Market Overview

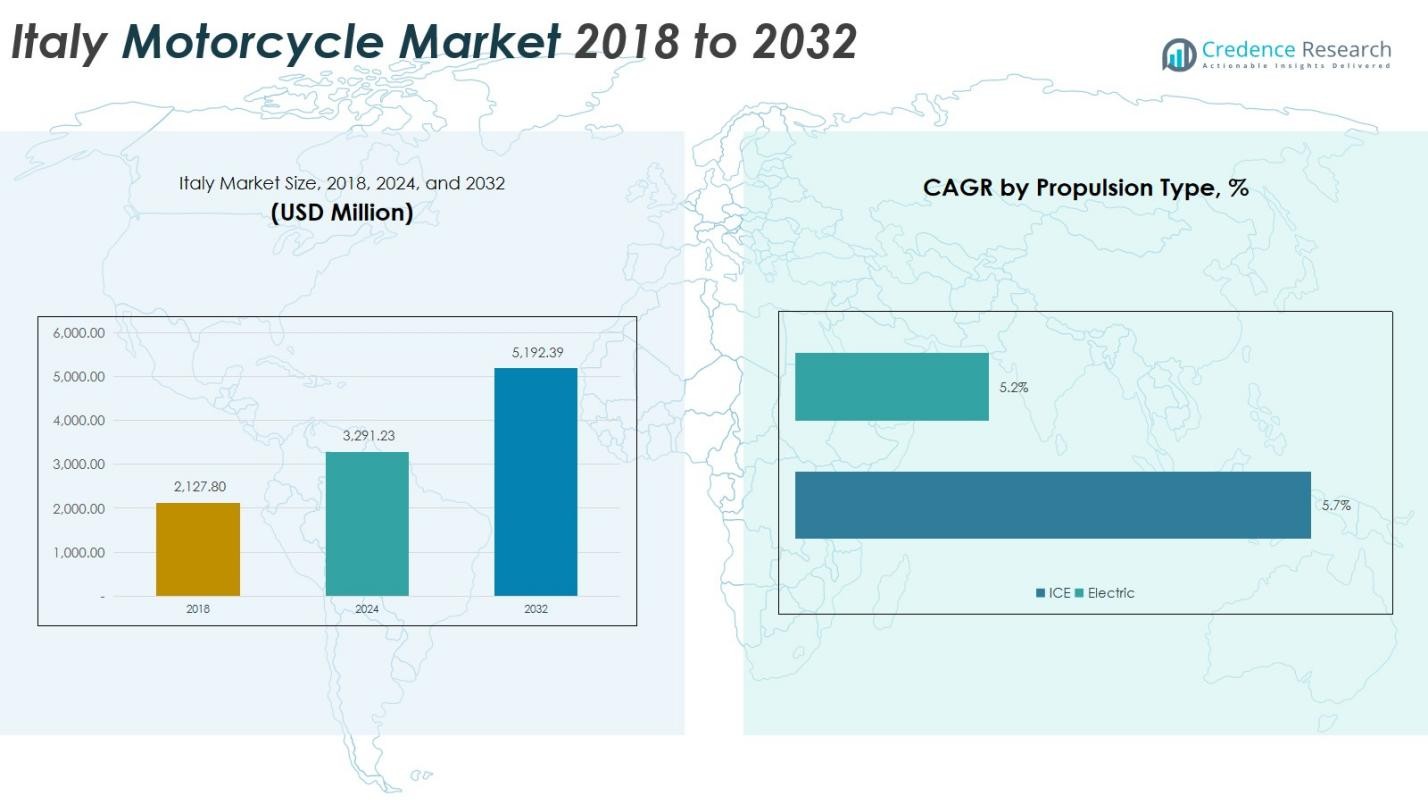

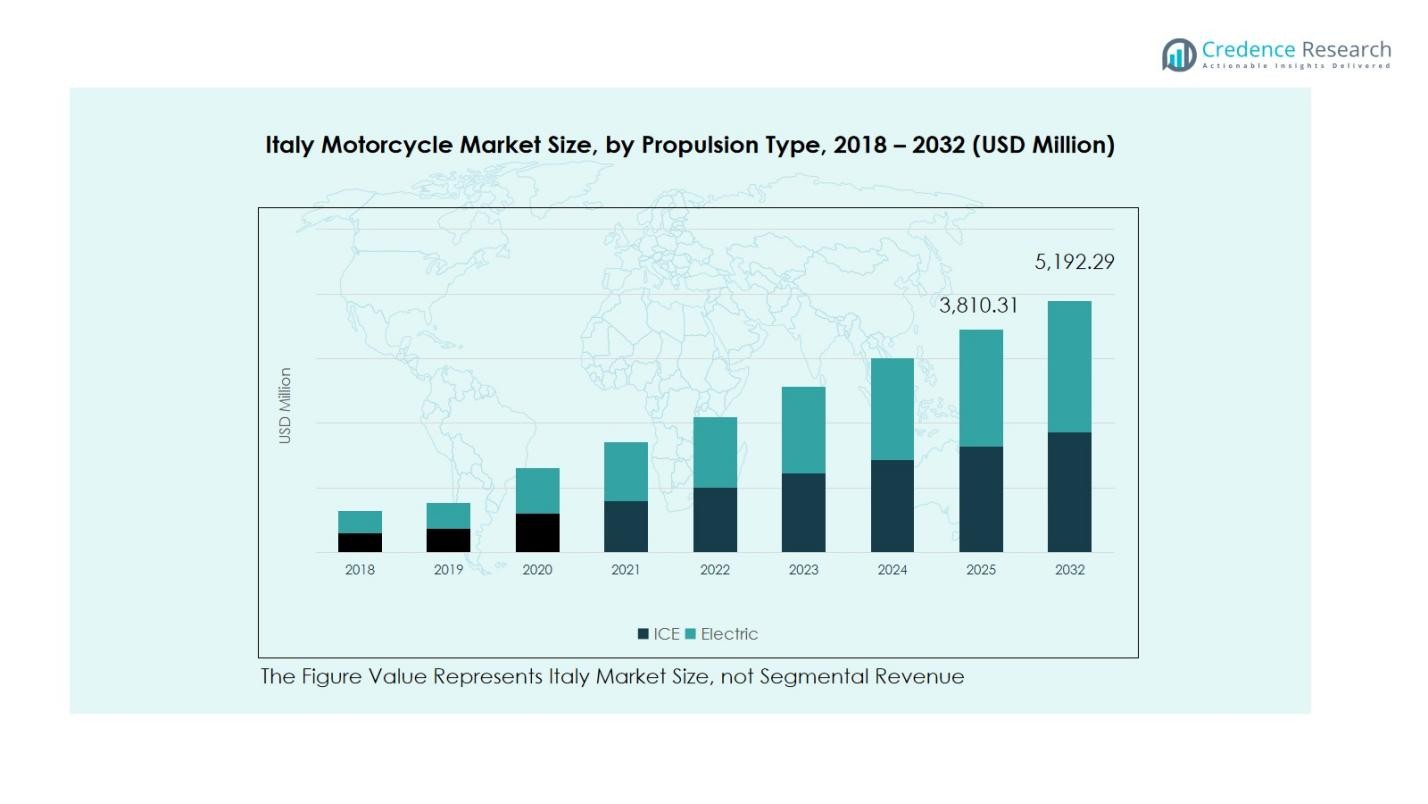

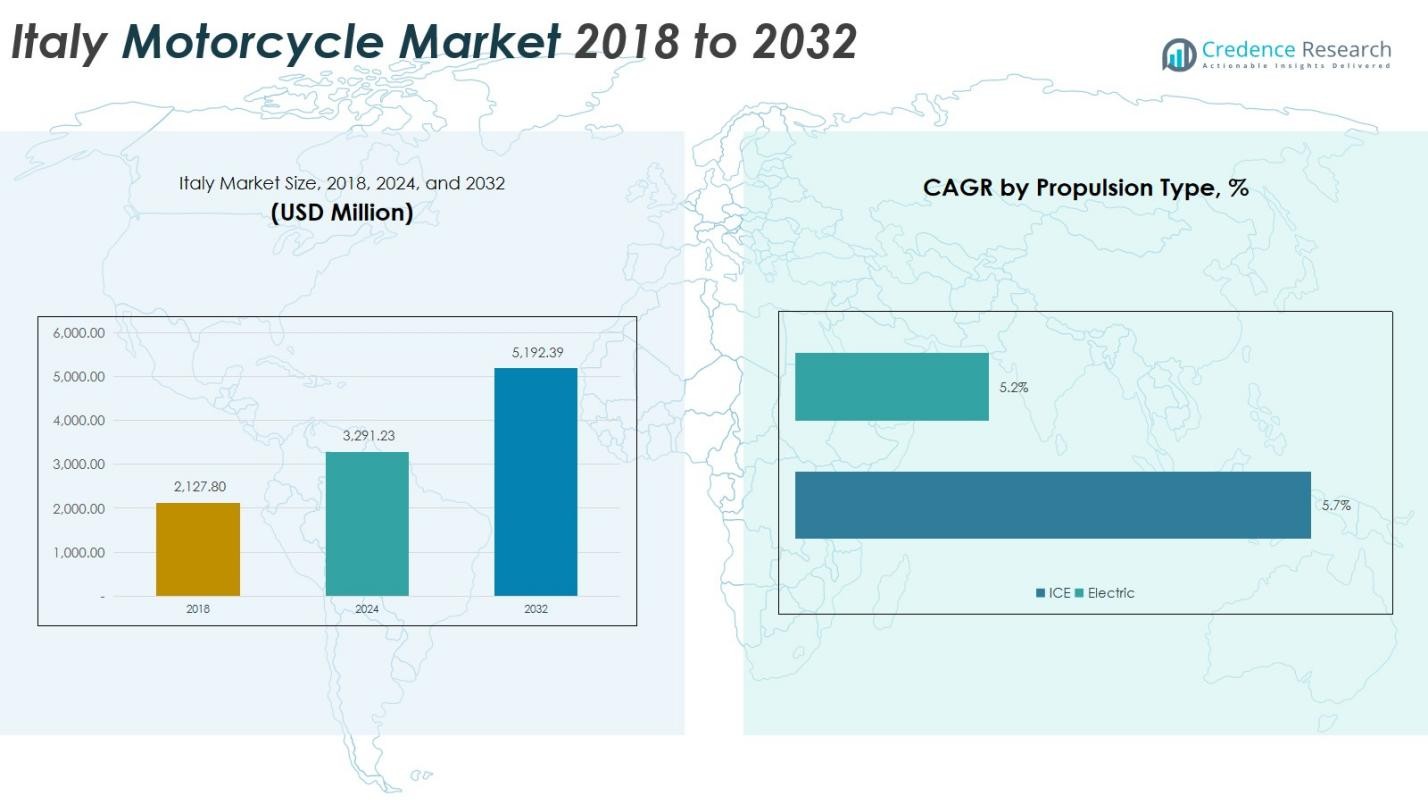

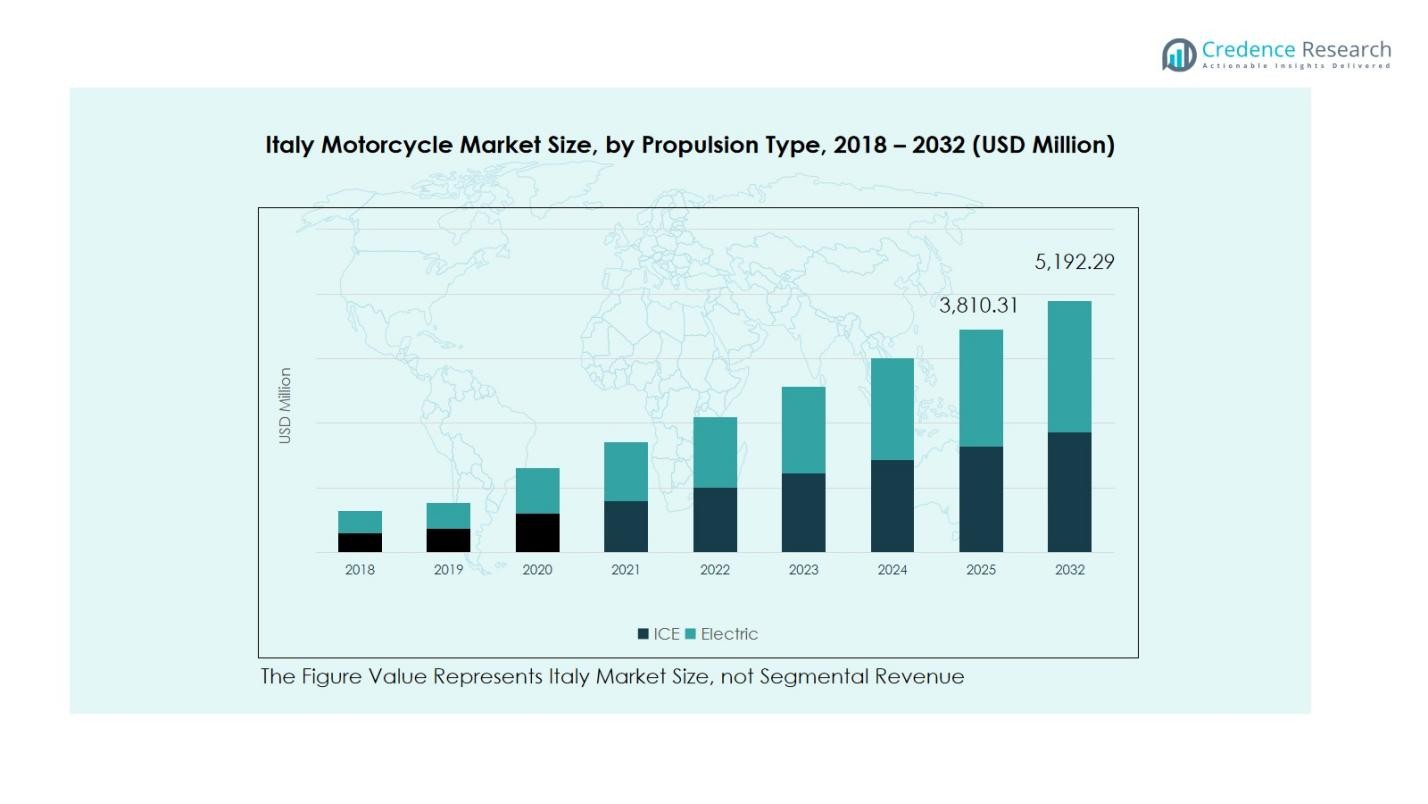

Italy Motorcycle Market size was valued at USD 2,127.80 million in 2018, reaching USD 3,291.23 million in 2024, and is anticipated to reach USD 5,192.39 million by 2032, growing at a CAGR of 5.81% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Motorcycle Market Size 2024 |

USD 3,291.23 Million |

| Italy Motorcycle Market, CAGR |

5.81% |

| Italy Motorcycle Market Size 2032 |

USD 5,192.39 Million |

The Italy Motorcycle Market is highly competitive, featuring key players such as Honda Motor Co., Ltd., Peugeot, KTM AG, BMW AG, Piaggio Group, Triumph Motorcycles Ltd., Ariel Motor Company Limited, Benda, Midual, and BSA Motorcycles. These companies focus on product innovation, advanced design, and expanding their presence in both conventional and electric motorcycle segments. Domestic manufacturer Piaggio maintains a strong foothold through its extensive local distribution network, while global brands like Honda and BMW dominate the premium and performance segments. Northern Italy leads the market with a 42% share in 2024, supported by high consumer purchasing power, established infrastructure, and a strong culture of motorcycling and tourism-driven demand.

Market Insights

- The Italy Motorcycle Market was valued at USD 3,291.23 million in 2024 and is expected to reach USD 5,192.39 million by 2032, growing at a CAGR of 5.81% during the forecast period.

- Rising urbanization, increasing commuter demand, and growing disposable income are major drivers accelerating motorcycle adoption across Italy, especially in cities with heavy traffic congestion.

- Market trends highlight a strong shift toward electric motorcycles and smart connectivity features, supported by government incentives and expansion of charging infrastructure nationwide.

- The market is moderately consolidated, with key players such as Honda, Piaggio, BMW, KTM, and Triumph focusing on product innovation, electric mobility solutions, and strategic partnerships to strengthen competitiveness.

- Northern Italy leads the market with a 42% regional share, while the standard motorcycle segment dominates overall sales with a 38% share, driven by affordability, versatility, and suitability for daily commuting.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Motorcycle Type

The standard motorcycle segment dominates the Italy motorcycle market, accounting for over 38% of total market share in 2024. Its dominance is driven by affordability, versatility, and suitability for both city commuting and short-distance travel. Standard motorcycles appeal to a wide consumer base due to low maintenance costs, fuel efficiency, and ease of handling. Rising urban traffic congestion and the growing preference for practical two-wheelers among daily commuters continue to strengthen this segment’s position, supported by steady demand from younger riders and first-time buyers.

For instance, BMW Motorrad reported a record sales result in 2024 with over 210,000 motorcycles sold, highlighting strong demand for versatile motorcycles suited for daily commuting and recreational use.

By Propulsion Type

The internal combustion engine (ICE) segment holds a commanding market share of 82% in 2024, reflecting Italy’s long-standing reliance on traditional fuel-powered motorcycles. High engine performance, widespread fuel availability, and an extensive service network contribute to this dominance. However, the electric motorcycle segment, though smaller, is expanding rapidly, supported by government incentives and the rollout of charging infrastructure. The ICE segment’s continued strength stems from its affordability and range advantages, while electric models are expected to gain notable traction over the next decade.

For instance, Honda unveiled the world’s first V3 motorcycle engine with an electrical compressor in Milan in 2024, showcasing continued innovation in ICE technology that supports strong market presence.

By Engine Capacity

Motorcycles with an engine capacity of up to 200cc lead the Italian market, representing 45% of total market share in 2024. These models are preferred for their cost-effectiveness, fuel efficiency, and ease of maneuverability in urban environments. Their popularity among students, delivery riders, and commuters reinforces their dominance. The 200cc–400cc category is witnessing growth as consumers seek enhanced performance and comfort. Nonetheless, the up-to-200cc segment remains the backbone of Italy’s motorcycle market, driven by its practicality, low ownership cost, and consistent demand in metropolitan areas.

Key Growth Drivers

Rising Urbanization and Commuter Demand

Rapid urbanization and traffic congestion across Italian cities have accelerated the demand for motorcycles as efficient, cost-effective commuting solutions. The growing working population and preference for two-wheelers over four-wheelers in dense urban areas further support market growth. Increasing disposable incomes, combined with enhanced road infrastructure and shorter travel distances, have made motorcycles an attractive alternative for daily transportation, contributing significantly to the expansion of Italy’s motorcycle market.

For instance, TVS Motor began operations in Italy in 2024 with a full range of scooters and electric motorcycles aimed at addressing urban mobility and commuter needs.

Technological Advancements and Electrification

Technological innovation in motorcycle design and performance is driving substantial market momentum. The integration of advanced features such as ABS, traction control, ride-by-wire systems, and smart connectivity enhances rider safety and comfort. Furthermore, the Italian government’s focus on reducing emissions through incentives for electric motorcycles is fostering adoption. Local manufacturers and global brands are investing heavily in electric propulsion technology, promoting sustainable mobility and reshaping Italy’s two-wheeler landscape.

For instance, Energica Motor Company, a Modena-based manufacturer, has co-engineered the EMCE electric motor with local company Mavel, streamlining production and boosting high-performance electric propulsion across its range.

Growing Tourism and Leisure Riding Culture

Italy’s strong tourism sector and scenic landscapes have stimulated demand for touring and sports motorcycles. Motorcycling is increasingly viewed as a leisure activity, supported by organized tours and biking events across popular regions like Tuscany and the Amalfi Coast. Rising participation in motorcycling clubs and adventure rides has strengthened the premium motorcycle segment. Brands offering high-performance and stylish models are capitalizing on this cultural shift, driving sales in both domestic and international markets.

Key Trends & Opportunities

Expansion of Electric Motorcycle Infrastructure

The growing focus on sustainable transport solutions is encouraging the development of charging infrastructure for electric motorcycles across Italy. The government’s supportive policies, including subsidies and tax benefits for EV buyers, are creating lucrative opportunities for manufacturers. Collaborations between energy providers and mobility companies to install fast-charging stations are enhancing the practicality of electric motorcycles. This transition toward green mobility presents a major opportunity for both domestic producers and international entrants.

For instance, Enel X and IP have established ultra-fast charging stations with up to 350 kW power at key locations such as Peschiera del Garda, Zanica, and Biandrate, enabling four vehicles to charge simultaneously in about 15 minutes.

Integration of Smart and Connected Features

The increasing adoption of Internet of Things (IoT) and smart connectivity solutions is transforming the Italian motorcycle market. Riders now seek real-time data on navigation, performance, and safety through mobile applications and digital dashboards. Manufacturers are focusing on developing connected motorcycles with features such as GPS tracking, anti-theft systems, and cloud-based diagnostics. This technological integration not only enhances user experience but also opens new revenue streams through data-driven services and software upgrades.

For instance, Morbidelli App provides real-time diagnostics, smart navigation, SOS panic alerts, and vehicle location tracking, enriching the riding experience with advanced safety and convenience tools.

Key Challenges

High Initial Costs and Maintenance Expenses

Despite growing popularity, high purchase and maintenance costs remain a key barrier for many consumers in Italy. Premium models with advanced technology and electric variants often come with elevated prices, limiting affordability. Additionally, the lack of widespread servicing networks for electric motorcycles increases long-term maintenance expenses. These factors collectively slow adoption rates, especially among younger or budget-conscious riders, and may restrict broader market penetration.

Regulatory and Environmental Compliance Issues

Stringent emission norms and evolving environmental regulations pose challenges for traditional motorcycle manufacturers. The transition from internal combustion engines to electric propulsion demands substantial investment in research, redesign, and production facilities. Compliance with Euro 5 and upcoming standards increases operational costs and development timelines. Smaller manufacturers, in particular, face financial and technical constraints in meeting these regulatory demands, affecting their competitiveness in the Italian market.

Regional Analysis

Northern Italy

Northern Italy dominates the country’s motorcycle market with a market share of 42% in 2024, driven by strong purchasing power, advanced road infrastructure, and a vibrant motorcycle culture. Regions such as Lombardy, Veneto, and Emilia-Romagna are key hubs for both motorcycle manufacturing and high-end sales. The presence of major brands, along with a strong network of dealerships and service centers, enhances market accessibility. Additionally, the popularity of touring and sports motorcycles in scenic areas like the Dolomites and Lake Garda further stimulates premium segment demand in this region.

Central Italy

Central Italy accounts for a market share of 28% in 2024, supported by a balanced mix of urban commuters and leisure riders. The region, home to Tuscany and Lazio, exhibits strong interest in standard and mid-capacity motorcycles due to dense city networks and moderate commuting distances. Growing tourism and weekend riding culture also contribute to segment growth. The availability of diverse terrains—from coastal highways to hilly routes—drives demand for touring and adventure models, while Rome and Florence remain key urban centers fostering steady motorcycle adoption.

Southern Italy

Southern Italy represents a market share of 19% in 2024, with increasing adoption fueled by improving economic conditions and expanding infrastructure. Regions such as Campania, Puglia, and Calabria are witnessing rising motorcycle sales, particularly in the entry-level and mid-range categories. Warm weather conditions and cost-conscious consumers make motorcycles a practical mobility choice. However, limited access to financing and fewer premium dealerships slightly constrain market expansion. Nevertheless, growing youth interest and the rise of motorcycle-sharing services are enhancing the market’s outlook across southern regions.

Islands (Sicily and Sardinia)

The island regions of Sicily and Sardinia collectively hold a market share of 11% in 2024, driven by favorable weather, tourism, and increasing reliance on two-wheelers for short-distance travel. Coastal routes and narrow urban roads make motorcycles a convenient and economical transportation mode. Tourism activities, particularly rental services catering to travelers exploring scenic routes, further support market growth. While infrastructure development remains slower compared to the mainland, the islands are witnessing rising interest in electric and lightweight motorcycles, spurred by sustainability initiatives and local government incentives.

Market Segmentations:

By Motorcycle Type:

- Standard

- Sports

- Cruiser

- Touring

- Others

By Propulsion Type:

- Internal Combustion Engine (ICE)

- Electric

By Engine Capacity:

- Up to 200cc

- 200cc to 400cc

- 400cc to 800cc

- More than 800cc

By Region

- Northern Italy

- Central Italy

- Southern Italy

- Islands

Competitive Landscape

The competitive landscape of the Italy Motorcycle Market is characterized by the presence of major players such as Honda Motor Co., Ltd., Peugeot, Ariel Motor Company Limited, Triumph Motorcycles Ltd., Benda, KTM AG, BMW AG, Midual, Piaggio Group, and BSA Motorcycles. These companies compete through innovation, design excellence, and strategic expansion in both conventional and electric motorcycle segments. Domestic manufacturers like Piaggio leverage strong local brand recognition and a wide distribution network, while international brands such as Honda and BMW focus on premium performance models and technological advancements. Partnerships, product launches, and investment in electric mobility are shaping competition across the market. The increasing demand for smart, connected, and eco-friendly motorcycles is prompting companies to enhance product portfolios and manufacturing efficiency. As consumer preferences evolve toward high-performance and sustainable models, key players are strengthening their presence through targeted marketing strategies and continuous product innovation.

Key Player Analysis

- Honda Motor Co., Ltd.

- Peugeot

- Ariel Motor Company Limited

- Triumph Motorcycles Ltd.

- Benda

- KTM AG

- Bayerische Motoren Werke (BMW) AG

- Midual

- Piaggio Group

- BSA Motorcycles

- Other Key Players

Recent Developments

- In October 2025, Hero MotoCorp entered the Italian market through a distribution partnership with Pelpi International, introducing models such as the Xpulse 200 and Hunk 440 to expand its European footprint.

- In April 2025, Damon Inc. collaborated with Italy’s Engines Engineering to accelerate the development of its HyperSport Race electric motorcycle, combining advanced AI-driven safety systems with Italian design expertise.

- n September 2025, TVS Motor Company acquired Italy’s Engines Engineering S.p.A. for over €5 million, establishing a Global Centre of Excellence in Bologna for electric and premium motorcycle development.

- in August 2025, Energica Motor Company was acquired by a group of Singaporean investors through a judicial sale aimed at revitalizing its global operations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Motorcycle Type, Propulsion Type, Engine Capacity and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Italy motorcycle market is projected to witness steady growth driven by rising urban mobility needs and lifestyle-oriented purchases.

- Increasing adoption of electric motorcycles will reshape the market, supported by government incentives and charging infrastructure development.

- Technological advancements such as connectivity, telematics, and smart safety systems will enhance rider experience and attract tech-savvy consumers.

- Demand for mid-capacity and touring motorcycles will grow due to the rising popularity of long-distance leisure rides.

- Local manufacturers will strengthen their production capabilities to compete with global brands entering the Italian market.

- Expanding e-commerce platforms and digital sales channels will simplify motorcycle purchases and aftersales services.

- Sustainability goals and emission regulations will push manufacturers toward electric and hybrid innovations.

- Youth-oriented marketing and financing schemes will boost motorcycle adoption among first-time buyers.

- Rental and motorcycle-sharing services will expand, particularly in urban and tourist-heavy regions.

- Overall market dynamics will remain positive, driven by innovation, affordability, and evolving consumer preferences.