Market Overview:

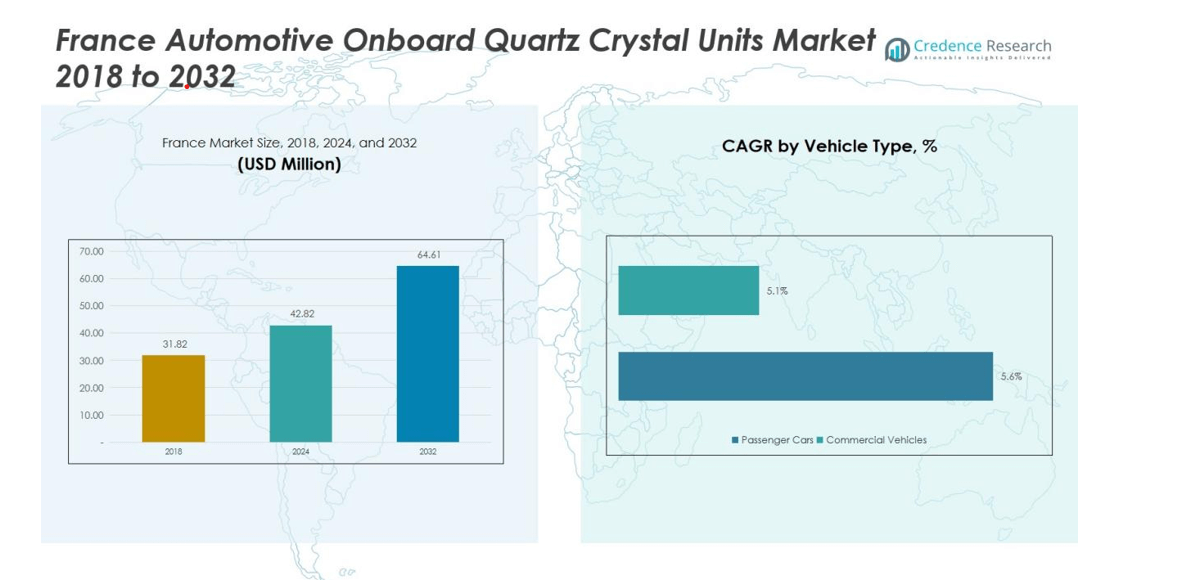

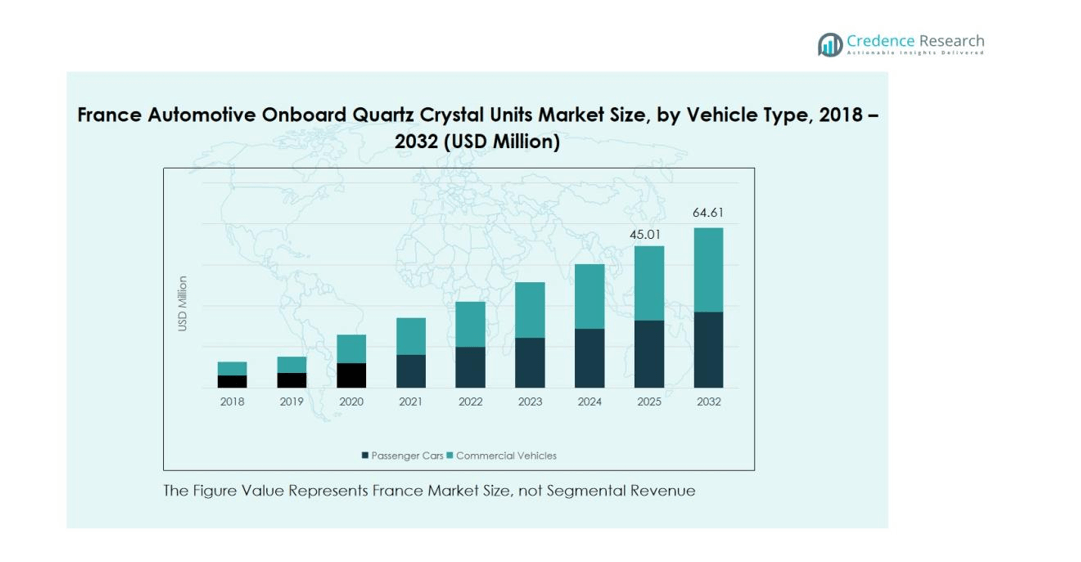

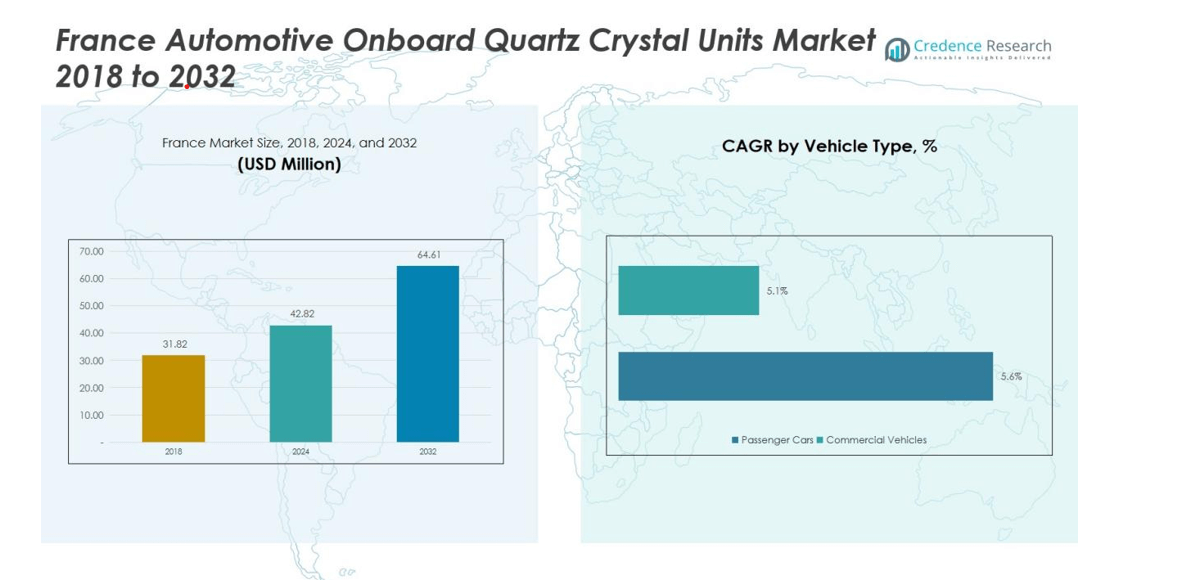

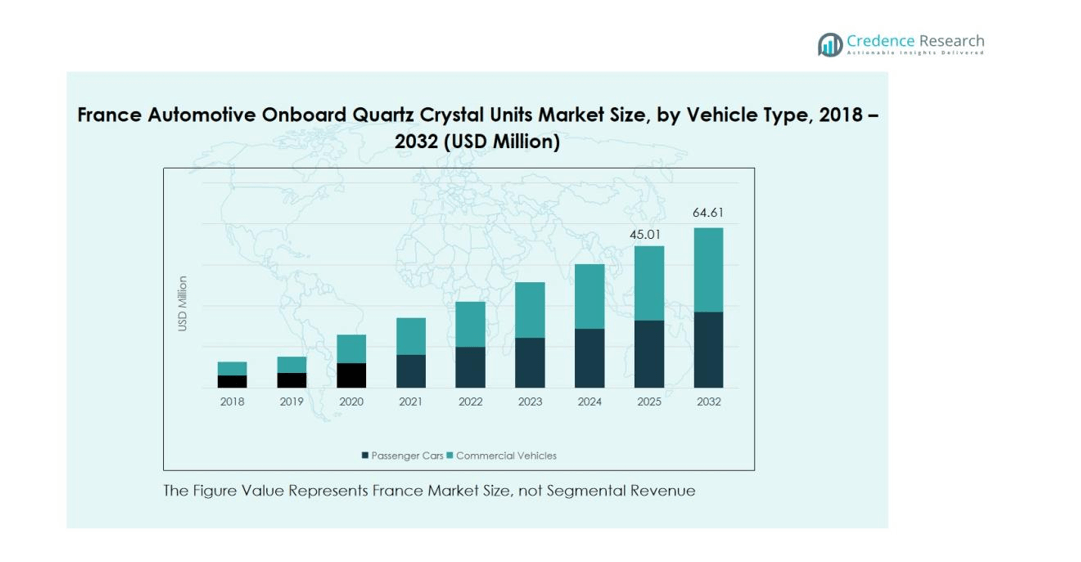

The France Automotive Onboard Quartz Crystal Units Market size was valued at USD 31.82 million in 2018 to USD 42.82 million in 2024 and is anticipated to reach USD 64.61 million by 2032, at a CAGR of 5.23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Automotive Onboard Quartz Crystal Units Market Size 2024 |

USD 42.82 million |

| France Automotive Onboard Quartz Crystal Units Market, CAGR |

5.23% |

| France Automotive Onboard Quartz Crystal Units Market Size 2032 |

USD 64.61 million |

Market growth is driven by rising adoption of electric and hybrid vehicles that require precise frequency control for electronic control units (ECUs), infotainment, and ADAS features. Advancements in vehicle connectivity and automation have increased the demand for compact, vibration-resistant, and energy-efficient crystal units. Manufacturers are focusing on miniaturization and high-temperature tolerance designs to meet automotive reliability and performance standards.

Regionally, France represents one of the leading markets in Western Europe for automotive quartz components, supported by strong domestic vehicle production and the presence of major automotive OEMs and electronic suppliers. The country’s commitment to sustainable mobility, R&D investments, and expansion of EV infrastructure continue to strengthen its position. Collaboration between local manufacturers and global semiconductor firms is expected to enhance technological competitiveness and long-term market growth.

Market Insights:

- The France Automotive Onboard Quartz Crystal Units Market was valued at USD 31.82 million in 2018, reached USD 42.82 million in 2024, and is projected to attain USD 64.61 million by 2032, growing at a CAGR of 5.23%.

- Western Europe holds the largest regional share of around 46%, driven by strong automotive production, technological leadership, and high R&D investment.

- Germany follows with a 28% share, supported by its advanced manufacturing base and continuous innovations in automotive electronics.

- The United Kingdom accounts for approximately 15% share, sustained by active vehicle modernization programs and adoption of smart mobility technologies.

- Central and Eastern Europe represent the fastest-growing regional cluster with a 7% share, expanding due to increasing localization of electronic component manufacturing.

- Passenger cars account for nearly 68% of total market revenue, reflecting higher electronic integration and consumer demand for advanced vehicle systems.

- Commercial vehicles contribute around 32% share, driven by the adoption of connected fleet technologies and energy-efficient control systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Integration of Advanced Automotive Electronics and Digital Systems

The France Automotive Onboard Quartz Crystal Units Market is driven by growing integration of advanced electronics across vehicles. Automakers increasingly rely on precision timing components for infotainment, communication, navigation, and driver assistance systems. Quartz crystal units ensure stable frequency control, supporting signal synchronization in complex electronic control units (ECUs). This integration strengthens system efficiency and reliability, aligning with the industry’s shift toward connected and intelligent mobility solutions.

- For instance, Renault’s Ampere division has developed a software-defined vehicle architecture that consolidates functionality into centralized systems, reducing the traditional approach that previously required up to 80 ECUs per vehicle.

Growth in Electric and Hybrid Vehicle Production

The expanding electric and hybrid vehicle segment is a major contributor to market growth. These vehicles require stable, low-power, and vibration-resistant frequency components to optimize power management, sensor accuracy, and communication systems. France’s growing EV infrastructure and government support for clean mobility further enhance adoption. The country’s automakers are prioritizing advanced crystal units to maintain precision in high-voltage, electronically controlled environments.

- For instance, Renault tripled the production capacity of its Cléon facility from 80,000 to 240,000 electric motors per year to support next-generation EVs while developing the Renault 5 E-Tech, slated for full-French production from mid-2025 with locally sourced components and batteries within a 300 km supply radius.

Increasing Demand for Reliable Components in Safety and ADAS Applications

Demand for advanced driver assistance systems (ADAS) continues to expand in France. Quartz crystal units support radar, LiDAR, and communication modules that enable collision detection, braking assistance, and lane-keeping technologies. The need for reliability and temperature stability drives manufacturers to produce high-performance crystal units that ensure accurate signal transmission. It enhances the safety and responsiveness of electronic systems in modern vehicles.

Technological Advancements and Miniaturization Trends

Continuous innovation in miniaturization and design optimization supports long-term market growth. Manufacturers are developing compact, thermally stable crystal units suited for next-generation automotive platforms. Collaboration between OEMs and semiconductor producers accelerates the introduction of durable, high-frequency solutions. These advancements help improve performance while reducing energy consumption and production costs, strengthening France’s competitiveness in automotive electronics manufacturing.

Market Trends:

Adoption of High-Precision Quartz Components in Connected and Autonomous Vehicles

The France Automotive Onboard Quartz Crystal Units Market is witnessing strong adoption of high-precision components for connected and autonomous vehicles. Automakers are integrating quartz units with enhanced frequency stability to support communication, navigation, and sensor synchronization. These components are critical for ensuring reliable data transfer between advanced driver assistance systems, infotainment modules, and onboard computing platforms. The rise of vehicle-to-everything (V2X) communication is increasing demand for quartz oscillators that can maintain consistent performance under thermal and vibration stress. It is also influencing Tier-1 suppliers to invest in high-temperature-resistant crystal units that ensure long-term durability. The expanding focus on automotive digitalization continues to create new opportunities for component suppliers across France’s manufacturing ecosystem.

- For Instance, Micro Crystal AG, a Swiss subsidiary, supplies low-jitter TCXOs to manufacturers for use in automotive electronics, including navigation and sensor fusion applications. The company provides products that can offer high timing precision, which is critical for these systems. Its European distribution network includes major channels in France.

Shift Toward Miniaturization, Low-Power Design, and Sustainable Production

A growing trend toward miniaturized and low-power quartz crystal units is transforming product development strategies. Manufacturers are designing compact, energy-efficient components to meet the space and performance constraints of modern automotive electronics. This shift aligns with the demand for lightweight, efficient vehicles that optimize energy usage and reduce emissions. It also supports the integration of multiple electronic modules into smaller form factors without compromising signal precision. French producers are incorporating automated manufacturing and eco-friendly materials to enhance quality and sustainability. The focus on cost-effective yet high-performance designs strengthens the country’s position in the European automotive electronics supply chain. Continuous R&D efforts in smart materials and surface acoustic wave (SAW) technology are expected to redefine product innovation in the coming years.

- For Instance, Micro Crystal AG, a subsidiary of the Swatch Group, is a leading manufacturer of miniature quartz crystals, real-time clock (RTC) modules, and oscillators for automotive and other applications. The company offers automotive-grade timing products across a wide frequency range, including 30 kHz to 250 MHz.

Market Challenges Analysis:

Supply Chain Disruptions and Raw Material Dependence

The France Automotive Onboard Quartz Crystal Units Market faces challenges from raw material dependence and global supply disruptions. Limited availability of high-purity quartz and electronic-grade materials increases production costs for manufacturers. Fluctuations in international supply chains impact lead times and pricing stability. It pressures component suppliers to diversify sourcing and maintain inventory resilience. Rising logistics costs and semiconductor shortages further strain market operations. These disruptions affect smaller producers more severely, limiting their ability to compete with established international suppliers.

Complex Manufacturing Standards and High Precision Requirements

Manufacturing quartz crystal units requires precision engineering and adherence to strict automotive standards. Minor deviations in frequency accuracy or temperature stability can lead to performance failures in vehicle systems. It raises the need for advanced testing and calibration facilities, increasing operational costs. The integration of crystal units into multiple vehicle electronics also demands close coordination between OEMs and Tier-1 suppliers. Rapid technological evolution challenges manufacturers to maintain compatibility with evolving ECUs and ADAS architectures. These technical and regulatory demands slow product development cycles and increase barriers for new entrants in the French market.

Market Opportunities:

Expansion of Electric and Autonomous Vehicle Ecosystem

The France Automotive Onboard Quartz Crystal Units Market offers strong growth potential through the expanding electric and autonomous vehicle ecosystem. Rising production of EVs and hybrid vehicles increases the need for precise timing components in powertrain control, communication, and battery management systems. Government incentives for clean mobility and investment in charging infrastructure strengthen this demand. It encourages OEMs and suppliers to develop high-frequency, low-power crystal units tailored for EV applications. The growth of autonomous technologies further drives demand for accurate timing solutions in radar, LiDAR, and camera modules. This transition creates long-term opportunities for manufacturers focused on innovation and performance reliability.

Technological Advancements and Localization of Component Manufacturing

Technological advancements in crystal miniaturization and surface acoustic wave (SAW) technology are creating new opportunities for product innovation. Manufacturers in France can benefit from localized production to reduce import dependence and improve supply resilience. It also allows customization of products for regional OEM needs while maintaining quality standards. Integration of automation and precision assembly enhances production efficiency and consistency. The country’s strong R&D infrastructure supports collaboration between semiconductor companies, universities, and automotive firms. These partnerships position France as a strategic hub for advanced automotive frequency control technologies in Europe.

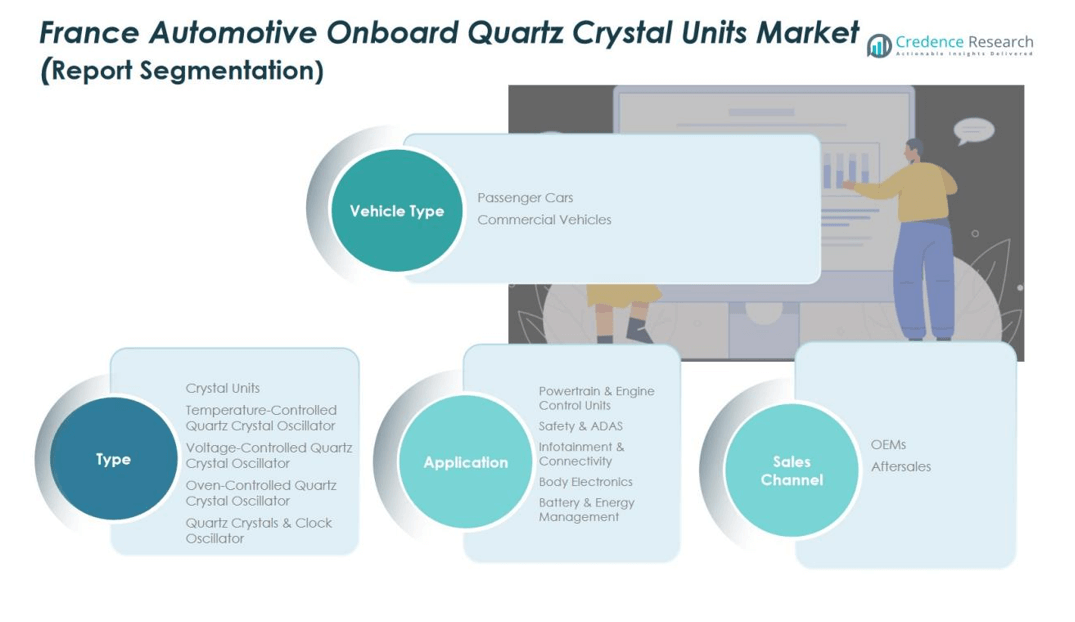

Market Segmentation Analysis:

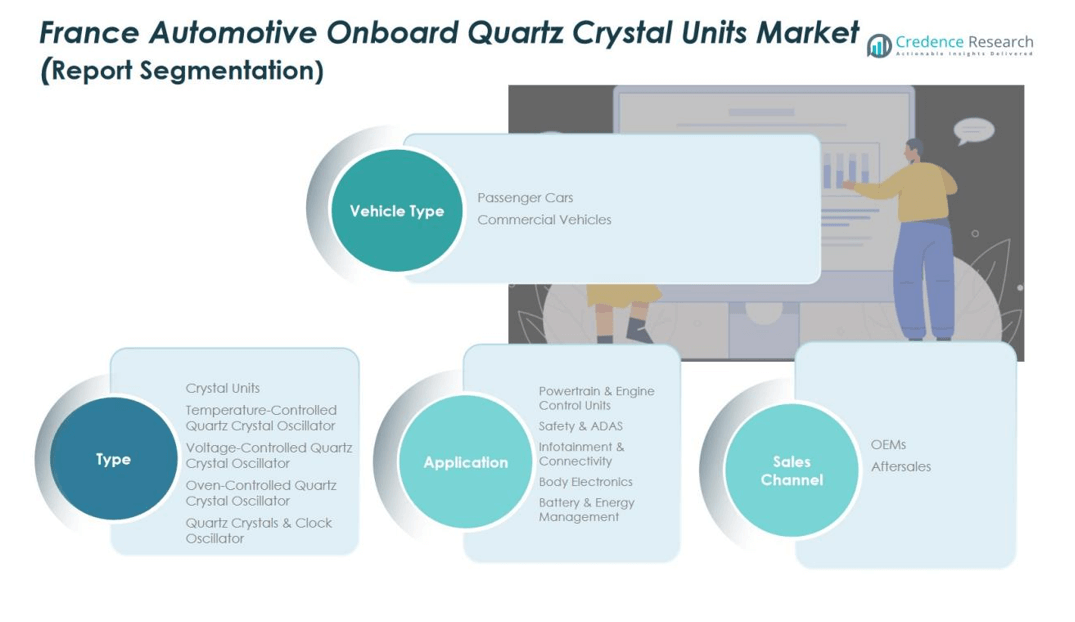

By Vehicle Segment

The France Automotive Onboard Quartz Crystal Units Market is segmented into passenger cars and commercial vehicles. Passenger cars account for the dominant share due to the rapid integration of infotainment systems, ADAS technologies, and electronic control units that require precise frequency regulation. It benefits from strong domestic demand and production of electric and hybrid passenger cars. Commercial vehicles show steady adoption driven by the growing need for fleet connectivity, telematics, and energy-efficient electronics in logistics and transport operations.

- For Instance, Electric vehicles, like the newer models in Renault’s lineup, utilize standard electronic components that include quartz crystal oscillators for precise timing. The Renault ZOE was discontinued in 2024, with its successor, the Renault 5 E-Tech, scheduled for a 2025 release.

By Application Segment

Key application areas include powertrain and engine control units, safety and ADAS, infotainment and connectivity, body electronics, and battery and energy management. Powertrain and ADAS applications hold major market shares due to their reliance on stable frequency control for high-speed data processing and safety-critical operations. It gains traction from regulatory focus on vehicle safety and emission efficiency. Infotainment and connectivity systems continue to expand with rising consumer demand for smart, networked vehicles.

- For Instance, Infineon’s current AURIX TC3xx microcontrollers feature up to six TriCore CPUs, with up to four operating in lockstep for ASIL-D safety compliance in powertrain and ADAS applications. High-end models offer up to 4,000 DMIPS total computing power, more than double the previous generation, while consuming under 2 watts.

By Type Segment

By type, the market includes crystal units, temperature-controlled, voltage-controlled, and oven-controlled quartz crystal oscillators, along with clock oscillators. Crystal units dominate due to their cost-effectiveness and wide suitability across automotive systems. Temperature-controlled oscillators are gaining preference in EVs and ADAS due to their superior frequency stability. It drives innovation toward compact, high-reliability designs supporting the next generation of connected and autonomous vehicles.

Segmentations:

By Vehicle Segment

- Passenger Cars

- Commercial Vehicles

By Application Segment

- Powertrain & Engine Control Units

- Safety & ADAS

- Infotainment & Connectivity

- Body Electronics

- Battery & Energy Management

By Type Segment

- Crystal Units

- Temperature-Controlled Quartz Crystal Oscillator (TCXO)

- Voltage-Controlled Quartz Crystal Oscillator (VCXO)

- Oven-Controlled Quartz Crystal Oscillator (OCXO)

- Quartz Crystals & Clock Oscillator

By Sales Channel Segment

Regional Analysis:

Strong Position within the Western European Automotive Ecosystem

The France Automotive Onboard Quartz Crystal Units Market benefits from the country’s strong position within Western Europe’s automotive manufacturing network. France serves as a major hub for automotive innovation, with strong participation from OEMs and Tier-1 suppliers in electronic systems development. Its focus on high-performance, sustainable mobility solutions drives continuous integration of precision electronic components. The nation’s advanced R&D infrastructure supports collaborations between semiconductor firms and automakers to enhance product reliability and efficiency. It helps strengthen France’s competitive edge within the region’s expanding automotive electronics sector.

Rising Demand Driven by Electrification and Digitalization Trends

The rapid growth of electric and hybrid vehicle production continues to shape regional demand patterns. France’s policies promoting EV adoption and battery innovation have accelerated integration of quartz-based frequency control systems in next-generation vehicles. It supports stable signal management and synchronization across power electronics and safety features. The presence of key automakers investing in EV assembly and smart vehicle platforms reinforces this demand. Expanding digitalization across vehicle subsystems further amplifies the use of precision oscillators, creating long-term market opportunities.

Export Opportunities and Regional Supply Chain Integration

France plays a strategic role in the European export network for automotive electronic components. It benefits from strong trade links with Germany, Italy, and Spain, ensuring a stable supply and demand balance across the region. Increasing localization of component manufacturing enhances supply chain resilience and reduces import dependency. It also supports France’s goal to strengthen domestic semiconductor and crystal component production. The combined effect of innovation, manufacturing strength, and strategic trade relationships positions France as a key contributor to Europe’s automotive quartz technology growth.

Key Player Analysis:

- Micro Crystal

- NDK

- TXC Corporation

- Kyocera

- Euroquartz Limited

- Daishinku Corp (KDS)

- TKD Science

- Guoxin Micro

- Diodes Incorporated

- CTS Corporation

- Golledge Electronics

Competitive Analysis:

The France Automotive Onboard Quartz Crystal Units Market is moderately consolidated, with key global and regional players driving innovation and supply. Major companies include Micro Crystal, NDK, TXC Corporation, Kyocera, Euroquartz Limited, Daishinku Corp (KDS), TKD Science, and Guoxin Micro. Competition focuses on product quality, frequency stability, and performance optimization for automotive electronics. It emphasizes technological advancements in temperature-controlled and low-power crystal oscillators suited for electric and autonomous vehicles. Manufacturers are expanding local partnerships and investing in R&D to strengthen their European presence. Continuous improvements in miniaturization, reliability, and vibration resistance remain central to sustaining market competitiveness in France’s evolving automotive electronics ecosystem.

Recent Developments:

- In August 2024, NDK formed a strategic alliance with Rotakorn Electronics AB, enabling the supply of crystal units and oscillators to customers in Nordic countries.

- In January 2025, Kyocera Corporation exhibited groundbreaking innovations at CES 2025 in Las Vegas, including the world’s first camera-LiDAR fusion sensor for autonomous driving, along with an AI-based depth sensor and cutting-edge mobility solutions aimed at advancing automotive safety and smart transportation systems

Report Coverage:

The research report offers an in-depth analysis based on Vehicle, Application, Type and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

-

- Demand for high-precision frequency components will increase with the growing adoption of electric and autonomous vehicles.

- France will strengthen its role as a leading European hub for automotive electronics innovation and integration.

- Rising production of EVs and hybrid vehicles will continue to expand the need for reliable quartz crystal units.

- Manufacturers will invest in localized production to reduce supply chain dependency and improve responsiveness.

- Advancements in miniaturization and temperature-compensated technologies will enhance component durability and accuracy.

- Collaboration between semiconductor suppliers and automotive OEMs will accelerate product customization for specific vehicle platforms.

- The growing integration of ADAS, infotainment, and connectivity systems will sustain market momentum.

- Sustainability initiatives will drive the development of eco-efficient materials and low-energy crystal oscillators.

- Increased automation in manufacturing processes will support consistent quality and lower production costs.

- France’s focus on digital transformation and smart mobility will ensure steady long-term growth for automotive quartz technologies.