Market Overview

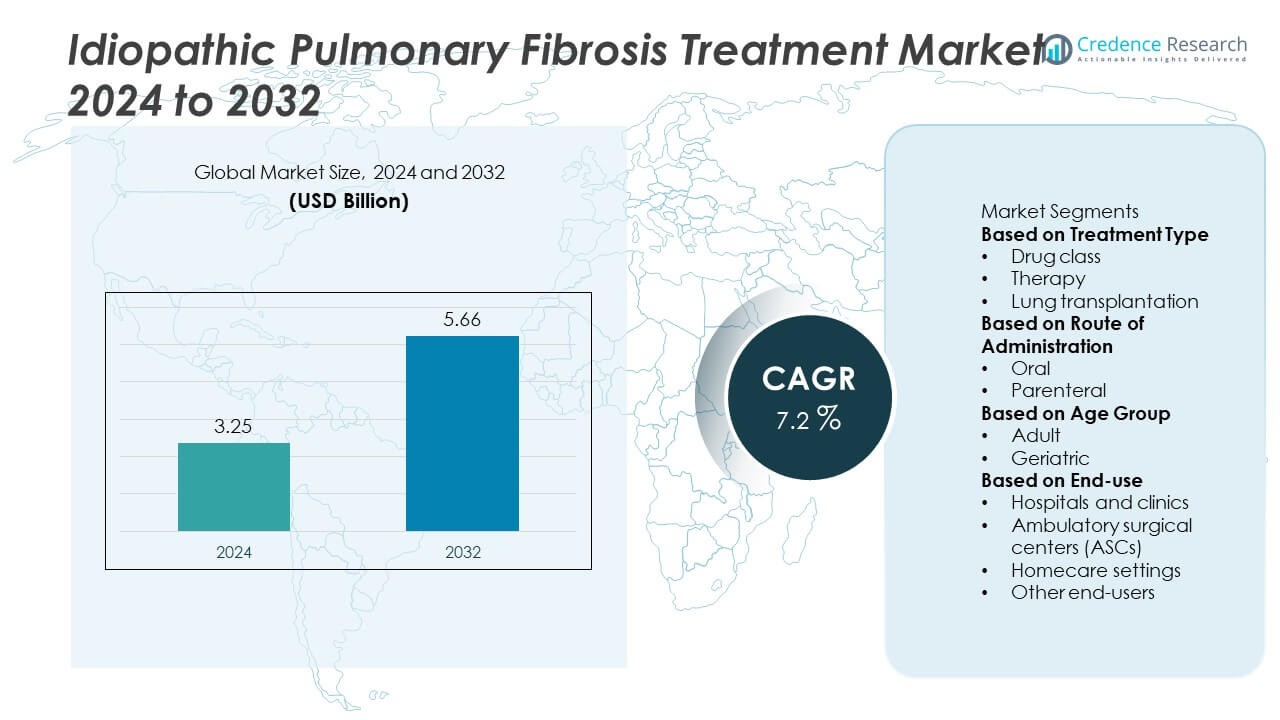

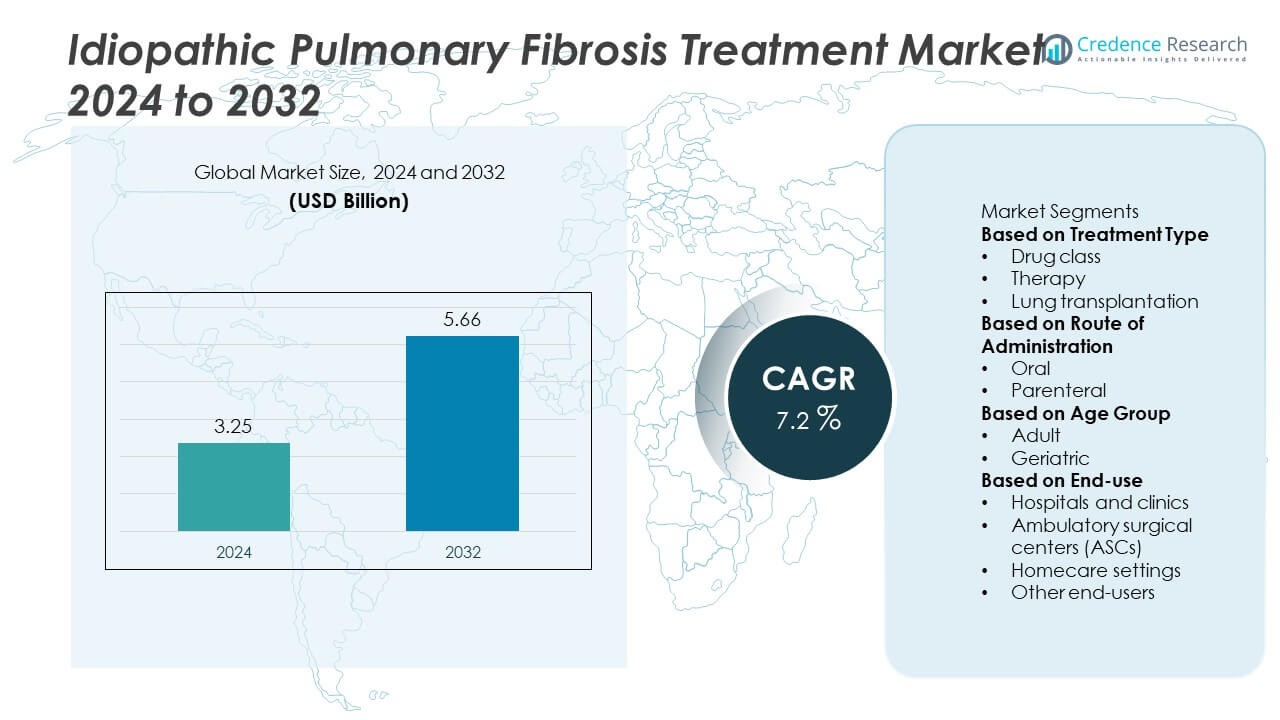

The Idiopathic Pulmonary Fibrosis (IPF) Treatment market was valued at USD 3.25 billion in 2024 and is projected to reach USD 5.66 billion by 2032, expanding at a CAGR of 7.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Idiopathic Pulmonary Fibrosis Treatment Market Size 2024 |

USD 3.25 Billion |

| Idiopathic Pulmonary Fibrosis Treatment Market, CAGR |

7.2% |

| Idiopathic Pulmonary Fibrosis Treatment Market Size 2032 |

USD 5.66 Billion |

The idiopathic pulmonary fibrosis (IPF) treatment market is driven by top players including F. Hoffmann-La Roche Ltd, Boehringer Ingelheim International GmbH, Bristol-Myers Squibb Company, Novartis AG, Fibrogen, Inc., Medicinova, Inc., Merck & Co., Inc., Galapagos NV, AstraZeneca plc, and Gilead Sciences, Inc. These companies lead with established antifibrotic therapies and strong pipelines targeting novel mechanisms such as immunotherapy and regenerative medicine. Regionally, North America led the market with a 37% share in 2024, supported by advanced healthcare systems and high adoption rates. Europe followed with 29% share, driven by strict clinical guidelines and reimbursement support, while Asia-Pacific accounted for 24% share, reflecting rapid healthcare advancements and expanding patient awareness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The idiopathic pulmonary fibrosis treatment market was valued at USD 3.25 billion in 2024 and is projected to reach USD 5.66 billion by 2032, growing at a CAGR of 7.2% during the forecast period.

- Growth is driven by rising prevalence of IPF in aging populations and increasing adoption of antifibrotic drugs such as pirfenidone and nintedanib, which accounted for 62% share under the drug class segment in 2024.

- Market trends highlight expansion of clinical trials targeting novel mechanisms, including regenerative therapies and immunomodulators, along with growing demand for oral administration, which held 68% share in 2024.

- Competitive landscape includes major players such as F. Hoffmann-La Roche Ltd, Boehringer Ingelheim, Bristol-Myers Squibb, Novartis AG, and Fibrogen, focusing on product innovation, partnerships, and global market expansion to strengthen portfolios.

- Regionally, North America led with 37% share in 2024, followed by Europe at 29% and Asia-Pacific at 24%, while Latin America and Middle East & Africa accounted for 6% and 4% shares, respectively.

Market Segmentation Analysis:

By Treatment Type

In 2024, the drug class segment dominated the IPF treatment market with a 62% share, driven by the effectiveness of antifibrotic drugs such as pirfenidone and nintedanib in slowing disease progression. These medications have gained strong adoption due to proven clinical benefits and growing physician preference over invasive options. Therapy, including pulmonary rehabilitation, continues to support quality of life but holds a smaller share, while lung transplantation, though effective, is limited by donor shortages and patient eligibility. Drug class remains the leading treatment type, supported by rising approvals and expanding access.

- For instance, Boehringer Ingelheim’s nintedanib (Ofev®) has been prescribed to more than 250,000 patients worldwide across over 80 countries, demonstrating its broad clinical adoption for idiopathic pulmonary fibrosis and related progressive fibrosing interstitial lung diseases.

By Route of Administration

The oral route of administration accounted for 68% share in 2024, making it the largest segment. Oral antifibrotic therapies such as nintedanib and pirfenidone are widely prescribed due to ease of use, long-term treatment feasibility, and patient compliance compared to parenteral methods. The parenteral segment is primarily used in hospital-based supportive therapies but remains limited in scope. The oral route is expected to maintain dominance as ongoing R&D drives development of new formulations with improved efficacy and reduced side effects.

- For instance, F. Hoffmann-La Roche Ltd. reported that its oral therapy pirfenidone (Esbriet®) has been used in more than 75,000 patients globally, supported by robust safety data from multiple phase IV real-world studies tracking long-term adherence and tolerability.

By Age Group

The geriatric segment led the IPF treatment market in 2024 with a 59% share, reflecting the higher prevalence of IPF among older adults, particularly those above 60 years of age. This dominance is driven by aging global populations and greater diagnostic awareness in developed countries. While adults represent a significant portion, disease onset is less frequent in younger age groups. Increasing screening efforts and improved healthcare access further drive adoption in geriatric patients, cementing their position as the key target group for both drug developers and healthcare providers.

Key Growth Drivers

Rising Prevalence of IPF

The growing prevalence of idiopathic pulmonary fibrosis, particularly among aging populations, is a major driver of market growth. With global life expectancy increasing, the number of at-risk individuals is rising significantly. Improved diagnostic methods and greater awareness enable earlier detection, boosting treatment adoption. This expanding patient pool strengthens demand for antifibrotic drugs, pulmonary therapies, and supportive care solutions. As cases continue to rise, healthcare systems are prioritizing IPF management, driving consistent market expansion worldwide.

- For instance, AstraZeneca had been investigating its antifibrotic candidate AZD5055, which completed Phase 1 studies evaluating safety and tolerability in healthy volunteers.

Advancements in Drug Development

Drug development progress strongly contributes to IPF market growth. Antifibrotic drugs such as pirfenidone and nintedanib have demonstrated proven effectiveness in slowing disease progression, fueling their adoption. Pharmaceutical companies are actively investing in clinical trials for next-generation antifibrotic therapies and combination regimens. These innovations are broadening treatment options, improving patient outcomes, and creating competitive opportunities. The growing research pipeline ensures that drug-based therapies will remain at the forefront of IPF management, securing long-term market growth.

- For instance, FibroGen’s pamrevlumab (FG-3019), a connective tissue growth factor inhibitor, showed positive Phase II results, including a 60% reduction in the decline of predicted forced vital capacity (FVC) over 48 weeks.

Supportive Regulatory and Reimbursement Frameworks

Supportive regulatory pathways and reimbursement policies encourage market expansion. Agencies like the FDA and EMA have introduced orphan drug designations, fast-track approvals, and favorable reimbursement coverage for IPF therapies. These frameworks accelerate innovation, reduce patient costs, and improve accessibility to antifibrotic drugs. Developed markets benefit from strong reimbursement systems, while emerging regions are gradually expanding insurance coverage. Regulatory and policy support continues to improve affordability and uptake, sustaining market growth across both advanced and developing healthcare systems.

Key Trends & Opportunities

Increasing Adoption of Precision Medicine

Precision medicine is transforming IPF treatment strategies. Advances in molecular diagnostics and biomarker analysis allow physicians to tailor therapies based on individual patient profiles. Personalized approaches improve clinical outcomes, enhance drug efficacy, and reduce adverse effects. Pharmaceutical companies are investing heavily in biomarker-driven antifibrotic and immunotherapy research. This trend represents a long-term opportunity, reshaping treatment pathways and aligning IPF management with precision healthcare models.

- For instance, Bristol Myers Squibb is advancing its approach with BMS-986278 (admilparant), a lysophosphatidic acid receptor 1 (LPA1) antagonist. In a phase II trial (NCT04308681), the twice-daily 60 mg dose of BMS-986278 was shown to reduce the rate of lung function decline over 26 weeks compared to placebo.

Growing Role of Combination Therapies

Combination therapies are emerging as a key opportunity for improved IPF management. Physicians increasingly prescribe antifibrotic drugs alongside supportive treatments to slow disease progression and enhance quality of life. Clinical trials are also evaluating novel drug combinations that target multiple pathways. This shift reflects the limitations of monotherapy and growing demand for holistic care solutions. Combination therapies are expected to expand significantly, providing new opportunities for pharmaceutical innovation and comprehensive patient management.

- For instance, Roche (through its subsidiary Genentech) has investigated the combination of pirfenidone (Esbriet) and nintedanib in a Phase IV safety and tolerability trial (NCT02598193).

Key Challenges

High Cost of Treatment

High treatment costs remain a critical challenge for the IPF market. Effective antifibrotic drugs like nintedanib and pirfenidone are expensive, creating affordability issues in both developed and emerging economies. While reimbursement programs help reduce patient costs, gaps in coverage persist. The financial burden often results in delayed or inconsistent therapy adoption. Unless cost barriers are addressed through pricing strategies or broader insurance coverage, market penetration will remain limited, particularly in low- and middle-income regions.

Limited Curative Options

The absence of curative therapies poses another major restraint. Current treatments focus on slowing disease progression and managing symptoms, without reversing fibrosis or restoring lung function. Lung transplantation remains the only curative option but is restricted by donor shortages and eligibility criteria. This unmet medical need highlights the urgency for innovation in regenerative medicine and advanced therapies. The lack of definitive cures continues to limit long-term patient outcomes, representing a significant challenge for the market’s growth potential.

Regional Analysis

North America

North America held a 37% share of the idiopathic pulmonary fibrosis treatment market in 2024, maintaining its leadership position. The region benefits from advanced healthcare infrastructure, strong regulatory support, and wide availability of antifibrotic drugs such as nintedanib and pirfenidone. The United States dominates due to high diagnosis rates, favorable reimbursement systems, and robust clinical trial activity. Canada also contributes steadily, supported by public health programs and rising awareness. Ongoing investments in research, adoption of precision medicine, and increasing patient enrollment in therapeutic programs sustain North America’s market leadership.

Europe

Europe accounted for 29% share of the idiopathic pulmonary fibrosis treatment market in 2024, supported by stringent healthcare standards and widespread access to advanced therapies. Countries such as Germany, the UK, and France are leading adopters of antifibrotic drugs due to strong reimbursement frameworks and established treatment guidelines. Regulatory agencies like the EMA actively promote orphan drug approvals, further driving therapeutic innovation. The region also shows increasing adoption of precision medicine approaches. With strong patient support systems and government-backed healthcare initiatives, Europe continues to be a mature but steadily expanding market.

Asia-Pacific

Asia-Pacific captured a 24% share of the idiopathic pulmonary fibrosis treatment market in 2024, making it one of the fastest-growing regions. Rising awareness of pulmonary diseases, expanding healthcare access, and growing investment in pharmaceutical infrastructure drive adoption. Countries such as Japan, China, and India are witnessing increasing diagnosis rates due to improved screening and medical education. Japan remains a leading contributor with established use of antifibrotics, while China and India present vast potential due to their large populations and rising healthcare spending. Asia-Pacific’s rapid urbanization and clinical trial expansion make it a critical growth driver.

Latin America

Latin America accounted for a 6% share of the idiopathic pulmonary fibrosis treatment market in 2024, with Brazil and Mexico leading regional adoption. Growth is fueled by rising awareness of rare lung diseases, improving healthcare infrastructure, and gradual expansion of access to antifibrotic drugs. However, affordability challenges and uneven reimbursement policies limit broader treatment penetration. Despite these restraints, foreign investments in healthcare and government-backed awareness initiatives are driving gradual improvements. The region presents long-term opportunities for global pharmaceutical companies as healthcare systems modernize and patient support programs expand.

Middle East & Africa

The Middle East & Africa region held a 4% share of the idiopathic pulmonary fibrosis treatment market in 2024, reflecting its status as an emerging market. Countries such as Saudi Arabia, the UAE, and South Africa are driving growth through increased investments in healthcare infrastructure and rising access to advanced therapies. However, limited diagnostic capabilities and lower awareness in many parts of the region restrict broader adoption. Despite these challenges, government initiatives aimed at strengthening healthcare access and expanding rare disease treatment programs offer steady growth opportunities for the future.

Market Segmentations:

By Treatment Type

- Drug class

- Therapy

- Lung transplantation

By Route of Administration

By Age Group

By End-use

- Hospitals and clinics

- Ambulatory surgical centers (ASCs)

- Homecare settings

- Other end-users

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape of the idiopathic pulmonary fibrosis (IPF) treatment market features leading players such as F. Hoffmann-La Roche Ltd, Boehringer Ingelheim International GmbH, Bristol-Myers Squibb Company, Medicinova, Inc., Merck & Co., Inc., Galapagos NV, Novartis AG, Fibrogen, Inc., AstraZeneca plc, and Gilead Sciences, Inc. These companies maintain strong market presence through established antifibrotic drugs, extensive R&D pipelines, and collaborations focused on novel therapeutic approaches. Market competition is shaped by the dominance of approved drugs like pirfenidone and nintedanib, while several players invest in next-generation treatments, including antifibrotic combinations, immunotherapies, and regenerative medicine. Strategic partnerships, licensing agreements, and clinical trials are key strategies used to expand therapeutic portfolios and strengthen global reach. In addition, regulatory incentives for orphan drugs and rising prevalence of IPF have intensified investment in innovative solutions. The landscape remains highly competitive, with established leaders reinforcing their positions while emerging players focus on disruptive treatment modalities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Galapagos NV

- Novartis AG

- Bristol-Myers Squibb Company

- Hoffmann-La Roche Ltd

- Merck & Co., Inc.

- Fibrogen, Inc.

- Boehringer Ingelheim International GmbH

- Medicinova, Inc

- AstraZeneca plc

- Gilead Sciences, Inc.

Recent Developments

- In September 2025, Boehringer Ingelheim announced pooled data showing nerandomilast monotherapy was linked to a nominally significant reduction in risk of death in IPF and PPF (progressive pulmonary fibrosis) patients.

- In September 2025, Helmholtz Munich and Boehringer Ingelheim signed a research collaboration to use AI and single-cell genomics to discover new treatment avenues for pulmonary fibrosis.

- In 2025, Boehringer Ingelheim disclosed that its FIBRONEER-ILD phase 3 trial met its primary endpoint (FVC) in progressive fibrotic lung disease, and FIBRONEER-IPF had met primary endpoint earlier.

Report Coverage

The research report offers an in-depth analysis based on Treatment Type, Route of Administration, Age Group, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for antifibrotic drugs will remain strong as they slow disease progression effectively.

- Research into regenerative therapies and stem cell approaches will create new treatment pathways.

- Oral route of administration will continue dominating due to convenience and higher patient compliance.

- Increasing prevalence among geriatric populations will expand the target patient base globally.

- Combination therapies will gain importance as companies explore synergistic treatment options.

- Rising investments in clinical trials will accelerate the development of next-generation antifibrotics.

- North America will sustain leadership with advanced healthcare infrastructure and reimbursement support.

- Asia-Pacific will emerge as a high-growth region with improved diagnosis and healthcare expansion.

- Collaborations between pharmaceutical companies and research institutes will strengthen innovation pipelines.

- Patient awareness campaigns and improved screening programs will enhance early diagnosis and treatment adoption.