Market Overview:

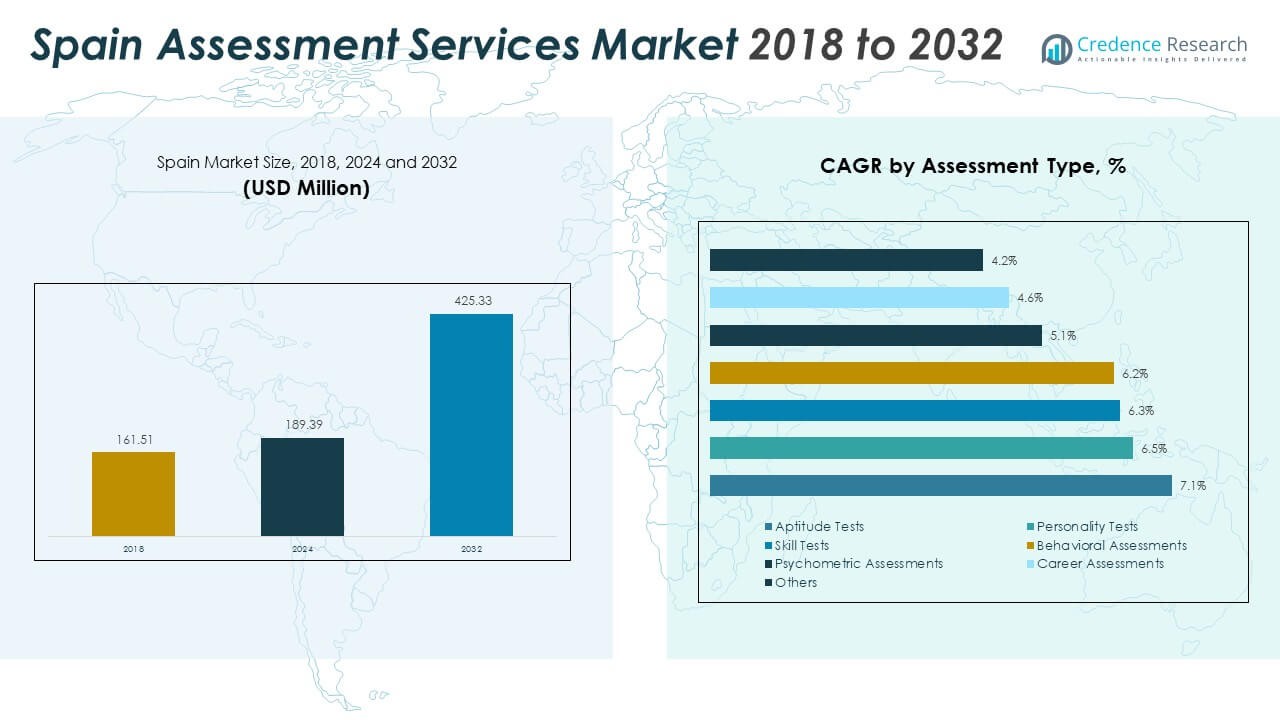

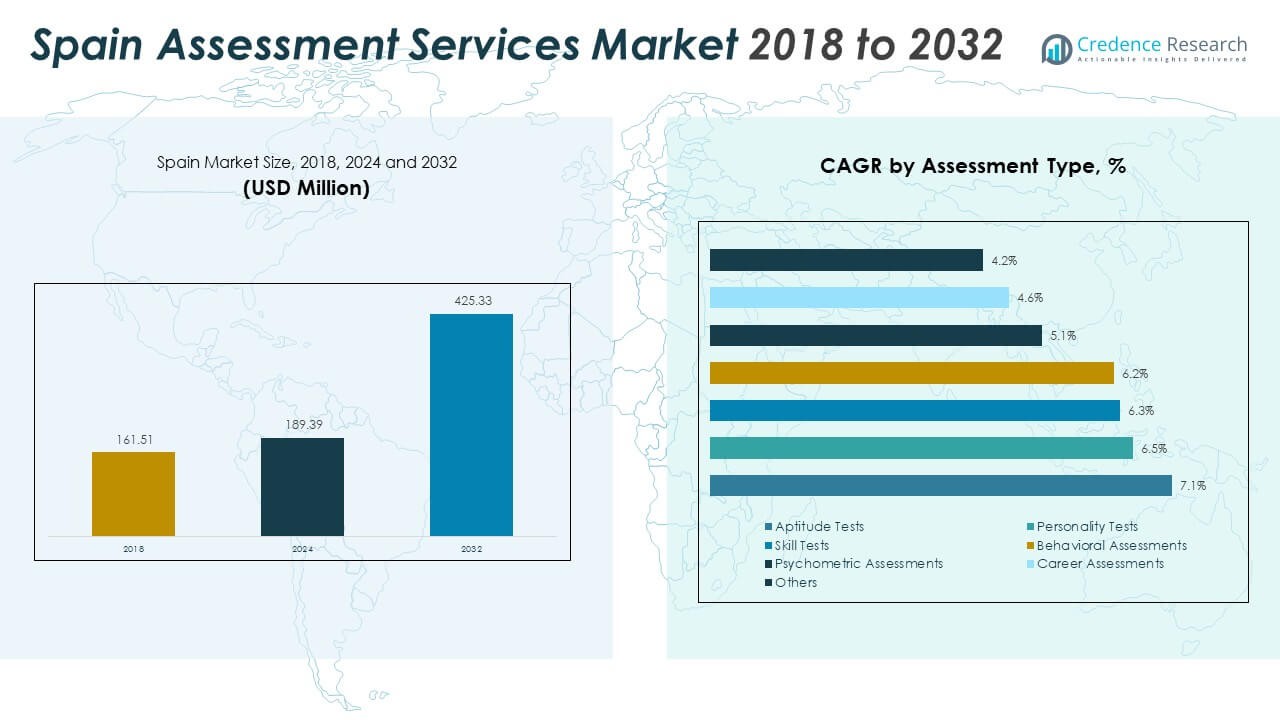

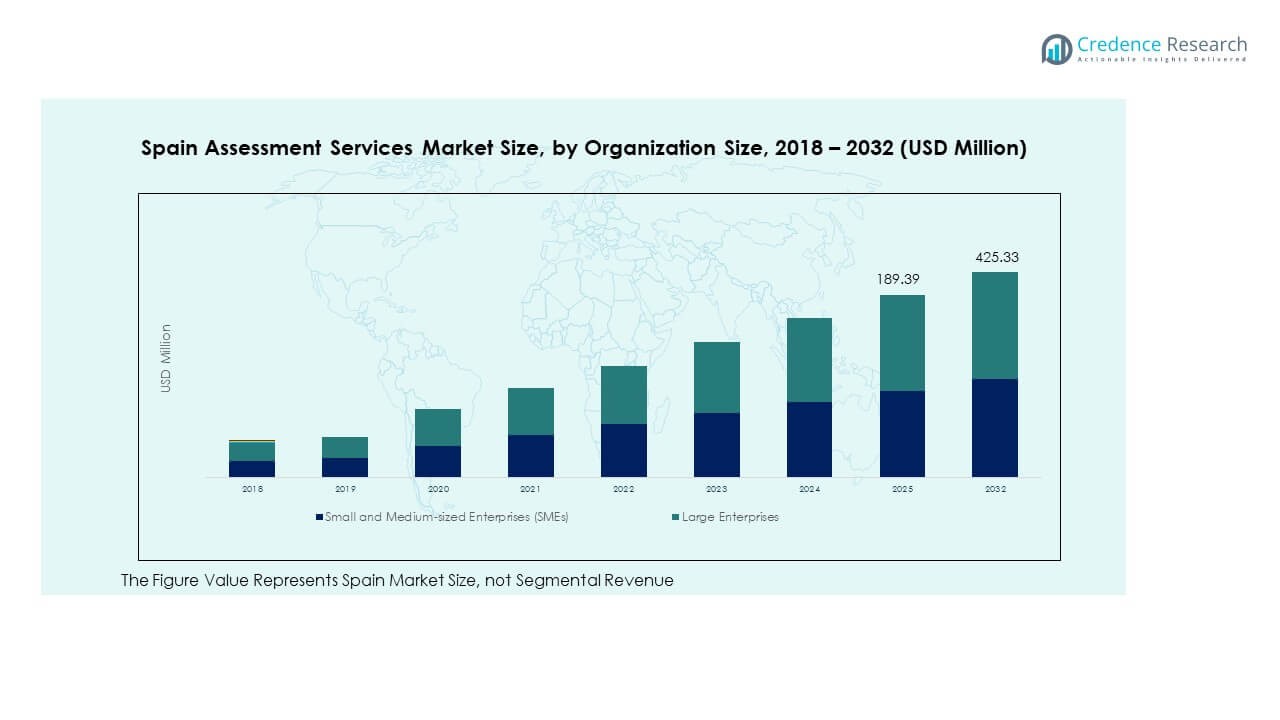

The Spain Assessment Services Market size was valued at USD 161.51 million in 2018 to USD 189.39 million in 2024 and is anticipated to reach USD 425.33 million by 2032, at a CAGR of 10.64% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spain Assessment Services Market Size 2024 |

USD 189.39 Million |

| Spain Assessment Services Market, CAGR |

10.64% |

| Spain Assessment Services Market Size 2032 |

USD 425.33 Million |

Growing adoption of digital tools, e-learning platforms, and AI-driven evaluation methods drives market growth in Spain. Educational institutions, corporate organizations, and government agencies are integrating assessment services to improve learning outcomes, recruitment accuracy, and employee performance management. The shift toward competency-based education and continuous assessment further supports market expansion, with demand increasing for scalable, secure, and data-driven assessment systems.

Regionally, Madrid and Catalonia lead the market due to strong educational infrastructure, digital literacy, and presence of major testing service providers. Andalusia and Valencia are emerging growth regions supported by government investments in education technology and workforce development programs. The growing adoption of online examination platforms and remote proctoring tools across urban and semi-urban areas strengthens Spain’s overall assessment service ecosystem.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Spain Assessment Services Market was valued at USD 161.51 million in 2018, reached USD 189.39 million in 2024, and is projected to attain USD 425.33 million by 2032, expanding at a CAGR of 10.64% during the forecast period.

- Central Spain (38%), led by Madrid, dominates due to its concentration of universities, corporate headquarters, and strong digital infrastructure supporting online and blended assessments.

- Catalonia (27%) and Andalusia (19%) follow, driven by innovation-focused education policies and expanding public investments in digital learning tools.

- Valencia and the Basque Country (16%) are the fastest-growing regions, fueled by SME participation, digital transformation programs, and strong adoption of blended assessment formats.

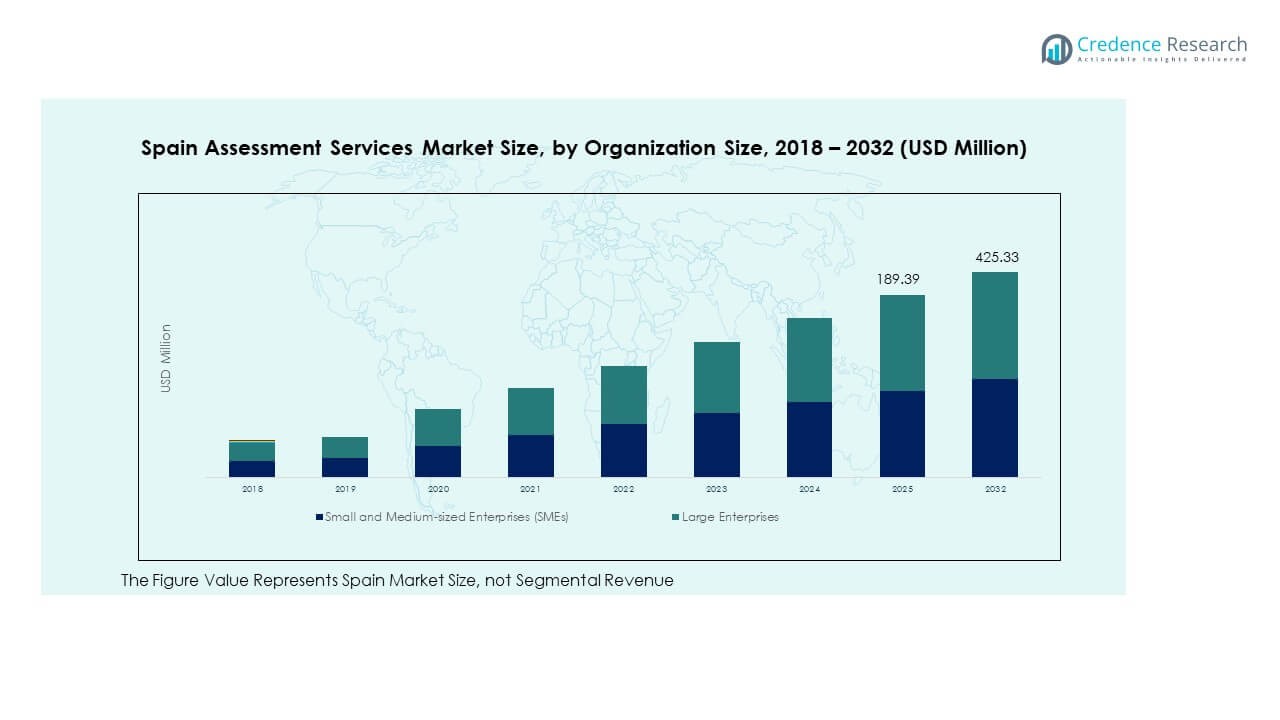

- By organization size, Large Enterprises account for about 60% of the total market, while SMEs hold 40%, reflecting rising uptake of cost-effective online assessment platforms among smaller organizations.

Market Drivers:

Digital Transformation Accelerating the Growth of Technology-Enabled Assessment Platforms

The Spain Assessment Services Market is expanding rapidly due to the digital transformation of the education and corporate sectors. Institutions are replacing manual testing systems with online assessments that enhance accuracy and reduce human error. Companies are investing in AI-based evaluation tools to improve recruitment, training, and employee development. The integration of cloud computing ensures scalable and secure testing environments. Universities and government agencies are adopting digital assessments to ensure transparency and standardization. The rise in remote learning after the pandemic boosted demand for digital testing platforms. It continues to drive innovation in user experience and data analytics.

- For instance, Telefónica Tech and Google Cloud were selected by GÉANT under the OCRE (Open Clouds for Research Environments) project to enable Spanish universities and research centers to access secure cloud infrastructure and digital collaboration tools, accelerating institutional adoption of cloud-based assessment systems.

Government Focus on Skill Development and Education Reform Driving Demand for Assessments

Spain’s government is prioritizing skill development programs and educational modernization to meet labor market needs. Policy initiatives emphasize competency-based learning and standardized testing. Vocational education institutions are using assessment solutions to align student skills with industry demands. The national focus on digital literacy strengthens adoption of online assessments in schools and higher education. Public-private partnerships are supporting assessment reforms in public education. Certification and licensing exams are moving toward automated evaluation systems. This structural shift drives consistent demand for professional assessment service providers.

- For instance, IBM’s SkillsBuild initiative in Spain provides verifiable digital credentials in fields such as AI, cloud computing, data analytics, and cybersecurity, supporting workforce readiness and digital upskilling recognized by Spain’s education and employment authorities through Credly’s global credentialing platform.

Corporate Sector Adoption of Assessment Tools for Workforce Optimization

Enterprises across Spain are leveraging assessments to identify talent and optimize workforce performance. Organizations use psychometric, cognitive, and technical tests to enhance hiring accuracy. Remote work models require skill assessments to monitor employee engagement and productivity. The Spain Assessment Services Market benefits from the need to evaluate learning outcomes from training programs. Data-driven evaluation supports talent retention and leadership development. Companies are implementing regular skill audits to ensure workforce readiness. It supports organizational agility in an evolving business environment.

Rise of Continuous and Formative Assessment Models in Educational Institutions

The education system in Spain is moving toward formative assessment models that track student progress over time. Schools are adopting continuous evaluation to complement traditional examinations. These models provide real-time feedback, improving student engagement and performance. The Spain Assessment Services Market benefits from digital platforms that facilitate adaptive testing. Teachers can analyze individual progress and customize learning materials. Universities employ AI tools for plagiarism detection and automated grading. Such tools support academic integrity and personalized education pathways.

Market Trends:

Growing Integration of Artificial Intelligence and Machine Learning in Assessment Tools

AI and ML technologies are transforming the assessment landscape in Spain. Intelligent analytics identify learning gaps and recommend targeted interventions. The Spain Assessment Services Market benefits from AI-driven proctoring systems ensuring test integrity. Adaptive testing uses algorithms to adjust question difficulty based on student responses. Machine learning enhances predictive performance analysis across education and enterprise settings. Automated scoring and data visualization improve evaluation speed. These advancements enhance both reliability and scalability of assessments.

- For instance, IE University officially integrated Smowl eProctoring technology into its academic programs to automate student identity verification using webcam‑based facial recognition and behavioral analytics, ensuring online exam integrity across its business and law schools.

Expansion of Remote Proctoring and Online Certification Programs

The growing adoption of online learning has increased demand for remote exam monitoring. Institutions use webcam-based invigilation and identity verification systems. The Spain Assessment Services Market experiences rising use of secure browser technologies for academic and corporate assessments. Online certification platforms offer flexibility to professionals seeking skill upgrades. Businesses and universities rely on cloud-based systems to conduct high-volume exams. The trend supports accessibility for learners in remote areas. It continues to redefine assessment logistics and participation rates.

- For instance, IE University incorporates online elements into its educational approach. Its admissions process includes an online test, with other assessments like the Kira assessment conducted on a virtual platform. Academic integrity for online exams is an industry-wide concern, and many institutions use proctoring software that must comply with data protection regulations like GDPR. However, there is no verified information linking IE University to a product called “Small’s.”

Emergence of Mobile-Based and Gamified Assessment Solutions

Mobile-enabled assessments are gaining traction across Spain due to higher smartphone penetration. Gamified evaluations engage students and employees through interactive learning. The Spain Assessment Services Market adapts to these technologies to improve participation and retention. Organizations implement game-based psychometric tests to measure creativity and problem-solving. Schools use mobile platforms for quizzes and quick knowledge checks. These innovations enhance motivation and reduce test anxiety. They also create more dynamic and engaging assessment ecosystems.

Growing Demand for Data Analytics and Real-Time Performance Dashboards

Educational institutions and enterprises are seeking actionable insights from assessment data. Real-time analytics track progress, identify weaknesses, and measure improvement. The Spain Assessment Services Market leverages data visualization tools for decision-making. Learning management systems integrate performance dashboards for continuous feedback. Predictive analytics support curriculum design and HR planning. Stakeholders use insights to personalize training and teaching methods. This data-centric trend increases accountability and learning efficiency.

Market Challenges Analysis:

Data Security Concerns and Integration Barriers Limiting Digital Assessment Adoption

The expansion of digital assessment solutions raises significant cybersecurity concerns. The Spain Assessment Services Market faces challenges in safeguarding student and employee data. Institutions must comply with strict data protection regulations such as GDPR. Limited technical infrastructure in smaller institutions slows full-scale adoption. Integration of new software with legacy systems creates operational friction. Organizations must ensure data encryption, secure storage, and reliable authentication mechanisms. These factors increase implementation costs and complexity for service providers.

Resistance to Change and Lack of Digital Skills Among Educators and Administrators

Educators often resist transitioning from traditional testing methods to digital platforms. The Spain Assessment Services Market is affected by skill gaps among teaching professionals and administrators. Many institutions lack structured digital training programs for staff. Limited awareness of AI-based assessment benefits hinders adoption. Budget constraints further restrict access to advanced technology. Some regions still face limited internet connectivity affecting rural implementation. Overcoming these challenges requires investment in digital literacy and structured policy support.

Market Opportunities:

Rising Demand for Personalized and Adaptive Learning Assessments

Personalized learning solutions create major opportunities for innovation in Spain’s education sector. The Spain Assessment Services Market can expand by offering adaptive testing models that match individual learning pace. AI-enabled systems analyze responses to adjust question difficulty dynamically. Such personalization improves learner engagement and academic outcomes. Schools and companies increasingly favor data-driven tools for competency tracking. These models support inclusive education and diverse learning needs. It positions adaptive assessments as a key growth driver in the future.

Strategic Collaborations Between EdTech Firms and Academic Institutions

Partnerships between educational institutions and EdTech providers are opening new growth avenues. The Spain Assessment Services Market benefits from collaborations focused on cloud-based, mobile, and AI-driven platforms. Universities are forming alliances with private testing firms to ensure secure, large-scale exam delivery. Corporate training platforms are integrating academic content for cross-sector skill development. Joint ventures in assessment innovation enhance reach and efficiency. These collaborations strengthen Spain’s position in Europe’s digital education ecosystem.

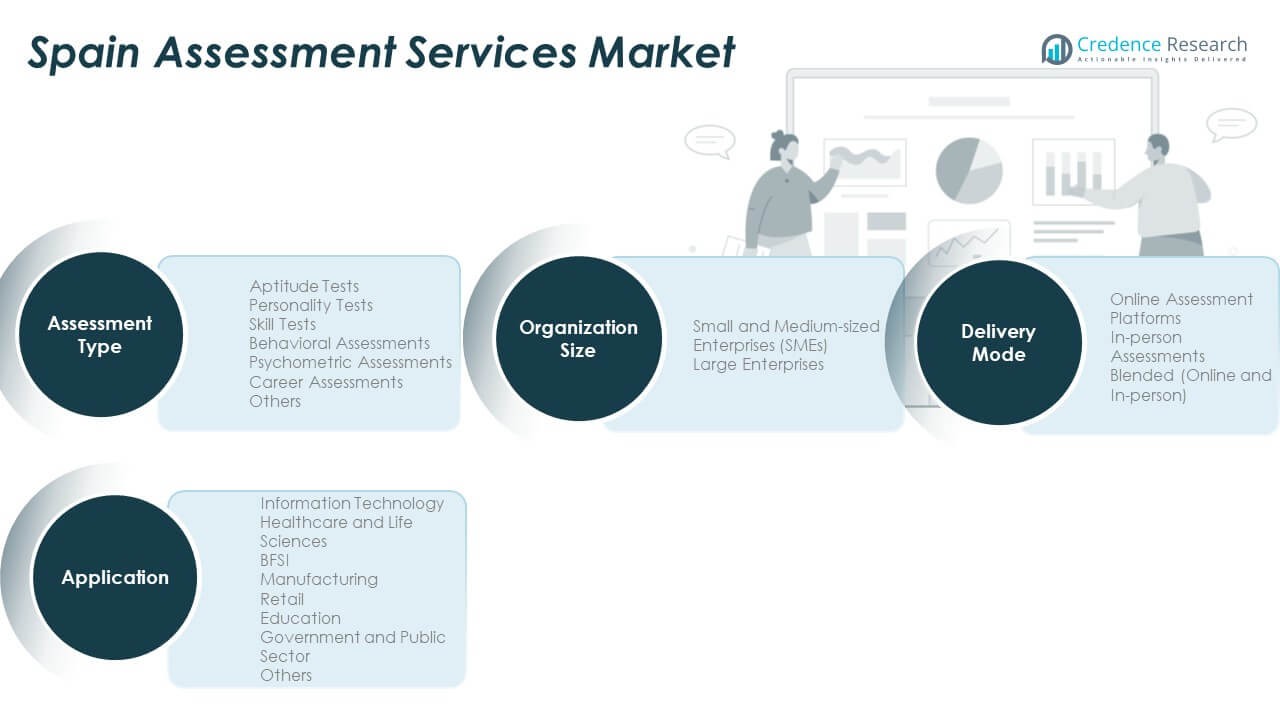

Market Segmentation Analysis:

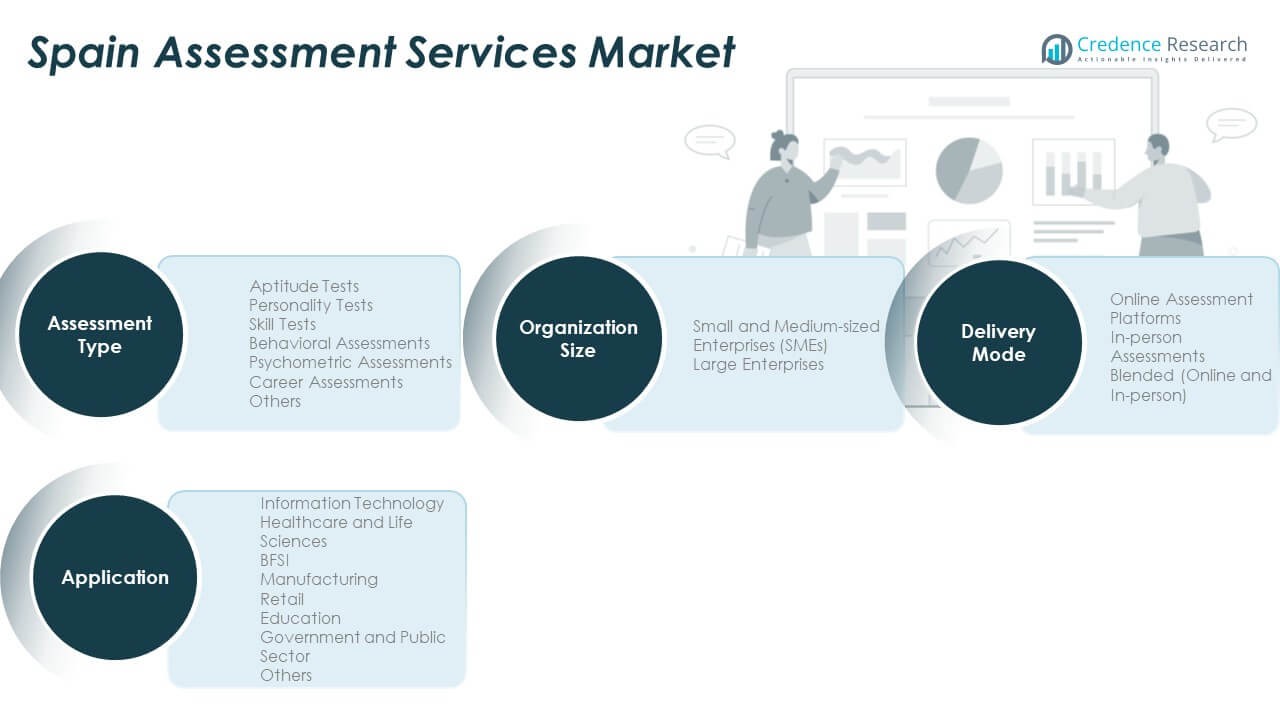

By Assessment Type

The Spain Assessment Services Market covers a wide range of evaluation tools catering to different professional and educational needs. Aptitude tests dominate due to their use in recruitment and student admission processes. Personality and behavioural assessments are gaining traction among corporate clients for improving team dynamics and leadership evaluation. Skill and psychometric assessments hold strong adoption in technical and academic fields, ensuring competency alignment with job requirements. Career assessments are used by universities and training centers to guide students toward suitable career paths. Other specialized tests, including cognitive and domain-specific evaluations, are steadily expanding across sectors seeking precision-driven assessment tools.

- For instance, Hogan Assessments operates in Spain through its local distributor IAssessment, offering psychometric and leadership tests for major consulting firms and corporations, strengthening validated, science‑based selection frameworks for Spanish enterprises.

By Application

The market serves diverse sectors including healthcare, BFSI, manufacturing, retail, education, and the government. Education remains the largest user segment, driven by digital learning transformation and institutional testing needs. Corporate applications such as BFSI and manufacturing leverage assessments for employee evaluation and compliance requirements. Public sector bodies adopt structured evaluation systems to enhance recruitment transparency. Emerging demand across healthcare and retail supports growth through continuous workforce assessments.

- For instance, Hospital Clínic de Barcelona, in collaboration with Leitat Technology Center, launched the Clinical Advanced Technologies Institute (CATI). The institute is a center for innovation in hospital technology with an international focus, designed to foster digital health innovation projects and integrate new health-tech and training solutions for healthcare professionals.

By Organization Size

Both small and medium-sized enterprises (SMEs) and large enterprises utilize assessment platforms, though SMEs show faster adoption due to low-cost digital tools. Large enterprises prioritize scalable and integrated platforms for bulk assessments and analytics-driven hiring decisions.

By Delivery Mode

Online assessment platforms dominate due to their scalability and efficiency. In-person and blended formats remain relevant for high-stakes or hands-on evaluations. It continues to shift toward digital-first models supporting hybrid education and recruitment ecosystems.

Segmentation:

By Assessment Type

- Aptitude Tests

- Personality Tests

- Skill Tests

- Behavioural Assessments

- Psychometric Assessments

- Career Assessments

- Others

By Application

- Information Organization Size

- Healthcare and Life Sciences

- BFSI

- Manufacturing

- Retail

- Education

- Government and Public Sector

- Others

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

By Delivery Mode

- Online Assessment Platforms

- In-person Assessments

- Blended (Online and In-person)

Regional Analysis:

Dominance of Central Spain with Strong Educational and Corporate Presence

Central Spain, particularly Madrid, holds the largest share of the Spain Assessment Services Market, accounting for nearly 38% of total revenue. The dominance stems from the region’s dense concentration of universities, corporate headquarters, and training institutions. Madrid’s strong digital infrastructure and government-backed education initiatives fuel adoption of AI-driven testing and e-learning platforms. Corporate entities in the city increasingly use psychometric and skill assessments for recruitment and employee development. The region also benefits from collaborations between EdTech firms and academic institutions to deliver scalable online testing solutions. Its leadership is reinforced by a well-established regulatory framework supporting standardized assessments across industries.

Catalonia and Andalusia Emerging as Expanding Regional Hubs

Catalonia contributes approximately 27% of the Spain Assessment Services Market, driven by a tech-oriented economy and innovation-focused education system. Barcelona’s growing startup ecosystem and multinational presence encourage advanced assessment adoption for both hiring and learning management. The regional education authorities are prioritizing competency-based evaluation systems aligned with European standards. Andalusia, holding nearly 19% of the market, shows growing traction due to public investments in education technology and rural digital inclusion programs. Universities and corporate training centers in Seville and Malaga are increasingly integrating cloud-based testing tools. Both regions are experiencing consistent growth in remote proctoring and data-driven evaluation systems.

Growth Momentum Across Valencia, Basque Country, and Other Regions

Valencia and the Basque Country collectively account for around 16% of the Spain Assessment Services Market. These regions benefit from expanding SME networks and government-backed digital transformation programs. Educational institutions are adopting blended assessment formats to enhance student evaluation efficiency. The Basque Country’s industrial sector demands technical and behavioural assessments for skill certification and workforce training. Smaller provinces across Northern Spain contribute to market expansion through gradual integration of online assessment tools. It continues to gain traction as regional authorities emphasize equitable access to digital education and professional certification systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Spain Assessment Services Market features a concentrated competitive landscape with a handful of major global and regional players controlling a significant portion of the value chain. Firms such as SHL Group Ltd., Korn Ferry, Saville Assessment, and PSI Services LLC (Cubiks) dominate through large-scale deployments, strong brand recognition and advanced analytics portfolios. Many competitors invest heavily in AI-driven assessment tools, while strategic collaborations and digital platforms boost service differentiation. It remains essential for entrants to offer niche innovation or cost-effective solutions to challenge incumbents. Market participants face increasing pressure to comply with stringent data-protection norms and to demonstrate clear ROI on assessment investments. Companies pursuing regional expansion or specialization in sector-specific assessments may secure sustainable growth trajectories.

Recent Developments:

- In February 2025, Giunti Psychometrics consolidated its shareholder control in Vetor Editora, expanding its presence in the Brazilian market and enabling the creation of locally tailored psychometric products while enhancing technological and scientific innovation capacity.

- In September 2025, ATAI Life Sciences announced progress toward acquiring Beckley Psytech Limited, a clinical-stage biotech firm focused on mental health therapies, with the acquisition expected to conclude in late 2025.

- In May 2023, SHL, supported by Exponent, acquired its third-party distributor SHL Japan, advancing its global expansion strategy and strengthening operations across Europe, the US, and Asia-Pacific.

Report Coverage:

The research report offers an in-depth analysis based on assessment type, application, organisation size and delivery mode segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for online assessment platforms will increase significantly across education and corporate sectors.

- Growth in blended (online + in-person) assessment offerings will offer flexible delivery models.

- Large enterprises will continue to dominate adoption, yet SMEs will emerge as fast-growing users.

- Behavioural assessments and career assessments will gain stronger importance in talent-management strategies.

- Usage of psychometric tests will expand beyond traditional recruitment into development and succession planning.

- Regions outside Madrid (urban and semi-urban) will show accelerated uptake as digital infrastructure improves.

- Compliance with EU data-protection regulation and secure test delivery will become key differentiators.

- AI-enabled analytics and adaptive testing will drive higher accuracy and engagement in assessments.

- Collaboration between assessment-service providers and learning-tech firms will create bundled solutions.

- Cost-effective and scalable platforms will open the market to higher volumes and lower-tier clients.