Market Overview

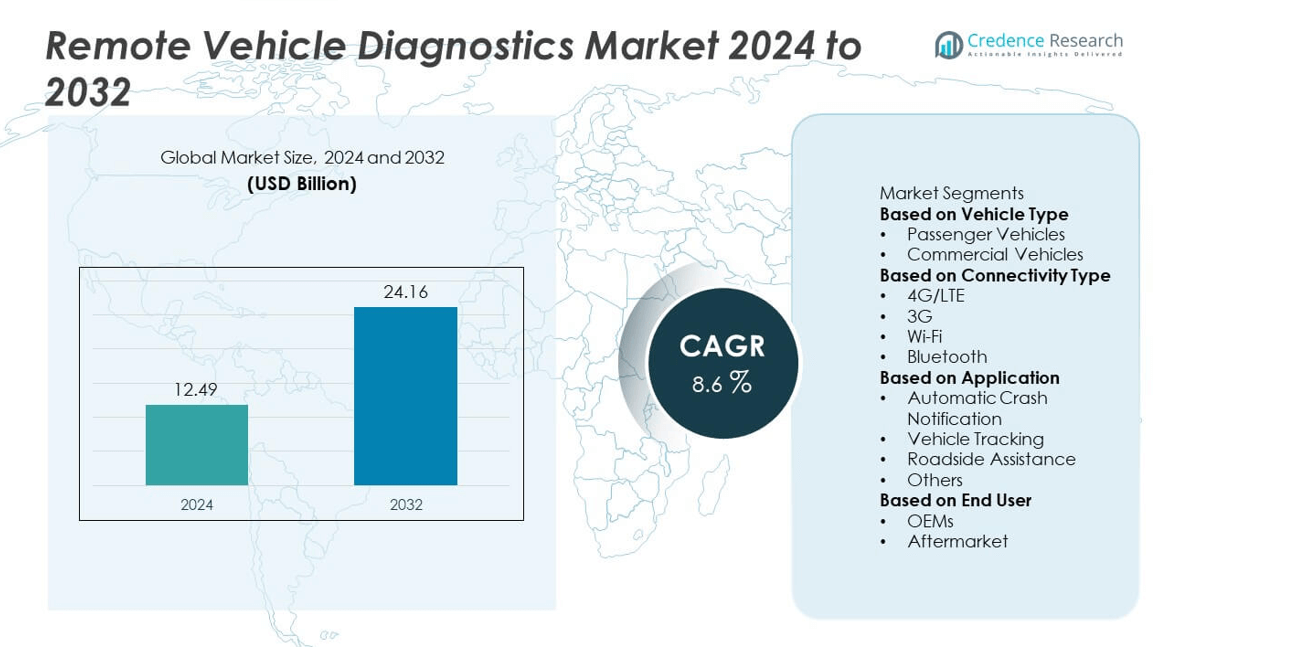

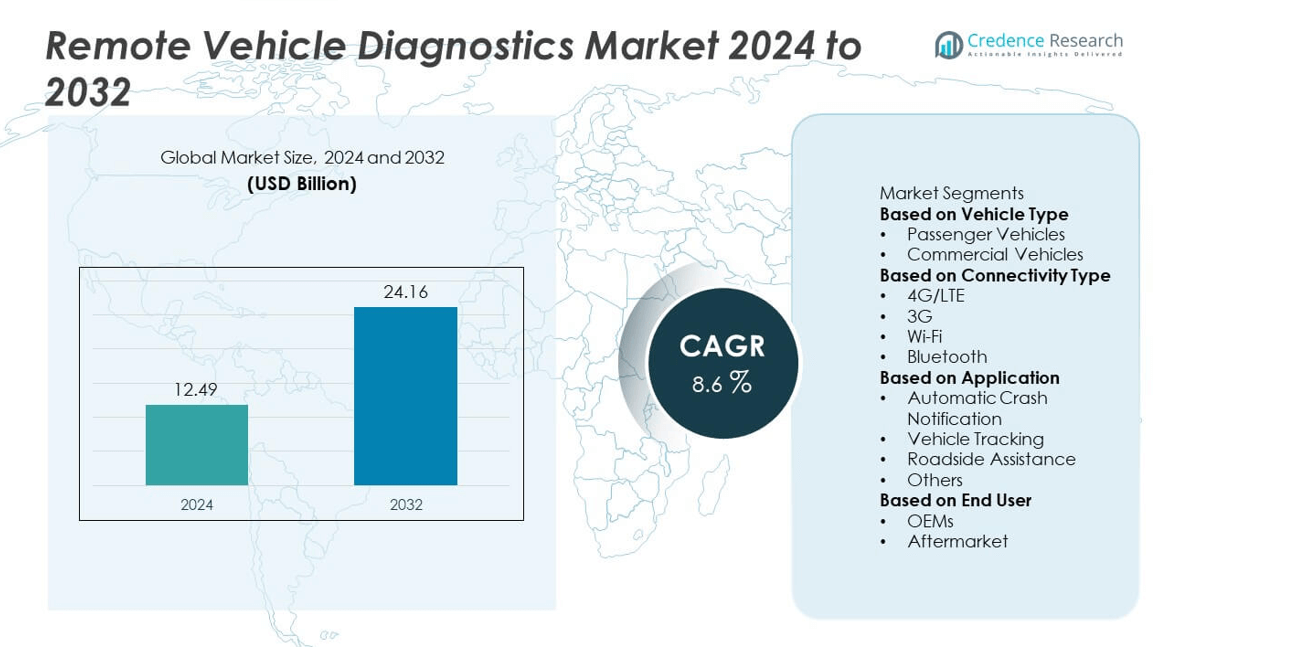

The Remote Vehicle Diagnostics market was valued at USD 12.49 billion in 2024 and is projected to reach USD 24.16 billion by 2032, growing at a CAGR of 8.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Remote Vehicle Diagnostics market Size 2024 |

USD 12.49 billion |

| Remote Vehicle Diagnostics market, CAGR |

8.6% |

| Remote Vehicle Diagnostics market Size 2032 |

USD 24.16 billion |

The remote vehicle diagnostics market is led by key players including Bosch Automotive Service Solutions, Continental AG, Delphi Technologies, DENSO Corporation, ZF Friedrichshafen AG, Texa S.p.A., Snap-on Inc., Siemens AG, Vidiwave Technologies, and Geotab Inc. These companies dominate through advanced diagnostic platforms, predictive maintenance tools, and cloud-based telematics integration. Bosch and Continental lead in large-scale OEM partnerships, while DENSO and ZF focus on vehicle electronics and system analytics. North America emerged as the leading region, capturing a 38% market share in 2024, supported by strong adoption of connected vehicle technologies and advanced fleet management systems.

Market Insights

- The remote vehicle diagnostics market was valued at USD 12.49 billion in 2024 and is projected to reach USD 24.16 billion by 2032, registering a CAGR of 8.6%.

- Market growth is driven by rising adoption of connected and smart vehicles, growing electric vehicle deployment, and increasing use of predictive maintenance systems that enhance fleet efficiency.

- The market is witnessing key trends such as AI-enabled diagnostics, cloud-based telematics platforms, and over-the-air update integration, which improve fault detection accuracy and reduce downtime.

- Major players including Bosch Automotive Service Solutions, Continental AG, Delphi Technologies, and DENSO Corporation dominate through technological innovation, OEM partnerships, and digital platform expansion.

- Regionally, North America led with 38% share in 2024, followed by Europe at 29% and Asia-Pacific at 25%. By vehicle type, passenger vehicles accounted for 63% of the market, driven by strong adoption of connected systems and consumer demand for smart mobility features.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Vehicle Type

Passenger vehicles dominated the remote vehicle diagnostics market with a 63% share in 2024. The segment’s leadership is due to increasing integration of onboard telematics and advanced diagnostic tools in modern passenger cars. Growing consumer preference for connected features that monitor fuel efficiency, engine health, and battery performance supports adoption. Automakers are embedding cloud-based diagnostic platforms to provide real-time fault alerts and predictive maintenance updates. The rise of electric and hybrid passenger vehicles further enhances the need for continuous remote monitoring to ensure performance reliability.

- For instance, DENSO Corporation, a long-time partner of Toyota, has developed advanced cloud-connected technologies, including the “Mobility IoT Core” platform. This platform, designed to enable real-time data collection and analysis, is fundamental to the development of next-generation connected and automated vehicles.

By Connectivity Type

The 4G/LTE segment held the largest share of 54% in 2024, driving the connectivity landscape in remote vehicle diagnostics. Its dominance is attributed to high-speed data transfer, low latency, and enhanced reliability, enabling real-time communication between vehicles and cloud platforms. 4G/LTE networks support advanced applications such as over-the-air software updates, continuous engine monitoring, and remote fault reporting. The increasing deployment of LTE-enabled telematics control units by leading OEMs accelerates data-driven diagnostics. As 5G infrastructure expands, 4G/LTE remains the primary connectivity backbone for most vehicle fleets globally.

- For instance, Continental AG’s telematics control units enable remote diagnostics and secure over-the-air (OTA) software updates, transmitting data over cellular networks like LTE and 5G.

By Application

Vehicle tracking emerged as the dominant application, accounting for a 39% share in 2024. This leadership stems from the growing demand for fleet visibility, driver behavior monitoring, and anti-theft solutions. Real-time tracking integrated with diagnostic alerts enables proactive maintenance scheduling and operational efficiency. Fleet operators benefit from predictive analytics that reduce downtime and maintenance costs. Rising adoption of IoT-based tracking systems by logistics companies strengthens the market for vehicle diagnostics. The segment also gains from increasing government mandates for GPS-based monitoring in commercial transportation.

Key Growth Drivers

Rising Adoption of Connected and Smart Vehicles

The widespread integration of telematics and IoT in vehicles is accelerating market growth. Automakers are embedding advanced diagnostic systems that monitor real-time engine health, emissions, and performance data. These systems enhance safety, reduce downtime, and improve the ownership experience. As consumers increasingly prefer connected and intelligent vehicles, manufacturers are investing in digital platforms that enable continuous monitoring and remote maintenance, supporting better reliability and higher operational efficiency across both personal and commercial vehicle categories.

- For instance, Bosch offers cloud-based diagnostic solutions that provide vehicle health data and analysis for improved workshop efficiency and proactive maintenance. Its connected mobility platforms can service multi-million vehicle fleets and handle large volumes of telematics data, enabling advanced predictive diagnostics and remote software updates.

Expanding Electric Vehicle Fleet Deployment

The rapid shift toward electric mobility is boosting demand for remote vehicle diagnostics. Electric vehicles depend heavily on digital sensors and control modules that require continuous health checks. Remote diagnostics help identify faults early, optimize charging performance, and extend battery life. Automakers are implementing AI-driven diagnostic tools that allow over-the-air updates and predictive maintenance. This expansion aligns with government sustainability initiatives and growing consumer interest in zero-emission transportation, creating strong momentum for connected diagnostic solutions.

- For instance, Siemens AG utilizes its industrial IoT platform (formerly known as MindSphere and now part of the Insights Hub) to provide advanced analytics for industrial assets. Siemens provides solutions for electric vehicle (EV) fleet management, focusing on optimizing operations, energy management, and charging infrastructure.

Increasing Demand for Predictive Maintenance Solutions

Predictive maintenance is becoming a cornerstone of modern fleet management. Remote diagnostics systems analyze live data to forecast potential issues before they disrupt operations. This proactive approach minimizes repair costs, extends component life, and increases fleet uptime. Automotive manufacturers and service providers are adopting cloud-based predictive tools that enable real-time insights into vehicle performance. The integration of machine learning and analytics further enhances diagnostic accuracy, transforming vehicle maintenance into a data-driven, cost-efficient process.

Key Trends & Opportunities

Integration of AI and Machine Learning in Diagnostics

Artificial intelligence is reshaping the landscape of remote vehicle diagnostics. Machine learning algorithms analyze vast amounts of performance data to detect early anomalies and predict mechanical failures. These smart systems help shift maintenance strategies from reactive to proactive. Automakers are using AI-driven insights to enhance system reliability and customer experience. This evolution opens new opportunities for software developers and telematics firms to provide smarter, more adaptive diagnostic solutions across vehicle networks.

- For instance, ZF Friedrichshafen AG introduced its ProAI system that uses artificial intelligence and big data analytics to offer advanced predictive maintenance and fleet management services for commercial vehicles.

Growing Adoption of Over-the-Air Updates

Over-the-air technology is transforming how vehicles are maintained and serviced. This approach allows remote updates to critical systems without requiring dealership visits. Automakers are extending OTA capabilities to include diagnostic recalibrations, software enhancements, and fault rectifications. The ability to resolve issues remotely reduces service time and operational costs. It also enhances driver convenience while enabling manufacturers to gather valuable system data for continuous improvement and performance optimization.

- For instance, Tesla has deployed over-the-air diagnostics and software updates to its fleet of millions of vehicles, enabling the remote correction of firmware issues without physical intervention.

Expansion of Cloud-Based Fleet Management Platforms

Cloud computing is becoming essential for large-scale diagnostics and fleet operations. Centralized cloud platforms enable seamless data access, storage, and monitoring across multiple vehicles in real time. Fleet managers can identify faults, schedule maintenance, and analyze performance metrics remotely. As network connectivity expands globally, demand for cloud-integrated diagnostics platforms continues to grow. This creates opportunities for telematics providers to offer flexible, subscription-based solutions that scale easily with fleet size and operational needs.

Key Challenges

Data Security and Privacy Concerns

The increasing digital interconnection of vehicles brings major cybersecurity challenges. Remote diagnostics rely on continuous data transmission between onboard systems and cloud platforms, raising privacy and security concerns. Any breach could expose sensitive driver or vehicle information. Automakers must adopt strong encryption methods, authentication protocols, and data governance frameworks. Building customer trust through transparent security practices is vital to ensure sustainable adoption of connected diagnostic systems.

High Implementation and Integration Costs

Implementing advanced diagnostic systems involves substantial infrastructure, hardware, and software costs. Smaller operators often struggle to afford the technology or align it with existing vehicle architectures. Integrating diagnostics across diverse platforms also adds technical complexity. Manufacturers face additional costs in ensuring system compatibility across multiple vehicle models. Reducing implementation expenses through modular platforms, scalable technologies, and subscription-based offerings will be key to driving broader market adoption.

Regional Analysis

North America

North America held the largest share of 38% in the remote vehicle diagnostics market in 2024. The dominance is driven by strong adoption of connected car technologies, advanced telematics, and data analytics solutions. Major automakers and fleet operators across the United States and Canada are integrating real-time diagnostic systems to enhance vehicle safety and operational efficiency. Supportive regulations promoting vehicle connectivity and emission monitoring further strengthen market growth. Expanding electric vehicle sales and increasing preference for predictive maintenance platforms continue to enhance the region’s leadership position in remote diagnostics adoption.

Europe

Europe accounted for 29% of the market share in 2024, supported by growing demand for intelligent mobility and stringent emission control standards. The region’s automotive industry is rapidly embracing remote diagnostic tools to ensure compliance with safety and environmental regulations. Automakers are deploying cloud-based diagnostic solutions to support connected and electric vehicle fleets. Countries such as Germany, the United Kingdom, and France lead in integrating telematics for predictive maintenance. Rising investments in 5G connectivity and vehicle-to-infrastructure communication are further enabling advanced remote monitoring and software-driven automotive diagnostics.

Asia-Pacific

Asia-Pacific captured a 25% share in 2024, emerging as a fast-growing market for remote vehicle diagnostics. Strong vehicle production in China, Japan, South Korea, and India supports widespread technology integration across passenger and commercial fleets. The rise of connected vehicle platforms, coupled with government support for electric mobility, drives adoption. Local automakers are investing in cloud-enabled diagnostics and predictive maintenance to enhance competitiveness. Expanding telecommunication infrastructure and consumer demand for smart mobility are accelerating the transition toward digital vehicle management systems across major automotive markets in the region.

Latin America

Latin America accounted for 5% of the remote vehicle diagnostics market share in 2024. The region’s growth is supported by expanding fleet operations, increasing use of telematics in logistics, and gradual connectivity upgrades in newer vehicles. Brazil and Mexico lead adoption, driven by urban transportation modernization and regulatory support for emission control. Local service providers are partnering with OEMs to introduce cost-efficient diagnostic platforms tailored for regional fleet needs. Growing awareness of preventive maintenance and integration of real-time tracking solutions further strengthen market penetration across Latin America’s developing automotive landscape.

Middle East & Africa

The Middle East & Africa region held a 3% share of the remote vehicle diagnostics market in 2024. Market growth is fueled by rising demand for fleet management and transportation safety solutions. Gulf nations, including the UAE and Saudi Arabia, are promoting connected mobility initiatives under national digital transformation agendas. Commercial fleet operators are increasingly adopting telematics to improve asset tracking and maintenance efficiency. Although adoption remains limited in parts of Africa, expanding 4G connectivity and smart logistics networks are creating new opportunities for remote vehicle diagnostics deployment across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

By Connectivity Type

- 4G/LTE

- 3G

- Wi-Fi

- Bluetooth

By Application

- Automatic Crash Notification

- Vehicle Tracking

- Roadside Assistance

- Others

By End User

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the remote vehicle diagnostics market is defined by major players such as Bosch Automotive Service Solutions, Continental AG, Delphi Technologies, DENSO Corporation, ZF Friedrichshafen AG, Texa S.p.A., Snap-on Inc., Siemens AG, Vidiwave Technologies, and Geotab Inc. These companies focus on developing advanced telematics and diagnostic platforms that enhance real-time vehicle monitoring, predictive maintenance, and over-the-air software management. Continuous investment in AI, IoT, and cloud integration remains central to their strategies, enabling improved fault detection and data analytics capabilities. Partnerships between OEMs and technology providers are expanding to deliver integrated diagnostic ecosystems supporting both ICE and EV vehicles. Additionally, leading firms are pursuing mergers and collaborations to strengthen product portfolios and regional presence. The growing need for scalable, subscription-based diagnostics solutions is driving competition among global and regional players, with innovation, connectivity, and data security emerging as key differentiating factors in this evolving market.

Key Player Analysis

Recent Developments

- In October 2025, Geotab Inc. surpassed 5 million connected-vehicle subscriptions globally, reinforcing its platform’s scale for real-time diagnostics and fleet telematics.

- In September 2024, ZF Friedrichshafen AG launched its “ZF [pro]Diagnostics” digital service providing multi-brand, multi-system diagnostics access for the European vehicle park.

- In 2024, Bosch Automotive Service Solutions rolled out new functions in its Remote Diagnostics Service (RDS), extending coverage to additional vehicle brands and markets.

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Connectivity Type, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Remote vehicle diagnostics adoption will expand with growing demand for connected and intelligent vehicles.

- Integration of artificial intelligence and machine learning will improve predictive maintenance accuracy.

- Electric vehicle growth will drive demand for advanced diagnostic systems and battery monitoring tools.

- Cloud-based diagnostic platforms will become standard for fleet and OEM operations.

- Over-the-air software updates will reduce service time and enhance vehicle performance.

- Automakers will strengthen cybersecurity measures to protect diagnostic data transmission.

- Partnerships between OEMs and telematics providers will enhance integrated mobility ecosystems.

- The aftermarket segment will grow as older vehicles adopt retrofit diagnostic solutions.

- Asia-Pacific will emerge as the fastest-growing region due to expanding vehicle production and connectivity infrastructure.

- Continuous innovation in sensor technology and 5G connectivity will redefine real-time diagnostics capabilities globally.