Market Overview:

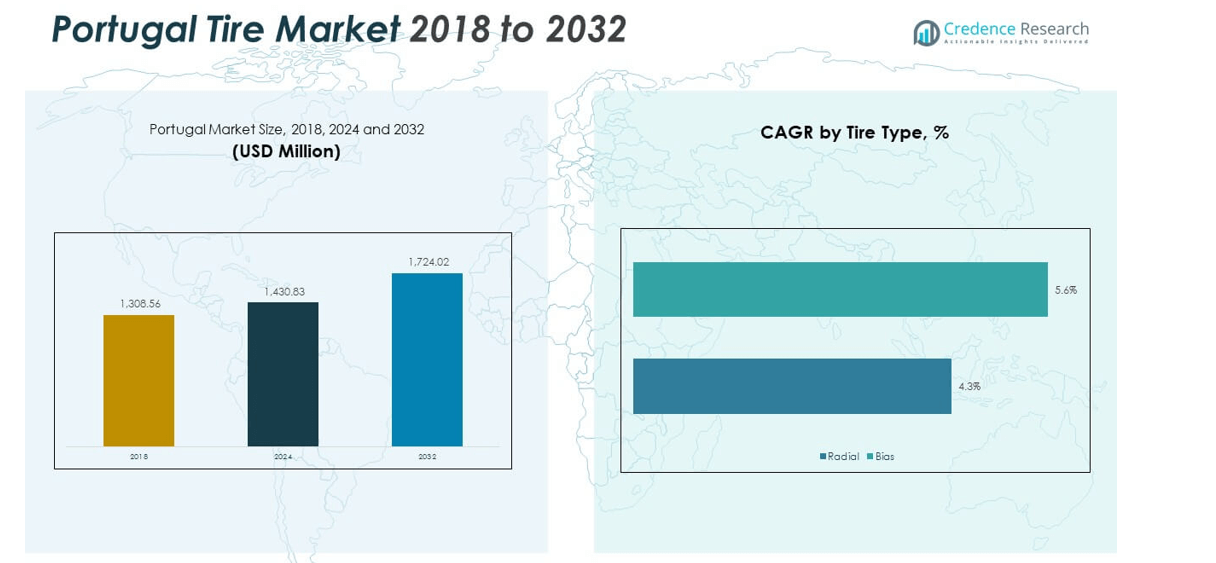

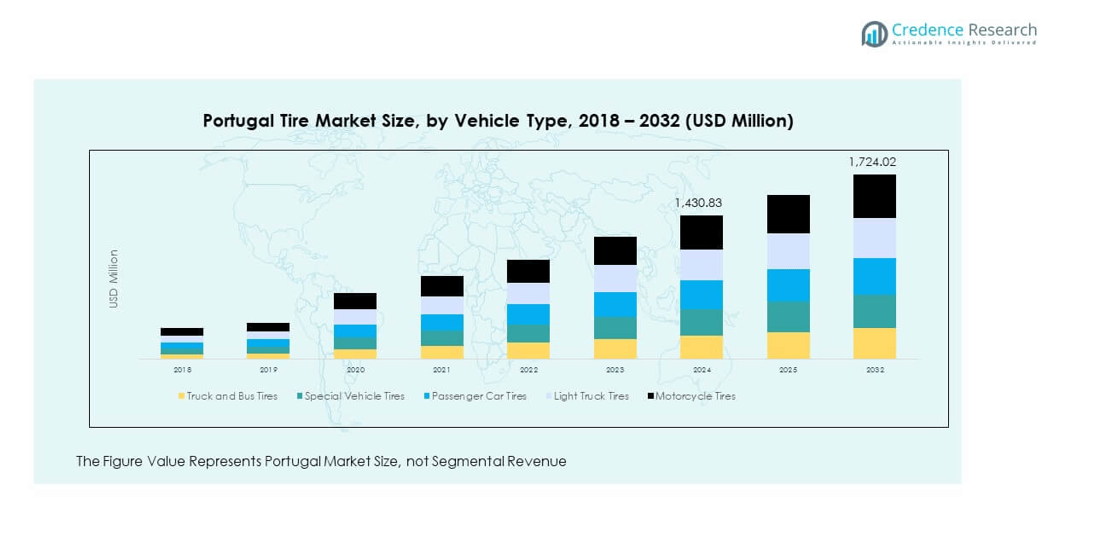

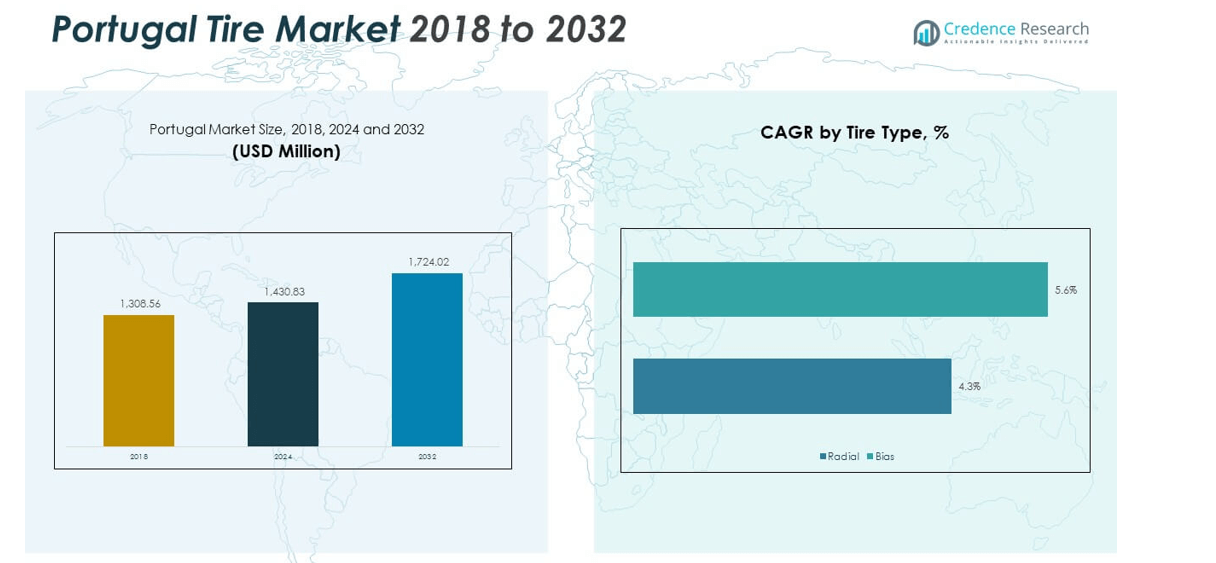

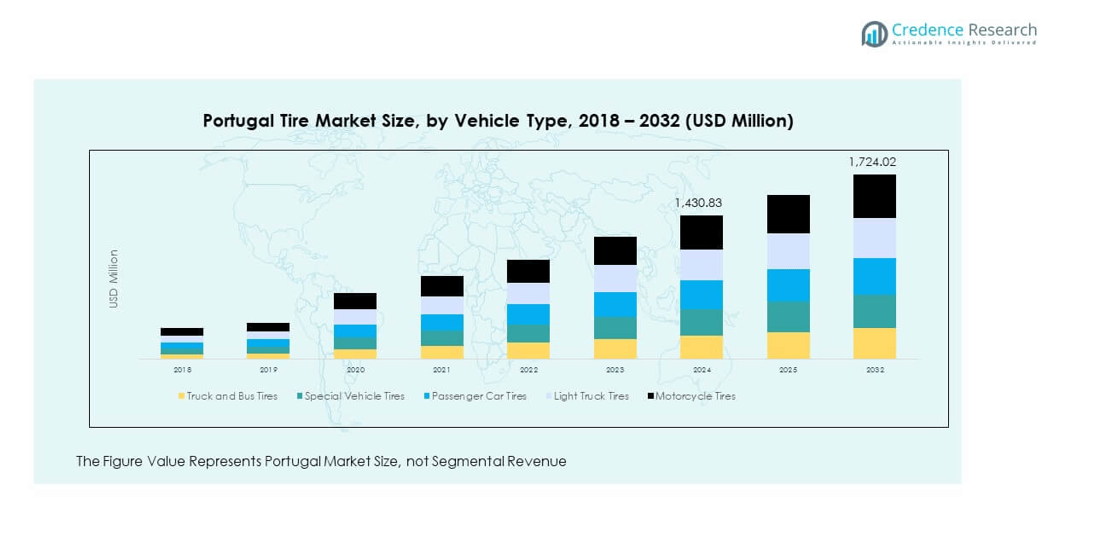

The Portugal Tire Market size was valued at USD 1,308.56 million in 2018 to USD 1,430.83 million in 2024 and is anticipated to reach USD 1,724.02 million by 2032, at a CAGR of 2.36% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Portugal Tire Market Size 2024 |

USD 1,430.83 million |

| Portugal Tire Market, CAGR |

2.36% |

| Portugal Tire Market Size 2032 |

USD 1,724.02 million |

The market is supported by increasing vehicle ownership, strong demand for replacement tires, and technological advancements in tire design. Consumers show rising preference for durable, fuel-efficient, and safe tires that meet regulatory standards. Growth in logistics and freight movement boosts demand for truck and bus tires, while expanding passenger car sales strengthen aftermarket sales. Manufacturers invest in advanced compounds, smart tire technologies, and EV-specific products, aligning with sustainability requirements. It reinforces long-term growth through continuous product innovation and adaptation to consumer trends.

Geographically, Southern Portugal holds the lead due to higher mobility needs from tourism and strong infrastructure projects. Lisbon and Algarve regions benefit from large rental fleets and premium vehicle demand, which increases adoption of high-performance tires. Northern Portugal shows steady growth with industrial and logistics hubs driving commercial tire demand. Central Portugal contributes through agricultural activities and rising passenger vehicle use in smaller cities. Islands like Madeira and Azores emerge as niche markets, supported by imports and localized distribution. It creates a balanced regional structure where both mature and developing areas sustain overall market expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Portugal Tire Market size was USD 1,308.56 million in 2018, reached USD 1,430.83 million in 2024, and is projected to grow to USD 1,724.02 million by 2032 at a CAGR of 2.36%.

- Southern Portugal leads with 38% share, supported by strong tourism, premium vehicle demand, and infrastructure expansion.

- Northern Portugal holds 34% share, driven by industrial hubs and logistics activities that strengthen commercial tire demand.

- Central Portugal accounts for 28% share, with agricultural and passenger vehicle segments supporting steady replacement tire sales.

- Passenger car tires dominate with 46% share in 2024, followed by truck and bus tires at 22%, reflecting balanced demand across consumer and commercial segments.

Market Drivers

Increasing Vehicle Ownership and Expanding Fleet Size Across Passenger and Commercial Segments

The rising number of vehicles on Portuguese roads drives consistent tire demand across multiple segments. Passenger car sales have grown due to urban mobility preferences, while commercial fleet operators expand capacity to support logistics and trade activities. The Portugal Tire Market benefits from increased replacement cycles tied to this growing vehicle base. Tire manufacturers introduce durable and fuel-efficient models that align with consumer and business requirements. Urbanization and rising disposable incomes support higher demand for personal cars, which further stimulates tire sales. Fleet operators in transport and delivery services require reliable, long-lasting tires to manage costs and efficiency. It creates sustained demand across both OEM and aftermarket channels. This dynamic supports overall market growth and long-term stability.

- For instance, in September 2024, Goodyear launched the EQMAX and EQMAX ULTRA tire series for fleets in Europe, achieving up to 20% better mileage and up to 6% improved rolling resistance over previous models, supporting fleet operators’ performance and efficiency requirements.

Government Regulations Supporting Road Safety Standards and Tire Quality Measures

The government enforces strict tire standards to ensure road safety, which boosts the need for certified products. Inspections across vehicle categories encourage replacement of worn tires, driving higher aftermarket sales. The Portugal Tire Market sees stronger adoption of advanced tire types designed to meet regulatory compliance. Manufacturers develop innovative products that fulfill European Union safety directives and environmental regulations. This alignment ensures competitive advantage for brands offering eco-friendly, high-performance solutions. Stricter emission rules push automakers and consumers toward energy-efficient tires. Consumers respond positively to awareness campaigns on safety and performance. It creates a market environment where regulation directly supports steady demand for premium tire offerings.

Technological Advancements Promoting Tire Durability, Fuel Efficiency, and Specialized Solutions

Tire technology evolves with innovations that improve performance, durability, and sustainability across passenger and commercial categories. Smart tire systems capable of monitoring pressure and temperature are gaining popularity in urban mobility and logistics. The Portugal Tire Market adopts advanced compounds that reduce rolling resistance and enhance fuel economy. Research focuses on long-lasting treads to reduce maintenance costs for both individuals and fleet operators. Automakers collaborate with tire producers to design EV-specific tires with noise reduction and stronger grip. Companies emphasize performance solutions for highways, urban roads, and off-road applications. It reinforces consumer confidence in advanced tire options that deliver value and reliability. This innovation-led approach ensures steady expansion of demand.

- For instance, as of January 2025, Continental’s ContiConnect 2.0 digital tire management system enables commercial fleet operators in Europe to continuously monitor tire pressure and temperature in real time, reducing tire-related breakdowns and costly maintenance while helping maximize vehicle uptime and optimize fuel savings.

Growth in E-Commerce Platforms Enhancing Tire Accessibility and Distribution Efficiency

The expansion of online platforms transforms the way customers purchase replacement tires in Portugal. Consumers prefer online channels offering transparent pricing, quick delivery, and access to a wide product range. The Portugal Tire Market benefits from rising confidence in digital purchasing of high-value products. Retailers adopt digital tools like virtual fitment guides and secure payment systems to improve user experience. Small distributors and tire workshops also leverage digital platforms to extend their reach. Direct-to-consumer sales models gain traction and increase market competition. It creates a more efficient distribution structure that benefits both buyers and suppliers. This shift in retail strategy strengthens adoption across younger, tech-driven customer segments.

Market Trends

Shift Toward Electric Vehicles Driving Demand for Specialized Tire Development

The transition toward electric vehicles (EVs) is reshaping tire design priorities across Portugal. EV adoption accelerates demand for low-noise, high-grip tires that support energy efficiency. The Portugal Tire Market experiences growth in EV-compatible solutions tailored to unique performance requirements. Manufacturers invest in advanced materials to handle higher torque and battery loads. Tire makers collaborate with automakers to integrate safety and durability features. Dedicated EV tire lines are launched to provide optimized mileage and noise reduction. It expands opportunities for premium offerings and strengthens competitive positioning. This growing focus ensures EV-related tire development becomes a long-term trend.

Rising Consumer Preference for Sustainable and Environmentally Friendly Tire Options

Eco-conscious purchasing behavior drives demand for tires made with recyclable and bio-based materials. Sustainability initiatives align with EU directives on waste reduction and carbon neutrality. The Portugal Tire Market gains from manufacturers adopting circular economy principles in production. Brands highlight green certifications to capture the loyalty of environmentally aware consumers. Low rolling resistance tires reduce fuel consumption and attract strong adoption across passenger vehicles. Innovative recycling technologies improve recovery of raw materials from end-of-life tires. It establishes sustainability as a clear trend influencing both supply and demand. This environmental shift reshapes strategies across product innovation and marketing.

Smart Tire Technology Adoption in Both Passenger Cars and Commercial Fleets

Digital transformation enables smart tire solutions with sensors tracking pressure, temperature, and wear conditions. Fleet managers integrate these systems to enhance efficiency and reduce operational risks. The Portugal Tire Market adapts by offering connected products that complement IoT platforms in mobility services. Passenger car drivers benefit from real-time data, improving safety and fuel efficiency. Manufacturers embed predictive maintenance features into smart tire solutions. Data-driven insights strengthen partnerships with automotive and logistics industries. It reflects growing acceptance of technology-enabled products as part of the mobility ecosystem. This trend enhances customer trust and strengthens aftermarket services.

- For example, Bridgestone’s Fleet Care, showcased at IAA 2024, integrates Webfleet telematics with tire management to deliver real-time insights such as tire pressure and predictive maintenance, enhancing fleet efficiency and road safety across Europe.

Expansion of Premium Tire Segment Catering to Performance-Oriented Consumer Preferences

Consumers increasingly invest in premium tire categories that offer advanced handling and driving comfort. Luxury vehicle sales drive this shift, supported by rising disposable incomes. The Portugal Tire Market expands with premium tire brands emphasizing innovation and brand image. High-performance variants with enhanced grip, noise control, and durability capture attention. Automakers collaborate with tire manufacturers to design exclusive OE tires for premium models. Consumers associate premium brands with safety, longevity, and advanced design. It elevates competition and motivates companies to differentiate through innovation. This premiumization trend positions advanced tire solutions as a growth driver in consumer markets.

- For instance, in March 2025, Pirelli launched the fifth-generation P Zero tire, rated “A” for wet grip in the EU label, with optimized tread and contact patch for improved handling and reduced braking distances, directly targeting the high-performance and luxury automotive market across Europe, including Portugal.

Market Challenges Analysis

Price Sensitivity and Strong Competition Among Domestic and International Tire Brands

Consumers in Portugal remain highly price-conscious, which limits rapid adoption of premium tires. Local distributors and retailers often compete on pricing rather than differentiation. The Portugal Tire Market faces strong competition from both global brands and regional producers. Companies focus on cost-effective production to meet market expectations while balancing profitability. Price-sensitive buyers often prefer budget-friendly options, delaying penetration of advanced tires. It creates challenges for premium manufacturers aiming to scale in mass markets. Marketing strategies must adapt to highlight value rather than luxury. This competitive environment keeps pressure on margins and strategic positioning.

Supply Chain Dependence and Volatility in Raw Material Costs Affecting Market Stability

The sector depends heavily on imports of rubber and advanced tire materials from global suppliers. Price fluctuations in raw materials directly impact manufacturing costs and profitability. The Portugal Tire Market faces risks from disruptions in shipping and logistics networks. Geopolitical tensions and trade restrictions increase uncertainty for sourcing strategies. Manufacturers invest in alternative supply networks, but challenges remain in securing long-term stability. It creates barriers for consistent pricing and reliable availability. Smaller distributors face difficulties managing inventory under volatile conditions. These supply chain challenges demand adaptive planning and localized strategies for resilience.

Market Opportunities

Rising EV Adoption and Government Incentives Creating Growth Avenues for Tire Innovation

The push toward electrification brings clear opportunities for tire companies to design new solutions. EV growth in Portugal accelerates demand for low-resistance, quiet, and high-grip products. The Portugal Tire Market benefits from supportive policies that encourage EV adoption. Manufacturers that introduce EV-specific tires gain first-mover advantages. Research into lightweight materials enhances performance and range optimization. It creates opportunities for premium offerings aligned with sustainability goals. The growing EV base strengthens long-term demand for advanced tire types. This trend encourages companies to diversify product portfolios and expand partnerships.

E-Commerce Expansion and Aftermarket Services Generating New Customer Touchpoints and Revenue

Digital retail channels present significant opportunities for tire producers and distributors across Portugal. Online sales platforms provide cost efficiency, broader reach, and data-driven insights. The Portugal Tire Market leverages digital growth to create stronger customer connections. Value-added services such as doorstep delivery and mobile fitment strengthen loyalty. Workshops expand partnerships with e-commerce platforms to scale operations. It fosters a competitive ecosystem centered on convenience and customer engagement. This opportunity highlights the importance of digital transformation in aftermarket strategies. Companies focusing on online sales and services unlock new revenue streams.

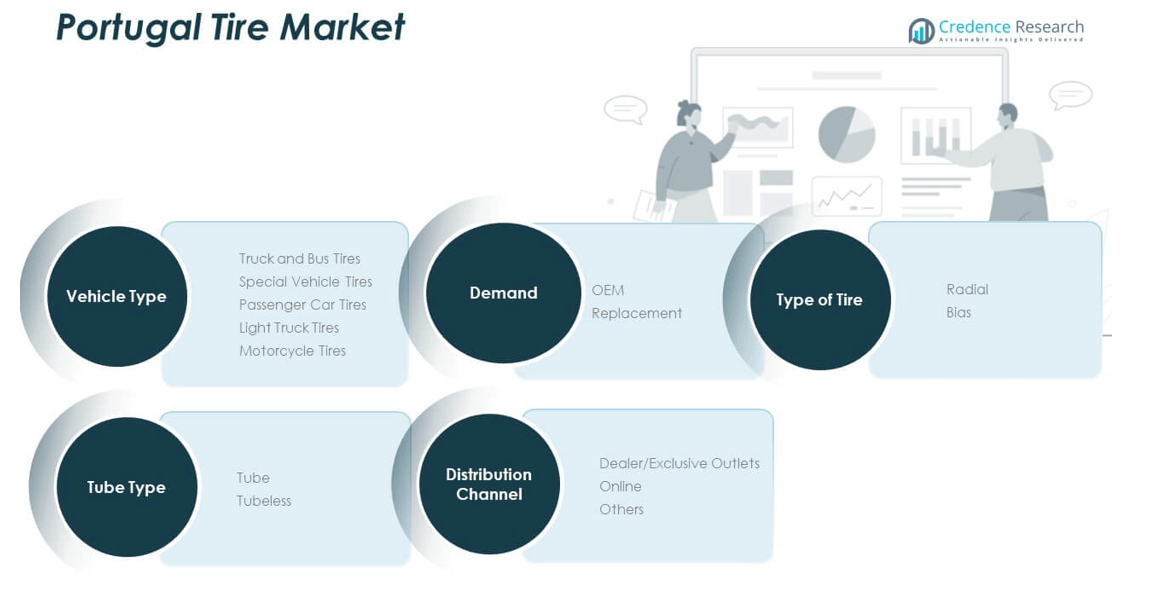

Market Segmentation Analysis

By vehicle type, passenger car tires hold the dominant share supported by rising ownership in urban regions. Truck and bus tires also account for steady demand driven by logistics and freight expansion. Light truck tires record consistent growth in rural and semi-urban mobility. Motorcycle tires maintain relevance in two-wheeler transportation, while special vehicle tires cater to niche industrial and agricultural activities. The Portugal Tire Market gains balance from this wide demand base across vehicle classes.

By demand, the replacement segment leads due to recurring tire wear and strong aftermarket presence. OEM demand remains stable with new vehicle sales but contributes less compared to replacements.

By type of tires, radial tires dominate for their durability and efficiency, while bias tires retain usage in limited heavy-duty operations. It demonstrates a clear preference toward advanced tire technology for both passenger and commercial fleets.

By tube type, tubeless tires command larger share due to their safety, durability, and ease of maintenance. Tube tires remain relevant in cost-sensitive and older vehicle categories.

- For instance, Apollo Tyres confirmed the European launch of its new Vredestein Ultrac Pro ultra-high-performance summer tire for 18–24 inch rims in Spring 2024, engineered with advanced structure and materials through a state-of-the-art virtual prototyping platform, and real-world testing is underway to optimize tubeless safety and comfort features.

By distribution channel, dealer and exclusive outlets remain the largest contributors due to trust and accessibility. Online channels gain traction, offering price transparency and convenience for younger consumers. Other channels, including independent workshops, maintain strong ties with local buyers. It creates a competitive distribution structure that strengthens the overall market.

- For instance, Goodyear expanded its direct online tyre sales platform across Europe in 2024, aligning with broader industry consensus that e-commerce remains the fastest growing distribution channel in the tyre sector. The company emphasizes enhancing customer experience and integrating digital sales networks to support performance and reach.

Segmentation

By Vehicle Type

- Truck and Bus Tires

- Special Vehicle Tires

- Passenger Car Tires

- Light Truck Tires

- Motorcycle Tires

By Demand

- OEM (Original Equipment Manufacturer)

- Replacement

By Type of Tires

By Tube Type

By Distribution Channel

- Dealer/Exclusive Outlets

- Online

- Others

Regional Analysis

Northern Portugal

Northern Portugal holds 34% share of the market, driven by industrial hubs and strong logistics activity. Porto and Braga act as economic centers that increase commercial vehicle demand. The Portugal Tire Market benefits from fleet operators requiring frequent tire replacement to support manufacturing and distribution. Passenger car ownership also grows steadily in urban areas, creating strong aftermarket sales. Road networks across the region expand, fueling demand for durable and fuel-efficient tires. It strengthens opportunities for both premium and mid-range tire segments, ensuring balanced growth.

Central Portugal

Central Portugal accounts for 28% share, supported by agricultural activities and growing passenger mobility. Coimbra and surrounding cities show rising adoption of private vehicles, which increases demand for radial and tubeless tires. The Portugal Tire Market expands in this region due to small transport businesses seeking reliable commercial vehicle tires. Replacement cycles drive most sales, while OEM demand remains consistent with stable car registrations. Local distributors focus on budget-friendly options to serve cost-conscious buyers. It keeps the region competitive in both aftermarket and new tire sales.

Southern Portugal and Islands

Southern Portugal, including Lisbon, Algarve, and Madeira, contributes 38% share, making it the leading subregion. Tourism growth in Lisbon and Algarve increases rental car fleets, driving replacement tire demand. The Portugal Tire Market strengthens here through premium tire adoption in luxury cars and high-performance vehicles. Strong infrastructure projects expand the need for truck and bus tires in construction logistics. Islands like Madeira and Azores rely on imports, which pushes local distributors to manage supply chains efficiently. It positions the south as both the largest and most dynamic contributor to market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Portugal Tire Market features strong competition among global leaders and established regional players. Key companies include Michelin, Bridgestone, Continental, Goodyear Dunlop, Pirelli, Yokohama, Toyo, Nokian, and Kumho. These players emphasize technology, product innovation, and distribution strength to maintain market share. Michelin and Bridgestone lead with premium offerings, while Continental focuses on safety-driven designs. Pirelli positions itself in the performance and luxury segment, targeting high-end vehicles across southern regions. It highlights competition centered on innovation and differentiation. The aftermarket holds significant weight in shaping competitive dynamics, pushing players to expand dealer networks and strengthen online sales platforms. Global brands rely on brand loyalty and premium positioning, while regional distributors target value-conscious consumers with cost-effective models. The Portugal Tire Market continues to see partnerships with automotive manufacturers to capture OEM demand. Companies also pursue mergers, acquisitions, and regional expansions to increase market presence. Strategic moves such as launching EV-compatible tires and introducing smart tire solutions define future competition.

Recent Developments

- In September 2024, Bridgestone EMEA entered a strategic partnership with Grupo BB&G and Versalis to establish a closed-loop ecosystem at a new production unit in Fatima, Portugal, enabling the recycling of end-of-life tires into new products using advanced pyrolysis technology, with the first batch of recycled tires slated for early 2025.

- In May 2025, Goodyear completed the sale of its Dunlop brand rights for Europe to Sumitomo Rubber Industries and implemented a transition agreement under which Goodyear will continue to manufacture, distribute, and sell Dunlop consumer tires in Europe including Portugal through December 2025, ensuring stable service and product availability during this phase.

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Demand, Type of Tires, Tube Type and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Portugal Tire Market will witness steady growth supported by increasing replacement demand across all vehicle categories.

- Expanding adoption of electric vehicles will drive innovation in tire designs optimized for efficiency and noise reduction.

- Strong regulatory frameworks in road safety and sustainability will shape product development priorities.

- Premium tire demand will grow, fueled by rising disposable incomes and a focus on high-performance vehicles.

- Online sales channels will expand further, enhancing accessibility and competitive pricing in the aftermarket.

- Tire technology will evolve with smart monitoring features integrated into both passenger and commercial segments.

- Regional supply chain improvements will strengthen availability, reducing import-related cost pressures.

- Partnerships between automakers and tire producers will accelerate OEM demand across luxury and mid-range vehicles.

- Southern Portugal will continue leading market share, driven by tourism-related mobility and infrastructure projects.

- Competition will intensify as global and regional players introduce differentiated solutions targeting varied consumer needs.