Market Overview

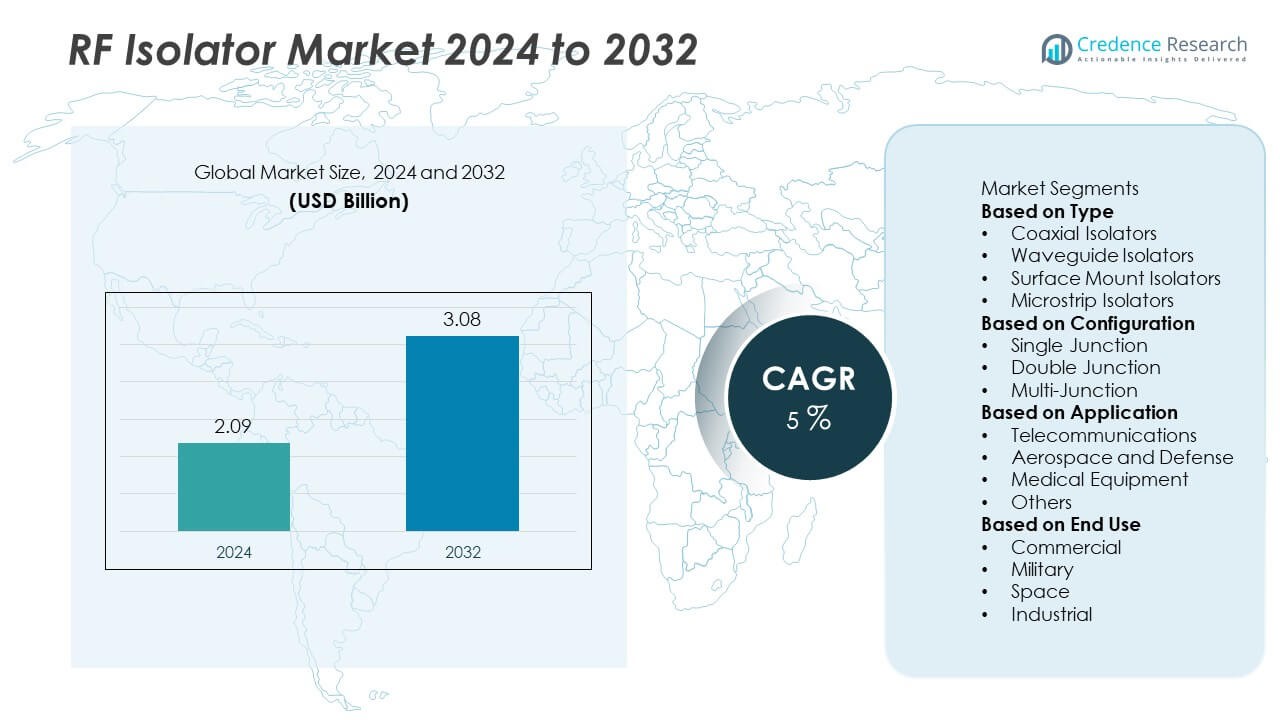

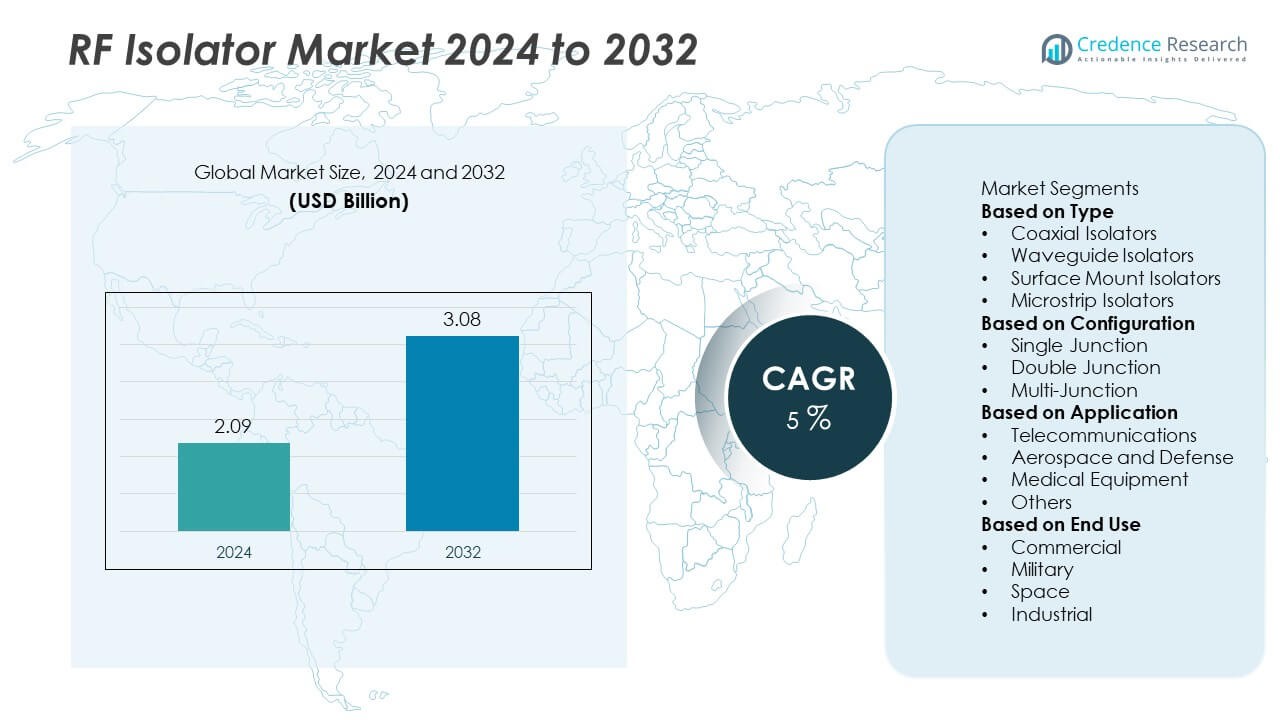

The RF Isolator market was valued at USD 2.09 billion in 2024 and is projected to reach USD 3.08 billion by 2032, growing at a CAGR of 5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| RF Isolator Market Size 2024 |

USD 2.09 Billion |

| RF Isolator Market, CAGR |

5% |

| RF Isolator Market Size 2032 |

USD 3.08 Billion |

The RF isolator market is led by key players such as ADMOTECH Inc., API Technologies Corp., DiTom Microwave Inc., Smiths Interconnect, RF-Lambda USA LLC, Skyworks Solutions, Inc., UTE Microwave Inc., M2 Global Technology Ltd., Teledyne Technologies Incorporated, and REC-USA, LLC. These companies dominate through innovations in compact design, wideband frequency performance, and high-power handling capabilities. North America led the market with a 38% share in 2024, driven by strong adoption in defense, radar, and 5G infrastructure. Europe followed with a 28% share, supported by aerospace modernization and telecom expansion, while Asia-Pacific held 25%, fueled by large-scale electronics manufacturing and rising investment in next-generation communication systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The RF isolator market was valued at USD 2.09 billion in 2024 and is projected to reach USD 3.08 billion by 2032, growing at a CAGR of 5%.

- Market growth is driven by expanding 5G infrastructure, increasing radar and satellite communication deployments, and rising use in defense and aerospace systems.

- Key trends include the development of miniaturized, low-loss isolators and integration of advanced ferrite materials to enhance signal stability and thermal performance.

- The market is moderately consolidated, with leading players such as Skyworks Solutions, Smiths Interconnect, and Teledyne Technologies focusing on innovation, R&D, and strategic partnerships to strengthen global presence.

- North America led the market with a 38% share in 2024, followed by Europe with 28% and Asia-Pacific with 25%; among types, coaxial isolators held a 43% share, driven by their efficiency and reliability in high-frequency communication networks.

Market Segmentation Analysis:

By Type

The coaxial isolator segment dominated the RF isolator market with a 43% share in 2024. Its dominance is driven by widespread adoption in telecommunications, radar, and satellite communication systems requiring stable signal transmission and high isolation performance. Coaxial isolators offer compact design, low insertion loss, and strong resistance to reflected signals, making them ideal for base stations and broadcasting equipment. Increasing deployment of 5G infrastructure and expansion of IoT networks are fueling demand for reliable coaxial isolators that ensure signal integrity and prevent interference across high-frequency communication channels.

- For instance, DiTom Microwave introduced broadband coaxial isolators covering 2 GHz to 43.5 GHz with insertion loss below 0.2 dB and isolation greater than 30 dB, designed for radar and satellite ground terminals.

By Configuration

Single junction isolators held the largest 49% share of the RF isolator market in 2024. Their leadership is attributed to cost efficiency, simple design, and suitability for low-to-medium power applications. These isolators are widely used in consumer electronics, wireless modules, and RF testing systems due to their compact size and reliability. Growing utilization of single junction configurations in 5G transceivers and defense communication equipment supports steady demand. Meanwhile, double and multi-junction isolators are gaining traction for high-power applications requiring enhanced performance and improved thermal stability.

- For instance, ADMOTECH has developed single-junction isolators for X-band operation between 10 GHz and 11.5 GHz with VSWR under 1.20:1 and isolation up to 17 dB for defense radar systems.

By Application

The telecommunications segment accounted for a 52% share of the RF isolator market in 2024, making it the largest application area. The segment’s dominance is driven by the expansion of 5G base stations, satellite communication networks, and mobile broadband infrastructure. RF isolators are crucial in preventing signal feedback and maintaining system efficiency in high-frequency communication systems. Increasing integration of advanced isolators in wireless routers, antennas, and transmission modules enhances performance and minimizes power loss. The growing shift toward next-generation communication technologies continues to strengthen demand across global telecom networks.

Key Growth Drivers

Expanding 5G Infrastructure and Wireless Communication Networks

The rapid global rollout of 5G networks is driving strong demand for RF isolators. These components play a critical role in ensuring stable signal transmission, preventing interference, and maintaining power efficiency in high-frequency systems. Telecom operators are integrating isolators into base stations, antennas, and network modules to enhance reliability and bandwidth capacity. The need for low-loss and high-performance RF components is further strengthened by the surge in connected devices, IoT applications, and next-generation wireless communication technologies.

- For instance, RF-Lambda produces a 500 W high-power coaxial circulator, as well as a range of coaxial isolators at lower power ratings, including some that cover frequencies relevant to 5G mid-band antenna systems.

Rising Adoption in Aerospace and Defense Systems

The aerospace and defense sector is increasingly adopting RF isolators for radar, satellite, and electronic warfare systems. These isolators protect sensitive RF receivers from reflected power, improving communication accuracy and signal stability in extreme conditions. Growing military modernization programs and satellite communication advancements are fueling demand for durable, high-frequency isolators. The push for enhanced security and real-time data transmission across airborne and ground platforms continues to accelerate market growth in this segment.

- For instance, Mi-Wave manufactures Ka-band isolators operating from 26.5 GHz to 40 GHz, with some models offering insertion loss as low as 1.2 dB, to achieve high signal integrity in millimeter wave test sets.

Increasing Demand for High-Frequency and Miniaturized Components

Technological advancements in communication and sensing systems are increasing the need for compact, high-performance RF isolators. Miniaturized isolators enable efficient signal control within portable and space-constrained devices such as smartphones, radar modules, and IoT sensors. Manufacturers are focusing on developing low-insertion-loss isolators that operate efficiently across wide frequency ranges. The shift toward miniaturization and integration of advanced materials supports the development of lightweight and thermally stable isolators suitable for modern electronic systems.

Key Trends & Opportunities

Integration of Isolators in IoT and Smart Devices

The proliferation of IoT devices and smart electronics presents significant growth opportunities for RF isolators. As connected ecosystems expand, isolators are essential for maintaining signal clarity and preventing interference across multi-device networks. Their application in smart homes, automotive communication systems, and industrial automation enhances overall connectivity and system stability. The growing use of compact surface mount isolators in low-power and high-speed wireless devices further boosts demand across consumer and commercial markets.

- For instance, API Technologies developed a range of SMT filters designed to provide high-performance EMI filtering with a minimal PCB footprint, which are used in various electronics applications.

Advancements in Material Science and Manufacturing Techniques

Emerging material innovations, such as ferrite-based composites and advanced ceramics, are improving isolator efficiency and durability. These materials enhance magnetic performance and allow operation across higher frequencies. Automated manufacturing and precision design techniques enable consistent quality and scalability for large-scale production. Continuous R&D in nanomaterials and integration of AI-based process optimization are opening opportunities for developing next-generation isolators with superior performance, reduced cost, and extended service life.

- For instance, Smiths Interconnect has a history of supplying high-reliability ferrite isolators and circulators for aerospace and defense applications, with some microstrip devices operating up to 32 GHz.

Key Challenges

High Production Costs and Design Complexity

The manufacturing of RF isolators involves complex design requirements and precision engineering, leading to high production costs. Advanced materials, magnetic components, and miniaturized configurations increase overall expenses, making cost optimization a major challenge. Smaller manufacturers face barriers in achieving economies of scale due to limited production capabilities. Additionally, stringent quality control and testing standards further elevate manufacturing costs, impacting overall profit margins and adoption in cost-sensitive markets.

Thermal Management and Frequency Stability Issues

Maintaining consistent performance under varying temperature and frequency conditions remains a technical challenge for RF isolator manufacturers. Excessive heat or frequency drift can reduce isolation efficiency and lead to performance degradation. These issues are particularly critical in defense and satellite applications that operate in extreme environments. Addressing thermal imbalance through material innovation and improved design architecture is crucial to ensure long-term reliability and stability in high-frequency applications.

Regional Analysis

North America

North America held the largest share of 38% in the RF isolator market in 2024. The region’s leadership is driven by strong presence of communication infrastructure, extensive 5G network deployments, and growing defense modernization projects. The United States dominates regional demand with high adoption in radar, aerospace, and satellite communication applications. Continuous R&D by leading companies and investments in high-frequency RF technologies further strengthen regional competitiveness. Increasing integration of isolators in data centers and wireless base stations continues to support long-term market expansion across North America.

Europe

Europe accounted for a 28% share of the RF isolator market in 2024. The region benefits from strong aerospace, defense, and telecommunication industries that heavily rely on RF systems for communication and navigation. Countries such as Germany, France, and the United Kingdom lead adoption through advanced R&D initiatives and defense modernization programs. The growing rollout of 5G networks and focus on developing miniaturized RF components drive further demand. Supportive government policies promoting semiconductor innovation and sustainable manufacturing enhance Europe’s technological growth in RF component production.

Asia-Pacific

Asia-Pacific captured a 25% share of the RF isolator market in 2024. The region’s rapid growth is driven by expanding telecommunications infrastructure, consumer electronics production, and defense investments. China, Japan, and South Korea dominate due to their strong manufacturing capabilities and large-scale 5G deployments. India is also emerging as a key market, supported by rising mobile connectivity and government initiatives to boost domestic electronics manufacturing. Increasing integration of isolators into automotive radar and IoT applications further fuels growth, making Asia-Pacific a strategic hub for global RF innovation.

Middle East & Africa

The Middle East & Africa region accounted for a 5% share of the RF isolator market in 2024. Growth is supported by rising adoption of satellite communication systems and increasing investment in defense and aerospace technologies. Countries like the United Arab Emirates, Israel, and Saudi Arabia are driving demand through advanced radar and electronic warfare programs. Regional telecom operators are also deploying RF isolators to enhance network reliability. However, limited manufacturing capacity and high import dependency continue to constrain broader market penetration across parts of Africa.

Latin America

Latin America represented a 4% share of the RF isolator market in 2024. Market growth is fueled by expanding telecommunication networks, digital transformation initiatives, and modernization of defense communication systems. Brazil and Mexico lead regional adoption due to increased investment in radar technology and wireless infrastructure. The shift toward 5G connectivity and industrial automation supports greater use of RF isolators across communication systems. However, budget constraints and reliance on imported components limit the speed of technological adoption across smaller economies within the region.

Market Segmentations:

By Type

- Coaxial Isolators

- Waveguide Isolators

- Surface Mount Isolators

- Microstrip Isolators

By Configuration

- Single Junction

- Double Junction

- Multi-Junction

By Application

- Telecommunications

- Aerospace and Defense

- Medical Equipment

- Others

By End Use

- Commercial

- Military

- Space

- Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the RF isolator market includes major players such as ADMOTECH Inc., API Technologies Corp., DiTom Microwave Inc., Smiths Interconnect, RF-Lambda USA LLC, Skyworks Solutions, Inc., UTE Microwave Inc., M2 Global Technology Ltd., Teledyne Technologies Incorporated, and REC-USA, LLC. These companies compete through product innovation, high-frequency design expertise, and strong global distribution networks. Leading manufacturers are focusing on developing compact, low-loss, and thermally stable isolators suitable for 5G, radar, and satellite communication applications. Strategic collaborations with telecom operators, defense agencies, and semiconductor manufacturers enhance technological development and market reach. Continuous R&D in ferrite materials, miniaturization, and wideband performance optimization further strengthens competitiveness. The market remains moderately consolidated, with key players prioritizing customized product solutions, cost efficiency, and advanced isolation technologies to address evolving demands across telecommunications, aerospace, and defense sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ADMOTECH Inc.

- API Technologies Corp.

- DiTom Microwave Inc.

- Smiths Interconnect

- RF-Lambda USA LLC

- Skyworks Solutions, Inc.

- UTE Microwave Inc.

- M2 Global Technology Ltd.

- Teledyne Technologies Incorporated

- REC-USA, LLC

Recent Developments

- In 2024, ADMOTECH Inc. developed a wideband “drop-in” RF isolator for ship-borne electronic warfare systems, covering X-Band frequencies (8-12 GHz) and dual isolator variants.

- In 2024, DiTom Microwave Inc. announced in-stock RF isolators operating from 500 MHz up to 43.5 GHz, featuring insertion loss as low as 0.1 dB and isolation of 30 dB.

- In 2023, M2 Global Technology Ltd. advanced its RF isolator manufacturing capabilities by introducing additional frequency bands (e.g., millimetre-wave above 20 GHz) for test and measurement equipment.

Report Coverage

The research report offers an in-depth analysis based on Type, Configuration, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for RF isolators will rise with the global expansion of 5G and satellite networks.

- Manufacturers will focus on developing compact and high-frequency isolators for modern communication systems.

- Integration of isolators in IoT and smart devices will enhance signal reliability and reduce interference.

- Advancements in ferrite materials will improve power handling and thermal performance.

- Defense and aerospace applications will continue to drive high-performance isolator adoption.

- Automation and AI-based manufacturing will improve production efficiency and design precision.

- Asia-Pacific will emerge as a key growth region with expanding telecom infrastructure.

- Collaboration between component suppliers and telecom operators will accelerate innovation.

- Miniaturization trends will support isolator use in portable and low-power devices.

- Continuous R&D investment will enable the creation of wideband and low-loss isolator designs.