Market Overview:

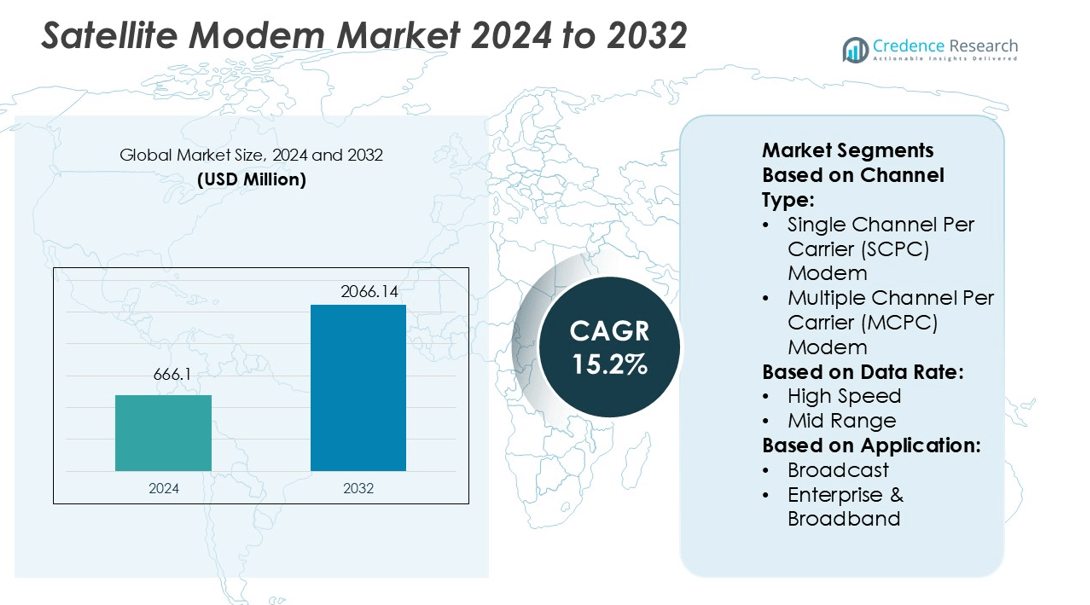

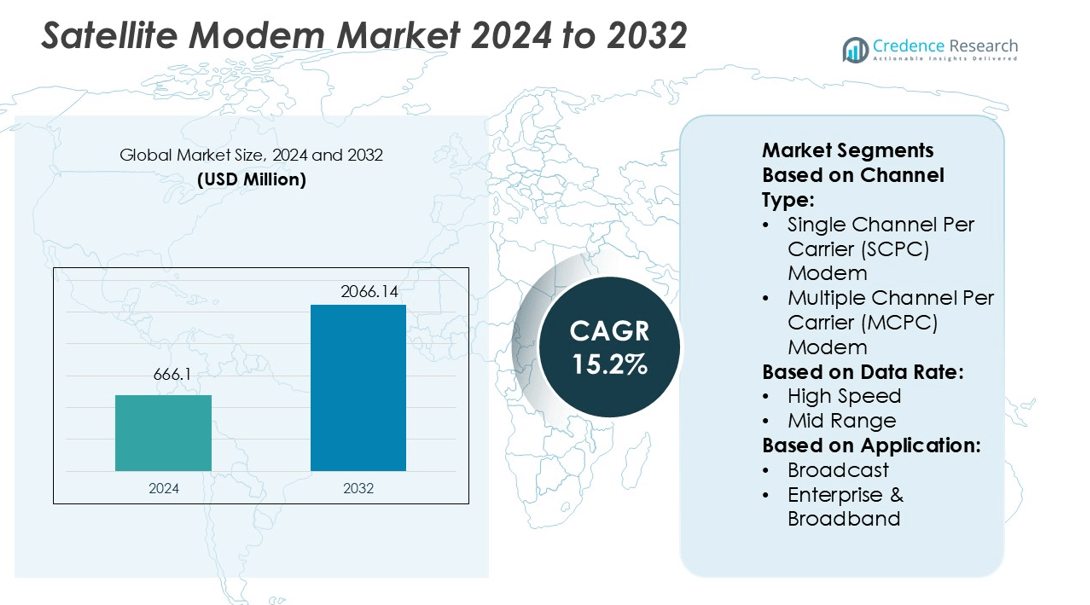

Satellite Modem Market size was valued USD 666.1 million in 2024 and is anticipated to reach USD 2066.14 million by 2032, at a CAGR of 15.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Satellite Modem Market Size 2024 |

USD 666.1 million |

| Satellite Modem Market, CAGR |

15.2% |

| Satellite Modem Market Size 2032 |

USD 2066.14 million |

The satellite modem market is driven by leading players such as NOVELSAT, ORBCOMM Inc., Hughes Network Systems, Datum Systems, SatixFy, Gilat Satellite Networks Ltd., AYECKA Ltd., ND SATCOM, Amplus Communication, and Comtech Telecommunications Corp. These companies focus on delivering high-performance modems that support advanced applications including enterprise broadband, broadcasting, in-flight connectivity, and maritime communication. Product innovations aligned with high-throughput satellites (HTS) and low Earth orbit (LEO) constellations strengthen their competitive position. North America emerges as the leading region with a 38% market share in 2024, supported by strong adoption across defense, aviation, and enterprise sectors.

Market Insights

- The Satellite Modem Market size was valued at USD 666.1 million in 2024 and is projected to reach USD 2066.14 million by 2032, registering a CAGR of 15.2% during the forecast period.

- Growing demand for high-speed connectivity in defense, aviation, maritime, and enterprise broadband drives market expansion, supported by innovations in secure and bandwidth-efficient communication.

- Integration with high-throughput satellites (HTS) and low Earth orbit (LEO) constellations is a key trend, enabling enhanced data capacity, reduced latency, and expanded applications across industries.

- High costs of deployment and competition from terrestrial and 5G networks act as major restraints, limiting adoption in price-sensitive regions despite strong connectivity benefits.

- North America leads the market with 38% share, followed by Europe at 27% and Asia Pacific at 22%, while enterprise broadband applications account for 30% share, making it the dominant segment in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Channel Type

The Single Channel Per Carrier (SCPC) modem segment dominates the satellite modem market with over 55% share in 2024. Its leadership comes from high reliability, dedicated bandwidth, and low latency performance, which are crucial for applications like defense, enterprise networks, and broadcast services. Demand for SCPC modems continues to rise with the growing need for uninterrupted, secure, and mission-critical communication. MCPC modems, while cost-effective for shared bandwidth scenarios, lag behind due to limitations in handling large data-intensive applications compared to SCPC solutions.

- For instance, NOVELSAT’s NS3000 professional modem supports data rates ranging from 100 Kbps to 850 Mbps, integrates DVB-S2X technology with efficiency gains of up to 40% in satellite spectrum use, and features built-in AES-256 encryption for secure transmissions.

By Data Rate

High-speed modems hold the largest share, capturing 48% of the market in 2024. Their dominance stems from increasing demand for real-time video streaming, enterprise broadband, and in-flight connectivity. Organizations and service providers prefer high-speed solutions to support data-heavy applications with consistent quality of service. Mid-range modems serve smaller enterprises and regional broadcasters, while entry-level models cater to basic communication needs. However, the surge in video-based services, telemedicine, and remote learning ensures that high-speed modems remain the most adopted choice across multiple industries.

- For instance, ORBCOMM’s ST 6100 satellite modem is engineered for industrial IoT and maritime connectivity, providing reliable, two-way messaging for tracking and monitoring fixed and mobile assets in remote areas.

By Application

Enterprise & broadband applications lead the market, representing 30% of the share in 2024. Enterprises rely on satellite modems to extend connectivity in remote and underserved regions, supporting critical functions like cloud access and secure data transfer. The broadcast segment also accounts for significant adoption due to increasing content distribution demands. In-flight connectivity is rapidly expanding, driven by rising air travel and passenger expectations for seamless internet. Meanwhile, offshore communication and tracking applications gain traction in maritime and logistics, though they remain smaller segments compared to enterprise broadband.

Market Overview

Rising Demand for High-Speed Connectivity

The increasing demand for high-speed and reliable connectivity is a primary growth driver for the satellite modem market. Industries such as aviation, maritime, defense, and energy require uninterrupted broadband services in remote locations. High-definition video streaming, cloud-based enterprise applications, and remote healthcare further boost demand. Satellite modems enable secure, low-latency data transmission, meeting critical communication needs where terrestrial networks are absent. This growing reliance on high-speed connectivity accelerates the adoption of advanced satellite modems worldwide.

- For instance, Hughes Network Systems’ JUPITER System hardware upgrades enabling throughputs exceeding 300 Mbps on the latest terminals, designed to meet the demands of enterprise, mobility, and cellular backhaul applications.

Expansion of Defense and Government Applications

Defense and government sectors significantly drive the satellite modem market due to rising requirements for secure, mission-critical communication. Military operations rely on satellite modems to ensure real-time data sharing, command, and surveillance in areas lacking terrestrial infrastructure. Governments invest heavily in modernizing communication systems to enhance national security and disaster management. The demand for resilient and encrypted satellite communication solutions continues to grow, ensuring stable revenue streams from public sector and defense contracts.

- For instance, Datum Systems’ M7LT modem is a configurable satellite modem that supports data rates up to 350 Mbps using DVB-S2X technology. It is designed to operate with low processing latency and offers a variety of configurations for applications requiring high spectral efficiency.

Growing Adoption of In-Flight and Maritime Connectivity

The aviation and maritime industries are increasingly adopting satellite modems to meet rising connectivity expectations. Airlines invest in in-flight broadband solutions to enhance passenger experience, while shipping operators use satellite systems for navigation, safety, and crew welfare. Growing international trade and global air travel further expand this demand. Satellite modems support seamless, high-bandwidth communication in these sectors, ensuring efficient operations. This adoption is further encouraged by technological advancements and partnerships between satellite operators and service providers.

Key Trends & Opportunities

Integration with High-Throughput Satellites (HTS)

A major trend in the satellite modem market is the integration with high-throughput satellites (HTS). HTS offers higher bandwidth capacity and efficiency, reducing cost per bit and enhancing service delivery. This integration allows satellite modems to support data-intensive applications like 4K broadcasting, telemedicine, and enterprise cloud services. Vendors are focusing on designing modems compatible with HTS networks to capitalize on the growing demand for high-capacity communication solutions.

- For instance, SatixFy’s SX-3000 modem chip supports high throughput rates and is capable of dynamic beam hopping, enabling efficient resource allocation in High-Throughput Satellite (HTS) systems.

Emergence of IoT and Remote Monitoring Applications

The growth of the Internet of Things (IoT) presents new opportunities for satellite modems. Industries such as oil & gas, logistics, and agriculture are increasingly deploying IoT-based remote monitoring and control systems. Satellite modems provide connectivity in regions lacking terrestrial infrastructure, ensuring continuous monitoring of critical assets. This trend creates a new market segment where lightweight, energy-efficient, and cost-effective modems gain adoption, fueling innovation and expansion.

- For instance, AYECKA’s SR1 satellite receiver supports DVB-S2 with downstream throughput up to 150 Mbps, enabling applications such as high-speed data casting and content delivery for meteorological services like EUMETCast and NOAAPORT.

Key Challenges

High Cost of Deployment and Maintenance

The high cost associated with satellite communication systems remains a major challenge. Satellite modem deployment requires significant investment in ground infrastructure, installation, and ongoing maintenance. For many enterprises and governments, especially in emerging economies, these expenses limit adoption. The high upfront cost compared to terrestrial alternatives creates entry barriers, slowing market penetration in price-sensitive regions despite the long-term benefits of satellite connectivity.

Competition from Terrestrial and 5G Networks

The rapid expansion of terrestrial broadband and 5G networks poses a competitive challenge for the satellite modem market. These technologies offer lower latency and cost advantages in urban and semi-urban areas, reducing the reliance on satellite solutions. As telecom operators aggressively expand 5G coverage, satellite modem providers face pressure to differentiate through unique offerings. To remain competitive, they must focus on niche markets like aviation, maritime, and remote regions where terrestrial options are limited.

Regional Analysis

North America

North America leads the satellite modem market with 38% share in 2024. The region benefits from strong adoption across defense, aerospace, and enterprise communication sectors. Government programs, such as military modernization and space exploration projects, drive consistent demand. Airlines increasingly deploy satellite-based in-flight connectivity, boosting commercial adoption. Large investments in broadband access for rural and underserved areas further strengthen market expansion. The presence of leading technology providers, along with advanced satellite infrastructure, positions North America as the dominant region. Continued focus on secure and high-capacity communication ensures sustained growth over the forecast period.

Europe

Europe holds 27% share in the satellite modem market in 2024, supported by strong uptake in enterprise broadband, broadcasting, and maritime communication. Leading aerospace and defense programs across France, Germany, and the UK fuel market growth. The European Union’s investments in digital inclusion projects and satellite constellations further enhance adoption. Rising demand for seamless connectivity in aviation and offshore industries also boosts modem deployments. Companies in Europe focus on innovations in bandwidth efficiency and HTS integration. These developments reinforce the region’s strong position in global satellite communication infrastructure and ensure steady market expansion through 2032.

Asia Pacific

Asia Pacific accounts for 22% share in the satellite modem market in 2024, emerging as the fastest-growing region. Expanding aviation, maritime, and telecom industries drive significant adoption. Countries such as China, India, and Japan invest heavily in space programs and broadband expansion to rural areas. The increasing use of in-flight connectivity and enterprise broadband strengthens regional demand. Growing trade and offshore activities add momentum to maritime applications. Rising government initiatives for digital infrastructure and rapid technology adoption make Asia Pacific a key growth engine, with strong prospects for surpassing Europe in the coming years.

Latin America

Latin America represents 7% share of the satellite modem market in 2024, with growth driven by increasing broadband penetration in remote and rural areas. Countries like Brazil and Mexico lead adoption, supported by government-backed initiatives to bridge the digital divide. The maritime and energy sectors in offshore oil and gas operations add further demand for satellite connectivity. Growing use of enterprise broadband solutions and broadcast services strengthens market growth. While infrastructure investment remains limited compared to other regions, rising reliance on satellite networks in underserved areas ensures steady expansion of the modem market in Latin America.

Middle East & Africa

The Middle East & Africa hold 6% share in the satellite modem market in 2024, supported by growing adoption in defense, oil and gas, and offshore communication. Countries such as Saudi Arabia, UAE, and South Africa are major contributors. The region’s reliance on satellite connectivity for rural and desert areas drives demand for modems. Increasing use in enterprise broadband and government-led projects to improve digital access further contribute to growth. Despite infrastructure and cost challenges, strong investments in energy, aviation, and defense communication ensure steady expansion of the satellite modem market in this region.

Market Segmentations:

By Channel Type:

- Single Channel Per Carrier (SCPC) Modem

- Multiple Channel Per Carrier (MCPC) Modem

By Data Rate:

By Application:

- Broadcast

- Enterprise & Broadband

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The satellite modem market features strong competition among key players such as NOVELSAT, ORBCOMM Inc., Hughes Network Systems, Datum Systems, SatixFy, Gilat Satellite Networks Ltd., AYECKA Ltd., ND SATCOM, Amplus Communication, and Comtech Telecommunications Corp. The satellite modem market is highly competitive, shaped by rapid technological advancements and evolving customer requirements. Companies compete by developing high-speed, bandwidth-efficient, and secure communication solutions to serve diverse applications such as enterprise broadband, broadcasting, in-flight connectivity, and maritime communication. Innovation in compatibility with high-throughput satellites (HTS) and low Earth orbit (LEO) constellations remains a central focus, enabling service providers to deliver enhanced performance at lower costs. Market players also invest in expanding global reach, forming strategic partnerships, and targeting specialized sectors like IoT, defense, and remote monitoring. This competitive environment drives continuous product development, positioning technology differentiation and scalability as critical success factors in sustaining market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- NOVELSAT

- ORBCOMM Inc.

- Hughes Network Systems

- Datum Systems

- SatixFy

- Gilat Satellite Networks Ltd.

- AYECKA Ltd.

- ND SATCOM

- Amplus Communication

- Comtech Telecommunications Corp.

Recent Developments

- In July 2025, Digital Communications Commission (DCC), which is the apex decision-making body in telecommunications. The recommendations of the Telecom Regulatory Authority of India (TRAI) will be reviewed, and the rules for the satellite communication (Satcom) services will be finalized in this meeting.

- In July 2025, Israel’s new national communications satellite, Dror-1, was successfully launched into space early Sunday morning from Elon Musk’s SpaceX With the use of SpaceX Falcon 9 two-stage rocket, the satellite was carried into orbit.

- In December 2024, Airbus and CNES successfully launched the TELEO optical link, which provides high-speed data transmission (10Gbps) between the Badr-8 geostationary satellite and ground stations. The launch highlights the potential of satellite laser communication to provide high-capacity, secure, and interference-resistant connectivity.

- In June 2024, Transcelestial and Axiom Space collaborated to develop advanced space laser communications in Southeast Asia, focusing on optical intersatellite links and space-based cloud infrastructure. This collaboration is aiming to develop joint demonstrations, share technical expertise, and align government agencies, revolutionizing space communications for commercial, civil, and defense sectors, with a focus on orbital data centers and secure connectivity

Report Coverage

The research report offers an in-depth analysis based on Channel Type, Data Rate, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see stronger adoption of high-throughput satellite compatible modems.

- Integration with low Earth orbit constellations will drive demand for advanced solutions.

- Enterprise broadband will remain the leading application segment for modem deployment.

- In-flight connectivity adoption will continue to expand with rising air passenger traffic.

- Maritime communication will witness steady growth supported by global trade expansion.

- IoT-driven applications will create opportunities for lightweight and energy-efficient modem designs.

- Defense and government sectors will invest in secure, encrypted satellite communication systems.

- Cost optimization will push innovation in compact and bandwidth-efficient modem technologies.

- Emerging markets in Asia Pacific and Latin America will accelerate adoption in rural areas.

- Strategic collaborations between operators and technology vendors will shape future market growth.