Market Overview

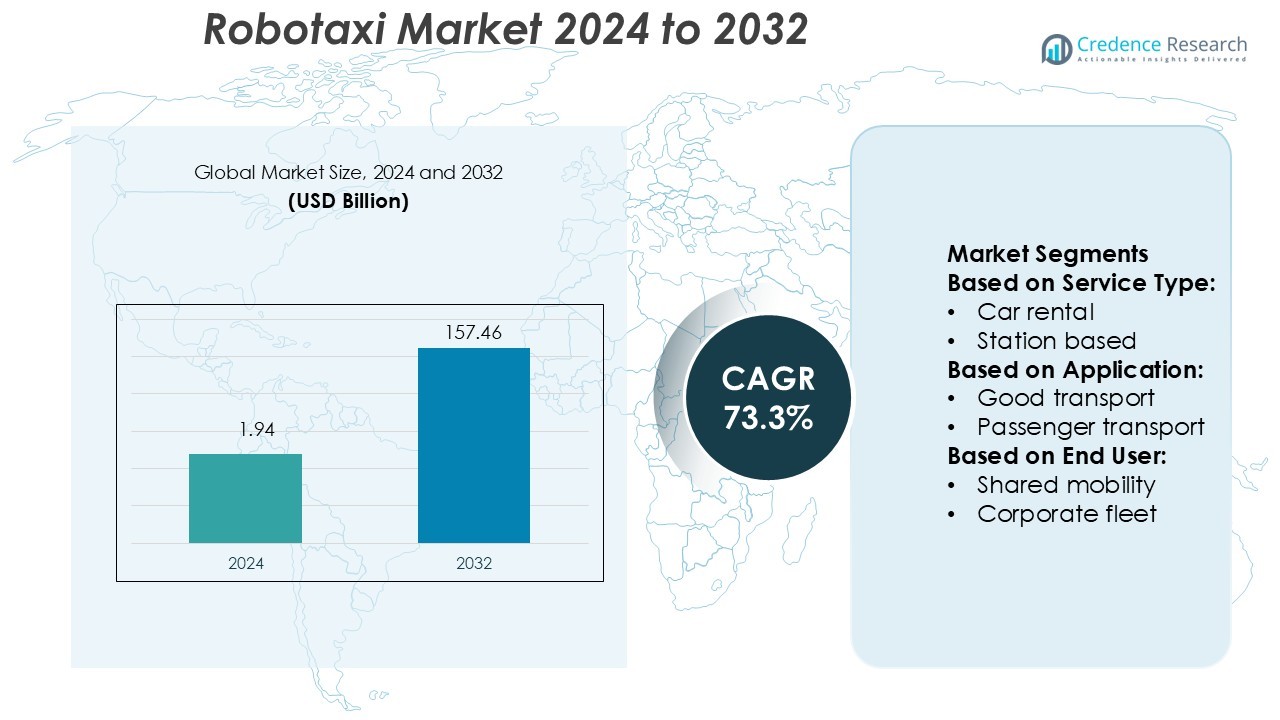

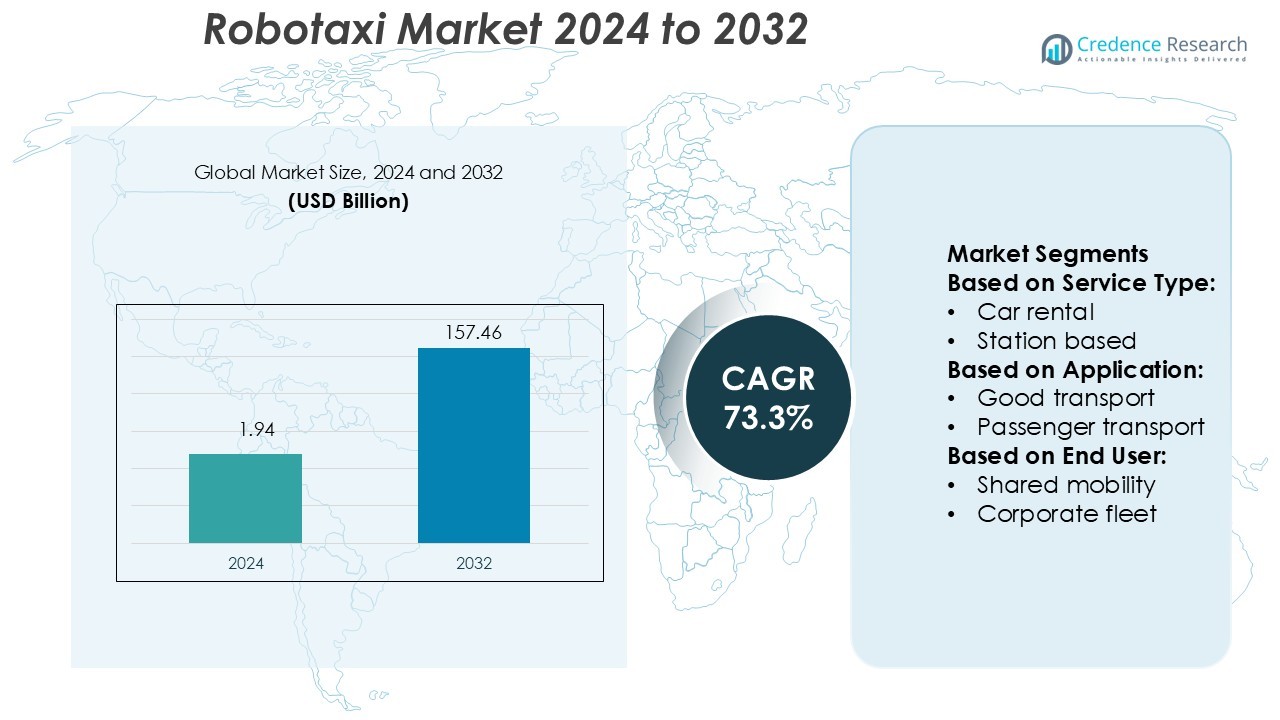

Robotaxi Market size was valued USD 1.94 billion in 2024 and is anticipated to reach USD 157.46 billion by 2032, at a CAGR of 73.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Robotaxi Market Size 2024 |

USD 1.94 Billion |

| Road Safety Market, CAGR |

73.3% |

| Road Safety Market Size 2032 |

USD 157.46 Billion |

The robotaxi market is characterized by strong competition among leading companies, including Aptiv, Lyft, Inc., Zoox, Inc., Waymo LLC, Baidu, Inc., Uber Technologies Inc., Cruise LLC, Didi Chuxing Technology Co., Ltd., EasyMile, and Tesla Inc. These players are accelerating commercialization through strategic partnerships, advanced AI integration, and large-scale pilot programs. Waymo and Cruise lead urban deployments, while Baidu and Didi are expanding across Asia with strong government backing. Tesla focuses on integrating autonomous driving systems into its fleet. North America leads the global market with a 37% share, driven by mature infrastructure, regulatory support, and early adoption of autonomous mobility solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The robotaxi market size was valued at USD 1.94 billion in 2024 and is projected to reach USD 157.46 billion by 2032, at a CAGR of 73.3% during the forecast period.

- Strong regulatory support, urban mobility demand, and rapid advancements in AI and sensor technology are driving market expansion globally.

- Key players are focusing on strategic partnerships, pilot programs, and autonomous driving innovation to gain a competitive edge and expand fleet operations.

- High deployment costs and regulatory complexities remain major restraints, slowing large-scale adoption in some regions.

- North America leads with a 37% regional share, followed by Europe at 29% and Asia Pacific at 24%, while car rental dominates the service type segment with the largest market share.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Service Type

Car rental leads the service type segment with a significant market share. This dominance is driven by flexible pricing, ease of access, and growing demand for short-distance autonomous rides. Robotaxi fleets in car rental models offer on-demand mobility without ownership costs, attracting urban commuters. Station-based services are expanding at a steady pace through fixed pickup and drop-off locations, supporting structured traffic flow and fleet optimization. The integration of advanced navigation, AI-driven dispatching, and route optimization strengthens service reliability, making car rental models the preferred option in high-density cities.

- For instance, Dhruva Space launched two Thybolt nanosatellites in November 2022, each weighing less than 750 grams. The mission was a technology demonstration for a store-and-forward communications payload for amateur radio operators.

By Application

Passenger transport holds the largest share in the application segment, supported by the rapid expansion of urban mobility networks. The demand for convenient, cost-efficient, and driverless commuting solutions fuels the adoption of robotaxis for daily transportation. Rising congestion levels and parking challenges in metropolitan areas further increase reliance on autonomous ride-hailing. Goods transport is gaining momentum as companies adopt robotaxi technology for last-mile deliveries. Automated fleets help reduce operational costs and enhance delivery efficiency, driving growth in logistics applications.

- For instance, Boeing’s contribution to the GOES‑15 weather satellite included a launch mass of 3,238 kg and a power system delivering about 2.3 kW at beginning-of-life.

By End User

Shared mobility dominates the end-user segment, accounting for the majority share due to its cost-effectiveness and high utilization rates. Urban residents increasingly prefer shared autonomous rides for daily travel, reducing private car ownership and parking demands. The shared model enables fleet operators to maximize vehicle uptime, improving profitability. Corporate fleet adoption is rising steadily, supported by enterprises integrating robotaxis into employee mobility programs. These fleets enhance operational efficiency and lower emissions, aligning with corporate sustainability goals and regulatory incentives.

Key Growth Drivers

Rising Demand for Autonomous Mobility Solutions

The growing preference for driverless vehicles is a major growth driver. Robotaxis reduce dependency on private vehicles, lower ownership costs, and improve transport efficiency. Urban areas face increasing congestion, creating demand for flexible and sustainable mobility services. Autonomous vehicles equipped with advanced sensors and AI systems offer safer and more reliable transport. Governments are supporting pilot programs and commercial operations, accelerating adoption. Companies are expanding fleets to meet rising commuter demand, positioning robotaxis as a core part of future mobility networks.

- For instance, EnduroSat’s Gen3 satellite platform, unveiled in 2025, features a payload capacity of up to 70 kg for certain models (such as the FRAME SmallSat), peak power of up to 3.5 kW, and data throughput of 2 Gbps, enabling rapid transmission of high-resolution environmental data.

Government Support and Regulatory Initiatives

Supportive policies and structured regulations are fueling market expansion. Governments across major economies are offering incentives for autonomous mobility deployment. Pilot programs, smart infrastructure investments, and emission reduction targets encourage fleet operators to adopt robotaxis. Regulations are creating frameworks for safety, operational guidelines, and liability standards, building trust among users. Strategic partnerships between public agencies and private mobility firms are strengthening infrastructure readiness. These coordinated efforts are driving market adoption and accelerating large-scale robotaxi deployment in urban transportation systems.

- For instance, Airbus Pléiades Neo constellation currently consists of two active satellites (launched in 2021) that deliver 30 cm native resolution imagery. Two additional satellites (Neo 5 and 6) were lost in a launch failure in December 2022, which prevented the full four-satellite constellation from being deployed.

Advancements in Autonomous Vehicle Technology

Rapid advancements in AI, LiDAR, sensors, and vehicle connectivity are boosting market growth. Improved perception systems enhance route accuracy, collision avoidance, and safety standards. Autonomous vehicles are now capable of operating in complex urban traffic environments with minimal human intervention. Companies are integrating over-the-air updates, enhancing fleet performance and adaptability. These innovations reduce operating costs and enable scalable fleet management. Enhanced software reliability and real-time data processing are increasing consumer confidence and supporting large-scale commercial robotaxi operations globally.

Key Trends & Opportunities

Expansion of Shared Mobility Ecosystems

Shared mobility models are emerging as a key opportunity for robotaxi deployment. The shared model allows cost-effective travel, high fleet utilization, and lower per-ride emissions. Urban populations prefer shared rides over private ownership, creating strong market potential. Companies are integrating robotaxis into existing mobility platforms, enabling seamless booking and payment systems. Subscription-based models and dynamic pricing further enhance user engagement. This trend aligns with cities’ sustainability goals and encourages operators to scale fleets efficiently in high-demand corridors.

- For instance, INVAP’s SAOCOM-1A and SAOCOM-1B satellites, launched in 2018 and 2020, each carry an L-band synthetic aperture radar with a 6.7 kW peak transmit power. Each satellite has a dry mass of around 1,600 kg and an overall launch mass of around 3,050 kg.

Integration with Smart Infrastructure

The integration of robotaxis with connected infrastructure presents a strong growth opportunity. Smart traffic signals, V2X communication, and intelligent transport systems enhance operational efficiency. These integrations reduce travel time, improve energy consumption, and optimize route planning. Cities investing in smart mobility corridors are enabling smoother navigation for autonomous vehicles. This trend supports safer and faster commercialization of robotaxi services. Collaboration between public agencies and technology firms ensures scalable infrastructure deployment that accelerates mass adoption.

- For instance, Blue Canyon Technologies offers the X-SAT Venus Class microsatellite platform, which supports a payload mass of up to 90 kg, though some variants of the platform may have lower payload capacities.

Rising Investment in Fleet Expansion

Fleet operators are increasingly investing in large-scale robotaxi deployments. Strategic partnerships and funding rounds enable technology upgrades and geographic expansion. Companies are focusing on autonomous electric vehicles to cut fuel costs and reduce emissions. Pilot programs in major cities demonstrate the operational feasibility of robotaxis, attracting more investors. This investment surge supports manufacturing growth, infrastructure development, and technological innovation.

Key Challenges

High Deployment and Maintenance Costs

Robotaxi operations require significant investment in advanced sensors, AI systems, and fleet infrastructure. The initial deployment cost is high, especially for scaling fleets in multiple cities. Maintenance and software upgrade expenses further increase operational costs. These factors limit smaller operators from entering the market and delay mass deployment. High costs also impact profitability timelines, requiring sustained investment from public and private stakeholders.

Safety, Liability, and Regulatory Uncertainty

Unclear regulatory frameworks and liability concerns pose major challenges. Autonomous vehicles must comply with evolving safety standards, which vary across regions. Accidents or malfunctions raise liability and insurance complexities. Building public trust remains critical, as consumers expect high safety assurance. Delays in policy standardization can slow commercial rollouts and affect investor confidence, making clear regulations essential for large-scale deployment.

Regional Analysis

North America

North America leads the global robotaxi market with a 37% share, driven by strong technological capabilities and early adoption of autonomous mobility. The U.S. dominates regional deployment through extensive pilot programs in major cities. High investment from technology firms and automakers accelerates commercialization. Well-developed road infrastructure and favorable regulatory environments support large-scale operations. Partnerships between ride-hailing companies and OEMs further strengthen market growth. Rising urbanization and strong consumer acceptance of autonomous transport make North America a key hub for robotaxi innovation and fleet expansion.

Europe

Europe holds a 29% market share, supported by strong government backing for sustainable and autonomous mobility. Countries like Germany, France, and the U.K. are investing heavily in smart city projects and pilot programs. Strict emission reduction policies accelerate the adoption of electric robotaxis. Advanced transport infrastructure and harmonized regulations enable smooth integration into urban mobility systems. Strategic collaborations between automotive manufacturers and technology providers drive regional growth. Consumer demand for efficient and eco-friendly transport solutions continues to boost adoption across major European cities.

Asia Pacific

Asia Pacific accounts for 24% of the robotaxi market, emerging as one of the fastest-growing regions. China and Japan lead with rapid fleet expansion and strong R&D investments. Growing urban populations and traffic congestion increase demand for autonomous mobility solutions. Governments support robotaxi trials and infrastructure development to reduce emissions and improve urban mobility. Technology firms and automakers collaborate to deploy cost-effective solutions tailored to local needs. Strong adoption in high-density cities positions Asia Pacific as a key market for future expansion.

Latin America

Latin America holds a 6% share of the global market, with early adoption led by Brazil and Mexico. The region is focusing on integrating autonomous solutions to address urban congestion and public transport gaps. Investments in pilot programs and partnerships with technology companies are expanding robotaxi availability. Infrastructure limitations and regulatory gaps slow large-scale deployment but create room for future growth. Government initiatives promoting smart mobility and electrification are expected to accelerate adoption in the coming years.

Middle East & Africa

The Middle East & Africa region captures a 4% share, with growth driven by smart city initiatives in the UAE and Saudi Arabia. High investments in advanced infrastructure and autonomous mobility programs strengthen market readiness. Governments actively support the deployment of autonomous fleets to enhance urban transport efficiency. Pilot projects in major cities like Dubai are positioning the region as a strategic testing ground. While adoption remains in early stages, supportive policies and infrastructure development are creating strong long-term growth potential.

Market Segmentations:

By Service Type:

By Application:

- Good transport

- Passenger transport

By End User:

- Shared mobility

- Corporate fleet

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the robotaxi market features key players including Aptiv, Lyft, Inc., Zoox, Inc., Waymo LLC, Baidu, Inc., Uber Technologies Inc., Cruise LLC, Didi Chuxing Technology Co., Ltd., EasyMile, and Tesla Inc. The robotaxi market is highly competitive, shaped by rapid technological progress and strategic partnerships. Companies are focusing on scaling autonomous fleets, improving vehicle safety, and integrating AI-driven systems to enhance operational efficiency. Investments in advanced sensor technologies, real-time data processing, and vehicle-to-infrastructure connectivity are accelerating commercial deployments. Pilot programs across major cities are validating service reliability and user acceptance. Ride-hailing platforms are integrating autonomous fleets to reduce operating costs and expand mobility access. Continuous innovation, supportive regulations, and infrastructure development are intensifying market competition and setting the stage for large-scale adoption.

Key Player Analysis

- Aptiv

- Lyft, Inc.

- Zoox, Inc.

- Waymo LLC

- Baidu, Inc.

- Uber Technologies Inc.

- Cruise LLC

- Didi Chuxing Technology Co., Ltd.

- EasyMile

- Tesla Inc.

Recent Developments

- In June 2025, Tesla, Inc. announced it would begin testing its long-anticipated robotaxi service in Austin, Texas, by the end of June. The initial rollout will include around 10 self-driving vehicles operating in select areas of the city. Over the following months, the company plans to scale the fleet up to approximately 1,000 vehicles.

- In September 2024, Foster City-based Zoox announced that they are entering the Bay Area robotaxi market with uniquely designed autonomous vehicles, featuring inward-facing seats and dual-side doors, aiming to differentiate itself from traditional robotaxi models.

- In June 2024, Waymo expanded its Waymo One robotaxi service beyond pilot stages across San Francisco, allowing anyone to hail self-driving rides via its app. Waymo’s fleet is all-electric and uses renewable energy, serving over 300,000 riders.

- In November 2023, Hyundai Motor Group and Motional announced the manufacture of the all-electric IONIQ 5 robotaxi at the new Hyundai Motor Group Innovation Center Singapore, with initial models set for U.S. deployment in 2024.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Service Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Autonomous fleet deployment will expand rapidly across major urban centers.

- Integration with smart city infrastructure will enhance operational efficiency.

- Electric robotaxis will gain traction to support zero-emission mobility goals.

- AI-driven route optimization will reduce travel time and costs.

- Shared mobility models will dominate high-demand corridors.

- Regulatory frameworks will become more standardized across key markets.

- Advancements in sensor technologies will improve safety and reliability.

- Strategic partnerships will accelerate fleet expansion and service coverage.

- Consumer trust in autonomous transport will continue to grow steadily.

- Robotaxis will play a central role in shaping future urban mobility systems.

Market Segmentation Analysis:

Market Segmentation Analysis: