Market Overview

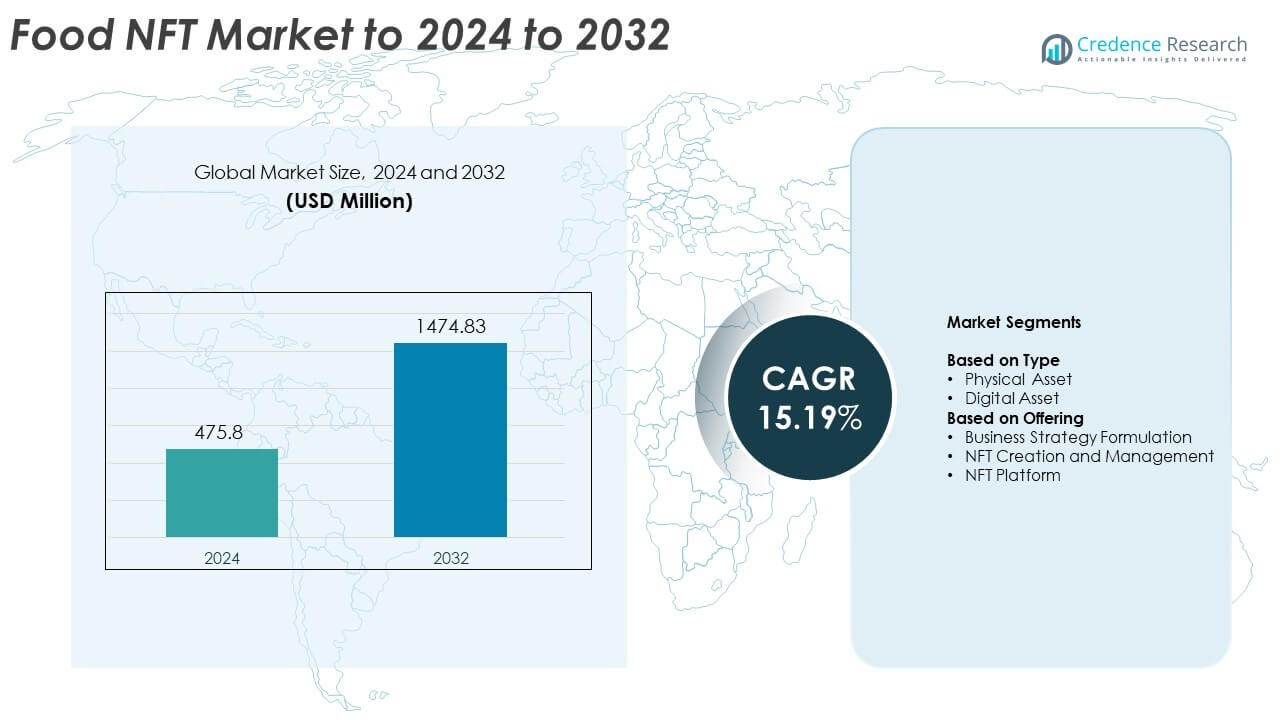

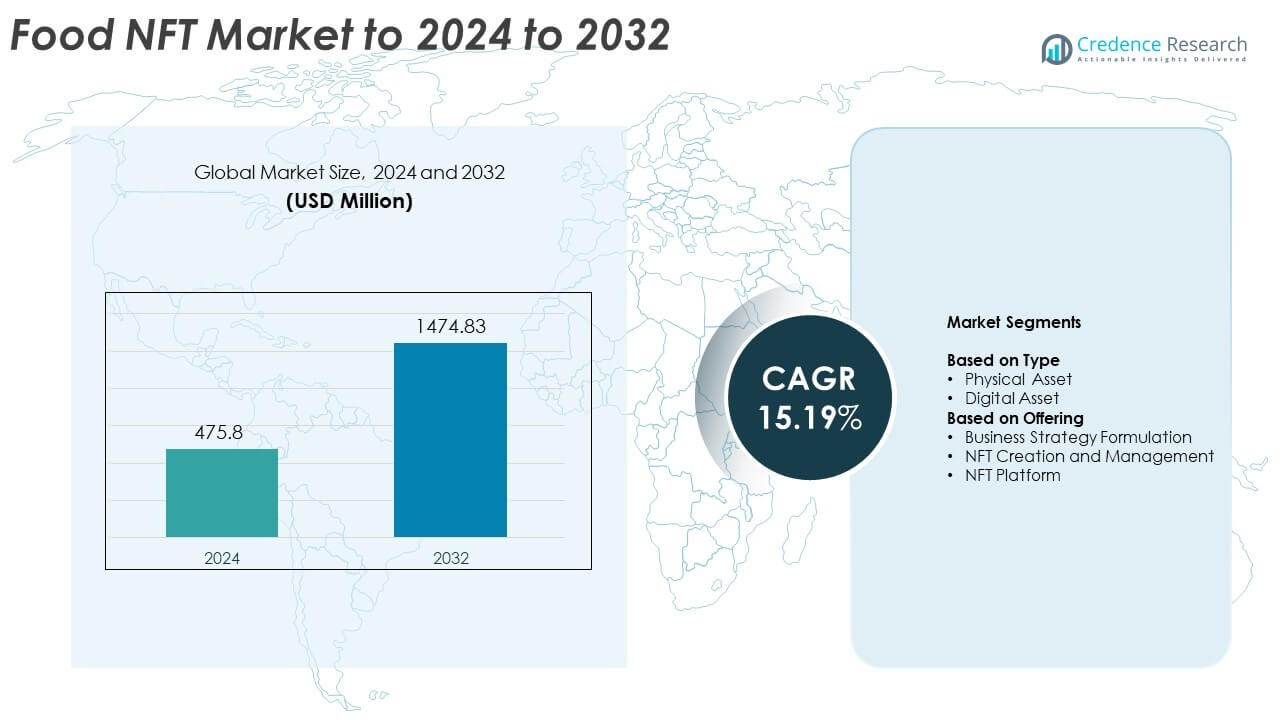

Food NFT Market size was valued at USD 475.8 Million in 2024 and is anticipated to reach USD 1474.83 Million by 2032, at a CAGR of 15.19% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food NFT Market Size 2024 |

USD 475.8 Million |

| Food NFT Market, CAGR |

15.19% |

| Food NFT Market Size 2032 |

USD 1474.83 Million |

The FOOD NFT Market features leading players such as VIV3, Coca Cola, SuperFarm, YellowHeart, BakerySwap, Enjin, OpenSea, Rarible, and Binance NFT Marketplace. These companies strengthen their positions by offering secure blockchain frameworks, scalable token-management tools, and enhanced integrations for food brands. Their focus on loyalty programs, digital collectibles, and authenticated physical assets supports fast market expansion. North America leads the global market with about 38% share due to strong digital adoption and high consumer awareness. Europe follows with nearly 30% share, supported by demand for traceable and premium food products enhanced through blockchain-backed NFT experiences.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market reached USD 475.8 Million in 2024 and is projected to hit USD 1474.83 Million by 2032, growing at a CAGR of 15.19%.

- Growth is driven by rising adoption of authenticated food assets and increased demand for NFT-linked loyalty programs, supported by strong use of physical-asset NFTs holding about 58% share.

- Key trends include expansion of cross-platform NFT ecosystems, growth of hybrid physical–digital food experiences, and wider use of NFT platforms, which led the offering segment with nearly 52% share.

- Competition intensifies as platforms improve minting systems, trading speed, and integration with food brands, while creators focus on exclusive digital drops and community-based engagement models.

- North America leads with 38% share, followed by Europe with 30% and Asia Pacific with 25%, while Latin America holds 4% and Middle East & Africa accounts for 3%, reflecting varied digital adoption and platform maturity across regions.

Market Segmentation Analysis:

By Type

Physical asset NFTs held the dominant share in 2024 with about 58%. Brands used physical-backed tokens to link real food products, limited-edition items, and supply-chain records with verifiable blockchain ownership. This structure increased trust because buyers could trace origin and authenticity. Digital asset NFTs grew as restaurants and food creators launched loyalty passes and exclusive content drops, but physical asset tokens stayed ahead due to wider adoption in premium packaged goods, food traceability programs, and edible collectibles supported by stronger consumer engagement.

- For instance, Flyfish Club minted a total of 3,035 membership NFTs that gate access to its New York dining club, held by 1,316 unique wallet owners on Ethereum.

By Offering

NFT platform solutions led the segment in 2024 with nearly 52% share. Food businesses preferred platform-based ecosystems because these systems support minting, trading, authentication, loyalty integration, and ownership transfers in one unified interface. Strategy formulation and NFT creation tools expanded as brands looked to design community-driven campaigns, but platform offerings remained dominant. Growth came from demand for scalable token infrastructure that helps food chains, gourmet brands, and niche creators launch secure and high-volume NFT programs tied to digital and physical food experiences.

- For instance, Burger King’s “Keep It Real Meals” campaign embedded NFT access via QR codes into 6,000,000 physical meal boxes, linking in-store purchases directly to digital collectibles.

Key Growth Drivers

Rising demand for authenticated food assets

Buyers seek trusted food products with clear origin data. Food NFTs help brands link physical goods with secure blockchain records. Consumers value verified sourcing and transparent supply chains, which boosts adoption. This trust-focused model supports premium packaged foods and specialty items. Growing interest in collectible food items also lifts demand. Brands use tokens to protect authenticity and avoid counterfeits. This driver strengthens market expansion across digital and physical categories.

- For instance, As of January 2024, Carrefour was actively leveraging blockchain technology to provide customers with product traceability by scanning a QR code on the packaging.In 2019, the program included over 20 product items in the grocery category, and the company planned to add 100 additional products across its offerings.

Growing use of NFTs in loyalty programs

Food chains adopt NFT-based loyalty tools to improve engagement. These tokens offer exclusive access, rewards, and membership benefits. Users enjoy personalized perks, which builds stronger brand ties. Restaurants use blockchain to simplify customer verification and reduce fraud. This structure encourages repeat purchases and wider program participation. NFT-driven loyalty boosts digital presence and helps brands stand apart from competitors. The model supports rising customer retention and steady revenue growth.

- For instance, Starbucks’ Odyssey “First Store Collection” offered 5,000 NFT stamps on Nifty Gateway, of which 4,579 were sold in the primary sale and were tied into the points-based loyalty rewards inside the Odyssey app.

Expansion of marketing and brand differentiation tools

Food creators use NFTs to launch unique campaigns that amplify visibility. Tokens help brands reach new digital audiences and expand community ties. Limited-edition NFTs generate stronger demand for both digital and physical food items. Brands gain flexibility through interactive menus, event passes, and chef-led digital drops. These tools offer fresh storytelling paths. As marketing budgets shift toward digital assets, NFT adoption grows faster. This driver supports creative branding strategies across global markets.

Key Trends and Opportunities

Integration of NFTs with physical food experiences

Companies blend real-world dining with token-based rewards. Restaurants offer NFT-linked tasting sessions, chef events, and exclusive menus. This mix attracts younger digital-native buyers. The experience-driven model boosts footfall and enhances customer connection. Brands also use NFTs to add value to premium food boxes or festival entries. This trend opens new revenue paths for creators. The opportunity grows as buyers seek immersive food journeys with verified digital ownership.

- For instance, Pizza Hut Canada’s “1 Byte Favourites” project released one pixelated pizza-slice NFT per day for eight days, resulting in 8 unique collectibles (featuring four different flavors), priced at roughly the cost of a single bite of real pizza.

Growth of cross-platform NFT ecosystems

Many food brands join multi-chain platforms to expand reach. Cross-platform growth helps users trade tokens easily across networks. This trend supports faster adoption because buyers avoid platform limits. Developers build tools that connect wallets, loyalty systems, and e-commerce. Such systems create unified experiences across digital and physical stores. These ecosystems improve creator flexibility and reduce operational barriers. The opportunity strengthens as cross-chain tools mature and offer stable performance.

- For instance, Bud Light’s “Bud Light N3XT Collection” created 12,722 unique NFTs, designed to tie a zero-carb beer launch to Web3 communities across compatible marketplaces and wallets.

Rise of community-driven digital food brands

NFT communities help new food labels build fast recognition. Creators launch digital-first brands that gather members before product rollout. Supporters gain early access and decision-making rights. This trend opens space for small creators with strong digital influence. Community voting guides recipes, packaging, and launch schedules. Brands use blockchain data for better customer insight. The opportunity expands as social commerce grows across global markets.

Key Challenges

Regulatory uncertainty across regions

Different countries apply varied rules for NFTs. This complexity slows brand adoption and increases compliance costs. Food companies must track tax rules, digital ownership laws, and consumer rights. Regulatory gaps reduce investor confidence. Smaller brands struggle with legal frameworks. Some regions restrict digital assets, which limits expansion. This challenge affects cross-border NFT campaigns. Greater clarity is needed for stable long-term growth.

Limited consumer understanding of NFT value

Many buyers lack awareness of token benefits. Confusion reduces participation in NFT-linked food programs. Users fear scams or technical issues. Brands must invest in education and simpler onboarding. Complex wallet setups also limit new users. Low awareness slows adoption in emerging markets. Clear messaging and easy platforms can reduce friction. This challenge remains important as the market expands globally.

Regional Analysis

North America

North America held the leading share in 2024 with about 38%. Strong adoption came from restaurant chains, food creators, and premium packaged goods brands exploring blockchain-backed authentication and loyalty programs. The region saw fast acceptance of NFTs for supply-chain transparency, exclusive memberships, and digital dining experiences. Supportive tech infrastructure and high consumer awareness pushed wider platform use. Growth remained strong as food companies formed collaborations with Web3 developers to extend token utility. Expanding digital communities and rising interest in collectible food assets continued to strengthen regional demand.

Europe

Europe accounted for nearly 30% share in 2024. Adoption increased as consumers showed strong interest in traceable and sustainably sourced food supported by blockchain records. Premium food brands used NFTs for origin verification, packaging transparency, and limited-edition products. Restaurant groups launched NFT-linked tasting events and loyalty rewards that improved customer engagement. Regulatory awareness and digital innovation hubs across Germany, France, and the U.K. encouraged structured adoption. Growing partnerships between food producers and NFT platforms helped expand tokenized product lines across retail channels.

Asia Pacific

Asia Pacific captured around 25% share in 2024, driven by large digital-native populations and rapid uptake of blockchain applications. Food chains, beverage brands, and online food creators used NFTs to build stronger communities and launch exclusive digital collectibles. Rising interest in fusion dining and premium packaged foods supported token-linked offerings. Markets such as Japan, South Korea, and Singapore advanced faster due to strong tech ecosystems. Expanding gaming and social commerce sectors also helped brands integrate NFTs into interactive food experiences, pushing wider demand across the region.

Latin America

Latin America held roughly 4% share in 2024. Adoption grew as restaurants and boutique food brands explored NFTs for loyalty programs, digital menus, and curated tasting events. Countries like Brazil and Mexico saw early traction with token-based membership communities. Limited blockchain access in smaller markets slowed overall uptake, but rising smartphone use supported digital expansion. Brands used NFTs to highlight food traceability and origin stories, which attracted younger buyers. Regional interest continued to climb as creators experimented with collectible food art and hybrid digital-physical experiences.

Middle East and Africa

Middle East and Africa accounted for about 3% share in 2024. Growth remained steady as premium dining groups, hospitality chains, and gourmet food producers tested NFT-based authentication and exclusive membership programs. Markets such as the UAE and Saudi Arabia led adoption due to strong blockchain investments and high-income digital consumers. Food brands used NFTs to promote luxury culinary events and limited-edition product lines. Broader regional progress was slower due to infrastructure gaps, but rising digital engagement and tourism-focused experiences supported emerging opportunities.

Market Segmentations:

By Type

- Physical Asset

- Digital Asset

By Offering

- Business Strategy Formulation

- NFT Creation and Management

- NFT Platform

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape includes VIV3, Coca Cola, SuperFarm, YellowHeart, BakerySwap, Enjin, OpenSea, Rarible, and Binance NFT Marketplace. Platforms compete through stronger minting tools and faster trading workflows. Many players focus on secure ownership records and flexible token formats. Several groups build loyalty features that support food brands and creators. Companies invest in easier onboarding that helps non-technical users join. Many platforms improve multi-chain support for wider asset movement. Firms enhance analytics to help brands study buyer behavior. Several players expand event tools that link tokens with dining experiences. Many ecosystems add storage layers that protect long-term digital assets. Platforms also grow integration with retail and restaurant systems. These actions strengthen market position and attract new partners.

Key Player Analysis

- VIV3

- Coca Cola

- SuperFarm

- YellowHeart

- BakerySwap

- Enjin

- OpenSea

- Rarible

- Binance NFT Marketplace

Recent Developments

- In 2025, OpenSea launched its revamped platform, known as OS2, which introduced multi-chain support for NFTs and an XP rewards system.

- In 2025, Coca-Cola India collaborated with the National Restaurant Association of India (NRAI) to launch Foodmarks 2.0.

- In 2022, YellowHeart planned to launch its utility token, HRTS, aimed at transforming ticketing and enhancing fan experiences through NFT tickets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Offering and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as more food brands adopt blockchain for authenticity and engagement.

- Tokenized loyalty programs will grow as restaurants use NFTs to build stronger customer ties.

- Physical-backed food NFTs will rise as buyers demand transparent sourcing and traceable products.

- Multi-chain platforms will support smoother trading and attract wider user participation.

- Digital food creators will launch community-driven product lines powered by NFT membership models.

- Fine-dining groups will use NFTs to offer curated culinary experiences and exclusive event access.

- Retailers will integrate NFT rewards into online and in-store shopping journeys.

- Partnerships between food brands and Web3 platforms will accelerate ecosystem development.

- Consumer education will improve adoption as platforms simplify onboarding and wallet use.

- Regulatory clarity will support stable investment and long-term growth across global markets.