Market Overview:

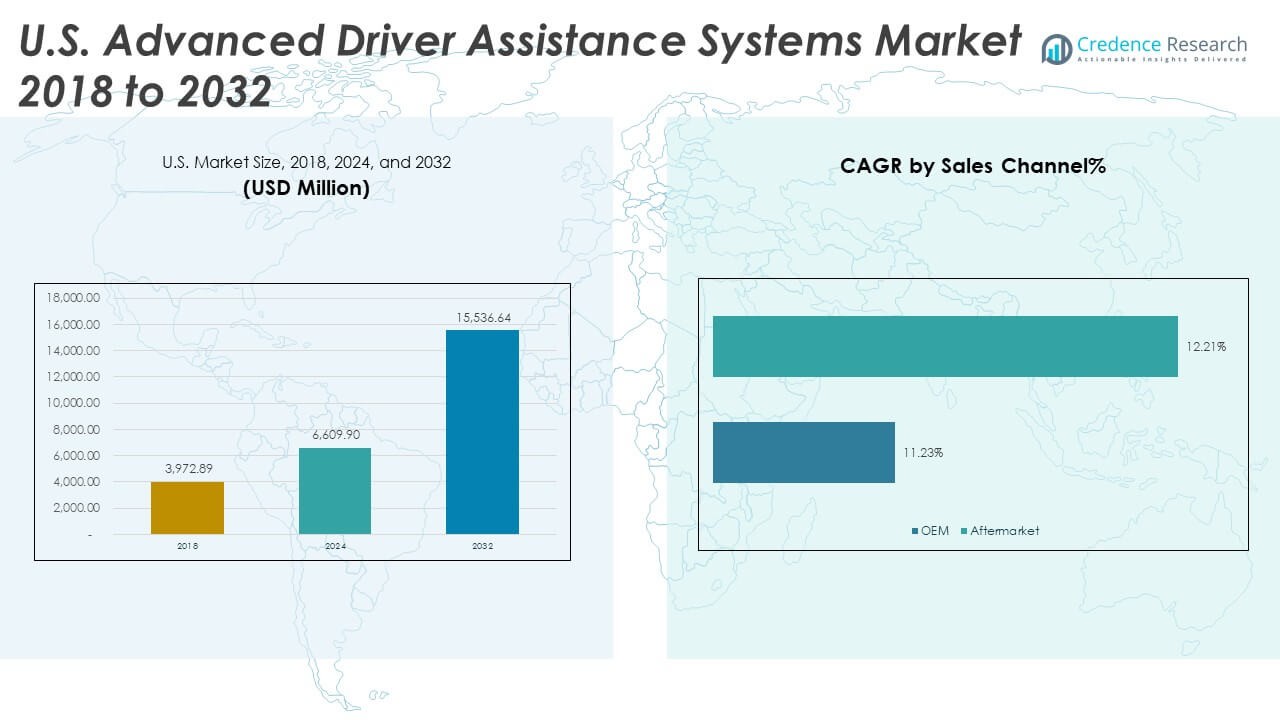

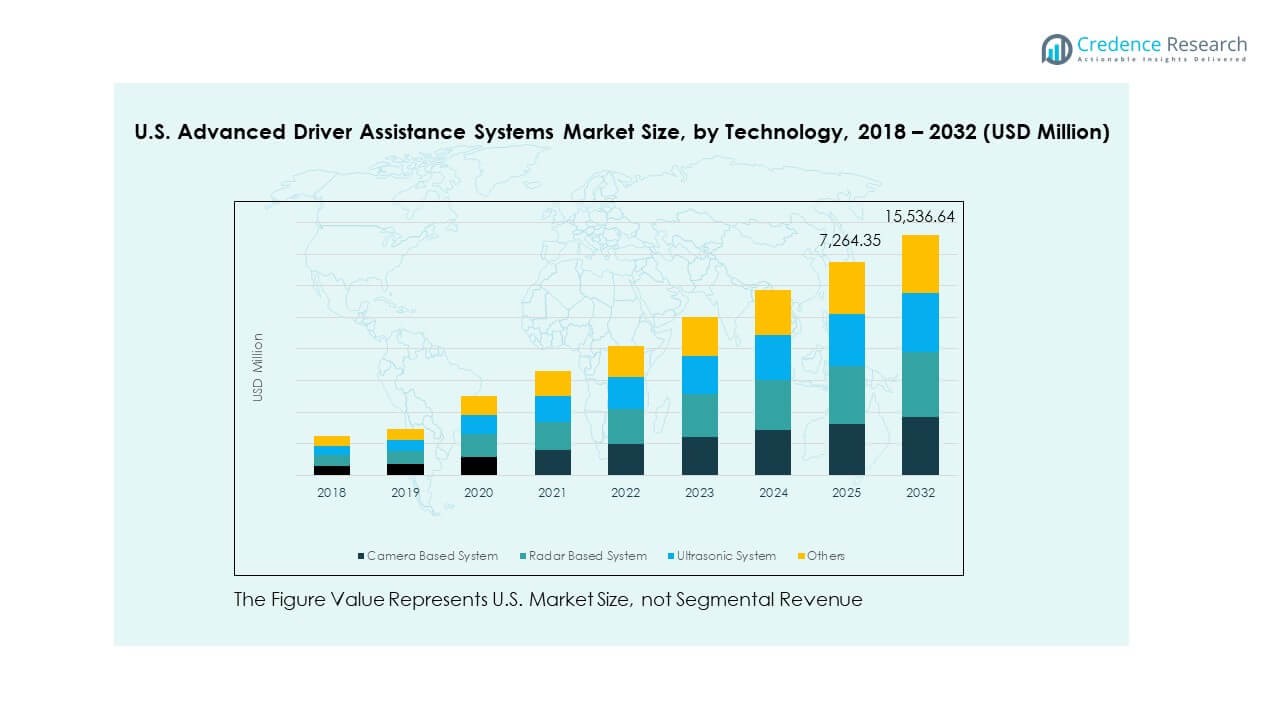

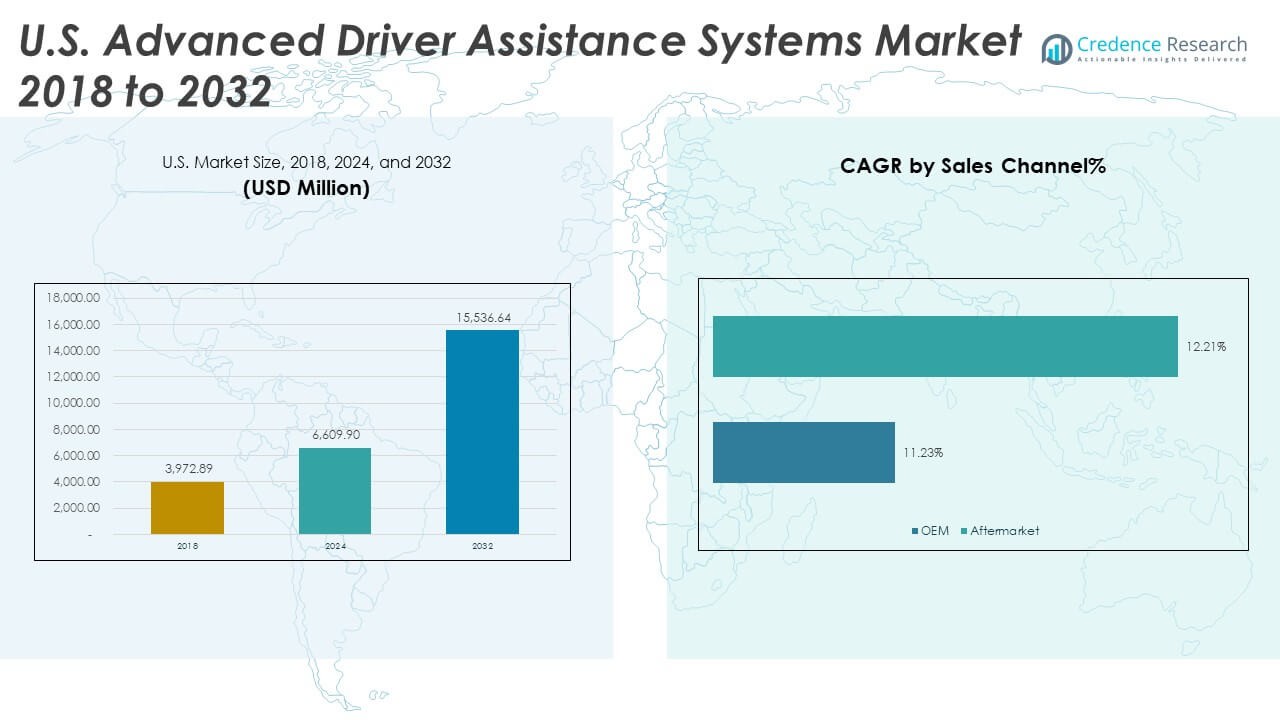

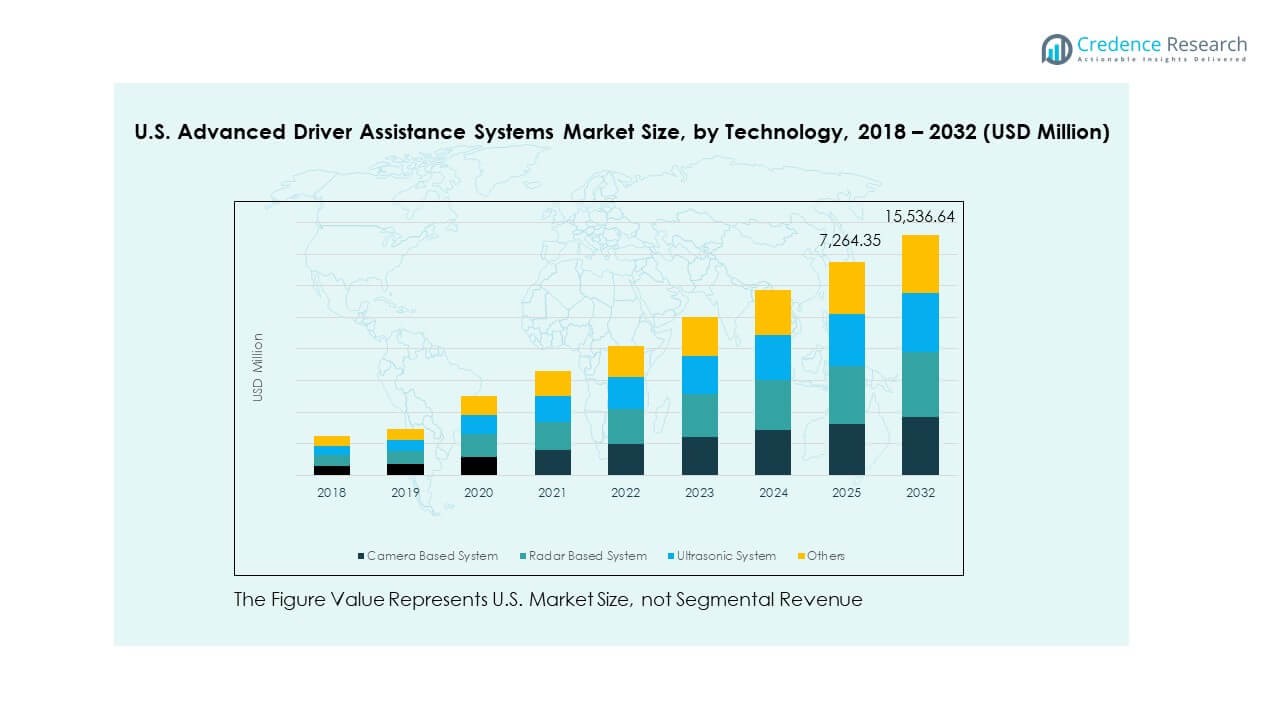

The U.S. Advanced Driver Assistance Systems Market size was valued at USD 3,972.89 million in 2018 to USD 6,609.90 million in 2024 and is anticipated to reach USD 15,536.64 million by 2032, at a CAGR of 11.27% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Advanced Driver Assistance Systems Market Size 2024 |

USD 6,609.90 Million |

| U.S. Advanced Driver Assistance Systems Market, CAGR |

11.27% |

| U.S. Advanced Driver Assistance Systems Market Size 2032 |

USD 15,536.64 Million |

The market growth is fueled by increasing safety regulations, consumer preference for driver assistance features, and rapid technological advancement in automotive electronics. Automakers integrate advanced systems such as adaptive cruise control, blind-spot detection, and lane-keeping assistance to enhance safety and driving comfort. The expansion of electric and semi-autonomous vehicles further accelerates adoption, supported by investments in AI-driven perception technologies and sensor fusion systems that improve situational awareness and vehicle response precision.

Regionally, North America dominates the market, with the U.S. leading adoption due to strong automotive innovation and the presence of major OEMs and technology developers. The Western states, led by California, play a critical role in advancing autonomous driving research and pilot programs. The Midwest continues to serve as a hub for automotive production and R&D collaboration, while the Southern and Northeastern regions witness growing integration of ADAS technologies across both commercial and passenger vehicles due to supportive safety initiatives and fleet modernization efforts.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. Advanced Driver Assistance Systems Market was valued at USD 3,972.89 million in 2018, reached USD 6,609.90 million in 2024, and is projected to attain USD 15,536.64 million by 2032, registering a CAGR of 11.27%.

- The Midwest and Southern regions collectively hold 42% share, supported by major automotive production hubs and expanding fleet modernization programs that drive ADAS integration.

- The Western region accounts for 30% share, led by California’s leadership in autonomous vehicle testing and strong collaboration between automakers and technology developers.

- The Northeast region holds 28% share and continues to grow steadily due to regulatory enforcement, dense urban traffic, and early adoption of connected vehicle technologies.

- Radar-based systems represent the largest segment with nearly 45% share, followed by camera-based systems at 35%, reflecting high reliance on precision sensing and visual recognition technologies across U.S. automakers.

Market Drivers

Rising Integration of Advanced Safety Systems Across Vehicle Models

The U.S. Advanced Driver Assistance Systems Market experiences strong growth through widespread integration of active safety features in passenger and commercial vehicles. Automakers implement adaptive cruise control, automatic emergency braking, and blind-spot monitoring to meet federal safety standards. Consumers prefer vehicles with driver assistance features that reduce fatigue and collision risk. The National Highway Traffic Safety Administration (NHTSA) supports mandatory inclusion of safety technologies to lower accident fatalities. Increasing focus on occupant protection encourages continuous technology adoption. Carmakers invest heavily in multi-sensor fusion systems that improve detection accuracy. The rise of connected and semi-autonomous vehicles further strengthens demand. It benefits from a shift toward intelligent mobility and regulatory enforcement.

- For example, a University of Michigan Transportation Research Institute (UMTRI) study using data from 3.7 million General Motors vehicles found that Automatic Emergency Braking and Forward Collision Alert together reduced rear-end striking crashes by 46%. Lane Keep Assist with Lane Departure Warning reduced roadway departure crashes by 20%, while Blind Zone Alert lowered lane-change crashes by 26%, demonstrating measurable real-world safety benefits of GM’s ADAS technologies.

Stringent Government Regulations Promoting Road Safety Compliance

Regulatory bodies drive expansion through compulsory installation of safety systems across new vehicle fleets. The U.S. Department of Transportation (DOT) sets standards for lane-keeping assistance, adaptive headlights, and pedestrian detection technologies. These rules promote consistent implementation of automation features across automotive segments. Manufacturers align product development strategies to comply with these evolving norms. Growing policy emphasis on Vision Zero initiatives supports vehicle safety improvement. Stringent crash avoidance and electronic stability control requirements shape vehicle design priorities. The push for enhanced driver monitoring ensures better accountability. It benefits from consistent government initiatives that prioritize driver safety and technology advancement.

Growing Consumer Demand for Technology-Enhanced Driving Experience

Rising consumer awareness of road safety and comfort boosts adoption of intelligent assistance systems. Buyers prioritize vehicles equipped with features like traffic sign recognition, collision avoidance, and automatic parking. Enhanced driver comfort and stress reduction increase market appeal. Manufacturers respond to this behavioral shift through digital cockpit integration and advanced sensor suites. Consumer trust in automation grows with improved real-world performance and transparency in system testing. Availability of mid-segment vehicles with ADAS capabilities broadens accessibility. Evolving lifestyle trends encourage preference for safety-supported driving. The U.S. Advanced Driver Assistance Systems Market benefits from consumers associating safety with modern driving experiences.

- For instance, Tesla’s Q2 2025 Vehicle Safety Report confirmed that Autopilot-enabled vehicles recorded one crash for every 6.69 million miles driven, compared with one crash per 702,000 miles nationally. Vehicles operated without Autopilot averaged one crash per 963,000 miles, highlighting a significant real-world safety improvement associated with Tesla’s advanced driver assistance technologies.

Rapid Technological Progress in Sensors, AI, and Vehicle Connectivity

Technological innovation fuels the sector’s evolution toward real-time situational awareness and autonomous readiness. Integration of radar, LiDAR, and machine vision enhances precision in object detection. Artificial intelligence enables vehicles to interpret complex traffic environments more effectively. Real-time data fusion supports accurate decision-making under challenging road conditions. Connectivity between vehicles and infrastructure enhances accident prevention measures. Continuous hardware optimization reduces system latency and improves sensor reliability. Automakers collaborate with tech firms to strengthen software capabilities. It gains significant momentum through AI-powered algorithms that redefine the boundaries of automotive safety.

Market Trends

Adoption of Level 2+ and Level 3 Semi-Autonomous Driving Systems

Automakers accelerate deployment of higher-level automation that supports hands-free and conditionally autonomous driving. Level 2+ systems dominate new launches with lane-centering and adaptive cruise functions operating simultaneously. Manufacturers integrate cloud-based updates to refine driver assistance features continuously. Sensor redundancy and fail-safe architecture ensure improved reliability. Integration of AI-based path prediction algorithms enhances control precision. Regulatory acceptance of partial autonomy expands consumer confidence. Tech firms collaborate with OEMs to validate performance across variable terrains. The U.S. Advanced Driver Assistance Systems Market gains traction with expanding real-world validation of semi-autonomous functionalities.

- For example, General Motors’ Super Cruise is officially available on more than 20 GM models and offers hands-free driving on over 700,000 miles of mapped roads across the U.S. and Canada. By the end of 2025, GM states Super Cruise will expand to 750,000 miles of highways, with Super Cruise-equipped vehicles having safely completed over 700 million miles of hands-free driving without a single reported crash attributed to the system.

Emergence of High-Definition Mapping and V2X Communication Networks

The integration of high-definition maps allows vehicles to perceive road layouts beyond sensor range. Vehicle-to-everything (V2X) communication creates real-time interaction between cars, pedestrians, and infrastructure. Smart city projects integrate these capabilities to optimize urban mobility. Cloud connectivity ensures real-time updates for road conditions and hazard warnings. The collaboration between automotive and telecom industries strengthens data-sharing frameworks. Accurate localization supports improved navigation and lane-level accuracy. Standardization of communication protocols increases interoperability among different brands. It benefits from growing infrastructure investments supporting connected vehicle ecosystems.

Shift Toward Software-Defined and Upgradable Vehicle Architectures

Manufacturers adopt centralized computing architectures that enable feature expansion through software updates. Over-the-air (OTA) capabilities reduce service dependency and enhance customer satisfaction. Continuous software enhancement ensures vehicles remain compliant with new regulations. Upgradable ADAS modules extend the functional lifespan of vehicles. Cybersecurity measures protect system integrity against unauthorized access. AI-based analytics refine driving pattern recognition for personalized assistance. Integration with digital dashboards improves user interaction and transparency. It reflects the industry’s move toward sustainable, flexible, and upgradable mobility solutions.

Integration of Driver Monitoring and Biometric Feedback Systems

Driver monitoring systems gain prominence to detect fatigue, distraction, and impaired driving. Infrared sensors track eye movements and facial expressions to ensure attentiveness. AI algorithms process behavioral cues to trigger safety interventions. Carmakers integrate biometric sensors for heart rate and stress detection. These systems reduce accidents caused by inattentive driving. Increasing adoption aligns with new regulatory mandates for driver awareness checks. Enhanced cabin monitoring improves overall safety compliance. The U.S. Advanced Driver Assistance Systems Market expands through adoption of behavior-aware safety technologies.

- For example, Volvo Cars’ EX90 features an industry-first dual-camera driver understanding system, using AI-powered gaze and behavioral analysis to detect driver distraction or drowsiness in real time. The driver monitoring software, developed by Smart Eye a supplier integrated in over 1 million production vehicles globally as of 2023 continuously evaluates the driver’s alertness and readiness to intervene, furthering Volvo’s vision of zero fatalities among occupants in new models.

Market Challenges Analysis

High Implementation Costs and Complex Sensor Calibration Requirements

The high cost of sensors, radar modules, and control units poses barriers for mass adoption. Installation requires precise calibration that increases maintenance and repair expenses. Smaller manufacturers struggle to achieve economies of scale in production. Vehicle design complexities complicate sensor alignment, especially after collisions or part replacements. Insurance coverage for ADAS components remains inconsistent, raising ownership costs. Consumers in price-sensitive segments hesitate to pay premiums for technology. Maintenance infrastructure in rural areas lacks capability for advanced diagnostics. The U.S. Advanced Driver Assistance Systems Market faces constraints due to integration and affordability challenges.

Regulatory Variations, Data Security, and Real-World Reliability Concerns

Varying federal and state regulations complicate deployment timelines across vehicle categories. Inconsistent safety testing protocols delay product certification and launch cycles. Data privacy concerns grow with increasing vehicle connectivity and cloud integration. Hackers targeting vehicle networks expose system vulnerabilities. Real-world conditions such as fog, heavy rain, and low-light environments limit sensor accuracy. False detection incidents reduce driver confidence in automation. Standardized validation frameworks remain under development to ensure reliability. It continues to face scrutiny over cybersecurity, trust, and operational consistency.

Market Opportunities

Expansion of Electric and Autonomous Vehicle Ecosystems Across North America

The growth of electric and autonomous mobility creates strong opportunities for ADAS integration. EV manufacturers adopt safety technologies to strengthen competitive differentiation. Federal funding for intelligent transport infrastructure accelerates deployment. Collaborations between automotive and AI startups boost innovation in navigation intelligence. The U.S. Advanced Driver Assistance Systems Market benefits from joint ventures focused on integrating self-driving features with sustainable vehicle platforms. Expanding charging networks and connectivity frameworks enhance ADAS performance. Tech companies focus on scalable solutions adaptable across multiple EV models.

Rising Demand for Aftermarket Upgrades and Predictive Maintenance Solutions

The aftermarket sector experiences steady expansion with growing retrofitting of ADAS features in older vehicles. Sensor kits and monitoring modules cater to cost-sensitive buyers seeking safety improvements. Predictive maintenance systems identify component wear using analytics, improving uptime and efficiency. Fleet operators adopt data-driven solutions to manage large vehicle networks safely. Subscription-based software services enable real-time feature activation. It captures value from long-term software maintenance and diagnostics support. Continuous product innovation strengthens ecosystem resilience and customer engagement.

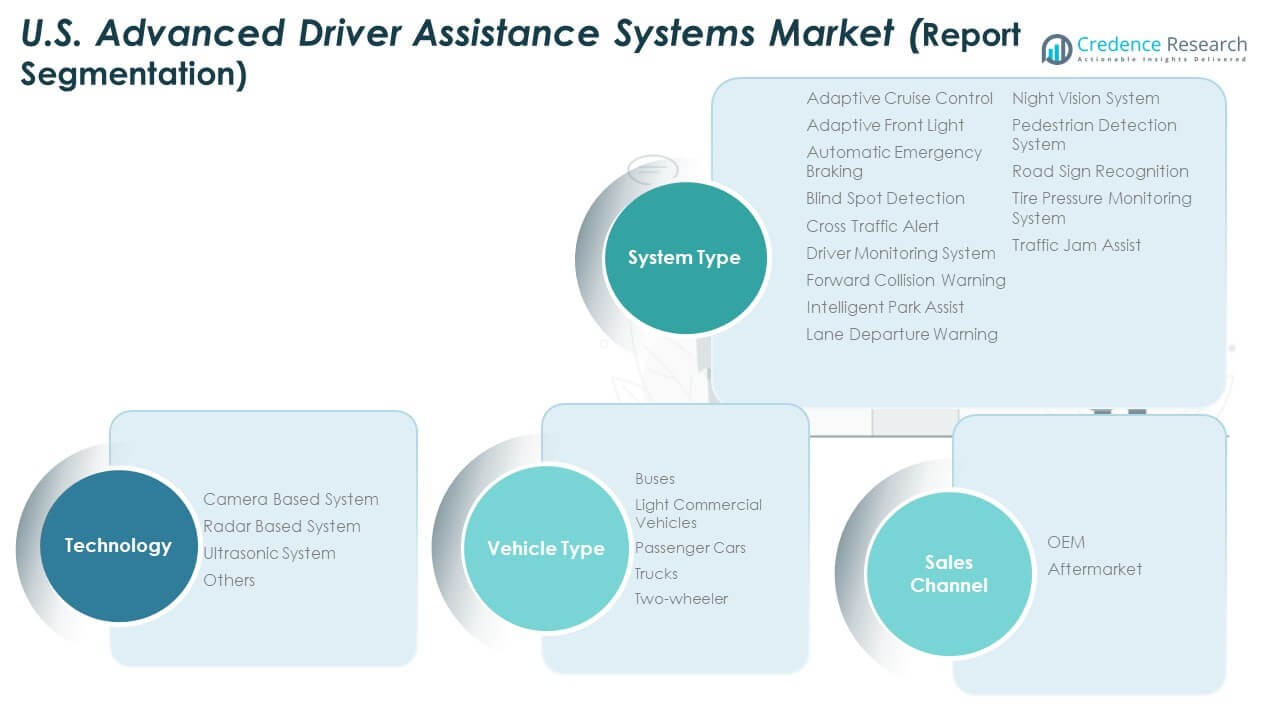

Market Segmentation Analysis

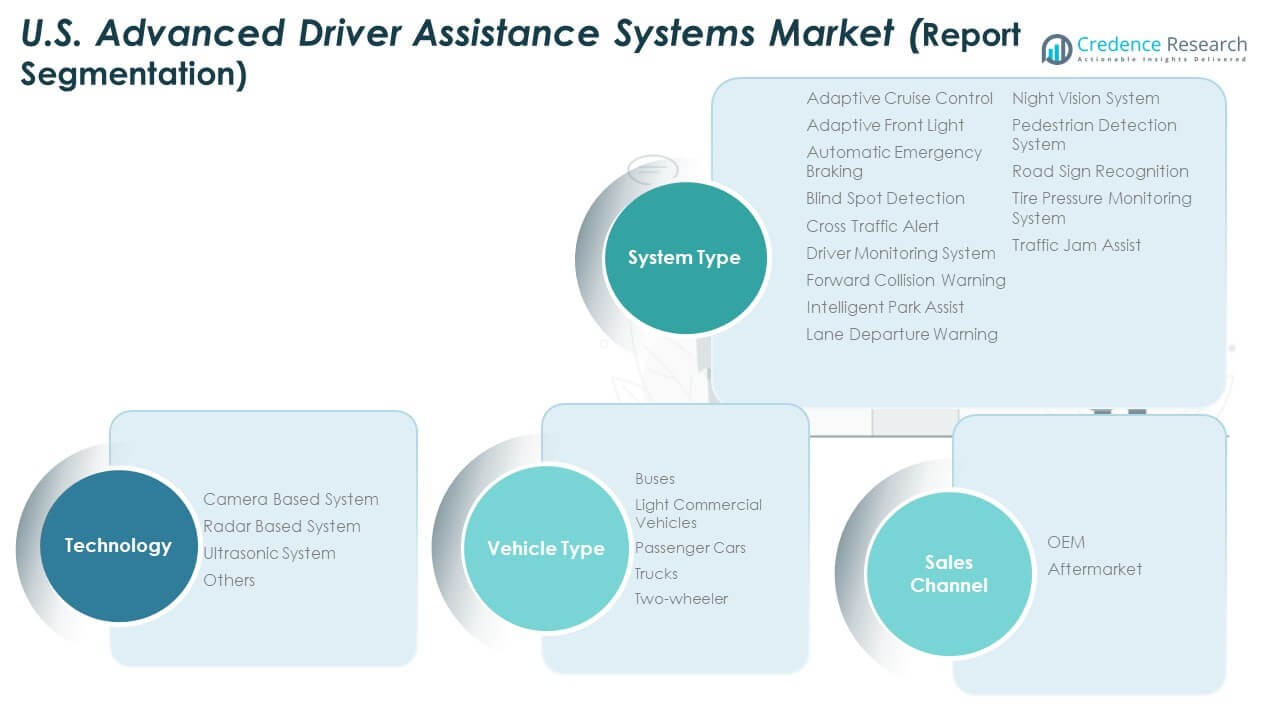

By System Type

The U.S. Advanced Driver Assistance Systems Market includes diverse system types enhancing driver awareness and safety. Adaptive Cruise Control and Automatic Emergency Braking dominate adoption due to regulatory mandates and growing consumer demand for collision prevention. Lane Departure Warning and Blind Spot Detection contribute to lane discipline and side-impact reduction. Driver Monitoring Systems gain traction with rising concerns about distracted driving. Pedestrian Detection, Traffic Jam Assist, and Road Sign Recognition improve urban driving safety. It benefits from integration of multiple subsystems offering real-time data analysis and adaptive control.

- For example, General Motors confirmed that its Cadillac CT4 and CT5 models are equipped with Automatic Emergency Braking (AEB) as part of the brand’s standard safety suite. This aligns with NHTSA’s 2024 final rule mandating AEB on all new light vehicles by 2029, reinforcing GM’s ongoing compliance with federal safety advancements.

By Technology

Camera-based and radar-based technologies lead the market due to high precision and reliability in vehicle perception. Radar-based systems provide superior performance under poor weather conditions, while camera systems enhance visual recognition and lane tracking. Ultrasonic systems support short-range detection for parking and low-speed maneuvers. Hybrid sensor integration combines multiple technologies for improved safety accuracy. The U.S. Advanced Driver Assistance Systems Market strengthens through advancements in machine vision, LiDAR calibration, and sensor fusion algorithms that enhance decision-making and environmental awareness.

- For example, ParkHelp Technology reports that its indoor ultrasonic parking sensors deliver a minimum of 99.9% accuracy in vehicle detection. These sensors form part of the company’s parking guidance solutions, designed to optimize space utilization and provide reliable real-time monitoring within indoor parking facilities.

By Vehicle Type

Passenger cars dominate due to large-scale production and consumer preference for safety-equipped vehicles. Light commercial vehicles increasingly adopt ADAS features to reduce accidents and logistics downtime. Trucks and buses integrate adaptive braking and monitoring systems to meet fleet safety standards. Two-wheelers gradually enter the ADAS ecosystem through smart assist features and collision alerts. It benefits from OEM investments aimed at creating multi-segment compatibility across diverse vehicle categories and improving road safety outcomes.

By Sales Channel

OEMs represent the primary sales channel with widespread installation during vehicle manufacturing stages. Automakers focus on incorporating ADAS modules to comply with federal safety standards and attract premium buyers. The aftermarket segment grows steadily with demand for retrofitting ADAS components in older vehicles. Consumers and fleet operators install upgrades for added safety and operational efficiency. The U.S. Advanced Driver Assistance Systems Market evolves with service providers offering calibration and maintenance solutions that ensure system accuracy and long-term reliability.

Segmentation

By System Type

- Adaptive Cruise Control

- Adaptive Front Light

- Automatic Emergency Braking

- Blind Spot Detection

- Cross Traffic Alert

- Driver Monitoring System

- Forward Collision Warning

- Intelligent Park Assist

- Lane Departure Warning

- Night Vision System

- Pedestrian Detection System

- Road Sign Recognition

- Tire Pressure Monitoring System

- Traffic Jam Assist

By Technology

- Camera-Based System

- Radar-Based System

- Ultrasonic System

- Others

By Vehicle Type

- Buses

- Light Commercial Vehicles

- Passenger Cars

- Trucks

- Two-Wheeler

By Sales Channel

Regional Analysis

Northeast United States

The Northeast region holds 28% of the U.S. Advanced Driver Assistance Systems Market share, driven by high vehicle density and early adoption of automotive technologies. States such as New York, Massachusetts, and Pennsylvania emphasize regulatory compliance and advanced safety initiatives. The concentration of research institutions and OEM collaborations accelerates innovation in driver monitoring and automated braking systems. Urban congestion fuels demand for adaptive cruise control and intelligent park assist. Infrastructure development supports integration of connected and semi-autonomous vehicles. It benefits from strong public-private partnerships advancing smart mobility and traffic management solutions.

Midwest and Southern United States

The Midwest and Southern regions collectively account for 42% of the market share, supported by strong manufacturing presence and steady demand from commercial fleets. Michigan, Ohio, and Texas act as industrial anchors with established automotive supply chains and OEM headquarters. Growing logistics and freight operations increase the need for ADAS-equipped trucks and buses. Favorable state incentives encourage vehicle modernization and fleet electrification, boosting sensor and radar-based system installations. The region’s evolving infrastructure and safety initiatives enhance adoption rates among both private and commercial vehicle users. It strengthens its position through sustained investment in vehicle automation testing centers.

Western United States

The Western region captures 30% of the U.S. Advanced Driver Assistance Systems Market share, led by California’s dominance in technology development and autonomous vehicle testing. The presence of leading AI companies, semiconductor firms, and mobility startups drives software innovation and hardware integration. Rising adoption of electric and hybrid vehicles in California and Washington amplifies the inclusion of ADAS features. State safety regulations and pilot programs for connected vehicle infrastructure accelerate real-world trials. Cross-industry collaboration fosters rapid development of adaptive and predictive assistance systems. It continues to benefit from high consumer awareness and supportive policy frameworks that promote next-generation mobility adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Altera Corporation

- Robert Bosch GmbH

- Continental AG

- DENSO Corporation

- Magna International Inc.

- ZF Friedrichshafen AG

- Aptiv PLC

- Valeo SA

- Mobileye

- Autoliv Inc.

- Other Key Players

Competitive Analysis

The U.S. Advanced Driver Assistance Systems Market features strong competition among established automotive suppliers and technology innovators. Leading players such as Robert Bosch GmbH, Continental AG, DENSO Corporation, and ZF Friedrichshafen AG dominate through large-scale manufacturing and deep partnerships with major automakers. These companies invest heavily in radar, LiDAR, and vision-based systems that enhance precision and reliability. Software-driven firms like Mobileye and Aptiv PLC strengthen their market presence through AI-enabled perception and real-time data processing solutions. Strategic alliances between hardware suppliers and semiconductor manufacturers create integrated platforms supporting Level 2+ and Level 3 automation. It benefits from an ecosystem where traditional OEMs and new mobility companies collaborate on advanced sensor fusion and predictive control technologies.Intense competition drives continuous innovation, with firms focusing on improving affordability, energy efficiency, and adaptability across vehicle types. Market participants prioritize R&D for scalable architectures that meet evolving federal safety standards. Mergers, acquisitions, and regional expansions enhance product portfolios and ensure supply chain resilience. Companies pursue proprietary algorithms and cloud-based monitoring platforms to offer differentiation in autonomous readiness.

Recent Developments

- In July 2025, Robert Bosch GmbH launched a state-of-the-art radar sensor designed for high-precision obstacle detection in urban driving scenarios. This new product is positioned to enhance lane keeping, emergency braking, and pedestrian detection features, strengthening Bosch’s ADAS portfolio across U.S. automakers.

- In January 2025, Continental AG unveiled a partnership with a major U.S.-based autonomous vehicle manufacturer to integrate Continental’s advanced camera and radar technologies into commercial fleets, aiming to streamline the rollout of ADAS functionalities at scale.

- In January 2025, Aptiv PLC made headlines by unveiling new ADAS and perception solutions at CES 2025, introducing an open, scalable ADAS platform alongside advanced perception hardware and software designed for hands-off driving.

- In January 2025, Rivian announced the launch of hands-free driver-assist for its R1T and R1S models, with an ‘eyes-off’ mode targeted for future release. This expanded its suite of highway ADAS features, marking a significant step towards higher-level autonomy on American roads.

Report Coverage

The research report offers an in-depth analysis based on System Type, Technology, Vehicle Type and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Integration of artificial intelligence will strengthen predictive safety, enabling faster object detection and decision-making accuracy.

- Growing adoption of semi-autonomous vehicles will expand system-level innovations in adaptive braking, lane management, and driver monitoring.

- OEMs will increasingly collaborate with semiconductor and software firms to develop scalable ADAS architectures across multiple vehicle classes.

- Advancements in radar and LiDAR sensors will improve environmental awareness, supporting higher-level automation readiness.

- Expansion of electric and connected vehicle ecosystems will accelerate demand for advanced driver assistance solutions in urban areas.

- Cloud-based updates and over-the-air enhancements will redefine post-sale upgrades and long-term system functionality.

- Regulatory mandates emphasizing zero-fatality road safety goals will continue to drive mandatory ADAS installation in new vehicles.

- Aftermarket growth will rise through retrofitting solutions, particularly for light commercial vehicles and public transport fleets.

- Continuous consumer education and awareness campaigns will encourage wider acceptance of partially autonomous driving features.

- Increasing cross-industry partnerships will shape new standards for data sharing, cybersecurity, and system interoperability across the U.S. market.