Market Overview

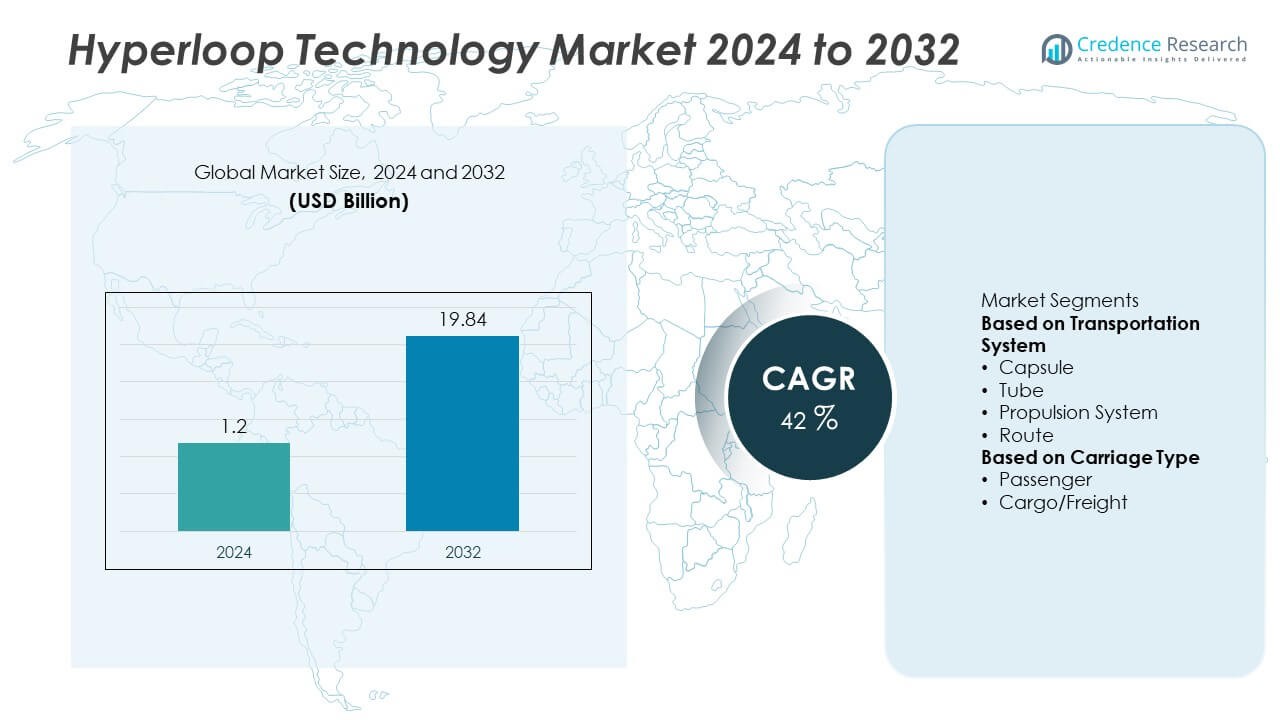

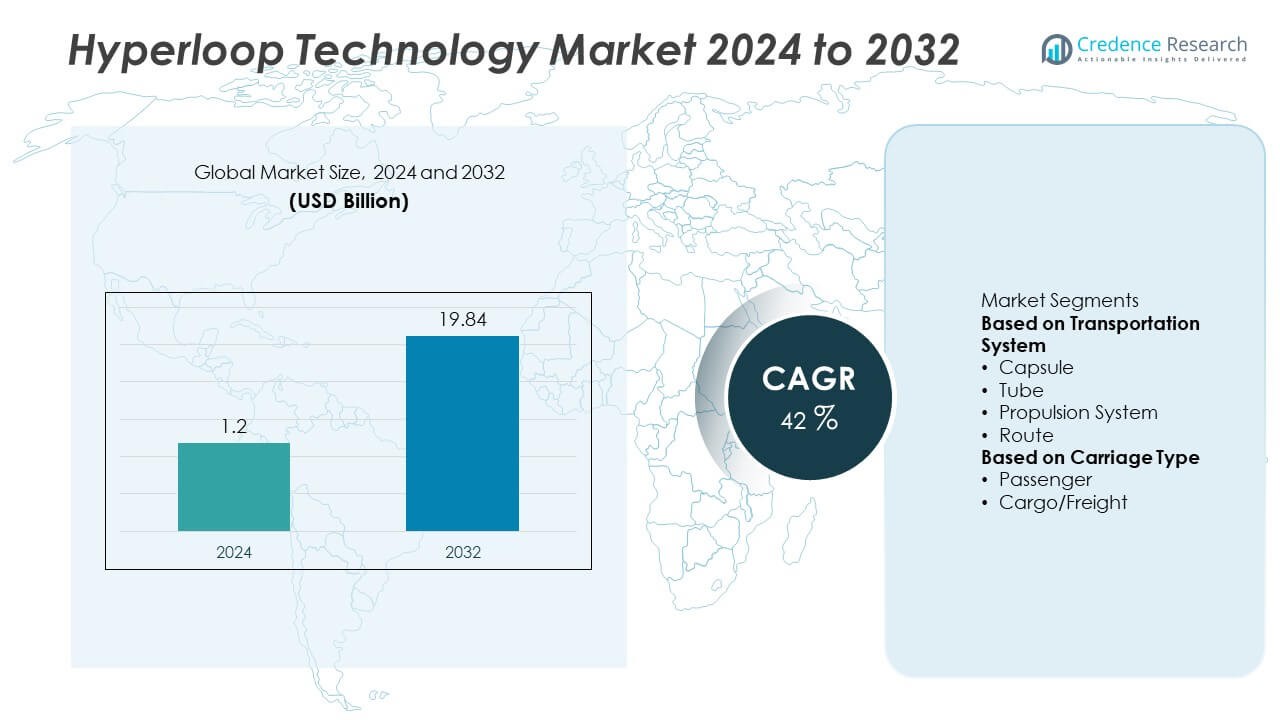

Hyperloop Technology market size was valued at USD 1.2 billion in 2024 and is anticipated to reach USD 19.84 billion by 2032, growing at a CAGR of 42% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hyperloop Technology Market Size 2024 |

USD 1.2 Billion |

| Hyperloop Technology Market, CAGR |

42% |

| Hyperloop Technology Market Size 2032 |

USD 19.84 Billion |

The Hyperloop Technology market is led by companies such as HyperloopTT, Space Exploration Technologies Corporation, Zeleros, Hardt B.V., TRANSPOD, Virgin Hyperloop, TUM Hyperloop, Hyper Chariot, Swisspod Technologies, and DGWHyperloop. These players are advancing capsule, propulsion, and tube systems to bring high-speed transportation closer to commercialization. In 2024, North America held the largest share at 36%, driven by strong investments in R&D and pilot testing projects led by U.S.-based firms. Europe followed with 33% share, supported by cross-border initiatives and EU-backed infrastructure development, while Asia-Pacific accounted for 25% share, boosted by government-backed urban mobility programs in China and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Hyperloop Technology market was valued at USD 1.2 billion in 2024 and is projected to reach USD 19.84 billion by 2032, growing at a CAGR of 42% during the forecast period.

- Rising demand for high-speed, sustainable, and efficient transportation systems drives growth, with passenger carriage leading at over 60% share due to urban mobility needs.

- A key trend is the integration of renewable energy and smart infrastructure, supporting eco-friendly hyperloop corridors across major economies.

- The market is competitive with players such as HyperloopTT, SpaceX, Zeleros, TRANSPOD, and Virgin Hyperloop focusing on partnerships, prototype testing, and large-scale pilot projects.

- Regionally, North America led with 36% share in 2024, followed by Europe at 33% and Asia-Pacific at 25%, while cargo/freight applications are gaining traction in Europe and Asia for logistics efficiency.

Market Segmentation Analysis:

By Transportation System

The capsule segment dominated the hyperloop technology market in 2024, accounting for over 40% share. Capsules are the core element of the system, designed to transport passengers and cargo at ultra-high speeds in low-pressure tubes. Their dominance is supported by ongoing R&D investments in aerodynamics, safety, and passenger comfort. Companies are focusing on lightweight materials and advanced engineering to enhance efficiency. While tubes, propulsion systems, and route infrastructure are critical components, capsules attract the highest share due to their direct role in operational functionality and their significance in pilot testing and demonstration projects.

- For instance, Swisspod Technologies achieved 40.7 km/h with a 1/12-scale capsule, covering 11.8 km under vacuum conditions on a 120m circular test track in Lausanne. This distance and speed were deemed equivalent to a full-scale journey of 141.6 km at 488.2 km/h.

By Carriage Type

Passenger carriage led the hyperloop technology market in 2024, capturing more than 55% share. Rising demand for high-speed, sustainable, and cost-efficient urban and intercity travel drives this segment’s dominance. Governments and private players are prioritizing passenger-focused systems to ease congestion and cut travel times, making this segment central to ongoing pilot projects worldwide. Cargo or freight carriage is also gaining momentum, supported by logistics companies exploring hyperloop for rapid goods transport. However, passenger services remain the focal point, as they offer broader economic and social benefits, strengthening their leadership in the global hyperloop ecosystem.

- For instance, Hardt Hyperloop set a European record with a passenger prototype reaching 85 km/h during trials at the Dutch European Hyperloop Center’s 420 m test track.

Key Growth Drivers

Rising Demand for High-Speed Transportation

The growing need for ultra-fast and efficient travel solutions is a primary driver of the hyperloop technology market. Unlike conventional rail or air transport, hyperloop systems promise speeds exceeding 1,000 km/h with lower energy consumption. Urbanization, expanding megacities, and increasing intercity travel demand make hyperloop attractive for reducing congestion and improving connectivity. Governments and private investors are exploring pilot projects to transform long-distance travel into shorter, more efficient journeys. This shift toward high-speed mobility strongly supports the adoption of hyperloop technology worldwide.

- For instance, Virgin Hyperloop’s full-scale test pod “XP-2” carried two passengers on a 500 m test track in Nevada during a trial run, where it reached a speed of 172 km/h (107 mph).

Focus on Sustainability and Carbon Reduction

Hyperloop technology aligns with global sustainability goals by offering an eco-friendly alternative to air and road travel. Powered primarily by renewable electricity, the system produces minimal emissions compared to conventional transport. With growing pressure to meet net-zero targets, countries are prioritizing green infrastructure investments. The ability of hyperloop to cut travel-related carbon footprints while providing mass transit solutions makes it highly relevant in today’s policy landscape. This sustainability focus continues to drive research funding and global interest in accelerating adoption.

- For instance, Zeleros developed a fully electric linear motor prototype, tested on a 100-meter track in Spain, that is designed for both container handling in port environments and as a stepping stone toward its hyperloop technology.

Growing Private and Public Investments

Rising financial support from governments, venture capital, and private enterprises is fueling hyperloop technology development. Pilot projects in the United States, Europe, and Asia are backed by significant R&D funding, enabling advancements in propulsion, safety, and materials. Public-private partnerships are accelerating feasibility studies and infrastructure planning, creating momentum for future deployments. Companies such as Virgin Hyperloop and Hyperloop Transportation Technologies are leading in innovation, attracting global attention. The inflow of investments ensures continuous technological progress, pushing hyperloop closer to commercialization within the forecast period.

Key Trends & Opportunities

Development of Passenger-Centric Systems

Passenger transport remains the central focus of hyperloop projects, with over half of initiatives targeting intercity travel. The opportunity lies in addressing increasing commuter demand while offering safer and faster alternatives to flights and high-speed rail. Integration with existing public transportation systems can further enhance accessibility. Pilot routes under development highlight the potential for passenger services to revolutionize daily travel and tourism. This trend provides companies with significant opportunities to attract investment, secure regulatory approvals, and demonstrate feasibility at a commercial scale.

- For instance, TUM Hyperloop achieved a speed of 482 km/h with its prototype pod at the 2019 SpaceX Hyperloop Pod Competition, setting a record for university-led hyperloop development. In July 2023, the team also performed Europe’s first passenger run under vacuum conditions in a separate, full-scale passenger pod on its 24-meter test track in Munich.

Expanding Applications in Cargo and Freight

Cargo transport is emerging as a significant opportunity in the hyperloop market, with companies exploring its role in logistics and supply chains. Hyperloop can move goods faster and more efficiently than traditional trucking or rail networks, reducing delivery times for high-value and time-sensitive shipments. With global e-commerce and trade volumes rising, freight-focused systems offer new revenue streams. Logistics companies are increasingly interested in partnerships for pilot projects, highlighting the potential of hyperloop technology to reshape cargo distribution and last-mile connectivity.

- For instance, TransPod’s “FluxJet”—designed for cargo and passengers—was demonstrated using a scaled-down prototype in Toronto, showcasing its potential for ultra-high-speed ground transportation that the company aims to operate at over 1,000 km/h in the future.

Key Challenges

High Infrastructure and Development Costs

One of the biggest challenges facing hyperloop adoption is the enormous cost of building routes, tubes, and propulsion systems. Land acquisition, construction, and technology integration require billions of dollars in investment, making it difficult for projects to scale. The long payback periods and uncertainty around return on investment discourage private investors in cost-sensitive regions. Without significant government funding and subsidies, the financial viability of large-scale hyperloop deployment remains uncertain, limiting its short-term adoption.

Regulatory and Safety Concerns

The lack of established regulatory frameworks for hyperloop technology is a critical barrier. Governments are still developing standards for safety, operations, and environmental impact. Questions regarding passenger safety at high speeds, emergency protocols, and long-term reliability delay approvals. Public acceptance also hinges on demonstrated safety through large-scale testing. Until international guidelines and certifications are established, the commercialization of hyperloop systems faces major hurdles, slowing down their widespread deployment despite technological advancements.

Regional Analysis

North America

North America accounted for over 35% share of the hyperloop technology market in 2024, making it the leading region. The United States leads adoption with major projects under development, supported by strong private investments and government-backed feasibility studies. Increasing urban congestion and demand for faster intercity travel boost adoption potential. Companies like Virgin Hyperloop are advancing test tracks and pilot routes, which strengthens the region’s leadership. Regulatory progress and strong R&D funding ensure that North America remains at the forefront of hyperloop development, with long-term opportunities in both passenger and freight transport.

Europe

Europe held more than 28% share of the hyperloop technology market in 2024, supported by sustainability initiatives and smart mobility programs. Countries such as Germany, France, and the Netherlands are leading pilot studies and R&D investments. The European Union’s carbon neutrality goals align with hyperloop’s low-emission profile, driving strong policy support. Infrastructure modernization and cross-border connectivity projects add momentum. Growing collaboration between technology developers and policymakers accelerates testing and certification efforts. With a focus on reducing aviation reliance, Europe positions hyperloop as a strategic solution for high-speed, eco-friendly regional transportation.

Asia-Pacific

Asia-Pacific captured over 30% share of the hyperloop technology market in 2024, ranking as a strong growth region. China, India, and Japan lead investments, supported by rapid urbanization and rising demand for efficient megacity-to-megacity transport. Government initiatives in infrastructure modernization and carbon reduction further support adoption. Pilot projects and feasibility studies highlight the potential for both passenger and freight applications. The region’s strong manufacturing base and expertise in large-scale infrastructure projects provide cost advantages. With ongoing partnerships between global technology providers and local governments, Asia-Pacific is expected to be a key driver of hyperloop commercialization.

Latin America

Latin America represented over 4% share of the hyperloop technology market in 2024, driven by growing urban populations and interest in innovative transport solutions. Brazil and Mexico are the primary markets, where feasibility studies are underway to evaluate long-distance passenger routes. Rising logistics demand also supports potential freight applications, though high development costs limit rapid adoption. Government support remains modest, but increasing collaboration with international hyperloop developers provides growth opportunities. As regional economies expand and infrastructure investment rises, Latin America is expected to show steady but gradual uptake of hyperloop technology.

Middle East & Africa

The Middle East & Africa accounted for nearly 3% share of the hyperloop technology market in 2024, with the Middle East driving most of the progress. The UAE and Saudi Arabia are spearheading large-scale projects, positioning hyperloop as part of long-term smart city and transport diversification plans. Investments in high-speed, sustainable infrastructure highlight the region’s ambition to lead in advanced mobility. In Africa, adoption remains limited but potential exists in urban hubs for cargo applications. Although constrained by high costs and regulatory gaps, the region’s strong infrastructure investments present long-term growth opportunities.

Market Segmentations:

By Transportation System

- Capsule

- Tube

- Propulsion System

- Route

By Carriage Type

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape of the Hyperloop Technology market features major players such as HyperloopTT, Space Exploration Technologies Corporation, Zeleros, TUM Hyperloop, Hardt B.V., TRANSPOD, Hyper Chariot, Virgin Hyperloop, DGWHyperloop, and Swisspod Technologies. These companies are driving innovation through advancements in capsule design, propulsion systems, and safety integration. HyperloopTT and Virgin Hyperloop are leading large-scale pilot projects, while SpaceX continues to support research and testing through its Hyperloop pod competitions. European firms like Zeleros, Hardt B.V., and TRANSPOD are focusing on scalable infrastructure and cross-border connectivity, aligning with EU transport goals. Start-ups including Swisspod Technologies and DGWHyperloop are contributing with modular systems and cost-efficient prototypes. The market is highly competitive, with firms emphasizing collaborations, government partnerships, and funding initiatives to accelerate commercial deployment. As global transport systems move toward high-speed, sustainable alternatives, competition among key players is expected to intensify, with strategic alliances and technology breakthroughs shaping the future of hyperloop adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- HyperloopTT

- Space Exploration Technologies Corporation

- Zeleros

- TUM Hyperloop

- Hardt B.V.

- TRANSPOD

- Hyper Chariot

- Virgin Hyperloop

- DGWHyperloop

- Swisspod Technologies

Recent Developments

- In March 2025, HyperloopTT completed the first “HyperPort” feasibility study in Brazil.

- In April 2024, Zeleros co-founded Battera, a JV focused on battery modules and packs for mobility and transport sectors.

- In December 2023, Virgin Hyperloop (formerly Hyperloop One) ceased operations, and its intellectual property was transferred to majority stakeholder DP World.

- In October 2023, Hardt formed a strategic alliance with Zeleros to accelerate hyperloop tech and commercialization.

Report Coverage

The research report offers an in-depth analysis based on Transportation System, Carriage Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly with increasing investments in next-generation transport systems.

- Passenger transport will remain the leading segment as demand for faster travel rises.

- Cargo and freight adoption will grow with emphasis on logistics efficiency and cost savings.

- North America will sustain leadership with government-backed pilot projects and private partnerships.

- Europe will strengthen growth through sustainability mandates and cross-border transport initiatives.

- Asia-Pacific will emerge as a high-growth region driven by urbanization and infrastructure upgrades.

- Renewable energy integration will enhance the sustainability of hyperloop networks.

- Partnerships between technology providers and governments will accelerate project implementation.

- High construction costs and regulatory barriers will remain key challenges for adoption.

- Ongoing R&D in propulsion and tube systems will improve performance and scalability.