Market Overview

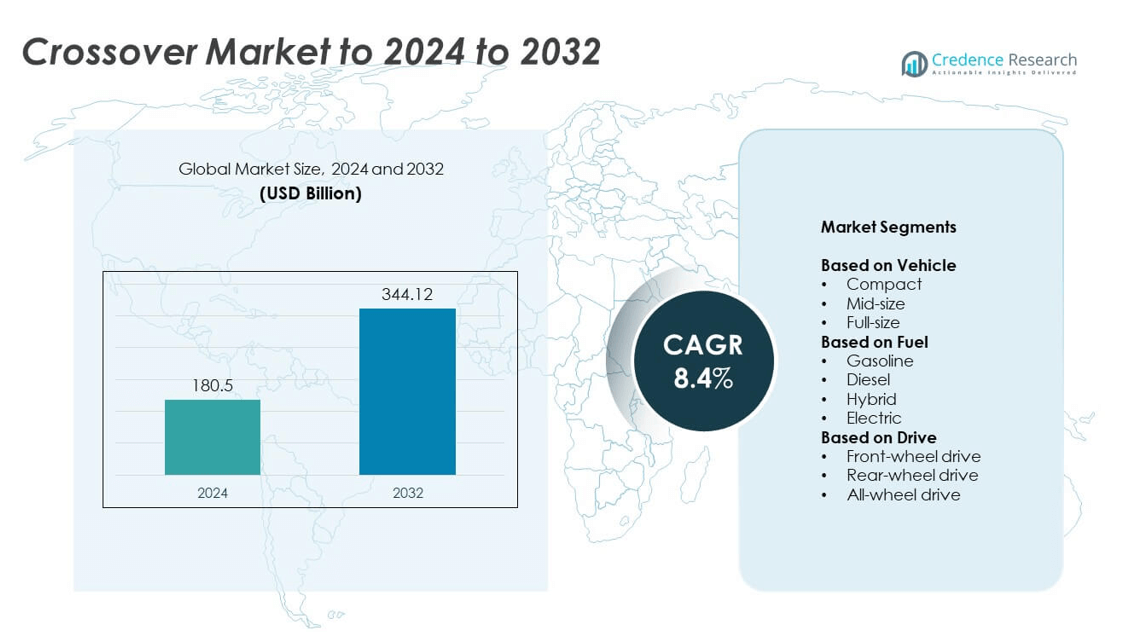

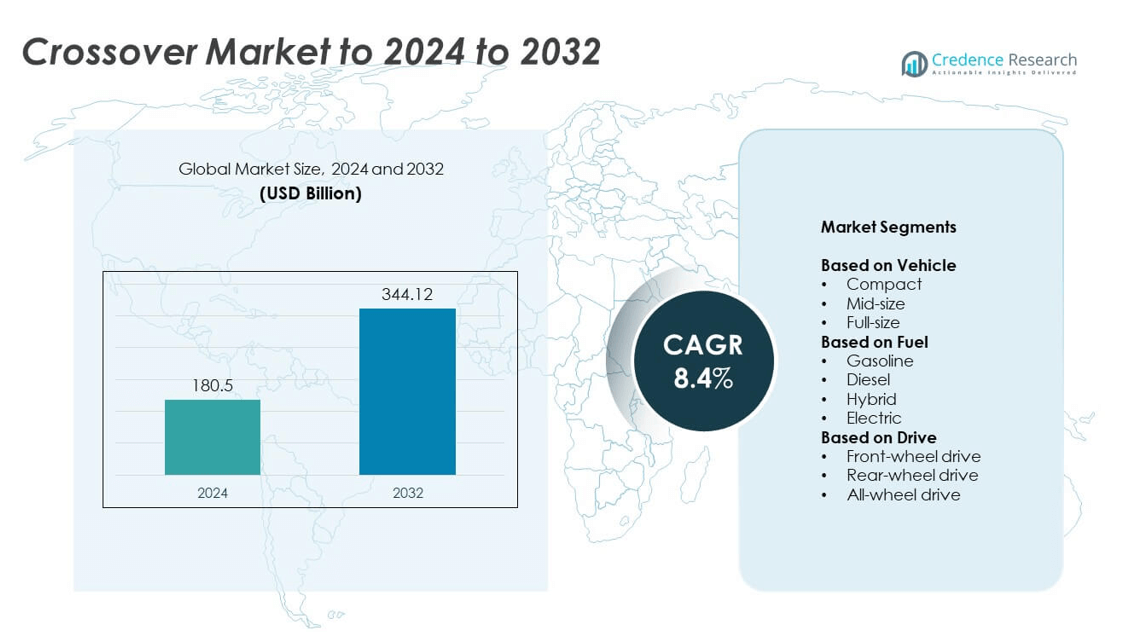

Crossover Market size was valued USD 180.5 billion in 2024 and is anticipated to reach USD 344.12 billion by 2032, at a CAGR of 8.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Crossover Market Size 2024 |

USD 180.5 billion |

| Crossover Market, CAGR |

8.4% |

| Crossover Market Size 2032 |

USD 344.12 billion |

The crossover market is led by major players including Hyundai, BMW, Nissan, Tesla, Ford, Mitsubishi, Toyota, Volkswagen, Stellantis N.V., Honda, Mercedes-Benz, General Motors, and Mazda Motor Europe. These companies dominate through extensive product portfolios, innovation in hybrid and electric powertrains, and continuous upgrades in safety and connectivity features. Manufacturers are focusing on expanding production capacity and introducing region-specific models to meet varying consumer preferences. North America emerged as the leading region with a 37% market share in 2024, driven by high demand for mid-size and premium crossovers supported by strong purchasing power and advanced infrastructure.

Market Insights

- The crossover market was valued at USD 180.5 billion in 2024 and is projected to reach USD 344.12 billion by 2032, growing at a CAGR of 8.4%.

- Rising consumer preference for versatile, fuel-efficient vehicles is driving market growth, supported by strong demand for mid-size crossovers that held a 47% share in 2024.

- Electrification and hybrid integration are key trends, with automakers focusing on eco-friendly models and advanced driver-assistance technologies to enhance safety and efficiency.

- Competition remains high as global manufacturers invest in digital connectivity, AI-based diagnostics, and lightweight materials, while high production costs and supply chain challenges limit growth.

- North America led the global market with a 37% share in 2024, followed by Europe at 30% and Asia-Pacific at 26%, supported by growing urbanization, regional manufacturing expansion, and increasing adoption of hybrid and electric crossover models.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Vehicle

The mid-size segment dominated the crossover market in 2024 with a 47% share. These vehicles offer an ideal balance between interior space, performance, and fuel efficiency, making them popular among families and urban buyers. Automakers are focusing on advanced safety features, connected infotainment, and hybrid options to attract consumers. Growing demand for vehicles that combine SUV capability with sedan comfort continues to strengthen mid-size crossovers. Expanding model availability across price ranges and improved ride quality are further boosting this segment’s leadership in both developed and emerging markets.

- For instance, Toyota RAV4 deliveries in the U.S. reached 475,193 units in 2024, an increase of 9.3% compared to 2023. This sales volume made the RAV4 the best-selling SUV in the U.S. for the eighth consecutive year.

By Fuel

The gasoline segment held the largest share of 56% in 2024, driven by widespread fuel infrastructure and affordability. Gasoline crossovers remain preferred for their smooth performance, lower initial cost, and high availability across global markets. However, hybrid and electric segments are gaining traction due to emission regulations and sustainability goals. Automakers such as Toyota and Hyundai are introducing efficient hybrid crossover variants to attract eco-conscious buyers. Technological improvements in engine efficiency and lightweight materials are also extending the relevance of gasoline crossovers during the transition toward electrification.

- For instance, For its first full calendar year on the U.S. market, the Honda Prologue sold just over 33,000 units in 2024, with initial sales starting in March of that year.

By Drive

The all-wheel-drive (AWD) segment accounted for the leading 41% share in 2024, supported by strong demand in regions with diverse terrain and harsh climates. AWD crossovers offer improved traction, stability, and handling, making them suitable for both urban and off-road conditions. The segment benefits from rising consumer preference for adventure-ready vehicles with enhanced safety. Brands like Subaru and Mazda are emphasizing advanced torque control and intelligent drive systems to boost performance. The continued expansion of AWD options in compact and hybrid models is further solidifying this segment’s dominance globally.

Key Growth Drivers

Rising Consumer Demand for Versatile Mobility

The growing preference for vehicles that combine SUV capability with car-like comfort is a major driver of the crossover market. Consumers are increasingly choosing crossovers for their elevated seating, cargo space, and flexible performance across urban and rural roads. Automakers are expanding model portfolios to address this demand, offering compact, mid-size, and luxury options. The trend toward multi-purpose vehicles that suit both family and individual needs continues to propel global crossover sales.

- For instance, Chevrolet Equinox EV hit 8,500+ U.S. sales in July 2025, a non-Tesla monthly record.

Technological Integration and Safety Advancements

Advancements in driver-assistance technologies, infotainment systems, and connectivity features are fueling crossover adoption. Modern models now include adaptive cruise control, lane-keeping assist, and advanced braking systems as standard or optional features. These improvements enhance driver safety and user experience, making crossovers appealing across demographics. Automakers are also integrating AI-based diagnostics and over-the-air software updates to improve performance and convenience, strengthening customer trust and loyalty.

- For instance, General Motors says Super Cruise coverage is expanding toward ~750,000 miles of mapped roads by end-2025.

Shift Toward Electrification and Hybrid Powertrains

The rapid adoption of hybrid and electric crossover models is another strong growth driver. Governments worldwide are offering incentives and implementing emission targets that encourage low-emission vehicles. Manufacturers are responding by launching plug-in hybrid and fully electric crossovers with longer driving ranges and faster charging capabilities. This shift aligns with growing environmental awareness among consumers, accelerating the transition toward sustainable mobility in both developed and emerging markets.

Key Trends & Opportunities

Expansion of Compact and Affordable Models

Automakers are expanding their lineup of compact crossovers to target price-sensitive buyers and first-time car owners. The segment offers an attractive balance of fuel efficiency, practicality, and advanced features at a competitive price. Compact models are also becoming more popular in densely populated regions where space and parking are limited. Growing demand from emerging markets in Asia-Pacific and Latin America provides an opportunity for manufacturers to increase market penetration and brand presence.

- For instance, BYD’s Song family recorded 89,135 sales in September 2024 in China.

Integration of Connected and Autonomous Features

The integration of connectivity, smart navigation, and semi-autonomous driving systems is reshaping the crossover market. Features such as remote diagnostics, real-time traffic assistance, and vehicle-to-everything communication are improving safety and convenience. Automakers are leveraging data analytics and cloud-based technologies to deliver personalized experiences. This digital shift offers new revenue opportunities through software updates, subscription-based services, and mobility solutions tailored to urban drivers.

- For instance, Hyundai states infotainment OTA updates typically complete in ~10 minutes; map updates can take up to 100 minutes.

Key Challenges

High Manufacturing and Battery Costs

The rising cost of raw materials, advanced electronics, and electric drivetrains poses a significant challenge for manufacturers. Producing hybrid and electric crossovers requires costly components such as lithium-ion batteries and semiconductor chips. These expenses often increase vehicle prices, limiting affordability for middle-income consumers. The challenge is to balance cost reduction through scale and innovation while maintaining performance and safety standards in a competitive market.

Infrastructure and Supply Chain Constraints

Limited charging infrastructure and global supply chain disruptions continue to hinder market expansion. Delays in component availability, particularly semiconductors, have affected production timelines. In developing regions, inadequate charging networks slow the adoption of electric crossovers. Manufacturers are focusing on localizing production and building partnerships to stabilize supply chains. However, sustained investment in logistics and infrastructure remains essential for achieving long-term market growth.

Regional Analysis

North America

North America held the largest share of 37% in the global crossover market in 2024. Strong consumer preference for versatile, family-oriented vehicles and advanced features drives demand across the United States and Canada. The region’s well-established infrastructure and high disposable income support premium and mid-size crossover sales. Automakers such as Ford, General Motors, and Toyota continue expanding hybrid and electric variants to align with emission goals. Increasing interest in safety technologies and off-road capable designs further strengthens North America’s leadership position in the global crossover market.

Europe

Europe accounted for a 30% share in 2024, supported by stringent emission standards and rising adoption of electric crossovers. Countries such as Germany, France, and the United Kingdom are witnessing strong growth due to urban mobility initiatives and incentives for low-emission vehicles. European automakers like Volkswagen, BMW, and Volvo are leading with electrified crossover portfolios. Compact and mid-size models dominate urban demand, while plug-in hybrid options are expanding rapidly. Continuous innovation in lightweight design and autonomous technology enhances vehicle efficiency and strengthens the region’s competitive position.

Asia-Pacific

Asia-Pacific captured a 26% share of the global crossover market in 2024, driven by growing urbanization, rising incomes, and expanding automotive production. China, Japan, and South Korea are major contributors due to strong consumer demand and government support for hybrid and electric vehicles. Automakers such as Hyundai, Honda, and Toyota are launching region-specific crossovers with advanced infotainment and safety features. Compact and affordable models dominate sales in emerging markets like India and Southeast Asia. Increasing local manufacturing and technological innovation are expected to further boost regional growth.

Latin America

Latin America represented a 5% share in the global crossover market in 2024. Countries such as Brazil, Mexico, and Argentina are witnessing steady growth due to the rising popularity of compact and mid-size crossovers. Consumers are drawn to their higher ground clearance, comfort, and fuel efficiency compared to sedans. Manufacturers are expanding local assembly operations and introducing flexible financing options to enhance affordability. Economic recovery and infrastructure development are expected to support long-term market stability, while growing availability of hybrid models improves the region’s environmental outlook.

Middle East & Africa

The Middle East & Africa region held a 2% share in 2024, reflecting moderate but consistent growth. Rising demand for durable and versatile vehicles suitable for varied terrains is boosting crossover adoption, especially in the Gulf countries and South Africa. Expanding road networks, improving living standards, and growing awareness of vehicle safety contribute to regional growth. International brands are introducing models adapted for extreme weather conditions and rough roads. As economic diversification and urbanization progress, the region is expected to record steady expansion in the coming years.

Market Segmentations:

By Vehicle

- Compact

- Mid-size

- Full-size

By Fuel

- Gasoline

- Diesel

- Hybrid

- Electric

By Drive

- Front-wheel drive

- Rear-wheel drive

- All-wheel drive

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The crossover market features strong competition among major automakers such as Hyundai, BMW, Nissan, Tesla, Ford, Mitsubishi, Toyota, Volkswagen, Stellantis N.V., Honda, Mercedes-Benz, General Motors, and Mazda Motor Europe. The market is characterized by continuous innovation in design, electrification, and advanced safety systems. Companies are focusing on hybrid and electric powertrain integration to align with global sustainability standards. Intense competition drives investments in digital connectivity, autonomous driving features, and lightweight architecture to improve efficiency. Strategic alliances and joint ventures are expanding global reach and supply chain resilience. Manufacturers are also strengthening aftersales networks and adopting flexible production models to address fluctuating demand. The increasing use of AI-driven analytics helps optimize production and customer engagement. Competitive intensity is expected to grow as brands introduce region-specific models with improved comfort, technology, and performance features to capture diverse consumer segments in emerging and developed markets alike.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hyundai

- BMW

- Nissan

- Tesla

- Ford

- Mitsubishi

- Toyota

- Volkswagen

- Stellantis N.V.

- Honda

- Mercedes-Benz

- General Motors

- Mazda Motor Europe

Recent Developments

- In 2025, Honda confirmed plans to launch 13 new-generation hybrid models globally starting in 2027.

- In April 2024, Mazda Motor Europe unveiled the first-ever Mazda CX-80 Crossover in Europe.

- In 2024, Tesla announced its plans to introduce a crossover, an entry-level budget EV from 2025, which is likely to be designed for India.

Report Coverage

The research report offers an in-depth analysis based on Vehicle, Fuel, Drive and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for compact and mid-size crossovers will continue to rise due to urban lifestyles.

- Automakers will expand electric and hybrid crossover portfolios to meet emission goals.

- Advanced driver-assistance systems will become standard across most new crossover models.

- Connected and AI-enabled infotainment systems will enhance the in-car experience.

- Lightweight materials and aerodynamic designs will improve vehicle efficiency and performance.

- Subscription-based ownership models will grow in popularity among younger consumers.

- Asia-Pacific will emerge as the fastest-growing regional market for crossovers.

- Manufacturers will focus on regional customization to meet diverse market preferences.

- Integration of autonomous driving technologies will redefine safety and convenience features.

- Partnerships between automakers and tech firms will accelerate innovation and smart mobility adoption.