuticals must comply with rigorous FDA, EMA, and ISO standards for leachability, stability, and labeling. Meeting these requirements demands extensive testing and validation, increasing development costs and time-to-market. Non-compliance can lead to product recalls, reputational damage, and financial losses. Ensuring consistent quality across global production sites and addressing serialization mandates add complexity for packaging suppliers serving multiple regions with varying regulatory expectations.

Regional Analysis

North America

North America held 37% share of the PET packaging in pharmaceutical market in 2024, driven by strong demand for prescription and OTC drugs. The U.S. leads the region with high adoption of PET bottles and vials for liquid and solid formulations due to their durability, safety, and compliance with FDA standards. Growth is supported by expanding biologics and nutraceutical production, along with rising investment in sustainable rPET solutions. Manufacturers in the region focus on lightweight designs and smart packaging integration to meet regulatory requirements and improve patient compliance, further strengthening North America’s leadership position.

Europe

Europe accounted for 31% share of the PET pharmaceutical packaging market in 2024, supported by a well-developed pharmaceutical industry and strict EMA packaging guidelines. Germany, Switzerland, and the U.K. are major contributors, driving demand for PET bottles and vials used in both generic and branded medicines. The region is prioritizing sustainability, accelerating the adoption of recyclable PET and bio-based PET materials. Growth is further fueled by increasing use of nutraceuticals, clinical trial supplies, and OTC medications. Manufacturers are investing in advanced barrier technologies and serialization-ready designs to comply with EU Falsified Medicines Directive requirements.

Asia-Pacific

Asia-Pacific captured 23% share of the PET packaging in pharmaceutical market in 2024 and is the fastest-growing region. Expansion of generic drug manufacturing in India and China is significantly boosting demand for PET bottles, jars, and vials. Rising healthcare spending, growing middle-class populations, and increasing awareness of self-medication support robust growth. Local manufacturers are investing in cost-efficient PET production lines, while global players are expanding partnerships to strengthen their regional presence. Government initiatives promoting pharmaceutical exports and sustainability programs are encouraging adoption of recyclable PET and innovative packaging formats across the region.

Latin America

Latin America held 6% share of the PET pharmaceutical packaging market in 2024, with Brazil and Mexico dominating demand. Rising consumption of OTC medicines, vitamin supplements, and syrups is driving PET bottle adoption. Investments from multinational pharmaceutical firms and contract manufacturing expansions are improving supply chain efficiency and boosting production volumes. Adoption of PET packaging is further supported by its affordability and compliance with GDP standards for drug storage and distribution. Growth opportunities lie in expanding rPET usage and introducing child-resistant and tamper-evident PET containers to meet rising safety requirements in regional markets.

Middle East & Africa

Middle East & Africa accounted for 3% share of the PET packaging in pharmaceutical market in 2024, driven by increasing pharmaceutical imports and government healthcare initiatives. GCC countries lead regional demand, supported by rising production of specialty medicines and focus on high-quality packaging. Investments in local pharmaceutical manufacturing and distribution infrastructure are driving PET bottle and vial adoption. Africa is experiencing growing demand for affordable PET containers to support vaccination programs and essential medicine distribution. Market growth is supported by the shift toward lightweight, durable packaging and expanding efforts to implement serialization and anti-counterfeiting measures.

Market Segmentations:

By Product Type

- Bottles

- Jars

- Vials

- Others (Preforms, Specialty Containers)

By Packaging Type

- Rigid PET Packaging

- Flexible PET Packaging

By Application

- Liquid Formulations (Syrups, Suspensions)

- Solid Dosage Forms (Tablets, Capsules)

- Topical Formulations (Creams, Gels, Ointments)

- Nutraceuticals and Dietary Supplements

By End-User

- Pharmaceutical Manufacturers

- Contract Manufacturing Organizations (CMOs)

- Healthcare Institutions & Retail Pharmacies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the PET packaging in pharmaceutical market is defined by major players such as GOLDMINE POLYMERS INDUSTRIES, Huhtamaki, Amcor, CCL Industries, West Pharmaceutical Services, Kamala Plastics, Gerresheimer, Sonoco, Graham Packaging, and AG Poly Packs Private Limited. These companies focus on delivering high-quality PET bottles, vials, and jars with excellent barrier properties to ensure drug safety and stability. Leading players are investing in recyclable PET (rPET) and bio-based PET solutions to meet sustainability goals and comply with global regulations. Many are adopting advanced molding technologies and automation to improve production efficiency and lower costs. Strategic partnerships with pharmaceutical manufacturers and CMOs help ensure reliable supply and timely delivery. Players are also developing smart packaging and serialization-ready designs to enhance traceability and fight counterfeiting. Continuous innovation, capacity expansion, and focus on lightweight, cost-effective solutions are key strategies driving competitiveness in this market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- GOLDMINE POLYMERS INDUSTRIES

- Huhtamaki

- Amcor

- CCL Industries

- West Pharmaceutical Services

- Kamala Plastics

- Gerresheimer

- Sonoco

- Graham Packaging

- AG Poly Packs Private Limited

Recent Developments

- In June 2025, Gerresheimer AG launched a web-based, audit-proof product database that includes documentation of its primary plastic packaging (including PET bottles) for pharma customers. This helps speed up drug registration processes.

- In January 2025, West Pharmaceutical Services introduced Daikyo PLASCAP RUV closures in a new nested format (6×8 tub configuration) compatible with 10 ml and 20 mm crown vials.

- In December 2024, Gerresheimer AG officially completed the Blitz LuxCo / Bormioli Pharma Group acquisition, strengthening its European footprint in plastic systems and solutions for pharmaceutical packaging.

- In October 2024, Gerresheimer AG introduced silicone oil-free prefillable syringe systems for ophthalmic applications, targeting very small volumes and reduced particle load in injectables.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Packaging Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for PET bottles and vials will rise with growing production of liquid and solid drugs.

- Adoption of recycled PET (rPET) and bio-based PET will increase to meet sustainability goals.

- Advanced barrier-coated PET will gain traction for biologics and sensitive formulations.

- Smart packaging with serialization and anti-counterfeiting features will see higher adoption.

- Manufacturers will invest in lightweight designs to reduce logistics costs and emissions.

- Growth of generic drug production in Asia-Pacific will boost regional PET packaging demand.

- Contract manufacturing organizations will expand PET packaging capacity to support pharma outsourcing.

- Digital printing and customization will enhance compliance labeling and brand differentiation.

- Global regulations will push higher quality standards and traceability for PET pharmaceutical packaging.

- Expansion of e-pharmacies and OTC products will drive demand for convenient, patient-friendly PET containers.

Market Insights

Market Insights