Market Overview

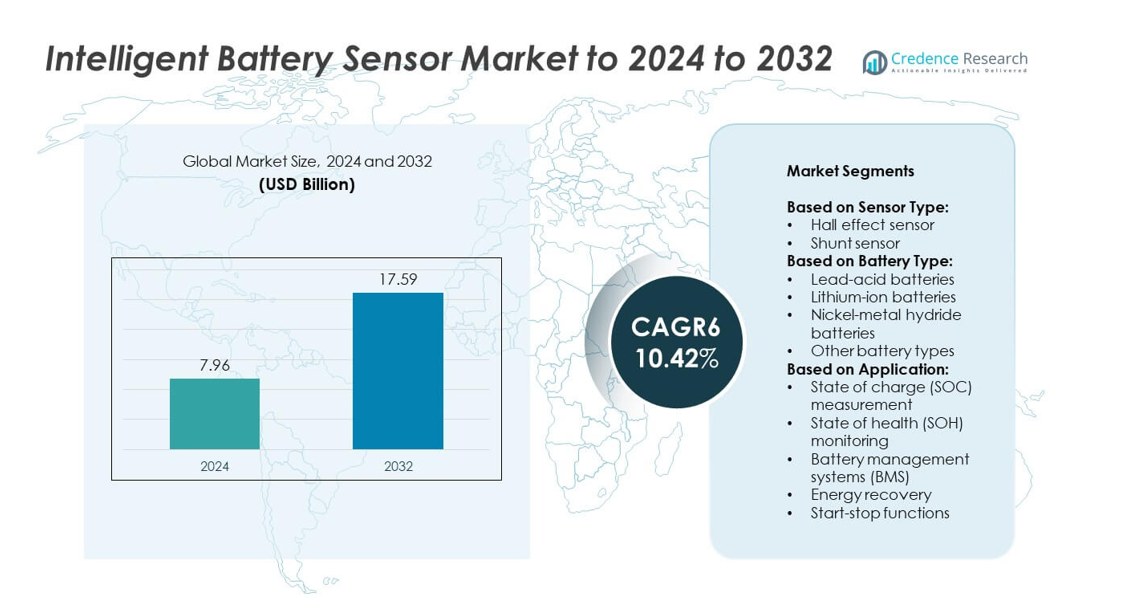

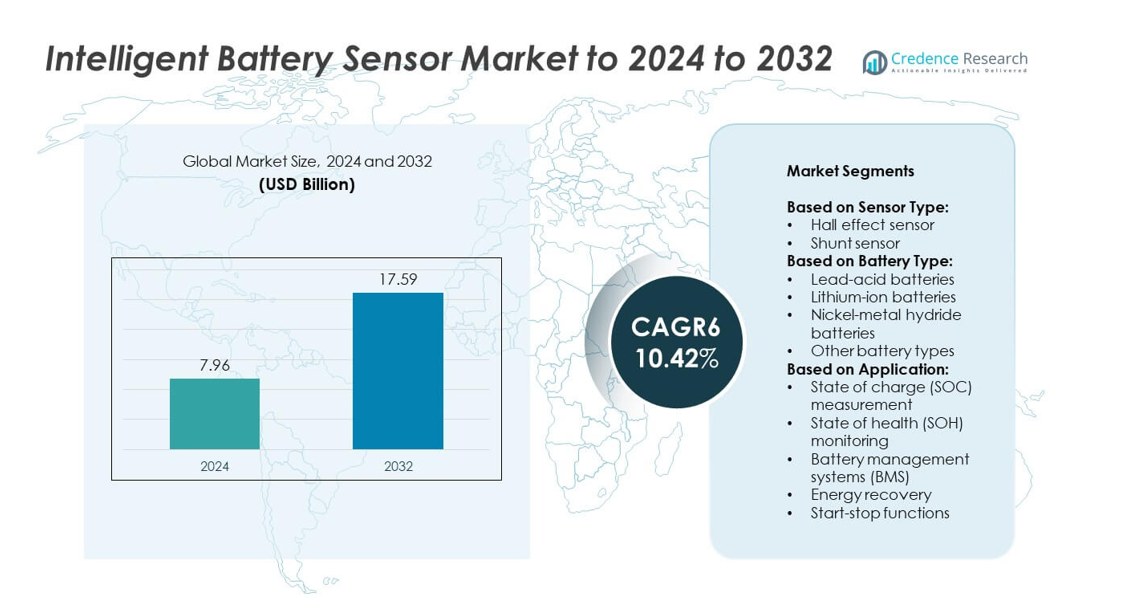

The Intelligent Battery Sensor market size was valued at USD 7.96 Billion in 2024 and is anticipated to reach USD 17.59 Billion by 2032, at a CAGR of 10.42% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Intelligent Battery Sensor market Size 2024 |

USD 7.96 Billion |

| Intelligent Battery Sensor market, CAGR |

10.42% |

| Intelligent Battery Sensor market Size 2032 |

USD 17.59 Billion |

The Intelligent Battery Sensor market is shaped by prominent players such as Infineon Technologies AG, Continental AG, HELLA GmbH & Co. KGaA, Analog Devices, DENSO Corporation, NXP Semiconductors, Texas Instruments Inc., Robert Bosch GmbH, and ams OSRAM. These companies focus on developing advanced sensor technologies that improve accuracy, efficiency, and integration with modern battery management systems, particularly in electric and hybrid vehicles. In terms of regional distribution, North America led the market in 2024, commanding 34% share, supported by strong EV adoption, strict emission regulations, and investments in renewable energy storage. Europe followed with 29% share, driven by stringent environmental policies and rapid electrification of transport, while Asia Pacific held 27%, fueled by large-scale EV production and battery innovation. This competitive and regionally diverse landscape highlights a strong growth trajectory for intelligent battery sensors globally.

Market Insights

- The Intelligent Battery Sensor market was valued at USD 7.96 Billion in 2024 and is projected to reach USD 17.59 Billion by 2032, expanding at a CAGR of 10.42%.

- Rising adoption of electric vehicles and stricter fuel efficiency regulations are key drivers boosting demand for intelligent battery sensors.

- Market trends show increasing integration with IoT platforms and expanding applications in renewable energy storage systems beyond the automotive sector.

- The market is competitive, with leading players focusing on advanced sensor technologies, partnerships with automakers, and expansion into emerging regions to strengthen their global presence.

- North America held the largest share at 34% in 2024, followed by Europe with 29% and Asia Pacific with 27%, while the Hall effect sensor segment dominated with over 60% share, supported by high accuracy and adoption in electric mobility solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Sensor Type

The Hall effect sensor segment dominated the Intelligent Battery Sensor market in 2024, capturing over 60% share. Its dominance is driven by superior accuracy in current measurement, compact design, and integration with advanced vehicle electronics. Automakers increasingly adopt Hall effect sensors to support real-time data collection and enhance efficiency in electric and hybrid vehicles. In contrast, shunt sensors, though cost-effective, hold a smaller share due to limitations in high-current applications. Rising demand for safety, precision, and energy optimization ensures continued growth of Hall effect sensors across automotive and industrial applications.

- For instance, Allegro MicroSystems ships over 1 billion Hall-effect sensor IC units annually, serving more than 50 automotive OEMs.

By Battery Type

Lithium-ion batteries accounted for the largest share of the Intelligent Battery Sensor market in 2024, representing more than 55% of revenue. Their dominance stems from widespread adoption in electric vehicles, renewable energy storage systems, and portable electronics. Intelligent battery sensors enhance performance by monitoring voltage, current, and thermal parameters, extending battery life and safety. Lead-acid batteries remain relevant in commercial vehicles and backup power systems, but their share is shrinking. Meanwhile, nickel-metal hydride batteries and other chemistries hold smaller portions, primarily serving niche applications in hybrid cars and low-power devices.

- For instance, LG Energy Solution’s BMS software is applied to more than 100,000 EVs, with a diagnosis error rate in the range of 1%.

By Application

Battery management systems (BMS) led the application segment in 2024 with nearly 40% share. Intelligent battery sensors play a central role in BMS by delivering precise state of charge and state of health data, enabling safe and efficient battery operation. Their use in electric vehicles and grid storage systems is rapidly growing as industries demand optimized performance and predictive maintenance. Other applications such as start-stop functions, SOC measurement, energy recovery, and SOH monitoring continue to expand, yet BMS remains the core driver of adoption due to its integration across diverse battery technologies and vehicle platforms.

Key Growth Drivers

Rising Electric Vehicle Adoption

The rapid adoption of electric vehicles is the primary growth driver of the Intelligent Battery Sensor market. Automakers integrate advanced sensors to ensure precise monitoring of state of charge and health, improving battery efficiency and extending lifespan. Government incentives, emission reduction policies, and increasing demand for sustainable mobility further accelerate EV penetration. Intelligent battery sensors support safety, predictive maintenance, and performance optimization, making them vital in EV architectures. As EV production scales globally, demand for intelligent sensors is expected to rise consistently throughout the forecast period.

- For instance, Tesla produced 1.84 million electric vehicles in 2023, each equipped with intelligent battery monitoring and sensor-based management systems.

Stringent Emission and Fuel Efficiency Regulations

Growing environmental concerns and strict government regulations drive the adoption of intelligent battery sensors in vehicles. These sensors support start-stop systems and energy recovery functions, enabling compliance with global emission and fuel economy standards. Automakers are under pressure to integrate smart technologies that reduce carbon footprints and enhance vehicle efficiency. Intelligent battery sensors provide real-time monitoring, helping optimize fuel consumption and reduce idle emissions. Their role in meeting stringent standards is crucial, making regulatory compliance a key driver of sustained market growth across developed and emerging economies.

- For instance, BMW Group sold a record 2,555,341 BMW, MINI, and Rolls-Royce vehicles globally in 2023, with 942,805 units delivered in Europe.

Increasing Demand for Advanced Battery Management Systems

The rising focus on battery management systems (BMS) is a significant growth driver for the Intelligent Battery Sensor market. BMS relies heavily on sensors to deliver accurate data on state of charge and state of health, ensuring safe and efficient operations. Growing use of lithium-ion batteries in electric mobility and stationary storage requires advanced monitoring solutions. Intelligent sensors enable predictive maintenance, prevent thermal runaway, and optimize charging cycles. With industries emphasizing efficiency and reliability, the demand for sensors in advanced BMS applications is expanding rapidly across automotive and energy sectors.

Key Trends & Opportunities

Integration with IoT and Connected Platforms

A major trend in the Intelligent Battery Sensor market is integration with IoT and connected vehicle platforms. Intelligent sensors now transmit real-time data to cloud systems, enabling predictive analytics and remote monitoring. This creates opportunities for fleet operators and energy companies to optimize asset performance and extend battery life. IoT-enabled sensors also support digital twin models, enhancing safety and efficiency in electric vehicles and renewable storage. As connected ecosystems expand, the use of intelligent sensors in smart mobility and energy applications presents strong growth opportunities.

- For instance, Bosch’s “Battery-in-the-Cloud” software services enhance electric vehicle battery performance and lifespan by using cloud-based algorithms to analyze real-time data. This technology can reduce battery wear and tear by up to 20% by optimizing charging processes based on factors such as ambient temperature and vehicle usage patterns.

Growing Role in Renewable Energy Storage Systems

The expansion of renewable energy storage creates opportunities for intelligent battery sensors beyond automotive applications. Grid-scale and residential energy storage solutions require accurate monitoring of battery state and performance. Intelligent sensors ensure reliability and efficiency in managing variable renewable inputs like solar and wind power. With global energy transition goals, governments and utilities are investing heavily in smart storage systems. Intelligent battery sensors provide the necessary precision to balance energy demand and supply, making them a critical component in achieving long-term sustainability targets.

- For instance, Sungrow deployed more than 10 GWh of battery energy storage systems worldwide in 2023, each integrated with intelligent monitoring sensors for grid stability.

Key Challenges

High Integration and Deployment Costs

One of the key challenges in the Intelligent Battery Sensor market is the high cost of integration and deployment. Incorporating advanced sensing technologies into battery systems requires significant investments from automakers and energy providers. Smaller manufacturers often face difficulties adopting these solutions due to limited budgets. Additionally, advanced sensors demand complex design and calibration, adding to overall production costs. These financial barriers slow adoption in price-sensitive markets, particularly in developing regions, despite the long-term benefits of enhanced efficiency and battery reliability.

Technical Limitations and Reliability Concerns

Another challenge is the technical limitation and reliability issues associated with intelligent battery sensors. Continuous exposure to high voltage, extreme temperatures, and vibrations in automotive environments can impact sensor durability. Failures or inaccuracies in sensor readings may compromise battery safety and performance, leading to higher risks for manufacturers. Developing sensors that maintain precision over long operational cycles remains difficult. These reliability concerns hinder large-scale adoption in critical applications such as electric vehicles and grid storage, where safety and consistent monitoring are essential.

Regional Analysis

North America

North America held the largest share of the Intelligent Battery Sensor market in 2024, accounting for 34%. The region benefits from strong electric vehicle adoption, strict fuel efficiency regulations, and the presence of leading automotive manufacturers. U.S. government incentives for EV infrastructure and renewable energy storage further enhance demand. Intelligent battery sensors are increasingly integrated into advanced battery management systems, supporting safety and performance optimization. Canada contributes through growth in renewable storage projects and clean energy initiatives. The region’s well-developed automotive ecosystem and emphasis on sustainability ensure steady market expansion during the forecast period.

Europe

Europe accounted for 29% share of the Intelligent Battery Sensor market in 2024, driven by stringent emission norms and rapid electrification of vehicles. The European Union’s Green Deal and climate neutrality targets are encouraging automakers to integrate intelligent sensors for enhanced efficiency and compliance. Germany leads adoption with strong EV production, while France and the UK are expanding renewable energy storage projects. Intelligent sensors support start-stop functions and energy recovery, aligning with EU emission reduction strategies. With increasing investments in sustainable mobility and renewable integration, Europe remains a crucial hub for market growth.

Asia Pacific

Asia Pacific captured 27% share of the Intelligent Battery Sensor market in 2024, led by China, Japan, and South Korea. Strong EV penetration, coupled with significant investment in renewable energy storage, drives adoption across the region. China’s large-scale EV manufacturing and government subsidies create robust demand for intelligent sensors, while Japan emphasizes advanced automotive technologies and BMS integration. India is also emerging with growing interest in EV adoption and energy transition policies. Expanding battery production capacity and increasing focus on energy efficiency position Asia Pacific as a high-growth region during the forecast period.

Latin America

Latin America represented 6% share of the Intelligent Battery Sensor market in 2024, with Brazil and Mexico leading adoption. Growth is supported by rising automotive production, increasing renewable energy projects, and gradual adoption of electric vehicles. Intelligent battery sensors are primarily used in start-stop systems and lead-acid battery applications, but demand for lithium-ion integration is rising. Government initiatives for cleaner transportation and energy efficiency are gradually shaping opportunities. However, limited infrastructure for EVs remains a barrier. With continued regional modernization and investment, Latin America is expected to increase its share over the forecast period.

Middle East and Africa

The Middle East and Africa accounted for 4% share of the Intelligent Battery Sensor market in 2024. The region is witnessing rising demand from energy storage systems for solar projects, particularly in Gulf countries. Automotive applications are slower due to limited EV infrastructure, but intelligent battery sensors are gaining traction in start-stop systems and backup power solutions. South Africa is leading adoption with renewable energy initiatives, while the UAE and Saudi Arabia invest in smart mobility projects. Although the market is at an early stage, MEA presents long-term potential as clean energy and EV adoption accelerate.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Sensor Type:

- Hall effect sensor

- Shunt sensor

By Battery Type:

- Lead-acid batteries

- Lithium-ion batteries

- Nickel-metal hydride batteries

- Other battery types

By Application:

- State of charge (SOC) measurement

- State of health (SOH) monitoring

- Battery management systems (BMS)

- Energy recovery

- Start-stop functions

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Intelligent Battery Sensor market is highly competitive, with leading players including Infineon Technologies AG, Continental AG, HELLA GmbH & Co. KGaA, Analog Devices, Inc., DENSO Corporation, NXP Semiconductors, AVX Corporation, Texas Instruments Inc., Eberspächer, Robert Bosch GmbH, General Motors (Delphi Technologies), Furukawa Electric Co., Ltd., and ams OSRAM. Market participants focus on developing advanced sensing technologies that deliver higher accuracy, improved durability, and seamless integration with modern battery management systems. Companies are investing in research and development to support electric mobility, renewable storage, and smart energy applications. Partnerships with automakers, energy firms, and technology providers are driving innovation, while product differentiation strategies emphasize efficiency and cost-effectiveness. Expansion into emerging markets, particularly Asia Pacific and Latin America, supports global reach. Competitive intensity is further fueled by regulatory requirements for emission reduction and energy efficiency, compelling players to accelerate innovation and strengthen their portfolios for sustainable growth.

Key Player Analysis

- Infineon Technologies AG

- Continental AG

- HELLA GmbH & Co. KGaA

- Analog Devices, Inc.

- DENSO Corporation

- NXP Semiconductors

- AVX Corporation

- Texas Instruments Inc.

- Eberspächer

- Robert Bosch GmbH

- General Motors (Delphi Technologies)

- Furukawa Electric Co., Ltd.

- ams OSRAM

Recent Developments

- In 2025, Texas Instruments Inc. Introduced new battery management technology, such as the BQ41Z90 and BQ41Z50 fuel gauges with Dynamic Z-Track technology.

- In 2024, Infineon Technologies AG Began leveraging new manufacturing capacity for Wide Bandgap semiconductors like Silicon Carbide (SiC) and Gallium Nitride (GaN) from its plant in Kulim, Malaysia.

- In 2023, NXP Semiconductors Launched a new Battery Cell Controller IC in November, designed for next-generation electric vehicles and energy storage systems. It featured an industry-leading cell measurement accuracy of 0.8 mV to optimize lifetime performance and enhance safety for lithium-ion batteries.

Report Coverage

The research report offers an in-depth analysis based on Sensor Type, Battery Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Intelligent Battery Sensor market will expand with rising electric vehicle adoption worldwide.

- Demand for precise state of charge and state of health monitoring will increase.

- Integration with advanced battery management systems will remain a key growth driver.

- Renewable energy storage projects will create new opportunities for intelligent sensors.

- IoT-enabled sensors will enhance real-time monitoring and predictive maintenance capabilities.

- Asia Pacific will witness the fastest growth due to large-scale EV production.

- Regulatory pressure on emission reduction will accelerate adoption in Europe and North America.

- Technical advancements will focus on improving sensor durability and accuracy.

- Cost reduction strategies will help expand adoption in developing markets.

- Long-term growth will be shaped by investments in smart mobility and clean energy.