Market Overview

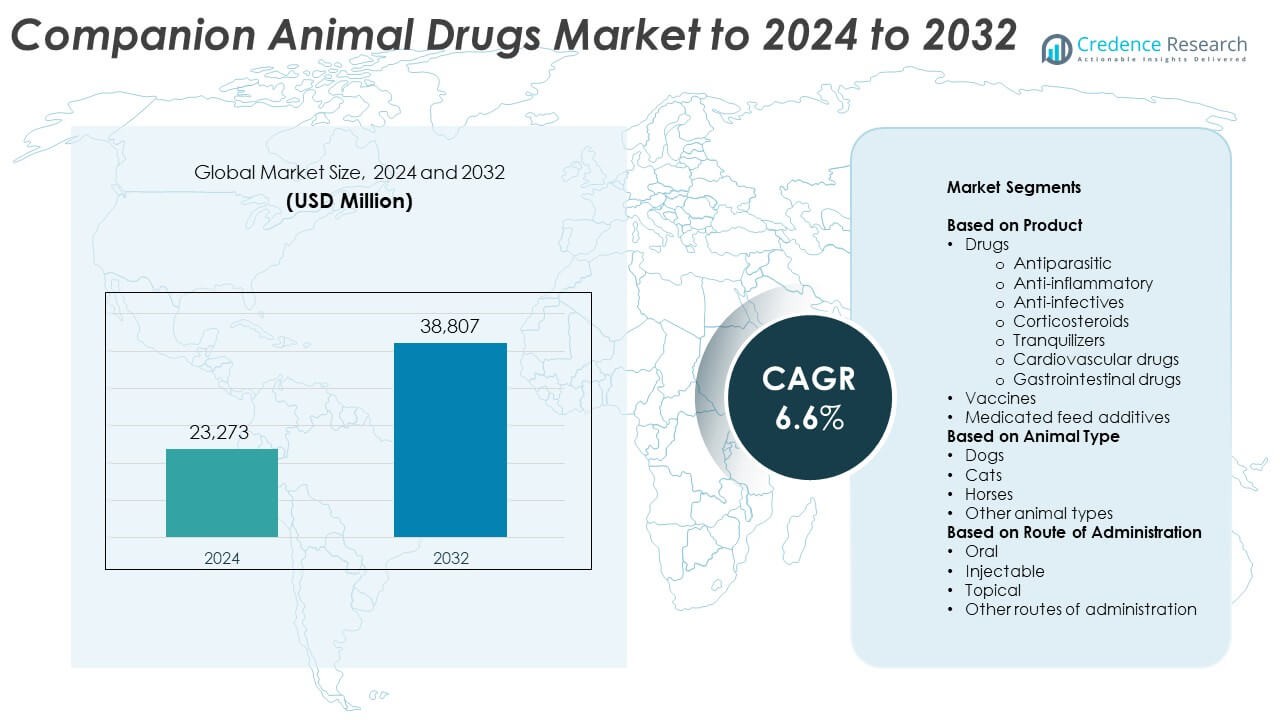

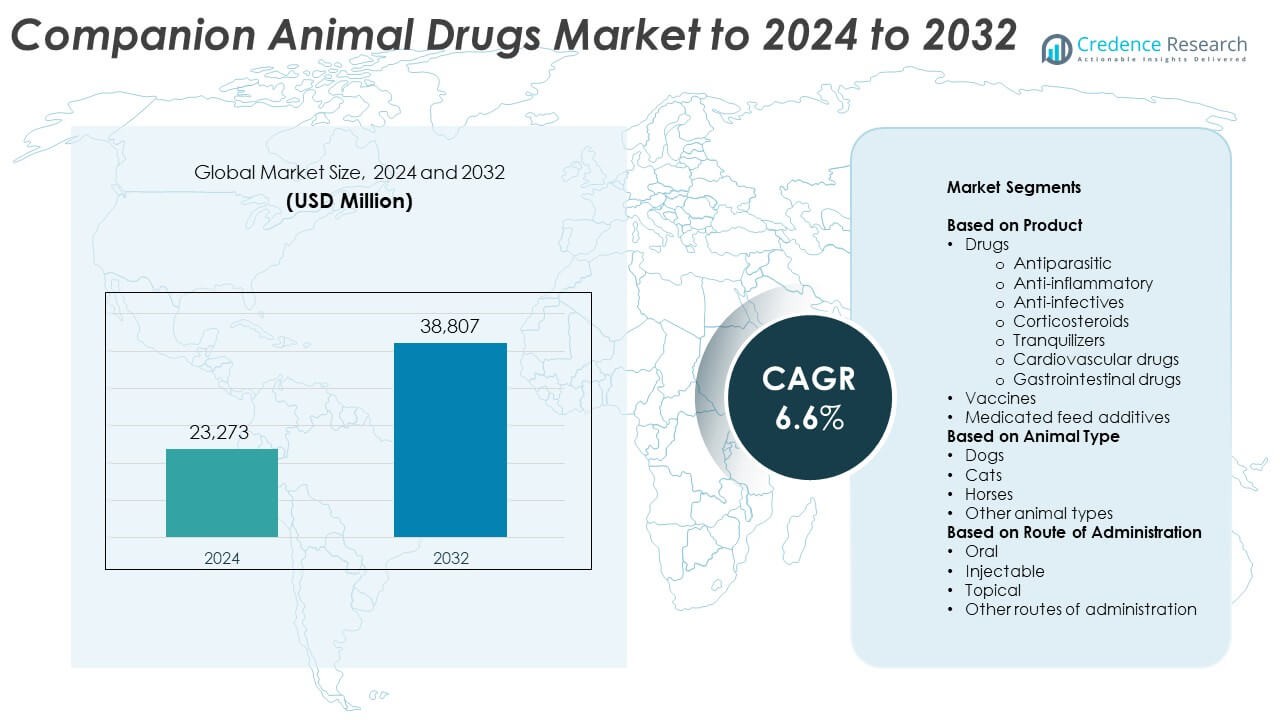

The Companion Animal Drugs Market size was valued at USD 23,273 Million in 2024 and is anticipated to reach USD 38,807 Million by 2032, at a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Companion Animal Drugs Market Size 2024 |

USD 23,273 Million |

| Companion Animal Drugs Market, CAGR |

6.6% |

| Companion Animal Drugs Market Size 2032 |

USD 38,807 Million |

The companion animal drugs market is dominated by major players such as Zoetis, Elanco Animal Health Incorporated, Boehringer Ingelheim International, Ceva Santé Animale, Merck, and Virbac. These companies lead through extensive R&D pipelines, diversified drug portfolios, and strong veterinary partnerships. North America remains the leading region, holding a 39.6% share in 2024, driven by high pet ownership and advanced healthcare infrastructure. Europe follows with a 28.4% share, supported by strong regulatory frameworks and preventive care programs. Asia Pacific, with a 19.7% share, is emerging as the fastest-growing market due to increasing pet adoption and improved access to veterinary services.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The companion animal drugs market was valued at USD 23,273 Million in 2024 and is projected to reach USD 38,807 Million by 2032, growing at a CAGR of 6.6% during the forecast period.

- Rising pet ownership, growing awareness of animal health, and higher spending on preventive treatments are key drivers boosting market growth globally.

- The market is witnessing trends such as increased demand for biologics, oral formulations, and digital veterinary care solutions supporting personalized treatments.

- Leading players focus on R&D, product innovation, and regional expansion, while stringent regulatory processes and high treatment costs act as restraints.

- North America dominates with a 39.6% share, followed by Europe at 28.4% and Asia Pacific at 19.7%, while drugs remain the leading product segment with a 62.7% share in 2024.

Market Segmentation Analysis:

By Product

Drugs dominated the companion animal drugs market in 2024, accounting for 62.7% of the total share. The demand is driven by increasing cases of parasitic infections, inflammation, and bacterial diseases among pets. Antiparasitic and anti-infective drugs are most prescribed, supported by wider veterinary accessibility and growing pet healthcare awareness. Anti-inflammatory and corticosteroid products are expanding due to rising arthritis and skin conditions in older pets. Advancements in novel formulations and extended-release therapies further enhance treatment outcomes and compliance across veterinary clinics and hospitals.

- For instance, Merck Animal Health reports more than 350 million flea-and-tick doses of its Bravecto products distributed in over 100 countries since the initial launch in 2014, reaching this milestone approximately eight years after introduction.

By Animal Type

Dogs held the largest market share of 54.3% in 2024, driven by their higher ownership rates and greater expenditure on pet healthcare. Increasing prevalence of obesity, arthritis, and cardiovascular disorders in dogs has led to rising drug prescriptions and preventive care adoption. Cats follow as the second-largest segment, supported by demand for oral and topical formulations for dermatologic and parasitic infections. The growing popularity of companion horses for sports and recreation also contributes to steady drug demand, particularly for anti-inflammatory and antiparasitic treatments.

- For instance, Zoetis states more than 1 million U.S. dogs received its once-monthly canine osteoarthritis antibody since the October 2023 launch, reflecting rapid uptake in dogs.

By Route of Administration

Oral drugs led the market with a 47.9% share in 2024, supported by their ease of administration and availability in chewable or flavored forms. The growing acceptance of oral tablets, suspensions, and feed-based medication among pet owners is driving consistent demand. Injectable drugs represent the second-largest segment, widely used for vaccines, antibiotics, and emergency treatments requiring rapid action. Topical formulations are also gaining traction, especially for treating dermatological issues and external parasites, reflecting a shift toward convenient and non-invasive therapeutic approaches in companion animal care.

Key Growth Drivers

Rising Pet Ownership and Health Awareness

The global rise in pet adoption, especially dogs and cats, is fueling demand for veterinary pharmaceuticals. Increasing awareness about pet health, preventive care, and regular medical checkups has expanded the use of antiparasitic, anti-inflammatory, and nutritional drugs. Pet humanization trends are driving owners to invest more in quality healthcare and premium therapies. Expanding veterinary infrastructure and the growing number of specialized clinics are further supporting the market’s sustained growth in both developed and emerging economies.

- For instance, Laboratorios Leti offers the canine leishmaniasis vaccine LetiFend®, which is given as a single initial dose, followed by a single annual booster, for dogs from six months of age. Protection starts 28 days (or 4 weeks) after the initial vaccination, encouraging simple preventive regimens.

Expansion of Veterinary Pharmaceutical Research

Growing investments in animal drug research and biotechnology have accelerated the development of advanced formulations and targeted therapies. Companies are focusing on long-acting, easy-to-administer products that enhance compliance and treatment efficiency. The adoption of novel drug delivery systems, such as oral chewables and extended-release injectables, supports steady growth. Regulatory approvals for innovative molecules and the rise of generic alternatives are broadening product availability and reducing treatment costs across major regional markets.

- For instance, Dechra’s labeled starting dose for its trilostane capsules is 2.2–6.7 mg/kg once daily with food, illustrating precise dosing guidance in endocrine therapies.

Increasing Prevalence of Chronic Diseases in Pets

The rising occurrence of chronic conditions such as arthritis, diabetes, cardiovascular disorders, and skin allergies is boosting drug consumption. Aging pet populations are more susceptible to long-term diseases, driving demand for continuous medication and specialized therapies. The growing use of preventive treatments and long-term care products has expanded the role of pharmaceuticals in pet health management. Enhanced diagnostic capabilities in clinics also support timely intervention, improving recovery outcomes and fueling sustained drug demand.

Key Trends & Opportunities

Growth of Preventive and Nutritional Medications

Preventive healthcare is becoming a major trend as pet owners prioritize wellness over treatment. Vaccines, nutraceuticals, and prophylactic antiparasitic drugs are seeing higher adoption. Veterinary product manufacturers are expanding preventive portfolios, including combination therapies that reduce disease risk. The shift toward immunity-boosting formulations and functional feeds presents opportunities for long-term market expansion and stable revenue generation.

- For instance, Ceva Santé Animale documented that Ophytrium/chlorhexidine pads reduced yeast counts within 7 days under daily application in controlled evaluations, reinforcing proactive dermatologic care.

Integration of Digital and Personalized Veterinary Care

Technological advances in veterinary diagnostics and telemedicine are transforming drug prescription and delivery. Smart monitoring tools and AI-assisted diagnostics enable early disease detection and individualized medication plans. This digital integration helps veterinarians optimize dosage accuracy and improve compliance. The opportunity lies in combining drug therapy with data-driven health tracking systems, creating a more connected and efficient pet healthcare ecosystem.

- For instance, IDEXX digital cytology enables board-certified pathologist review in 2 hours or less, allowing faster, personalized treatment decisions at the point of care.

Rising Demand for Biologics and Specialty Therapies

The companion animal sector is witnessing rising interest in biologics, including monoclonal antibodies and recombinant vaccines. These advanced therapies offer targeted treatment with fewer side effects and higher efficacy. Pharmaceutical companies are investing in R&D for disease-specific biologics that address chronic and immune-related conditions. The expansion of biologics in veterinary medicine is creating new opportunities for high-value, precision-based treatments.

Key Challenges

Stringent Regulatory Frameworks and Approval Timelines

Complex approval procedures and varying regulations across regions pose challenges for drug manufacturers. Compliance with safety, efficacy, and residue testing standards often delays product launches and increases development costs. Smaller companies face barriers in navigating these requirements, limiting innovation. Harmonizing veterinary drug approval processes and improving international regulatory alignment remain crucial for accelerating market access and growth.

High Cost of Veterinary Treatment and Limited Accessibility

The rising cost of veterinary drugs and services restricts adoption, particularly in developing economies. Many pet owners still lack access to affordable medication or advanced veterinary facilities. Rural regions face shortages of trained veterinarians and supply chain inefficiencies that delay treatment. Addressing cost barriers through generic drug expansion and improved distribution networks is essential to enhance accessibility and support overall market expansion.

Regional Analysis

North America

North America held the largest share of 39.6% in the companion animal drugs market in 2024, driven by high pet ownership and advanced veterinary healthcare infrastructure. The United States leads the region due to strong demand for antiparasitic, anti-inflammatory, and chronic disease medications. Extensive veterinary networks, insurance coverage, and a growing focus on preventive treatments further support growth. Increased R&D investments and early adoption of biologics strengthen market expansion. Rising expenditure on pet wellness and the availability of prescription and over-the-counter products continue to fuel steady revenue generation across the region.

Europe

Europe accounted for a 28.4% share of the market in 2024, supported by growing awareness of animal health and strict regulatory frameworks ensuring product quality. Countries such as Germany, the United Kingdom, and France dominate regional sales through advanced veterinary practices and established pharmaceutical companies. Preventive healthcare initiatives and vaccination programs have boosted drug demand. The rising trend of pet humanization, coupled with the expansion of veterinary insurance, continues to enhance product adoption. Ongoing innovation in oral and topical formulations also strengthens market competitiveness across the European region.

Asia Pacific

Asia Pacific captured a 19.7% market share in 2024, driven by expanding pet populations and improving access to veterinary care. Rising disposable incomes and urbanization have increased pet ownership in countries like China, Japan, and India. Local manufacturers are investing in cost-effective generics and region-specific formulations, supporting affordability and availability. Growing awareness of preventive and therapeutic treatments is encouraging the use of antiparasitic and vaccine products. The development of modern veterinary clinics and government initiatives promoting animal health further contribute to the region’s strong growth potential in the coming years.

Latin America

Latin America held a 7.6% share of the companion animal drugs market in 2024, with Brazil and Mexico as key contributors. Expanding pet ownership and increasing middle-class spending on animal healthcare drive regional growth. The region is witnessing a steady rise in vaccination and antiparasitic drug usage. Ongoing veterinary education programs and distribution partnerships with global pharmaceutical players are enhancing accessibility. Although infrastructure challenges persist, the availability of affordable generic drugs and greater awareness of zoonotic disease prevention are helping to improve overall market penetration across Latin American countries.

Middle East and Africa

The Middle East and Africa region accounted for 4.7% of the global companion animal drugs market in 2024. Market growth is supported by increasing pet adoption in urban centers and a growing interest in premium veterinary products. South Africa and the United Arab Emirates represent major markets due to expanding pet healthcare infrastructure. However, limited access to advanced veterinary services and high treatment costs restrict broader adoption. Ongoing efforts to improve veterinary education, alongside the gradual introduction of preventive healthcare programs, are expected to drive moderate growth in the region over the forecast period.

Market Segmentations:

By Product

- Drugs

- Antiparasitic

- Anti-inflammatory

- Anti-infectives

- Corticosteroids

- Tranquilizers

- Cardiovascular drugs

- Gastrointestinal drugs

- Vaccines

- Medicated feed additives

By Animal Type

- Dogs

- Cats

- Horses

- Other animal types

By Route of Administration

- Oral

- Injectable

- Topical

- Other routes of administration

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The companion animal drugs market features strong competition among leading companies such as Zoetis, Elanco Animal Health Incorporated, Boehringer Ingelheim International, Ceva Santé Animale, Merck, Virbac, Dechra Pharmaceuticals, Vetoquinol, Norbrook, HIPRA, Agrolabo, Chanelle Pharma, Endovac Animal Health, Symrise, and Indian Immunologicals. The competitive environment is driven by continuous product innovation, expanded distribution networks, and strategic mergers. Major players focus on developing advanced formulations, vaccines, and biologics to address chronic and infectious diseases in pets. R&D investments remain centered on long-acting and combination therapies that improve treatment compliance. Companies are also prioritizing preventive healthcare portfolios and integrating digital solutions for personalized veterinary care. Partnerships with veterinary clinics, enhanced marketing strategies, and regional expansion in emerging markets are shaping long-term growth. Sustainability and regulatory compliance have become key differentiators, encouraging manufacturers to adopt eco-friendly production and quality assurance standards to strengthen their global presence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Zoetis

- Elanco Animal Health Incorporated

- Boehringer Ingelheim International

- Ceva Santé Animale

- Merck

- Virbac

- Dechra Pharmaceuticals

- Vetoquinol

- Norbrook

- HIPRA

- Agrolabo

- Chanelle Pharma

- Endovac Animal Health

- Symrise

- Indian Immunologicals

Recent Developments

- In 2024, Dechra Pharmaceuticals Limited announced the upcoming acquisition of Invetx, a developer of protein-based therapeutics for companion animals.

- In 2023, Zoetis: Launched Librela (bedinvetmab injection) in the U.S. for the control of pain associated with osteoarthritis in dogs.

- In 2023, Elanco launched AdTab (lotilaner), a non-prescription oral monthly flea and tick product for both dogs and cats in Europe.

Report Coverage

The research report offers an in-depth analysis based on Product, Animal Type, Route of Administration and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The companion animal drugs market will continue expanding with rising global pet ownership.

- Increasing focus on preventive care and wellness products will drive sustained drug demand.

- Growth in chronic disease prevalence among pets will boost long-term medication use.

- Advances in biotechnology will lead to wider adoption of biologics and targeted therapies.

- Veterinary telemedicine and digital diagnostics will enhance prescription accuracy and compliance.

- Expansion of pet insurance coverage will improve access to advanced treatments and drugs.

- Development of flavor-enhanced and easy-to-administer formulations will increase owner compliance.

- Generic drug production will grow, improving affordability in developing markets.

- Collaborations between veterinary hospitals and pharmaceutical companies will strengthen distribution networks.

- Rising sustainability goals will promote eco-friendly packaging and responsible manufacturing practices.