Market Overview

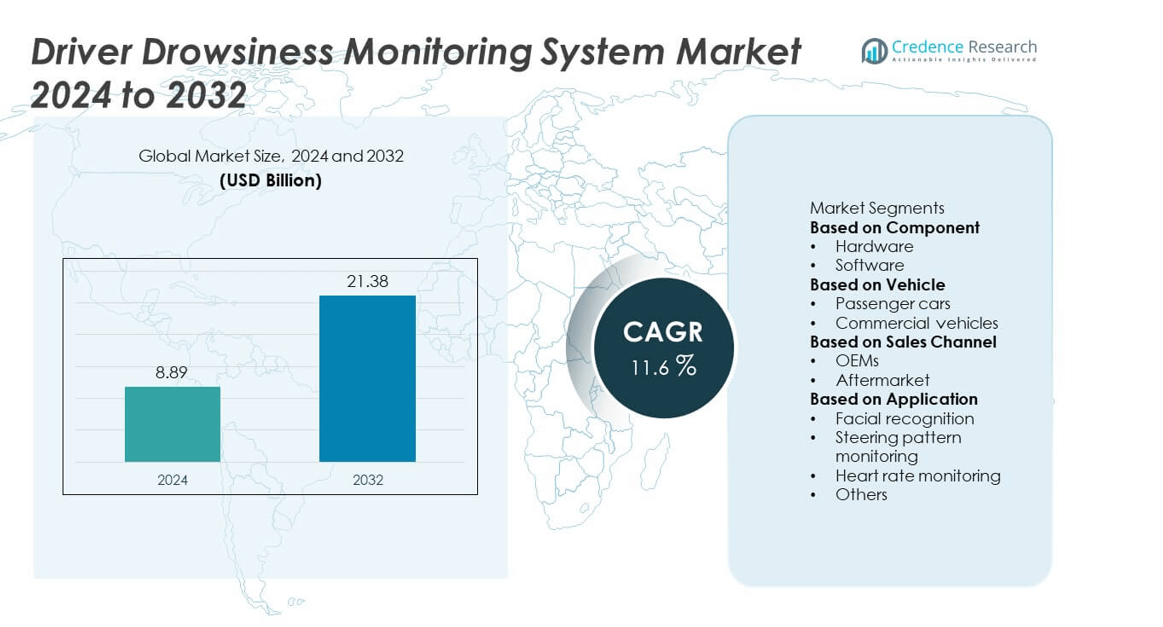

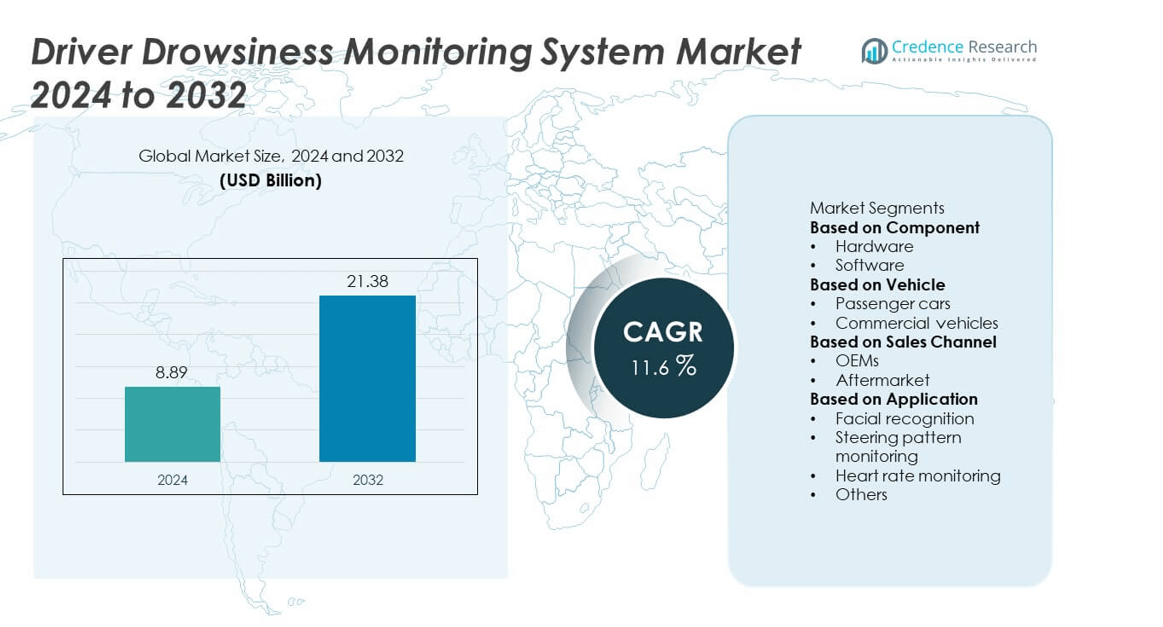

The Driver Drowsiness Monitoring System Market was valued at USD 8.89 billion in 2024 and is projected to reach USD 21.38 billion by 2032, registering a CAGR of 11.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Driver Drowsiness Monitoring System Market Size 2024 |

USD 8.89 billion |

| Driver Drowsiness Monitoring System Market , CAGR |

11.6% |

| Driver Drowsiness Monitoring System Market Size 2032 |

USD 21.38 billion |

The driver drowsiness monitoring system market is led by prominent players such as Robert Bosch, Continental, Denso, Aptiv, Magna International, Panasonic, ZF Friedrichshafen, Hella GmbH, Volkswagen, and Volvo Trucks. These companies dominate through strong R&D capabilities, integration of AI-based monitoring technologies, and collaboration with OEMs for next-generation safety solutions. Advanced camera and sensor systems are increasingly standard in modern vehicles, aligning with global safety mandates. North America led the market in 2024 with a 36% share, supported by early ADAS adoption and regulatory enforcement, followed by Europe with 31% and Asia-Pacific with 27%, driven by expanding automotive production and connected vehicle development.

Market Insights

- The driver drowsiness monitoring system market was valued at USD 8.89 billion in 2024 and is projected to reach USD 21.38 billion by 2032, growing at a CAGR of 11.6% during the forecast period.

- Increasing road safety regulations and rising awareness of fatigue-related accidents are driving adoption across both passenger and commercial vehicles.

- Integration of AI, infrared cameras, and in-cabin sensors is emerging as a key trend, enhancing real-time driver behavior analysis and system reliability.

- Major players such as Robert Bosch, Continental, Denso, and Aptiv are expanding partnerships with OEMs to develop advanced, regulation-compliant monitoring systems.

- North America led with a 36% share in 2024, followed by Europe (31%) and Asia-Pacific (27%), while by vehicle type, passenger cars dominated with a 68% share, supported by growing demand for advanced driver assistance technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

The hardware segment dominated the driver drowsiness monitoring system market in 2024, accounting for a 61% share. Its leadership is attributed to the widespread integration of cameras, sensors, and steering angle detectors that enable real-time driver fatigue detection. Increasing adoption of infrared and image-based monitoring systems by OEMs enhances accuracy and responsiveness. Automakers are prioritizing high-performance hardware to comply with global vehicle safety standards. Continuous innovation in sensor miniaturization and advanced vision technology further strengthens the hardware segment’s role in improving road safety and reducing fatigue-related accidents.

- For instance, Denso Corporation developed its driver status monitoring system equipped with a near-infrared camera capable of detecting eyelid movement at 30 frames per second, integrated into Toyota’s Crown and Lexus LS models.

By Vehicle

The passenger car segment held the largest share of 68% in 2024, driven by rising integration of advanced safety systems in mid-range and luxury vehicles. Growing consumer awareness of driver safety and supportive regulatory mandates in Europe and North America fuel adoption. Automakers are incorporating AI-based alert systems and facial recognition technologies to enhance user experience. Expansion of connected car platforms and increasing focus on occupant protection strengthen the dominance of driver monitoring systems in the passenger vehicle category across global markets.

- For instance, Tesla deployed its cabin-facing camera in Model 3 and Model Y vehicles for driver attention monitoring, enabling real-time feedback via its Autopilot safety feature.

By Sales Channel

The OEM segment led the market with a 72% share in 2024, supported by rising installation of drowsiness detection systems as standard safety features in new vehicles. Government mandates, such as the EU’s General Safety Regulation, require OEMs to equip vehicles with fatigue monitoring systems. Automotive manufacturers are collaborating with technology providers to integrate AI-powered and vision-based solutions into factory-installed driver assistance packages. Growing demand for advanced driver safety and automated features continues to drive OEM adoption, while the aftermarket segment gains traction through retrofit solutions for older vehicle models.

Key Growth Drivers

Rising Implementation of Vehicle Safety Regulations

Governments and safety agencies are mandating driver monitoring systems to reduce fatigue-related accidents. The European Union’s General Safety Regulation and the U.S. NHTSA initiatives require fatigue detection as a standard feature in new vehicles. Automakers are integrating camera-based systems and steering sensors to meet compliance standards. The growing emphasis on road safety and accident prevention is accelerating large-scale OEM adoption across passenger and commercial vehicles, fueling strong market growth worldwide.

- For instance, Bosch developed its interior monitoring system equipped with a camera and artificial intelligence to monitor a driver’s attention to ensure compliance with EU safety directives. The AI uses intelligent image-processing algorithms trained on real driving situations to analyze the driver’s behavior, including eye movements and posture.

Increasing Integration of AI and Computer Vision Technologies

Artificial intelligence and computer vision advancements are revolutionizing drowsiness detection accuracy. AI algorithms analyze facial expressions, eyelid movement, and steering patterns to predict fatigue in real time. Leading manufacturers are adopting deep learning models to enhance adaptive responses. This shift enables systems to distinguish between distraction and fatigue more effectively. The growing trend toward intelligent driver assistance systems is boosting demand for AI-enabled solutions across mid-range and premium vehicle categories.

- For instance, NVIDIA’s DRIVE IX software platform supports real-time driver monitoring, including gaze and head position interpretation, utilizing the AI compute power of hardware like the DRIVE AGX Orin system.

Growing Demand for ADAS and Autonomous Vehicles

The rapid growth of Advanced Driver Assistance Systems (ADAS) and semi-autonomous driving platforms is a major driver. Driver drowsiness monitoring systems serve as a core component in ensuring driver attention in Level 2 and Level 3 autonomous vehicles. Increasing deployment in electric and connected cars enhances safety performance and aligns with global crash prevention standards. Automakers are investing in integrated monitoring platforms combining driver awareness, lane detection, and adaptive cruise control, expanding market opportunities.

Key Trends & Opportunities

Adoption of Camera-Based and Infrared Monitoring Systems

Automotive OEMs are shifting from sensor-only systems to camera-based solutions that track facial movements and gaze direction. Infrared technology enables precise monitoring under varying light conditions, ensuring reliability during night driving. This evolution enhances real-time fatigue detection accuracy and supports seamless integration with infotainment systems. Increasing use of compact, embedded cameras and cloud-based data analytics creates new opportunities for performance optimization and regulatory compliance.

- For instance, Panasonic developed an eye-tracking system for its automotive Augmented Reality Head-Up Display (AR HUD), which uses a proprietary infrared camera to recognize a driver’s line of sight. This technology dynamically adjusts imagery based on the driver’s head movement to ensure precise and clear AR overlays.

Emergence of In-Cabin Sensing and Emotion Recognition

The market is witnessing growing integration of emotion and attention monitoring features alongside drowsiness detection. AI-driven in-cabin sensing solutions assess stress levels, posture, and cognitive load to improve comfort and safety. Automakers are leveraging these insights to personalize alerts and optimize vehicle settings. Collaborations between automotive OEMs and AI firms are driving innovation in multi-modal systems, paving the way for holistic human-machine interaction within next-generation vehicles.

- For instance, Affectiva’s Automotive AI analyzes over 5.2 million facial expressions across 87 countries, enabling real-time emotion recognition for adaptive cockpit environments.

Key Challenges

High System Cost and Integration Complexity

The implementation of driver drowsiness monitoring systems involves high costs due to advanced sensors, cameras, and AI software. Integrating these components into vehicle architectures adds technical complexity and increases production costs. Small and mid-size automakers face challenges in scaling these systems affordably. Although regulatory mandates encourage adoption, cost optimization and component standardization remain critical to achieving mass-market penetration, especially in developing economies.

Privacy and Data Security Concerns

Driver monitoring systems rely on continuous image and behavioral data capture, raising privacy concerns. Unauthorized data access or misuse poses risks to consumer trust and regulatory compliance. As data protection laws tighten, automakers and technology providers must ensure robust encryption and user consent mechanisms. Developing privacy-centric AI algorithms and transparent data handling practices will be essential to maintain market credibility and foster user acceptance globally.

Regional Analysis

North America

North America dominated the driver drowsiness monitoring system market in 2024 with a 36% share, driven by strict road safety regulations and high adoption of ADAS technologies. The United States leads due to the National Highway Traffic Safety Administration’s initiatives promoting advanced driver monitoring in passenger and commercial vehicles. Automakers are integrating camera-based and steering behavior detection systems to reduce fatigue-related crashes. Growing consumer demand for premium safety features and rapid expansion of semi-autonomous vehicles further support market growth across the region.

Europe

Europe accounted for a 31% market share in 2024, supported by strong regulatory frameworks such as the European Union’s General Safety Regulation mandating driver monitoring systems in new vehicles. Germany, France, and the United Kingdom lead adoption due to robust automotive manufacturing bases and consumer awareness of safety technologies. Increasing integration of AI-driven facial recognition systems and smart dashboards enhances vehicle safety compliance. Rising sales of electric and connected cars, along with government incentives for intelligent transportation systems, continue to drive market expansion across the region.

Asia-Pacific

Asia-Pacific held a 27% share in 2024, propelled by rapid urbanization, increasing road safety awareness, and growth in mid-range passenger car production. China leads the region with strong government support for advanced vehicle safety systems and expanding EV production. Japan and South Korea are early adopters of camera-based fatigue detection integrated into ADAS platforms. India’s rising automotive demand and adoption of connected mobility solutions further stimulate growth. The region’s focus on AI integration and smart vehicle technologies ensures sustained momentum in the driver monitoring market.

Latin America

Latin America represented a 4% share in 2024, driven by growing emphasis on road safety and adoption of driver monitoring systems in commercial fleets. Brazil and Mexico are leading markets due to government-supported safety programs and increasing production of connected vehicles. Regional demand is also supported by fleet operators adopting fatigue detection systems to minimize road accidents. However, cost-sensitive consumers and limited regulatory enforcement slow large-scale adoption. Expanding partnerships between automakers and technology suppliers are expected to accelerate market penetration in the coming years.

Middle East & Africa

The Middle East & Africa captured a 2% share in 2024, driven by improving road safety infrastructure and rising luxury vehicle sales. Gulf countries, including Saudi Arabia and the UAE, are promoting advanced safety systems under national transportation modernization programs. Increasing commercial fleet deployment and integration of fatigue monitoring in heavy vehicles support adoption. In Africa, South Africa remains the key contributor due to government focus on driver behavior analytics and accident prevention. Gradual policy development and investments in connected mobility solutions are expected to boost regional demand.

Market Segmentations:

By Component

By Vehicle

- Passenger cars

- Commercial vehicles

By Sales Channel

By Application

- Facial recognition

- Steering pattern monitoring

- Heart rate monitoring

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the driver drowsiness monitoring system market includes key players such as Aptiv, Continental, Denso, Hella GmbH, Magna International, Panasonic, Robert Bosch, Volkswagen, Volvo Trucks, and ZF Friedrichshafen. These companies focus on integrating AI-driven facial recognition, infrared sensors, and in-cabin monitoring technologies to enhance accuracy and driver safety. Strategic collaborations between automotive OEMs and technology suppliers are accelerating innovation in real-time fatigue detection and adaptive alert systems. Leading manufacturers are expanding their portfolios with camera-based and sensor-fusion platforms compatible with ADAS and autonomous vehicles. Continuous R&D investments in neural network algorithms and low-power embedded hardware support improved performance and scalability. The market remains moderately consolidated, with companies differentiating through technological expertise, regulatory compliance, and partnerships with global automakers to strengthen their competitive advantage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Panasonic

- Volvo Trucks

- Magna International

- Aptiv

- ZF Friedrichshafen

- Continental

- Hella GmbH

- Robert Bosch

- Denso

- Volkswagen

Recent Developments

- In May 2025, Continental AG reached the milestone of producing 200 million radar sensors and highlighted its future safety architectures—including integrated driver monitoring sensors—as part of its ADAS roadmap.

- In May 2025, Queclink Wireless Solutions launched a compact, window-mounted DMS camera for fleet vehicles. The 720p HD system monitors driver distraction behaviors such as smoking, phone use, and fatigue.

- In June 2024, ZF demonstrated an advanced in-vehicle monitoring system that detects driver drowsiness or inattention and triggers appropriate intervention actions, reinforcing its safety technology portfolio in heavy-duty applications.

- In March 2024, Smart Eye signed a major contract for their AIS system. The newly launched product is an integrated hardware and software solution that can be installed in new or aftermarket commercial vehicles like trucks and buses

Report Coverage

The research report offers an in-depth analysis based on Component, Vehicle, Sales Channel, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for driver drowsiness monitoring systems will grow as global road safety regulations tighten.

- Integration of AI and machine learning will improve detection accuracy and response time.

- Automakers will increasingly make driver monitoring systems a standard feature in new vehicles.

- Camera-based and infrared technologies will dominate due to their superior performance in low-light conditions.

- Growth in electric and autonomous vehicles will accelerate adoption of advanced monitoring systems.

- Partnerships between automotive OEMs and tech firms will expand to enhance in-cabin sensing capabilities.

- Cost optimization and sensor standardization will make systems more accessible in mid-range vehicles.

- Real-time emotion and attention monitoring will evolve into a core feature of connected vehicles.

- Europe and North America will maintain leadership, while Asia-Pacific will emerge as the fastest-growing market.

- Continuous R&D investments will drive innovation in compact, energy-efficient, and data-secure monitoring solutions.