Market Overview

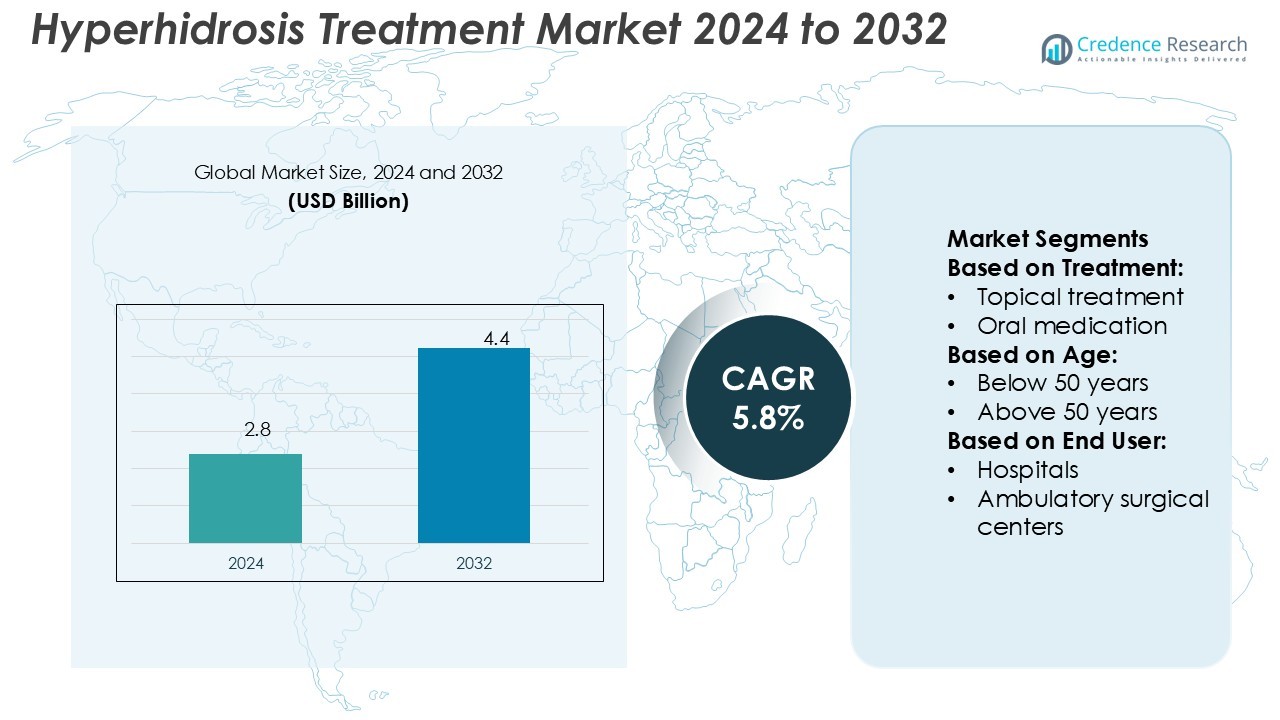

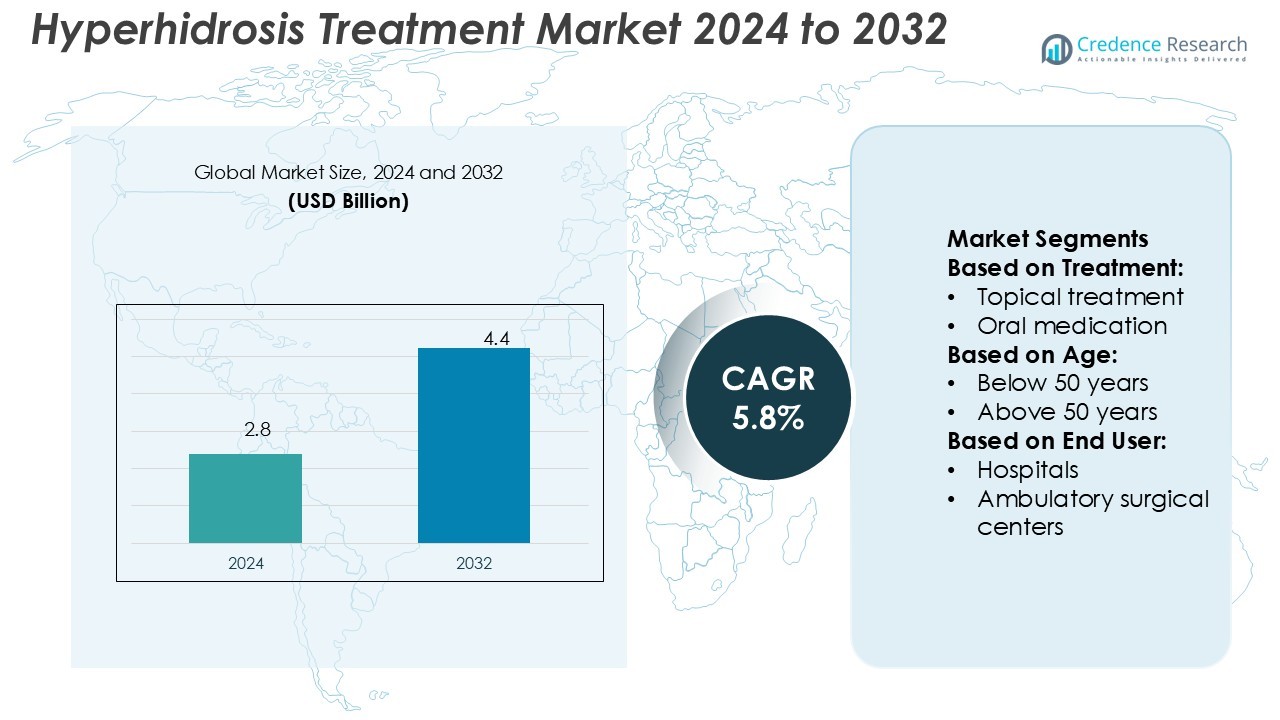

Hyperhidrosis Treatment Market size was valued USD 2.8 billion in 2024 and is anticipated to reach USD 4.4 billion by 2032, at a CAGR of 5.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hyperhidrosis Treatment Market Size 2024 |

USD 2.8 Billion |

| Hyperhidrosis Treatment Market, CAGR |

5.8% |

| Hyperhidrosis Treatment Market Size 2032 |

USD 4.4 Billion |

The hyperhidrosis treatment market is driven by leading players such as AbbVie Inc., Dermavant Sciences Inc., Kaken Pharmaceutical Co., Ltd., Eli Lilly and Company, Hugel, Inc., Intas Pharmaceuticals Ltd., Avanor Healthcare Ltd., Dermadry Laboratories Inc., Brickell Biotech Inc., and Eirion Therapeutics, Inc. These companies focus on expanding their portfolios through advanced drug formulations, innovative devices, and strategic partnerships to strengthen global presence. North America dominates the market with a 38% share, supported by strong healthcare infrastructure, high awareness, and favorable reimbursement policies. The region’s leadership is reinforced by the availability of specialized dermatology services and advanced treatment adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The hyperhidrosis treatment market size was USD 2.8 billion in 2024 and is projected to reach USD 4.4 billion by 2032, growing at a CAGR of 5.8%.

- Market growth is driven by rising awareness, increasing diagnosis rates, and strong demand for minimally invasive therapies such as botulinum toxin injections, which hold the largest treatment share.

- Key trends include the adoption of advanced devices like iontophoresis systems, integration of lifestyle-oriented treatments in dermatology clinics, and innovation in long-lasting drug formulations to improve patient compliance.

- Competition is shaped by global players focusing on innovation and partnerships, while restraints include high treatment costs, limited reimbursement in many regions, and side effects that affect patient compliance.

- North America leads with 38% share, followed by Europe with 29% and Asia-Pacific with 22%, while hospitals dominate end-user segments due to infrastructure and advanced treatment availability.

Market Segmentation Analysis:

By Treatment

The hyperhidrosis treatment market is dominated by botulinum toxin injections, holding the largest share due to their proven effectiveness and long-lasting results. These injections temporarily block the nerves responsible for excessive sweating, making them a preferred choice among patients seeking non-invasive yet reliable outcomes. Demand is further driven by rising awareness, increased cosmetic applications, and FDA approvals for multiple body areas. While topical treatments and iontophoresis are gaining adoption, particularly for mild cases, botulinum toxin injections remain the market leader because of their high success rate and strong clinical evidence.

- For instance, Dermavant Sciences Inc. reported positive Phase III trial results for Qbrexza (glycopyrronium tosylate) cloth, where gravimetric sweat testing supported a significant reduction in sweat production compared to vehicle after four weeks of daily use, in studies involving over 450 individuals.

By Age

The below 50 years segment accounts for the dominant market share, driven by higher prevalence of primary hyperhidrosis in younger individuals. Patients in this age group actively seek treatment to improve daily comfort, work productivity, and social interactions. Increased awareness campaigns, availability of advanced therapies, and willingness to undergo procedures like botulinum toxin injections contribute to strong uptake. Above 50 years shows steady growth as aging populations turn to treatment for secondary hyperhidrosis, but younger demographics remain the key driver of market demand.

- For instance, Kaken Pharmaceutical’s ECCLOCK® (sofpironium bromide gel, 5%) was approved in November 2020 following positive results from a Japanese Phase 3 trial of 281 patients.

By End-user

Hospitals represent the leading end-user segment, capturing the largest share due to advanced infrastructure and availability of multidisciplinary treatment options. Patients often prefer hospitals for procedures such as botulinum toxin injections and surgical treatments, which require trained specialists and advanced facilities. The hospital segment is further supported by reimbursement policies and wider accessibility in urban areas. Dermatology clinics and ambulatory surgical centers are also gaining ground due to personalized care and cost-effective services, but hospitals continue to dominate as the primary hub for advanced hyperhidrosis treatment.

Key Growth Drivers

Rising Awareness and Diagnosis Rates

Growing awareness campaigns and improved clinical diagnosis significantly drive the hyperhidrosis treatment market. Patients increasingly recognize excessive sweating as a treatable condition rather than a lifestyle issue. Dermatologists and healthcare organizations actively promote advanced therapies such as botulinum toxin injections and iontophoresis. Educational initiatives and patient support groups improve treatment-seeking behavior, particularly among younger populations. Enhanced diagnosis rates expand the patient pool, fueling demand for both non-invasive and surgical options. This increasing acceptance directly boosts revenue growth across hospitals, clinics, and ambulatory centers, consolidating the market’s overall expansion.

- For instance, Hugel develops botulinum toxin products under names such as Botulax / Letybo, including 50 IU, 100 IU and 200 IU formulations. In Q2 2025, Hugel’s net sales from toxin products reached KRW 61.2 billion, supporting over 100 billion cumulative toxin sales in the first half.

Advancements in Minimally Invasive Therapies

The availability of innovative, minimally invasive treatment options fuels strong market growth. Botulinum toxin injections, iontophoresis, and topical antiperspirants are gaining preference due to proven efficacy, reduced downtime, and better safety profiles. Manufacturers are developing new formulations and devices that improve patient compliance and treatment outcomes. For instance, long-lasting botulinum toxin solutions are being explored to reduce repeated sessions. These advancements attract patients who prefer effective yet convenient solutions. The focus on improved patient experience continues to strengthen adoption, positioning minimally invasive options as critical growth drivers in the hyperhidrosis treatment market.

- For instance, AbbVie and Allergan presented positive Phase 3 trial data showing that Botox formulations met all primary and secondary endpoints in treating platysma prominence.

Increasing Cosmetic and Lifestyle Applications

The growing overlap between dermatology and aesthetics enhances demand for hyperhidrosis treatments. Excessive sweating impacts self-confidence, driving patients to seek therapies for underarms, palms, and facial areas. Rising disposable incomes and heightened interest in personal grooming encourage treatment uptake. Cosmetic clinics integrate hyperhidrosis procedures into their service portfolios, promoting affordability and accessibility. The association between appearance, confidence, and social acceptance makes treatments appealing to younger demographics. Expanding lifestyle-driven demand not only broadens the patient base but also positions hyperhidrosis care as a profitable segment in dermatology and cosmetic practices globally.

Key Trends & Opportunities

Integration of Advanced Dermatology Devices

The market is witnessing a strong shift toward device-based solutions like iontophoresis and laser therapies. These technologies provide safer, long-term results and are increasingly offered in dermatology clinics. Integration of wearable devices to monitor sweating patterns also supports personalized treatment approaches. Companies are innovating with portable and user-friendly devices, creating opportunities in home-based care. This technological evolution not only improves patient adherence but also opens avenues for manufacturers to expand into consumer-centric segments, positioning advanced devices as a key growth frontier in the hyperhidrosis treatment market.

- For instance, Brickell has developed its proprietary patient-report outcome scale HDSM-Ax, validated such that a 1-point change (on a 0–4 scale) is clinically meaningful.

Expanding Medical Tourism in Emerging Economies

Emerging economies, particularly in Asia-Pacific and Latin America, present strong opportunities through medical tourism. Countries such as Thailand, India, and Brazil offer cost-effective dermatological procedures, attracting international patients. The availability of skilled specialists and advanced infrastructure at competitive prices boosts the appeal. Patients from developed countries increasingly seek affordable hyperhidrosis treatments abroad, particularly botulinum toxin procedures. This trend strengthens cross-border collaborations and stimulates investment in local healthcare infrastructure. Growing affordability and international patient inflow highlight medical tourism as a major opportunity for regional growth in the hyperhidrosis treatment landscape.

- For instance, Eirion’s pipeline includes ET-01, a topical botulinum formulation using nanoemulsion transdermal delivery and skin microporation. This two-step application is completed in under 10 minutes and avoids injections.

Key Challenges

High Treatment Costs and Limited Reimbursement

The elevated cost of advanced treatments such as botulinum toxin injections and surgical procedures remains a key barrier. In many regions, reimbursement coverage for hyperhidrosis treatments is limited or excluded, categorizing them as cosmetic rather than medical. This restricts accessibility for middle- and low-income patients, particularly in emerging economies. Even in developed markets, insurance limitations force patients to bear significant out-of-pocket expenses. The high cost burden reduces adoption rates and hinders market expansion, posing a significant challenge for long-term growth potential.

Side Effects and Patient Compliance Issues

Side effects associated with treatments create concerns for both patients and physicians. Botulinum toxin injections may cause muscle weakness, while oral medications often carry systemic side effects such as dry mouth or blurred vision. Surgical procedures, though effective, involve risks of compensatory sweating and scarring. These complications reduce patient willingness to pursue certain therapies. Additionally, repetitive treatments such as iontophoresis demand consistent compliance, which many patients find difficult to maintain. Safety risks and compliance hurdles act as restraining factors, slowing the pace of adoption across treatment modalities.

Regional Analysis

North America

North America leads the hyperhidrosis treatment market with a 38% share, supported by strong adoption of advanced therapies such as botulinum toxin injections and iontophoresis. High awareness levels, favorable reimbursement frameworks, and strong presence of leading pharmaceutical companies drive growth. The U.S. dominates the region, benefiting from advanced healthcare infrastructure and active clinical research in dermatology. Rising demand for minimally invasive treatments and FDA approvals for wider applications reinforce regional dominance. Canada contributes steadily, driven by growing patient awareness and government initiatives supporting access to dermatology services, further strengthening North America’s leadership position.

Europe

Europe holds 29% of the global hyperhidrosis treatment market, driven by rising awareness and supportive healthcare systems. Countries such as Germany, the UK, and France lead adoption due to high spending on dermatological care and access to innovative therapies. The region benefits from strong penetration of botulinum toxin treatments, supported by CE approvals and skilled practitioners. Growing emphasis on outpatient services at dermatology clinics fuels accessibility for younger patients. Southern and Eastern Europe are emerging with increasing demand, supported by improving healthcare infrastructure. The combination of innovation, regulation, and affordability positions Europe as a strong market player.

Asia-Pacific

Asia-Pacific accounts for 22% of the hyperhidrosis treatment market and is projected as the fastest-growing region. Rising awareness of hyperhidrosis, expanding healthcare infrastructure, and growing affordability of dermatology services drive growth. Japan, South Korea, and China lead adoption with advanced technologies and high cosmetic treatment demand. Increasing medical tourism in countries like Thailand and India also contributes to regional expansion. Young populations and rising disposable incomes further support treatment uptake. Local manufacturers introducing cost-effective solutions are strengthening accessibility, while government initiatives to modernize healthcare systems create opportunities for advanced treatment penetration across the region.

Latin America

Latin America captures 6% of the hyperhidrosis treatment market, driven by growing demand in Brazil, Mexico, and Argentina. Expanding middle-class populations and rising awareness of dermatological conditions contribute to higher treatment adoption. Brazil leads with advanced aesthetic and dermatology sectors, supporting strong uptake of botulinum toxin injections. However, limited reimbursement coverage and economic disparities restrict wider access in rural areas. Multinational companies are increasing investments to strengthen distribution networks and enhance awareness. While growth is moderate compared to developed regions, improving healthcare accessibility and rising demand for cosmetic procedures create favorable conditions for regional market expansion.

Middle East & Africa

The Middle East & Africa account for 5% of the global hyperhidrosis treatment market, with growth concentrated in Gulf countries like Saudi Arabia and the UAE. Rising disposable incomes, expanding private healthcare facilities, and high demand for aesthetic treatments fuel adoption. Hospitals and dermatology clinics in urban centers offer advanced procedures such as botulinum toxin injections and surgical treatments. However, limited awareness and affordability challenges in African countries hinder widespread adoption. International collaborations and government investments in healthcare infrastructure are expected to improve access, positioning the region for gradual growth in the coming years.

Market Segmentations:

By Treatment:

- Topical treatment

- Oral medication

By Age:

- Below 50 years

- Above 50 years

By End User:

- Hospitals

- Ambulatory surgical centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The hyperhidrosis treatment market is characterized by strong competition among leading players including Dermavant Sciences Inc., Kaken Pharmaceutical Co., Ltd., Avanor Healthcare Ltd., Eli Lilly and Company, Dermadry Laboratories Inc., Hugel, Inc., Intas Pharmaceuticals Ltd., AbbVie Inc., Brickell Biotech Inc., and Eirion Therapeutics, Inc. The hyperhidrosis treatment market is highly competitive, shaped by continuous innovation in both drug-based and device-based solutions. Companies are focusing on developing advanced therapies such as long-lasting botulinum toxin formulations, improved iontophoresis devices, and topical treatments with enhanced efficacy and safety profiles. The competitive environment is further driven by strategic collaborations, licensing agreements, and research investments aimed at expanding treatment indications and improving patient compliance. Emerging players are entering the market with cost-effective alternatives, increasing accessibility across regions. This dynamic landscape emphasizes innovation, affordability, and global reach as key factors influencing competition.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Dermavant Sciences Inc.

- Kaken Pharmaceutical Co., Ltd.

- Avanor Healthcare Ltd.

- Eli Lilly and Company

- Dermadry Laboratories Inc.

- Hugel, Inc.

- Intas Pharmaceuticals Ltd

- AbbVie Inc.

- Brickell Biotech Inc.

- Eirion Therapeutics, Inc.

Recent Developments

- In February 2025, Fred Hutch researchers engineered 3D-printed skin organoids to screen 20 anti-HSV compounds, identifying several candidates with minimal cytotoxicity.

- In January 2025, Dermata Therapeutics and Revance Therapeutics reports positive Phase 2a data for a topical botulinum toxin platform that achieved meaningful sweat reduction without injections, opening a path to compete head-on with energy devices.

- In July 2024, Botanix Pharmaceuticals launched Sofdra through a digital-first strategy and centralized pharmacy distribution Botanix Pharmaceuticals.

- In October 2023, Rational Vaccines received in NIH grants for HSV research, including a new diagnostic test, live-attenuated HSV-1 strain for ocular herpes, and development of a prophylactic and therapeutic vaccine.

Report Coverage

The research report offers an in-depth analysis based on Treatment, Age, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising awareness and improved diagnostic rates.

- Botulinum toxin injections will remain the leading treatment choice.

- Device-based therapies like iontophoresis will gain wider adoption.

- Topical and oral medications will improve with better safety profiles.

- Younger demographics will continue driving strong treatment demand.

- Hospitals and dermatology clinics will strengthen their role as primary providers.

- Emerging economies will experience higher growth through medical tourism.

- Technological innovations will enhance minimally invasive treatment options.

- Reimbursement improvements will support greater patient accessibility.

- Competition will intensify as new entrants introduce cost-effective solutions.