Market Overview

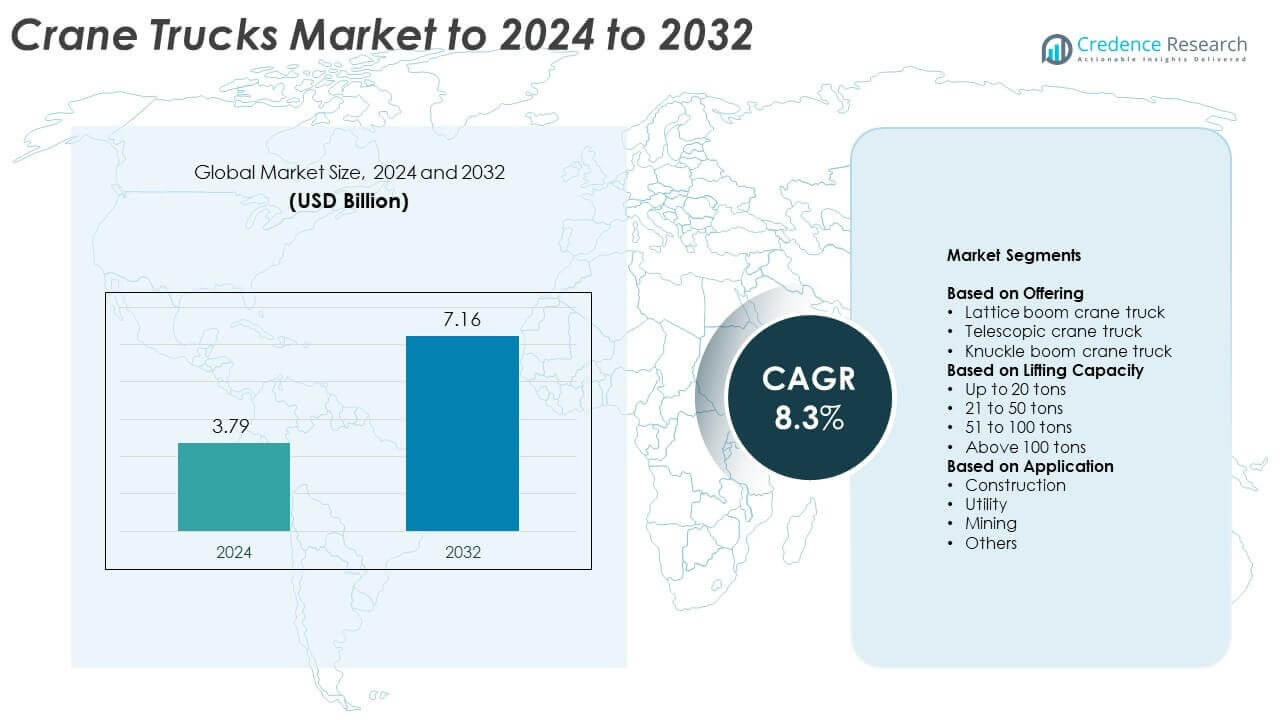

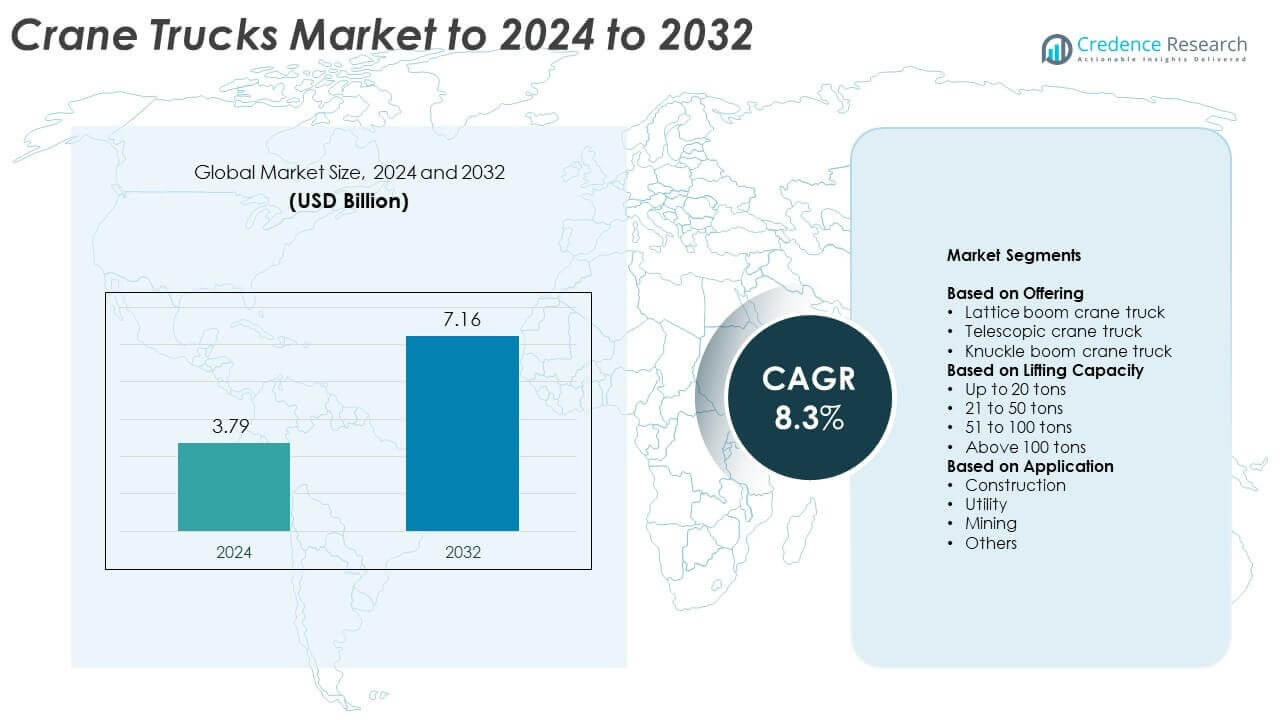

Crane Trucks Market size was valued at USD 3.79 Billion in 2024 and is anticipated to reach USD 7.16 Billion by 2032, at a CAGR of 8.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Crane Trucks Market Size 2024 |

USD 3.79 Billion |

| Crane Trucks Market, CAGR |

8.3% |

| Crane Trucks Market Size 2032 |

USD 7.16 Billion |

The crane trucks market features strong competition among global leaders including Liebherr, Tadano, Sany, Manitowoc, XCMG, Palfinger AG, Terex, Kato Works, Kobelco Cranes, and Zoomlion. These companies focus on expanding product lines with advanced hydraulics, automation, and telematics for improved operational efficiency. Manufacturers are emphasizing innovation in hybrid and electric-powered models to meet tightening emission regulations. Strategic alliances with construction, energy, and logistics companies enhance service coverage and fleet capabilities. Continuous investment in R&D, aftersales support, and rental services strengthens their global market position. Regionally, Asia Pacific led the market with a 35% share in 2024, followed by North America and Europe.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The crane trucks market was valued at USD 3.79 billion in 2024 and is projected to reach USD 7.16 billion by 2032, growing at a CAGR of 8.3%.

• Growth is driven by rising infrastructure development, renewable energy installations, and modernization of utility networks across developing and developed economies.

• Emerging trends include the integration of IoT, telematics, and automation for predictive maintenance and fleet optimization, alongside increasing adoption of hybrid and electric models.

• The market remains competitive, with leading manufacturers focusing on advanced lifting systems, safety features, and expanded rental services to strengthen global presence.

• Asia Pacific led with a 35% share in 2024, followed by North America with 26% and Europe with 23%, while the telescopic crane truck segment dominated by offering with a 46% share, supported by its versatility in construction and maintenance applications.

Market Segmentation Analysis:

By Offering

The telescopic crane truck segment dominated the market in 2024 with a 46% share. Its dominance stems from versatility, compact design, and ease of setup for lifting operations in urban and industrial projects. The telescopic boom’s adjustable length allows for high flexibility, making it preferred for utility maintenance, construction, and logistics applications. Continuous innovations such as hydraulic telescopic systems and load-sensing technologies enhance operational precision and reduce setup time, supporting wider adoption across mid- to large-scale infrastructure projects.

- For instance, Tadano’s GT-750EL-3 has a 47 m boom, up to 61.2 m with jib, and 75,000 kg max capacity, supporting fast telescopic setups.

By Lifting Capacity

The 21 to 50 tons segment led the market in 2024, accounting for 39% of total revenue. This range offers an optimal balance between lifting capability and mobility, suitable for construction, utility, and logistics operations. Growing urban infrastructure projects and industrial facility expansion have strengthened demand for mid-range capacity trucks. Manufacturers focus on integrating advanced control systems and fuel-efficient engines to boost productivity and reduce operating costs, further promoting adoption across emerging economies.

- For instance, XCMG’s XCT25L5 lists a 42 m five-section boom, 25 t max load, 50.2 m max lifting height, and 38.5 m working radius, fitting mid-range jobs.

By Application

The construction segment held the largest market share in 2024, representing 52% of the total. Increasing global construction activities, including residential, commercial, and infrastructure projects, are driving demand for mobile lifting solutions. Crane trucks enable quick material handling and structure assembly, improving project timelines. Rising investments in smart city and transportation infrastructure projects across Asia-Pacific and North America continue to strengthen the segment’s growth, with key players focusing on expanding rental and fleet services to meet rising construction demands.

Key Growth Drivers

Rising Infrastructure Development Projects

Expanding global infrastructure projects, including highways, ports, and smart cities, are driving crane truck demand. Governments across Asia-Pacific, North America, and the Middle East are investing heavily in large-scale construction and public infrastructure. Crane trucks offer high mobility, flexibility, and lifting efficiency, making them vital for project execution. Increasing urbanization and industrialization further enhance equipment utilization rates, while advanced lifting systems improve operational precision and safety, supporting strong market growth through improved project timelines and reduced labor dependency.

- For instance, the SANY STC250 series includes several variants, but a common configuration offers a 33.5 m main boom, which can be extended with either a fixed 8 m jib or, on some models, a 14.6 m luffing jib.

Growth in Renewable Energy Installations

The global transition toward renewable energy has boosted the deployment of crane trucks in wind and solar projects. Their ability to lift and position heavy turbines, panels, and structural components efficiently makes them essential for installation activities. Rising renewable energy targets in countries like China, India, and Germany create steady equipment demand. Manufacturers are designing specialized models for terrain adaptability and higher lifting heights, ensuring efficient handling in remote project locations and reinforcing long-term growth in this energy-driven sector.

- For instance, Vestas reports more than 193 GW of installed wind capacity worldwide, evidencing sustained turbine deployment that requires heavy lift support.

Expansion in Utility and Maintenance Operations

Rapid urban development and aging utility infrastructure are increasing the need for crane trucks in maintenance applications. Power grid expansion, telecom tower installations, and municipal repairs require compact and maneuverable lifting vehicles. Crane trucks provide quick setup and mobility in congested environments, improving service timelines and worker safety. The shift toward preventive maintenance and public infrastructure modernization strengthens market adoption, while fleet operators increasingly invest in hydraulic and remote-control-equipped models for enhanced precision and operational efficiency.

Key Trends & Opportunities

Integration of Advanced Automation and Telematics

Automation and telematics integration are transforming the crane truck industry. Smart systems enable real-time monitoring, predictive maintenance, and load management, reducing downtime and improving productivity. Fleet operators adopt IoT-based solutions for route optimization and fuel efficiency. The trend toward semi-autonomous operation enhances safety in complex environments. Manufacturers focus on integrating AI-driven diagnostics and digital platforms for performance analytics, aligning with Industry 4.0 initiatives and creating opportunities for connected, data-driven crane operations.

- For instance, Manitowoc’s CCS with MAXbase provides asymmetrical outrigger capability and a wide cab with 20° tilt, supporting safer, data-driven operations on constrained sites.

Rising Demand for Electric and Hybrid Models

Sustainability concerns and emission regulations are driving interest in electric and hybrid crane trucks. Governments promote cleaner fleets through incentives and emission mandates, prompting OEMs to develop battery-electric and hybrid variants. These models reduce noise, operational costs, and carbon footprint. Growing adoption in urban construction and utility maintenance supports this shift, especially in Europe and East Asia. Continuous improvements in battery capacity and charging infrastructure further enhance feasibility, positioning electric crane trucks as a major future opportunity.

- For instance, Zoomlion’s ZTC250N-EV electric truck crane is rated 25 t, claims over 260 km driving range, 90 km/h top speed, and ≤ 65 dB operating sound.

Key Challenges

High Ownership and Maintenance Costs

Crane trucks involve significant upfront investment and recurring maintenance costs, which limit adoption among small contractors. Routine servicing, hydraulic system upkeep, and component replacement increase operational expenses. Fuel price fluctuations add to the burden for fleet operators. In developing regions, limited financing options further restrict access. Manufacturers are focusing on modular designs and extended service intervals to lower lifecycle costs, yet affordability remains a key barrier for widespread deployment, especially among small and mid-sized enterprises.

Skilled Operator Shortage and Safety Concerns

The industry faces a shortage of trained operators capable of handling advanced lifting equipment. Inadequate training can lead to operational inefficiencies and safety incidents. Complex control systems in modern crane trucks require specialized knowledge, creating workforce skill gaps. Regulatory bodies emphasize operator certification and regular safety audits, yet regional disparities persist. Manufacturers and training institutes are investing in simulator-based programs and digital learning platforms to improve operator competency and safety compliance, but the gap remains a significant industry challenge.

Regional Analysis

North America

In North America, the crane trucks market commanded approximately 26 % of global share in 2024, driven by robust infrastructure repair and utility maintenance demand. The United States and Canada led adoption owing to regulatory emphasis on safe lifting and construction efficiency. Market growth was supported by fleet modernisation, replacement needs, and expansion in renewable-energy sites requiring mobile lifting solutions. However, higher equipment costs and emissions regulations somewhat tempered faster growth in this region.

Asia Pacific

Asia Pacific held about 35 % of the crane trucks market share in 2023 and remained the fastest-growing region into 2024 and beyond. Rapid industrial expansion in China and India, combined with large-scale public infrastructure and smart-city projects, underpinned demand for mobile lifting solutions. Manufacturers targeted this region with locally-adapted models, enhancing affordability and deployment speed. Strong logistics growth and port upgrades also contributed to Asia Pacific’s strong regional performance.

Europe

In Europe, the crane trucks market accounted for roughly 23 % of the global share in 2023, anchored by mature construction, utilities and mining sectors. The region’s emphasis on advanced safety systems and emission-compliant equipment boosted demand for premium crane-truck models. Urban redevelopment and infrastructure renewal in Western Europe further sustained the market. Slower growth compared with emerging regions reflected market saturation and higher base-levels of fleet ownership.

Latin America

Latin America represented about 8 % of the global crane trucks market in 2024, reflecting moderate infrastructure investment and growing construction activity. Countries such as Brazil and Mexico showed increasing uptake of mobile lifting vehicles in urban development and utility maintenance projects. However, the region faced challenges in financing and equipment availability which constrained faster adoption rates. Nonetheless, growing mining operations and port expansions present improvement potential.

Middle East & Africa

The Middle East & Africa region captured approximately 8 % of global market share in 2024, supported by large-scale oil-and-gas infrastructure, port developments and urban construction. Gulf Cooperation Council (GCC) countries led investment into smart-city and large development schemes requiring versatile crane trucks. Operational conditions—such as harsh environments and remote job sites—drove demand for rugged, high-capacity equipment. Yet, economic and political uncertainties in some African markets limited more robust regional expansion.

Market Segmentations:

By Offering

- Lattice boom crane truck

- Telescopic crane truck

- Knuckle boom crane truck

By Lifting Capacity

- Up to 20 tons

- 21 to 50 tons

- 51 to 100 tons

- Above 100 tons

By Application

- Construction

- Utility

- Mining

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The global crane trucks market is characterized by strong competition among leading manufacturers such as Liebherr, Tadano, Sany, Manitowoc, XCMG, Palfinger AG, Terex, Kato Works, Kobelco Cranes, and Zoomlion. Companies focus on enhancing product efficiency through advanced hydraulic systems, digital control interfaces, and telematics integration. Strategic partnerships with construction and utility service providers support fleet modernization and strengthen regional distribution networks. Firms invest heavily in R&D to develop energy-efficient, lightweight, and high-lifting-capacity models tailored to urban and industrial applications. Continuous innovation in hybrid powertrains and remote-control features is improving operational safety and reducing emissions. Manufacturers are also expanding aftersales service networks and rental solutions to meet growing global infrastructure demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Liebherr

- Tadano

- Sany

- Manitowoc

- XCMG

- Palfinger AG

- Terex

- Kato Works

- Kobelco Cranes

- Zoomlion

Recent Developments

- In 2024, Manitowoc Cranes Introduced the Igo M 24-19 self-erecting crane, a compact machine designed for rapid deployment on smaller jobsites.

- In 2023, Tadano Launched new truck cranes, the GT1200XL-2 and GT-800XL-2, with 120 and 80-tonne lifting capacities, at CONEXPO 2023.

- In 2023, XCMG Developed the world’s largest tonnage wheeled crane, the XCA3000, which has an 10-axle chassis design and can lift 3,000 tons.

Report Coverage

The research report offers an in-depth analysis based on Offering, Lifting Capacity, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The crane trucks market will experience steady growth driven by expanding infrastructure development worldwide.

- Rising demand for fleet modernization will boost adoption of technologically advanced crane trucks.

- Integration of IoT and telematics will enhance equipment monitoring, efficiency, and predictive maintenance.

- Electric and hybrid crane trucks will gain traction as emission norms tighten globally.

- Asia Pacific will remain the fastest-growing region due to strong construction and industrial activity.

- Rental and leasing services will expand as companies seek cost-efficient fleet management.

- Automation and remote-control operations will improve safety and precision in lifting tasks.

- Manufacturers will focus on compact and versatile designs for urban and confined job sites.

- Partnerships between OEMs and digital solution providers will accelerate smart crane innovations.

- Increased investment in renewable energy infrastructure will sustain long-term demand for mobile lifting equipment.