Market Overview:

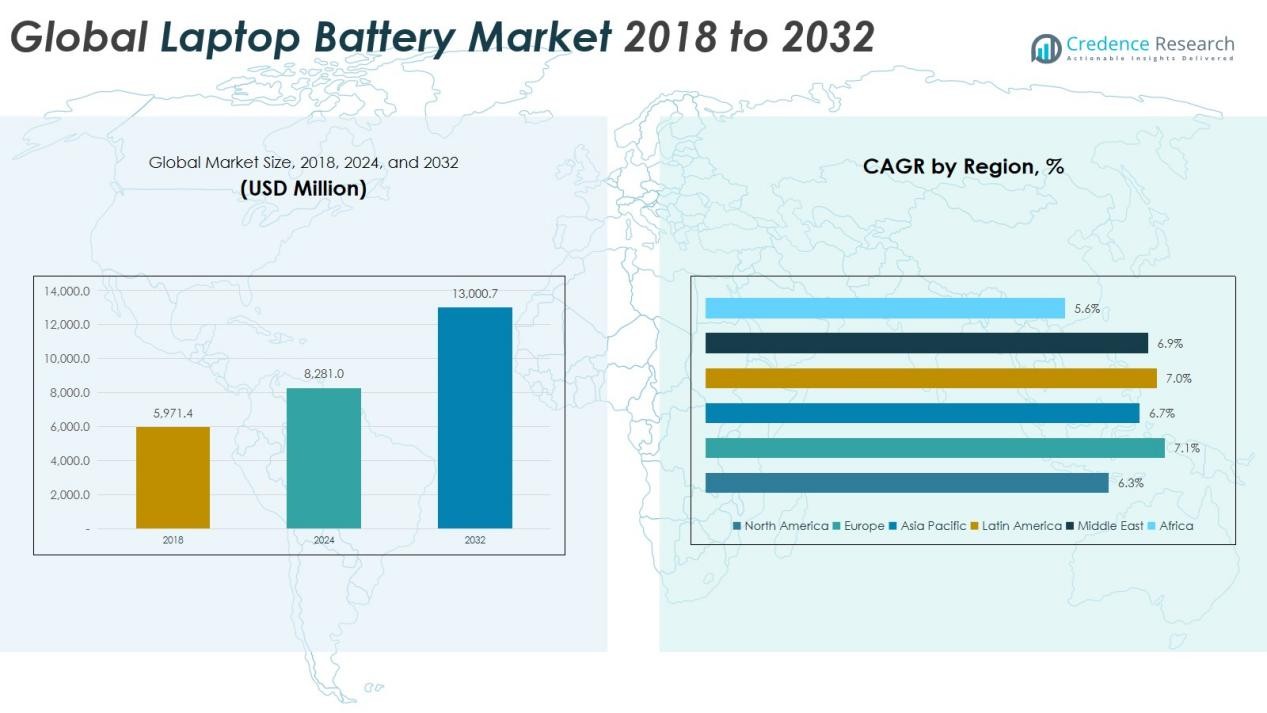

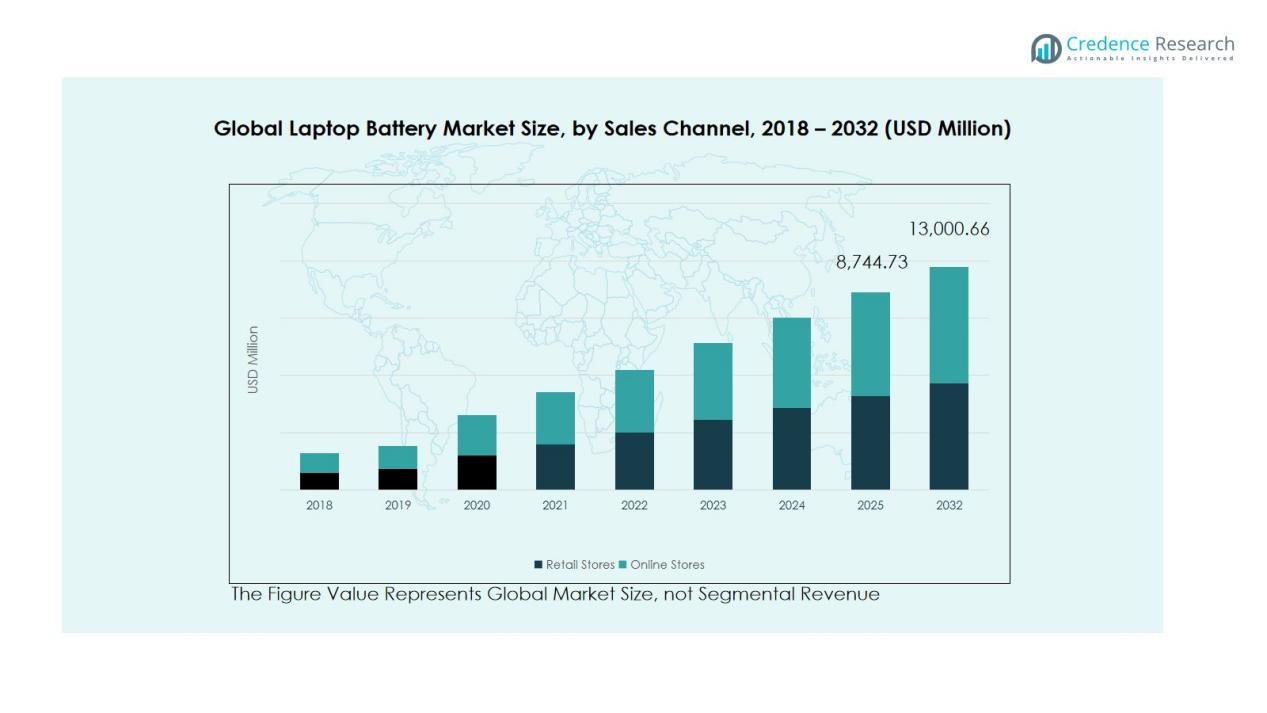

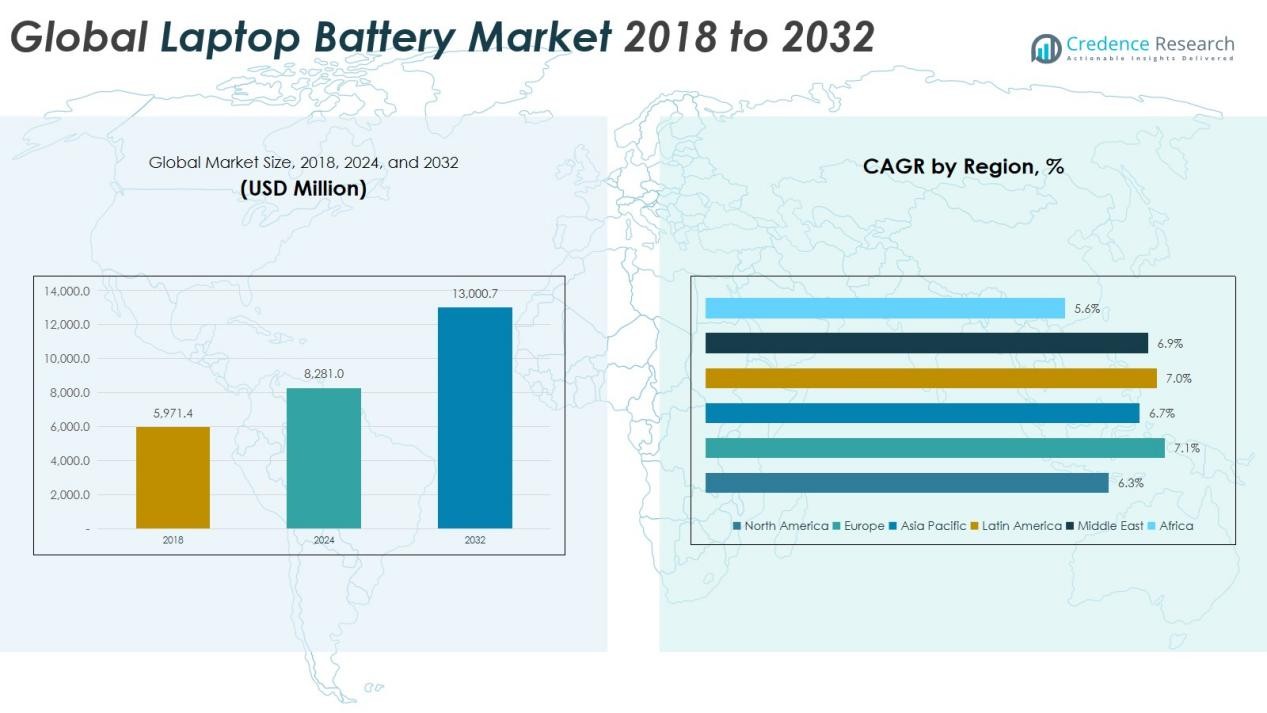

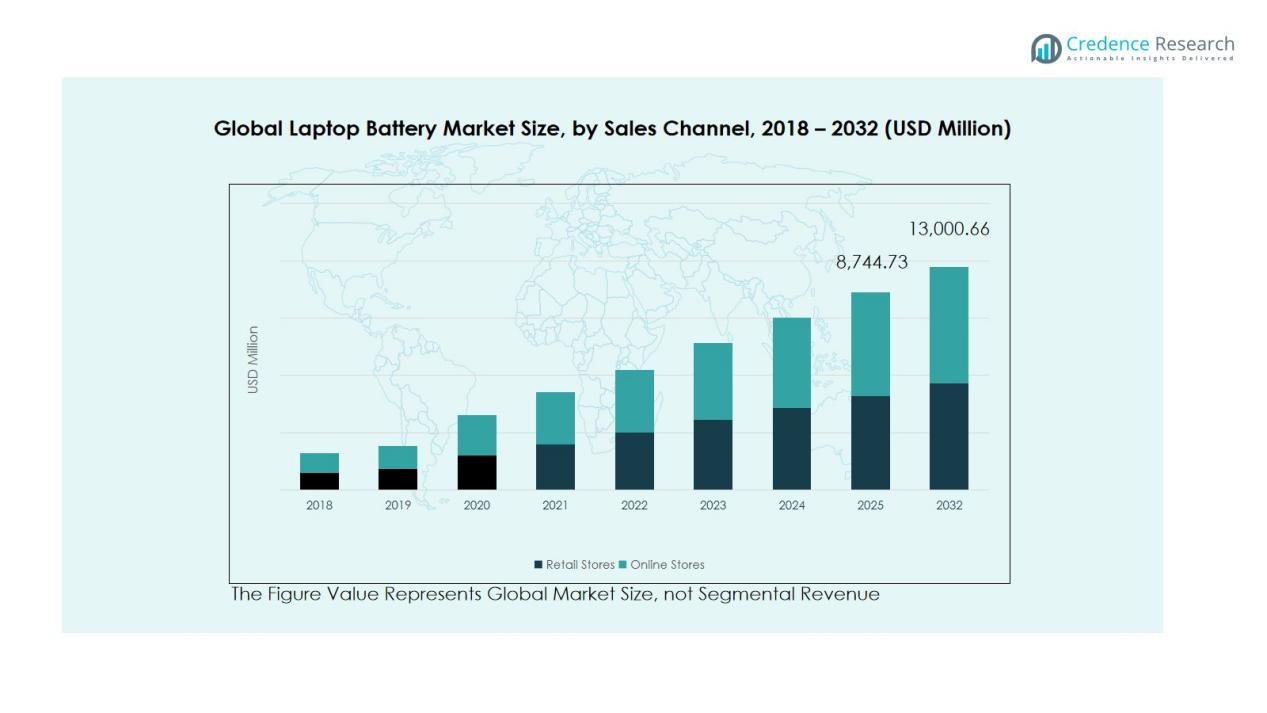

The Global Laptop Battery Market size was valued at USD 5,971.4 million in 2018 to USD 8,281.0 million in 2024 and is anticipated to reach USD 13,000.7 million by 2032, at a CAGR of 5.83% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Laptop Battery Market Size 2024 |

USD 8,281.0 Million |

| Laptop Battery Market, CAGR |

5.83% |

| Laptop Battery Market Size 2032 |

USD 13,000.7 Million |

Key factors fueling the market include the rising use of laptops for remote work, e-learning, and gaming applications. Manufacturers are focusing on higher energy density, faster charging, and improved safety features to meet modern device requirements. Integration of smart battery management systems and recyclable materials also aligns with global sustainability goals, encouraging replacements and upgrades.

Regionally, Asia-Pacific dominates the Global Laptop Battery Market due to large-scale manufacturing in China, Japan, and South Korea. North America follows, driven by strong consumer electronics demand and early adoption of next-generation batteries. Europe shows steady growth, supported by stringent environmental standards and innovation in battery recycling technologies. Emerging economies in Latin America and the Middle East are witnessing rising imports and assembly operations, strengthening regional competitiveness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Laptop Battery Market was valued at USD 5,971.4 million in 2018, reached USD 8,281.0 million in 2024, and is projected to reach USD 13,000.7 million by 2032, growing at a CAGR of 5.83% during the forecast period.

- Asia-Pacific holds the largest regional share at 42.5%, driven by large-scale production in China, Japan, and South Korea. North America follows with 26.7%, supported by technological innovation and high replacement demand, while Europe accounts for 18.3% due to sustainability initiatives and battery recycling advancements.

- Latin America emerges as the fastest-growing region with a 6.4% market share, fueled by rising imports, expanding e-commerce distribution, and growing laptop adoption across education and enterprise sectors.

- By number of cells, 6-cell batteries lead with a 38.2% share due to their balance of performance and durability, followed by 9-cell and 12-cell variants with a combined 27.4% share catering to gaming and professional devices.

- By source, OEMs dominate with 63.5% of market revenue due to high reliability and compatibility, while the aftermarket segment holds 36.5%, expanding rapidly through online and retail sales networks.

Market Drivers:

Rising Laptop Adoption Across Work, Education, and Gaming Sectors

The Global Laptop Battery Market grows strongly with the rise in remote work, e-learning, and digital entertainment. Increasing laptop usage across corporate offices, schools, and gaming communities drives consistent demand for reliable batteries. It benefits from consumers preferring portable devices with longer runtime and faster recharge capabilities. The shift toward hybrid work environments further amplifies battery replacement and upgrade needs worldwide.

- For instance, Apple’s MacBook Pro models featuring the M4 chip achieve up to 24 hours of battery life—the longest ever offered in a Mac—enabling remote workers and educators to operate for extended periods without requiring frequent charging.

Technological Advancements in Battery Chemistry and Design Efficiency

Continuous innovation in lithium-ion and lithium-polymer technologies strengthens the market outlook. Manufacturers focus on higher energy density, reduced charging time, and enhanced safety features. It encourages users to upgrade older devices with advanced battery solutions that improve lifespan and performance. Adoption of compact and lightweight battery architectures supports thinner, high-performance laptops across brands.

- For instance, Samsung SDI has developed upgraded Electric Vehicle (EV) battery packs that can achieve a rapid charging rate of 80% capacity in just 9 minutes, with a goal of mass production by 2026.

Shift Toward Sustainable and Recyclable Battery Materials

Environmental awareness and regulatory standards are promoting eco-friendly manufacturing practices. Companies invest in recyclable materials and cleaner production techniques to reduce waste and emissions. The Global Laptop Battery Market benefits from initiatives encouraging circular economy models and efficient recycling systems. It supports the industry’s transition toward low-impact production aligned with global sustainability goals.

Expanding OEM Collaborations and Aftermarket Distribution Networks

Strategic partnerships between battery manufacturers and laptop brands enhance product integration and reliability. Expansion of global supply chains and e-commerce distribution increases product availability for both OEM and aftermarket buyers. It ensures timely replacements and supports consistent revenue flow across major regions. Growing collaborations enable innovation in battery management systems and intelligent charging solutions.

Market Trends:

Market Trends:

Growing Demand for High-Capacity and Fast-Charging Batteries

The Global Laptop Battery Market experiences a strong shift toward high-capacity, fast-charging solutions. Consumers demand batteries that deliver extended runtime and shorter recharge cycles to support multitasking and mobility needs. It drives manufacturers to adopt advanced chemistries such as solid-state and graphene-enhanced lithium cells. Integration of quick-charging technologies helps improve productivity and convenience for professionals and gamers. Compact battery modules are now designed to balance power output and thermal stability. The demand for adaptive power management systems is also growing to optimize energy use and extend battery life. This shift is reshaping design priorities across leading laptop brands.

- For Instance, Samsung SDI established a pilot line (called the ‘S-line’) for all-solid-state batteries (ASBs) and began producing samples with a target energy density of over 900 Wh/L.

Integration of Smart Battery Management and Sustainable Manufacturing Practices

Intelligent battery management systems are becoming standard in modern laptops to enhance performance and safety. These systems use sensors and AI-driven analytics to monitor charge cycles, prevent overheating, and extend service life. It enables real-time optimization and predictive maintenance, improving device reliability. The Global Laptop Battery Market is also witnessing a move toward green manufacturing practices and material reuse. Companies are adopting eco-certified materials and designing batteries for easier recycling and recovery. Smart energy storage technologies are merging with sustainability objectives to meet tightening environmental standards. This convergence supports long-term efficiency and reinforces consumer trust in advanced battery solutions.

- For instance, MSI laptops employ proprietary phase-change thermal pads with a thermal conductivity coefficient of up to 8.5W/mK—three times greater than traditional thermal pastes—enabling efficient heat transfer and preventing degradation issues.

Market Challenges Analysis:

Volatility in Raw Material Prices and Supply Chain Disruptions

The Global Laptop Battery Market faces persistent challenges due to fluctuations in the prices of lithium, cobalt, and nickel. These materials form the backbone of modern battery production and directly influence manufacturing costs. It creates pressure on pricing strategies and profit margins for both OEMs and component suppliers. Global supply chain disruptions, driven by geopolitical conflicts and logistic constraints, further strain inventory management. Delays in raw material delivery impact production timelines and market availability. Manufacturers are exploring alternative chemistries and localized sourcing models to mitigate these risks. Ensuring consistent supply remains critical for market stability.

Thermal Management, Safety Risks, and Disposal Concerns

Overheating and battery degradation remain serious issues affecting product reliability and consumer trust. It compels manufacturers to improve cell design, insulation, and temperature monitoring systems. The Global Laptop Battery Market must also address end-of-life disposal challenges caused by non-biodegradable components and limited recycling infrastructure. Strict regulatory requirements on safety and waste handling increase operational costs. Fire hazards linked to counterfeit or low-quality batteries further complicate market control. Companies are investing in safer electrolytes and sustainable disposal practices to minimize risks. Building consumer confidence through durability and safety remains a top priority for industry growth.

Market Opportunities:

Expansion of Energy-Dense and Next-Generation Battery Technologies

The Global Laptop Battery Market presents strong opportunities through innovations in energy-dense battery chemistries. Solid-state, lithium-sulfur, and graphene-based batteries are gaining attention for their longer lifespan and higher safety margins. It allows manufacturers to create thinner, lighter, and more powerful laptops for diverse users. These technologies support extended runtime and faster recharging, addressing modern mobility demands. Collaborations between tech firms and battery developers are accelerating product commercialization. Government-backed research funding further supports advanced energy storage innovation. The focus on next-generation materials is setting a new direction for market expansion.

Rising Demand for Sustainable and Smart Power Solutions

The growing emphasis on sustainability offers a major opportunity for eco-friendly and recyclable battery production. It drives companies to invest in closed-loop recycling systems and low-carbon manufacturing. The Global Laptop Battery Market benefits from policies encouraging green energy use and electronic waste reduction. Integration of smart power systems capable of self-optimization enhances battery efficiency and lifespan. Consumer awareness of responsible technology use also supports market differentiation. Partnerships with renewable energy firms and battery management software providers create value-added opportunities. This sustainability-driven shift promotes innovation and long-term competitiveness across the industry.

Market Segmentation Analysis:

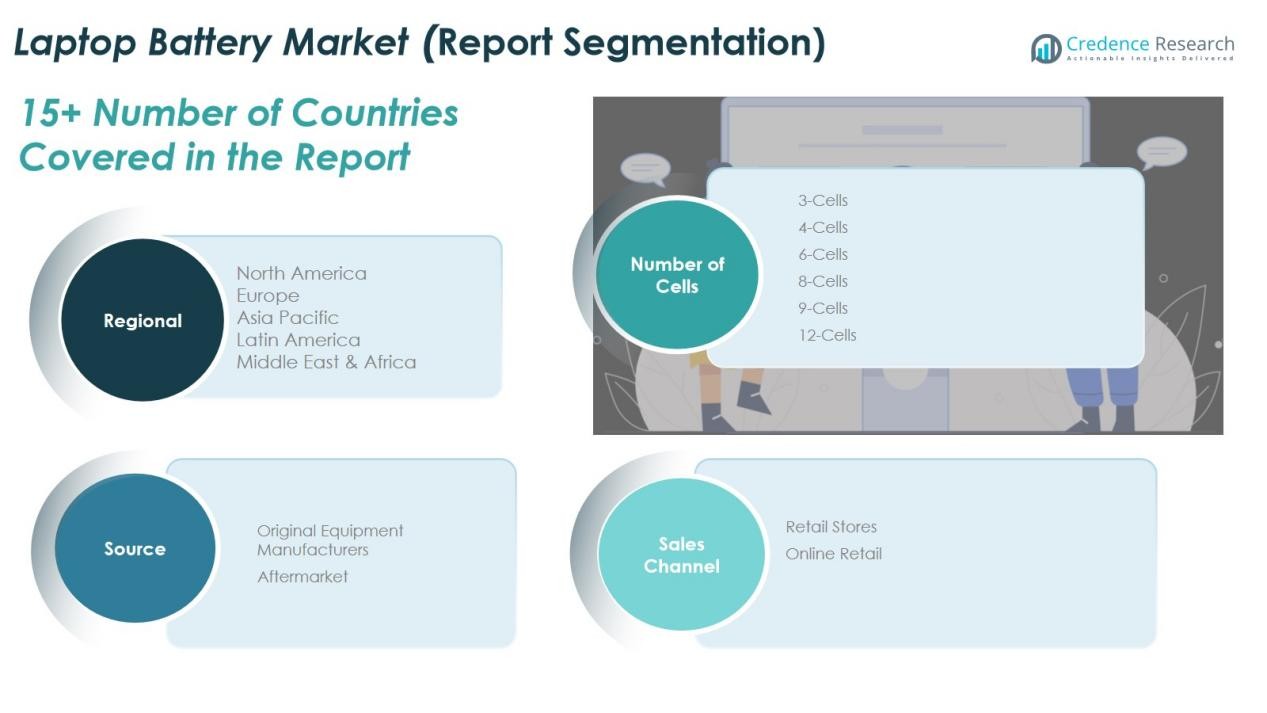

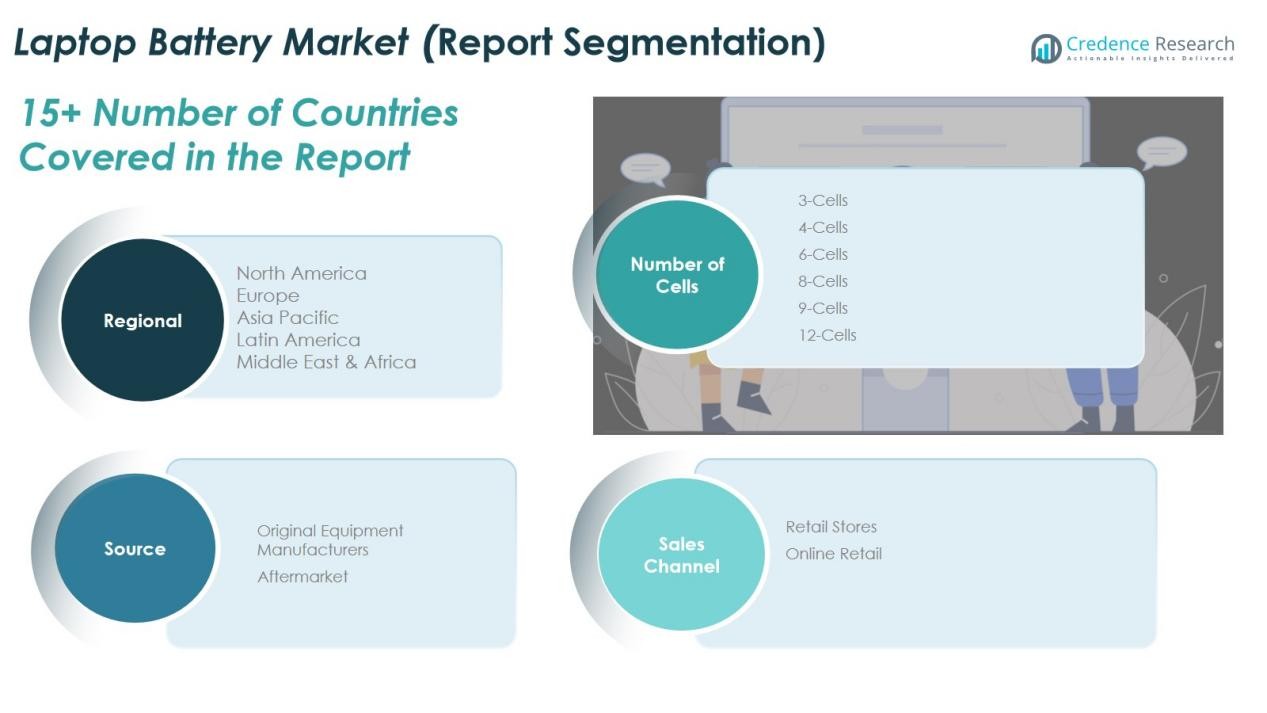

By Number of Cells

The Global Laptop Battery Market is segmented by the number of cells into 3-cell, 4-cell, 6-cell, 8-cell, 9-cell, and 12-cell configurations. Six-cell batteries dominate due to their balanced performance, weight, and runtime. It remains the preferred choice for mainstream laptops used in education, corporate, and personal settings. High-capacity batteries, such as 9-cell and 12-cell variants, are gaining traction in gaming and professional-grade laptops that demand extended backup. Compact 3-cell and 4-cell batteries serve lightweight ultrabooks where portability outweighs endurance, reflecting diverse user requirements.

- For Instance, HP’s Pavilion x360 series does not typically feature six-cell batteries, but some current models are officially rated to deliver up to 9–11 hours of battery life, depending on the specific configuration and usage conditions

By Source

Based on source, the market is divided into Original Equipment Manufacturers (OEMs) and the aftermarket segment. OEMs hold a larger share due to their assurance of compatibility, safety, and warranty-backed reliability. It benefits from integration with branded laptops and consistent demand for replacements within warranty cycles. The aftermarket segment is expanding through cost-effective alternatives and availability across multiple regional distributors. Growing online presence and consumer price sensitivity strengthen this segment’s growth potential.

- For Instance, Dell Technologies operates a significant OEM (Original Equipment Manufacturer) Solutions division that designs and provides robust, long-lifecycle technology infrastructure (servers, storage, etc.) to enterprise customers across various industries, all typically backed by comprehensive service and warranty agreements tailored to enterprise needs.

By Sales Channel

By sales channel, the market includes retail stores and online retail. Retail stores remain vital for immediate replacement and service-based sales. It continues to attract customers seeking verified authenticity and installation support. Online retail is growing rapidly due to wide availability, competitive pricing, and consumer convenience. E-commerce platforms and brand websites are key drivers of future distribution expansion worldwide.

Segmentations:

Segmentations:

By Number of Cells:

- 3-Cells

- 4-Cells

- 6-Cells

- 8-Cells

- 9-Cells

- 12-Cells

By Source:

- Original Equipment Manufacturers (OEMs)

- Aftermarket

By Sales Channel:

- Retail Stores

- Online Retail

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific Leads with Strong Manufacturing and Export Capacity

The Global Laptop Battery Market is led by Asia Pacific, supported by large-scale production facilities and strong export networks. China, Japan, and South Korea dominate due to advanced battery manufacturing technologies and established supply chains. It benefits from high consumer electronics demand and favorable government initiatives promoting clean energy production. Regional manufacturers like LG Chem and Samsung SDI continue to invest in next-generation lithium-based batteries. Rapid digitalization, growing laptop penetration, and rising disposable income further strengthen market expansion. Southeast Asian nations are also emerging as key assembly and distribution hubs.

North America Driven by Technological Innovation and Replacement Demand

North America demonstrates consistent growth fueled by the adoption of premium and high-performance laptops. The region’s demand is supported by strong consumer preference for long-lasting, fast-charging, and energy-efficient batteries. It gains momentum from a mature laptop market and growing replacement cycles among professionals and students. Manufacturers in the U.S. are focusing on integrating smart battery management systems to enhance safety and efficiency. The market also benefits from the presence of technology leaders and increasing adoption of eco-friendly materials. Regulatory standards supporting battery recycling further drive innovation across the region.

Europe Emphasizes Sustainability and Circular Energy Initiatives

Europe represents a stable market driven by sustainability mandates and advanced recycling frameworks. The Global Laptop Battery Market in this region benefits from the EU’s focus on reducing carbon emissions and promoting resource recovery. It shows growing adoption of batteries designed for durability and low environmental impact. Regional brands invest in renewable power sourcing and green logistics to align with environmental goals. Demand from corporate, education, and consumer sectors remains strong, especially in Germany, the UK, and France. Strategic collaborations between OEMs and research institutes continue to enhance competitiveness in battery innovation.

Key Player Analysis:

- Amperex Technology

- Likk Power

- Lishengyuan

- Teksus Power Solution

- Apple Inc.

- LG Chem

- Samsung SDI

- BTI

- Amstron Corporation

Competitive Analysis:

The Global Laptop Battery Market features strong competition among established global and regional manufacturers. Key players include Amperex Technology, Likk Power, Lishengyuan, Teksus Power Solution, Apple Inc., LG Chem, Samsung SDI, BTI, and Amstron Corporation. It remains highly consolidated, with top companies holding significant market share through innovation and vertical integration. Leading firms focus on enhancing energy density, safety, and charging efficiency to meet evolving device requirements. Strategic partnerships between OEMs and battery producers strengthen supply reliability and technological advancement. Continuous investment in R&D and sustainable production practices supports competitive differentiation. The market’s long-term growth depends on innovation speed, product quality, and the ability to align with environmental and performance standards.

Recent Developments:

- In November 2025, Amperex Technology (CATL) began sourcing lithium ore from external suppliers after its flagship mine remained closed, representing a significant supply chain adjustment for the battery manufacturer.

- In November 2024, Tianjin Lishen, which may be related to Lishengyuan by transliteration, launched ten new battery products at its newly built factory, including high-energy density and fast-charging models aimed at commercial and automotive uses.

Report Coverage:

The research report offers an in-depth analysis based on Number of Cells, Source, Sales Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Laptop Battery Market will advance with growing demand for lightweight, energy-efficient, and longer-lasting devices.

- It will see strong adoption of solid-state and graphene-based batteries enhancing power density and safety.

- Manufacturers will invest more in recyclable and eco-friendly materials to meet sustainability goals.

- Smart battery management systems will become standard, improving monitoring, performance, and life cycle efficiency.

- OEM collaborations with battery technology firms will accelerate product innovation and customization.

- The market will experience higher demand from education, gaming, and remote work sectors worldwide.

- Aftermarket sales will expand through online platforms offering accessible and cost-effective replacements.

- Automation and digital supply chain systems will enhance manufacturing precision and reduce production delays.

- Regional players will emerge in Asia and Latin America, diversifying the global production base.

- It will evolve toward circular energy practices, integrating recovery and reuse in every stage of battery manufacturing.

Market Trends:

Market Trends: Segmentations:

Segmentations: