Market Overview

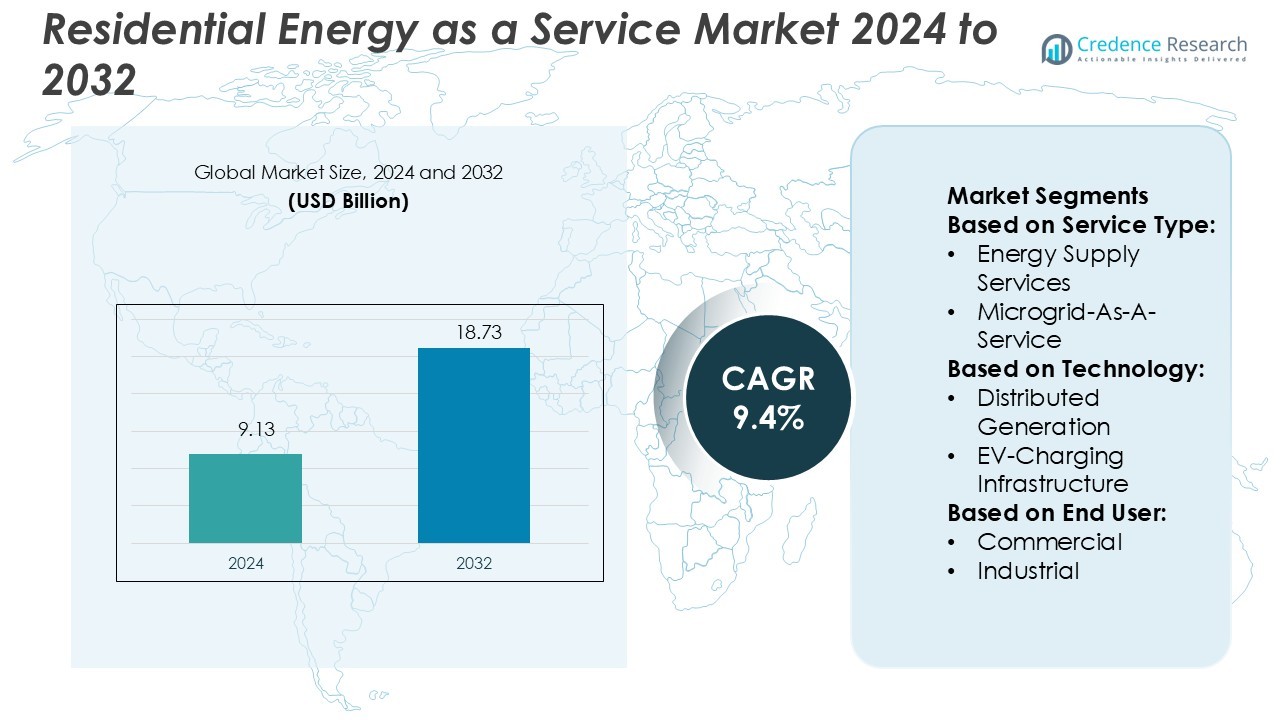

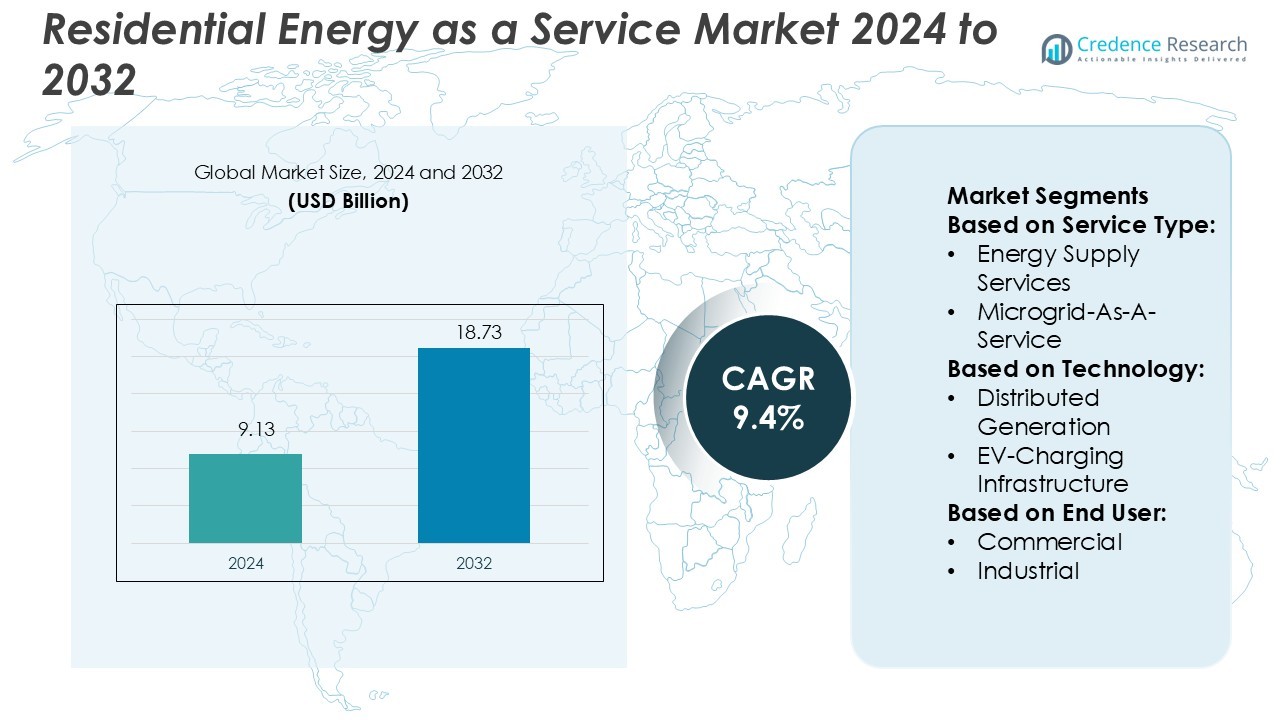

Residential Energy as a Service Market size was valued USD 9.13 billion in 2024 and is anticipated to reach USD 18.73 billion by 2032, at a CAGR of 9.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Residential Energy as a Service Market Size 2024 |

USD 9.13 Billion |

| Residential Energy as a Service Market, CAGR |

9.4% |

| Residential Energy as a Service Market Size 2032 |

USD 18.73 Billion |

The Residential Energy as a Service market include Centrica Business Solutions, Honeywell International Inc, Budderfly, Johnson Controls, GridX.Inc, Enel X, Bernhard Energy Solutions, ENGIE Impact, Capstone Green Energy Corporation, and Ameresco. These companies lead through innovations in smart home integration, IoT-enabled energy management, subscription-based solar solutions, and home battery storage. Strategic partnerships, technology adoption, and customer-focused services strengthen their market position. North America remains the leading region, holding a 35% market share, driven by high adoption of renewable energy, government incentives, and advanced energy infrastructure. The U.S. dominates with smart home energy solutions and digital platforms, while Canada contributes through grid modernization and residential solar services. Strong R&D investments and consumer demand for sustainable, cost-effective energy solutions ensure continued growth, positioning these players to expand operations and capture emerging opportunities across the global residential energy market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Residential Energy as a Service market was valued at USD 9.13 billion in 2024 and is projected to reach USD 18.73 billion by 2032, growing at a CAGR of 9.4%.

- North America leads the market with a 35% share, driven by smart home energy solutions, renewable adoption, and government incentives. Europe follows with strong residential solar and energy efficiency programs, while Asia Pacific shows rapid growth due to urbanization and digital energy platforms. Latin America and the Middle East & Africa present emerging opportunities with increasing renewable energy adoption.

- Key players such as Centrica Business Solutions, Honeywell International Inc, Budderfly, Johnson Controls, GridX.Inc, Enel X, Bernhard Energy Solutions, ENGIE Impact, Capstone Green Energy Corporation, and Ameresco focus on IoT-enabled energy management, subscription-based solar services, and home battery storage.

- Market trends include adoption of smart energy platforms, AI-enabled consumption optimization, and subscription-based models for residential users.

- Challenges include high initial costs, regulatory variations across regions, and slow adoption in developing areas.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Service Type

The Residential Energy as a Service market is segmented into Energy Supply Services, Microgrid-as-a-Service, Energy Infrastructure Services, and other specialized solutions. Energy Supply Services dominate, accounting for approximately 42% of the market, driven by rising residential electricity demand and consumer preference for predictable energy costs. Growth is fueled by the adoption of renewable energy subscriptions and integrated energy management solutions. Microgrid-as-a-Service is expanding as homeowners and communities seek reliable, localized power during outages. Energy Infrastructure Services support deployment of smart meters, solar systems, and storage solutions, further strengthening the service ecosystem.

- For instance, Ormat’s McGinness Hills complex in Nevada uses binary cycle technology. The complex has been expanded in phases, reaching a total capacity of approximately 160 MW.

By Technology

Market segmentation by technology includes Distributed Generation, EV-Charging Infrastructure, Energy Storage, and smart energy management solutions. Distributed Generation holds a dominant share of around 38%, supported by the growing adoption of rooftop solar panels and residential co-generation systems. Demand is driven by policy incentives, net metering programs, and the rising focus on carbon reduction. EV-Charging Infrastructure is witnessing rapid growth as electric vehicle adoption rises in residential communities. Energy Storage and smart home energy management systems complement generation technologies, offering enhanced efficiency, load balancing, and grid support capabilities.

- For instance, Mitsubishi Heavy Industries (MHI) has supplied over 100 geothermal steam turbines with a total installed capacity exceeding 3,200 MW across 13 countries, positioning the company among the world’s largest geothermal turbine providers.

By End User

Residential Energy as a Service caters to Commercial, Industrial, and multi-family residential segments. The Commercial segment leads, representing roughly 46% of the market, due to high energy consumption and cost optimization priorities. Businesses adopt energy-as-a-service models to reduce operational costs, integrate renewables, and ensure backup power reliability. Industrial users are expanding usage driven by energy-intensive operations and sustainability commitments. Multi-family residential units are increasingly implementing bundled energy services, combining supply, storage, and infrastructure solutions, while government incentives and utility partnerships further accelerate adoption across all end-user categories.

Key Growth Drivers

Rising Demand for Energy Efficiency

The Residential EaaS market benefits from growing consumer demand for energy-efficient solutions. Households increasingly seek systems that optimize electricity usage and reduce utility costs. Providers offer smart meters, connected appliances, and demand-response programs to monitor and control energy consumption. Government incentives, such as tax rebates for energy-efficient upgrades, further encourage adoption. As energy prices rise, consumers prioritize subscription-based energy services to manage bills and reduce environmental impact. This shift drives steady market growth globally.

- For instance, Atlas Copco’s DrillAir X-Air⁺ 750-25 portable compressor for geothermal drilling delivers a free air delivery between 678 and 701 cfm, with working pressures from 232 to 363 psi.

Integration of Renewable Energy Sources

Integration of solar panels, battery storage, and microgrids boosts Residential EaaS adoption. Providers enable homeowners to generate, store, and manage renewable energy efficiently. Technological improvements, including smart inverters and predictive energy management software, enhance system reliability. Renewable adoption aligns with carbon-reduction targets and sustainability goals, encouraging public and private investments. Customers increasingly prefer service models over upfront equipment costs, making EaaS an attractive solution. Consequently, renewable energy integration is a major market growth catalyst.

- For instance, Ansaldo offers geothermal steam turbines that operate with steam pressures up to 20 bar and superheat levels of up to 10 °C, adapting to diverse site steam conditions.

Advanced Digital Platforms and IoT Solutions

Digital platforms and IoT-driven energy management are accelerating market expansion. Smart home devices, connected thermostats, and energy analytics platforms allow real-time monitoring and predictive optimization. Data-driven insights enhance operational efficiency and user convenience, fostering adoption. Energy service providers leverage AI algorithms for demand forecasting, fault detection, and personalized energy recommendations. The combination of IoT and cloud-based platforms simplifies energy management for households, driving growth by offering seamless, subscription-based energy solutions.

Key Trends & Opportunities

Growth of Subscription-Based Models

Subscription-based Residential EaaS models are gaining traction, reducing upfront costs for consumers. Pay-as-you-go or monthly plans allow flexible access to energy services, including solar panels, battery storage, and smart management systems. This model encourages adoption among budget-conscious households while enabling service providers to scale operations efficiently. Partnerships with fintech and energy companies create bundled offerings that enhance value. The trend presents a significant opportunity for providers to expand revenue streams and strengthen long-term customer relationships.

- For instance, Turboden was selected to supply three ORC units, each rated at 60 MW gross, for Phase II of Fervo Energy’s Cape Station project in Utah, bringing an additional 180 MW of capacity to that site.

Expansion of Smart Home Integration

Residential EaaS is increasingly integrated with smart home ecosystems. Connected devices, voice-controlled appliances, and automated energy scheduling improve convenience and efficiency. Providers leverage smart home data to optimize energy consumption and offer personalized services. Integration supports demand-response programs and grid stabilization, benefiting utilities and consumers. The convergence of home automation and energy services opens new market segments, offering providers an opportunity to differentiate offerings and enhance customer engagement through advanced technology solutions.

- For instance, Toshiba’s Geoportable™ small-scale geothermal systems (used in Indonesia) are skid-mounted and compact enough to occupy ≈ 250 m², enabling them to be co-located near solar or wind farms for shared land use and transmission lines.

Rising Government Incentives and Regulatory Support

Government initiatives promoting renewable energy and energy efficiency drive Residential EaaS growth. Incentives, rebates, and tax credits for solar, battery storage, and efficiency upgrades lower adoption barriers. Regulatory frameworks encouraging demand-side management and distributed energy resources further support market expansion. Public-private partnerships and pilot projects increase awareness and confidence in subscription-based energy services. These supportive policies create a favorable environment for providers to scale operations and innovate solutions that align with sustainability and carbon-reduction targets.

Key Challenges

High Initial Infrastructure Costs

Implementing Residential EaaS requires significant investment in infrastructure, including smart meters, IoT devices, and renewable energy systems. Service providers face challenges in financing large-scale deployment and integrating diverse technologies into households. Consumers may hesitate due to perceived costs, limiting adoption in price-sensitive markets. Maintenance, upgrades, and system interoperability further increase operational complexity. Addressing these cost barriers through financing models, partnerships, and scalable technology solutions remains a critical challenge for the market’s sustainable growth.

Data Privacy and Cybersecurity Concerns

Residential EaaS relies on connected devices and cloud platforms, raising concerns about data privacy and security. Personal energy usage patterns and home automation data are vulnerable to cyberattacks. Consumers may resist adoption due to fear of unauthorized access or data misuse. Providers must invest in robust cybersecurity measures, compliance with privacy regulations, and transparent data policies. Failure to ensure secure energy management systems could hinder market growth and erode trust in subscription-based energy services globally.

Regional Analysis

North America

North America dominates the Residential Energy as a Service market, holding approximately 35% share in 2025. Growth is driven by rising adoption of smart home technologies and government incentives promoting renewable energy solutions. The U.S. leads with advanced energy management systems, while Canada focuses on grid modernization. Increased consumer awareness about energy efficiency and sustainability fuels demand. Key players invest in innovative solutions such as subscription-based solar and home battery services. Expansion of regional energy-as-a-service platforms and supportive policies further strengthen market presence, positioning North America as a hub for technological adoption and scalable residential energy solutions.

Europe

Europe accounts for nearly 28% of the Residential Energy as a Service market, with strong growth in Germany, the UK, and France. Government regulations encouraging decarbonization, energy efficiency, and renewable adoption drive market expansion. Rising consumer preference for subscription-based energy solutions and smart metering accelerates adoption. Regional energy-as-a-service providers integrate advanced software and IoT-enabled platforms to optimize residential energy consumption. Investments in renewable infrastructure and cross-border energy trade enhance service offerings. Increasing collaborations between utilities and tech companies enable innovative financing models, further strengthening Europe’s market position. Sustainable energy initiatives support steady growth and technology adoption across households.

Asia Pacific

Asia Pacific holds roughly 22% market share, driven by urbanization, increasing electricity demand, and government renewable initiatives. Countries such as China, Japan, and Australia are key contributors, adopting residential energy solutions like solar-as-a-service and smart home integration. Rapid digitalization, along with growing consumer awareness about energy efficiency, fuels adoption. Investments from major energy providers in IoT-enabled management systems support market growth. Emerging economies, including India and Southeast Asia, show significant potential for scalable energy services due to government support and incentive programs. The region combines affordability, renewable energy adoption, and technological advancement, making it a fast-growing market for residential energy services.

Latin America

Latin America contributes around 8% to the global Residential Energy as a Service market. Brazil, Mexico, and Chile drive demand through residential solar and battery storage solutions. Increasing electricity tariffs and rising energy costs push consumers toward service-based energy models. Regional utilities collaborate with tech firms to deploy smart metering and home energy management systems. Renewable energy adoption, government incentives, and financing programs enhance accessibility for households. Market expansion is supported by growing urban populations and sustainability awareness. Latin America remains a developing but promising market, with opportunities for service providers to scale operations and deliver energy efficiency solutions to residential consumers.

Middle East & Africa

The Middle East & Africa region holds about 7% market share, led by countries such as the UAE, Saudi Arabia, and South Africa. Rising electricity demand, coupled with renewable energy initiatives, drives residential energy service adoption. Governments promote solar energy and smart home technologies through incentives and policy frameworks. Residential energy-as-a-service providers focus on subscription-based solar, home batteries, and energy optimization platforms. Increasing urbanization, rising disposable income, and sustainability awareness contribute to market growth. Strategic partnerships between energy providers and technology firms enhance service penetration, while infrastructure investments and regulatory support pave the way for long-term expansion in residential energy solutions.

Market Segmentations:

By Service Type:

- Energy Supply Services

- Microgrid-As-A-Service

By Technology:

- Distributed Generation

- EV-Charging Infrastructure

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Residential Energy as a Service market include Centrica Business Solutions, Honeywell International Inc, Budderfly, Johnson Controls, GridX.Inc, Enel X, Bernhard Energy Solutions, ENGIE Impact, Capstone Green Energy Corporation, and Ameresco. The Residential Energy as a Service market is highly competitive, driven by rapid technology adoption and evolving consumer demands. Companies focus on advanced energy management systems, smart home integration, and renewable energy solutions to differentiate offerings. Innovation in IoT-enabled platforms, subscription-based solar services, and home battery storage enhances service efficiency and customer experience. Strategic partnerships, mergers, and acquisitions are common to expand market reach and capabilities. Providers emphasize sustainability, cost optimization, and digital solutions to meet growing residential energy needs. Continuous investment in R&D, coupled with government incentives and supportive policies, fosters market growth. Rising awareness of energy efficiency and decarbonization further intensifies competition, encouraging companies to deliver scalable, customized energy solutions for residential consumers across North America, Europe, Asia Pacific, and other emerging regions.

Key Player Analysis

- Centrica Business Solutions

- Honeywell International Inc

- Budderfly

- Johnson Controls

- Inc

- Enel X

- Bernhard Energy Solutions

- ENGIE Impact

- Capstone Green Energy Corporation

- Ameresco

Recent Developments

- In March 2025, Itron and Schneider Electric joined forces with Microsoft to embed distributed intelligence into grid-edge devices, upgrading utility visibility and control.

- In March 2025, Carrier Global Corporation and Google Cloud have unveiled a strategic alliance to deliver AI-enabled home energy ecosystems, integrating battery-equipped HVAC equipment with cloud analytics.

- In February 2025, Vantage Data Centers and VoltaGrid announced plans to deploy over 1 GW of natural-gas microgrid capacity to support hyperscale data center campuses in constrained markets.

- In April 2024, Huawei Digital Power, the solar energy arm of the multinational technology company, has teamed up with REVO Energia to introduce Energy as a Service (EaaS) in Brazil. The partnership aimed to boost the EaaS footprint in various sectors covering residential and commercial applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Service Type, Technology, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of smart home energy solutions is expected to grow steadily.

- Residential solar and battery services will expand across urban and suburban areas.

- IoT-enabled energy management platforms will drive operational efficiency.

- Companies will increasingly offer subscription-based and performance-driven energy models.

- Integration of AI and analytics will optimize residential energy consumption.

- Government incentives and renewable policies will support market growth.

- Collaboration between utilities and technology providers will enhance service delivery.

- Consumer demand for sustainable and cost-effective energy solutions will rise.

- Emerging markets in Asia Pacific and Latin America will see rapid adoption.

- Investments in R&D and innovation will create new residential energy offerings.

Market Segmentation Analysis:

Market Segmentation Analysis: