Market Overview:

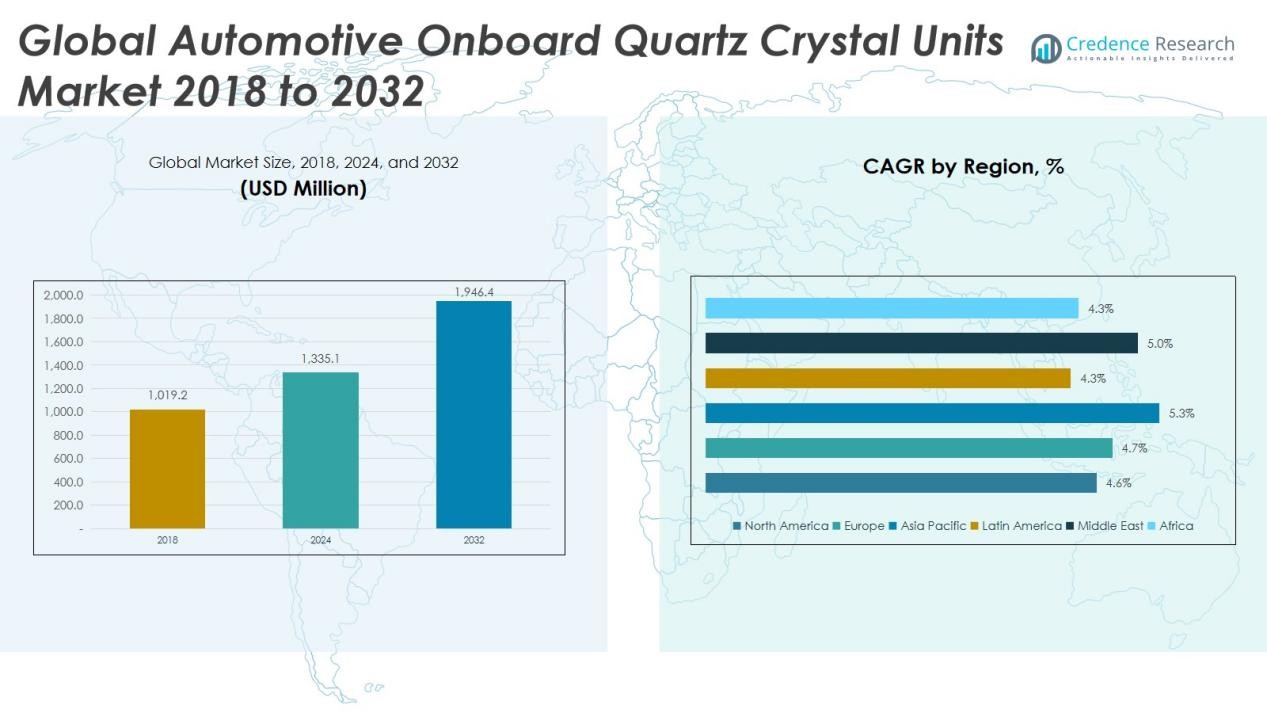

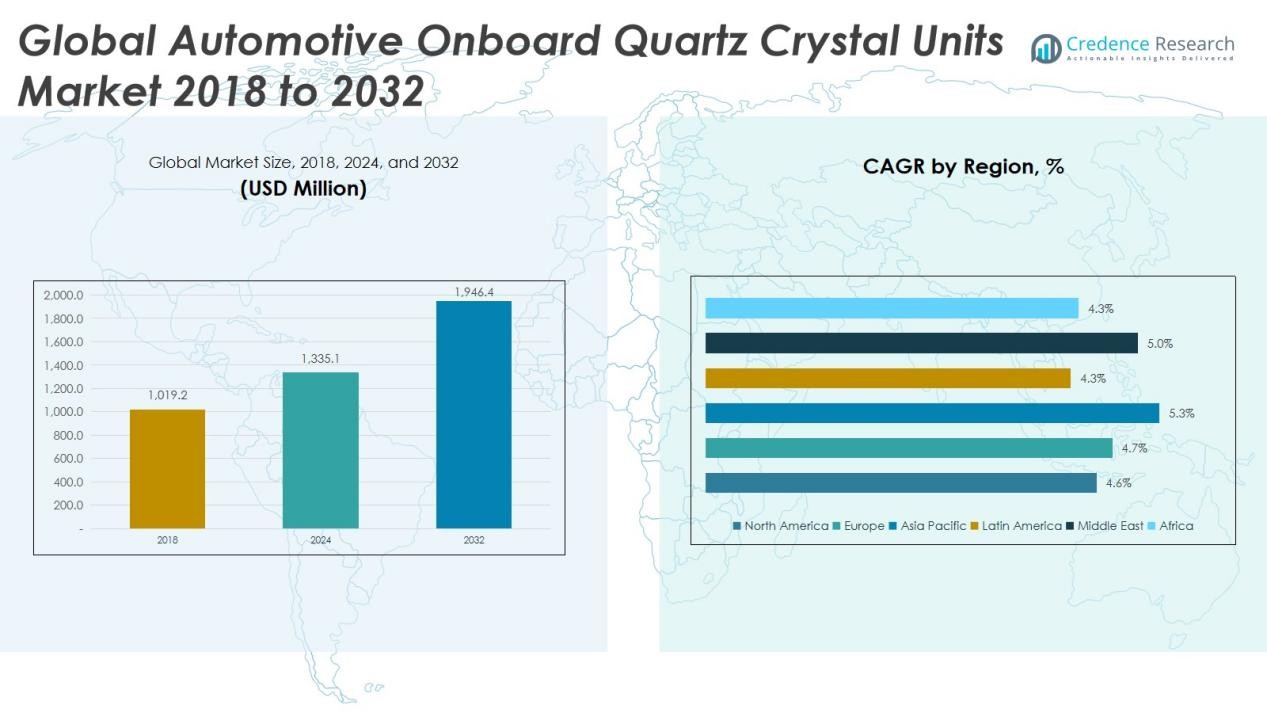

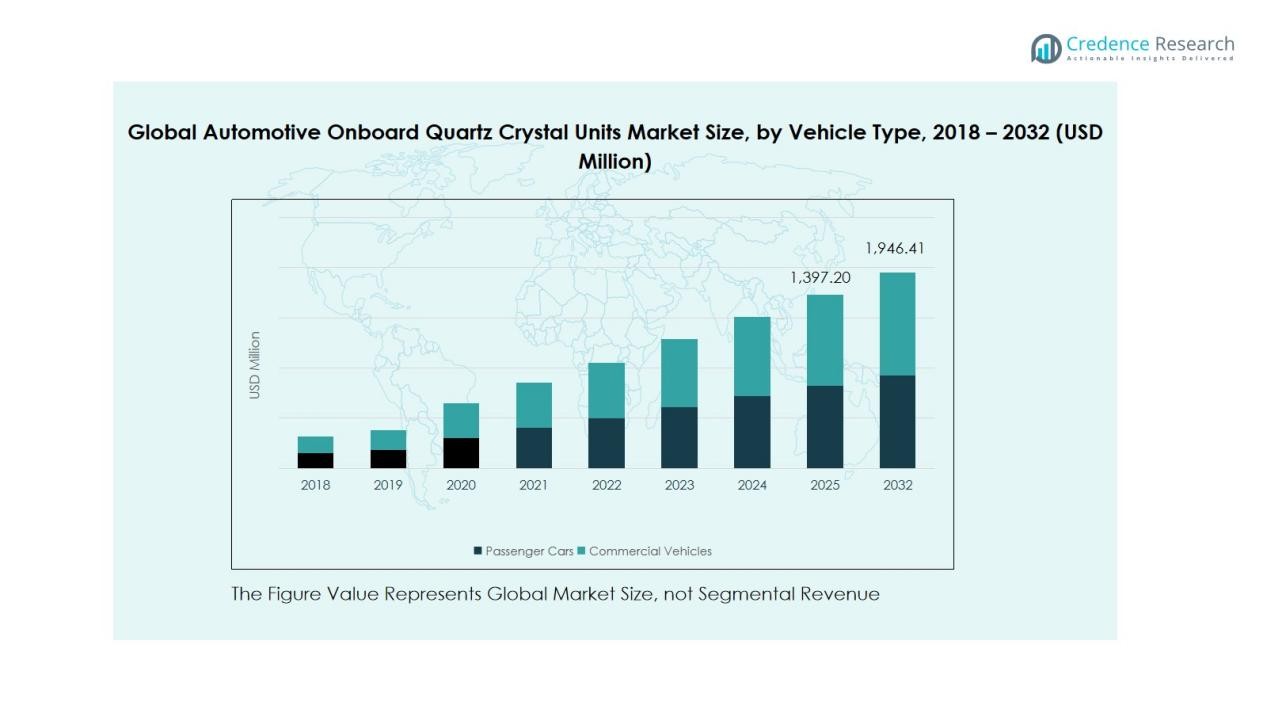

The Global Automotive Onboard Quartz Crystal Units Market size was valued at USD 1,019.2 million in 2018 to USD 1,335.1 million in 2024 and is anticipated to reach USD 1,946.4 million by 2032, at a CAGR of 4.85% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Onboard Quartz Crystal Units Market Size 2024 |

USD 1,335.1 Million |

| Automotive Onboard Quartz Crystal Units Market, CAGR |

4.85% |

| Automotive Onboard Quartz Crystal Units Market Size 2032 |

USD 1,946.4 Million |

Technological advancements in connected and autonomous vehicles are key growth drivers for the market. Automakers increasingly integrate sensors, radar systems, and communication modules that rely on stable timing signals. The growing shift toward electric and hybrid vehicles further expands the need for high-accuracy crystal components to ensure reliable power management and signal synchronization across systems.

Regionally, Asia Pacific dominates the Global Automotive Onboard Quartz Crystal Units Market, supported by a large automotive manufacturing base in China, Japan, and South Korea. North America follows, driven by strong adoption of connected vehicle technologies and advanced automotive electronics. Europe shows steady growth due to its focus on vehicle safety, precision engineering, and compliance with stringent emission and safety regulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Automotive Onboard Quartz Crystal Units Market was valued at USD 1,019.2 million in 2018, increased to USD 1,335.1 million in 2024, and is expected to reach USD 1,946.4 million by 2032, growing at a CAGR of 4.85% during the forecast period.

- Asia Pacific held the largest share of 39% in 2024, supported by strong automotive production in China, Japan, and South Korea and rising adoption of EV and ADAS technologies.

- North America accounted for 23% share in 2024, driven by increasing integration of connected systems, ADAS, and electric powertrain technologies across U.S.-based manufacturers.

- Europe captured 20% share in 2024 due to its focus on safety compliance, high-end automotive manufacturing, and precision engineering advancements.

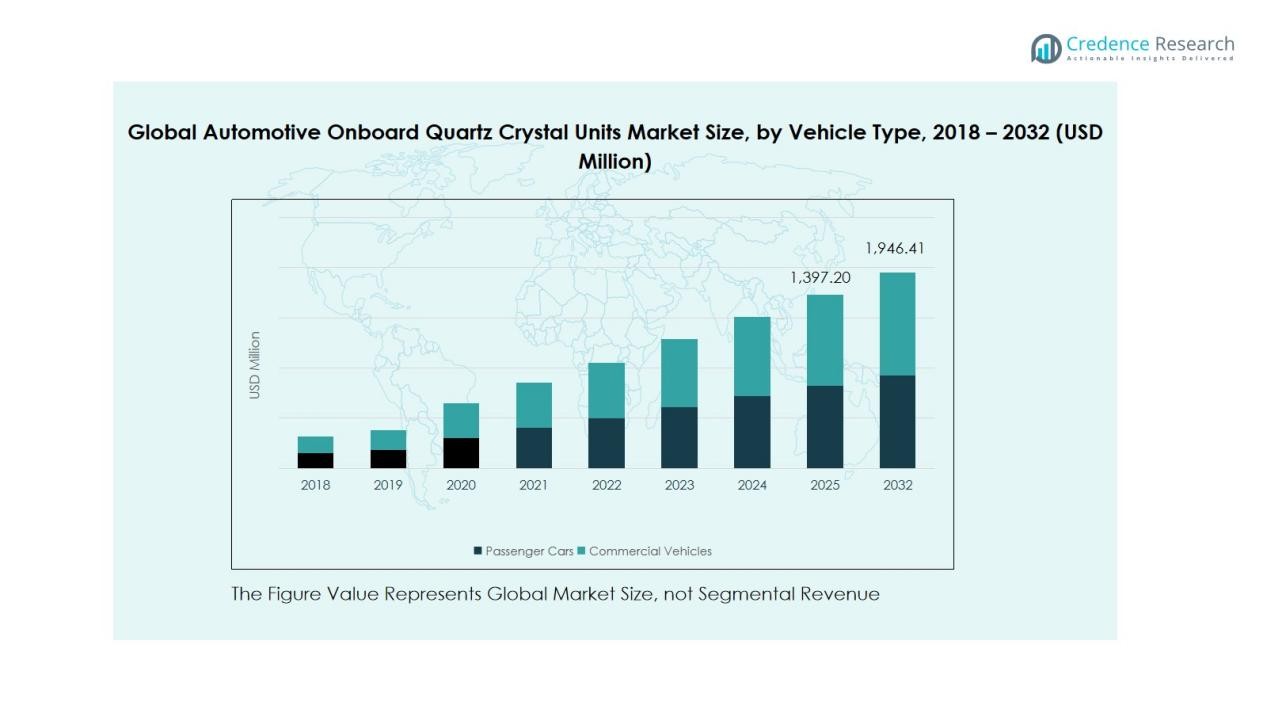

- By vehicle type, passenger cars dominated the market with 68% share in 2024, while commercial vehicles held 32%, driven by growth in logistics and telematics-based fleet operations.

Market Drivers:

Rising Demand for Advanced Vehicle Electronics and Connectivity

The Global Automotive Onboard Quartz Crystal Units Market is driven by the growing integration of electronic systems in vehicles. Modern vehicles rely on electronic control units for infotainment, powertrain, and safety applications. Quartz crystal units ensure precise frequency control and signal stability in these systems. Their role in supporting real-time data transmission and synchronization enhances performance in connected and autonomous vehicles. This growing reliance on electronics strengthens their demand across both passenger and commercial vehicles.

- For instance, NDK Corporation, holding a commanding 55% global market share in automotive crystal devices, supplies crystal units to luxury vehicles that integrate 70 to 100 crystal devices per car, with mid-priced vehicles using 30-40 devices and an average of 30 crystal devices per vehicle.

Expansion of Electric and Hybrid Vehicle Production

The increasing production of electric and hybrid vehicles significantly boosts the market demand for quartz crystal units. These vehicles depend on high-frequency components for energy management, communication, and navigation systems. Quartz crystals provide the precision required to maintain voltage control and motor synchronization. It supports power conversion efficiency and improves the reliability of electric vehicle subsystems. The push for clean mobility and government incentives further encourage manufacturers to adopt advanced crystal-based technologies.

- For Instance, In 2024, Tesla’s Gigafactory Nevada and other facilities were involved in much higher electric drive unit production, with the company celebrating its 10 millionth global drive unit milestone in July 2024.

Growing Adoption of ADAS and Safety Technologies

Automotive safety regulations are encouraging wider adoption of ADAS technologies, fueling demand for accurate timing components. Quartz crystal units are essential in radar, camera, and sensor systems that require precise synchronization. It ensures consistent signal processing for lane detection, collision avoidance, and adaptive cruise control. The expansion of semi-autonomous and autonomous features in mass-market vehicles creates consistent growth opportunities. Continuous innovation in safety systems amplifies the need for reliable quartz crystal solutions.

Technological Advancements in Communication and Sensor Integration

The advancement of in-vehicle communication networks like CAN, LIN, and Ethernet promotes wider use of quartz crystal units. These components stabilize clock frequencies and enhance communication reliability between sensors and control units. It helps reduce data loss and interference in high-speed automotive systems. Increasing sensor integration in vehicles for diagnostics, telematics, and environment monitoring drives component miniaturization. The rising preference for compact and high-performance quartz units supports sustained market growth.

Market Trends:

Integration of Miniaturized and High-Frequency Quartz Components in Vehicle Electronics

Miniaturization and high-frequency performance have become key trends in the Global Automotive Onboard Quartz Crystal Units Market. Automakers are adopting compact quartz components to support the growing number of sensors and microcontrollers in modern vehicles. These units deliver stable frequency output while minimizing space within dense electronic assemblies. It improves overall system efficiency and reliability in critical functions like infotainment, telematics, and ADAS. Advancements in surface-mount crystal technology are enabling higher vibration resistance and thermal stability. The shift toward smaller, more energy-efficient components aligns with the broader trend of vehicle electrification and digitalization. Manufacturers are investing in precision-cutting and photolithography techniques to enhance performance consistency across high-volume production.

- For instance, Murata Manufacturing has developed the XRCGB series crystal units measuring just 2.0 × 1.6 × 0.7mm with frequency stability of ±35 ppm across the automotive standard operating temperature range of -40°C to +125°C, covering frequencies from 24 MHz to 48 MHz.

Shift Toward Automotive-Grade Quartz Units for Connected and Autonomous Vehicles

The increasing adoption of connected and autonomous vehicle technologies is driving demand for automotive-grade quartz crystal units. These components offer superior temperature tolerance and frequency stability under harsh operating conditions. It supports real-time data synchronization essential for vehicle-to-everything (V2X) communication and sensor fusion. The market is witnessing stronger partnerships between crystal unit suppliers and automotive OEMs to co-develop customized timing solutions. 5G integration, IoT-based monitoring, and advanced driver interfaces are creating new application opportunities. Manufacturers are expanding product portfolios to include high-precision oscillators and MEMS-based hybrids that meet automotive quality standards. The trend reflects the growing importance of precision timing in ensuring safe, efficient, and connected vehicle operations.

- For Instance, TXC advertises that some of its products are rated for the automotive standard temperature range of –40°C to +125°C, with a frequency stability of ±10 ppm or better.

Market Challenges Analysis:

Fluctuating Raw Material Costs and Complex Manufacturing Processes

The Global Automotive Onboard Quartz Crystal Units Market faces challenges due to fluctuating costs of raw materials such as quartz, metals, and electronic substrates. Price instability affects production costs and profit margins for manufacturers. The manufacturing of high-precision crystal units requires complex cutting, shaping, and calibration processes. It demands specialized equipment and skilled labor, raising overall production expenses. Meeting automotive-grade quality standards adds further cost pressure. Variations in material purity and supply chain disruptions also affect consistency in product performance. These factors collectively slow down scalability and increase time-to-market for new product launches.

High Competition and Rising Substitution from MEMS Oscillator Technology

Intense competition among suppliers has led to pricing pressures and limited differentiation. The growing use of MEMS oscillator technology presents a direct substitution threat to traditional quartz crystal units. MEMS devices offer improved shock resistance, lower power consumption, and compact form factors. It challenges quartz manufacturers to innovate and retain relevance in emerging applications. Strict automotive certification requirements further limit the speed of new product integration. Manufacturers must invest in continuous R&D to maintain technological parity and reliability. The need to balance innovation with cost efficiency remains a major challenge for sustained market growth.

Market Opportunities:

Expanding Demand from Electric and Autonomous Vehicle Ecosystems

The Global Automotive Onboard Quartz Crystal Units Market holds strong opportunities within the expanding electric and autonomous vehicle landscape. Electric vehicles require high-precision timing components for battery management, inverter control, and communication systems. Quartz units deliver the accuracy needed for real-time power regulation and signal stability. It supports safety-critical operations in autonomous systems, where synchronization between sensors and processors is vital. Growing government incentives for EV adoption further expand production opportunities for crystal suppliers. Integration with ADAS, lidar, and V2X communication platforms is expected to drive long-term demand. Manufacturers investing in automotive-grade innovations will benefit from evolving vehicle architectures.

Development of High-Temperature and Ruggedized Crystal Solutions

The growing complexity of automotive electronics creates demand for quartz units that can perform under extreme conditions. High-temperature and vibration-resistant components are increasingly sought for engine control, transmission, and safety systems. It enables reliable operation in harsh thermal and mechanical environments. Advancements in material science and packaging technology support the creation of ruggedized quartz solutions. The trend toward miniaturized yet durable components opens new revenue streams in performance vehicles and heavy-duty fleets. Expanding partnerships between OEMs and component manufacturers can accelerate customized solution development. Companies that address durability and stability challenges are well-positioned to capture niche growth segments.

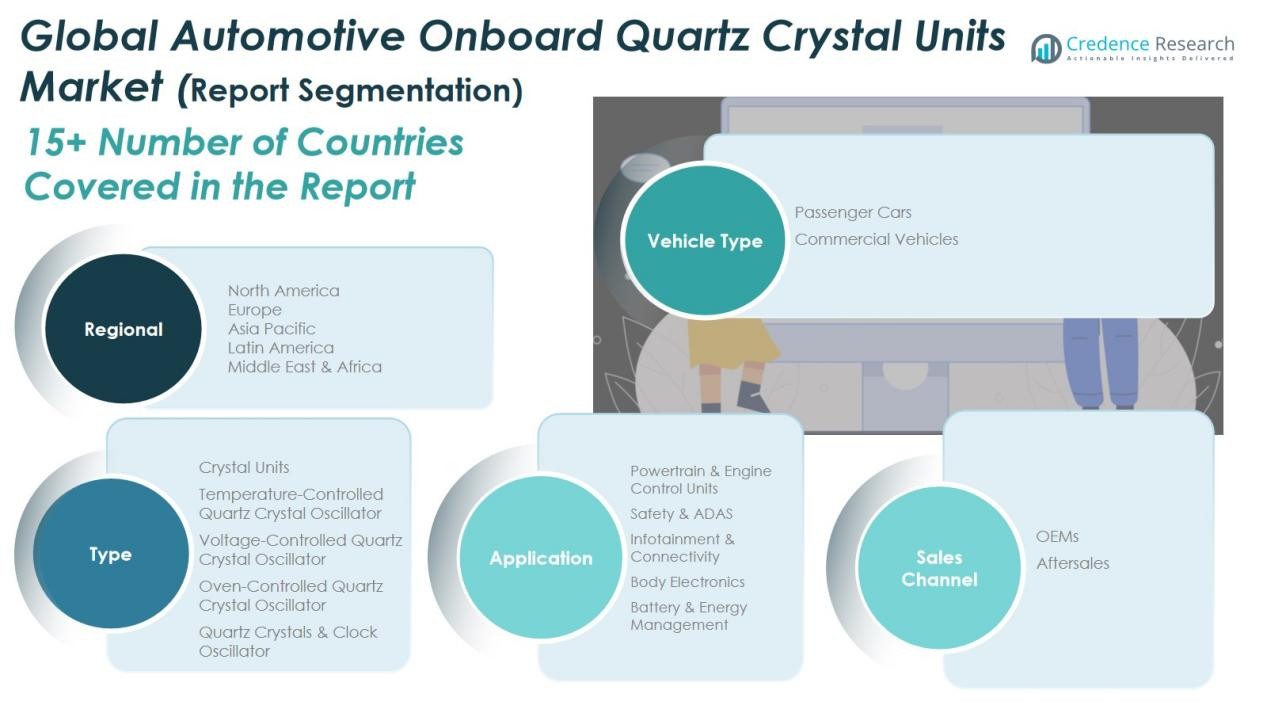

Market Segmentation Analysis:

By Vehicle Segment

The Global Automotive Onboard Quartz Crystal Units Market is segmented into passenger cars and commercial vehicles. Passenger cars accounted for a major share in 2024 due to higher integration of electronic systems such as infotainment, ADAS, and engine control units. The growing demand for connected and autonomous passenger vehicles supports wider adoption of quartz crystal components. It benefits from increased focus on comfort, safety, and energy efficiency. Commercial vehicles are showing steady growth driven by the expansion of logistics, fleet management, and telematics applications requiring accurate frequency control.

- For Instance, Daimler Truck announced it had surpassed one million connected trucks and buses globally through its established digital platform, which supports services like Mercedes-Benz Trucks Uptime and Fleetboard in Europe

By Type Segment

Based on type, the market includes crystal units, temperature-controlled quartz crystal oscillators (TCXO), voltage-controlled quartz crystal oscillators (VCXO), oven-controlled quartz crystal oscillators (OCXO), and quartz crystals & clock oscillators. Crystal units dominate due to their wide use in basic timing and synchronization circuits. TCXO and VCXO are gaining traction for their enhanced temperature stability and voltage sensitivity. It provides reliable performance in high-frequency automotive environments. OCXO units are preferred for precision applications in advanced communication and navigation systems.

- For instance, NIHON DEMPA KOGYO CO., LTD. launched a revolutionary automotive TCXO in 2024 with a compact size of 2.0 x 1.6 mm (0.8 mm height) that operates at high temperatures up to +125°C and delivers high-frequency output up to 100 MHz.

By Application

By application, the market is divided into powertrain & engine control units, safety & ADAS, infotainment & connectivity, body electronics, and battery & energy management. Safety and ADAS applications lead due to increasing vehicle automation and regulatory focus on safety compliance. It enhances precision in radar and sensor operations. Powertrain and battery management systems are emerging as key growth areas with rising electric vehicle production.

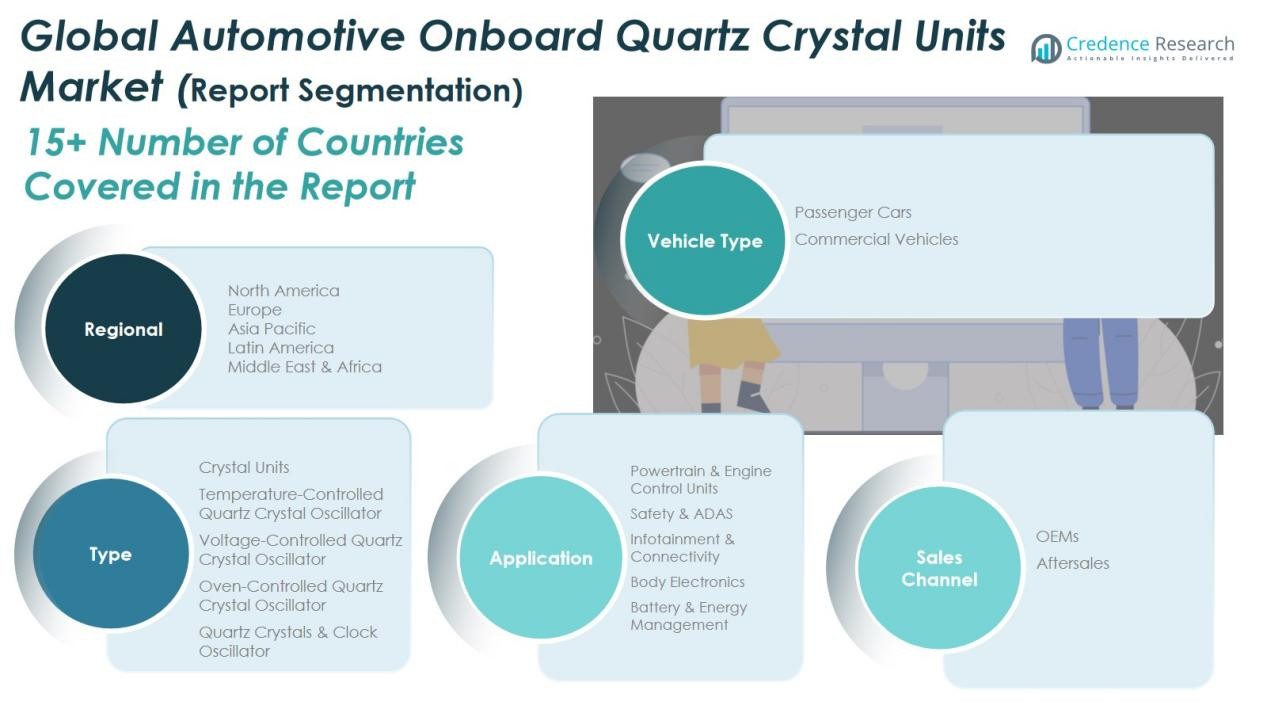

Segmentations:

By Vehicle Segment:

- Passenger Cars

- Commercial Vehicles

By Application Segment:

- Powertrain & Engine Control Units

- Safety & ADAS

- Infotainment & Connectivity

- Body Electronics

- Battery & Energy Management

By Type Segment:

- Crystal Units

- Temperature-Controlled Quartz Crystal Oscillator (TCXO)

- Voltage-Controlled Quartz Crystal Oscillator (VCXO)

- Oven-Controlled Quartz Crystal Oscillator (OCXO)

- Quartz Crystals & Clock Oscillator

By Sales Channel:

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Automotive Onboard Quartz Crystal Units Market size was valued at USD 266.12 million in 2018 to USD 342.82 million in 2024 and is anticipated to reach USD 488.55 million by 2032, at a CAGR of 4.6% during the forecast period. The region held 23% share of the Global Automotive Onboard Quartz Crystal Units Market in 2024. Strong adoption of advanced automotive electronics and connected systems supports market growth. The presence of major OEMs and tier-one suppliers enhances local manufacturing capacity. It benefits from rising integration of ADAS, infotainment, and electric powertrain systems. The U.S. leads regional demand due to increasing investments in autonomous and electric vehicle development. Continuous innovation in frequency control technologies strengthens North America’s competitive position.

Europe

The Europe Automotive Onboard Quartz Crystal Units Market size was valued at USD 225.35 million in 2018 to USD 293.31 million in 2024 and is anticipated to reach USD 423.93 million by 2032, at a CAGR of 4.7% during the forecast period. Europe accounted for 20% share of the Global Automotive Onboard Quartz Crystal Units Market in 2024. The region’s focus on vehicle safety, emission compliance, and electrification drives steady demand. Leading automakers in Germany, France, and the UK integrate advanced timing systems into high-end models. It benefits from strong R&D capabilities and collaboration between automotive and semiconductor industries. Demand for energy-efficient and high-performance components supports innovation in crystal unit design. The market is further driven by expansion in electric vehicle production across Western Europe.

Asia Pacific

The Asia Pacific Automotive Onboard Quartz Crystal Units Market size was valued at USD 353.37 million in 2018 to USD 474.96 million in 2024 and is anticipated to reach USD 715.89 million by 2032, at a CAGR of 5.3% during the forecast period. Asia Pacific dominated with 39% share of the Global Automotive Onboard Quartz Crystal Units Market in 2024. China, Japan, and South Korea serve as major production hubs for automotive electronics. Strong domestic demand, rapid industrialization, and expanding EV manufacturing fuel regional growth. It benefits from cost-effective production facilities and supportive government policies for automotive innovation. Growing investments in autonomous and connected vehicle technologies accelerate quartz unit adoption. Regional suppliers are also scaling operations to serve global automotive OEMs.

Latin America

The Latin America Automotive Onboard Quartz Crystal Units Market size was valued at USD 89.29 million in 2018 to USD 113.18 million in 2024 and is anticipated to reach USD 157.66 million by 2032, at a CAGR of 4.3% during the forecast period. The region held 9% share of the Global Automotive Onboard Quartz Crystal Units Market in 2024. Expanding automotive manufacturing in Brazil and Mexico supports market growth. Rising use of vehicle electronics in infotainment and safety systems drives regional demand. It faces challenges from limited local production capacity and reliance on imports. However, OEMs are increasing partnerships with global component suppliers to strengthen local supply chains. Gradual recovery in vehicle sales and industrial output provides moderate growth potential.

Middle East

The Middle East Automotive Onboard Quartz Crystal Units Market size was valued at USD 48.72 million in 2018 to USD 64.51 million in 2024 and is anticipated to reach USD 95.37 million by 2032, at a CAGR of 5.0% during the forecast period. The region accounted for 5% share of the Global Automotive Onboard Quartz Crystal Units Market in 2024. Rising investment in smart mobility and electric vehicle infrastructure drives adoption. The Gulf countries are integrating more electronics into premium and luxury vehicles. It benefits from technology imports from Asian and European suppliers. Government initiatives promoting clean transportation encourage the use of advanced automotive components. The market is growing steadily with increasing demand for connected and energy-efficient vehicles.

Africa

The Africa Automotive Onboard Quartz Crystal Units Market size was valued at USD 36.39 million in 2018 to USD 46.35 million in 2024 and is anticipated to reach USD 65.01 million by 2032, at a CAGR of 4.3% during the forecast period. Africa represented 4% share of the Global Automotive Onboard Quartz Crystal Units Market in 2024. The market is gradually expanding with the growth of the automotive assembly industry in South Africa and Egypt. It benefits from rising vehicle imports and adoption of electronic systems in new models. Limited manufacturing infrastructure and lower consumer purchasing power restrain faster growth. However, urbanization and government focus on automotive localization support gradual adoption. Increasing demand for affordable, technology-enabled vehicles creates new opportunities for component suppliers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Murata Manufacturing

- NDK

- TXC Corporation

- Kyocera

- Seiko Epson Corp

- Daishinku Corp (KDS)

- TKD Science

- Guoxin Micro

- Harmony

- Shenzhen Yangxing

- JGHC

Competitive Analysis:

The Global Automotive Onboard Quartz Crystal Units Market is highly competitive, driven by continuous technological advancement and product reliability standards. Major players such as Murata Manufacturing, NDK, TXC Corporation, Kyocera, Seiko Epson Corp, Daishinku Corp (KDS), and TKD Science dominate global supply through extensive production networks and diversified product portfolios. It focuses on innovation in high-frequency, temperature-stable, and miniaturized quartz solutions to meet rising automotive electronic demands. Strategic partnerships with OEMs and component manufacturers strengthen market presence and ensure compliance with automotive-grade certifications. Companies are expanding production capacities and improving material quality to enhance performance in electric and connected vehicle systems. The competition is centered on technological precision, cost efficiency, and integration flexibility, with leading firms emphasizing research investment and long-term supply collaborations to maintain their leadership positions.

Recent Developments:

- In October 2025, Murata Manufacturing entered a joint development agreement with QuantumScape to scale manufacturing of ceramic separators for next-generation solid-state batteries, leveraging Murata’s ceramics expertise to advance energy density and safety in electric vehicle batteries.

- In October 2025, Kyocera announced a partnership with iPrint to expand the application of inkjet technology for commercial print providers, deepening its industry presence and technological reach.

Report Coverage:

The research report offers an in-depth analysis based on Vehicle Segment, Application Segment, Type Segment, Sales Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Automotive Onboard Quartz Crystal Units Market will expand with rising demand for advanced vehicle electronics and precise frequency control.

- Integration of crystal units in electric and hybrid vehicles will continue increasing with stronger adoption of energy-efficient systems.

- Manufacturers will focus on developing miniaturized, high-performance quartz components to meet compact automotive design needs.

- Emergence of autonomous and connected vehicles will create sustained demand for high-stability timing devices.

- Collaboration between automakers and component suppliers will enhance innovation and improve system compatibility.

- High-temperature and vibration-resistant quartz units will gain traction in performance and off-road vehicle segments.

- Technological advancements in MEMS-based and hybrid oscillators will open new opportunities for smart mobility applications.

- Regional production expansion in Asia Pacific will strengthen the global supply chain and lower manufacturing costs.

- Growing emphasis on safety and communication technologies will increase adoption of precise timing components across vehicle models.

- Ongoing R&D investments and adoption of Industry 4.0 practices will drive innovation and long-term competitiveness in the market.