Market Overview

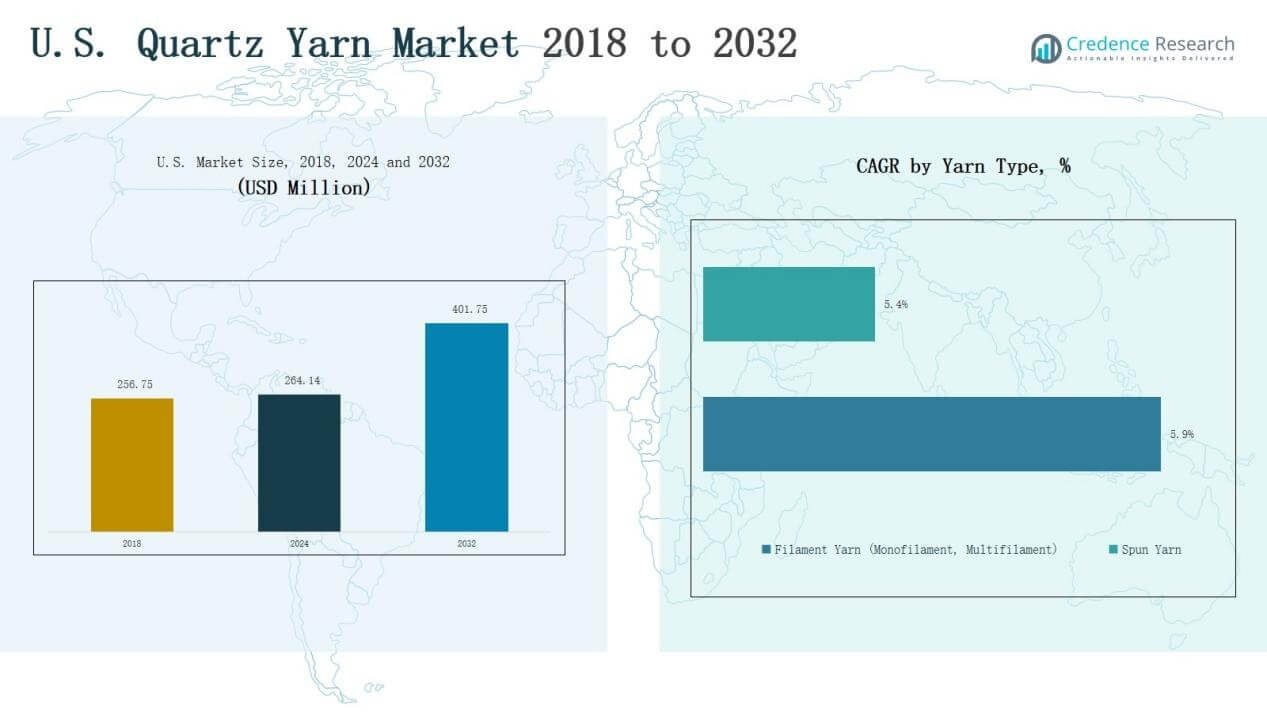

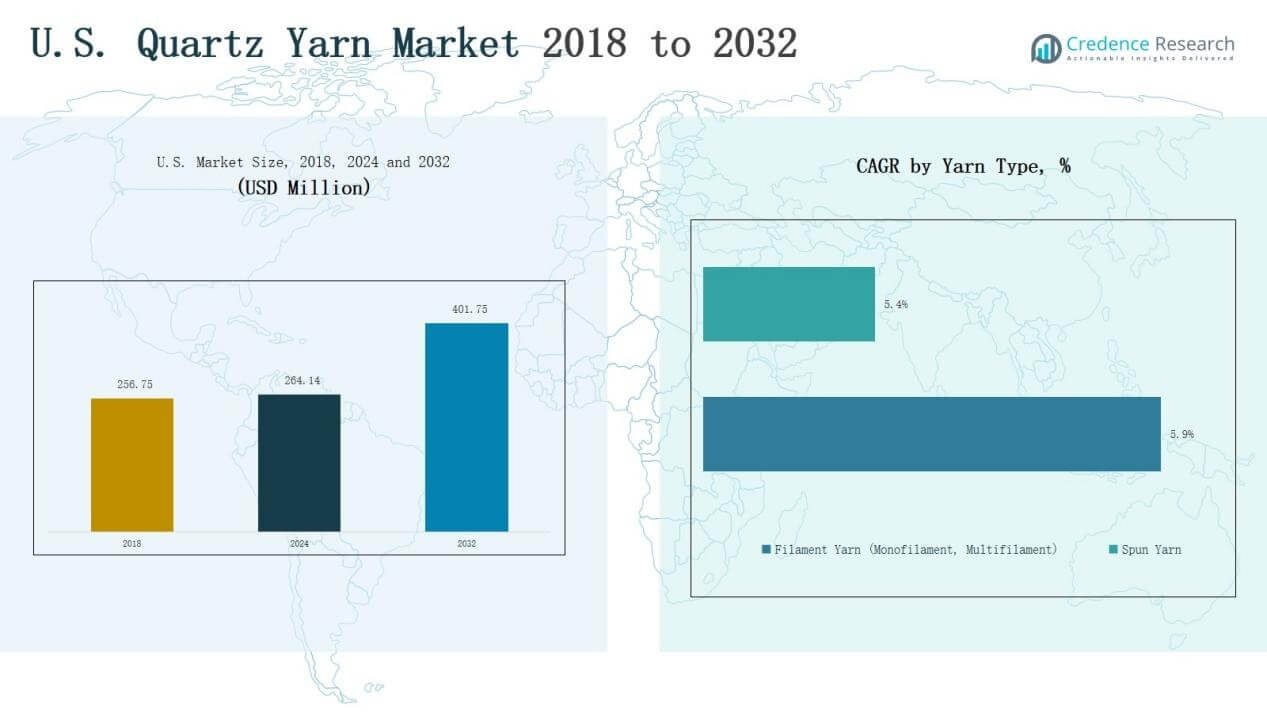

The U.S. Quartz Yarn Market size was valued at USD 256.75 million in 2018, reached USD 264.14 million in 2024, and is anticipated to reach USD 401.75 million by 2032, at a CAGR of 5.38% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Quartz Yarn Market Size 2024 |

USD 264.14 Million |

| U.S. Quartz Yarn Market, CAGR |

5.38% |

| U.S. Quartz Yarn Market Size 2032 |

USD 401.75 Million |

The U.S. Quartz Yarn Market is shaped by established players including JPS Composite Materials, Saint-Gobain Quartz, 3M Company, AGY Holding Corp., Nippon Electric Glass, and Unifrax. These companies strengthen competitiveness through advanced product development, R&D investments, and long-term partnerships across aerospace, automotive, and industrial sectors. Innovation in high-purity grades and thermal-resistant yarns remains central to their strategies. Regionally, the Northeast leads with 34% share in 2024, supported by its strong aerospace and defense base, advanced material research facilities, and growing industrial applications.

Market Insights

Market Insights

- The U.S. Quartz Yarn Market grew from USD 256.75 million in 2018 to USD 264.14 million in 2024 and will reach USD 401.75 million by 2032.

- Leading players include JPS Composite Materials, Saint-Gobain Quartz, 3M Company, AGY Holding Corp., Nippon Electric Glass, and Unifrax, focusing on high-purity and thermal-resistant yarns.

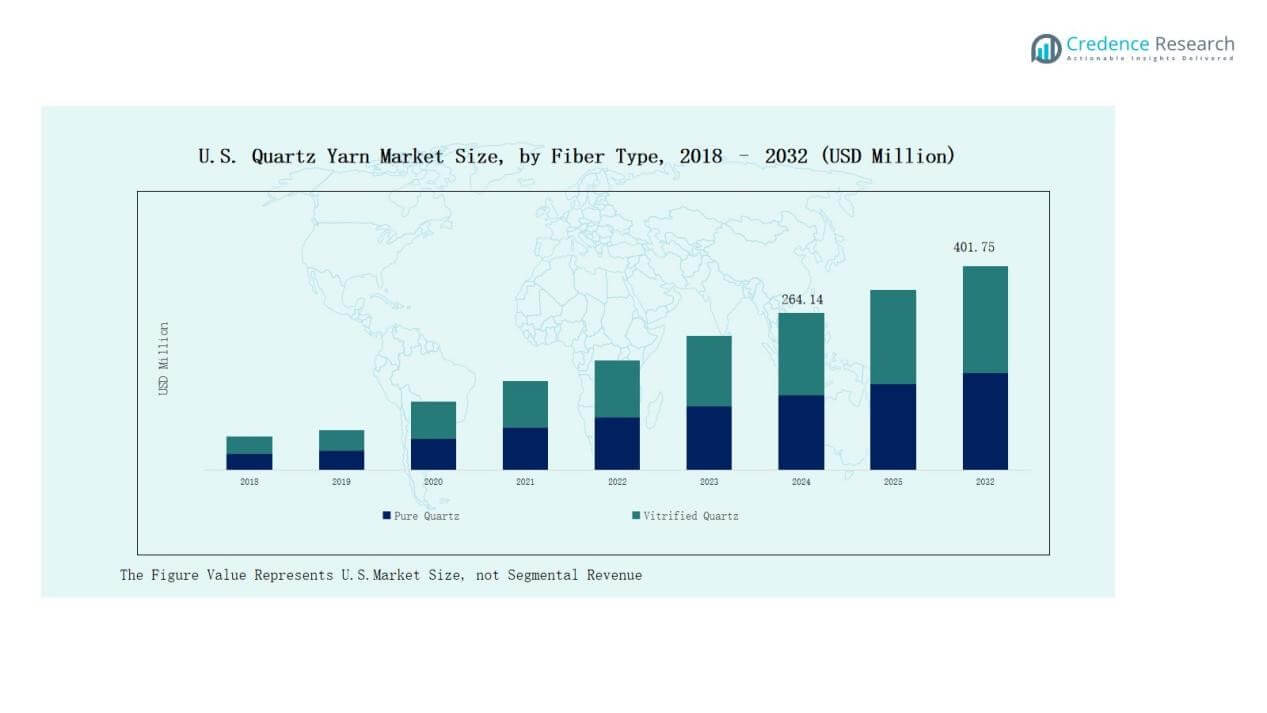

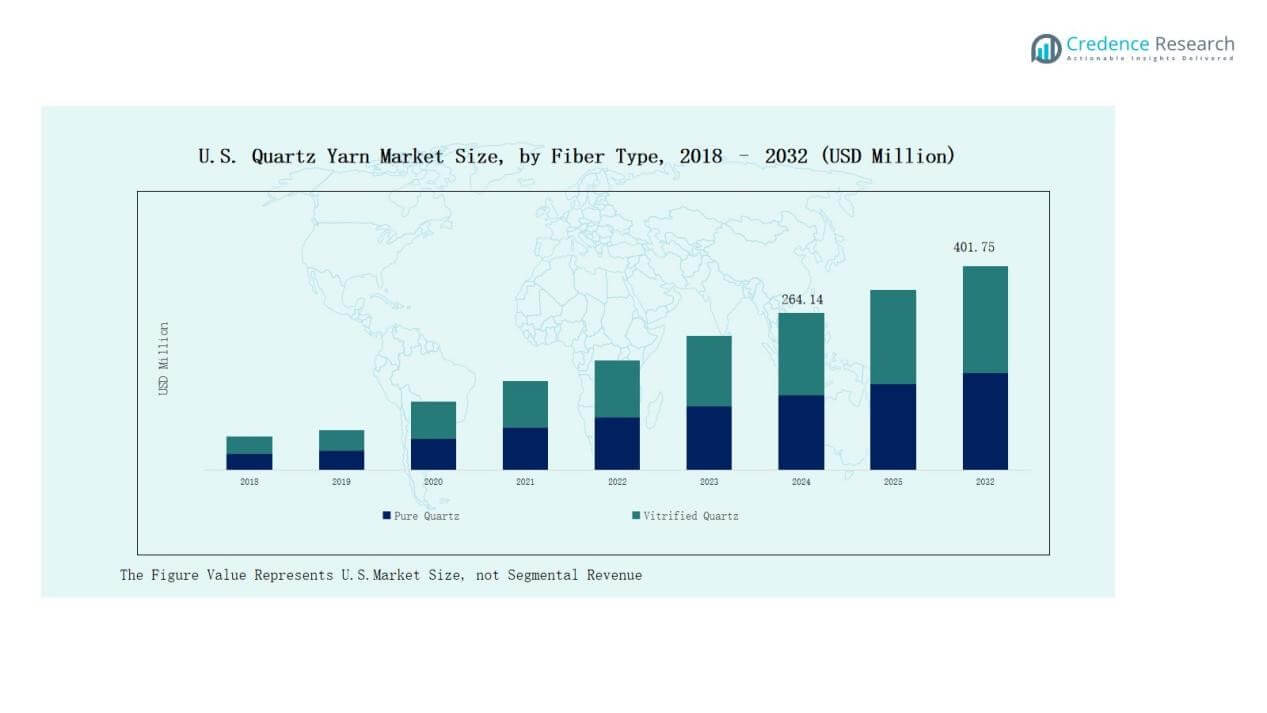

- By fiber type, pure quartz dominates with 63% share in 2024, driven by demand in aerospace, defense, and chemical applications requiring high strength and thermal resistance.

- By yarn type, filament yarn leads with 68% share in 2024, with multifilament gaining traction in aerospace composites and automotive reinforcement for its flexibility and durability.

- The Northeast leads regionally with 34% share in 2024, supported by its aerospace and defense hub, strong research infrastructure, and growing demand from advanced industrial sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Fiber Type

The U.S. Quartz Yarn Market by fiber type is led by pure quartz, holding nearly 63% share in 2024. Its dominance is driven by superior thermal resistance, high tensile strength, and purity standards required in aerospace, defense, and chemical applications. Pure quartz fibers are preferred for advanced composites, filtration, and insulation where durability under extreme conditions is essential. Vitrified quartz, though smaller in share, is gaining adoption in cost-sensitive industries for moderate-performance applications.

For instance, Saint-Gobain Quartz expanded its production of high-purity quartz fibers used in aerospace heat shielding, enhancing applications in thermal protection systems.

By Yarn Type

The yarn type segment is dominated by filament yarn, accounting for about 68% share in 2024. Within this, multifilament yarn is more widely adopted due to its flexibility, ease of weaving, and high strength-to-weight ratio, making it vital in aerospace composites and automotive reinforcements. Monofilament yarn serves niche filtration and insulation needs, while spun yarn remains a smaller segment, catering to specialized sealing and thermal insulation applications. Strong demand for lightweight and durable yarns supports filament yarn’s leadership.

For instance, Toray Industries developed a new high-tenacity multifilament yarn designed for aerospace structural components, enhancing durability while reducing weight.

By End-Use Industry

The aerospace and defense sector dominates the U.S. Quartz Yarn Market, capturing nearly 39% share in 2024. Demand is fueled by the need for high-purity, heat-resistant fibers in aircraft composites, missile systems, and thermal protection solutions. The automotive sector follows, leveraging quartz yarn in lightweight structures and exhaust insulation. Chemical processing, construction, and oil & gas industries contribute steadily, adopting quartz yarn for filtration, sealing, and corrosion-resistant reinforcement. Growth is reinforced by rising investments in advanced manufacturing.

Key Growth Drivers

Rising Aerospace & Defense Demand

The aerospace and defense industry drives strong demand for quartz yarn due to its superior thermal resistance, high purity, and durability in extreme conditions. Applications in aircraft composites, missile shielding, and space exploration materials make quartz yarn indispensable. With the U.S. maintaining leadership in defense spending and expanding aerospace production, the segment continues to boost market growth. Strategic R&D investments by manufacturers further support advanced material adoption in next-generation aerospace technologies.

For instance, Bally Ribbon Mills’ 3D orthogonally woven 3DMAT quartz composite, developed with NASA, is used in the Orion spacecraft’s compression pads, providing critical ablative thermal protection during Earth reentry on Artemis missions.

Expanding Automotive Lightweight Applications

The U.S. automotive industry increasingly uses quartz yarn in exhaust systems, heat shields, and lightweight structural composites. Automakers seek advanced materials to improve fuel efficiency and meet stringent emission standards. Quartz yarn’s high tensile strength and thermal insulation make it suitable for demanding automotive applications. The shift toward electric vehicles also strengthens its role in battery protection and thermal management. These factors collectively position automotive as a major growth driver within the U.S. Quartz Yarn Market.

For instance, Shenjiu quartz wool, composed of pure quartz fiber, is used in automotive glass tempering furnaces and as thermal insulation material due to its resistance to temperatures up to 1050°C long-term.

Growth in Chemical Processing and Industrial Use

Chemical processing facilities demand quartz yarn for filtration, corrosion resistance, and reinforcement in aggressive environments. The yarn’s ability to withstand high heat and chemical exposure makes it vital for industrial filters, gaskets, and sealing applications. Rising investments in chemical and petrochemical plants across the U.S. are creating consistent growth opportunities. Furthermore, expanding adoption of advanced filtration systems in industries like pharmaceuticals, semiconductors, and oil refining boosts demand, making chemical and industrial use a key driver.

Key Trends & Opportunities

Key Trends & Opportunities

Advancements in Composite Reinforcement

Composite reinforcement remains a core application of quartz yarn, with innovations in high-performance materials offering growth potential. Increasing use of composites in aerospace, defense, and automotive industries supports greater adoption. Emerging research focuses on developing hybrid composites combining quartz yarn with carbon or glass fibers, enhancing durability and reducing weight. This trend opens opportunities for U.S. manufacturers to supply advanced composite solutions, particularly in defense and space projects demanding cutting-edge thermal and mechanical performance.

For instance, Airbus tested composite reinforcements integrating quartz yarn with glass fibers for lightweight aircraft cabin interiors, improving fire resistance and structural reliability.

Sustainability and Green Manufacturing

Sustainability initiatives are shaping opportunities in the U.S. Quartz Yarn Market. Manufacturers are investing in energy-efficient production and recycling processes to reduce carbon emissions. End users in automotive and aerospace prioritize suppliers that align with sustainability goals, creating a competitive advantage for eco-conscious producers. The growing adoption of renewable energy and green procurement policies by corporations also fuels demand for quartz yarn in eco-friendly product designs. This alignment with sustainability standards offers long-term growth potential.

For instance, Owens Corning introduced an advanced low-carbon glass fiber product line that uses recycled raw materials and reduced-energy manufacturing, designed for lightweight composites in aerospace and defense.

Key Challenges

High Production Costs

Producing quartz yarn requires energy-intensive processes, advanced purification methods, and specialized equipment, driving up costs. High manufacturing expenses limit adoption in cost-sensitive industries like construction and consumer goods. Small- and medium-scale manufacturers often struggle to compete with larger players that benefit from economies of scale. The challenge of balancing quality, consistency, and affordability continues to restrict wider market penetration, making cost optimization critical for sustained growth in the U.S. Quartz Yarn Market.

Supply Chain Constraints

Quartz yarn production depends on a steady supply of high-purity quartz, which faces supply chain bottlenecks. Fluctuations in raw material availability and global trade disruptions often delay production and increase prices. Import reliance for certain grades of quartz further adds to supply vulnerabilities. These challenges affect the ability of U.S. manufacturers to meet rising demand across aerospace, automotive, and industrial sectors. Strengthening domestic sourcing and diversifying supply chains remain essential strategies for market players.

Competition from Alternative Materials

The U.S. Quartz Yarn Market faces competition from alternative materials such as carbon fibers, aramid fibers, and advanced ceramics. These materials often provide comparable performance at lower costs or better availability, making them attractive substitutes in specific applications. For example, carbon fiber dominates in automotive composites due to cost-effectiveness and high strength-to-weight ratio. This competition pressures quartz yarn producers to differentiate through advanced product innovation, value-added features, and stronger positioning in niche high-performance applications.

Regional Analysis

Northeast

The Northeast region leads the U.S. Quartz Yarn Market, holding 34% share in 2024. It benefits from the concentration of aerospace and defense manufacturers, research centers, and advanced material suppliers. The presence of major automotive design facilities and chemical processing plants strengthens demand for high-purity yarns. It is further supported by government-backed innovation programs and strong infrastructure for composite research. The region’s reliance on cutting-edge applications positions it as the dominant hub for future growth.

Midwest

The Midwest accounts for 26% share in 2024, driven by its strong automotive and construction industries. Quartz yarn demand in this region is fueled by insulation and reinforcement needs in automotive supply chains and industrial facilities. It is also supported by investments in chemical and petrochemical processing plants, which require durable filtration and sealing materials. The region’s established manufacturing ecosystem creates steady adoption across multiple sectors. Its role as a production base sustains a stable demand outlook.

South

The South region represents 22% share in 2024, with growth led by oil and gas activities and expanding construction projects. Quartz yarn is widely used in filtration, sealing, and insulation within energy operations across Texas and Gulf states. The aerospace sector also contributes, with increasing demand for lightweight composites in defense and aircraft production facilities. It benefits from favorable industrial policies and strong logistics infrastructure. The region’s focus on energy and defense ensures consistent adoption of quartz yarn solutions.

West

The West region holds 18% share in 2024, supported by the presence of high-technology industries and expanding aerospace programs. California’s strong base in electronics and advanced materials boosts demand for high-purity quartz yarns in composites and insulation. The construction sector also contributes with increasing use of durable reinforcement materials in infrastructure projects. It benefits from innovation hubs and partnerships with leading research institutes. The region’s diverse industrial base drives steady demand across multiple applications, strengthening its long-term role.

Market Segmentations:

Market Segmentations:

By Fiber Type

- Pure Quartz

- Vitrified Quartz

By Yarn Type

- Filament Yarn

- Monofilament

- Multifilament

- Spun Yarn

By End-Use Industry

- Aerospace & Defense

- Automotive

- Chemical Processing

- Construction

- Oil & Gas

By Application

- Composite Reinforcement

- Filtration

- Insulation

- Sealing Threads

By Region

- Northeast

- Midwest

- South

- West

Competitive Landscape

The U.S. Quartz Yarn Market is moderately consolidated, with competition led by established multinational and regional players. Key participants include JPS Composite Materials, Saint-Gobain Quartz, 3M Company, AGY Holding Corp., Nippon Electric Glass, and Unifrax. These companies compete through product innovation, high-purity grades, and advanced yarn technologies tailored for aerospace, automotive, and industrial applications. It is shaped by strategic initiatives such as capacity expansions, long-term supply agreements, and R&D investments focused on thermal resistance and durability. Partnerships with aerospace and defense contractors remain critical to maintaining market leadership. Companies also strengthen competitiveness through sustainability initiatives and digital manufacturing practices. The landscape reflects high entry barriers due to capital-intensive production and technical expertise requirements, limiting the presence of smaller firms. Continuous innovation and customized solutions remain central strategies, while competition from alternative materials compels market players to enhance value-added features and broaden their application scope.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- JPS Composite Materials (USA)

- Saint-Gobain Quartz

- 3M Company

- AGY Holding Corp.

- Nippon Electric Glass

- Unifrax (U.S.-based)

Recent Developments

- In Sep 3, 2025, AGY Holding Corp. and A+ Composites showcased new S2 glass-fiber thermoplastic UD tapes at CAMX 2025. This is a product introduction to the composites market.

- In March 2024, 3M Company signed a joint research project with HD Hyundai KSOE on Glass Bubbles for liquid hydrogen storage.

- In Feb 22, 2024, Saint-Gobain Advanced Ceramic Composites began oxide-fiber production to meet rising CMC demand, expanding on its Quartzel® quartz-fiber legacy.

Report Coverage

The research report offers an in-depth analysis based on Fiber Type, Yarn Type, End Use Industry, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand from aerospace and defense will remain the primary growth driver.

- Automotive applications will expand with rising adoption of lightweight composites.

- Chemical processing industries will continue to rely on quartz yarn for filtration and sealing.

- Construction projects will create steady demand for insulation and reinforcement applications.

- Oil and gas operations will increase use of quartz yarn in thermal and sealing solutions.

- Filament yarn, especially multifilament, will retain dominance due to flexibility and strength.

- Research in hybrid composites will open new application opportunities across industries.

- Sustainability practices in production will gain importance among leading manufacturers.

- Supply chain localization will strengthen resilience and reduce raw material dependency.

- Competition with alternative fibers will encourage more innovation and product differentiation.

Market Insights

Market Insights Key Trends & Opportunities

Key Trends & Opportunities Market Segmentations:

Market Segmentations: