Market Overview

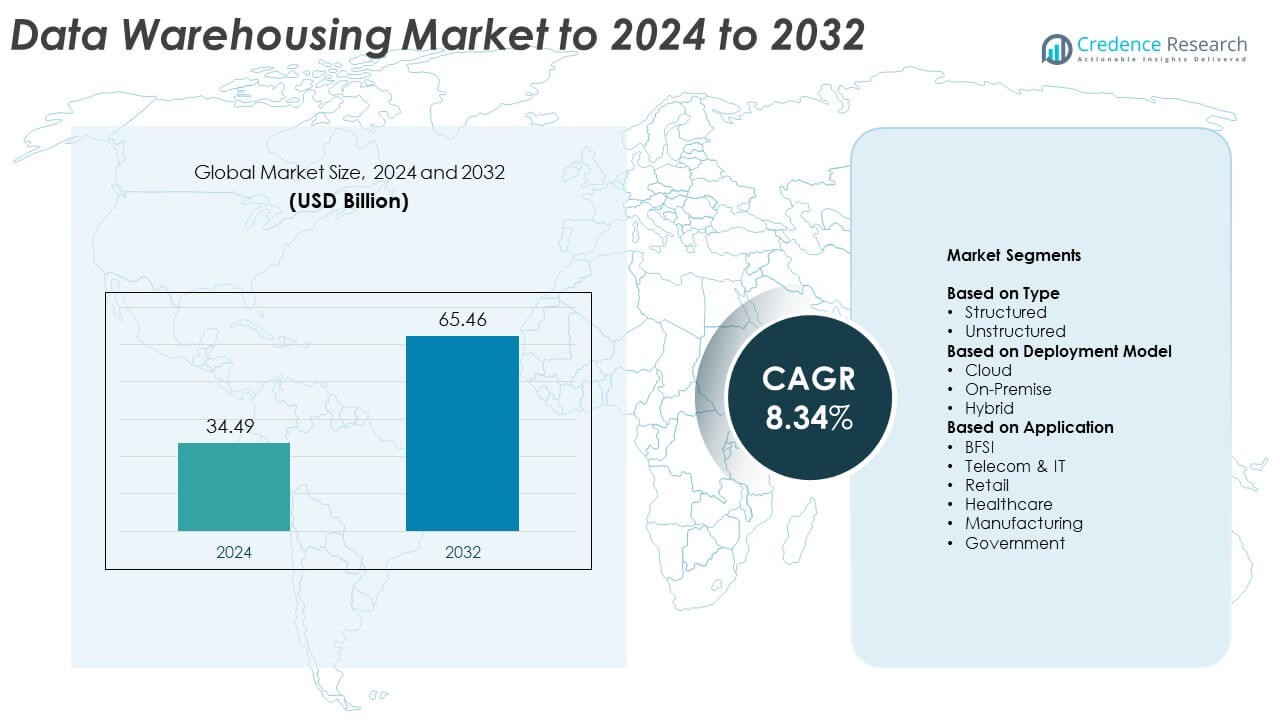

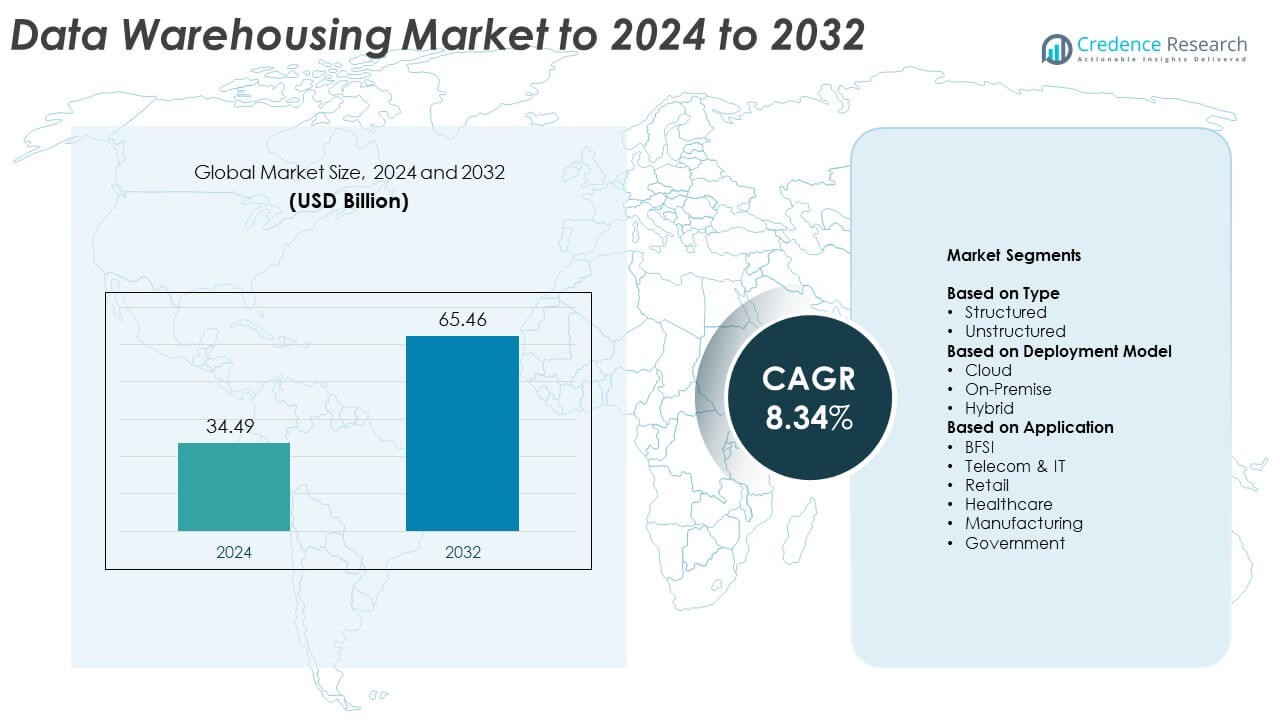

The Data Warehousing Market size was valued at USD 34.49 billion in 2024 and is anticipated to reach USD 65.46 billion by 2032, at a CAGR of 8.34% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Data Warehousing Market Size 2024 |

USD 34.49 Billion |

| Data Warehousing Market, CAGR |

8.34% |

| Data Warehousing Market Size 2032 |

USD 65.46 Billion |

The data warehousing market is led by major players such as Oracle Corp, IBM Corp, Teradata Corp, Microsoft Fabric, SAP AG, and Databricks, which dominate through advanced analytics, AI integration, and scalable cloud-based architectures. These companies focus on real-time data processing, automation, and hybrid deployment models to enhance enterprise efficiency and security. Continuous innovation and strategic collaborations strengthen their global reach across industries such as BFSI, retail, and healthcare. Regionally, North America accounted for the largest market share of 37% in 2024, driven by high adoption of digital transformation initiatives and cloud data infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The data warehousing market was valued at USD 34.49 billion in 2024 and is projected to reach USD 65.46 billion by 2032, growing at a CAGR of 8.34%.

- The market growth is fueled by rising adoption of cloud-based platforms, real-time analytics demand, and increasing enterprise data generation.

- Key trends include the integration of AI and machine learning for predictive insights and the shift toward hybrid and multi-cloud deployment models.

- The market remains competitive, with companies focusing on automation, security, and AI-driven data management innovations.

- North America leads with a 37% share, followed by Europe at 28% and Asia-Pacific at 25%, while the structured data segment dominates with a 63% share globally.

Market Segmentation Analysis:

By Type

The structured data segment dominated the data warehousing market in 2024 with a 63% share. Its leadership is driven by the rapid growth of transactional and relational databases across enterprises. Structured data supports faster querying and analytics, enabling real-time decision-making in sectors like banking and retail. The rise of SQL-based analytical tools and enterprise data platforms further strengthens this segment’s position. Companies continue to prioritize structured data warehousing for its reliability, scalability, and compatibility with legacy systems and business intelligence applications.

- For instance, Oracle’s Autonomous Data Warehouse study reported a 417% ROI for customers, evidencing strong structured-warehouse value.

By Deployment Model

The cloud segment held the largest market share of 54% in 2024, driven by scalability, cost efficiency, and integration flexibility. Cloud-based data warehousing platforms enable organizations to process massive datasets while reducing infrastructure costs. Leading providers offer advanced AI and automation tools that enhance performance and data governance. Increasing adoption of hybrid cloud strategies and serverless architectures supports agile data management. Enterprises in BFSI and retail are accelerating migration to cloud environments to improve accessibility and streamline analytics workloads.

- For instance, Microsoft confirmed 25,000 paid customers for Microsoft Fabric, underscoring rapid cloud analytics adoption.

By Application

The BFSI segment led the data warehousing market in 2024, accounting for 28% of total revenue. Financial institutions rely on data warehouses to manage regulatory compliance, fraud detection, and risk analysis. The growing volume of customer transactions and digital banking data drives strong adoption. Integration with AI-powered analytics enables faster insights into credit risk and investment performance. Moreover, the implementation of open banking and stringent data regulations encourages secure and scalable warehousing solutions, supporting greater transparency and operational efficiency across financial ecosystems.

Key Growth Drivers

Rising Adoption of Cloud-Based Data Warehousing

Cloud deployment is becoming a primary driver as enterprises seek scalable and flexible data storage. Organizations are shifting workloads from traditional on-premise systems to cloud platforms to reduce maintenance costs and enhance data accessibility. Cloud vendors are integrating AI and analytics to deliver faster insights. This transition enables real-time analytics, disaster recovery, and global data collaboration. The rise of multi-cloud strategies further supports seamless integration, empowering companies to handle complex, high-volume data with improved security and performance.

- For instance, Amazon Redshift customers queried over 77 exabytes of data in data lakes during 2024, demonstrating hyperscale cloud usage.

Expanding Demand for Real-Time Analytics

The growing focus on real-time data processing is propelling market growth. Enterprises across finance, retail, and manufacturing increasingly depend on instant insights to support operational decisions. Data warehouses equipped with in-memory computing and advanced analytics tools help businesses respond faster to market changes. The integration of streaming analytics and event-driven architectures enhances decision accuracy. This demand is amplified by the adoption of IoT and edge computing, which generate large volumes of dynamic data requiring immediate analysis and response.

- For instance, IBM Db2 Warehouse delivered 4× faster queries versus prior releases, enabling quicker operational insights.

Growing Volume of Enterprise Data

The exponential increase in enterprise data generated through digital channels, IoT devices, and e-commerce platforms is a major growth catalyst. Companies are deploying advanced warehousing solutions to manage structured and unstructured data efficiently. Data warehousing enhances governance, accessibility, and compliance for large datasets. The surge in business intelligence and predictive analytics applications further amplifies adoption. Enterprises are prioritizing robust data infrastructure to unlock insights that drive competitiveness, customer engagement, and revenue optimization across industries.

Key Trends & Opportunities

Integration of AI and Machine Learning

Artificial intelligence and machine learning are transforming data warehousing through predictive analytics and automation. AI-driven optimization enhances query performance, anomaly detection, and workload balancing. Machine learning models enable intelligent data categorization and forecasting, improving business decision accuracy. The use of AI also supports advanced data cleansing and integration processes. As enterprises invest in AI-enabled data warehouses, the market is witnessing greater efficiency, reduced latency, and improved resource utilization, creating new opportunities for vendors offering intelligent data management tools.

- For instance, at Google Cloud Next ’24, Google highlighted having more than 300 customer and partner AI stories.

Adoption of Data Lakehouse Architecture

The convergence of data lakes and warehouses into unified lakehouse platforms presents a major opportunity. This architecture allows organizations to store structured, semi-structured, and unstructured data in one system, improving flexibility and cost efficiency. It eliminates data duplication and simplifies analytics pipelines. Enterprises in technology, retail, and BFSI are adopting lakehouses to support diverse analytics workloads. The trend enhances interoperability between data engineering and analytics functions, enabling faster insight generation and more effective utilization of enterprise-wide datasets.

- For instance, as of September 2025, Databricks announced it serves more than 20,000 customers worldwide, including over 60% of the Fortune 500.

Emphasis on Data Governance and Compliance

As global regulations on data privacy tighten, companies are emphasizing strong governance frameworks within data warehouses. Enterprises are deploying metadata management and lineage tracking tools to ensure transparency. Compliance with GDPR, HIPAA, and other regional standards drives investment in secure and auditable warehousing platforms. This trend is creating opportunities for vendors offering governance-centric solutions with integrated access control and encryption features, ensuring accountability and trust across data ecosystems.

Key Challenges

High Implementation and Maintenance Costs

Establishing and maintaining advanced data warehousing systems requires significant financial investment. Costs associated with infrastructure setup, software licensing, and skilled personnel often limit adoption among small and mid-sized enterprises. Continuous upgrades and integration with analytics platforms add to expenses. Despite cloud solutions reducing upfront costs, long-term operational charges can remain substantial. Vendors are addressing these challenges by offering modular pricing models and managed services to make data warehousing more accessible and cost-effective across industries.

Data Security and Privacy Concerns

Data warehousing involves the storage of large volumes of sensitive business and customer information, making security a critical concern. Cyber threats, data breaches, and unauthorized access can lead to financial and reputational damage. As data sharing expands across cloud and hybrid environments, ensuring consistent protection becomes complex. Companies must adopt encryption, tokenization, and multi-factor authentication to safeguard data assets. Compliance with global data protection standards further adds complexity, requiring continuous monitoring and risk mitigation strategies.

Regional Analysis

North America

North America held a 37% share of the data warehousing market in 2024, driven by strong adoption of cloud-based analytics and digital transformation initiatives. The United States leads due to extensive enterprise investments in big data infrastructure and AI-driven warehousing solutions. Major industries such as BFSI, healthcare, and retail rely on advanced analytics platforms to enhance operational intelligence. Strategic partnerships between cloud providers and analytics firms further strengthen the region’s leadership. Canada also contributes through growing adoption of hybrid data storage models across mid-sized enterprises.

Europe

Europe accounted for a 28% share of the data warehousing market in 2024, supported by rising compliance requirements and data governance standards under GDPR. Countries such as Germany, the United Kingdom, and France are leading adopters of enterprise data platforms. Growing demand for real-time analytics in banking and manufacturing industries fuels regional growth. Organizations are increasingly adopting hybrid cloud warehousing models to balance security and scalability. Investments in AI-integrated data management systems further enhance decision-making efficiency and drive innovation in the European market.

Asia-Pacific

Asia-Pacific captured a 25% share of the data warehousing market in 2024, fueled by rapid digitalization and the growth of e-commerce and fintech sectors. China, India, and Japan are key contributors, with enterprises expanding cloud infrastructure to handle growing data volumes. Government-led digital transformation programs and smart city projects accelerate adoption. Regional firms increasingly leverage AI and data analytics to optimize business operations. The rising number of data centers and partnerships between local providers and global vendors further strengthen market expansion across the region.

Middle East & Africa

The Middle East & Africa region held a 6% share of the data warehousing market in 2024, driven by government-backed digital initiatives and enterprise modernization efforts. Countries such as the United Arab Emirates and Saudi Arabia are leading investments in cloud computing and analytics. BFSI and telecom sectors are adopting advanced data platforms to improve service delivery and regulatory compliance. Increasing partnerships with global cloud providers enhance scalability and performance. The region is gradually shifting toward hybrid deployment models to meet growing data management demands.

Latin America

Latin America represented a 4% share of the data warehousing market in 2024, with Brazil and Mexico emerging as major contributors. Expanding digital banking and retail sectors are accelerating adoption of analytics-driven warehousing systems. Cloud-based platforms are gaining traction due to cost efficiency and flexibility in deployment. Regional enterprises are investing in AI and machine learning capabilities to improve decision-making. Supportive government initiatives for digital infrastructure and partnerships with international technology firms are fostering data modernization across key industries in the region.

Market Segmentations:

By Type

By Deployment Model

By Application

- BFSI

- Telecom & IT

- Retail

- Healthcare

- Manufacturing

- Government

By Geography

North America

-

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The data warehousing market is highly competitive, with leading players such as Oracle Corp, IBM Corp, Teradata Corp, Microsoft Fabric, SAP AG, Databricks, HP Co, Actian Corp, EMC Corp, ParAccel Inc, Calpont Corp, and Konsolidator driving innovation through advanced technologies and strategic partnerships. Companies are focusing on developing AI-integrated warehousing platforms to deliver real-time analytics and automation capabilities. Emphasis is placed on cloud-native architecture, hybrid deployment flexibility, and security compliance to meet enterprise data management needs. Vendors are expanding their service portfolios by integrating data lakehouse and multi-cloud solutions that enhance scalability and interoperability. Strategic collaborations with analytics providers and hyperscale cloud platforms are strengthening market presence across industries. Continuous investments in R&D are enabling improved query performance, faster data integration, and better governance. Additionally, regional expansion and targeted acquisitions remain key strategies to capture emerging opportunities and sustain competitiveness in the evolving data warehousing landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Oracle Corp

- IBM Corp

- Teradata Corp

- Microsoft Fabric

- SAP AG

- Databricks

- HP Co

- Actian Corp

- EMC Corp

- ParAccel Inc

- Calpont Corp

- Konsolidator

Recent Developments

- In 2025, Konsolidator launched its financial data warehouse, a new product designed for CFOs and finance departments

- In 2023, Databricks Acquired MosaicML to advance its large language model (LLM) training capabilities and released updates focused on optimizing data warehouse performance

- In 2023, Microsoft (Fabric) launched and made generally available its unified Software-as-a-Service (SaaS) platform, Microsoft Fabric. It brings together a suite of data tools, including Synapse Data Warehouse, under a single lakehouse architecture (OneLake).

Report Coverage

The research report offers an in-depth analysis based on Type, Deployment Model, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady expansion driven by increasing cloud data adoption.

- AI and machine learning integration will enhance data automation and predictive analytics.

- Hybrid and multi-cloud deployments will become standard for enterprise data management.

- Real-time analytics demand will continue to reshape warehousing architecture and design.

- Data lakehouse models will gain wider adoption for handling structured and unstructured data.

- Security and compliance solutions will strengthen due to rising data privacy concerns.

- Self-service analytics tools will empower non-technical users within enterprises.

- Edge computing integration will support faster processing and decentralized analytics.

- Strategic partnerships between cloud providers and analytics firms will intensify.

- Emerging markets in Asia-Pacific and the Middle East will drive significant adoption growth.