Market Overview

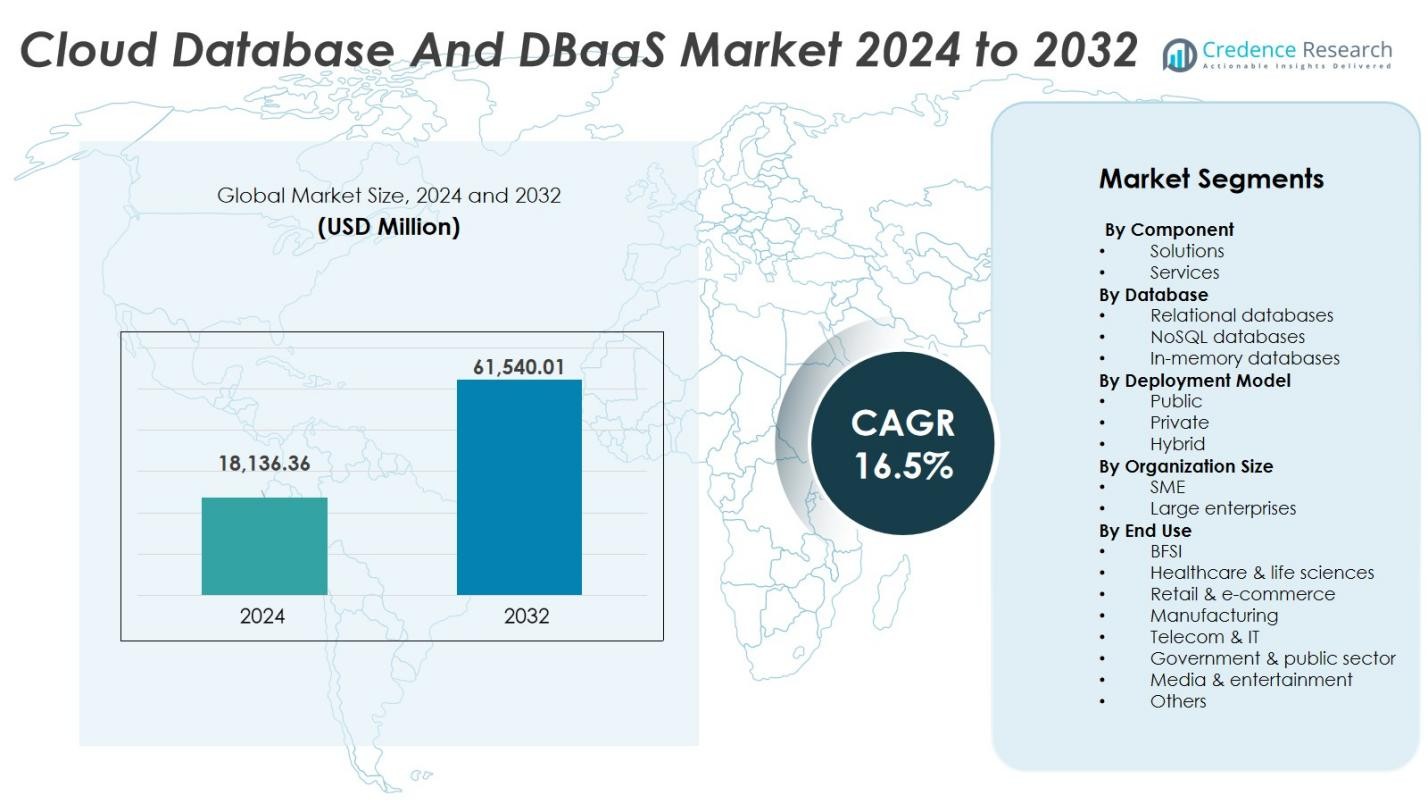

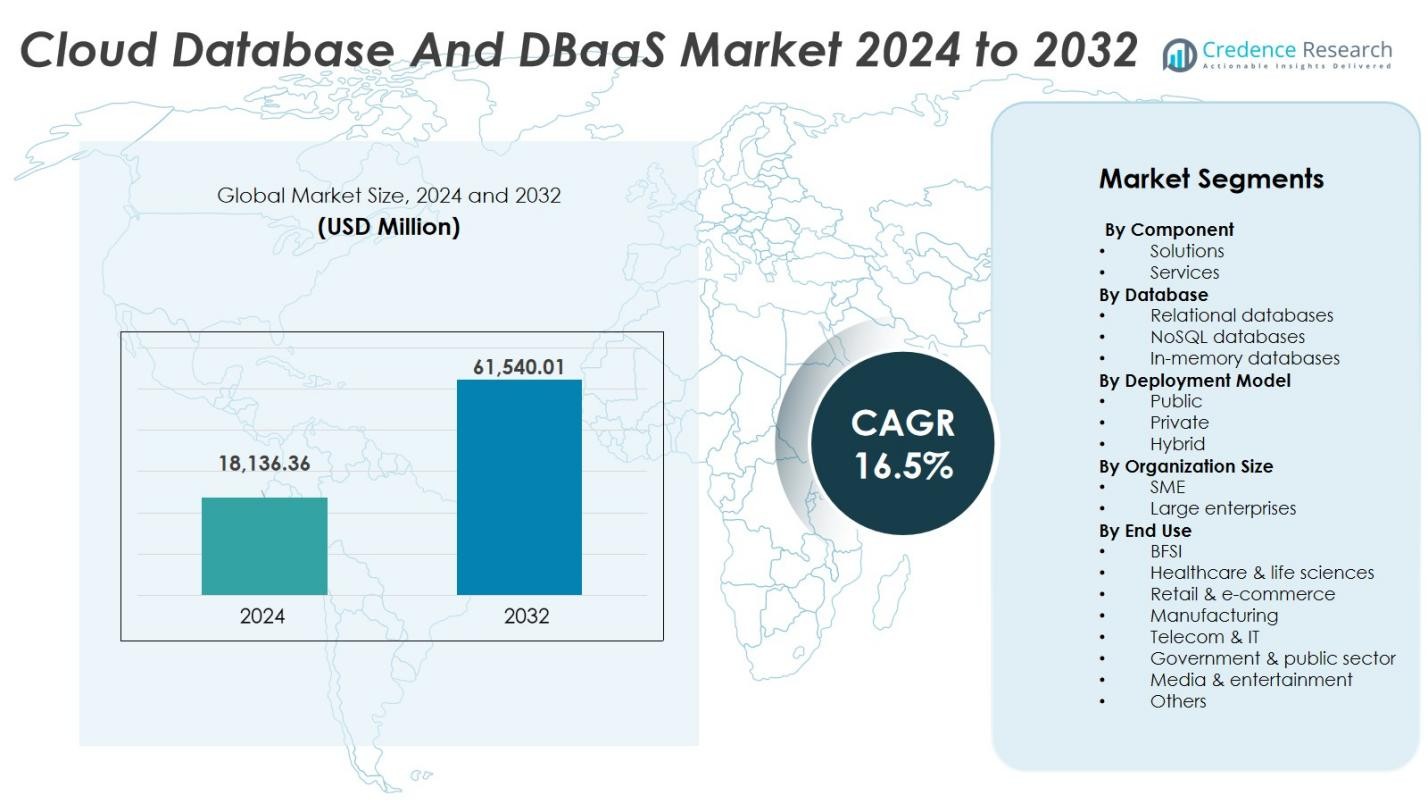

Cloud Database And DBaaS Market size was valued at USD 18,136.36 million in 2024 and is anticipated to reach USD 61,540.01 million by 2032, at a CAGR of 16.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cloud Database And DBaaS MarketSize 2024 |

USD 18,136.36 Million |

| Cloud Database And DBaaS Market, CAGR |

16.5% |

| Cloud Database And DBaaS Market Size 2032 |

USD 61,540.01 Million |

The Cloud Database and DBaaS market is led by global players such as AWS, Microsoft Azure, Google Cloud, IBM, Oracle, Alibaba Cloud, SAP SE, NEC Corporation, Thales Group, and IDEMIA. These vendors offer scalable database engines, real-time analytics, multi-region clustering, and advanced automation that support enterprise-grade workloads. Strategic investments in serverless architectures and AI-driven performance optimization strengthen their competitive position. North America leads the market with the highest global share, accounting for over 38% of total revenue, driven by high cloud adoption across BFSI, telecom, healthcare, and e-commerce sectors. Europe and Asia Pacific follow as fast-growing regions due to digital transformation, government cloud policies, and expanding data center infrastructure.

Market Insights

- The Cloud Database and DBaaS market was valued at USD 18,136.36 million in 2024 and will reach USD 61,540.01 million by 2032, growing at a CAGR of 16.5%.

- Rising digital transformation and the shift from on-premise storage to cloud-native database platforms drive adoption across BFSI, telecom, retail, and government sectors. Enterprises prefer DBaaS for automated scaling, reduced infrastructure cost, and real-time analytics.

- Relational databases hold the largest segment share, supported by high usage in transactional applications. Public cloud deployment also leads because of flexible pricing and broad availability from AWS, Microsoft, and Google.

- The competitive landscape includes AWS, Microsoft Azure, Google Cloud, IBM, Oracle, Alibaba Cloud, and SAP, who expand multi-region clusters, serverless offerings, and AI-optimized database engines to retain customers.

- North America dominates with over 40% market share, while Asia Pacific shows the fastest growth due to rapid digitization, SME adoption, and regional data center expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Component

The Cloud Database and DBaaS market includes solutions and services. Solutions dominate the segment with 62.3% market share in 2024 as enterprises shift to cloud-native databases to reduce infrastructure spending, automate scaling, and improve data security. Businesses choose managed database platforms to support real-time analytics and disaster recovery across hybrid and multi-cloud setups. The services segment grows due to demand for migration, integration, and managed operations, but solutions remain the primary revenue generator because organizations prioritize high availability, faster deployment, and seamless data mobility.

- For instance, Ciena, a telecommunications equipment supplier, uses Snowflake and Striim for real-time analytics, processing 40-90 million business events daily to provide instant network insights and improve customer experience.

By Database Type

Relational databases hold the largest share of around 58% in the market, driven by their strong transactional consistency and ACID compliance, which are critical for BFSI, government, and telecom applications. Enterprises prefer SQL-based DBaaS platforms for structured data, predictable queries, and secure processing. NoSQL databases account for nearly 18% of the market, expanding rapidly due to unstructured and big data workloads from IoT and e-commerce platforms. In-memory databases represent a smaller segment, gaining adoption for low-latency analytics, but relational databases remain dominant due to their proven reliability in mission-critical operations.

- For instance, MongoDB introduced full ACID transactions in version 4.0, enabling multi-document transactions across collections, which is vital for handling dynamic schema and scalability in e-commerce environments.

By Deployment Model

Public cloud holds the largest share of around 71% in the cloud database deployment market due to flexible pricing, fast provisioning, and wide availability through major providers like AWS, Google Cloud, and Microsoft Azure. SMEs and large enterprises prefer public DBaaS to cut hardware costs and support remote operations. Hybrid cloud accounts for about 22%, expanding rapidly in regulated sectors that need both local storage and cloud scalability, while private cloud represents roughly 7%, remaining vital for sensitive applications requiring strict control and security.

Key Growth Drivers

Adoption of Cloud-Native Infrastructure

The rapid shift from on-premise data centers to cloud-native architectures drives strong demand in the Cloud Database and DBaaS market. Organizations modernize legacy systems to improve scalability, resilience, and storage efficiency while lowering operational overhead. Cloud-native platforms automate provisioning, backup, and security, allowing enterprises to focus on innovation rather than maintenance. Artificial intelligence, advanced analytics, and real-time applications also require high-performance databases with distributed processing and near-zero downtime. As digital transformation accelerates across banking, healthcare, retail, and media, companies migrate transactional and analytical workloads to DBaaS for flexible scaling and global accessibility.

- For instance, Oracle’s Autonomous Database provides enterprise-grade governance and security controls that simplify data migration and management, allowing companies to focus on innovation rather than infrastructure maintenance.

Rising Data Volumes and Real-Time Analytics

Exploding data volumes from IoT devices, mobile applications, e-commerce platforms, and digital services fuel market growth. Enterprises use Cloud DBaaS platforms to process structured, semi-structured, and unstructured data at scale. Real-time analytics, fraud detection, supply chain forecasting, and personalized marketing require instant data processing and high-speed computing. Cloud databases, especially in-memory and NoSQL models, provide the flexibility and scalability needed for these workloads. Businesses avoid high capital investments by adopting subscription-based pricing and pay-as-you-grow storage models. Serverless databases further reduce administrative effort and enable auto-scaling across peak traffic periods.

- For instance, Amazon Aurora Serverless automatically scales database capacity up or down based on real-time demand, reducing administrative overhead and costs for businesses with fluctuating workloads.

Strong Adoption Across SMEs and Large Enterprises

Both large enterprises and SMEs are accelerating adoption of DBaaS to simplify data operations and improve efficiency. Large enterprises migrate mission-critical applications to cloud-hosted databases to achieve faster deployment, automated failover, and improved disaster recovery. SMEs benefit from lower upfront costs, minimal maintenance, and access to enterprise-grade database engines without needing dedicated IT teams. Cloud DBaaS platforms offer native encryption, identity management, and security compliance, helping businesses protect sensitive data across distributed environments. With remote work, multi-region collaboration, and digital service delivery becoming standard, organizations require centralized, scalable data systems accessible anywhere.

Key Trends & Opportunities

Growth of Multi-Cloud and Hybrid Database Deployments

Enterprises increasingly deploy databases across multiple cloud platforms to improve resilience, vendor flexibility, and data sovereignty. Multi-cloud DBaaS enables workload distribution and prevents lock-in, giving businesses the freedom to run analytics or applications on their preferred cloud environments. Hybrid models combine on-premise security with cloud scalability, which appeals to banks, healthcare institutions, and public sector agencies. Regulatory-driven industries use hybrid DBaaS to store sensitive information locally while running real-time analytics in the cloud. As data privacy laws tighten, providers enhance encryption, access control, and cross-cloud synchronization tools, opening new revenue opportunities.

- For instance, MongoDB Atlas allows organizations to distribute data across AWS, GCP, and Azure, enabling seamless multi-region data management and automated backups, which is crucial for global operations.

Serverless and AI-Optimized Database Platforms

Serverless DBaaS adoption rises as companies seek cost efficiency and simplified operations. Serverless databases remove provisioning and capacity planning tasks, allowing the system to scale automatically based on demand. This model suits unpredictable workloads, e-commerce spikes, and real-time analytics. AI-enabled DBaaS platforms now automate indexing, self-healing, performance tuning, and anomaly detection, reducing reliance on database administrators. These intelligent features improve uptime, reduce query latency, and optimize storage allocation. Vendors integrate machine learning capabilities directly into data pipelines, supporting fraud detection, personalization, and predictive analytics.

- For instance, Amazon DynamoDB is a fully managed, serverless NoSQL database service that handles massive workloads with minimal setup. It is designed to run high-performance applications at scale, offering automatic scaling based on demand, encryption at rest, and region replication.

Key Challenges

Data Security and Compliance Risks

Despite strong adoption, data security remains a major challenge. Cloud-hosted databases store sensitive customer information, financial records, healthcare data, and intellectual property, making them targets for breaches. Enterprises must meet strict compliance requirements such as GDPR, HIPAA, and PCI-DSS, which raises concerns around data residency and access control. Misconfigurations, insecure APIs, and third-party integrations increase vulnerability. Companies demand stronger encryption, identity management, and zero-trust frameworks to reduce risk. Although major DBaaS vendors invest heavily in security, growing cyberattacks and insider threats make organizations cautious, slowing full cloud migration in some industries.

Vendor Lock-In and Migration Complexity

Vendor lock-in is another major barrier in the Cloud Database and DBaaS market. Proprietary database engines, custom APIs, and storage formats make it difficult for businesses to move data between platforms. Migration from legacy systems to cloud databases requires high cost, skilled talent, and careful downtime planning. Enterprises running mission-critical applications fear dependency on a single vendor, especially when pricing changes or regional downtime affects operations. Limited interoperability across cloud providers also restricts flexibility. Although multi-cloud and open-source DBaaS options reduce lock-in, migration complexity continues to slow adoption for large organizations with deeply integrated legacy databases.

Regional Analysis

North America

North America holds the largest share of 38% in the Cloud Database and DBaaS market, driven by strong cloud adoption, advanced digital infrastructure, and heavy investment in analytics and AI. The U.S. leads regional growth through large-scale migrations from on-premise systems to platforms by AWS, Microsoft Azure, Google Cloud, and IBM. Major enterprises across banking, telecom, healthcare, and e-commerce dominate demand, while automation and compliance needs further strengthen the region’s leadership.

Europe

Europe accounts for 27% of the market, supported by strict data protection under GDPR and growing digital transformation across financial, retail, and manufacturing sectors. Germany, the U.K., and France lead adoption as industries modernize IT systems and shift toward hybrid cloud models. Increasing IoT data, e-commerce growth, and data sovereignty requirements drive steady DBaaS expansion, with local and global vendors building more regional data centers.

Asia Pacific

Asia Pacific captures 24% of the market and shows the fastest growth rate, propelled by cloud-first policies, digital infrastructure expansion, and government incentives for data localization. China, India, Japan, and South Korea lead DBaaS integration for fintech, e-commerce, and smart city projects. SMEs rely on public cloud to lower costs, while enterprises adopt hybrid and multi-cloud models. Providers like Alibaba Cloud, AWS, and Google continue expanding capacity to meet rising demand.

Latin America

Latin America holds 7% of the market, driven by modernization of IT infrastructure and digital adoption in Brazil and Mexico. BFSI, telecom, and retail sectors lead the shift toward cloud databases, while SMEs gain from pay-as-you-go models. Despite lower maturity than developed regions, investments by AWS, Microsoft, and Google are improving access, compliance, and scalability for regional enterprises.

Middle East & Africa

The Middle East & Africa represent 4% of the market, showing gradual growth supported by national cloud strategies and investments in smart governance. The UAE, Saudi Arabia, and South Africa are major contributors, adopting DBaaS in banking, telecom, and public administration. Regional data centers from AWS, Microsoft, and Google enhance compliance and performance. Growing analytics adoption and secure digital services continue to boost market potential across the region.

Market Segmentations

By Component

By Database

- Relational databases

- NoSQL databases

- In-memory databases

By Deployment Model

By Organization Size

By End Use

- BFSI

- Healthcare & life sciences

- Retail & e-commerce

- Manufacturing

- Telecom & IT

- Government & public sector

- Media & entertainment

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Cloud Database and DBaaS market features strong competition among global cloud service providers, database technology vendors, and specialized managed service companies. Leading players such as AWS, Microsoft, Google, IBM, Oracle, Alibaba Cloud, and SAP focus on expanding scalable DBaaS portfolios that support structured and unstructured data, automated backup, advanced analytics, and multi-region replication. Vendors invest heavily in AI-enabled database optimization, serverless models, and automated performance tuning to attract enterprise workloads. Strategic partnerships with telecom operators, government agencies, and IT integrators further strengthen market reach. Startups offering niche database engines and open-source platforms also intensify competition by targeting cost-sensitive enterprises and developers. Companies differentiate through flexible pricing, enhanced security features, global data center expansion, and compliance support. As hybrid and multi-cloud architectures gain popularity, service providers develop cross-cloud integration tools and migration services, increasing market competitiveness and customer retention.

Key Player Analysis

- Thales Group

- Oracle

- Alibaba Cloud

- NEC Corporation

- Google

- AWS

- Microsoft

- SAP SE

- IDEMIA

- IBM Corporation

Recent Developments

- In August 2025, MariaDB plc announced the acquisition of SkySQL Inc., an AI-powered serverless DBaaS platform, to strengthen its cloud service capabilities.

- In September 2024, Tessell has launched its Database-as-a-Service (DBaaS) product, Tessell for Oracle Exadata Database Service on Dedicated Infrastructure (ExaDB-D), on Oracle Cloud Infrastructure (OCI).

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Component, Database, Deployment Model, Organization Size, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Cloud Database and DBaaS services will continue replacing on-premise databases as companies modernize IT systems.

- AI-driven automation will improve database tuning, indexing, and query performance with minimal human intervention.

- Serverless DBaaS adoption will rise because enterprises prefer consumption-based pricing and automatic scaling.

- Hybrid and multi-cloud deployments will expand as organizations avoid vendor lock-in and improve data control.

- More companies will use DBaaS for real-time analytics, fraud detection, and personalized customer experiences.

- Security, encryption, and zero-trust models will strengthen as cyber threats increase across cloud environments.

- Low-latency, edge-connected databases will grow alongside 5G, IoT, and smart infrastructure applications.

- Open-source cloud databases will gain traction as businesses seek flexible and cost-efficient platforms.

- Industry-specific DBaaS solutions will emerge in healthcare, BFSI, and government to meet compliance demands.

- Global cloud data center expansion will support faster deployment, regional data residency, and localized performance.