| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| New Energy Vehicles Market Size 2024 |

USD 520.0 million |

| New Energy Vehicles Market, CAGR |

19.10% |

| New Energy Vehicles Market Size 2032 |

USD 2,120.6 million |

Market Overview:

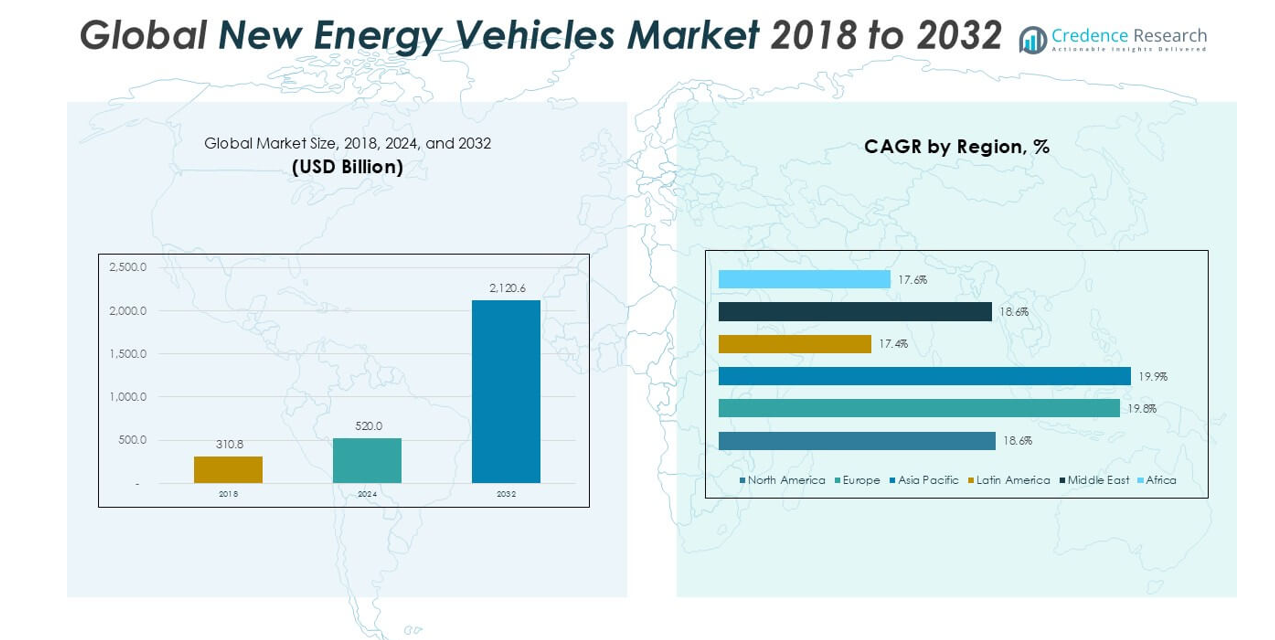

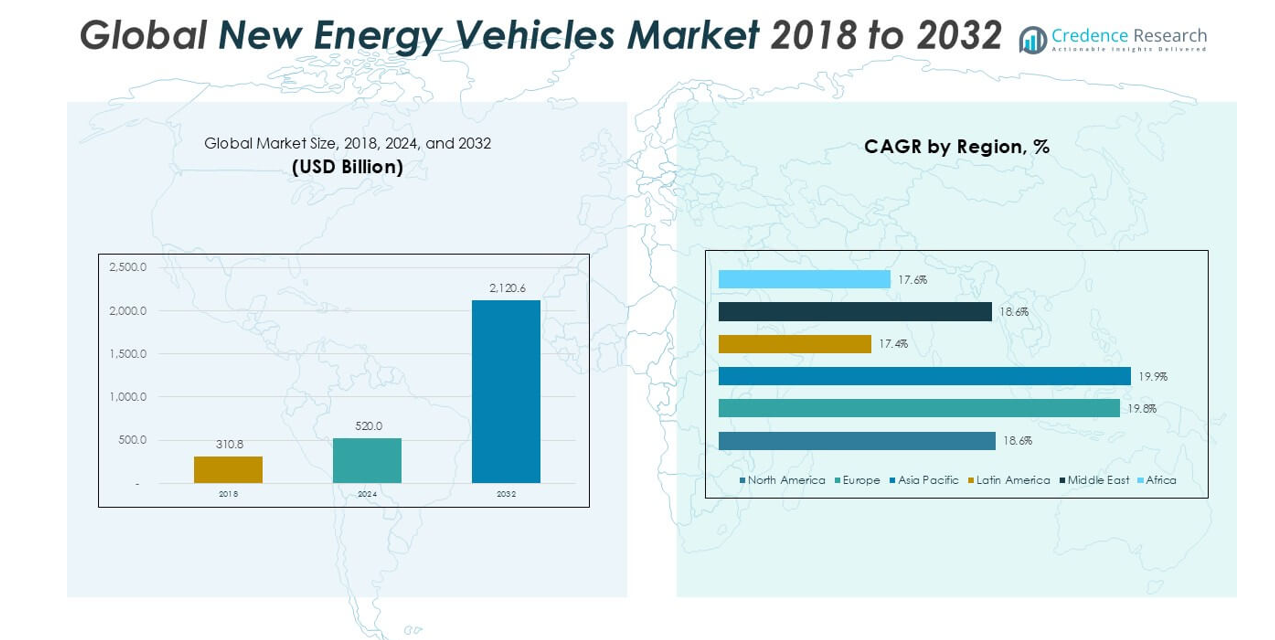

The New Energy Vehicles market size was valued at USD 310.8 million in 2018, reached USD 520.0 million in 2024, and is anticipated to reach USD 2,120.6 million by 2032, at a CAGR of 19.10% during the forecast period.

The New Energy Vehicles market is led by prominent players such as Toyota Kirloskar Motor, Nissan, Tesla, Mitsubishi Electric Corporation, General Motors, Ford Motor Company, BMW AG, Renault, Daimler AG, and AB Volvo. These companies drive industry growth through extensive R&D investments, diverse electric and hybrid portfolios, and strategic alliances across the value chain. Asia Pacific holds the leading regional position, capturing approximately 27% of the global market share in 2024, supported by robust manufacturing capabilities and government policies favoring electrification. North America and Europe follow, with 32% and 21% market shares respectively, underpinned by strong consumer demand, innovation, and regulatory mandates that further accelerate the adoption of new energy vehicles across these markets.

Market Insights

- The New Energy Vehicles market was valued at USD 520.0 million in 2024 and is projected to reach USD 2,120.6 million by 2032, registering a CAGR of 19.10% during the forecast period.

- Market growth is fueled by government incentives, advancing battery technologies, and strong consumer demand for cleaner mobility options, especially in passenger cars, which account for over 60% of the segment share.

- Major trends include increased investment in fast-charging infrastructure, rising adoption of connected vehicle features, and a shift toward sustainable urban mobility across leading cities.

- The competitive landscape features leading companies such as Toyota Kirloskar Motor, Tesla, Nissan, and BMW AG, all expanding electric portfolios, though high initial costs and limited rural charging infrastructure remain key restraints.

- Asia Pacific commands 27% of the global market, North America leads with a 32% share, and Europe follows at 21%, reflecting the impact of supportive policies, industrial investments, and robust manufacturing ecosystems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Vehicle Type:

Passenger cars represent the dominant segment in the New Energy Vehicles market, accounting for over 60% of the total market share in 2024. This leadership is driven by strong consumer adoption, supportive government policies, and increasing model availability from global automakers. The commercial vehicles segment, including buses and delivery vans, shows steady growth due to urban fleet electrification and emission regulations. Meanwhile, two-wheelers and specialty vehicles are expanding in emerging markets, supported by low-cost electric models and demand for sustainable mobility in urban and industrial settings.

- For instance, Tesla delivered 1,808,581 electric vehicles worldwide in 2023, setting a company record for annual deliveries.

By Propulsion Technology:

Battery Electric Vehicles (BEVs) hold the largest share among propulsion technologies, comprising nearly 70% of the market in 2024. Their dominance is fueled by advancements in battery technology, improved charging infrastructure, and ongoing cost reductions. Plug-in Hybrid Electric Vehicles (PHEVs) also capture a notable portion, serving consumers seeking flexible driving ranges. Fuel Cell Electric Vehicles (FCEVs) remain a niche segment, primarily adopted in regions with significant investments in hydrogen infrastructure, but are expected to gain momentum as technology matures and fuel availability improves.

- For instance, Hyundai’s NEXO fuel cell vehicle recorded over 16,000 units sold globally by the end of 2023, reflecting growing adoption in the FCEV segment.

Market Overview

Government Incentives and Policy Support

Robust policy frameworks and financial incentives remain primary growth drivers in the New Energy Vehicles (NEV) market. Governments worldwide provide subsidies, tax breaks, and registration benefits to promote NEV adoption, especially for passenger and commercial fleets. Stringent emission standards and bans on future internal combustion engine vehicle sales further accelerate the shift toward electric mobility. These initiatives create a favorable environment for manufacturers and buyers, encouraging significant investments in electric vehicle technology and infrastructure, and enabling sustained growth across developed and emerging markets.

- For instance, the U.S. Inflation Reduction Act allocated $7.5 billion specifically for the development of a national electric vehicle charging network.

Advancements in Battery Technology

Rapid progress in battery technology significantly propels NEV market expansion. Improvements in energy density, charging speed, and battery lifespan have led to lower costs and extended driving ranges, addressing key consumer concerns. The development of solid-state and lithium-ion batteries enhances vehicle performance, safety, and affordability, making electric vehicles more competitive with traditional vehicles. These technological advances not only increase consumer confidence but also enable automakers to introduce new models across various segments, driving overall market growth.

- For instance, CATL achieved a battery energy density of 255 Wh/kg in its Qilin battery, which enables select electric vehicles to reach over 1,000 km on a single charge.

Expanding Charging Infrastructure

The accelerated deployment of charging stations supports widespread NEV adoption. Both public and private investments focus on building fast-charging networks and home charging solutions, reducing range anxiety for consumers. The growth of smart grid technology and integration of renewable energy sources further optimize charging efficiency. Enhanced infrastructure accessibility, particularly in urban centers and along key transport corridors, strengthens consumer trust and supports the transition to electric mobility, positioning charging infrastructure as a pivotal driver in the NEV market.

Key Trends & Opportunities

Rising Demand for Sustainable Urban Mobility

Urbanization and growing environmental awareness drive a trend toward sustainable transport solutions, creating new opportunities in the NEV market. Cities prioritize clean mobility through electric buses, car-sharing platforms, and two-wheelers, aligning with global efforts to reduce air pollution and traffic congestion. This shift encourages further investment in NEVs tailored for urban use and positions manufacturers to capitalize on evolving mobility needs, fueling long-term market growth.

- For instance, BYD delivered over 15,000 electric buses worldwide by 2023, supporting urban transport decarbonization in over 300 cities.

Integration of Digital and Connected Technologies

A key trend in the NEV market is the integration of digital features and connected technologies. Advanced driver-assistance systems, smart infotainment, and over-the-air updates enhance user experience and differentiate NEV models. The adoption of vehicle-to-grid (V2G) capabilities and telematics offers additional value for both consumers and fleet operators. These innovations not only boost vehicle attractiveness but also open up new revenue streams for automakers and technology providers.

- For instance, Ford’s BlueCruise hands-free driving system accumulated more than 100 million hands-free miles by early 2024, showcasing the widespread adoption of advanced connected vehicle technologies.

Key Challenges

High Initial Purchase Costs

Despite long-term cost savings, high upfront costs remain a significant challenge for NEV adoption. The price of advanced batteries and the inclusion of smart technologies contribute to higher retail prices compared to conventional vehicles. While incentives partially offset these costs, price sensitivity in emerging markets slows the pace of adoption. Manufacturers continue to seek economies of scale and technological improvements to make NEVs more accessible.

Charging Infrastructure Gaps

Insufficient charging infrastructure, particularly in rural and developing areas, poses a barrier to market growth. Limited access to reliable and fast charging stations creates range anxiety and discourages potential buyers. Addressing these infrastructure gaps requires coordinated efforts between governments, utilities, and private investors to ensure equitable access and support for widespread NEV use.

Battery Raw Material Supply Risks

Securing a stable supply of critical battery materials, such as lithium, cobalt, and nickel, presents another key challenge for the NEV market. Price volatility, supply chain disruptions, and concerns over ethical sourcing can increase costs and hinder production. The industry is investing in recycling programs and alternative chemistries, but ensuring long-term material security remains an ongoing concern for manufacturers and policymakers.

Regional Analysis

North America

North America reached USD 166.50 million in 2024, accounting for approximately 32% of the global New Energy Vehicles market. The market grew from USD 101.90 million in 2018 and is projected to reach USD 657.38 million by 2032, with a CAGR of 18.6%. This leadership is fueled by stringent emission regulations, high investments in charging infrastructure, and surging consumer preference for electric models. The United States, supported by robust incentives and innovative automakers, drives the region’s substantial market presence and ongoing adoption across both personal and commercial mobility sectors.

Europe

Europe posted a 2024 market size of USD 109.70 million, representing a 21% share of the global market. The region’s market expanded from USD 63.23 million in 2018 and is forecasted to hit USD 468.65 million by 2032, registering a CAGR of 19.8%. Ambitious decarbonization targets, comprehensive subsidy schemes, and rapid expansion of public charging infrastructure underpin Europe’s strong market position. Countries like Germany, Norway, and the UK are accelerating NEV penetration, ensuring Europe remains a global leader in sustainable mobility and electric vehicle integration.

Asia Pacific

Asia Pacific registered USD 142.88 million in 2024, capturing about 27% market share. The region increased from USD 81.85 million in 2018 and is set to reach USD 614.97 million by 2032, at a CAGR of 19.9%. Dominated by China’s large-scale production and consumer base, the region benefits from extensive government policies, cost-effective manufacturing, and increasing urbanization. Asia Pacific’s rapid innovation and supportive infrastructure developments solidify its vital role in the global NEV market.

Latin America

Latin America accounted for USD 50.38 million in 2024, equating to roughly 10% of the market share. The region’s market rose from USD 32.48 million in 2018 and is forecasted to achieve USD 183.85 million by 2032, with a CAGR of 17.4%. Market growth is driven by public incentives, clean mobility campaigns, and the electrification of urban transport fleets, especially in Brazil and Mexico. These factors position Latin America for steady growth despite a currently smaller market size.

Middle East

The Middle East’s 2024 value stood at USD 36.06 million, holding a 7% share of the market. It grew from USD 22.10 million in 2018 and is projected to reach USD 142.08 million by 2032, with a CAGR of 18.6%. Economic diversification, investments in mobility innovation, and national electrification programs—especially in the UAE and Saudi Arabia—drive NEV market advancement and create opportunities for future expansion across the region.

Africa

Africa represented USD 14.52 million in 2024, or about 3% of global market share. From a base of USD 9.29 million in 2018, the region’s market is expected to reach USD 53.65 million by 2032, at a CAGR of 17.6%. Growth is gradual but supported by rising urbanization, renewable energy investments, and government-led clean transport initiatives. Countries like South Africa and Egypt are emerging as focal points for NEV deployment, laying the foundation for long-term adoption throughout Africa.

Market Segmentations:

By Vehicle Type:

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers

- Specialty Vehicles

By Propulsion Technology:

- Battery Electric Vehicle

- Plug-In Hybrid Electric Vehicles

- Fuel Cell Electric Vehicle

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the New Energy Vehicles (NEV) market is characterized by intense rivalry among global automotive leaders and emerging players, each striving to strengthen their position through innovation, strategic partnerships, and portfolio diversification. Companies such as Toyota Kirloskar Motor, Nissan, Tesla, Mitsubishi Electric Corporation, General Motors, Ford Motor Company, BMW AG, Renault, Daimler AG, and AB Volvo dominate market dynamics with significant investments in research and development, battery technology, and next-generation vehicle design. Market participants are rapidly expanding their electric and hybrid vehicle portfolios to address diverse consumer needs and comply with increasingly stringent emission regulations worldwide. Collaborations with technology providers and energy companies further accelerate the rollout of advanced propulsion systems and charging solutions. This competitive environment fosters continuous improvement in vehicle range, performance, and affordability, while robust after-sales networks and brand reputation play pivotal roles in customer acquisition and retention within the evolving NEV market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Toyota Kirloskar Motor

- Nissan

- Tesla

- Mitsubishi Electric Corporation

- General Motors

- Ford Motor Company

- BMW AG

- Renault

- Daimler AG

- AB Volvo

Recent Developments

- In May 2025, Tesla is expected to refresh the Model Y with new Performance and 7-seat variants, along with a rear-wheel-drive version offering longer range. These additions aim to broaden the appeal of the Model Y to both performance-oriented drivers and families. Additionally, Tesla is working on more affordable versions of the Model 3 and Model Y and is preparing for the launch of its Robotaxi in 2026.

- In April 2025, Mitsubishi is rolling out four new models in 2025, including two all-electric vehicles and new hybrid options, as part of its Momentum 2030 plan. The company aims for 50% electrified sales by 2030 and full electrification by 2035. Mitsubishi is investing $1.5 billion in battery procurement and targeting significant CO2 reductions. The 2025 Outlander features advanced connectivity and driver-assistance systems, reflecting a broader shift toward sustainable, tech-forward vehicles.

- In March 2025, General Motors(GM) continued its expansion of the electric vehicle (EV) lineup, notably with the 2025 Chevrolet Equinox EV. This model offers an EPA-estimated range of 319 miles on a full charge for the front-wheel-drive (FWD) version, according to General Motors. GM’s broader strategy involves increasing the availability and variety of EVs across its brands, supporting the transition to an all-electric future.

- In January 2025, the Renault 5 E-Tech electric and the Alpine A290, both built on the AmpR Small platform, were jointly awarded the prestigious “Car of the Year 2025” title in Europe. This dual win underscores Renault’s successful transition to electric vehicles and the appeal of its new generation of EVs, which emphasize design, technology, and a strong focus on the customer experience.

- In 2025, BMW will begin series production of its NEUE KLASSE generation, starting with the BMW iX3. This marks a significant step in BMW’s electrification strategy, following a strong year of growth in BEV sales, which accounted for over 17% of total sales in 2024. BMW is also collaborating with Toyota to develop hydrogen fuel-cell vehicles, with a target release date of 2028 for their first production model.

Market Concentration & Characteristics

The New Energy Vehicles market exhibits moderate to high market concentration, with a few established automotive manufacturers—such as Tesla, Toyota Kirloskar Motor, Nissan, BMW AG, General Motors, and Daimler AG—controlling a significant share of global sales. It is marked by strong barriers to entry due to high capital requirements, proprietary battery technologies, and complex supply chains for critical raw materials. Companies in this market emphasize continuous research and development, innovative propulsion systems, and strategic alliances to strengthen their competitive positions. The market shows rapid technological advancements, frequent model launches, and aggressive expansion into emerging markets. Leading players leverage established distribution networks, brand reputation, and after-sales support to build customer loyalty. The presence of strong regulatory mandates and government incentives accelerates product adoption and drives ongoing investment in charging infrastructure and manufacturing capacity. Intense competition, evolving consumer preferences, and fast-paced innovation shape the dynamic and growth-oriented nature of this sector.

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Propulsion Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market for new energy vehicles is expected to grow rapidly due to increasing environmental regulations and emission reduction targets.

- Consumer demand for electric and hybrid vehicles continues to rise as awareness about climate change and fuel savings improves.

- Government subsidies and policy incentives are playing a key role in accelerating the adoption of new energy vehicles globally.

- Advancements in battery technology are reducing charging time and increasing driving range, making EVs more practical for daily use.

- Automakers are investing heavily in R&D and expanding their new energy vehicle lineups to capture evolving market needs.

- The expansion of charging infrastructure is supporting market penetration in both urban and rural areas.

- Partnerships between technology firms and automotive companies are leading to innovation in smart and connected vehicle solutions.

- Emerging markets such as India and Southeast Asia are witnessing increased adoption due to urbanization and supportive policies.

- Fleet operators and logistics companies are integrating new energy vehicles to lower operational costs and meet sustainability goals.

- The market is expected to witness increased competition, leading to lower prices and more consumer-friendly financing options.