Market Overview:

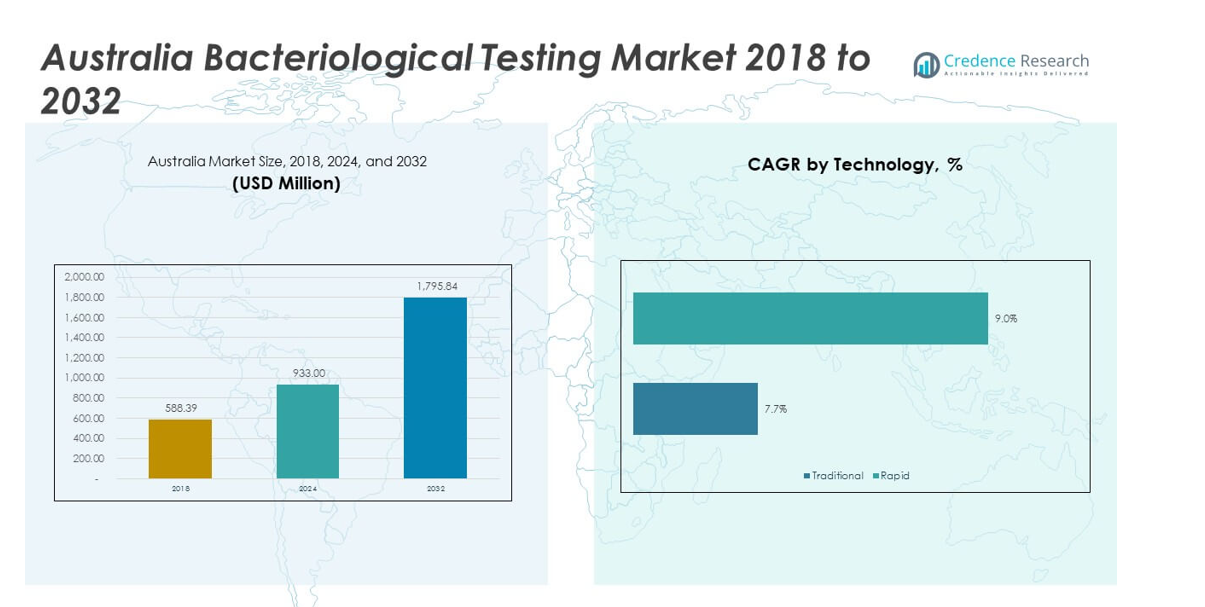

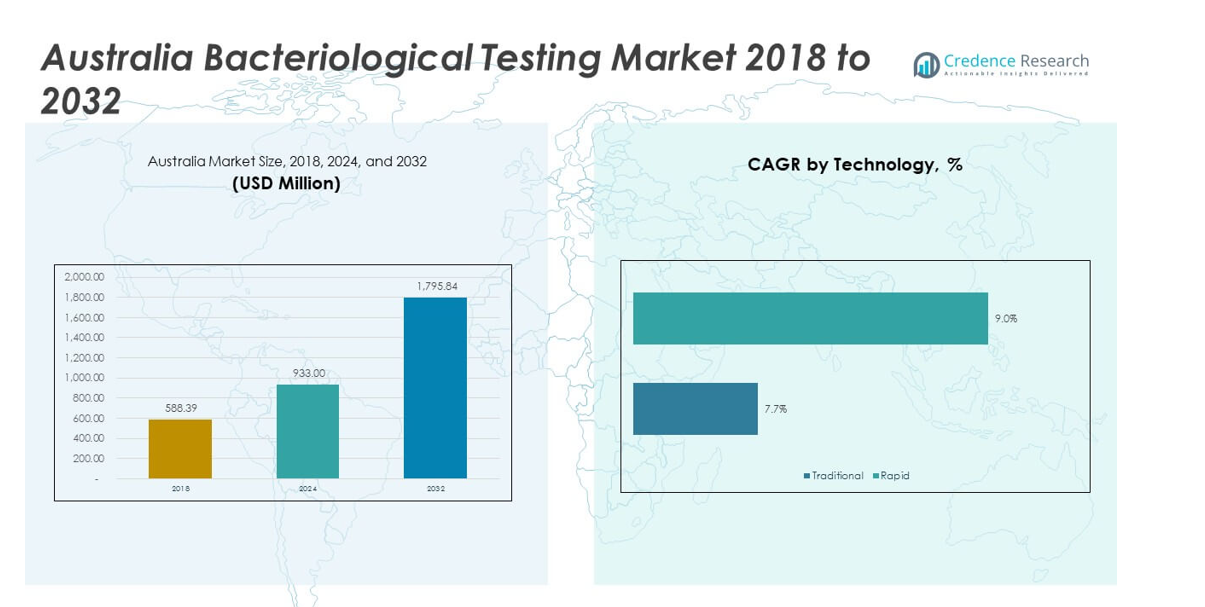

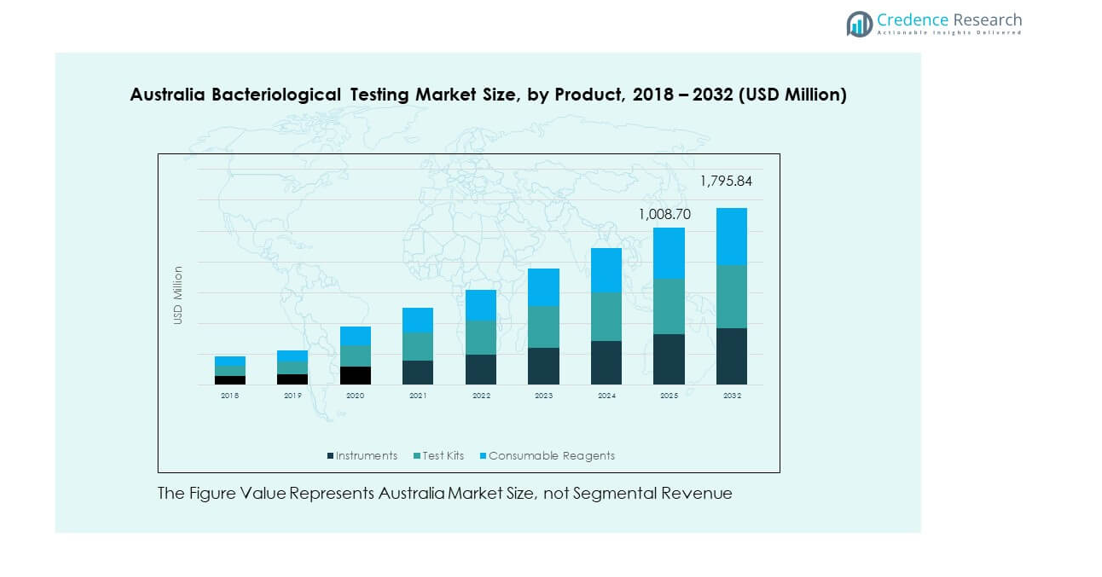

The Australia Bacteriological Testing Market size was valued at USD 588.39 million in 2018, reached USD 933 million in 2024, and is anticipated to reach USD 1,795.84 million by 2032, growing at a CAGR of 8.53% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Bacteriological Testing Market Size 2024 |

USD 933 million |

| Australia Bacteriological Testing Market, CAGR |

8.53% |

| Australia Bacteriological Testing Market Size 2032 |

USD 1,795.84 million |

The market growth is driven by increasing concerns about food safety, water quality, and public health regulations. Rising instances of foodborne illnesses and contamination incidents encourage strict compliance with testing standards across the food and beverage sector. Growing demand from industries such as pharmaceuticals, dairy, packaged food, and environmental monitoring further supports expansion. Advancements in testing technologies that provide faster results with greater accuracy are strengthening adoption across laboratories, government agencies, and industrial users. Strong awareness campaigns and mandatory testing policies also create sustained momentum for the market.

Regionally, growth in Australia’s bacteriological testing market is concentrated in major urban hubs such as Sydney, Melbourne, and Brisbane, where industrial clusters and advanced healthcare systems are well established. These regions lead due to high regulatory enforcement, infrastructure, and the presence of large-scale food processing units. Emerging demand is observed in semi-urban and rural areas, driven by expanding agricultural exports, rising dairy output, and growing emphasis on water quality monitoring. Together, this urban-rural balance ensures that market penetration widens, supported by strong government oversight and growing industry responsibility for quality assurance.

Market Insights:

- The Australia Bacteriological Testing Market was valued at USD 588.39 million in 2018, reached USD 933 million in 2024, and is expected to hit USD 1,795.84 million by 2032, growing at a CAGR of 8.53%.

- Eastern Australia (42%), Western Australia (28%), and Southern Australia (18%) dominate due to strong food exports, healthcare infrastructure, and established laboratory networks.

- Northern Australia (12%) is the fastest-growing region, supported by water quality testing and rising agricultural output.

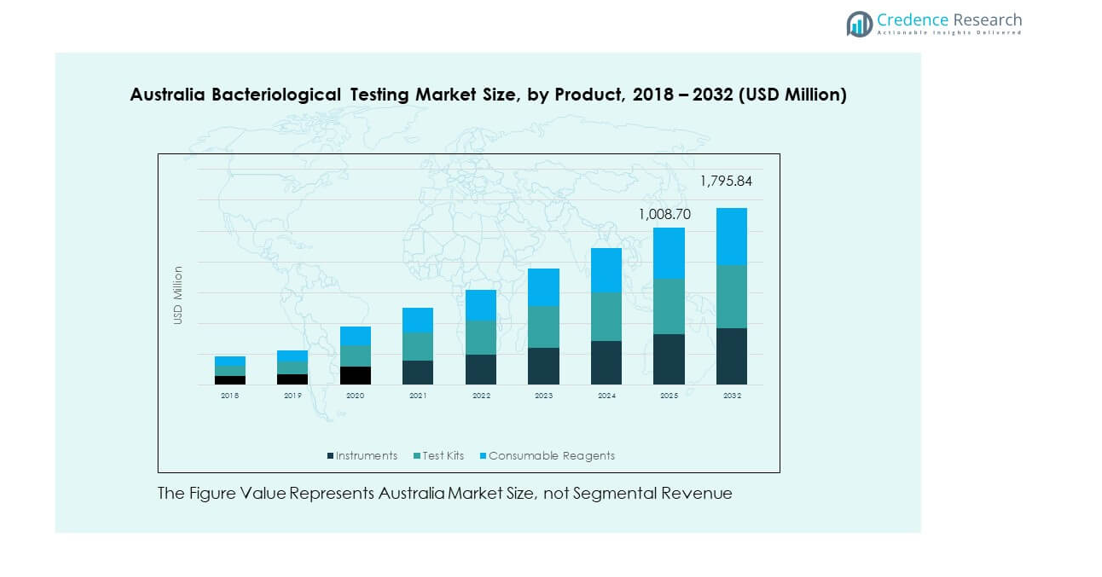

- By product, Instruments hold around 38% share in 2024, driven by demand in laboratories and large-scale facilities.

- Test kits and consumable reagents together account for 62% share, supported by recurring use in routine testing across food, water, and pharmaceutical industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Stringent Food Safety Regulations Driving Bacteriological Testing Demand

The Australia Bacteriological Testing Market benefits from strict government policies that emphasize food safety and hygiene standards. Authorities mandate testing for pathogens in meat, dairy, and packaged foods to protect consumers from contamination. It encourages manufacturers to adopt comprehensive bacteriological testing across their operations. The food export sector, especially meat and dairy products, requires compliance with global standards, pushing demand further. Testing supports transparency and boosts brand reliability for local producers. The market gains steady growth momentum from frequent updates to regulatory frameworks. It positions bacteriological testing as a critical requirement in the Australian food ecosystem.

- For instance, Thermo Fisher Scientific’s SureTect Salmonella Species PCR Assay has achieved AOAC-OMA validation for testing up to 375 grams of raw ground beef per sample, enabling laboratories to detect Salmonella across a broad range of food matrices and helping companies meet both local and international safety standards.

Growing Incidence of Foodborne Illnesses and Rising Public Health Concerns

Increasing foodborne illness cases drive heightened awareness among consumers and regulatory bodies. Rising bacterial contamination events create pressure on industries to maintain strict monitoring practices. Foodborne pathogens such as Salmonella, E. coli, and Listeria remain critical risks that require timely detection. The Australia Bacteriological Testing Market reflects this urgency with expanding use of rapid detection methods. Hospitals and laboratories record higher demand for reliable bacteriological testing services. Public awareness campaigns strengthen consumer demand for safe food products. Stronger enforcement of quality checks ensures companies comply with mandatory safety measures. The market demonstrates resilience by prioritizing health outcomes through comprehensive testing approaches.

- For instance, Bio-Rad Laboratories’ Droplet Digital PCR technology has demonstrated the ability to quantify absolute numbers of pathogens—detecting as few as single digits of target bacteria per microliter—supporting hospitals and laboratories across Australia in rapid screening of Salmonella, Legionella, and other critical bacteria to enhance public health outcomes.

Technological Advancements Enhancing Efficiency and Accuracy of Tests

Innovations in bacteriological testing enhance speed, reliability, and affordability for industries and laboratories. Automated systems and molecular diagnostics provide faster results compared to conventional culture methods. The Australia Bacteriological Testing Market leverages these improvements to support high-volume testing with minimal errors. Adoption of advanced diagnostic kits ensures cost efficiency for industries operating under strict timelines. Enhanced sensitivity of testing platforms allows earlier detection of contamination risks. Such technological progress drives higher acceptance across food and beverage sectors. The pharmaceutical industry also benefits from accurate testing for raw materials and final products. It strengthens industry-wide reliance on next-generation bacteriological testing systems.

Expanding Industrial Base Supporting Growth of Testing Services Across Sectors

Multiple industries, including pharmaceuticals, beverages, cosmetics, and water treatment, increasingly integrate bacteriological testing practices. Rising demand from these end-user sectors expands the market beyond traditional food safety applications. The Australia Bacteriological Testing Market experiences strong support from water quality monitoring initiatives. Industrial growth amplifies the need for sustainable solutions and routine testing protocols. Increasing pharmaceutical production volumes create further reliance on bacteriological testing to maintain compliance with international standards. Cosmetics and personal care sectors adopt microbiological testing to guarantee consumer safety. The diversity of applications broadens the market’s scope and secures future expansion. It highlights the role of bacteriological testing as a cross-sector requirement in Australia.

Market Trends:

Integration of Digital Platforms and Data Analytics in Testing Processes

The market observes a shift toward digitalized solutions for sample management and reporting. Companies adopt data analytics to enhance precision in monitoring contamination risks. The Australia Bacteriological Testing Market incorporates digital tracking for improved traceability across supply chains. Laboratories benefit from automated data management that reduces manual errors. Digital platforms also support real-time reporting of test results. Industries integrate these systems to streamline compliance with regulatory authorities. Adoption of digital solutions enhances transparency between producers and regulators. It reflects a growing preference for technology-enabled bacteriological testing practices.

- For instance, Agilent Technologies has formalized instrument control partnerships and integrated its OpenLAB software with multiple chromatography hardware systems, enabling real-time management of analysis for hundreds of food and water samples daily and reducing manual data entry errors across large-scale food manufacturing operations.

Expansion of Rapid and Portable Testing Kits for On-Site Applications

The growing need for fast results drives adoption of portable bacteriological testing kits. Industries prefer these kits for immediate detection in food processing plants and agricultural fields. The Australia Bacteriological Testing Market highlights strong demand for solutions that minimize downtime. Portable devices reduce delays linked to laboratory processing. Rapid testing kits provide flexibility for small and medium enterprises. They allow industries to conduct in-house tests and respond to contamination quickly. Increased portability fosters wider adoption among water treatment facilities and remote locations. It accelerates the market shift toward convenience and efficiency.

- For instance, Bactiquick has developed a handheld device for real-time water testing that can detect a broad range of bacteria, including coliand Salmonella, in just 15 minutes. This technology allows individuals, communities, and water quality regulators to test water sources like rivers, coastal waters, and swimming pools in the field.

Rising Focus on Sustainable Testing Solutions Across Industries

Sustainability goals push industries toward eco-friendly bacteriological testing practices. Laboratories adopt energy-efficient equipment and reduce water consumption during testing. The Australia Bacteriological Testing Market adapts by embracing methods that align with corporate sustainability targets. Companies invest in greener alternatives that lower operational impact. Environmental monitoring initiatives encourage industries to evaluate ecological safety through bacteriological testing. Industries view sustainable practices as both a compliance measure and a branding advantage. The emphasis on environmental responsibility supports innovation in testing solutions. It reinforces a long-term trend of aligning microbiological testing with sustainability objectives.

Growing Collaboration Between Industry and Academic Research Bodies

Collaboration fosters knowledge sharing and innovation in testing technologies. Research institutions partner with industries to develop advanced diagnostic tools. The Australia Bacteriological Testing Market benefits from joint ventures that accelerate commercialization of novel methods. Universities contribute to pilot projects that refine testing accuracy and speed. Partnerships also strengthen workforce training in bacteriological testing procedures. Academic inputs enrich testing protocols with scientific advancements. Industries gain access to new solutions while researchers secure real-world application opportunities. It enhances the overall innovation ecosystem supporting bacteriological testing in Australia.

Market Challenges Analysis:

High Costs of Advanced Testing Methods Limiting Broad Adoption

The Australia Bacteriological Testing Market faces challenges due to expensive equipment and advanced diagnostic kits. Small and medium-sized enterprises struggle to afford high-end solutions. Testing costs increase overall production expenses for food and pharmaceutical industries. Limited budgets restrict adoption in rural or smaller facilities. Laboratories require significant capital investment for automation and molecular technologies. High cost barriers also slow innovation adoption across emerging sectors. It creates a gap between large corporations and small businesses in compliance. The industry must address affordability issues to ensure uniform adoption of modern testing systems.

Complex Regulatory Frameworks and Lack of Standardization in Procedures

Testing industries face difficulties in navigating multiple regulatory requirements. Lack of standardized protocols leads to inconsistencies in results across laboratories. The Australia Bacteriological Testing Market reflects these disparities in quality assurance outcomes. Variations in testing methodologies create challenges for exporters meeting international standards. Smaller companies often lack resources to adapt to evolving regulatory landscapes. Confusion around accreditation further complicates market compliance. Industries require harmonized procedures for smoother integration of bacteriological testing practices. It underlines the need for stronger alignment between domestic and international frameworks.

Market Opportunities:

Rising Export Potential of Food Products Boosting Testing Requirements

Australia’s strong role as a global food exporter generates opportunities for bacteriological testing providers. Meat, dairy, and processed food exports demand strict compliance with international safety standards. The Australia Bacteriological Testing Market benefits from this demand through increased testing volumes. Export-driven growth strengthens laboratory infrastructure across key regions. Producers invest in advanced technologies to gain competitive advantage in global trade. Rising demand from international markets supports broader industry expansion. It positions bacteriological testing as a critical enabler of Australia’s food export credibility.

Adoption of Innovative Testing Technologies Offering New Revenue Streams

Technological advancements open opportunities for expansion into untapped applications. Companies introduce faster and more cost-effective diagnostic solutions. The Australia Bacteriological Testing Market capitalizes on innovation to serve diverse sectors. Emerging technologies create opportunities for industries such as water treatment and cosmetics. Rapid adoption of portable devices expands service accessibility for small enterprises. Research-driven solutions strengthen trust among global buyers of Australian products. It establishes testing as a profitable avenue for technology developers and service providers.

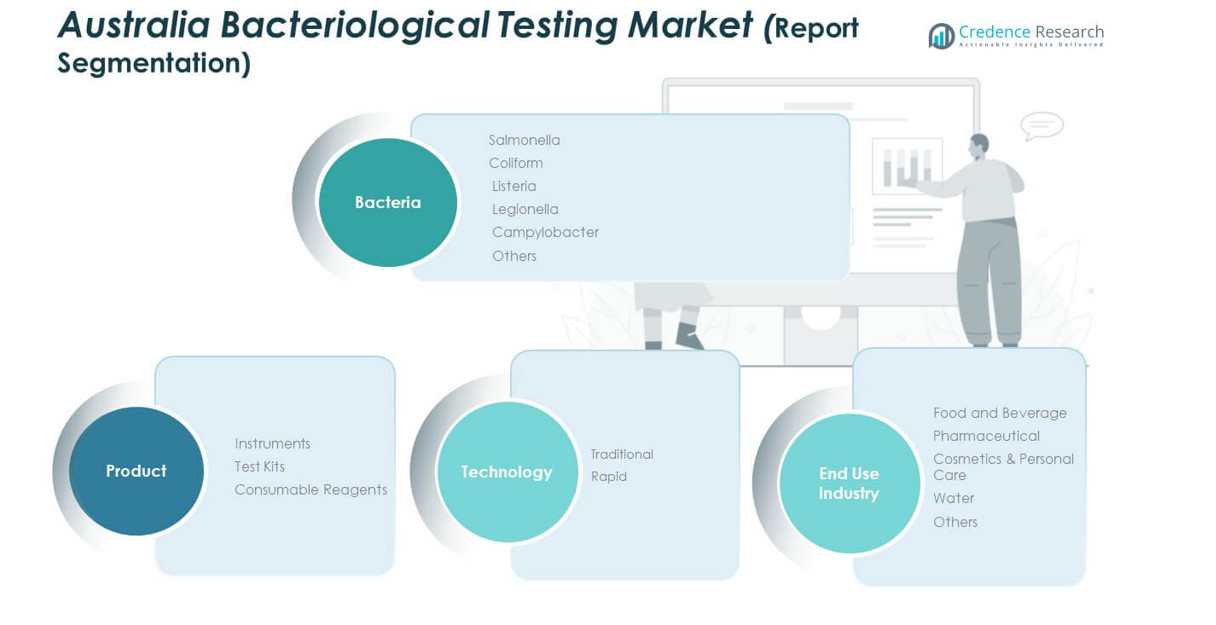

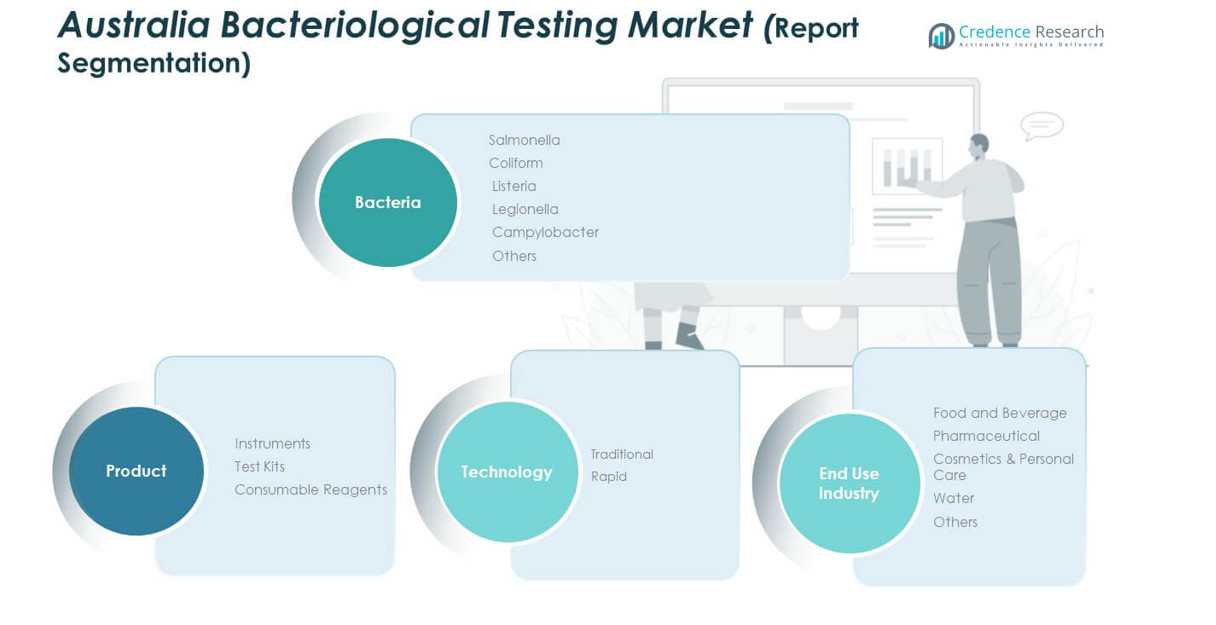

Market Segmentation Analysis:

By Product Segment

Instruments hold a strong share, supported by adoption in laboratories and large-scale food processing facilities. Test kits are gaining traction due to faster results and ease of use across small and medium enterprises. Consumable reagents secure recurring demand, driven by routine testing requirements and widespread adoption across industries. The Australia Bacteriological Testing Market relies on this balance of high-value instruments and repeat-use consumables to sustain steady revenue growth.

By Bacteria Segment

Salmonella dominates due to its frequent association with foodborne outbreaks. Coliform testing is critical for water and beverage safety monitoring. Listeria detection rises with growing demand for dairy and ready-to-eat food safety checks. Legionella testing expands through strict water system monitoring protocols. Campylobacter remains relevant in poultry and meat safety testing. Other bacteria categories add breadth, ensuring industries address multiple contamination risks.

- For instance, bioMérieux’s GENE-UP® PCR technology offers a fast and reliable method for detecting Campylobacter and other pathogens in food products for the poultry industry and other sectors. It is an internationally validated system and is used by food processors to enhance food safety and process control.

By Technology Segment

Traditional testing methods retain use in established laboratories due to proven reliability. Rapid testing solutions are expanding quickly, offering faster results and stronger support for real-time decision-making in food and pharmaceutical sectors. It reflects a clear industry preference for speed and efficiency while maintaining compliance with regulatory standards.

By End User Segment

Food and beverage leads the market, supported by strict safety standards and rising exports. Pharmaceutical industries follow with a focus on quality and sterile production. Cosmetics and personal care increasingly adopt testing to meet regulatory compliance. Water testing ensures public health protection and infrastructure monitoring. Other end users add diversity, strengthening the scope of adoption across multiple sectors.

Segmentation:

By Product Segment

- Instruments

- Test Kits

- Consumable Reagents

By Bacteria Segment

- Salmonella

- Coliform

- Listeria

- Legionella

- Campylobacter

- Others

By Technology Segment

By End User Segment

- Food and Beverage

- Pharmaceutical

- Cosmetics & Personal Care

- Water

- Others

Regional Analysis:

Eastern Australia

Eastern Australia commands the largest share of the Australia Bacteriological Testing Market, accounting for around 42% in 2024. The region benefits from the presence of major metropolitan hubs such as Sydney, Melbourne, and Brisbane, where strict food safety regulations and advanced healthcare infrastructure drive adoption. Strong demand from the food and beverage industry supports continuous investment in testing systems. Pharmaceutical and cosmetic manufacturers concentrated in this corridor also contribute significantly to market growth. The export-oriented meat and dairy industries in New South Wales and Victoria strengthen reliance on bacteriological testing to meet international standards. It maintains leadership through high testing volumes, government oversight, and robust laboratory networks.

Western Australia

Western Australia holds around 28% share of the market, with growth fueled by its resource-rich economy and expanding agricultural exports. The food industry, particularly meat and seafood, plays a major role in driving bacteriological testing demand. Regional laboratories are increasingly adopting rapid testing solutions to support real-time quality checks. Government initiatives to improve water quality monitoring in mining areas also expand applications. Pharmaceutical and healthcare industries are gradually adopting advanced technologies to ensure compliance with national standards. It strengthens its position by focusing on export safety, local food security, and water quality management.

Northern and Southern Australia

Northern and Southern Australia together contribute approximately 30% share to the market, supported by diverse economic activities. In the Northern region, water quality testing dominates due to climate challenges and reliance on groundwater sources. Agricultural activities, including livestock and crop production, also drive consistent demand. In Southern Australia, food processing and dairy industries are primary adopters of bacteriological testing. Regional laboratories prioritize compliance with safety protocols to sustain trade reliability. It leverages local government policies, agricultural diversity, and growing consumer awareness to strengthen market presence across these regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Australia Bacteriological Testing Market is characterized by strong competition among global leaders and regional players. Thermo Fisher Scientific, Eurofins, Agilent Technologies, and Bio-Rad Laboratories maintain a robust presence with extensive product portfolios and advanced technologies. Local firms such as Aquacorp Pty Ltd and InterMed AU strengthen their position through specialized solutions and regional expertise. It demonstrates high competitiveness driven by continuous innovation, regulatory compliance, and expanding service offerings. Companies invest in R&D, partnerships, and laboratory expansions to address demand from food, pharmaceutical, and water industries. Market leadership depends on reliability, cost efficiency, and the ability to meet strict Australian safety standards.

Recent Developments:

- In June 2025, Bio-Rad Laboratories Inc. finalized the acquisition of Stilla Technologies, a next-generation digital PCR developer, which strengthens Bio-Rad’s global digital PCR and bacteriological testing portfolio, impacting applications in clinical diagnostics and the life sciences sector in Australia.

Report Coverage:

The research report offers an in-depth analysis based on product, bacteria, technology, and end-user segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for bacteriological testing will expand with stricter food safety regulations.

- Rapid testing methods will gain preference across industries for faster results.

- Water quality monitoring will strengthen testing requirements in urban and rural areas.

- Pharmaceutical and cosmetic industries will increase reliance on advanced diagnostics.

- Export-focused sectors will drive adoption to meet international compliance standards.

- Local laboratories will adopt digital platforms to streamline data and reporting.

- Partnerships between research bodies and industry will boost innovation pipelines.

- Portable testing kits will gain popularity in remote and field-based applications.

- Sustainability goals will influence testing technologies and laboratory practices.

- Competitive intensity will remain high, with global firms and local players expanding portfolios.