Market Overview

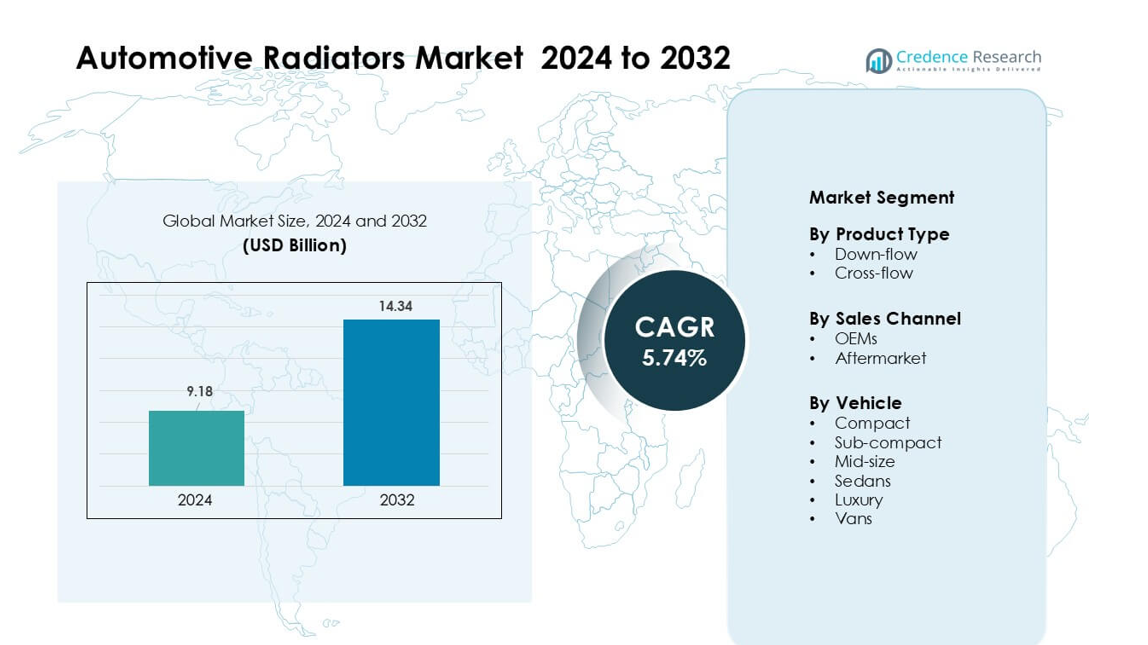

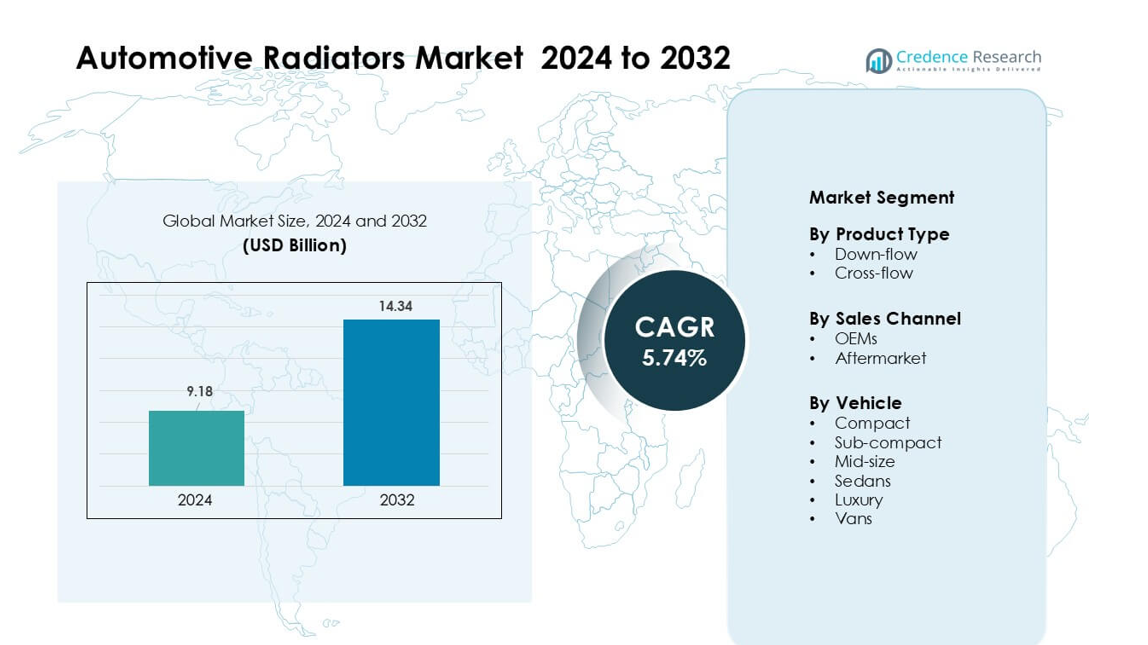

Automotive Radiators Market was valued at USD 9.18 billion in 2024 and is anticipated to reach USD 14.34 billion by 2032, growing at a CAGR of 5.74 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Radiators Market Size 2024 |

USD 9.18 billion |

| Automotive Radiators Market, CAGR |

5.74% |

| Automotive Radiators Market Size 2032 |

USD 14.34 billion |

The Automotive Radiators Market features major players such as Modine Manufacturing Company, Sanden Holdings Corporation, T.RAD Co., Ltd., General Electric, Denso Corporation, Nissen A/S, TYC Brother Industrial Co. Ltd., Calsonic Kansei Corporation, Mahle GmbH, and Zhejiang Yinlun Machinery Co., Ltd. These companies compete through high-efficiency aluminum radiators, advanced cooling modules, and strong OEM partnerships. They also expand production in cost-efficient regions to meet rising global demand. Asia-Pacific emerged as the leading region in 2024 with 41% share, driven by high vehicle production, strong aftermarket activity, and rapid adoption of hybrid and electric vehicles requiring advanced thermal-management systems.

Market Insights

- The Automotive Radiators Market reached USD 9.18 billion in 2024 and is projected to hit USD 14.34 billion by 2032, growing at a CAGR of 5.74%.

- Rising vehicle production and higher adoption of turbocharged engines drive radiator demand, with cross-flow radiators holding about 62% share due to superior cooling efficiency.

- Lightweight aluminium radiators, integrated thermal modules, and EV battery-cooling systems shape key trends as OEMs shift toward high-performance, compact heat-exchange designs.

- Competition intensifies among global players offering advanced aluminium cores and expanded OEM contracts, while price pressure and volatile aluminium costs remain major restraints.

- Asia-Pacific dominated in 2024 with 41% share, followed by North America at 27%, supported by strong OEM production; mid-size vehicles led the segment with about 39% share across global markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Cross-flow radiators held the dominant share in 2024 with about 62% due to better cooling efficiency, lighter construction, and wider use in passenger cars and light commercial vehicles. Automakers favored cross-flow designs because the horizontal tank layout improved heat rejection and supported high-performance engines. Down-flow systems kept a stable niche in older vehicle platforms, but demand slowed as OEMs shifted toward compact and fuel-efficient designs. Growth in cross-flow units also came from rising turbocharged engines that required stronger thermal management and improved thermal durability.

- For instance, MAHLE developed a high-performance aluminum cross-flow radiator for turbocharged gasoline engines that uses flat-tube geometry with fin densities up to 22 fins per inch, improving heat-transfer efficiency by more than 10% compared with older tube-and-fin designs.

By Sales Channel

OEMs led the segment in 2024 with nearly 71% share as car manufacturers installed advanced aluminum radiators during initial vehicle production. OEM demand grew with rising global vehicle output and stricter emission rules that required efficient cooling systems. Aftermarket sales expanded due to frequent radiator replacements in aging vehicles and higher adoption of premium performance radiators. The aftermarket gained traction in regions with longer vehicle lifecycles, but OEM supply remained dominant because factory-fitted radiators ensured better compatibility, durability, and warranty compliance.

By Vehicle Type

Mid-size vehicles dominated the segment in 2024 with about 39% share because this category balanced engine power, cabin space, and mass-market appeal across global markets. Higher production volumes in Asia-Pacific and North America supported radiator demand in this segment. Compact and sub-compact models followed due to strong sales in urban regions, while sedans saw moderate growth as buyers shifted toward SUVs. Luxury vehicles adopted high-performance radiators with improved heat dissipation, and vans generated steady demand from logistics fleets needing durable cooling systems for long-distance operations.

- For instance, DENSO supplies aluminum radiators for global passenger-vehicle platforms using high-conductivity multi-channel tubes and optimized fin structures to improve heat rejection. The company reports that its radiators undergo vibration, thermal-shock, and pressure-cycle testing to meet OEM durability standards.

Key Growth Drivers

Rising Vehicle Production and Model Diversification

Global vehicle production continues to rise, which boosts radiator demand across passenger cars, commercial vehicles, and new-age mobility platforms. Automakers release more variants within compact, mid-size, and SUV segments, and each model requires customized cooling design, creating consistent procurement cycles. Growing sales in emerging economies add large-volume demand, especially in Asia-Pacific. Higher production of turbocharged engines increases thermal loads, which pushes OEMs to adopt advanced aluminium radiators. As hybrids grow, new heat-exchange needs emerge, further expanding product scope. This wide production landscape strengthens the long-term growth base for radiator suppliers.

- For instance, according to statistics from OICA, world motor vehicle production in 2023 reached about 93.5 million units, directly expanding demand for engine cooling systems.

Stringent Emission Standards Driving Advanced Thermal Management

Governments enforce tighter emission rules, which push automakers to improve combustion efficiency and reduce heat stress. Modern engines run hotter due to downsizing, turbocharging, and higher compression ratios. Radiators therefore shift toward lightweight, high-efficiency aluminum cores with improved fin geometry and larger heat-exchange surfaces. Cooling systems now integrate with engine control units, enabling better temperature regulation under varied loads. These efficiency demands stimulate innovation in high-performance radiators. Regulations in Europe, China, and North America accelerate this transition, supporting long-term adoption of advanced cooling parts across all vehicle classes.

Growing Aftermarket Demand from Aging Vehicle Fleet

Aging fleets drive strong aftermarket demand, especially in regions where vehicles run beyond ten years. Older engines face higher thermal stress, leading to frequent radiator replacements and repairs. Road conditions in developing countries add wear and tear, increasing cooling-system failures. Fleets in logistics, ride-hailing, and commercial transport replace radiators proactively to avoid downtime. Rising availability of cost-effective aftermarket aluminum radiators encourages mass adoption. The expanding distributor networks and e-commerce platforms also ease product access and widen consumer reach. This large replacement cycle builds a steady aftermarket revenue stream.

- For instance, Nissens Automotive states that its aluminum radiators undergo OEM-grade validation, including thermal-cycle testing between –40°C and +120°C and vibration testing up to 8 g to ensure long-term durability. The company designs its radiator program for vehicles that typically remain in service for more than seven to ten years across Europe.

Key Trends & Opportunities

Shift Toward Lightweight and High-Efficiency Radiators

Automotive manufacturers move toward aluminum and hybrid composite radiators to reduce weight, improve fuel economy, and enhance heat-transfer efficiency. Multi-layer brazed cores and advanced fin structures support higher cooling performance for modern engines. Electric and hybrid vehicles create new opportunities for integrated thermal modules that manage battery, inverter, and motor temperatures. Suppliers introduce modular radiator platforms to reduce production costs and speed up OEM adoption. Growing emphasis on thermal optimization creates innovation opportunities in design, materials, and manufacturing processes.

- For instance, aluminum radiators can weigh 30–40% less than comparable copper-brass designs because aluminum has a density of about 2.7 g/cm³ versus roughly 8.9 g/cm³ for brass. This lower mass allows automakers to reduce overall cooling-system weight without sacrificing heat-exchange performance. Many modern aluminum radiators also use thin multi-channel tubes and high-density fins to achieve strong thermal efficiency in a compact package.

Rising Adoption of Electric and Hybrid Vehicles

Electrification expands radiator applications beyond engines to battery packs, power electronics, and fast-charging systems. EVs use multi-loop cooling networks, which increases system complexity and raises demand for advanced radiators and liquid-cooling modules. Hybrid vehicles still rely on engine cooling, creating dual requirements that increase part count. Governments promote EV manufacturing, opening doors for radiator makers to supply thermally efficient solutions. As high-voltage batteries grow in capacity, suppliers invest in high-conductivity materials and compact heat exchangers to address emerging cooling needs.

- For instance, many modern EVs use closed-loop liquid cooling systems that circulate coolant through aluminum cold plates inside the battery pack, then route the heated coolant to a dedicated radiator for heat rejection. Industry guidelines from major EV manufacturers show that liquid cooling maintains battery temperatures in an optimal band of about 15 °C to 35 °C to protect cell longevity and fast-charging performance.

Aftermarket Digitalization and Performance-Grade Radiator Demand

Online retail strengthens aftermarket radiator sales due to wider product selection and transparent pricing. Vehicle owners increasingly purchase upgraded performance radiators for towing, off-roading, motorsports, and high-output engines. Workshops adopt diagnostic tools to detect cooling inefficiencies early, increasing part replacement rates. Digital catalogs improve fitment accuracy, reducing return rates and boosting consumer trust. This digital shift gives radiator manufacturers a broader customer base and new revenue opportunities through performance-grade and premium replacement units.

Key Challenges

Price Pressures and High Raw-Material Costs

Radiator manufacturing depends on aluminium, copper, plastics, and composite materials, all subject to global price volatility. OEMs negotiate aggressively on component costs, squeezing supplier margins. Competition from low-cost Asian manufacturers increases pricing pressure, especially in the aftermarket. Aluminium brazing and precision manufacturing add high operational costs. Fluctuating energy costs and global supply disruptions also strain profitability. Suppliers must balance affordability with durability and performance, which becomes challenging in a cost-sensitive automotive landscape.

Integration Complexity in EV and Advanced Powertrain Platforms

Next-generation vehicles use integrated thermal systems linking batteries, motors, cabin cooling, and power electronics. Radiator suppliers must design compact, efficient modules that meet varied heat loads across different components. This integration adds engineering complexity and longer development cycles. EV platforms demand precise thermal control and new materials that withstand wider temperature ranges. Limited standardization across automakers raises design costs. As vehicles become more software-driven, radiators must integrate sensors and control interfaces, raising technical challenges for traditional manufacturers.

Regional Analysis

North America

North America held about 27% share in 2024, driven by strong production of SUVs, pickup trucks, and mid-size vehicles that require high-capacity radiators. U.S. automakers adopted lightweight aluminum radiators to improve fuel efficiency and manage higher engine temperatures from turbocharged units. Aftermarket replacement demand remained strong due to an aging fleet and high vehicle ownership rates. Canada added stable commercial-vehicle demand, while Mexico supported OEM growth with expanding manufacturing plants. Rising EV production created new opportunities for multi-loop cooling modules used in batteries and power electronics, strengthening regional radiator development.

Europe

Europe accounted for nearly 24% share in 2024, supported by strict emission rules that pushed OEMs to use advanced high-efficiency radiators. Germany, France, and the U.K. led adoption as automakers integrated compact aluminum cores to reduce thermal losses in downsized engines. Strong growth in hybrid and electric vehicles created new thermal-management needs, increasing demand for integrated cooling modules. The region’s mature aftermarket remained steady due to long vehicle lifespans and rising maintenance requirements. Eastern Europe expanded radiator manufacturing as suppliers tapped into lower-cost production sites to meet rising OEM procurement needs.

Asia-Pacific

Asia-Pacific dominated the market with about 41% share in 2024, driven by high vehicle production in China, India, Japan, and South Korea. Rapid expansion of compact and mid-size vehicles boosted OEM radiator installations across domestic automakers. China’s fast-growing EV sector increased demand for advanced battery cooling systems, while India’s expanding two-wheeler and small-car industry supported mass-volume radiator manufacturing. Strong aftermarket activity, driven by aging vehicles and harsh driving conditions, added steady replacement demand. Regional suppliers also benefited from cost-effective production capabilities and rising export volumes to Europe and North America.

Latin America

Latin America captured around 5% share in 2024, with demand led by Brazil and Mexico’s growing passenger-car and light-commercial-vehicle segments. Economic recovery in major economies improved vehicle sales, supporting OEM radiator installations. The aftermarket remained active due to older vehicle fleets and challenging road conditions that increased failure rates. Suppliers expanded aluminum radiator offerings to meet emission compliance targets and improve vehicle efficiency. Local manufacturing investments and rising popularity of compact and sub-compact vehicles further supported radiator adoption across the region.

Middle East & Africa

The Middle East & Africa region held nearly 3% share in 2024, driven by demand from SUVs, pickups, and commercial fleets operating in high-temperature environments. Radiators with enhanced cooling capacity gained traction due to extreme climatic conditions. Gulf countries supported OEM sales through rising vehicle imports, while Africa showed strong aftermarket potential because of aging cars and limited service infrastructure. Fleet operators preferred durable aluminium radiators to reduce overheating risks and maintenance costs. Gradual economic growth and expanding road networks helped sustain long-term radiator demand across key markets.

Market Segmentations:

By Product Type

By Sales Channel

By Vehicle

- Compact

- Sub-compact

- Mid-size

- Sedans

- Luxury

- Vans

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Automotive Radiators Market includes leading companies such as Modine Manufacturing Company, Sanden Holdings Corporation, T.RAD Co., Ltd., Denso Corporation, Nissen A/S, TYC Brother Industrial Co. Ltd., Calsonic Kansei Corporation, Mahle GmbH, and Zhejiang Yinlun Machinery Co., Ltd. These companies compete through advanced aluminium radiator designs, improved heat-exchange efficiency, and enhanced durability for modern powertrain needs. Global suppliers invest in lightweight materials, multi-loop thermal systems, and high-performance cores to meet rising adoption of turbocharged, hybrid, and electric vehicles. Many players expand manufacturing footprints across Asia-Pacific to leverage cost advantages and proximity to major auto hubs. Strategic partnerships with OEMs help secure long-term contracts, while aftermarket-focused firms introduce performance and premium replacement radiators to target aging vehicle fleets. Continuous innovation in compact radiators, battery cooling modules, and integrated thermal systems shapes the competitive momentum across major regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2025, Sanden Holdings Corporation Publicised technology engagement activities and demonstrations of integrated Thermal Management Systems (TMS) and EV cooling solutions (including 24 V parking cooling, electric coolant heaters and CRU/TMS demo vehicles) with European commercial vehicle partners. This highlights Sanden’s push into EV truck/ commercial vehicle thermal systems.

- In May 2024, Sanden Holdings Corporation Started production of 800V electric coolant heaters for electrified vehicles a component increasingly important for high-voltage BEV thermal systems (helps fast-charging readiness and battery thermal control).

- In January 2024, Modine Manufacturing Company Launched the Aluminum Tank e-Fan Cooling Module (AT-ECM) a rugged aluminum bar-plate radiator + e-fan cooling module designed for commercial vehicles (diesel/CNG/hybrid buses) that integrates radiator, charge-air cooler and smart fans for improved thermal performance.

Report Coverage

The research report offers an in-depth analysis based on ProductType, Sales Channel, Vehicle and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market

Future Outlook

- Demand will rise as global vehicle production expands across key markets.

- Advanced aluminum radiators will gain adoption due to efficiency and weight benefits.

- EV growth will increase the need for multi-loop thermal systems and battery-cooling units.

- Hybrid vehicles will drive demand for compact, dual-purpose cooling solutions.

- Aftermarket sales will grow as aging fleets require frequent radiator replacements.

- Thermal-management integration with vehicle electronics will become more common.

- OEMs will invest in modular radiator platforms to reduce development time.

- Smart radiators with sensors will support predictive maintenance in advanced vehicles.

- Suppliers will expand production in Asia-Pacific to meet rising local and export demand.

- Sustainable materials and improved recyclability will shape future radiator designs.