Market Overview

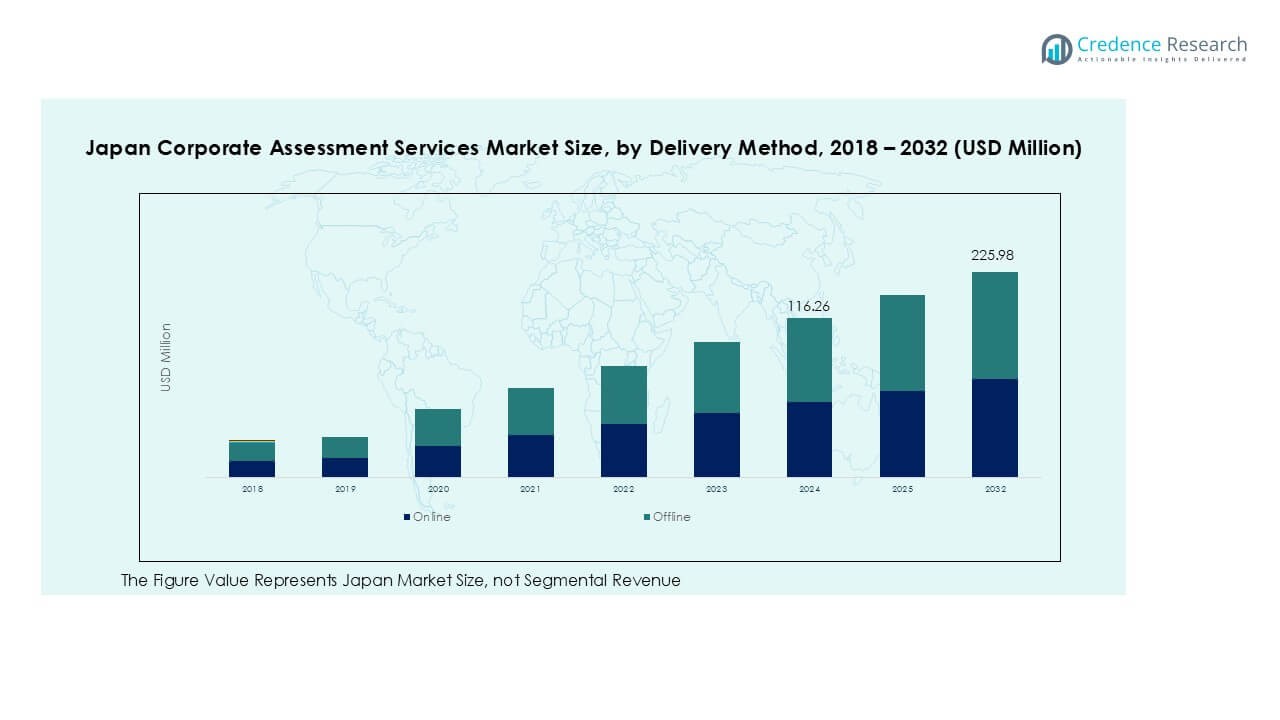

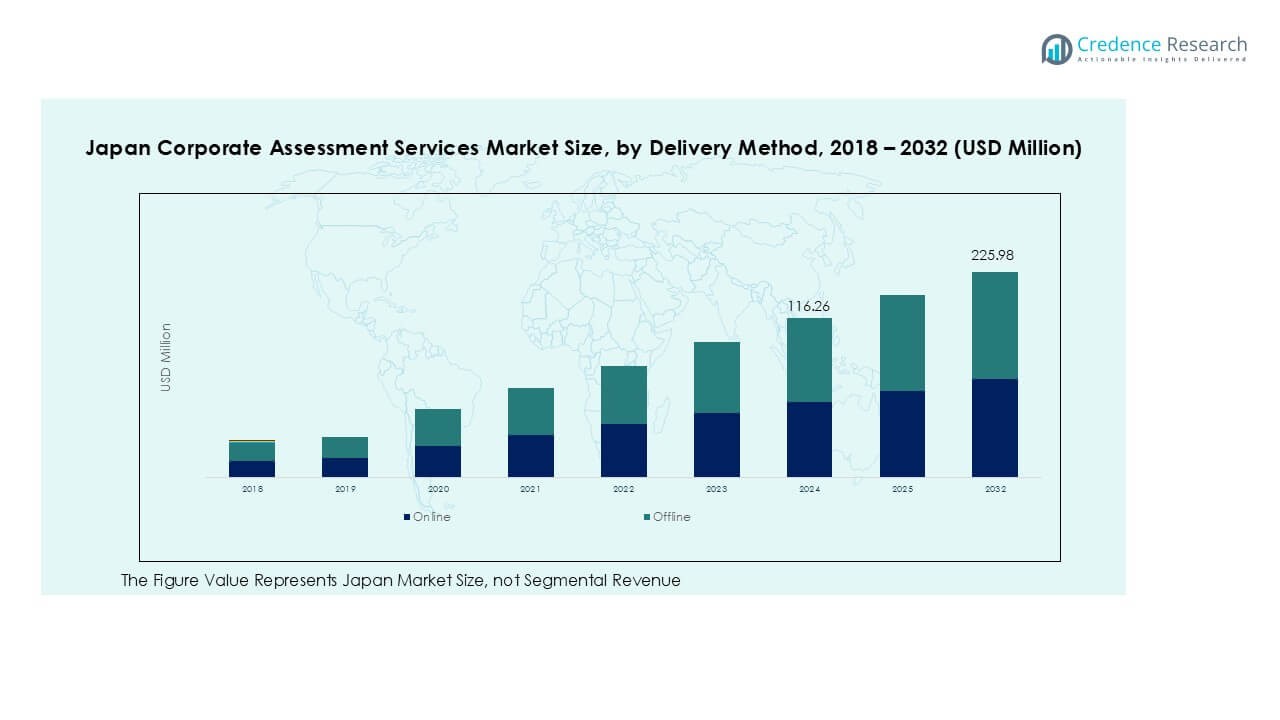

Japan Corporate Assessment Services market size was valued at USD 87.87 million in 2018 and grew to USD 116.26 million in 2024. It is anticipated to reach USD 225.98 million by 2032, registering a CAGR of 8.66% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Corporate Assessment Services Market Size 2024 |

USD 116.26 Million |

| Japan Corporate Assessment Services Market, CAGR |

8.66% |

| Japan Corporate Assessment Services Market Size 2032 |

USD 225.98 Million |

The Japan corporate assessment services market is led by major players such as Korn Ferry, SHL Group Ltd., Aon plc, Mercer | Mettl, and Hogan Assessments. These companies dominate through advanced psychometric testing, leadership evaluation tools, and AI-integrated digital assessment platforms. They focus on talent analytics, cultural fit measurement, and data-driven hiring strategies to support enterprise workforce development. The Kanto region leads the market with a 39% share, driven by Tokyo’s concentration of corporate headquarters and strong adoption of cloud-based HR technologies. Kansai and Chubu regions follow, supported by industrial modernization and demand for structured leadership assessment programs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Japan Corporate Assessment Services market was valued at USD 116.26 million in 2024 and is projected to reach USD 225.98 million by 2032, growing at a CAGR of 8.66%.

- Growing demand for data-driven recruitment and leadership assessment tools is driving market expansion, supported by AI-enabled and cloud-based platforms that improve evaluation accuracy.

- Trends such as digital transformation in HR operations, gamified testing, and personalized analytics are reshaping talent management strategies across enterprises.

- The market is moderately consolidated, with key players like Korn Ferry, SHL Group Ltd., Aon plc, and Mercer | Mettl leading through technology-driven assessment solutions and strategic partnerships.

- Regionally, the Kanto region holds the largest share at 39%, followed by Kansai with 21% and Chubu with 18%; by service type, employee assessment dominates with 42%, driven by increased focus on skill benchmarking and workforce productivity.

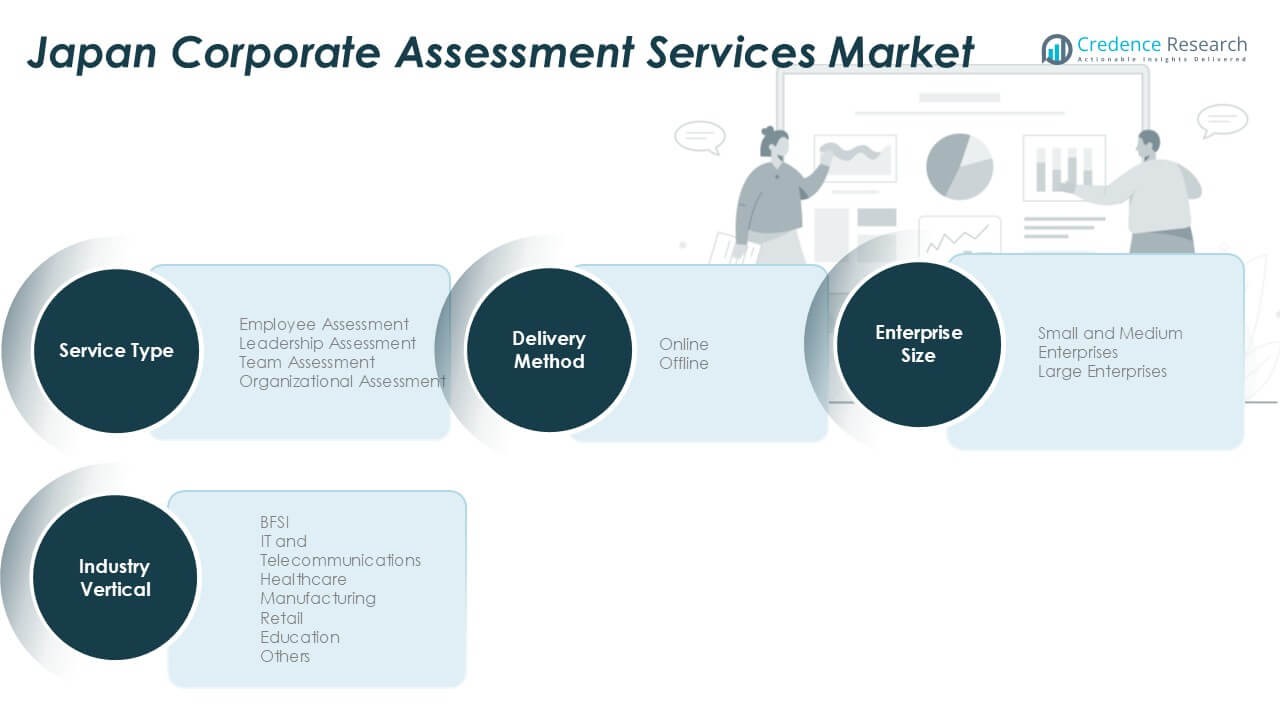

Market Segmentation Analysis:

By Service Type

The employee assessment segment dominated the Japan corporate assessment services market in 2024 with a 42% share. This dominance is driven by the growing need for data-driven hiring, skill evaluation, and performance benchmarking across organizations. Companies increasingly use psychometric and behavioral tools to enhance workforce productivity and align employee potential with business objectives. The rise of AI-enabled analytics and remote hiring platforms has further supported this segment’s growth. Leadership and organizational assessments are also gaining traction, supported by executive development programs and digital talent management solutions.

- For instance, SHL reports delivering 35 million assessments annually across Japan and worldwide, integrating those into local recruitment workflows.

By Industry Vertical

The BFSI segment accounted for the largest share of 28% in the Japan corporate assessment services market in 2024. Financial institutions rely heavily on assessment tools to evaluate leadership competency, integrity, and compliance alignment among employees. The adoption of AI-driven behavioral and cognitive testing supports precise hiring and internal promotion decisions. The IT and telecommunications sectors also display strong growth, driven by demand for digital skill evaluation and agile team assessment tools. Healthcare and education sectors follow, with a rising focus on competency-based performance assessment and workforce optimization.

- For instance, Recruit Holdings (Japan) uses its internal HR and assessment operations to screen tens of millions of candidate profiles annually, leveraging its platform ecosystem and the scale of its recruitment operations.

By Enterprise Size

Large enterprises dominated the market in 2024 with a 63% share, driven by structured HR frameworks and strategic talent development initiatives. These companies implement comprehensive assessment programs for recruitment, succession planning, and leadership training. The integration of predictive analytics and cloud-based platforms enhances assessment accuracy and scalability. Small and medium enterprises (SMEs) are emerging adopters, driven by increasing awareness of employee engagement benefits and cost-effective digital platforms. Government initiatives promoting SME digitalization are also boosting assessment adoption across smaller firms, expanding market penetration in this segment.

Key Growth Drivers

Rising Demand for Data-Driven Talent Decisions

The Japan corporate assessment services market is expanding as organizations increasingly adopt data-driven hiring and performance evaluation practices. Businesses are shifting from traditional interviews to scientifically validated psychometric and cognitive assessments that ensure better talent alignment. Employers seek analytics-based tools to identify leadership potential, predict job performance, and minimize turnover risk. The growing use of AI and machine learning in assessment platforms enhances accuracy and efficiency, allowing firms to analyze large candidate pools quickly. The emphasis on fair and bias-free recruitment further strengthens adoption among multinational corporations and local enterprises.

- For instance, SHL reports that 35 million assessments are taken globally each year. The company also operates in Japan through its subsidiary Japan S.H.L., and employers there use its tools for selection and development.

Integration of Digital and AI-Based Platforms

Digital transformation across HR operations is a major growth accelerator for Japan’s corporate assessment services market. Cloud-based assessment platforms enable seamless integration with HR management systems, providing real-time analytics and predictive insights. AI-powered algorithms are enhancing test customization, skill-mapping precision, and automated reporting for HR professionals. Organizations are leveraging digital solutions for remote assessments and leadership evaluations, particularly after the pandemic-driven shift toward hybrid work models. These technologies reduce manual workload, improve assessment accuracy, and offer scalable solutions for enterprises of all sizes, fueling consistent market growth.

- For instance, SHL’s remote proctoring infrastructure is used in its TalentCentral platform to support hundreds of thousands of remote tests annually across global clients, including Japan.

Emphasis on Leadership Development and Succession Planning

Japanese corporations are increasingly focusing on structured leadership development to address workforce aging and management succession challenges. Leadership assessments help identify high-potential employees and support strategic succession planning. Major enterprises are investing in competency-based evaluation models to prepare future leaders capable of managing digital transformation and globalization pressures. The demand for executive coaching and 360-degree feedback tools has also grown, strengthening the leadership assessment ecosystem. As corporations emphasize internal leadership pipelines over external hires, structured assessment programs are becoming essential to long-term talent sustainability strategies.

Key Trends & Opportunities

Expansion of Cloud-Based and Mobile Assessment Platforms

The rapid adoption of cloud-based solutions is transforming how assessments are delivered and managed in Japan. These platforms provide flexible, scalable, and cost-effective deployment options for enterprises and SMEs. Mobile-enabled assessments allow candidates to complete tests anytime, improving accessibility and participation rates. Companies benefit from centralized data management and advanced analytics dashboards that enhance decision-making. Vendors offering multilingual and customizable platforms are capturing strong market traction. This trend presents significant opportunities for service providers to develop mobile-first, AI-enhanced solutions tailored to Japan’s digitally evolving corporate environment.

- For instance, Recruit Holdings’ HR Technology division (Indeed and Glassdoor) recorded over 350 million monthly unique visitors globally in 2024 through its cloud-driven recruitment and mobile assessment interfaces, supporting digital hiring in Japan.

Growing Adoption in Non-Traditional Sectors

Beyond HR departments, corporate assessments are increasingly applied in training, learning, and organizational culture alignment. Sectors such as healthcare, education, and retail are implementing workforce assessments to measure skill gaps and improve employee engagement. Startups and SMEs use cost-efficient online tools for competency evaluation and productivity tracking. The integration of gamified assessments and behavioral analytics is improving candidate experience and response accuracy. This broadening scope across industries creates new opportunities for service providers to diversify offerings and target untapped verticals with sector-specific solutions.

Key Challenges

High Implementation Costs for Advanced Platforms

The integration of AI-driven and cloud-based assessment platforms involves significant initial investment, which limits adoption among smaller enterprises. The costs include platform customization, employee training, and subscription-based usage models. SMEs often struggle to justify such expenditure without immediate measurable ROI. Additionally, the need for secure data handling and compliance with Japan’s strict privacy laws increases operational complexity. Many firms still rely on manual evaluation methods, slowing digital transformation. Vendors must address cost sensitivity by offering modular, pay-per-use, or scalable packages to drive broader market penetration.

Cultural Resistance and Limited Awareness

Cultural factors present another major challenge to market expansion in Japan. Many traditional organizations still prioritize seniority and personal recommendations over data-based evaluations in hiring and promotion. This conservative mindset limits acceptance of automated and psychometric tools. Limited awareness of the long-term benefits of corporate assessment also hampers adoption among mid-sized firms. Moreover, employees often perceive assessments as judgmental rather than developmental. Overcoming these barriers requires targeted awareness programs, localized content, and culturally sensitive assessment frameworks that align with Japan’s corporate ethics and work culture.

Regional Analysis

Kanto Region

The Kanto region dominated the Japan corporate assessment services market in 2024 with a 39% share. Tokyo, the nation’s business hub, drives demand through large enterprises and multinational corporations focusing on structured hiring and leadership programs. The region’s concentration of financial institutions, IT firms, and consulting companies promotes the adoption of digital and AI-driven assessment tools. Continuous investments in cloud-based HR technologies and workforce analytics solutions further strengthen Kanto’s market position. Strong demand for leadership development and employee engagement programs is expected to sustain steady growth across corporate sectors.

Kansai Region

The Kansai region accounted for a 21% share in the Japan corporate assessment services market in 2024. Osaka, Kyoto, and Kobe serve as industrial and commercial centers, driving demand for leadership and team assessment tools. The manufacturing and healthcare industries in this region are key adopters, integrating behavioral and performance assessments to enhance productivity. Increased emphasis on digital transformation in HR practices supports market growth. The growing presence of tech startups and mid-sized enterprises implementing online assessment platforms also contributes to Kansai’s expanding role in the national market.

Chubu Region

The Chubu region held an 18% share of the Japan corporate assessment services market in 2024. Nagoya and surrounding industrial zones contribute significantly, supported by automotive and engineering companies. These firms rely on technical skill and competency-based assessments for workforce optimization. The increasing adoption of leadership assessment tools aligns with the region’s focus on manufacturing innovation and global expansion. Strong investments in HR analytics and digital evaluation systems further enhance growth. The presence of diversified enterprises adopting structured hiring and development frameworks continues to boost Chubu’s regional influence.

Kyushu and Okinawa Region

Kyushu and Okinawa captured a 10% share of the Japan corporate assessment services market in 2024. The region’s growing IT, manufacturing, and service industries are increasingly using employee assessment and performance management systems. Universities and public institutions in Fukuoka and Okinawa also adopt organizational assessment programs to strengthen workforce development. Government-led digitalization initiatives and the rise of technology-driven enterprises support further adoption. Expanding regional infrastructure and an increasing number of startups are enhancing the market’s potential, positioning Kyushu and Okinawa as emerging hubs for talent evaluation services.

Hokkaido and Tohoku Region

The Hokkaido and Tohoku region represented a 7% share of the Japan corporate assessment services market in 2024. Adoption is rising among public organizations, educational institutions, and regional service providers. Businesses in the agricultural and tourism sectors are adopting employee assessment platforms to improve workforce productivity. Digital HR platforms and remote assessment tools are gradually increasing in popularity. Regional development initiatives and improved internet infrastructure are supporting broader deployment of online assessment systems, enhancing accessibility across northern Japan. The market here shows gradual but consistent growth potential.

Chugoku and Shikoku Region

The Chugoku and Shikoku region accounted for a 5% share of the Japan corporate assessment services market in 2024. The presence of manufacturing and logistics industries drives modest but stable demand for employee and team assessment tools. Hiroshima and Takamatsu serve as key centers for adoption due to industrial modernization efforts. Local enterprises are integrating cloud-based solutions to support HR transformation and workforce efficiency. Increasing focus on leadership development programs among regional corporations and SMEs continues to create growth opportunities within this emerging regional segment.

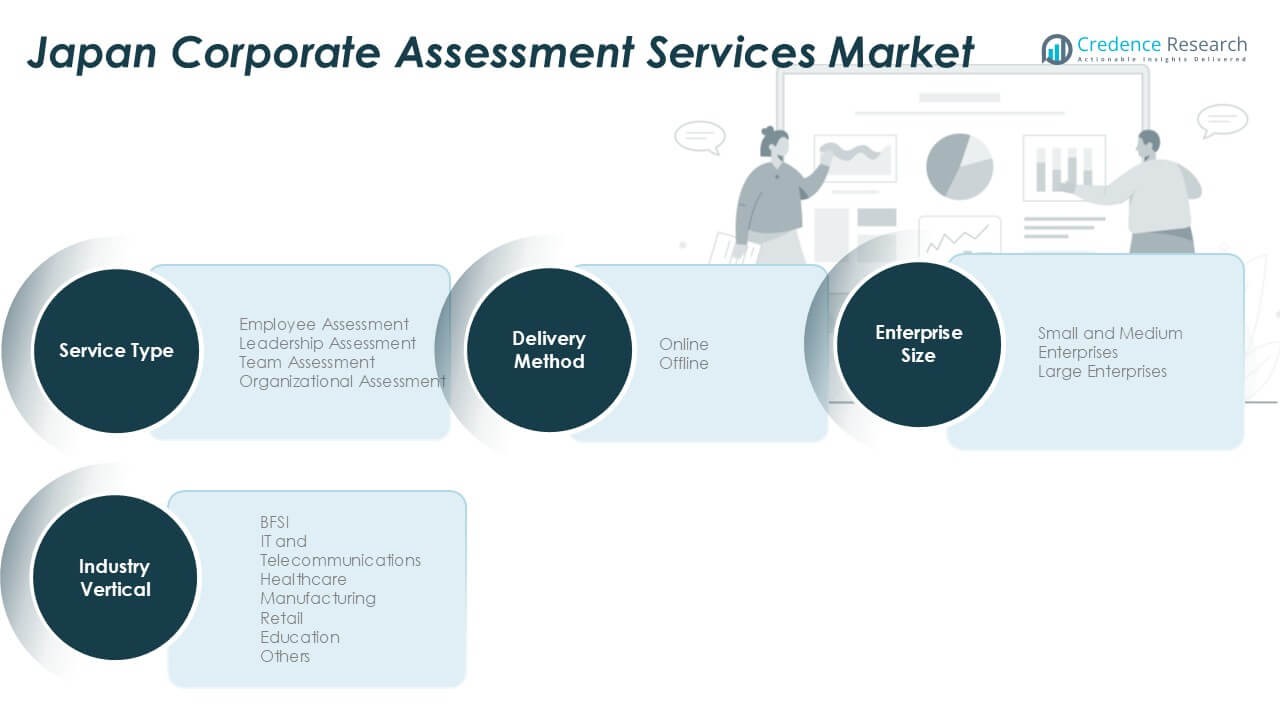

Market Segmentations:

By Service Type

- Employee Assessment

- Leadership Assessment

- Team Assessment

- Organizational Assessment

By Industry Vertical

- BFSI

- IT and Telecommunications

- Healthcare

- Manufacturing

- Retail

- Education

- Others

By Enterprise Size

- Small and Medium Enterprises

- Large Enterprises

By Delivery Mode

By Geography

- Kanto Region

- Kansai Region

- Chubu Region

- Kyushu and Okinawa Region

- Hokkaido and Tohoku Region

- Chugoku and Shikoku Region

Competitive Landscape

The Japan corporate assessment services market is moderately consolidated, with leading players such as Korn Ferry, SHL Group Ltd., Aon plc, Thomas International, and Mercer | Mettl dominating through advanced digital platforms and analytics-based assessment tools. These companies focus on AI-driven psychometric testing, leadership evaluations, and data-backed employee insights to meet evolving corporate needs. Local service providers are strengthening their market presence by offering customized, cost-effective assessment solutions tailored to Japan’s business culture. Strategic partnerships with HR technology firms and investments in cloud-based platforms are enabling global and domestic players to expand reach. Continuous innovation in digital testing, gamified assessments, and predictive analytics supports market competitiveness. The emphasis on leadership development, employee engagement, and cultural fit assessment further differentiates leading firms in this growing market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2023, IBM Corporation introduced AI-driven recruitment tools that assess behavioral patterns and predict job success. These tools leverage machine learning to minimize biases in recruitment processes, enhancing efficiency and fairness in candidate evaluation

- In 2023, Mercer Mettl Launched the “Mercer|Mettl Online Assessments,” an AI-powered platform to evaluate soft skills, technical competencies, and cognitive abilities. It includes advanced proctoring features for remote hiring and corporate training, emphasizing test security and scalability.

Report Coverage

The research report offers an in-depth analysis based on Service Type, Industry Vertical, Enterprise Size, Delivery Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI and machine learning will enhance precision in employee and leadership assessments.

- Cloud-based assessment platforms will become standard for large and mid-sized enterprises.

- Increased focus on data-driven recruitment will boost demand for psychometric and cognitive testing tools.

- Integration of gamified and mobile-friendly assessments will improve candidate engagement.

- Leadership development and succession planning will remain top priorities for Japanese corporations.

- SMEs will increasingly adopt affordable digital platforms for workforce evaluation and training.

- Customization of assessment tools to align with Japanese work culture will gain importance.

- Partnerships between HR tech firms and global assessment providers will expand market accessibility.

- Continuous upskilling and reskilling initiatives will create sustained demand for competency assessments.

- Regional expansion beyond Kanto, especially in Kansai and Chubu, will support long-term market growth.