Market Overview

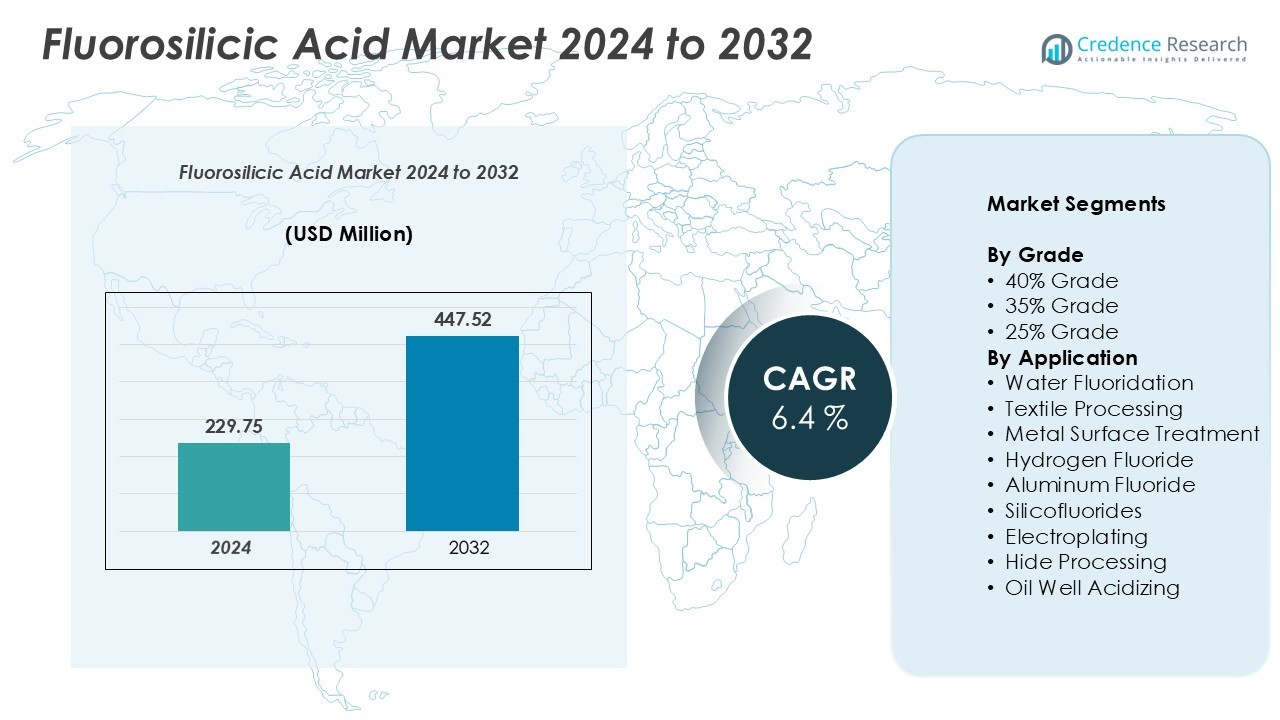

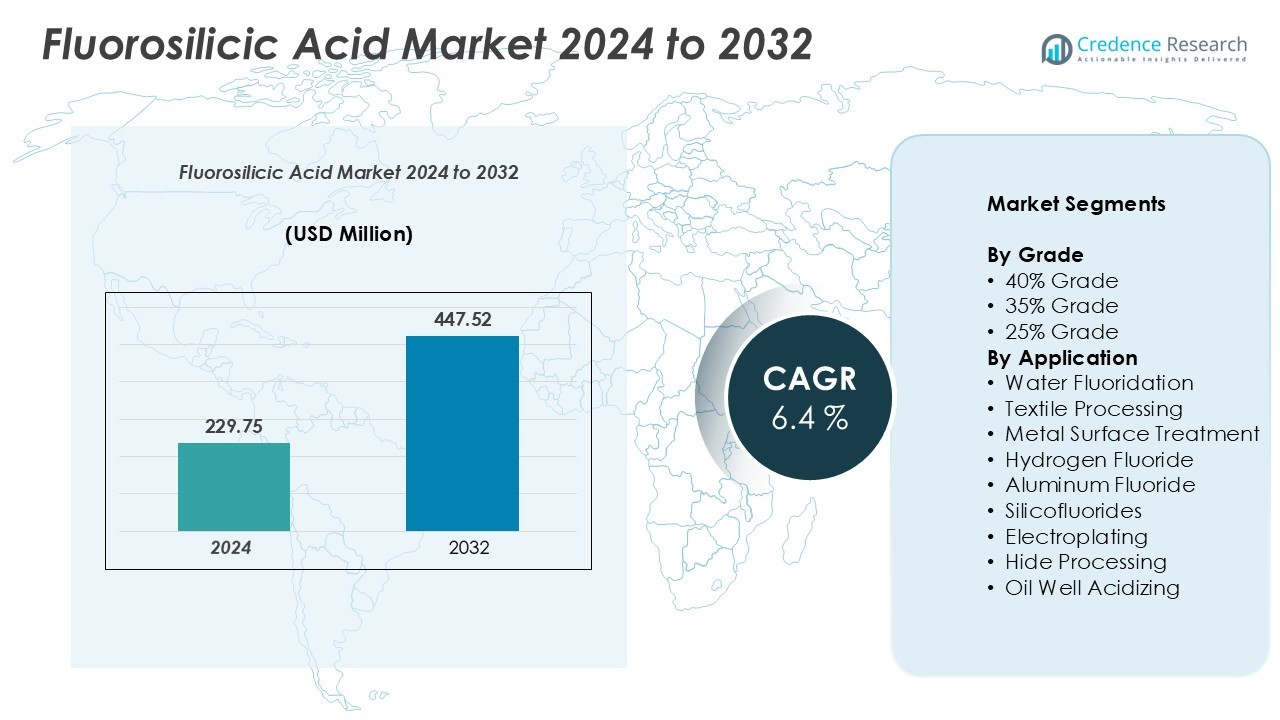

The glucosinolates market size was valued at USD 239.75 million in 2024 and is anticipated to reach USD 306.15 million by 2032, at a CAGR of 3.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Glucosinolates Market Size 2024 |

USD 239.75 Million |

| Glucosinolates Market, CAGR |

3.6% |

| Glucosinolates Market Size 2032 |

USD 306.15 Million |

The glucosinolates market is led by prominent companies including Brightol, Incbel, Jarrow Formulas GmbH, Native Extracts, Nutra Canada, Xian Yuensun Biological Co. Ltd, Seagate Products, Kirkman Group, Interherb Ltd., and NutraValley, which drive growth through innovation, strategic partnerships, and global distribution networks. North America dominates the market with approximately 32% share, supported by high consumer awareness and strong adoption of functional foods and nutraceuticals. Europe follows closely at 28%, fueled by regulatory support and preference for natural, plant-based ingredients. Asia-Pacific holds around 25%, reflecting rising health consciousness and expanding functional food sectors in China, Japan, and India. Latin America and the Middle East & Africa account for 10% and 5% respectively, presenting emerging opportunities for market expansion. Collectively, these regions and players shape a competitive and rapidly evolving global glucosinolates landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global glucosinolates market was valued at USD 239.75 million in 2024 and is projected to reach USD 306.15 million by 2032, growing at a CAGR of 3.6%.

- Market growth is driven by increasing consumer awareness of health benefits, including antioxidant, anti-inflammatory, and anticancer properties, which boosts demand in functional foods, nutraceuticals, and dietary supplements.

- Key trends include rising adoption in functional foods, nutraceuticals, and personal care products, as well as the integration of glucosinolates in plant-based and clean-label formulations. Aliphatic glucosinolates dominate the type segment, while cruciferous vegetables lead the source segment.

- The competitive landscape features major players such as Brightol, Incbel, Jarrow Formulas GmbH, Native Extracts, Nutra Canada, and others, focusing on R&D, product innovation, and strategic partnerships to strengthen their market positions.

- Regionally, North America holds 32% market share, Europe 28%, Asia-Pacific 25%, Latin America 10%, and Middle East & Africa 5%, reflecting varying consumer awareness, regulatory support, and industry adoption across segments.

Market Segmentation Analysis:

By Source

The glucosinolates market is primarily segmented by source, including cruciferous vegetables, seeds, fruits, herbs and spices, and other plant sources. Cruciferous vegetables dominate this segment, holding the largest market share due to their high glucosinolate content and widespread consumption in diets worldwide. The growing consumer preference for natural, plant-based compounds and health-conscious foods drives demand. Seeds and herbs are emerging sub-segments, benefiting from their concentrated glucosinolate levels, which are increasingly utilized in supplements, functional foods, and nutraceutical formulations, supporting overall market expansion.

- For instance, in a study of 80 broccoli genotypes, the total glucosinolate content in florets ranged from 0.467 to 57.156 µmol/g dry weight, with the highest content being approximately 122-fold higher than the lowest.

By Application

In terms of application, glucosinolates are extensively used in the food and beverage industry, pharmaceuticals, cosmetics and personal care products, animal feed additives, and functional foods and nutraceuticals. The food and beverage industry is the dominant sub-segment, accounting for the highest market share, driven by the rising demand for natural antioxidants, flavor enhancers, and health-promoting ingredients. The pharmaceutical and nutraceutical sectors are also growing rapidly, leveraging glucosinolates for their potential anti-cancer, anti-inflammatory, and metabolic health benefits, which strengthens their adoption across functional product lines.

- For instance, Mustard seeds are a rich source of glucosinolates, which contribute to the pungent flavor in mustard condiments, but mustard seed oil is a poor source of these compounds, which are largely left behind in the meal after oil extraction.

By Type

The market by type includes aliphatic, aromatic, indolic, and sulfur-containing glucosinolates. Aliphatic glucosinolates hold the largest share within this segment, attributed to their high prevalence in commonly consumed cruciferous vegetables such as broccoli, cabbage, and kale. Their strong antioxidant and detoxification properties drive extensive use in functional foods, supplements, and nutraceutical products. Indolic and sulfur-containing glucosinolates are gaining traction for specialized health applications, particularly in cancer prevention and metabolic regulation, contributing to diversification of product offerings and furthering market growth.

Key Growth Drivers

Rising Consumer Awareness of Health Benefits

Growing awareness of the health-promoting properties of glucosinolates is a primary driver of market growth. Consumers increasingly seek natural compounds with potential antioxidant, anti-inflammatory, and anticancer benefits, creating robust demand in functional foods, nutraceuticals, and dietary supplements. This trend is particularly evident in developed regions where preventive healthcare practices are widely adopted. The incorporation of glucosinolates in food and beverage products allows manufacturers to market products with added health value, encouraging repeat purchases and brand loyalty. Additionally, the surge in lifestyle-related diseases has prompted healthcare professionals and nutritionists to recommend glucosinolate-rich diets, further reinforcing consumer adoption and expanding the market globally.

- For instance, Arjuna Natural Extracts Ltd., an Indian company, did develop the patented curcumin formulation known as BCM-95 (also sold as Curcugreen). This formulation is widely used in dietary supplements and research indicates it has enhanced anti-inflammatory and antioxidant properties.

Expansion of Functional Foods and Nutraceuticals

The growth of the functional foods and nutraceutical segment serves as a key catalyst for glucosinolate adoption. Manufacturers increasingly incorporate glucosinolates into products such as dietary supplements, fortified beverages, and meal replacements due to their bioactive properties. Rising consumer demand for immunity-boosting and metabolism-supporting products has led to a surge in R&D investment for glucosinolate-enriched formulations. Regulatory support for plant-derived bioactive ingredients in many regions has also encouraged product innovation. The ability of glucosinolates to enhance nutritional profiles while maintaining taste and safety makes them highly attractive for product differentiation in a competitive food and supplement market.

- For instance, A study by the USDA Agricultural Research Service found that mild, short-term heating of broccoli using methods like microwaving or steaming can increase the yield and bioavailability of sulforaphane, a compound formed from glucoraphanin upon cell damage, which is associated with anti-cancer effects. Another USDA-funded study found that the human gut microbiome can help convert glucoraphanin to sulforaphane, with highly variable efficiency across individuals.

Technological Advancements in Extraction and Formulation

Innovations in extraction, purification, and formulation technologies are accelerating market growth. Modern techniques, including enzymatic extraction, supercritical fluid extraction, and microencapsulation, enable higher yield, stability, and bioavailability of glucosinolates in final products. These advancements allow manufacturers to develop powders, liquids, capsules, and granules that retain active compounds for longer shelf life. Additionally, the improved solubility and incorporation into diverse food matrices facilitate use in beverages, functional foods, and cosmetics. Such technological developments reduce production costs and expand market accessibility, fostering adoption across various industries while supporting large-scale commercialization of glucosinolate-based products.

Key Trends & Opportunities

Integration into Sustainable and Plant-Based Products

A significant trend in the glucosinolates market is their integration into sustainable and plant-based food and personal care products. Manufacturers are increasingly using glucosinolate-rich extracts from cruciferous vegetables, seeds, and herbs to develop vegan supplements, natural cosmetics, and eco-friendly nutraceuticals. The rising consumer preference for clean-label, non-GMO, and environmentally responsible products presents a lucrative opportunity. By positioning glucosinolate-based products as both health-promoting and sustainable, companies can appeal to environmentally conscious consumers while tapping into rapidly growing plant-based product segments across food, beverage, and personal care markets.

- For instance, Arjuna Natural Extracts Ltd., an Indian company specializing in plant-based active compounds, has developed BCM-95, a patented formulation of curcumin, which is widely used in dietary supplements for its anti-inflammatory properties.

Growth in Preventive Healthcare and Personalized Nutrition

The trend toward preventive healthcare and personalized nutrition is creating strong opportunities for glucosinolates. Consumers increasingly seek tailored dietary solutions targeting immunity, metabolic health, and chronic disease prevention. Glucosinolate-enriched functional foods, supplements, and beverages align with these needs, enabling personalized health management. This trend has encouraged partnerships between nutraceutical companies and research institutions to develop evidence-based formulations. The combination of scientific validation, consumer education, and technology-driven product customization is expected to expand market adoption and reinforce glucosinolates as a key ingredient in next-generation health solutions.

- For instance, Sigma-Tau, the Italian pharmaceutical company that preceded Leadiant Biosciences, had a portfolio of more than 100 products. Its product range covered a broad array of therapeutic areas, including cardiometabolic, orthopedic, rheumatologic, and gastroenterology disorders, as well as oncology, infectious diseases, and rare diseases. Leadiant Biosciences, the successor company, now focuses exclusively on the development and distribution of therapies for rare diseases.

Rising Demand in Cosmetic and Personal Care Applications

Glucosinolates are increasingly incorporated into cosmetic and personal care products due to their antioxidant and detoxifying properties. Consumers demand products that protect skin from oxidative stress, reduce inflammation, and enhance overall appearance using natural ingredients. This trend creates opportunities for glucosinolates in creams, serums, lotions, and hair care products, particularly within premium and natural product segments. As awareness of plant-based bioactives grows, companies can differentiate products and target niche markets by highlighting glucosinolate benefits, driving innovation and premium pricing in the personal care industry.

Key Challenges

Limited Awareness in Emerging Markets

Despite rising global interest, limited awareness of glucosinolates and their health benefits in emerging markets remains a key challenge. Consumers in these regions often lack knowledge about bioactive compounds, leading to slower adoption of functional foods and nutraceuticals. Additionally, cultural dietary habits and limited access to fortified products hinder market penetration. Companies must invest in consumer education, awareness campaigns, and collaborations with healthcare professionals to build trust and highlight the benefits of glucosinolate-rich products, which can require significant marketing expenditure and long-term commitment.

Regulatory and Standardization Barriers

Regulatory challenges and lack of standardized guidelines for glucosinolate content in products pose hurdles for manufacturers. Variations in permissible concentrations across countries and the absence of uniform labeling standards complicate product development and cross-border trade. Compliance with stringent regulations for health claims, safety, and efficacy testing increases operational costs and limits rapid market expansion. These challenges necessitate continuous research, documentation, and quality control measures, making it essential for companies to navigate complex regulatory frameworks while maintaining product consistency and consumer trust.

Regional Analysis

North America

North America holds the largest share of the global glucosinolates market, accounting for approximately 32%. The United States dominates the region due to high consumer awareness of health benefits, strong adoption of functional foods, and supportive regulatory frameworks for plant-based bioactives. Rising demand for preventive healthcare products and natural dietary supplements drives market growth. Manufacturers in food and beverage, pharmaceuticals, and personal care sectors increasingly incorporate glucosinolates into their offerings. Continuous innovation in extraction and formulation technologies strengthens product availability, making North America a hub for both market expansion and premium product development.

Europe

Europe represents roughly 28% of the global glucosinolates market. Germany, France, and the UK lead consumption, fueled by a preference for natural, plant-derived functional ingredients and stringent health and safety regulations. Aliphatic glucosinolates dominate the market, primarily used in nutraceuticals and functional foods. Consumer interest in preventive healthcare, clean-label products, and personalized nutrition supports adoption. Investments in R&D and advanced formulation technologies enhance product quality, helping European manufacturers maintain a competitive edge. The region’s strong regulatory framework and health-conscious population drive consistent market growth and innovation.

Asia-Pacific

Asia-Pacific holds an estimated 25% market share and is the fastest-growing region due to increasing health awareness, rising disposable incomes, and adoption of functional foods. China, Japan, and India dominate consumption because of traditional diets rich in cruciferous vegetables and urbanization-driven lifestyle changes. The food, beverage, and pharmaceutical sectors are major contributors to growth, while research collaborations enhance product development. Expansion of e-commerce and health-focused marketing accelerates market penetration. Asia-Pacific offers high potential for long-term growth, driven by a large population base and increasing interest in natural health-promoting ingredients.

Latin America

Latin America accounts for around 10% of the global glucosinolates market. Brazil and Mexico drive consumption, supported by the growth of functional foods and nutraceuticals. Increasing awareness of health benefits, preventive healthcare adoption, and organic dietary solutions contribute to market expansion. Challenges such as limited distribution infrastructure and low consumer knowledge are gradually addressed through government initiatives, partnerships with international manufacturers, and educational campaigns. The market presents opportunities for growth through awareness-building, product innovation, and improved access to glucosinolate-enriched products.

Middle East & Africa

The Middle East & Africa represents approximately 5% of the global glucosinolates market. Countries like the UAE, Saudi Arabia, and South Africa show rising demand for functional foods, nutraceuticals, and personal care products enriched with glucosinolates. Urbanization, increasing health consciousness, and higher disposable incomes drive gradual adoption. However, regulatory variations, high product costs, and limited consumer awareness hinder rapid market growth. Companies are focusing on awareness campaigns, strategic partnerships, and product innovation to capture emerging opportunities and strengthen their presence in this developing region.

Market Segmentations:

By Source

- Cruciferous Vegetables

- Seeds

- Fruits

- Herbs and Spices

- Other Plant Sources

By Application

- Food and Beverage Industry

- Pharmaceuticals

- Cosmetics and Personal Care Products

- Animal Feed Additives

- Functional Foods and Nutraceuticals

By Type

- Aliphatic Glucosinolates

- Aromatic Glucosinolates

- Indolic Glucosinolates

- Sulfur-containing Glucosinolates

By End User

- Food and Beverage Manufacturers

- Pharmaceutical Companies

- Research Institutions

- Cosmetics Manufacturers

- Healthcare Providers

By Formulation

- Liquid

- Powder

- Capsules and Tablets

- Granules

- Emulsions

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The glucosinolates market is moderately fragmented, with key players focusing on product innovation, strategic partnerships, and geographic expansion to strengthen their market positions. Leading companies such as Brightol, Incbel, Jarrow Formulas GmbH, Native Extracts, Nutra Canada, Xian Yuensun Biological Co. Ltd, Seagate Products, Kirkman Group, Interherb Ltd., and NutraValley are actively investing in research and development to enhance extraction efficiency, bioavailability, and formulation versatility of glucosinolate-based products. These players are also expanding distribution networks across North America, Europe, and Asia-Pacific to capture growing demand in functional foods, nutraceuticals, pharmaceuticals, and personal care segments. Additionally, mergers, acquisitions, and collaborations with research institutions enable companies to develop high-quality, standardized products while meeting regulatory requirements. Competitive pricing, quality differentiation, and brand recognition remain critical factors in driving market share and sustaining growth in this dynamic industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Brightol

- Incbel

- Interherb Ltd.

- Jarrow Formulas GmbH

- Kirkman Group

- Native Extracts

- Nutra Canada

- NutraValley

- Seagate Products

- Xian Yuensun Biological Co. Ltd

Report Coverage

The research report offers an in-depth analysis based on Source, Application, Type, End-User, Formulation and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for glucosinolates is expected to grow steadily due to rising health awareness.

- Functional foods and nutraceuticals will remain the primary growth drivers.

- Increasing adoption in personal care and cosmetic products will expand market applications.

- Aliphatic glucosinolates are likely to maintain dominance in the type segment.

- Cruciferous vegetables will continue to be the leading source of glucosinolates.

- Technological advancements in extraction and formulation will improve product quality and stability.

- Emerging markets in Asia-Pacific and Latin America will offer significant growth opportunities.

- Collaboration between manufacturers and research institutions will accelerate innovation.

- Regulatory support for natural and plant-based ingredients will facilitate market expansion.

- Clean-label, sustainable, and plant-based product trends will influence future product development and consumer adoption.