Market Overview

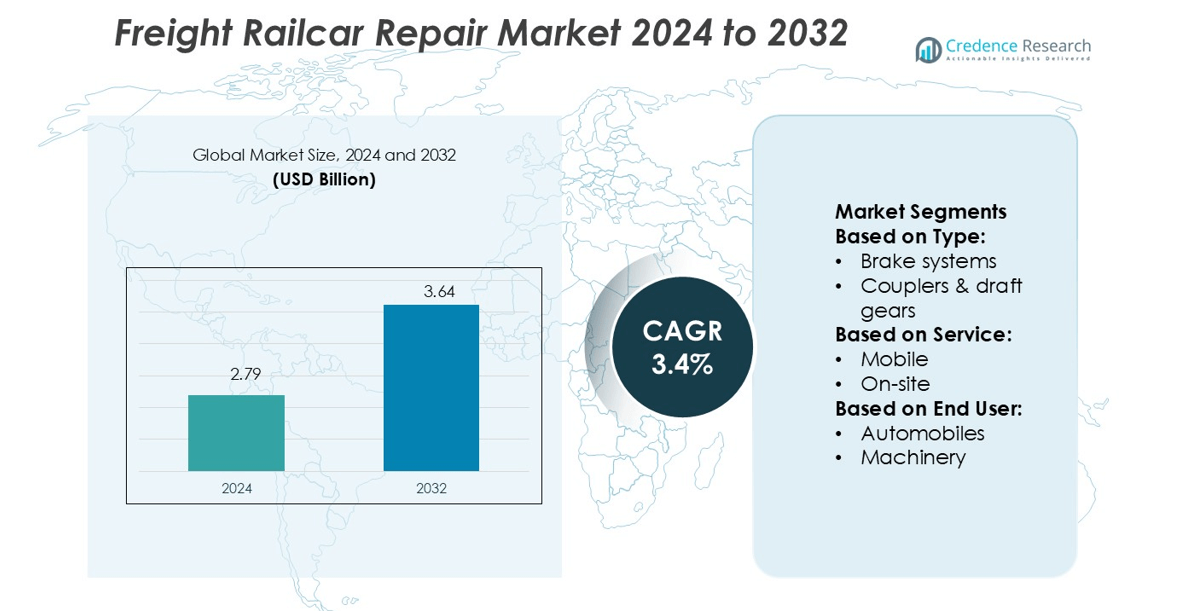

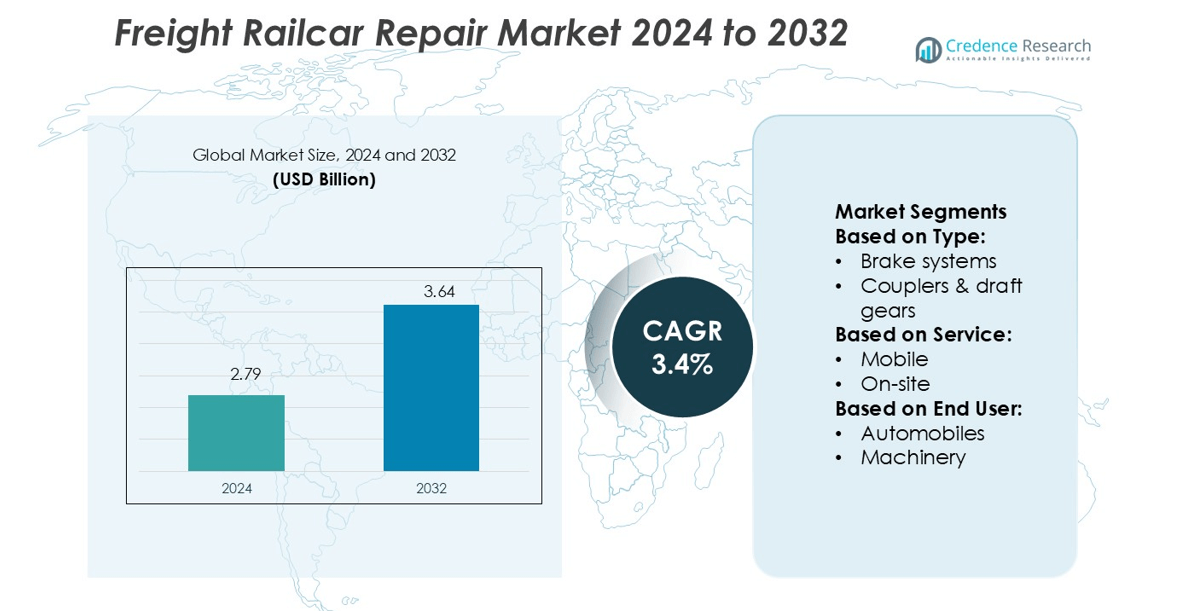

Freight Railcar Repair Market size was valued USD 2.79 billion in 2024 and is anticipated to reach USD 3.64 billion by 2032, at a CAGR of 3.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Freight Railcar Repair Market Size 2024 |

USD 2.79 billion |

| Freight Railcar Repair Market, CAGR |

3.4% |

| Freight Railcar Repair Market Size 2032 |

USD 3.64 billion |

The Freight Railcar Repair Market is driven by prominent players such as Union Tank Car Company (UTLX), Trinity Industries, Siemens, The Greenbrier Companies, Cathcart Rail, Wabtec Corporation, Watco Companies, TTX, Alstom, and Progress Rail. These companies lead through advanced maintenance technologies, digital diagnostics, and strategic partnerships with major freight operators. Their focus on predictive maintenance, component modernization, and eco-friendly repair practices strengthens market competitiveness. North America dominates the market with a 36% share, supported by a large aging fleet, strict safety regulations, and extensive freight infrastructure. The region’s strong investment in mobile repair services and IoT-based monitoring further reinforces its leadership position.

Market Insights

- The Freight Railcar Repair Market was valued at USD 2.79 billion in 2024 and is projected to reach USD 3.64 billion by 2032, growing at a CAGR of 3.4%.

- Rising demand for predictive maintenance and fleet modernization is driving the market, supported by increasing regulatory requirements for safety and operational reliability.

- Digital diagnostics, IoT-based monitoring, and mobile repair solutions are shaping key market trends, improving repair turnaround times and reducing costs.

- Strong competition among leading players is driving technological innovation, while high capital intensity and skilled labor shortages act as restraints.

- North America leads the market with a 36% share, followed by Europe at 27% and Asia Pacific at 24%, with the mechanical repair segment dominating due to its critical role in fleet performance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The mechanical segment dominates the Freight Railcar Repair Market with the highest market share. Mechanical components require frequent maintenance to ensure railcar reliability and operational safety. Regular inspections of structural integrity and frame alignment drive consistent demand in this segment. Rising freight volumes and extended service life of railcars further increase repair frequency. Investments in precision repair tools and advanced welding technologies improve repair turnaround time and reduce downtime. This segment benefits from regulatory mandates on railcar safety standards, encouraging scheduled maintenance programs and modernization of existing fleets.

- For instance, Siemens introduced its Industrial Copilot for Operations running on its Xcelerator platform and NVIDIA GPUs maintenance time reduction figure of 30% is likely outdated, as more recent pilot data indicates a 25% average reduction.

By Service

The on-site service segment holds the largest share in the market. Rail operators prefer on-site repairs to minimize railcar movement, reduce costs, and limit operational disruptions. On-site servicing improves fleet availability and speeds up turnaround for time-sensitive freight operations. Mobile workshops and specialized service teams allow railcars to be serviced at depots or yards. This flexibility helps operators maintain schedules and meet safety compliance. Growing adoption of predictive maintenance tools supports on-site efficiency, as technicians can address issues before failures occur, boosting service reliability.

- For instance, The Greenbrier Companies, a member of the RailPulse coalition since 2021, manages approximately 450,000 railcars through its services network.

By End User

The automobile sector leads the market among end users. High shipment volumes and strict delivery timelines create strong demand for timely railcar repairs in this segment. Automakers rely on freight rail for cost-efficient bulk transport of vehicles and components. Any downtime affects supply chain continuity and delivery performance. Preventive repair and scheduled overhauls ensure minimal disruption to logistics operations. Additionally, growth in electric vehicle manufacturing and intermodal freight movement increases reliance on well-maintained railcar fleets, reinforcing demand for frequent and efficient repair services.

Key Growth Drivers

Rising Freight Demand

The rapid expansion of logistics and supply chain networks is increasing freight traffic, boosting demand for freight railcar repair. Industrial goods, agricultural commodities, and energy products rely heavily on rail transport. Frequent use leads to accelerated wear of brake systems, bearings, and wheelsets, driving regular maintenance cycles. Fleet operators prioritize repair services to maintain regulatory compliance and reduce downtime. This trend is supported by growing rail freight volumes across North America and Europe, where rail infrastructure remains critical to bulk transportation efficiency.

- For instance, Wabtec deployed a pantograph auto-drop device produced via additive manufacturing that cut component weight by 70 % and halved production time—leveraging Nikon SLM AM technology.

Stringent Safety and Regulatory Standards

Global transportation authorities are enforcing stricter safety and maintenance regulations for freight railcars. These rules require periodic inspections, certified component replacements, and system upgrades to meet operational standards. Non-compliance can lead to severe penalties or service interruptions, pushing operators to invest in repair services. Safety-driven regulations particularly impact critical components such as pneumatic systems, couplers, and wheels. This regulatory push not only ensures operational safety but also creates stable demand for certified repair providers, strengthening market growth.

- For instance, TugVolt system—as stated by Intramotev—has already moved over 250,000 tons and delivered more than 3,500 car-loads in production service.

Aging Railcar Fleet Replacement and Modernization

A large portion of the global freight railcar fleet is aging, requiring frequent repairs and modernization. Older cars need structural upgrades and component replacements to extend service life and comply with updated safety norms. Rail operators are prioritizing retrofit programs to enhance performance and reduce lifecycle costs. This driver is most visible in North America and Europe, where many fleets exceed 25 years of operation. Investments in modernization reduce replacement costs and increase repair service demand.

Key Trends & Opportunities

Digitalization of Maintenance Operations

Rail operators are adopting predictive maintenance systems using IoT and AI technologies. Real-time data from sensors monitors components like axles, brake systems, and bearings to identify faults early. This approach improves repair scheduling and reduces unplanned downtime. Digital platforms also help optimize inventory for spare parts, increasing operational efficiency. The trend creates new opportunities for repair service providers that integrate digital tools and offer advanced diagnostics, boosting competitiveness in the market.

- For instance, TTX began deploying GPS and sensor devices in 2023 on approximately 1,700 boxcars equipped, 1,000 were outfitted with multi-sensor suites designed to monitor impact, door/hatch status, empty/load status, and handbrake position.

Expansion of Mobile and On-Site Repair Services

Mobile and on-site repair services are gaining traction due to their ability to reduce turnaround time. Instead of transporting damaged cars to workshops, operators receive maintenance directly at terminals or sidings. This approach cuts costs and increases operational uptime for freight carriers. Mobile repair units equipped with advanced diagnostic tools and skilled personnel are becoming common across major freight corridors. Companies offering flexible service models gain a competitive edge in contract bids.

- For instance, Progress Rail markets and sells the company states that the system’s performance is based on monitoring more than 300,000 batteries across over 75,000 sites.

Growing Investments in Green Rail Infrastructure

Sustainability goals are shaping rail infrastructure investments, creating new repair service opportunities. Many operators are adopting energy-efficient technologies and lightweight materials to lower emissions. Green retrofits require specialized repair capabilities to handle new materials and eco-friendly braking systems. Government incentives supporting low-emission freight transport amplify this trend. Service providers that align with these sustainability goals can secure long-term contracts with major freight operators.

Key Challenges

High Capital Intensity and Skilled Labor Shortage

Freight railcar repair requires advanced equipment, specialized tools, and skilled technicians. Setting up certified facilities involves high capital investment, which restricts market entry for smaller players. In addition, a shortage of skilled labor, particularly in welding, braking systems, and pneumatic components, increases operational costs and delays repair timelines. This gap impacts service capacity and limits scalability for repair providers.

Volatile Freight Volumes and Economic Cycles

The demand for railcar repair services fluctuates with economic cycles and freight volumes. During downturns, freight activity declines, leading to deferred maintenance and lower service demand. Market uncertainty affects investment in repair infrastructure and capacity expansion. This volatility poses challenges for service providers in maintaining stable revenue streams and long-term planning. Operators often reduce repair frequency in slow periods, further impacting profitability.

Regional Analysis

North America

North America holds a 36% share of the freight railcar repair market, supported by its extensive rail infrastructure and high freight volumes. The U.S. and Canada lead in demand due to large fleets of aging railcars and strict regulatory maintenance standards. Increased commodity transport drives frequent repairs of wheels, brake systems, and couplers. Key repair hubs in Illinois, Texas, and Ontario offer advanced maintenance facilities with digital diagnostic capabilities. Investments in predictive maintenance and mobile repair units enhance operational efficiency. Strong government oversight and continuous infrastructure modernization further strengthen North America’s dominant market position.

Europe

Europe accounts for 27% of the market share, driven by well-established freight rail networks and safety regulations. Countries like Germany, France, and the U.K. emphasize periodic inspection programs and certified repair facilities. The region is adopting digital maintenance solutions and eco-friendly retrofits to meet emission targets. Aging rolling stock and increased intermodal freight traffic create steady demand for component overhauls and structural repairs. Government funding for sustainable rail transport supports service providers offering modernized maintenance. The region’s strong regulatory framework and push for green freight operations make it a key contributor to global repair service growth.

Asia Pacific

Asia Pacific holds 24% of the market share, with China, India, and Australia driving growth. Rapid industrialization and rising bulk freight movement create strong demand for railcar repair services. Expanding rail infrastructure and large-scale fleet modernization programs increase the need for scheduled maintenance. The region is adopting predictive maintenance technologies to reduce downtime and improve operational reliability. Governments are investing heavily in rail logistics to support economic growth, boosting service opportunities. Emerging third-party maintenance providers and growing private investments are expanding repair capacity across major freight corridors, strengthening Asia Pacific’s competitive position.

Latin America

Latin America represents 7% of the market share, supported by growing mineral and agricultural freight activity. Brazil, Mexico, and Argentina are key contributors, with expanding rail infrastructure driving maintenance demand. The region focuses on upgrading older railcar fleets to meet international safety standards. However, repair capacity remains concentrated in a few hubs, limiting service coverage. Investments in mobile and on-site maintenance are improving operational flexibility. Economic reforms supporting private participation in freight rail are creating opportunities for service providers. Steady growth in bulk commodity exports is expected to strengthen the repair market in the region.

Middle East & Africa

The Middle East & Africa account for 6% of the market share, with demand growing due to expanding freight corridors and infrastructure projects. Countries like Saudi Arabia, South Africa, and the UAE are investing in rail modernization and maintenance facilities. The market focuses on repairing and upgrading tank cars, hoppers, and flatcars used in industrial transport. Limited local repair expertise creates opportunities for international service providers. Increased cross-border trade and government investment in logistics infrastructure drive future growth. Gradual adoption of predictive maintenance technologies is expected to enhance service efficiency and regional competitiveness.Top of FormBottom of Form

Market Segmentations:

By Type:

- Brake systems

- Couplers & draft gears

By Service:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Freight Railcar Repair Market is shaped by key players such as Union Tank Car Company (UTLX), Trinity Industries, Siemens, The Greenbrier Companies, Cathcart Rail, Wabtec Corporation, Watco Companies, TTX, Alstom, and Progress Rail. The Freight Railcar Repair Market is defined by strong technological integration, service expansion, and regulatory compliance. Companies are prioritizing digital maintenance solutions, including IoT-based monitoring and predictive diagnostics, to minimize downtime and extend fleet life cycles. Many service providers are expanding mobile and on-site repair capabilities to deliver faster turnaround times and reduce operational costs. Focus on sustainable practices and advanced component repair strengthens long-term competitiveness. Continuous investments in skilled labor, automation, and certified facilities enable efficient, high-quality services. Strategic collaborations with freight operators and logistics networks further reinforce market presence and customer loyalty.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In February 2025, CRRC signed a contract to supply freight railcars for Hafeet Rail. This project will strengthen logistics links between the UAE and Oman, improving rail transport efficiency reported by the railway transport news portal railway supply.

- In January 2025, Union Tank Car Company announced a strategic partnership to serve railcar owners and shippers. Conveniently located on the South-side of the Houston Ship Channel, the collaboration between the two companies will consist of UTLX providing railcar cleaning and repair services at 225 Rail’s 1,000 railcar storage terminal in Pasadena, TX.

- In October 2024, Genesee & Wyoming Inc. announced that its previously proposed transaction to partner with Grupo México Transports (GMXT) as owners of CG Railway, LLC closed. As part of this transaction, G&W now independently owns Central Gulf Railcar Services (CGRS), a railcar repair shop located in Mobile, Alabama.

- In December 2023, Wabtec announced its entrance into the railcar telematics market via an agreement with Intermodal Telematics B.V., a Dutch company, under which Wabtec will create a railcar telematics platform using IMT technology. Wabtec’s new railcar telematics platform will deliver real-time information to railcar and tank container owners and operators, allowing them to turn rail cargo into smart, connected assets.

Report Coverage

The research report offers an in-depth analysis based on Type, Service, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for predictive maintenance solutions will increase to reduce repair downtime.

- Adoption of digital monitoring tools will enhance fleet performance and service planning.

- Mobile and on-site repair services will expand across major freight corridors.

- Aging railcar fleets will drive consistent demand for structural and component repairs.

- Investment in skilled labor and advanced repair facilities will grow steadily.

- Regulatory compliance will continue to shape maintenance strategies and service standards.

- Sustainability initiatives will push operators to adopt eco-friendly repair practices.

- Partnerships between rail operators and service providers will strengthen market reach.

- Integration of automation and AI will improve repair precision and efficiency.

- Emerging economies will become key growth markets due to expanding freight networks.