Market Overview

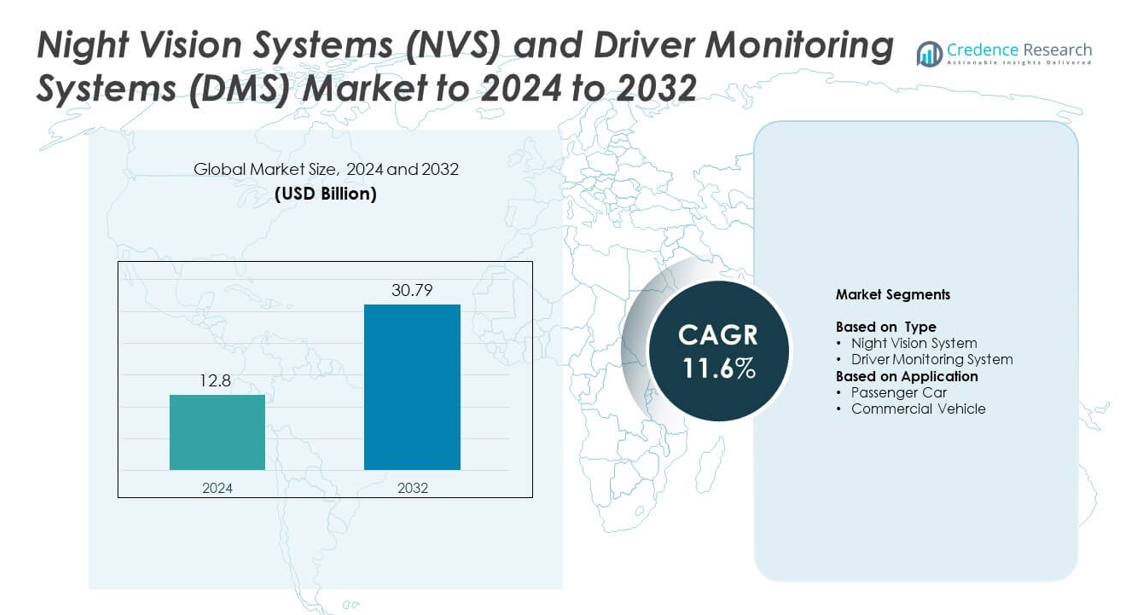

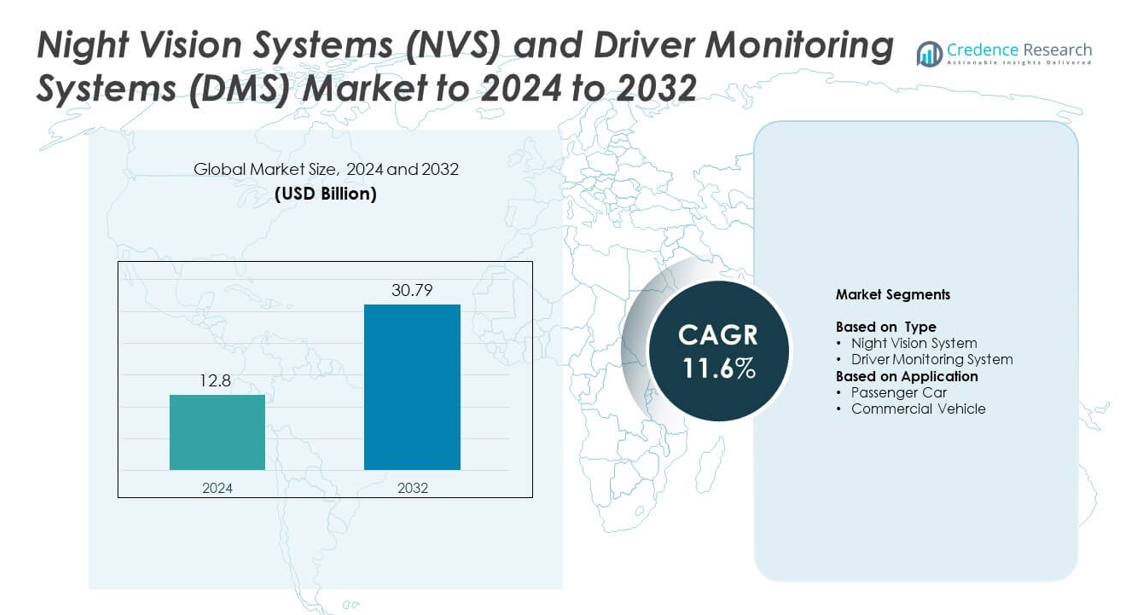

Night Vision Systems (NVS) and Driver Monitoring Systems (DMS) Market size was valued at USD 12.8 billion in 2024 and is anticipated to reach USD 30.79 billion by 2032, at a CAGR of 11.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Night Vision Systems (NVS) and Driver Monitoring Systems (DMS) Market Size 2024 |

USD 12.8 billion |

| Night Vision Systems (NVS) and Driver Monitoring Systems (DMS) Market, CAGR |

11.6% |

| Night Vision Systems (NVS) and Driver Monitoring Systems (DMS) Market Size 2032 |

USD 30.79 billion |

The Night Vision Systems (NVS) and Driver Monitoring Systems (DMS) Market is shaped by major players including Aisin Seiki, Continental, OMRON, Autoliv, Magna International, Smart Eye AB, Valeo, Robert Bosch, Denso, and Delphi Automotive. These companies advance thermal imaging, infrared cameras, and AI-driven driver-attention technologies to support rising safety requirements and automation features. North America led the market in 2024 with about 36% share, driven by strong ADAS adoption and strict regulations. Europe followed with nearly 29% share, supported by NCAP mandates, while Asia Pacific held about 27% share due to rapid expansion of smart-vehicle production.

Market Insights

- The Night Vision Systems (NVS) and Driver Monitoring Systems (DMS) Market was valued at USD 12.8 billion in 2024 and is projected to reach USD 30.79 billion by 2032 at a CAGR of 11.6%.

- Rising safety regulations and mandatory driver-attention features drive strong adoption across passenger cars, which held a 71% share in 2024.

- Thermal imaging, AI-driven monitoring, and sensor-fusion upgrades shape current trends as automakers enhance night-time visibility and distraction detection.

- Leading players compete through advanced infrared cameras, in-cabin sensing platforms, and ADAS integration to expand adoption in both premium and mid-range vehicles.

- North America led the market with 36% share in 2024, followed by Europe at 29% and Asia Pacific at 27%, while the driver monitoring system segment dominated by type with 58% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The Driver Monitoring System segment held the dominant share in 2024 with about 58% of the Night Vision Systems (NVS) and Driver Monitoring Systems (DMS) Market. Demand grew as automakers integrated real-time eye-tracking and fatigue-detection features to meet rising safety mandates in Europe, China, and North America. Carmakers used DMS to reduce distraction-related crashes and support Level-2 and Level-3 automated driving functions. Adoption increased due to regulatory pressure from NCAP programs and wider deployment in mid-range vehicles, while Night Vision Systems expanded steadily through improved infrared sensors and stronger performance in low-light driving.

- For instance, Seeing Machines reported its driver monitoring technology installed in over 2.2 million vehicles by the end of FY2024, showing growing DMS penetration in series-production cars.

By Application

Passenger cars dominated the application segment in 2024 with nearly 71% share. Growth came from rising installation of DMS and NVS in mass-market and premium models as safety standards tightened worldwide. Demand increased as buyers valued features that reduce human-error accidents and enhance night-time visibility. Carmakers introduced these systems to support ADAS upgrades and boost safety ratings, which encouraged rapid deployment across new vehicle platforms. Commercial vehicles adopted these systems at a slower pace but gained traction through fleet safety programs and regulatory focus on fatigue-related incidents.

- For instance, Smart Eye stated that its driver monitoring system software was already included in more than 3,000,000 cars on the road, backed by a total of 366 design wins from 23 global automakers, including brands like GM, BMW, Porsche, and Volvo. The company’s technology is embedded in 365 production car models.

Key Growth Drivers

Rising Safety Regulations and Mandates

Global safety agencies increased pressure on automakers to adopt advanced monitoring and vision technologies. NCAP programs in Europe, China, and the U.S. pushed DMS and NVS integration to reduce distraction-related and low-visibility accidents. Carmakers responded by adding mandatory driver-attention features and nighttime detection tools across new models. These rules accelerated adoption in both premium and mid-range segments, strengthening demand throughout 2024.

- For instance, Valeo disclosed that it has produced more than 1.5 billion driving-assistance sensors over roughly 30 years, reflecting sustained investment to meet tightening active-safety and ADAS regulations.

Expansion of ADAS and Semi-Autonomous Driving

Automakers relied on NVS and DMS to support Level-2 and Level-3 automation. These systems improved lane-keeping accuracy, driver handover processes, and overall system reliability in poor lighting or complex traffic. Growing deployment of ADAS packages in mass-market vehicles encouraged higher installation rates. Strong benefits in accident prevention and smoother automation performance made this a core adoption driver across most regions.

- For instance, Mobileye reported that its solutions had been installed in approximately 190 million vehicles across roughly 1,200 vehicle models worldwide as of the end of 2024, underscoring its role in supporting ADAS and higher automation levels.

Growing Consumer Focus on Safety and Comfort

Buyers demanded vehicles with real-time fatigue alerts, distraction warnings, and better night-time visibility. Rising awareness of road fatalities increased interest in active safety technologies that detect micro-sleep or unseen hazards. Carmakers marketed these features as premium value additions, boosting adoption in luxury and mid-range cars. Expanding urban traffic density also encouraged users to choose vehicles equipped with supportive driver-assistance tools.

Key Trends & Opportunities

Integration of AI-Driven In-Cabin Monitoring

AI models enabled deeper analysis of driver behavior, including gaze direction, drowsiness patterns, and head position. Automakers used these insights to build smarter, predictive safety responses. This shift opened opportunities for software-driven upgrades and cloud-connected safety platforms. Growing interest in continuous monitoring for ridesharing and fleet services strengthened adoption across commercial use cases.

- For instance, Qualcomm stated that more than 350 million vehicles on the road use Snapdragon Digital Chassis solutions, which provide the compute platform for advanced cockpit, connectivity, and driver-assistance features.

Thermal Imaging and Sensor Fusion Expansion

Manufacturers improved NVS by combining thermal cameras with infrared and radar sensors. This fusion enhanced detection of pedestrians, animals, and obstacles in low-visibility areas, creating a strong opportunity for premium and autonomous vehicles. The trend accelerated as falling sensor costs made high-performance night-vision systems more accessible. This created new prospects for deployment in mainstream passenger cars.

- For instance, Teledyne FLIR reports that its thermal sensors for automotive night-vision systems have been deployed in more than 1.2 million vehicles, enhancing detection in dark and low-visibility conditions.

Adoption of Cabin Interaction and Personalization Features

Carmakers explored DMS as part of wider in-cabin experience design. Systems supported gesture control, mood detection, and personalized settings tied to driver identity. These upgrades created new opportunities for user-centric vehicle design and integration with infotainment systems. Growth in connected vehicles further pushed demand for multi-function camera platforms.

Key Challenges

High System Cost and Integration Complexity

NVS and DMS required advanced sensors, thermal cameras, and processing units, which raised development and installation costs. Automakers struggled to balance performance with affordability, slowing adoption in low-cost vehicles. Integration with ADAS platforms also demanded significant calibration and testing. These technical barriers limited broader penetration in emerging markets.

Privacy Concerns and Regulatory Constraints

Driver monitoring raised concerns about in-cabin data collection and facial recognition. Buyers questioned how automakers stored and used behavioral information. Inconsistent global privacy laws added compliance challenges, especially in regions with strict data-protection rules. These concerns created hesitation among some consumers and required stronger data-governance frameworks to support market expansion.

Regional Analysis

North America

North America led the Night Vision Systems (NVS) and Driver Monitoring Systems (DMS) Market in 2024 with about 36% share. Strong adoption came from strict safety rules, rapid integration of ADAS, and a high share of premium vehicles that already use advanced monitoring features. Automakers deployed NVS and DMS widely to meet regulatory expectations and improve crash-prevention scores. Growth also increased as large fleets adopted monitoring tools to reduce fatigue-related incidents. Expanding autonomous driving programs in the U.S. created further demand for enhanced night-vision and in-cabin behaviour tracking technologies.

Europe

Europe held nearly 29% share in 2024, supported by strong NCAP requirements and early adoption of in-cabin monitoring systems. Countries prioritised technologies that reduce distraction, drowsiness, and nighttime collision risks. Carmakers used NVS and DMS to meet upcoming safety mandates linked to the General Safety Regulation. Premium brands expanded deployment in both combustion and EV models. Continued growth of semi-autonomous driving features and rising interest in sensor fusion supported broader integration across new vehicle platforms in key markets such as Germany, France, and the United Kingdom.

Asia Pacific

Asia Pacific accounted for about 27% share in 2024 and showed the fastest growth as China, Japan, and South Korea expanded ADAS and smart-vehicle programs. Rising production of mid-range cars boosted adoption of DMS features, driven by new safety scoring systems in China. Carmakers integrated NVS to improve low-visibility driving in dense urban and rural regions. Domestic manufacturers increased the use of AI-based monitoring to remain competitive with global brands. Strong EV production and government support for advanced safety technology helped accelerate overall market expansion in the region.

Latin America

Latin America captured nearly 5% share in 2024, with adoption growing steadily as awareness of road safety improved. Deployment remained higher in premium and imported vehicles where NVS and DMS were added as part of advanced safety packages. Fleet operators showed rising interest in monitoring systems to reduce fatigue-related accidents, especially in commercial transport. Limited affordability and lower regulatory pressure slowed wider adoption, but improving safety norms in countries such as Brazil and Mexico supported gradual market expansion across new models.

Middle East and Africa

The Middle East and Africa region held around 3% share in 2024, reflecting early-stage adoption focused mainly on luxury vehicles and high-end SUVs. Growth came from rising demand for technologies that enhance night-time visibility in low-light desert conditions. Premium car buyers valued advanced monitoring features that improve comfort and reduce driver fatigue on long routes. Broader market penetration remained slow due to high system costs and limited regulatory requirements. However, expanding vehicle imports and improving safety awareness supported steady interest in NVS and DMS technologies.

Market Segmentations:

By Type

- Night Vision System

- Driver Monitoring System

By Application

- Passenger Car

- Commercial Vehicle

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Night Vision Systems (NVS) and Driver Monitoring Systems (DMS) Market is shaped by leading players such as Aisin Seiki, Continental, OMRON, Autoliv, Magna International, Smart Eye AB, Valeo, Robert Bosch, Denso, and Delphi Automotive. The market features strong competition driven by rapid advancements in AI-powered monitoring, thermal imaging, and multi-sensor fusion platforms. Companies focus on improving real-time driver behaviour detection, enhancing night-time visibility, and supporting Level-2 and Level-3 autonomous functions. Many manufacturers invest in software algorithms, infrared cameras, and in-cabin sensing modules to strengthen product performance. Strategic partnerships with automakers accelerate integration into new vehicle platforms, while rising regulatory pressure boosts demand for compliant safety technologies. Continuous innovation in cost-optimized sensors supports expansion into mid-range passenger cars and commercial fleets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Aisin Seiki

- Continental

- OMRON

- Autoliv

- Magna International

- Smart Eye AB

- Valeo

- Robert Bosch

- Denso

- Delphi Automotive

Recent Developments

- In 2024, Robert Bosch GmbH Partnered with companies like drivebuddyAI to advance its AI-powered ADAS and DMS platforms.

- In 2024, Valeo S.A. and Teledyne FLIR announced a strategic collaboration to integrate and deliver thermal imaging technology for automotive safety systems.

- In 2023, Smart Eye AB Launched a new Driver Monitoring System (DMS) metric in June to further improve road safety and driver health.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see wider adoption as safety rules tighten across major regions.

- Automakers will integrate more AI-based driver behaviour analytics for deeper insights.

- Sensor fusion combining thermal, infrared, and radar will enhance night-time detection accuracy.

- Mass-market vehicles will increasingly adopt DMS features previously limited to premium models.

- Semi-autonomous driving growth will boost demand for reliable in-cabin monitoring systems.

- Fleet and commercial operators will expand use of monitoring tools to reduce fatigue-related risks.

- Carmakers will add multi-function in-cabin systems that support personalization and interaction.

- Falling sensor costs will make advanced NVS technology more accessible to mid-range vehicles.

- Privacy and data-governance frameworks will influence the pace of DMS adoption in key markets.

- Partnerships between automakers and AI software firms will accelerate feature development and deployment.