Market Overview

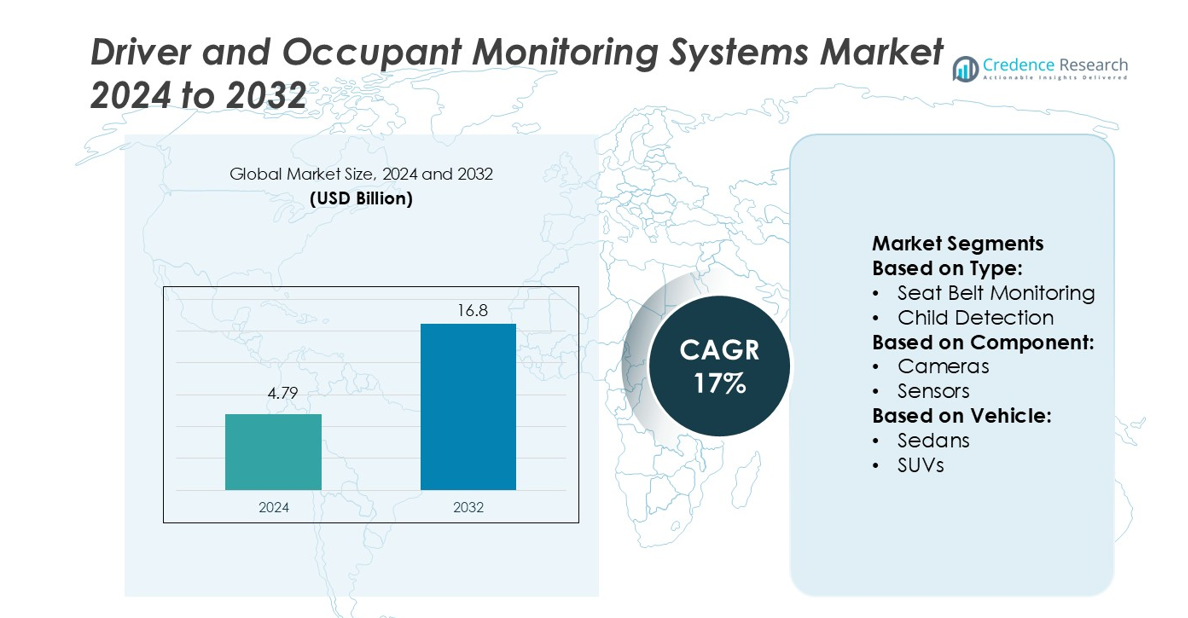

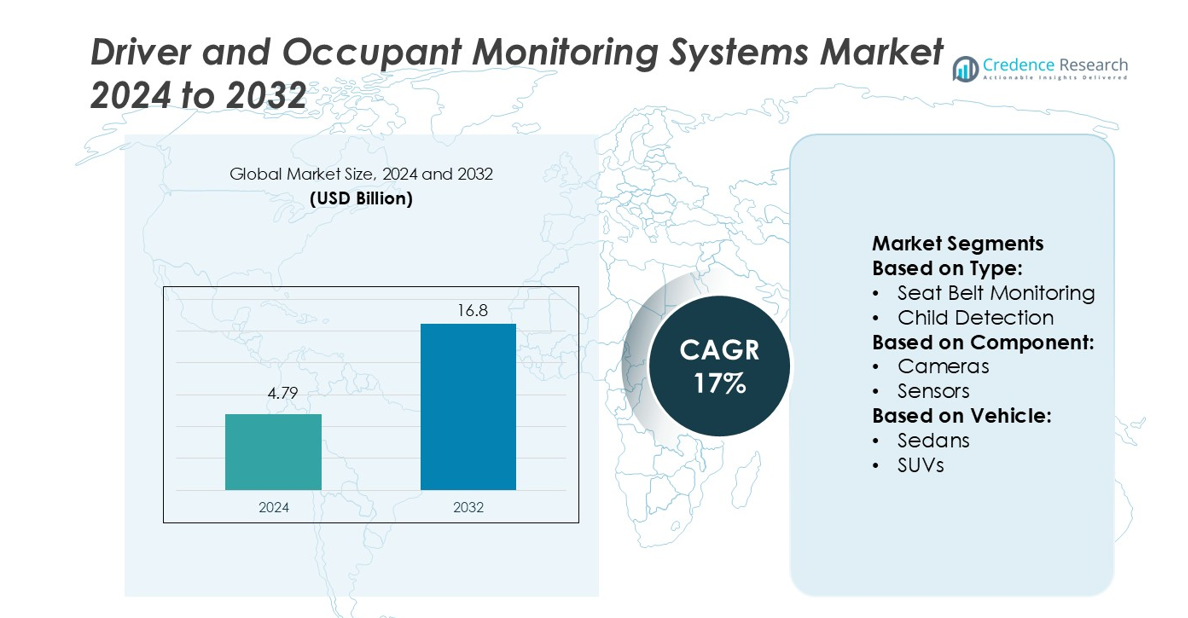

Driver and Occupant Monitoring Systems Market size was valued USD 4.79 billion in 2024 and is anticipated to reach USD 16.8 billion by 2032, at a CAGR of 17% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Driver and Occupant Monitoring Systems Market Size 2024 |

USD 4.79 billion |

| Driver and Occupant Monitoring Systems Market, CAGR |

17% |

| Driver and Occupant Monitoring Systems Market Size 2032 |

USD 16.8 billion |

The Driver and Occupant Monitoring Systems Market Gentex, Valeo, Bosch, Tobii, Denso, Robert Bosch GmbH, Harman, Continental, Magna, and Aptiv lead the Driver and Occupant Monitoring Systems market, focusing on advanced driver and occupant safety solutions. These companies invest in AI-driven software, high-resolution cameras, and sensors to enhance drowsiness detection, eye-tracking, facial recognition, and occupant presence monitoring. Strategic partnerships with OEMs and autonomous vehicle developers strengthen their market positions. North America leads the market with a 32% share, driven by stringent safety regulations, high ADAS adoption, and increasing consumer awareness of vehicle safety. Continuous innovation, combined with the growing demand for electric and semi-autonomous vehicles, supports expansion in passenger and commercial vehicle segments. The top players leverage technology integration and predictive analytics to maintain competitiveness while meeting evolving regulatory and consumer requirements globally.

Market Insights

- The Driver and Occupant Monitoring Systems Market was valued at USD 4.79 billion in 2024 and is projected to reach USD 16.8 billion by 2032, growing at a CAGR of 17% during the forecast period.

- North America leads the market with a 32% share, followed by Europe at 28% and Asia Pacific at 25%, driven by strict safety regulations and high ADAS adoption.

- Driver Monitoring Systems dominate the type segment with a 62% share, led by drowsiness and distraction detection technologies, while Occupant Monitoring Systems account for 38% of the market.

- Key players including Gentex, Valeo, Bosch, Tobii, Denso, Robert Bosch GmbH, Harman, Continental, Magna, and Aptiv focus on AI-driven software, cameras, and sensors, leveraging partnerships with OEMs and autonomous vehicle developers.

- Market growth is driven by increasing consumer safety awareness, EV and autonomous vehicle adoption, and advanced in-cabin monitoring trends, while high implementation costs and data privacy concerns remain key challenges.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The Driver Monitoring Systems (DMS) segment dominates the market with a 62% share, driven by increasing safety regulations and adoption of Advanced Driver Assistance Systems (ADAS). Drowsiness detection leads within DMS due to rising fatigue-related accident concerns, supported by automakers integrating real-time alert systems. Distraction detection and facial recognition complement these solutions, enhancing overall vehicle safety and enabling personalized in-cabin monitoring.The Occupant Monitoring Systems (OMS) segment holds 38% of the market, led by occupant presence detection, which ensures airbag deployment and safety compliance. Child detection and seat belt monitoring are increasingly adopted in family and commercial vehicles. Passenger behavior analysis supports insurance telematics and fleet safety, driving OMS growth as regulations and safety awareness expand globally.

- For instance, Mack Trucks has surpassed a milestone of 200,000 Class 8 trucks built with its proprietary telematics gateway since 2014. This confirms the active truck figure cited.

By Component

Hardware dominates the segment with 58% market share, mainly due to the widespread integration of cameras and sensors. Cameras support facial recognition, eye-tracking, and head position monitoring, while sensors enable real-time drowsiness and distraction detection. Control and display units further enhance monitoring accuracy. Software adoption is growing steadily, particularly in analytics for occupant behavior, alert systems, and predictive safety algorithms, reflecting the shift toward intelligent, data-driven vehicle monitoring solutions.

- For instance, Dennis Eagle introduced the Olympus Midi in April 2025 for narrow urban streets. It offers 9.8 m³, 10.8 m³, and 11.8 m³ body capacities. The vehicle’s 3.25 m wheelbase and 2,350 mm width boost maneuverability in tight spaces.

By Vehicle

Passenger vehicles hold a dominant 65% market share, with SUVs and EVs leading adoption due to higher integration of ADAS and advanced safety features. Sedans and hatchbacks are increasingly adopting DMS and OMS for regulatory compliance and consumer safety demand. Commercial vehicles, including HCVs, LCVs, and buses, are integrating monitoring systems primarily for driver safety, fatigue management, and fleet telematics, driving adoption in logistics and transportation sectors worldwide.

Key Growth Drivers

Increasing Road Safety Regulations

Strict global safety regulations are driving the adoption of driver and occupant monitoring systems. Governments mandate advanced safety features like drowsiness detection, seat belt monitoring, and child presence detection in new vehicles. Automotive OEMs comply by integrating DMS and OMS to meet crash test and safety rating requirements. This regulatory push ensures widespread deployment across passenger and commercial vehicles, fostering market growth. Compliance-driven adoption also encourages continuous innovation in sensor technology, software analytics, and AI-based monitoring systems to enhance in-cabin safety and accident prevention.

- For instance, Amrep advertisement stating its automated side loaders can handle up to 1,200 homes per route, depending on route density and landfill proximity, is an efficiency claim based on ideal operating conditions.

Rising Demand for Advanced Driver Assistance Systems (ADAS)

The growth of ADAS in modern vehicles directly boosts the demand for DMS and OMS. Features such as eye-tracking, facial recognition, and distraction detection are increasingly integrated with lane departure warnings, adaptive cruise control, and automated braking systems. OEMs focus on seamless monitoring for both driver alertness and passenger safety. The rising preference for semi-autonomous and electric vehicles accelerates adoption, as these vehicles require advanced in-cabin monitoring to ensure safety and compliance, driving investment in hardware sensors, cameras, and predictive software analytics.

- For instance, Peterbilt’s Model 520EV delivers 670 hp, supports a GCWR of 66,000 lbs, and handles up to 1,100 bin pickups (≈80–120 miles) on a single charge. It also charges fully in about 3 hours, featuring regenerative braking for added efficiency.

Growing Consumer Awareness on Vehicle Safety

Consumers are increasingly prioritizing vehicle safety, creating demand for enhanced monitoring systems. Awareness campaigns highlighting fatigue-related accidents, child safety, and passenger protection drive adoption of occupant presence detection and behavior analysis features. Families and fleet operators prefer vehicles equipped with seat belt reminders, child detection, and real-time driver monitoring. This consumer-driven demand encourages OEMs to integrate intelligent monitoring solutions across vehicle segments. Consequently, market expansion is fueled by the rising willingness to pay for features that enhance in-cabin safety and reduce accident risks.

Key Trends & Opportunities

Integration of AI and IoT Technologies

AI and IoT integration is transforming the DMS and OMS market. AI enables accurate fatigue detection, distraction analysis, and predictive passenger behavior modeling. IoT connectivity allows seamless data transfer between vehicle systems and cloud platforms for fleet monitoring and insurance analytics. OEMs and tech providers capitalize on this trend by developing intelligent, connected solutions, enhancing real-time safety alerts, and enabling remote monitoring. This technological evolution presents growth opportunities in predictive safety services, smart fleet management, and enhanced consumer personalization of in-cabin monitoring systems.

- For instance, Curbtender’s PowerPak ASL achieves a high compaction rating of 1,000 pounds per cubic yard, with pack cycles completed in 16–20 seconds. Its 2,000-pound-capacity Power Arm lifts standard 300-gallon containers and includes a 5-year structural warranty.

Adoption in Electric and Autonomous Vehicles

The rise of electric and autonomous vehicles presents significant opportunities for DMS and OMS adoption. EVs and self-driving vehicles require robust monitoring systems to ensure passenger safety and driver engagement during automated operations. Eye-tracking, facial recognition, and occupant behavior analytics support safe operation and regulatory compliance. Manufacturers increasingly integrate DMS and OMS into autonomous vehicle platforms to enhance user confidence, reduce accident risks, and optimize fleet management. This trend opens opportunities for advanced sensor development and software solutions tailored to EV and autonomous mobility markets.

- For instance, Dennis Eagle’s purpose-built ProView chassis supports municipal and specialized fleets. It offers a best-in-class turning circle as small as 66.7 feet (curb-to-curb), aiding tight urban navigation.The low-entry cab has an 18.4‑inch ground-to-step height, flat walkthrough floor, and panoramic windows—ideal for crew safety and better driver visibility.

Key Challenges

High Implementation Costs

The adoption of advanced monitoring systems is limited by high hardware and software costs. Cameras, sensors, and AI-based software require significant investment, which can deter OEMs, especially in cost-sensitive vehicle segments. Integrating these systems without increasing vehicle prices poses a challenge, particularly for mass-market sedans and hatchbacks. Additionally, maintenance and calibration costs further affect adoption. Manufacturers must balance system performance and affordability to ensure market penetration while maintaining profitability and meeting growing regulatory and consumer safety expectations.

Data Privacy and Security Concerns

Driver and occupant monitoring systems generate sensitive personal data, raising privacy and security challenges. Facial recognition, behavior analysis, and real-time monitoring could be vulnerable to data breaches or misuse. Stringent data protection regulations and consumer apprehension affect adoption rates, especially in regions with strict privacy laws. OEMs and software providers must implement robust encryption, secure data storage, and transparent consent mechanisms to address these concerns. Failure to manage privacy risks could hinder market growth and slow the deployment of connected monitoring technologies across vehicle segments.

Regional Analysis

North America

North America dominates the Driver and Occupant Monitoring Systems Market with a 32% share, led by the U.S. and Canada. Strong regulatory frameworks, including NHTSA safety guidelines, drive widespread adoption of DMS and OMS across passenger and commercial vehicles. High awareness of driver fatigue, distraction-related accidents, and advanced ADAS integration fuels market growth. OEMs and technology providers invest in AI-based monitoring solutions, eye-tracking, and occupant behavior analytics. The region’s mature automotive sector and rising fleet safety initiatives further accelerate adoption. Continued innovation in connected vehicle technologies ensures North America remains the leading regional market globally.

Europe

Europe accounts for 28% of the global market, driven by stringent safety regulations and Euro NCAP requirements. Countries like Germany, France, and the UK actively mandate advanced monitoring systems in new vehicles. DMS features such as drowsiness and distraction detection lead adoption, while OMS adoption grows in passenger and commercial segments. Rising EV and autonomous vehicle penetration supports integration of AI-powered monitoring solutions. Automotive OEMs and tech suppliers focus on intelligent cameras, sensors, and predictive software analytics. Government incentives for vehicle safety and sustainable mobility further enhance the region’s market growth prospects.

Asia Pacific

Asia Pacific holds a 25% market share, led by China, Japan, and South Korea. Rapid automotive production, growing passenger vehicle sales, and rising road safety awareness drive DMS and OMS adoption. Increasing EV penetration and ADAS implementation encourage integration of eye-tracking, facial recognition, and occupant behavior analysis. Government initiatives to reduce road accidents, coupled with urban fleet modernization, support growth in both passenger and commercial vehicle segments. OEMs and tech providers focus on affordable, scalable monitoring solutions to meet rising demand. Asia Pacific offers significant growth potential due to expanding automotive markets and evolving safety regulations.

Latin America

Latin America captures 9% of the global market, with Brazil and Mexico leading adoption. Growing awareness of road safety and increasing regulatory standards drive DMS and OMS integration in passenger and commercial vehicles. Fleet management initiatives and urbanization further support market growth, particularly in LCVs and buses. Adoption focuses on drowsiness detection, distraction monitoring, and occupant presence detection. OEMs target cost-effective hardware and software solutions to cater to emerging markets. Rising consumer preference for vehicle safety features and government efforts to improve traffic safety standards offer long-term growth opportunities in the region.

Middle East & Africa

The Middle East & Africa region holds 6% of the market, driven by fleet safety management and rising commercial vehicle sales. Countries such as the UAE, Saudi Arabia, and South Africa emphasize DMS adoption for driver alertness and fatigue monitoring. OMS features like child detection and seat belt monitoring gain traction in passenger vehicles. Urbanization, road infrastructure development, and fleet modernization fuel demand. OEMs focus on rugged, climate-resistant monitoring solutions suitable for extreme conditions. Increasing government regulations and corporate safety initiatives are expected to drive moderate growth, with gradual adoption across passenger and commercial vehicle segments.

Market Segmentations:

By Type:

- Seat Belt Monitoring

- Child Detection

By Component:

By Vehicle:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Driver and Occupant Monitoring Systems market players such as Gentex, Valeo, Bosch, Tobii, Denso, Robert Bosch GmbH, Harman, Continental, Magna, and Aptiv. The Driver and Occupant Monitoring Systems market is characterized by a focus on advanced technologies, including eye-tracking, facial recognition, and drowsiness detection, all integrated to enhance vehicle safety. Companies are heavily investing in AI-based software, high-resolution cameras, and sensor technologies to improve driver and occupant monitoring capabilities. Collaborations with OEMs, electric vehicle manufacturers, and autonomous vehicle developers are driving market growth and product development. Companies are also differentiating themselves through the customization of monitoring systems and predictive analytics, offering real-time safety alerts and enhancing the overall user experience. With continuous R&D efforts and the rise of global safety regulations, the competition intensifies, leading to constant innovation across both passenger and commercial vehicle segments. This dynamic environment is shaping the future of in-cabin safety technology.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Gentex

- Valeo

- Bosch

- Tobii

- Denso

- Robert Bosch Gmbh

- Harman

- Continental

- Magna

- Aptiv

Recent Developments

- In January 2025, Gentex introduced its next-generation driver monitoring system (DMS) platform at CES that uses cameras incorporated into mirrors to monitor the cabin in two-dimensional and three-dimensional views. The system detects eye movement and head position, drowsiness with increased distractions, and even the level of cognition when in semi-autonomous driving mode.

- In January 2025, Valeo announced its collaboration with Amazon Web Services (AWS) to create cloud-native simulation environments to speed up the development of advanced driver assistance (ADAS) systems and driver monitoring systems (DMS), allowing for faster validation cycles and over-the-air features.

- In February 2024, Rosmerta Technologies Limited unveiled its AI-based Driver Monitoring & Alert System at the Bharat Mobility Global Expo 2024, targeting fleet operators. The system integrates real-time tracking video, AI-based driver behavior monitoring, and in-cabin alerts for trucks, using a device equipped with two cameras, IR blasters, GPS with SIM connectivity, and G-sensors to monitor vehicle acceleration and braking.

- In February 2024, Harman expanded its partnership with Ferrari to include the use of its driver attention and biometric sensing system in future vehicle models. This technology is designed to support a personalized response to safety, adjusting real-time vehicle alerts based on driver distraction levels

Report Coverage

The research report offers an in-depth analysis based on Type, Component, Vehicle and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of driver and occupant monitoring systems will increase across passenger and commercial vehicles.

- AI and machine learning integration will enhance real-time driver behavior analysis.

- Expansion of electric and autonomous vehicles will drive demand for in-cabin monitoring solutions.

- Drowsiness and distraction detection technologies will become standard safety features.

- Occupant presence and child detection systems will see wider implementation in family vehicles.

- Integration with fleet management platforms will improve driver safety and operational efficiency.

- Hardware innovations in cameras and sensors will enhance monitoring accuracy and reliability.

- Regulatory compliance will continue to push adoption globally, especially in developed regions.

- Connected vehicle platforms will enable predictive safety alerts and remote monitoring.

- Market growth will be supported by rising consumer awareness of vehicle safety features.