Market Overview

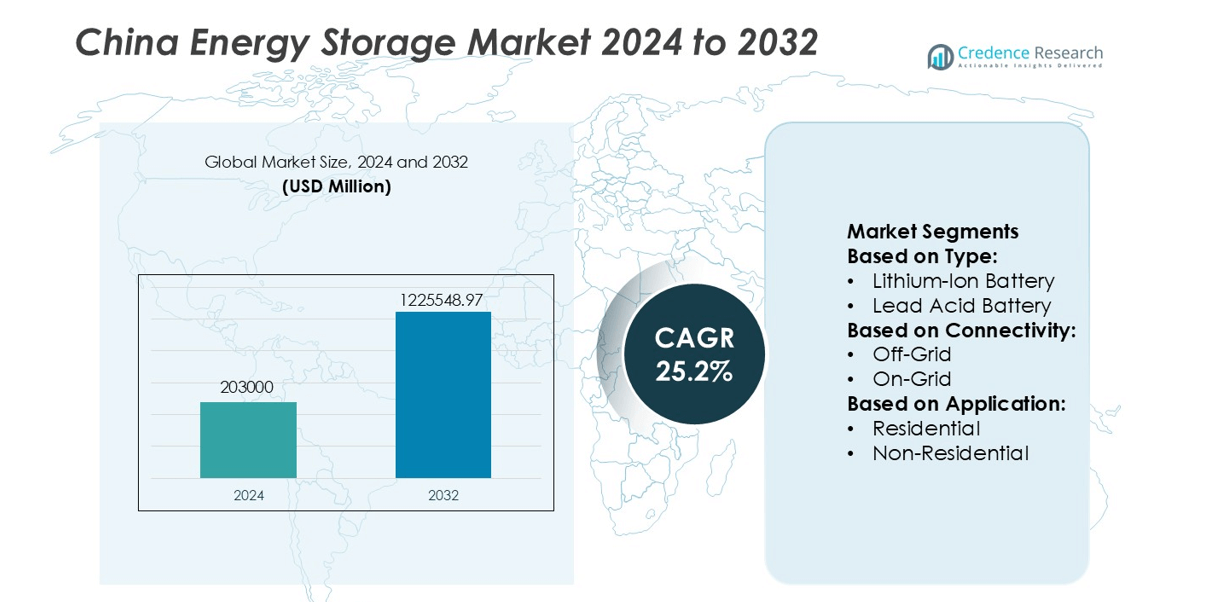

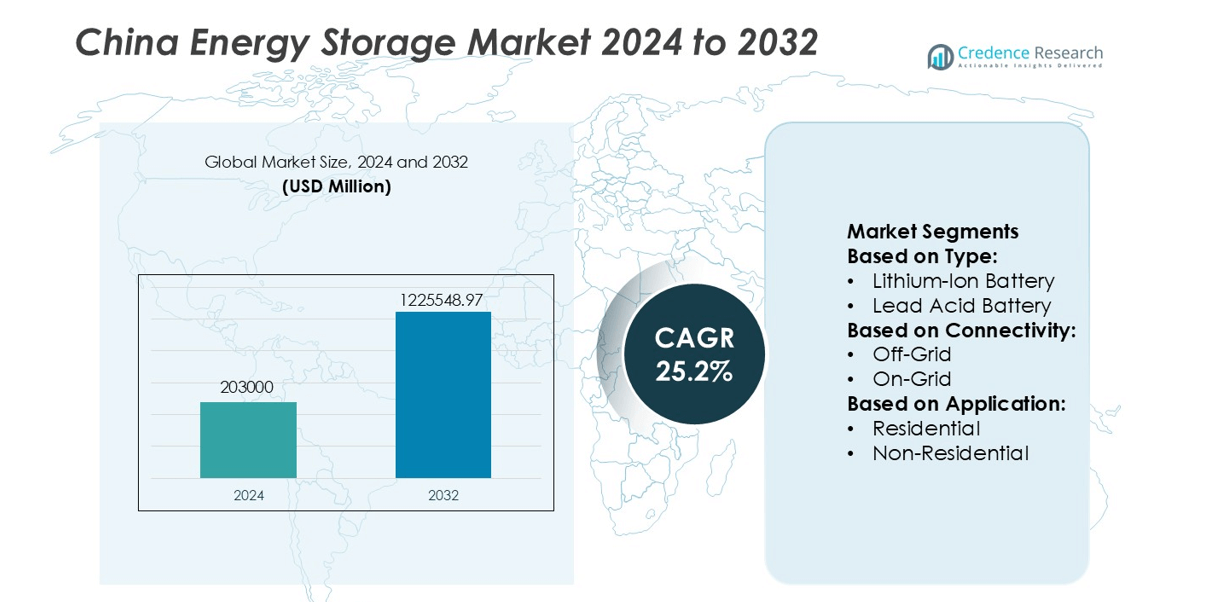

China Energy Storage Market size was valued USD 203000 million in 2024 and is anticipated to reach USD 1225548.97 million by 2032, at a CAGR of 25.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| China Energy Storage Market Size 2024 |

USD 203000 million |

| China Energy Storage Market, CAGR |

25.2% |

| China Energy Storage Market Size 2032 |

USD 1225548.97 million |

The China Energy Storage Market features strong competition among domestic and global technology providers offering lithium-ion batteries, power conversion systems, and integrated BESS solutions. Major players focus on large utility projects, EV charging infrastructure, and commercial energy management systems supported by digital monitoring platforms. Price reductions, long cycle life, and scalable modular designs strengthen deployment across grid-side and user-side applications. East China leads the market with a 32% market share, driven by high renewable energy penetration, advanced grid modernization, and strong investment from industrial parks and utilities. Growing project pipelines and supportive provincial policies continue to reinforce the region’s leadership.

Market Insights

- China Energy Storage Market size reached USD 203000 million in 2024 and will touch USD 1225548.97 million by 2032, registering a CAGR of 25.2%.

- Market drivers include renewable expansion, grid modernization, and rising demand for peak load management in industrial and commercial facilities.

- Key trends include deployment of virtual power plants, EV charging-side storage, and growth in lithium-ion and flow battery technologies for long-duration storage.

- Competitive activity remains strong as suppliers invest in large BESS projects, digital monitoring software, and modular battery systems for grid-side and user-side applications, while price reductions support faster adoption.

- East China leads with 32% regional share and holds the largest deployment of utility-scale storage, while lithium-ion batteries dominate the technology segment with the highest share due to long cycle life, fast response, and strong domestic manufacturing capacity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Lithium-ion batteries hold the dominant share in the China energy storage market due to high energy density, long cycle life, and falling battery cell prices. Their share continues to rise as large-scale renewable projects, electric vehicles, and grid-stabilization systems prefer lithium-ion for fast charge–discharge response and space efficiency. Lead-acid batteries remain in backup power and telecom sites, while flow batteries gain traction in long-duration storage projects. Government subsidies for battery manufacturing and giga-factory expansion further strengthen lithium-ion deployment in utility and commercial segments.

- For instance, Ormat’s McGinness Hills complex in Nevada uses binary cycle technology. The complex has been expanded in phases, reaching a total capacity of approximately 160 MW.

By Connectivity

On-grid energy storage leads the market with the highest share, supported by large renewable integration, peak-shaving needs, and grid frequency regulation programs. China’s focus on stabilizing solar and wind power output drives heavy investment in grid-connected systems across coastal and inland provinces. On-grid storage also benefits from policy incentives, ancillary service markets, and strong participation from state-owned utilities. Off-grid systems grow in remote industrial zones and rural electrification, but the scale remains smaller compared to grid-based deployments.

- For instance, Mitsubishi Heavy Industries (MHI) has supplied over 100 geothermal steam turbines with a total installed capacity exceeding 3,200 MW across 13 countries, positioning the company among the world’s largest geothermal turbine providers.

By Application

Utility-scale storage dominates the application segment, holding the largest market share as state utility companies install large lithium-ion and flow battery systems to manage renewable intermittency and maintain grid reliability. Residential and commercial users adopt smaller systems for energy savings and backup power. In ownership, utility-owned projects account for the major share due to large capital budgets, long-term planning, and nationwide clean-energy mandates. Third-party ownership models grow in industrial parks, while customer-owned systems rise in households adopting rooftop solar and battery packs.

Key Growth Drivers

Rising Renewable Energy Integration

China increases renewable capacity across wind, solar, and hybrid plants, creating strong demand for advanced energy storage. Grid operators use storage to stabilize frequency, balance intermittent power output, and reduce curtailment of renewable assets. The government supports large-scale battery deployments to improve local grid resilience and peak-load management. Utility operators expand storage at wind-solar bases and remote grids to reduce reliance on coal-based balancing sources. Favorable policies, declining battery costs, and rising renewable penetration continue to solidify storage as a critical component of China’s long-term energy transition strategy.

- For instance, Hitachi Energy announced an expanded large-power-transformer facility near Varennes, Quebec, which will nearly triple annual production capacity at that site and create around 500 new jobs.

Strong Policy Push and Investment Support

Subsidies, tax incentives, and pilot demonstration projects continue to drive large-scale storage installations. Central and provincial governments promote battery manufacturing, R&D, and industrial chain localization. State-owned utilities deploy storage solutions to meet new grid regulations for reliability and efficiency. Authorities introduce standards for safety, quality, and recycling, increasing confidence among investors and developers. Local deployment mandates require solar and wind projects to integrate storage, ensuring widespread market adoption. These policy frameworks encourage capital inflow, private participation, and faster commercialization of both front-of-the-meter and behind-the-meter systems.

- For instance, ABB’s medium-voltage switchgear enabled the 192 MWp floating solar power plant at Cirata Reservoir in West Java, Indonesia — the plant covers around 250 ha and avoids an estimated 214,000 tons of CO₂ annually.

Rapid Expansion of EV Battery Supply Chain

China leads global lithium-ion battery manufacturing, providing strong supply advantages for the storage sector. Large producers scale gigafactories, improving energy density, cycle life, and cost profiles. Energy storage companies benefit from shared technology platforms, localized raw material processing, and recycling initiatives. Second-life EV batteries enter the market, supporting stationary applications in residential, commercial, and industrial segments. Strategic partnerships between automakers, utilities, and technology providers accelerate new product development. As production capacity expands, system prices fall, enabling broader adoption and competitive bidding for grid-level projects.

Key Trends & Opportunities

Growth in Grid-Scale Storage Projects

Utility companies build large battery farms to support peak shaving, grid congestion management, and renewable balancing. Advanced technologies like flow batteries and hybrid BESS systems gain traction for long-duration applications. Developers explore multi-GWh installations linked to solar mega-parks and industrial parks. Virtual power plants, smart grid controls, and AI-based energy dispatch enhance operational efficiency. Growing electricity demand, carbon-neutral goals, and renewable project clustering create new business models for project developers and system integrators.

- For instance, Abengoa’s 280 MW gross “Solana Generating Station” parabolic-trough solar plant in Arizona includes a six-hour thermal energy storage system that allows dispatchable electricity production after sunset.

Rising Adoption in Commercial and Industrial Sector

Factories, data centers, and commercial buildings deploy storage for demand-charge reduction, backup power, and energy efficiency. Storage paired with rooftop solar helps enterprises optimize energy bills and improve power reliability during peak hours. Digital management platforms provide real-time analytics, remote monitoring, and predictive maintenance. Leasing and energy-as-a-service models attract customers without large upfront costs. As power tariffs rise and sustainability goals tighten, C&I storage adoption expands across manufacturing hubs and urban clusters.

- For instance, RMB 180 billion cumulative R&D figure was officially reported by BYD in its 2024 financial report. It is important to note that since the report, BYD has continued to invest, with the cumulative amount exceeding RMB 210 billion by September 2025.

Advancement in Battery Safety and Recycling

Manufacturers invest in fire-resistant chemistries, thermal management systems, and AI-based safety controls. Solid-state and sodium-ion batteries gain visibility as alternatives to traditional lithium-ion solutions. Recycling companies recover lithium, cobalt, and nickel, reducing supply chain pressure. Government regulations promote reuse and traceability across the battery lifecycle. Safe storage systems create new opportunities in residential and utility markets, especially in densely populated urban regions.

Key Challenges

Safety Risks and Technical Failures

Thermal runaway, fire hazards, and system malfunctions pose risk to large-scale deployments. Incidents result in operational losses and tighter safety inspections. Developers must use advanced fire suppression, thermal management, and monitoring software. High-density urban projects face stricter approvals and insurance barriers. As battery systems scale, technical reliability and standardized safety protocols remain critical for long-term market confidence and investor acceptance.

High Upfront Costs and Long Payback Cycles

Large grid-connected storage projects require significant capital investment, engineering, and integration costs. Return on investment depends on utilization rates, market pricing, and regulatory incentives. Smaller enterprises hesitate due to long payback periods and limited financing options. Energy-as-a-service and leasing models help, but adoption still requires favorable tariffs and revenue mechanisms. Without mature price signals for ancillary services and peak pricing, investment attractiveness remains uneven across provinces.

Regional Analysis

North America

North America holds a 34% market share in China-linked energy storage trade and technology deployment. Utilities in the United States and Canada continue to import lithium-ion battery cells and Battery Energy Storage Systems (BESS) from Chinese manufacturers. These systems support peak load shifting, renewable integration, and backup applications in solar and wind farms. Data centers, EV charging stations, and smart buildings add more commercial demand. Federal incentives and renewable targets improve procurement, while Chinese suppliers partner with EPC companies for turnkey storage projects. Product reliability and strong pricing advantages help China maintain a dominant supply position in this region.

Europe

Europe accounts for a 28% market share, driven by large solar and wind capacity across Germany, Spain, the UK, and France. China supplies battery modules, inverters, and complete BESS units for grid flexibility and industrial energy management. Rising EV adoption pushes demand for charging-side storage, especially in urban charging networks. Utility companies deploy large battery farms to reduce curtailment and stabilize transmission. New policies under the European Green Deal support more renewable storage projects. Despite local battery manufacturing, European buyers continue importing from China due to competitive cost, fast delivery, and strong production capacity.

Asia-Pacific (excluding China)

Asia-Pacific (excluding China) holds a 19% market share, supported by rising storage demand in India, Japan, South Korea, Australia, and Southeast Asia. Solar-plus-storage projects are expanding in industrial, commercial, and remote areas. Chinese BESS systems help reduce blackout risks, grid congestion, and high peak tariffs. Countries deploy micro-grids in islands and rural zones to replace diesel generators. Industrial parks use storage to improve power stability and cut operating costs. Growth continues as renewable targets rise across the region. Strong freight links and large production output allow Chinese suppliers to capture recurring orders and long-term contracts.

Latin America

Latin America captures a 9% market share, led by Brazil, Chile, and Mexico. Many solar-rich regions add storage to support grid balancing and avoid power cuts. Mining companies and remote industrial sites use containerized battery systems to support operations in areas with weak grids. Utility-scale storage supports renewable integration, frequency control, and capacity backup. Partnerships between Chinese equipment makers and local EPC contractors help accelerate installation timelines. Falling battery prices, import partnerships, and rising green hydrogen interest support future deployments. Although total market size remains smaller, the region continues to show steady growth potential.

Middle East & Africa

The Middle East & Africa region holds a 10% market share, driven by large solar farms in the UAE, Saudi Arabia, and South Africa. Countries invest in battery storage to support desert solar plants, reduce generator usage, and stabilize grids affected by demand spikes. Commercial buildings, airports, and industrial parks use BESS for backup power and energy bill optimization. Large-scale micro-grid projects support remote communities and islands. Chinese suppliers secure contracts due to competitive pricing and fast installation. Government sustainability goals and energy diversification plans support long-term storage deployment across both grid-side and user-side projects.

Market Segmentations:

By Type:

- Lithium-Ion Battery

- Lead Acid Battery

By Connectivity:

By Application:

- Residential

- Non-Residential

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the China Energy Storage Market includes Exide Technologies, CATL, Johnson Controls, LG Energy Solution, Durapower Group, Hitachi Energy, BYD Company, General Electric, ABB, and Burns & McDonnell. The China Energy Storage Market remains intense as manufacturers, EPC companies, and technology providers expand production capacity and project pipelines. Large domestic battery suppliers focus on lithium-ion technology, particularly LFP chemistry, due to strong safety profiles, long cycle life, and cost efficiency. Grid-scale storage developers invest in advanced power conversion systems, battery management software, and digital platforms for real-time monitoring and predictive maintenance. Engineering firms deliver turnkey solutions for utility projects, micro-grids, and renewable integration sites. Continuous price reductions, government policy support, and rapid renewable expansion drive aggressive competition, forcing suppliers to offer higher performance, faster deployment timelines, and long-term service agreements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Exide Technologies

- CATL

- Johnson Controls

- LG Energy Solution

- Durapower Group

- Hitachi Energy

- BYD Company

- General Electric

- ABB

- Burns & McDonnell

Recent Developments

- In June 2025, CATL announced mass production and delivery of its next-generation large-capacity energy storage cell, the 587Ah model, improving energy density and efficiency, a major technological advancement for the industry.

- In March 2024, Durapower’s subsidiary Suzhou Durapower Technology began construction on a new battery manufacturing factory in Suzhou, China. The factory, expected to be operational by Q2 2025, will have an annual production capacity of 2.0 GWh, double the output of their existing factory.

- In February 2024, LG Energy Solution agreed with WesCEF to expand and strengthen its lithium supply chain for competitive procurement. As per the agreement, WesCEF is poised to supply up to 85,000 tons of lithium concentrate, a crucial raw material for cathodes

Report Coverage

The research report offers an in-depth analysis based on Type, Connectivity, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Installed battery storage capacity will rise as renewable generation expands across provinces.

- Large grid-scale storage projects will support peak shaving, frequency control, and load shifting.

- Industrial and commercial users will adopt storage to cut peak tariffs and improve backup reliability.

- Virtual power plants will grow as digital platforms connect distributed batteries for grid services.

- EV charging networks will integrate charging-side storage to reduce stress on local distribution grids.

- Flow batteries and hybrid systems will gain interest for long-duration storage needs.

- Residential storage demand will increase with rooftop solar and smart home adoption.

- Policy incentives and carbon targets will encourage utilities to expand storage investments.

- Local manufacturing capacity will grow, reducing reliance on imported components.

- Energy storage will support rural electrification and micro-grid deployment in remote areas.