Market Overview

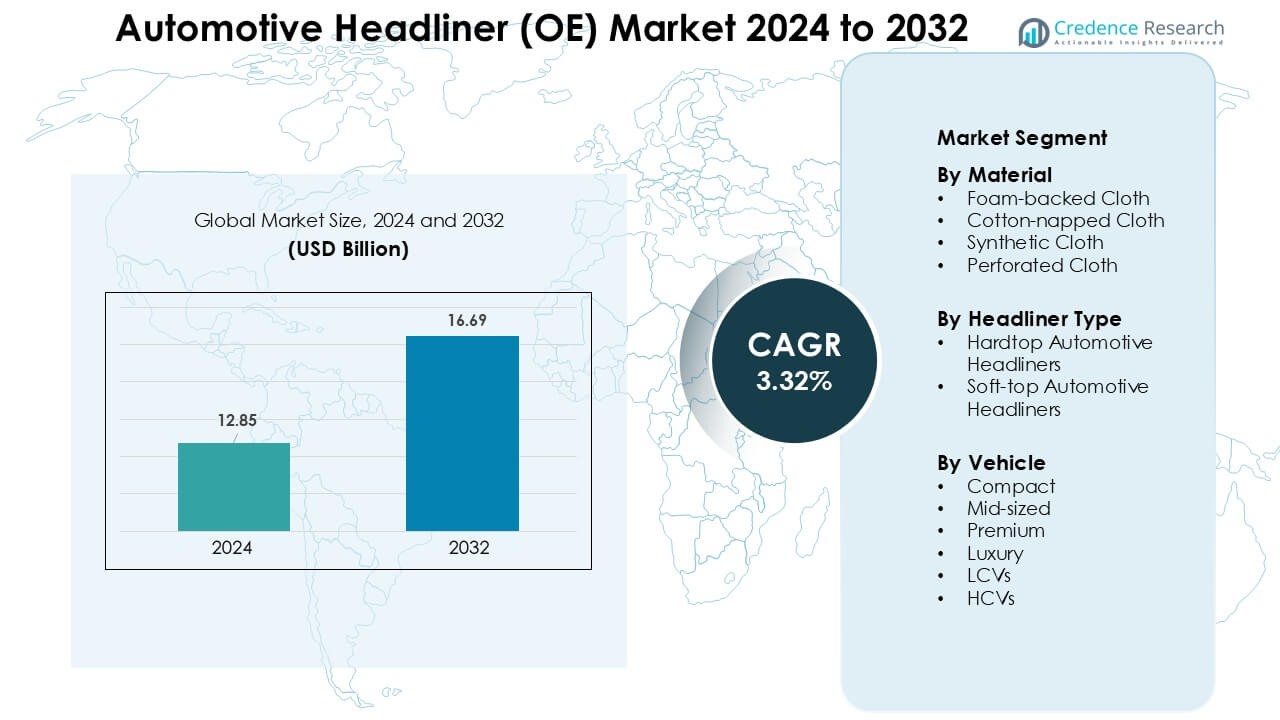

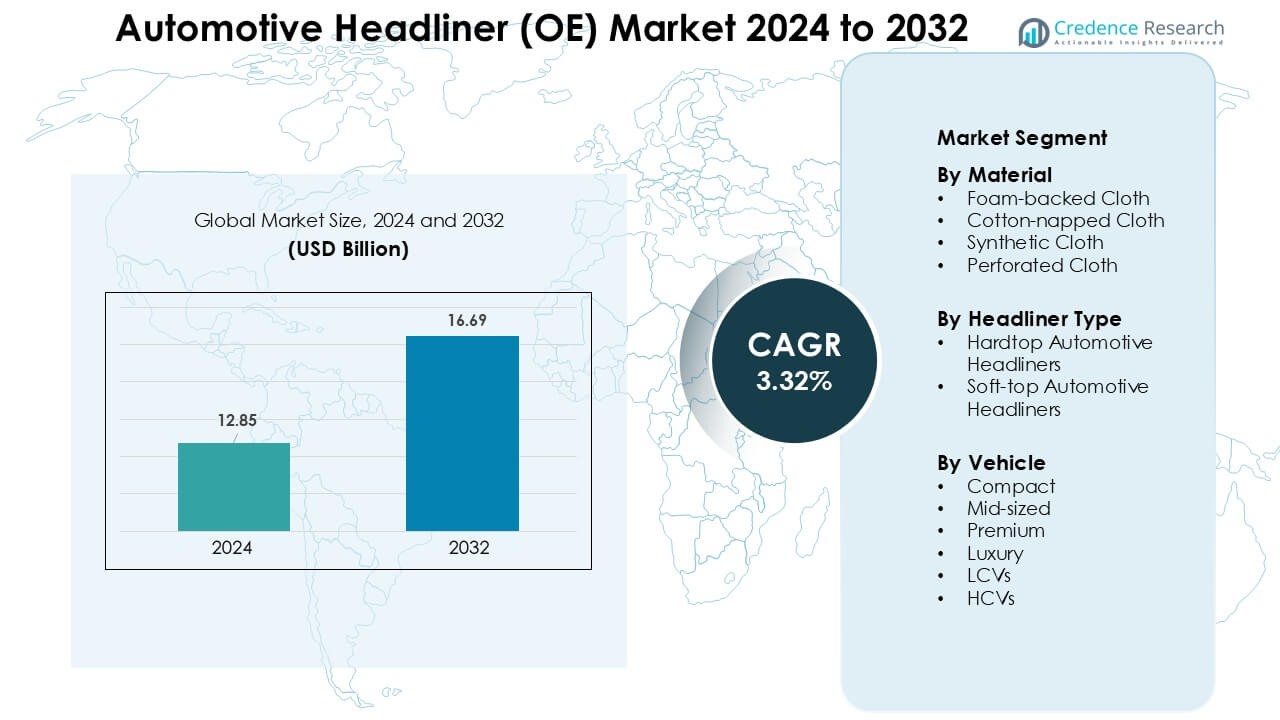

Automotive Headliner (OE) Market was valued at USD 12.85 billion in 2024 and is anticipated to reach USD 16.69 billion by 2032, growing at a CAGR of 3.32% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Anemia Treatment Drugs Market Size 2024 |

USD 12.85 Billion |

| Anemia Treatment Drugs Market, CAGR |

3.32% |

| Anemia Treatment Drugs Market Size 2032 |

USD 16.69 Billion |

The Automotive Headliner (OE) Market is driven by major players such as Freudenberg Performance Materials, Lear Corporation, Harodite Industries, Motus Integrated Technologies, Atlas Roofing Corporation, IAC Group, Grupo Antolin, Howa-Tramico, Adient plc, and Industrialesusd S.p.A. These companies strengthen their position through advanced lightweight materials, improved acoustic laminates, and automated manufacturing systems that support large-scale OEM programs. Strategic collaborations with global automakers help expand their regional supply networks and enhance product customization. Asia-Pacific remained the leading region in 2024 with about 39% share, supported by high vehicle production, rising EV adoption, and strong localization of headliner manufacturing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The automotive headliner (OE) market reached USD 12.85 billion in 2024 and is projected to hit USD 16.69 billion by 2032, growing at a CAGR of 3.32%.

- Rising demand for improved cabin comfort and better NVH control drives broader adoption of foam-backed cloth, which held 46% share in 2024.

- Trends include increased use of lightweight composites, integration of ambient lighting modules, and expansion of sustainable headliner materials across EV platforms.

- Leading players focus on automation, material innovation, and OEM partnerships, with companies such as Freudenberg Performance Materials and Lear advancing multi-layer acoustic systems to strengthen competitiveness.

- Asia-Pacific dominated the market with 39% share in 2024, supported by high passenger vehicle output, while compact vehicles led the segment with about 34% share due to strong adoption in China and India.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Material

Foam-backed cloth dominated the material segment in 2024 with about 46% share due to strong use in passenger cars and light commercial vehicles. Automakers preferred this material because the foam layer improved cabin insulation and reduced vibration. Demand grew as OEMs upgraded interior comfort in mid-sized and compact models. Synthetic cloth gained steady traction through better durability, while cotton-napped cloth held a niche position in cost-focused trims. Perforated cloth advanced in premium cars, yet foam-backed cloth stayed ahead because it balanced cost, comfort, and acoustic control.

- For instance, Covestro a global supplier of polyurethane foam for automotive interiors reports that its PU-foam car-seat solutions are used in placements such as seats, headliners and instrument panels, and that PU foams dampen noise and vibrations while also insulating thermally and providing added comfort.

By Headliner Type

Hardtop automotive headliners led the segment in 2024 with nearly 71% share, supported by wide installation across compact, mid-sized, and SUV models. The structure offered better rigidity, thermal stability, and easy integration with wiring harnesses, airbags, and lighting modules. OEMs adopted hardtop designs to meet rising noise and vibration standards in urban markets. Soft-top headliners grew in convertibles and specialty vehicles, but adoption remained limited due to higher production cost and low global volume. Hardtop designs maintained clear leadership because they fit mainstream models.

- For instance, Industry reports indicate that the fabric segment holds the largest market share and is anticipated to maintain its dominant position. Soft-top, foam-backed cloth headliners are widely used because they offer a superior balance of aesthetics, functionality, cost, and weight reduction.

By Vehicle

Compact vehicles dominated the vehicle segment in 2024 with about 34% share, driven by high production volumes in Asia-Pacific and Europe. Buyers preferred compact models due to lower running costs and better fuel efficiency, which pushed OEMs to equip these cars with improved headliners for comfort and noise control. Mid-sized and premium vehicles grew at steady rates as brands added lightweight composites and better acoustic layers. Luxury, LCVs, and HCVs showed rising demand for durable headliners, yet compact vehicles held the lead because of their mass-market scale.

Key Growth Drivers

Rising Demand for Enhanced Cabin Comfort and NVH Performance

Automakers increased focus on better cabin insulation, which strengthened demand for advanced headliner materials. Buyers preferred vehicles with quieter interiors, stronger acoustic absorption, and improved temperature control, pushing OEMs to upgrade thermal-foam layers and composite laminates. Compact and mid-sized cars adopted improved NVH packages to match rising comfort expectations seen earlier only in premium vehicles. Urban driving conditions also raised noise exposure, leading manufacturers to integrate multi-layer headliners with better vibration damping. OEMs further invested in lighter materials that reduced vehicle weight while maintaining acoustic strength. These enhancements supported fuel efficiency goals and expansion of electrified models. The combined push for comfort, quieter cabins, and material innovation positioned upgraded headliners as a core interior component across global automotive platforms.

- For instance, Tecman a supplier of automotive acoustic insulation solutions offers multi-layer laminate headliner materials combining lightweight scrim and acoustic foam, specifically designed for electric and hybrid vehicles where high-frequency noise (from motors or inverters) becomes more pronounced.

Growth in Passenger Car Production Across Emerging Markets

Emerging markets such as India, China, Indonesia, and Mexico recorded strong passenger vehicle output, which boosted headliner demand. Compact and mid-sized segments expanded as rising incomes encouraged first-time car buyers. Governments introduced incentives for local manufacturing, prompting OEMs to increase plant capacity and launch regional models with enhanced interior fit and finish. Suppliers expanded their footprint near assembly plants to ensure faster delivery of headliner modules. Growing popularity of SUVs further supported volume, as these models required larger and more durable headliner structures. Automakers also customized materials to match climate variations across regions, increasing use of moisture-resistant and heat-stable headliners. This production growth created a sustained demand pipeline for OE headliners across multiple price segments.

- For instance, global data show that in 2024, total worldwide vehicle production reached over 92 million units.

Shift Toward Lightweight and Sustainable Interior Materials

Automotive brands accelerated the use of lightweight substrates and recycled fibers to meet emission norms and sustainability goals. Foam-backed cloth and composite laminates became popular as they reduced vehicle weight while retaining structural strength. OEMs explored natural fiber reinforcements such as hemp, jute, and kenaf for eco-friendly headliner solutions. Regulations in Europe and North America encouraged the use of recyclable materials and reduced VOC emissions inside cabins. Suppliers invested in bio-based adhesives and lighter foam formulations to support circular design. The shift toward electric vehicles further intensified the need for light, structurally stable headliners to extend driving range. This sustainability-driven transition created new opportunities for innovative material suppliers.

Key Trend & Opportunity

Integration of Electronics and Advanced Functional Modules

OEMs adopted multifunctional headliners that support embedded lighting, sensors, microphones, and wiring harnesses. Panoramic sunroof architectures and smart-cabin concepts increased the need for stronger, modular headliner shells. Voice-control systems and ambient lighting packages required precision-formed headliners with embedded mounts and heat-resistant zones. Advanced driver monitoring systems and cabin sensors expanded opportunities for integrated electronics. Automakers also explored thin-film lighting and printed circuits to reduce bulk while improving functionality. As EVs added smart interiors and connected features, suppliers shifted toward modular headliner assemblies that support plug-and-play integration. This trend positioned headliners as a functional electronics platform, not just a decorative surface.

- For instance, according to recent industry analysis, modern headliners are evolving into multifunctional structures housing lighting, microphones, antennas and airbag deployment mechanisms, enabling OEMs to integrate voice-command microphones, cabin-sensor wiring, and ambient lighting into the headliner assembly.

Expansion of EV and Premium Interior Upgrades

Electric vehicles pushed OEMs to redesign interiors with quieter cabins and improved material quality, creating new demand for premium headliners. EV platforms required better acoustic absorption to balance motor noise and road noise. Premium trims adopted suede-finish, perforated cloth, and composite-backed headliners to elevate cabin aesthetics. Automakers also invested in customizable interior themes, boosting use of stitched patterns and soft-touch materials. Growth in shared mobility services further encouraged durable and stain-resistant headliners to withstand high usage. The rise of luxury EVs in China, Europe, and the U.S. opened opportunities for suppliers offering advanced lightweight composites and eco-friendly linings.

- For instance, Autoneum’s Hybrid-Acoustics ECO+ headliner system (part of its broader interior product line) uses a multilayer PET-based composite structure that provides significant acoustic performance and can be up to 50 percent lighter than conventional solutions, contributing to a greater driving range for electric vehicles.

Localization of Headliner Manufacturing and Automation

OEMs increased localized sourcing to reduce logistics costs and meet regional manufacturing policies. Suppliers responded by setting up automated production lines for thermoforming, lamination, and cutting to improve consistency and reduce waste. High-volume models relied on robotic trimming and adhesive applications to deliver stable quality across batches. Localization also encouraged material innovation suited to local climate needs, such as humidity-resistant headliners for tropical markets. Automated plants helped shorten delivery cycles and supported just-in-time inventory for OEMs. This shift toward regionalized and automated production opened strong growth opportunities for established and new suppliers.

Key Challenge

Volatility in Raw Material Prices and Supply Chain Disruptions

Fluctuating costs of polyurethane foam, polyester fabrics, adhesives, and composite substrates created uncertainty for suppliers. Many raw materials depended on petrochemical feedstocks, which faced price swings due to geopolitical events and energy market shifts. Supply chain disruptions after global logistics delays further impacted material availability, forcing OEMs to adjust procurement plans. Tier-1 suppliers faced pressure to maintain quality while managing rising input costs, often reducing margins. Weather-related disruptions and trade restrictions also delayed shipments of specialty fabrics and resins. These factors created procurement challenges, especially for mass-production models that rely on stable material supply.

Increasing Technical Complexity and Compliance Requirements

Modern headliners needed higher precision, tighter tolerances, and compatibility with electronic systems, raising production complexity. OEMs imposed strict fire-resistance, VOC emission, and crash-safety requirements, which limited material choices. Suppliers investing in new tooling and manufacturing processes faced high capital costs. Integration of sensors and wiring required advanced engineering to prevent heat damage, vibration issues, or fitment errors. Premium and EV models demanded multi-layer structures that were harder to assemble at scale. Meeting varied global regulations increased design and testing timelines. This complexity challenged smaller suppliers and increased the need for continuous technological upgrades.

Regional Analysis

North America

North America held about 27% share in the Automotive Headliner (OE) Market in 2024, supported by strong production of SUVs, pickups, and premium vehicles. Automakers in the U.S. and Canada adopted lightweight headliners with improved acoustic control to meet rising comfort expectations. Major OEMs upgraded material specifications to support EV interiors, which boosted demand for thermally stable and vibration-resistant laminates. The region also expanded use of composite-backed and foam-backed cloth materials to enhance cabin quality. Investments in localized manufacturing and automation further strengthened supply reliability across major vehicle platforms.

Europe

Europe accounted for nearly 25% share in 2024, driven by high adoption of advanced interior materials and strict emission norms that encouraged lightweight headliner solutions. Germany, France, Italy, and the U.K. led innovation with composite laminates, eco-friendly fabrics, and low-VOC adhesives. Premium automakers expanded use of perforated and suede-like headliners to elevate cabin aesthetics in luxury models. Growth in EV production supported demand for better acoustic insulation to counter road and motor noise. Strong R&D investments and established Tier-1 suppliers helped Europe maintain its position as a leading market for high-spec headliners.

Asia-Pacific

Asia-Pacific dominated the market with about 39% share in 2024, supported by large-scale vehicle production in China, India, Japan, and South Korea. High demand for compact and mid-sized cars boosted installation of foam-backed cloth headliners due to cost efficiency and improved cabin comfort. Regional OEMs expanded facilities and adopted automated thermoforming technologies to meet rising export demand. Growth in electric vehicles and premium trims accelerated use of advanced materials and multi-layer acoustic headliners. Rising middle-class adoption and strong localization policies further strengthened Asia-Pacific as the fastest-growing region.

Latin America

Latin America captured around 6% share in 2024, supported by moderate growth in vehicle production across Brazil, Mexico, and Argentina. Automakers focused on cost-effective headliner materials such as synthetic and foam-backed cloth to serve compact and mid-sized models. Demand grew as OEMs introduced refreshed interiors with better NVH performance. Local suppliers expanded capacity to shorten delivery cycles and reduce import dependence. Economic fluctuations limited high-end material adoption, yet steady expansion in regional assembly plants supported ongoing headliner demand.

Middle East & Africa

The Middle East & Africa region held nearly 3% share in 2024, driven by rising vehicle assembly operations in South Africa, Morocco, and emerging Gulf markets. SUVs and light commercial vehicles dominated demand, encouraging the use of durable, heat-resistant headliner materials that withstand extreme temperatures. Governments promoted local manufacturing, which encouraged OEMs to invest in regional sourcing. Premium vehicle sales in GCC countries boosted adoption of high-quality headliners with enhanced insulation. While market size remained smaller, gradual expansion in localized production and rising mobility needs supported stable growth.

Market Segmentations:

By Material

- Foam-backed Cloth

- Cotton-napped Cloth

- Synthetic Cloth

- Perforated Cloth

By Headliner Type

- Hardtop Automotive Headliners

- Soft-top Automotive Headliners

By Vehicle

- Compact

- Mid-sized

- Premium

- Luxury

- LCVs

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Automotive Headliner (OE) Market is shaped by leading players such as Freudenberg Performance Materials, Lear Corporation, Harodite Industries, Motus Integrated Technologies, Atlas Roofing Corporation, IAC Group, Grupo Antolin, Howa-Tramico, Adient plc, and Industrialesusd S.p.A. These companies expanded material portfolios to include lightweight composites, foam-backed laminates, and eco-friendly fabrics that support modern interior designs. Suppliers invested in automated thermoforming, robotic trimming, and precise lamination systems to meet OEM requirements for consistent fitment and improved NVH performance. Partnerships with global automakers strengthened supply stability, while growth in EVs encouraged development of advanced acoustic and heat-resistant headliners. Many players enhanced regional manufacturing footprints to reduce logistics cost and support just-in-time delivery models. Continuous innovation in recyclable substrates and multi-layer structures helped companies maintain competitiveness and align with global sustainability goals.

Key Player Analysis

Recent Developments

- In 2025, Howa-Tramico, with Fibroline, moved a new solvent-free, dry-impregnated car headliner into full industrial production, targeting lighter and more recyclable OEM roof systems.

- In June 2025, Faway Adient adopted Lectra’s VectorAutomotive iP9 digital cutting solution to boost capacity and reduce costs for seating and interior trim manufacturing, supporting Adient’s supply of lightweight headliner and interior modules to global OEMs.

- In May 2025, Lear Corporation Reported Q1 2025 results and reiterated investments in automation, footprint optimisation and new business wins that support its seating and E-Systems businesses (moves that backstop its thermal-comfort and interior component capabilities closely related to headliner/overhead systems).

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Material, Headliner Type, Vehicle and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will shift toward lighter multi-layer materials to support EV efficiency targets.

- OEMs will increase adoption of recycled and bio-based fabrics to meet sustainability goals.

- Smart headliners with embedded lighting, sensors, and microphones will gain wider use.

- Automation in thermoforming and trimming will expand to improve quality and reduce waste.

- Premium vehicles will drive demand for suede-like and advanced acoustic headliners.

- Regional manufacturing footprints will grow as OEMs localize sourcing for faster delivery.

- Improved NVH performance requirements will push suppliers to develop higher-density foam layers.

- Headliners designed for panoramic roofs and large glass areas will become more common.

- Material innovations will target heat resistance and durability for extreme climate markets.

- Collaboration between OEMs and Tier-1 suppliers will strengthen for modular headliner integration.

Market Segmentation Analysis:

Market Segmentation Analysis: