Market Overview

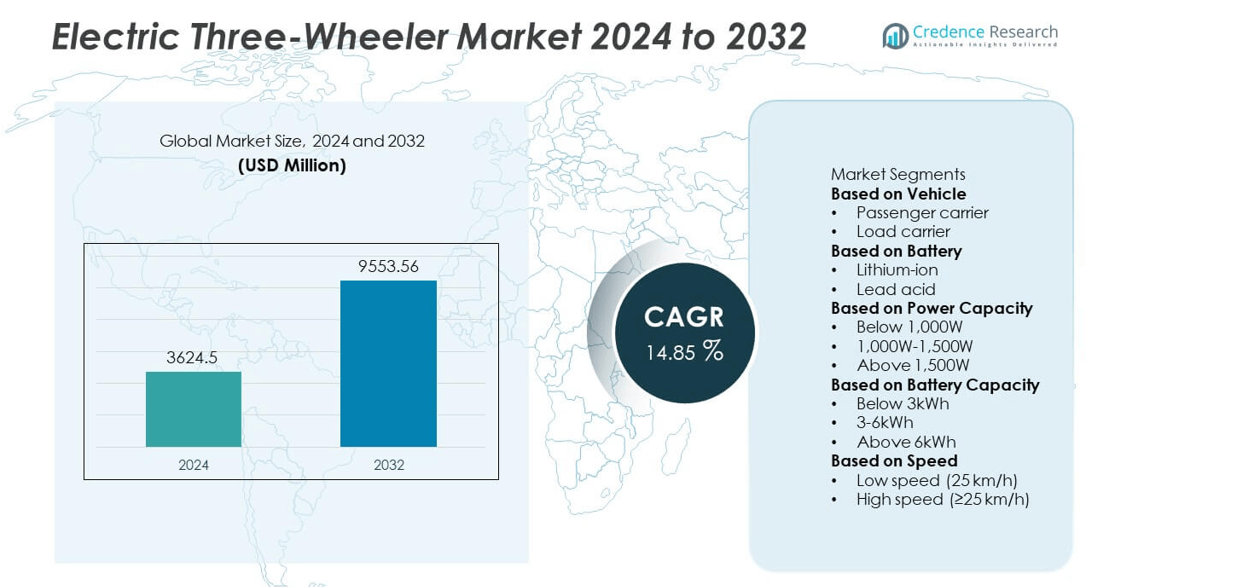

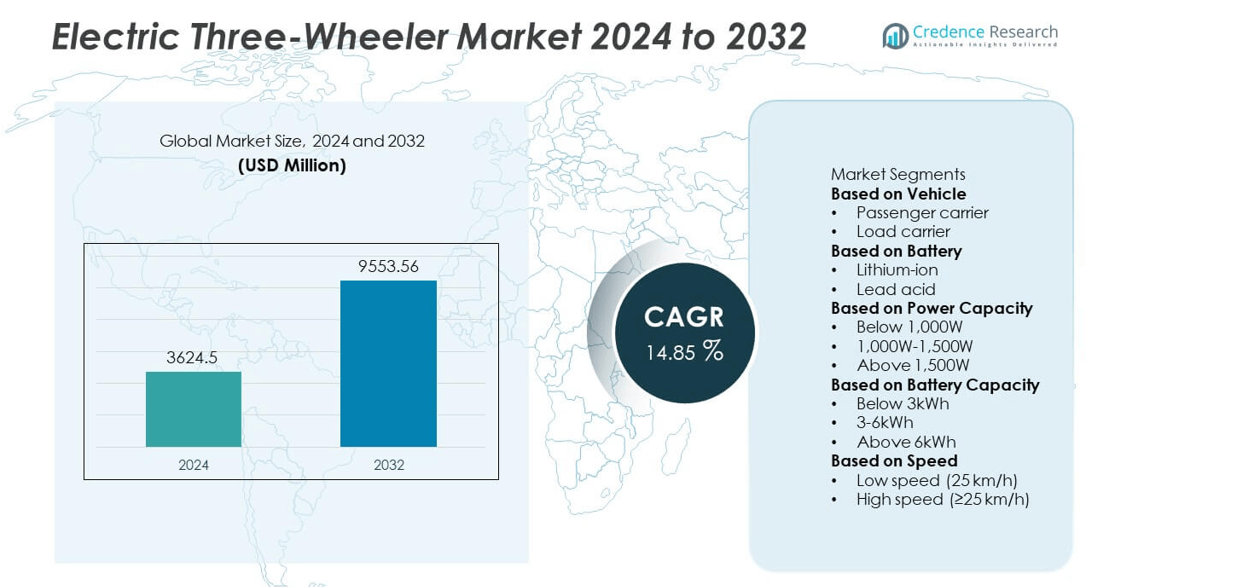

The Electric Three-Wheeler Market was valued at USD 3,624.5 million in 2024 and is projected to reach USD 9,553.56 million by 2032, expanding at a CAGR of 14.85 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Three-Wheeler Market Size 2024 |

USD 3,624.5 million |

| Electric Three-Wheeler Market, CAGR |

14.85% |

| Electric Three-Wheeler Market Size 2032 |

USD 9,553.56 million |

The Electric Three-Wheeler Market is led by major players such as Mahindra Last Mile Mobility, Saera Electric Auto, YC Electric, Piaggio Vehicles, Unique International, Mini Metro EV, Bajaj Auto, Energy Electric Vehicles, Hotage India, and Dilli Electric Auto. These manufacturers dominate through strong regional networks, product innovation, and affordable electric mobility solutions. Asia-Pacific emerged as the leading region with a 65 percent market share in 2024, driven by rising urbanization, government incentives, and large-scale adoption in India and China. Europe followed with 13 percent, supported by sustainable transport initiatives, while Latin America and the Middle East are witnessing growing demand for electric last-mile connectivity.

Market Insights

- The Electric Three-Wheeler Market was valued at USD 3,624.5 million in 2024 and is projected to reach USD 9,553.56 million by 2032, growing at a CAGR of 14.85 percent.

- Rising demand for affordable, eco-friendly urban mobility and government incentives promoting electric transport are key factors driving market growth.

- The market is witnessing strong trends toward lithium-ion battery adoption, improved range, and integration of battery-swapping infrastructure for efficient fleet operations.

- Key players such as Mahindra Last Mile Mobility, Piaggio Vehicles, Bajaj Auto, YC Electric, and Saera Electric Auto are focusing on product innovation, localized production, and strategic partnerships to strengthen their presence.

- Asia-Pacific dominated the market with a 65 percent share in 2024, followed by Europe with 13 percent and Latin America with 6 percent, while the passenger carrier segment led with 62 percent due to its high demand in shared and public transport systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Vehicle

The passenger carrier segment dominated the Electric Three-Wheeler Market in 2024, accounting for 62 percent of the total share. Its dominance is driven by rising demand for affordable and eco-friendly public transportation across urban and semi-urban areas. Governments in countries such as India, Bangladesh, and Thailand are promoting electric mobility through subsidies and low-interest financing for e-rickshaws. These vehicles offer low operating costs, easy maintenance, and quick payback periods, making them ideal for short-distance travel. Growing ride-hailing services and shared mobility platforms further boost the adoption of electric passenger carriers.

- For instance, the Mahindra Last Mile Mobility Treo passenger e-rickshaw operates with a 7.4 kWh lithium-ion battery and delivers an ARAI-certified range of 139 km per charge. The model supports a 3 hour and 50 minute charging time on a 16 A socket.

By Battery

The lithium-ion battery segment held the largest share of 58 percent in 2024, driven by its superior energy density, faster charging capability, and longer lifespan compared to lead-acid batteries. Advancements in battery chemistry and falling lithium-ion prices are improving affordability for small commercial operators. Governments are supporting battery manufacturing and recycling initiatives to strengthen local supply chains. The shift toward lightweight and maintenance-free batteries is accelerating adoption across both passenger and cargo electric three-wheelers. Additionally, lithium-ion systems enable better vehicle range and performance, making them the preferred choice for urban fleet operations.

- For instance, Piaggio Vehicles introduced its Ape E-City with a 4.5 kWh lithium-ion swappable battery pack, offering a certified range of 68 km per swap through Sun Mobility’s swap stations. The quick battery replacement process allows for minimal downtime.

By Power Capacity

The 1,000W–1,500W power capacity segment led the market with a 51 percent share in 2024, supported by its suitability for both passenger and load-carrying applications. Vehicles in this range offer an ideal balance between power, energy efficiency, and cost-effectiveness. These three-wheelers are widely used for urban transport and short-distance logistics due to their ability to handle moderate payloads and inclines. Manufacturers are focusing on improving motor efficiency and durability while ensuring compliance with evolving electric mobility standards. The growing deployment of mid-range power models in fleet and delivery operations continues to strengthen this segment’s dominance.

Key Growth Drivers

Rising Demand for Affordable Urban Mobility

Growing demand for low-cost and sustainable transportation solutions is a key driver of the Electric Three-Wheeler Market. These vehicles offer an economical alternative to conventional auto-rickshaws, reducing fuel expenses and emissions. Urbanization and rising population density are increasing dependence on short-distance public transport. Governments are promoting electric mobility through subsidies, tax benefits, and fleet electrification programs. The affordability and adaptability of electric three-wheelers make them ideal for urban and peri-urban commuting, particularly in developing nations across Asia-Pacific and Africa.

- For instance, YC Electric Vehicle’s Deluxe e-rickshaw is equipped with a 1.4 kW BLDC motor and offers a range of 75-90 km per charge. The company has deployed thousands of units, including in North India, and supports emission-free commuting.

Government Incentives and Policy Support

Strong policy frameworks and financial incentives are accelerating electric three-wheeler adoption. Governments are implementing subsidy schemes, reduced registration fees, and interest-free loans to support EV penetration. National programs such as India’s FAME initiative and China’s NEV policy are improving affordability and accessibility. In addition, growing investments in charging infrastructure and battery-swapping stations are enhancing convenience for drivers. Such measures encourage both individual ownership and commercial fleet deployment, solidifying electric three-wheelers as a vital component of sustainable mobility ecosystems.

- For instance, under India’s Electric Mobility Promotion Scheme (EMPS) 2024, Mahindra Last Mile Mobility’s Treo electric three-wheelers are eligible for demand incentives. The scheme provides demand incentives of up to ₹25,000 per vehicle for small electric three-wheelers, which reduces the final invoice price for the consumer.

Expansion of Last-Mile Delivery and E-Commerce

The surge in e-commerce and urban logistics is fueling demand for electric three-wheelers in last-mile delivery operations. Their compact design, low operating cost, and zero-emission performance make them ideal for navigating congested city routes. Logistics providers and retailers are increasingly adopting electric fleets to meet sustainability targets and reduce fuel costs. Partnerships between manufacturers and logistics firms are growing to develop purpose-built cargo models. This trend aligns with the broader shift toward green and efficient urban transportation networks worldwide.

Key Trends and Opportunities

Advancements in Battery Technology and Range

Technological advancements in lithium-ion batteries are extending vehicle range and reducing charging time. Lightweight battery packs, improved thermal management, and energy-efficient powertrains enhance performance and reliability. Battery-swapping infrastructure is also gaining traction, particularly in high-utilization fleet operations. These developments lower downtime and make electric three-wheelers more suitable for commercial and passenger applications. Ongoing research into solid-state and fast-charging batteries is expected to further accelerate adoption and reduce total cost of ownership in the coming years.

- For instance, Saera Electric Auto offers e-rickshaws with lithium-ion battery options. Some of their lithium-ion-powered e-rickshaws have a 100 Ah capacity, which provides a range of 90 to 100 km and a charging time of 5 to 6 hours.

Growth of Fleet Electrification and Shared Mobility

Shared mobility platforms and fleet operators are increasingly deploying electric three-wheelers for ride-hailing and delivery purposes. The focus on sustainable urban transport and cost efficiency is driving large-scale fleet electrification. Many startups and established OEMs are collaborating to offer subscription-based or lease models to reduce upfront costs. This approach supports mass adoption in both passenger and logistics sectors. Expansion of digital ride-sharing platforms across Asia and Africa further strengthens opportunities for electric three-wheeler deployment in shared urban transport systems.

- For instance, Mahindra Last Mile Mobility partnered with Magenta Mobility to deploy 100 Treo Zor cargo three-wheelers in Bengaluru. Each vehicle features an 8 kW motor and offers an 80 km real-world range per charge.

Key Challenges

Limited Charging Infrastructure

Insufficient availability of charging and battery-swapping stations remains a major challenge for electric three-wheeler expansion. In many developing markets, unreliable electricity access and sparse charging networks hinder fleet operations. Drivers often rely on home or informal charging setups, limiting operational hours and coverage. Governments and private players are investing in fast-charging and modular infrastructure, but progress is gradual. Strengthening public-private partnerships and standardizing charging protocols are essential to overcome this barrier and support large-scale fleet integration.

High Initial Cost and Battery Replacement Concerns

Despite low operating costs, high upfront purchase prices continue to restrain market growth. Lithium-ion batteries account for a significant portion of total vehicle cost, making initial investment challenging for small operators. Additionally, battery replacement expenses after a few years of use raise ownership concerns. Manufacturers are focusing on localized production and leasing models to lower costs. However, financial accessibility and long-term battery durability remain key challenges that must be addressed to ensure sustained market growth.

Regional Analysis

North America

North America held a market share of 9 percent in 2024, driven by growing adoption of electric mobility solutions for urban delivery and shared transport. The United States and Canada are witnessing increasing use of electric three-wheelers in logistics, postal services, and local mobility programs. Supportive state policies, investment in charging infrastructure, and emission reduction goals are fostering adoption. Manufacturers are introducing lightweight and compact models suited for urban operations. Rising participation of e-commerce and delivery companies in fleet electrification initiatives continues to strengthen regional market growth.

Europe

Europe accounted for 13 percent of the Electric Three-Wheeler Market in 2024, supported by stringent emission regulations and the push for zero-emission transportation. Countries such as Germany, France, and the United Kingdom are promoting electric last-mile mobility through subsidies and infrastructure expansion. The market is witnessing increasing adoption of electric cargo three-wheelers in urban logistics and commercial delivery. Advancements in lithium-ion batteries and sustainable fleet operations are further driving market penetration. The focus on smart city development and renewable integration supports long-term growth across the European market.

Asia-Pacific

Asia-Pacific dominated the global Electric Three-Wheeler Market with a 65 percent share in 2024, fueled by strong demand from India, China, and Southeast Asian nations. Growing urban population, rising fuel costs, and government incentives for EV adoption are major drivers. India leads with widespread use of electric rickshaws in passenger transport and last-mile delivery. Local manufacturers are rapidly expanding production to meet domestic and export demand. Favorable financing schemes, expanding charging networks, and partnerships between OEMs and fleet operators continue to accelerate regional market growth and technological advancement.

Middle East and Africa

The Middle East and Africa captured 7 percent of the global Electric Three-Wheeler Market in 2024, supported by electrification initiatives and growing urban transport needs. Countries such as South Africa, Kenya, and the UAE are adopting electric three-wheelers for sustainable mobility and delivery applications. Government-backed clean energy programs and low-cost mobility projects are encouraging local assembly and pilot deployments. Limited charging infrastructure remains a challenge, but investments in renewable-powered charging systems are emerging. Expanding awareness and affordable financing are gradually improving adoption across urban and peri-urban areas.

Latin America

Latin America accounted for 6 percent of the Electric Three-Wheeler Market in 2024, driven by expanding e-commerce, logistics, and shared mobility services. Brazil and Mexico are leading markets, supported by favorable government policies promoting low-emission transport. The demand for electric load carriers is growing rapidly in urban delivery and small business operations. Rising fuel prices and sustainability commitments from logistics providers are supporting electrification. Regional manufacturers are focusing on cost-effective, durable models designed for local terrain conditions. Continuous investment in urban infrastructure and charging networks supports steady long-term growth across the region.

Market Segmentations:

By Vehicle

- Passenger carrier

- Load carrier

By Battery

By Power Capacity

- Below 1,000W

- 1,000W-1,500W

- Above 1,500W

By Battery Capacity

- Below 3kWh

- 3-6kWh

- Above 6kWh

By Speed

- Low speed (25 km/h)

- High speed (≥25 km/h)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Electric Three-Wheeler Market includes key players such as Mahindra Last Mile Mobility, Saera Electric Auto, YC Electric, Piaggio Vehicles, Unique International, Mini Metro EV, Bajaj Auto, Energy Electric Vehicles, Hotage India, and Dilli Electric Auto. These companies dominate the market through diverse product portfolios, strong dealer networks, and continuous innovation in battery technology and vehicle design. Manufacturers are focusing on developing high-efficiency motors, lightweight structures, and improved range to meet growing demand from passenger and cargo applications. Strategic collaborations with battery suppliers and fleet operators are enhancing operational efficiency and cost competitiveness. Companies are also expanding manufacturing capacities and exploring export opportunities in Southeast Asia and Africa. Growing emphasis on localized production, affordability, and aftersales support remains key to sustaining leadership in this rapidly evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2025, Bajaj Auto announced potential supply challenges for the GoGo e-rickshaw line due to a shortage of rare-earth magnets used in traction motors. The company indicated that localized sourcing strategies are being developed to sustain monthly production capacity of 3,000 units.

- In July 2025, Bajaj Auto confirmed the commercial launch of its new GoGo electric three-wheeler after completing 10,000 km of pilot testing. The vehicle uses a 48 V battery platform and is planned for large-scale manufacturing at the company’s Akurdi plant.

- In February 2025, Mahindra Last Mile Mobility launched the Treo Zor DV cargo variant equipped with a 7.4 kWh lithium-ion battery. The vehicle supports a payload of 500 kg and delivers a real-world range of 80 km per charge, with a charging duration of 3 hours 50 minutes from a 16 A socket.

- In April 2024, Mahindra Last Mile Mobility introduced the metal-bodied Treo Plus to improve structural durability for fleet operations. The model features a 10.24 kWh battery pack, regenerative braking, and a rated motor output of 8 kW, designed for extended urban and peri-urban usage

Report Coverage

The research report offers an in-depth analysis based on Vehicle, Battery, Power Capacity, Battery Capacity, Speed and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow rapidly due to rising demand for affordable electric mobility solutions.

- Government incentives and emission regulations will continue to drive adoption across emerging economies.

- Advancements in lithium-ion batteries will improve vehicle range and reduce charging time.

- Battery-swapping infrastructure will expand to support commercial fleet operations.

- Manufacturers will focus on lightweight designs and energy-efficient powertrains.

- Growing e-commerce and logistics sectors will boost demand for electric load carriers.

- Partnerships between OEMs and fleet operators will enhance large-scale deployment.

- Urbanization and last-mile connectivity projects will strengthen market penetration.

- Localized production and component standardization will reduce vehicle costs.

- Asia-Pacific will remain the dominant region with strong adoption in passenger and cargo applications.