Market Overview

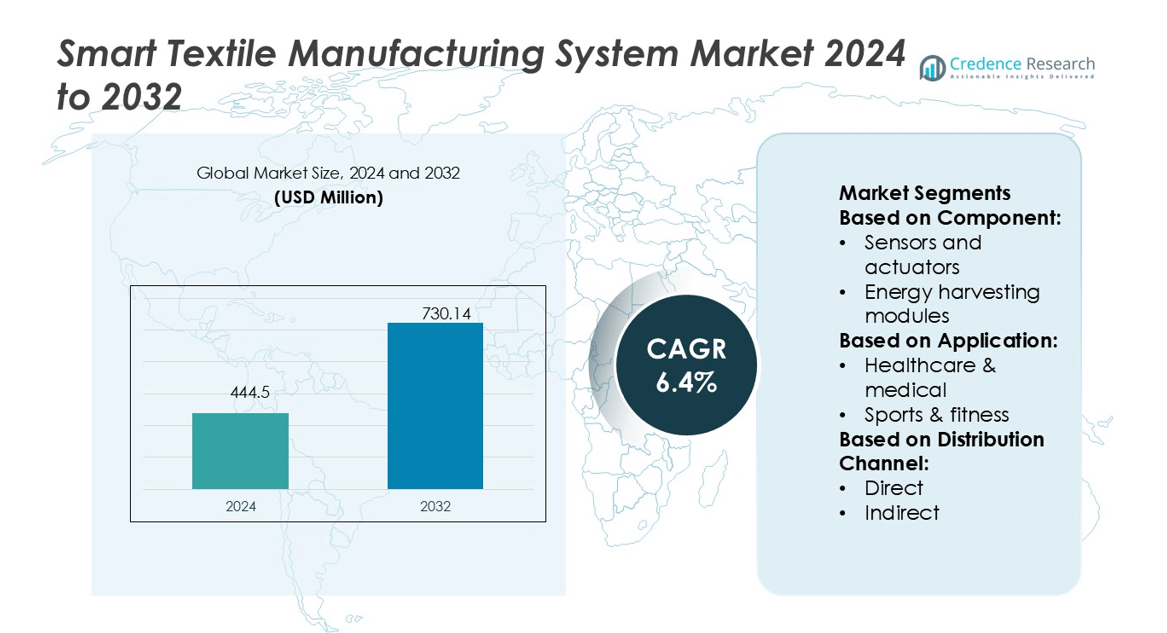

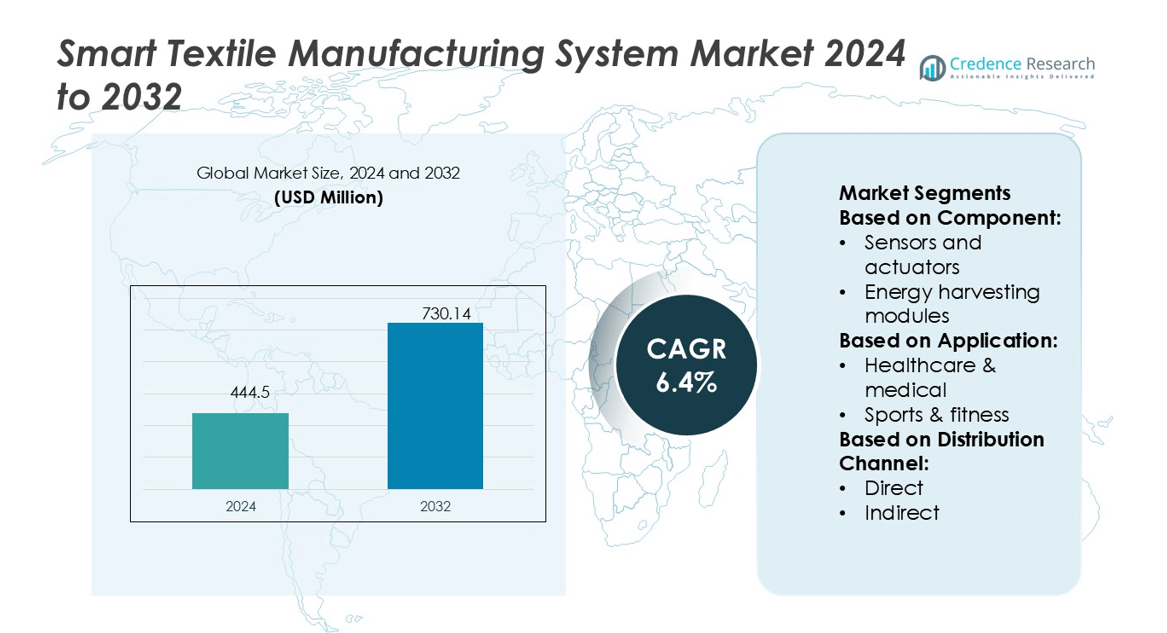

Smart Textile Manufacturing System Market size was valued USD 444.5 million in 2024 and is anticipated to reach USD 730.14 million by 2032, at a CAGR of 6.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Textile Manufacturing System Market Size 2024 |

USD 444.5 million |

| Smart Textile Manufacturing System Market, CAGR |

6.4% |

| Smart Textile Manufacturing System Market Size 2032 |

USD 730.14 million |

The Smart Textile Manufacturing System Market is characterized by strong competition among players such as Karl Mayer Group, Interactive Wear AG, AiQ Smart Clothing Inc., LECTRA, Gentherm Incorporated, Loomia, BRM, aitex, Dupont De Nemours Inc., and Embro. These companies emphasize innovations in sensors, connectivity modules, and energy-harvesting fabrics to expand adoption across healthcare, defense, automotive, and sports applications. North America leads the global market with a 36% share in 2024, supported by advanced R&D, strong consumer demand, and government-backed initiatives in healthcare and defense modernization. This leadership underscores the region’s role as a hub for innovation and large-scale adoption.

Market Insights

- The Smart Textile Manufacturing System Market was valued at USD 444.5 million in 2024 and will reach USD 730.14 million by 2032, growing at a CAGR of 6.4%.

- Market growth is driven by rising demand for wearable healthcare solutions, advanced defense applications, and increasing adoption in sports and fitness apparel.

- Trends highlight growing use of IoT-enabled fabrics, sustainable energy-harvesting modules, and expanding adoption in fashion and entertainment sectors.

- Competition is intense with players like Karl Mayer Group, Interactive Wear AG, AiQ Smart Clothing Inc., LECTRA, Gentherm Incorporated, Loomia, BRM, aitex, Dupont De Nemours Inc., and Embro focusing on innovation, though high production costs remain a key restraint.

- North America leads with a 36% share in 2024, followed by Europe at 29% and Asia-Pacific at 24%, while healthcare holds the largest application share, supported by strong adoption of patient monitoring and remote healthcare solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

In the Smart Textile Manufacturing System Market, sensors and actuators hold the dominant share. Their widespread use stems from their ability to monitor physiological parameters, detect movement, and provide responsive outputs in textiles. High adoption in healthcare and sports wearables drives growth, supported by advancements in miniaturization and accuracy. Energy harvesting modules, microcontrollers, and connectivity modules add complementary value, but sensors remain the critical foundation. The rising integration of IoT-enabled fabrics further strengthens demand, as these components allow textiles to deliver real-time, actionable data.

- For instance, Karl Mayer Group develops advanced 3D warp knitting machines that can be integrated with sensor yarns, enabling data collection for sports garments. This allows for the precise measurement of biomechanical data.

By Application

Healthcare and medical applications lead the market with the largest share, driven by demand for continuous patient monitoring and chronic disease management. Smart textiles with embedded biosensors are increasingly adopted in remote care and hospital settings to improve diagnostic accuracy. The sports and fitness segment follows, fueled by consumer interest in performance-tracking apparel. Military, defense, and industrial safety applications are also expanding as textile systems enhance situational awareness and protective functions. Healthcare dominance is underpinned by government focus on digital health solutions and growing acceptance of wearable medical devices.

- For instance, Aclara won a major contract to supply 3.9 million smart meters to utilities serving parts of New York City, Westchester, and Orange & Rockland Counties, using its AclaraConnect™ RF network for two-way communications and remote outage detection.

By Distribution Channel

Direct distribution channels dominate the market, holding the largest share due to strong collaborations between manufacturers and end-users across healthcare, defense, and industrial sectors. These channels enable tailored product integration, better after-sales support, and cost efficiency in bulk orders. Indirect channels, including retailers and online platforms, are growing in importance, particularly for fashion and fitness applications. However, direct partnerships remain the preferred route for critical use cases requiring customization and technical assurance. The dominance of direct channels reflects the need for reliability and specialized solutions in professional applications.

Key Growth Drivers

Rising Demand for Wearable Healthcare Solutions

The growing adoption of smart textiles in healthcare is a major driver. These fabrics integrate sensors to monitor vital signs such as heart rate, respiration, and body temperature. They support chronic disease management, early diagnosis, and personalized treatment. Increasing demand for remote patient monitoring and home-based care accelerates adoption. Hospitals and healthcare providers prefer textile-based solutions for comfort and accuracy. As digital health ecosystems expand, smart textiles strengthen their position as reliable, non-invasive monitoring tools, boosting innovation and market growth.

- For instance, Virga Fashion cutter, which is an automatic single-ply fabric cutter by Lectra, achieves up to 120 meters per minute (m/min) in cutting speed, with blades lasting an average of 35 km of use.

Advancements in IoT and Connectivity Technologies

Integration of IoT, Bluetooth, Wi-Fi, and NFC has transformed smart textiles into connected ecosystems. These technologies enable real-time data transfer and enhance performance in applications like sports, defense, and healthcare. High bandwidth and low-latency connectivity improve functionality, making wearables more reliable and scalable. Manufacturers leverage IoT-enabled platforms for predictive analytics and continuous monitoring. This integration also opens new revenue models through data-driven services. With increasing 5G adoption, IoT-enabled smart textiles gain stronger efficiency, supporting wider applications and fueling global market expansion.

- For instance, Itron’s Meter Integration Services have a proven track record, having been used for integrating over 40 million smart meters from more than 10 vendors and across 50 meter types.

Increasing Military and Defense Applications

Defense organizations are investing in smart textiles to enhance soldier performance and safety. Fabrics embedded with sensors and actuators monitor physical strain, hydration levels, and environmental hazards. Advanced textile systems also enable adaptive camouflage and communication support. Governments prioritize defense modernization, pushing adoption of such technologies. The reliability of smart textiles in extreme conditions further strengthens demand. Military projects and funded R&D collaborations with manufacturers are expanding scope, ensuring consistent demand from defense sectors and positioning the segment as a high-value growth driver.

Key Trends & Opportunities

Sustainability and Energy Harvesting

The industry is witnessing a shift toward sustainable smart textiles integrated with energy harvesting modules. Solar fabrics and kinetic energy systems provide self-powering capabilities, reducing reliance on external batteries. This supports long-term usage in outdoor, military, and healthcare environments. Manufacturers are investing in eco-friendly production processes using biodegradable materials. With rising regulatory focus on sustainability, energy-efficient and recyclable textiles present strong opportunities. These advancements not only cut operational costs but also appeal to environmentally conscious consumers, strengthening adoption across multiple industries.

- For instance, CHINT introduced a new DLMS GCP-compliant meter (CHS320) in collaboration with Itron, embedding Gen5 NIC connectivity and supporting multi-vendor interoperability across 40 million meters globally.

Expansion into Sports and Fitness Market

Smart textiles are increasingly penetrating the sports and fitness sector, where demand for performance-tracking apparel continues to grow. Products with embedded sensors measure biometrics like oxygen levels, posture, and movement efficiency. Athletes and fitness enthusiasts adopt these solutions for personalized training and injury prevention. Consumer preference for wearable technology drives collaborations between textile companies and sports brands. The expansion of connected fitness ecosystems creates new growth opportunities. As disposable incomes rise, sports-focused smart textiles are becoming mainstream, fueling broader market acceptance.

- For instance, ABB supports integration with over 300 third-party brands across smart meters, inverters, EV chargers, and energy storage devices.

Fashion and Entertainment Innovation

Fashion and entertainment industries are adopting smart textiles for interactive and aesthetic applications. Fabrics with integrated LEDs, responsive color changes, and haptic feedback enhance consumer experiences. Designers leverage these innovations to deliver immersive clothing lines, stage costumes, and event solutions. Entertainment companies view smart textiles as tools for differentiation and audience engagement. Growth in experiential fashion shows and digital integration opens new business avenues. This trend creates opportunities for cross-industry collaborations, expanding the role of smart textiles beyond functional uses into lifestyle markets.

Key Challenges

High Manufacturing and Integration Costs

Smart textile manufacturing involves advanced sensors, microcontrollers, and connectivity modules, which significantly increase production costs. Specialized processes and materials raise investment requirements for both startups and established firms. High costs limit large-scale adoption, particularly in price-sensitive markets like consumer fashion. Integration challenges, such as durability during washing or wear, add to expenses. The need for continuous R&D further strains resources. Unless costs are reduced through economies of scale or material innovation, affordability remains a barrier to widespread adoption.

Regulatory and Standardization Barriers

The lack of unified regulations and standards poses challenges for global adoption of smart textiles. Variations in safety certifications, connectivity compliance, and data privacy laws slow cross-border trade and commercialization. For healthcare applications, compliance with medical device standards increases complexity. The absence of standardized testing for durability and performance also raises buyer uncertainty. Manufacturers face delays in approvals and added costs for regional customization. Establishing global frameworks for safety, interoperability, and performance validation is critical to overcoming these hurdles and ensuring sustainable growth.

Regional Analysis

North America

North America holds the largest share in the Smart Textile Manufacturing System Market, accounting for 36% in 2024. The region’s dominance is driven by strong adoption in healthcare, military, and sports sectors. The U.S. leads with extensive R&D investments and collaborations between tech firms and textile manufacturers. Government initiatives supporting defense modernization and digital health further accelerate deployment. Wearable adoption in consumer fitness also boosts growth. Canada contributes with innovations in sustainable textiles and medical applications. High purchasing power, advanced infrastructure, and a strong innovation ecosystem ensure the region maintains leadership throughout the forecast period.

Europe

Europe represents 29% of the market share in 2024, supported by established fashion, sports, and healthcare industries. Countries such as Germany, France, and the U.K. lead adoption with strong demand for high-performance textiles. The region benefits from active collaborations between universities, research institutions, and manufacturers. Regulations promoting sustainability foster growth in energy-harvesting and eco-friendly fabrics. Military and defense investments in smart uniforms further contribute to adoption. Sports brands in Europe actively integrate biometric monitoring apparel, reinforcing regional strength. Growing consumer demand for innovative lifestyle products ensures steady expansion of smart textile applications across multiple sectors.

Asia-Pacific

Asia-Pacific accounts for 24% of the market share in 2024 and is the fastest-growing region. Rapid industrialization, rising disposable incomes, and large-scale textile production drive adoption. China, Japan, and South Korea lead innovation with investments in IoT-enabled fabrics and wearable technologies. Healthcare adoption is rising due to growing demand for remote monitoring solutions in aging populations. Strong government support for smart manufacturing accelerates growth. Fashion and consumer electronics markets also play a vital role. Expanding export capacity and technology-driven manufacturing ensure Asia-Pacific continues to capture a larger share in the global smart textile ecosystem.

Latin America

Latin America holds a 6% share of the Smart Textile Manufacturing System Market in 2024, with gradual adoption across healthcare and sports. Brazil leads regional growth due to its advanced textile industry and rising consumer interest in fitness technologies. Demand is increasing for smart uniforms and safety gear in industrial and occupational sectors. Limited infrastructure and high costs slow adoption, but partnerships with global players are expanding reach. Growing awareness of wearable healthcare applications presents opportunities for wider usage. While still emerging, the region demonstrates potential for stronger adoption over the forecast period.

Middle East & Africa

The Middle East & Africa region accounts for 5% of the market share in 2024, representing the smallest but steadily expanding segment. Growth is driven by rising investments in healthcare infrastructure and defense modernization programs. Countries such as the UAE and Saudi Arabia are early adopters, leveraging smart textiles in military and industrial safety applications. Africa shows growing potential with increasing interest in wearable healthcare solutions. However, high costs and limited manufacturing capabilities pose challenges. Strategic collaborations with international players and government-backed digitalization initiatives are expected to improve adoption across key applications in coming years.

Market Segmentations:

By Component:

- Sensors and actuators

- Energy harvesting modules

By Application:

- Healthcare & medical

- Sports & fitness

By Distribution Channel:

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The Smart Textile Manufacturing System Market features strong competition among leading players including Karl Mayer Group, Interactive Wear AG, AiQ Smart Clothing Inc., LECTRA, Gentherm Incorporated, Loomia, BRM, aitex, Dupont De Nemours Inc., and Embro. The Smart Textile Manufacturing System Market is highly competitive, driven by rapid technological innovation and expanding application areas. Companies focus on integrating sensors, energy modules, and connectivity platforms to deliver advanced functionalities in healthcare, defense, sports, and fashion. Investments in automation, sustainable materials, and IoT-enabled fabrics strengthen product performance and broaden adoption. The market also sees rising collaborations between textile manufacturers, technology providers, and research institutes to accelerate innovation and meet regulatory standards. Continuous R&D, along with growing demand for wearable solutions, ensures a dynamic landscape where product differentiation and innovation remain critical for competitive advantage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In December 2024, the Canadian Space Agency (CSA) awarded Hexoskin, based in Montreal, Canada, a contract to develop and adapt its astroskin smart garments for medical research in the upcoming space station that will orbit the moon.

- In November 2024, Myant Corporation, a Canadian company based in Toronto, announced the acquisition of Swiss firms Nanoleq and Osmotex, marking a strategic move to strengthen its position in the smart textiles and wearable technology markets.

- In November 2024, the acquisition of Nanoleq by Myant was finalized, with the goal of advancing preventive healthcare solutions through smart textiles that can monitor and improve health outcomes in real time.

- In March 2024, PYKRS, a Spanish startup, launched the PYKRS X-TREME Parka, a smart jacket designed for urban commuters, cyclists, and motorcyclists. This includes innovative features which can be controlled by mobile app or remote

Report Coverage

The research report offers an in-depth analysis based on Component, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising adoption of healthcare monitoring textiles.

- Sports and fitness wearables will see stronger demand for performance-tracking applications.

- Defense investments will boost demand for advanced smart uniforms and protective gear.

- Energy harvesting fabrics will gain popularity for self-sustaining power solutions.

- Fashion and entertainment sectors will increasingly adopt interactive textile technologies.

- IoT-enabled connectivity will drive real-time data usage in multiple applications.

- Sustainable and recyclable textiles will attract consumer and regulatory preference.

- Industrial safety adoption will rise with smart uniforms and hazard monitoring systems.

- Automotive applications will grow with integration of heating and sensing textiles.

- Strategic partnerships will accelerate innovation and expand global manufacturing capacity.