Market Overview

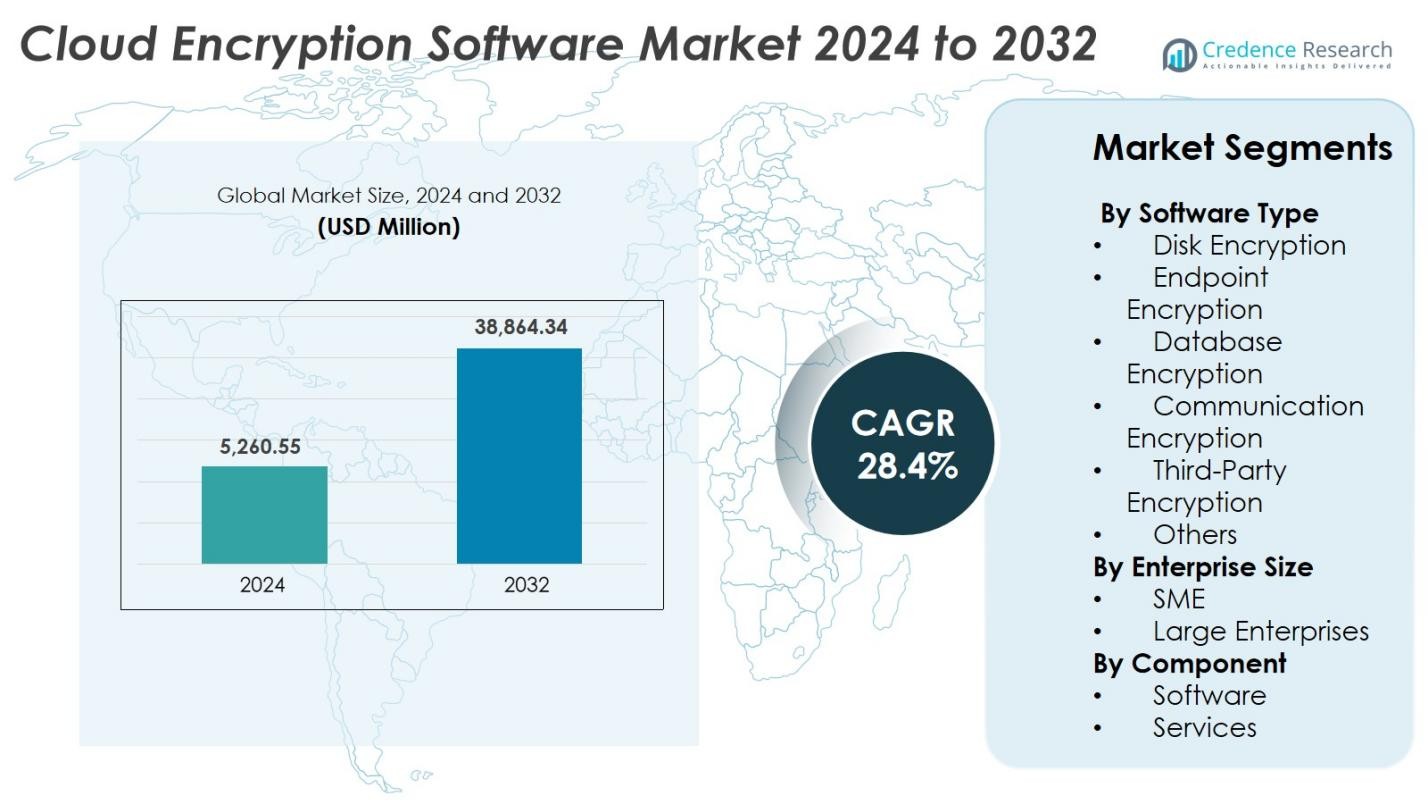

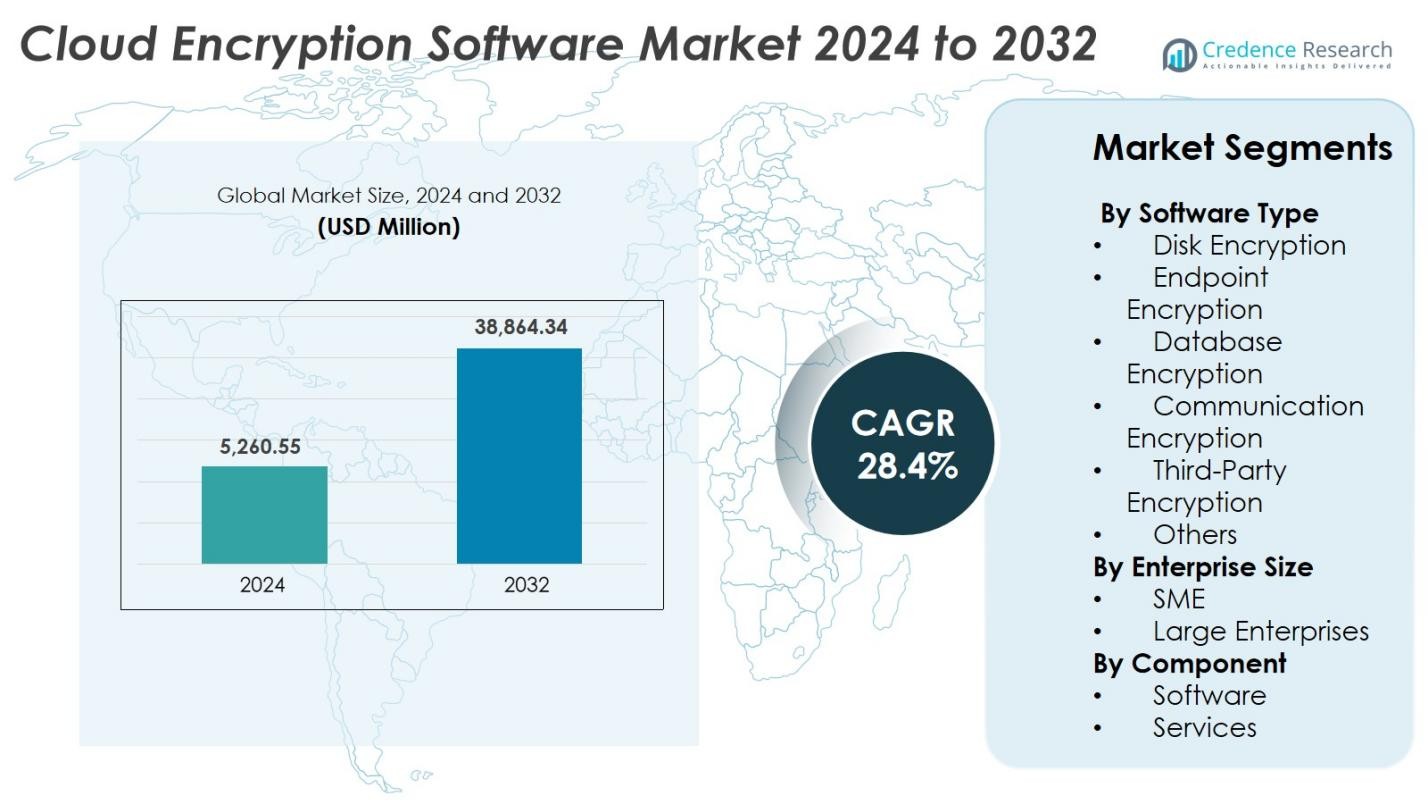

Cloud Encryption Software Market size was valued USD 5,260.55 million in 2024 and is anticipated to reach USD 38,864.34 million by 2032, at a CAGR of 28.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cloud Encryption Software Market Size 2024 |

USD 5,260.55 Million |

| Cloud Encryption Software Market, CAGR |

28.4% |

| Cloud Encryption Software Market Size 2032 |

USD 38,864.34 Million |

Major players in the Cloud Encryption Software market include Check Point Software Technologies Ltd., Dell Technologies Inc., Hewlett Packard Enterprise, Intel Corp., Proofpoint Inc., Sophos Ltd., Symantec (Broadcom), Thales Group, Trend Micro Inc., and IBM Corporation. These companies offer disk, database, and endpoint encryption integrated with automated key management and zero-trust security. Product innovation, cloud partnerships, and subscription-based deployment models strengthen their competitive position across large enterprises and SMEs. North America leads the global market with a 38% share, driven by early cloud adoption, strong regulatory compliance needs, and high cybersecurity spending across financial, government, and healthcare sectors.

Market Insights

- The Cloud Encryption Software market was valued at USD 5,260.55 million in 2024 and is projected to reach USD 38,864.34 million by 2032, growing at a CAGR of 28.4% during the forecast period.

- Growing cloud adoption across BFSI, healthcare, and government sectors drives demand for encryption solutions, as enterprises secure data at rest, in transit, and in use across hybrid and multi-cloud platforms.

- Key trends include rising use of AI-driven automated key management and increased adoption of subscription-based encryption models, which support SMEs and reduce infrastructure costs.

- The market features strong competition among global players offering disk, database, and endpoint encryption, while partnerships with cloud providers improve integration and compliance.

- North America leads with 38% market share, followed by Europe at 27% and Asia-Pacific at 24%, while disk encryption holds the largest segment share due to high adoption in data-heavy industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Software Type

Disk encryption holds the largest share of the Cloud Encryption Software Market, accounting for around 32% of total revenue. Organizations depend on disk-level security to protect sensitive data stored in virtual machines and cloud databases. Growing ransomware attacks and strict compliance mandates encourage enterprises to secure data at rest. Endpoint and communication encryption represent 25% combined, gaining traction as remote work expands and data moves across multiple devices and networks. Database encryption contributes 20%, rising in demand among finance and healthcare firms. Third-party encryption maintains 15%, remaining essential for cloud-native applications to ensure protection when data is processed or shared outside internal IT environments.

- For instance, Microsoft enhanced its BitLocker management features for Azure in early 2023, strengthening cloud-based disk encryption capabilities.

By Enterprise Size

Large enterprises dominate the Cloud Encryption Software Market with 60% share due to the widespread use of multi-cloud ecosystems, vast data volumes, and regulatory compliance needs. These companies invest in advanced encryption solutions integrated with identity management, key vaults, and zero-trust frameworks. SMEs account for 40%, showing strong growth as affordable subscription-based models reduce deployment costs. Increasing cyber-attacks on small firms and privacy mandates push SMEs to adopt endpoint and disk encryption. The shift toward cloud-based operations continues to drive spending across both enterprise segments.

- For instance, IBM’s Guardium Data Encryption suite is widely adopted by large organizations to automate compliance controls and secure diverse environments, integrating capabilities like key vaults and identity management.

By Component

Software accounts for the major share of 70% in the Cloud Encryption Software Market. Businesses prefer scalable tools that secure data at rest, in transit, and in use across hybrid and public clouds. Automated key management, seamless workload integration, and minimal performance loss drive this dominance. Services hold 30%, growing steadily due to rising demand for deployment support, encryption key lifecycle management, and compliance consulting. Managed security providers play a key role in serving SMEs without dedicated cybersecurity teams, further accelerating service-based market expansion.

Key Growth Drivers

Rising Cloud Adoption Across Enterprises

Rapid migration from on-premise infrastructure to public and hybrid cloud systems drives strong demand for Cloud Encryption Software. Organizations store sensitive data in SaaS, IaaS, and PaaS environments, increasing the need for tools that secure information at rest and in transit. Growth in remote workforces further accelerates cloud usage, pushing businesses to secure distributed data flows. Cloud-native workloads also require encryption controls that integrate with identity access management and zero-trust security frameworks. As enterprises expand digital transformation initiatives and adopt multi-cloud strategies, encryption becomes a core requirement to protect intellectual property and ensure operational continuity across global data centers.

- For instance, Microsoft Azure implements 256-bit AES encryption across all storage systems with customer-managed key options through Azure Key Vault, enabling organizations to maintain encryption control while leveraging cloud infrastructure.

Stringent Data Protection Regulations

Global cybersecurity mandates compel enterprises to deploy encryption to avoid penalties, breach liabilities, and reputational loss. Regulations such as GDPR, HIPAA, PCI-DSS, and CCPA enforce strict guidelines for protecting customer data and financial information in cloud environments. Industries like BFSI, healthcare, and government face heavy compliance scrutiny, driving rapid adoption of disk, database, and communication encryption tools. Many countries now impose data localization rules that require secure data storage within national borders, boosting encrypted cloud storage demand. Enterprises increasingly invest in robust encryption and key management platforms to meet evolving compliance audits and maintain secure cross-border data flow.

- For instance, in healthcare, the U.S. Department of Health and Human Services (HHS) proposed in 2025 to require encryption and multifactor authentication for all systems handling patient data, closing previous regulatory flexibility gaps.

Growing Incidents of Cyberattacks and Data Breaches

Frequent cyberattacks on public, private, and hybrid cloud environments fuel market expansion. Ransomware, phishing, and insider threats target stored datasets, business emails, and payment records across industries. Cloud Encryption Software protects sensitive information even if networks or endpoints are compromised. Enterprises adopt multi-layered security with file-level, disk-level, and application-layer encryption to prevent unauthorized data access. Cloud providers also partner with encryption vendors to offer embedded security features in managed services. As attack sophistication increases, organizations seek advanced encryption integrated with monitoring, authentication, and automated key rotation, further accelerating market adoption.

Key Trends & Opportunities

Growth of Encryption-as-a-Service and Subscription Models

Subscription-based encryption services are gaining traction, especially among SMEs seeking scalable protection without heavy capital investment. Vendors offer pay-as-you-go tools that secure data across cloud applications, virtual machines, and collaboration platforms. Managed encryption services also reduce the burden of key provisioning and compliance, making cloud security more accessible. This trend creates strong opportunities for vendors offering integrated encryption bundles with threat analytics, identity governance, and zero-trust security. As digital transformation expands in emerging markets, cloud-native encryption subscriptions provide a cost-effective pathway for widespread adoption.

- For instance, Utimaco introduced its u.trust LAN Crypt Cloud in November 2023, a cloud-based file encryption-as-a-service solution that offers end-to-end encryption, role-based access controls, and administrative visibility for rapid enterprise deployment.

Increasing Use of AI-Driven Automated Key Management

Automation is becoming a major advancement, reducing manual security gaps and preventing human error in encryption key lifecycle management. AI-based tools generate, rotate, and revoke keys automatically while monitoring usage patterns for anomalies. Predictive analytics help detect threats before they escalate, making encryption solutions more proactive. Enterprises integrating AI-driven encryption gain faster response times and stronger protection for large-scale cloud workloads. As data volumes and multi-cloud deployments grow, automated key orchestration presents a new opportunity for vendors to differentiate their offerings with enhanced intelligence and real-time protection.

- For instance, Microsoft Azure AI Search uses customer-managed keys with Azure Key Vault and Hardware Security Modules (HSMs) to automate key rotation and revocation, providing secure, real-time controls over encryption keys.

Key Challenges

Integration Complexity in Multi-Cloud Environments

Enterprises adopt multiple cloud platforms to enhance flexibility and performance, but managing encryption across different architectures remains difficult. Varying encryption policies, key management standards, and storage formats create interoperability issues. IT teams must ensure seamless encryption during data migration and cross-cloud communication, raising costs and deployment timelines. Without unified management, encryption gaps increase the risk of breach exposure. Vendors must develop centralized platforms that support automated policies, standardized key vaults, and universal APIs to overcome this challenge and improve usability for both SMEs and large enterprises.

High Costs and Performance Overheads

Strong encryption improves security but can reduce system performance and increase operating expenses. Small businesses struggle with licensing fees, hardware requirements for key storage, and ongoing maintenance of encryption frameworks. High computational load also slows processing speeds for database queries and file transfers, forcing enterprises to balance cost, speed, and security. Vendors must innovate lightweight encryption algorithms and optimized processing to minimize latency. Broader adoption of subscription-based models and managed services is helping reduce barriers, but performance concerns remain a major restraint for large-scale deployment.

Regional Analysis

North America

North America holds 38% of the Cloud Encryption Software market, the largest regional share. Strong adoption of public and hybrid cloud services in banking, retail, and healthcare drives steady demand. The United States leads due to mature cybersecurity spending and the presence of major cloud vendors offering advanced disk, endpoint, and communication encryption. Regulatory pressures and zero-trust adoption encourage enterprises to secure data stored across multiple clouds. Large organizations also invest in automated key management and compliance-focused encryption, reinforcing North America’s dominant position.

Europe

Europe accounts for 27% of the global market, backed by strict compliance with GDPR and sector-specific data protection laws. Enterprises in BFSI, government, and healthcare focus on encrypted cloud storage and secure data transfer across borders. Germany, the United Kingdom, and France remain major revenue contributors as companies deploy encryption in multi-cloud environments. Growing interest in zero-trust frameworks, secure communication channels, and encrypted virtual machines also drives adoption. Vendor expansion of regional data centers supports localized encryption and key vault services.

Asia-Pacific

Asia-Pacific holds 24% of the Cloud Encryption Software market and remains the fastest-growing region. Rapid digital transformation, rising cyberattacks, and expansion of cloud data centers in China, India, Japan, and South Korea fuel adoption. SMEs rely on subscription-based encryption for secure remote working and digital payments. Banks, telecom providers, and e-commerce platforms deploy database and endpoint encryption to safeguard customer records. Increasing data localization policies further accelerate market growth as regional businesses secure cloud workloads.

Latin America

Latin America represents 6% of the market and shows a steady growth outlook. Enterprises in Brazil, Mexico, and Chile transition to public and hybrid cloud models to support online banking, mobile payments, and digital commerce. Ransomware and payment fraud concerns drive higher demand for database and communication encryption. SMEs increasingly adopt subscription-based encryption services due to lower costs and limited internal IT resources. Vendor investments in local data centers support wider regional adoption.

Middle East & Africa

The Middle East & Africa region holds 5% of the market, driven by government digitization, telecom upgrades, and banking modernization. The UAE, Saudi Arabia, and South Africa lead deployment of cloud-based encryption to secure citizen data and financial transactions. Large enterprises remain primary users, though SMEs are adopting managed encryption services for compliance. Smart city initiatives, cybersecurity regulations, and cloud expansion from global vendors continue to support gradual market growth.

Market Segmentations

By Software Type

- Disk Encryption

- Endpoint Encryption

- Database Encryption

- Communication Encryption

- Third-Party Encryption

- Others

By Enterprise Size

By Component

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Cloud Encryption Software market features strong competition among global cybersecurity vendors, cloud service providers, and emerging encryption specialists. Leading companies focus on advanced data-at-rest and data-in-transit protection while integrating automated key management and zero-trust frameworks. Vendors enhance product portfolios with disk, database, and endpoint encryption that support hybrid and public cloud workloads. Strategic partnerships with cloud providers enable embedded encryption in SaaS and IaaS platforms, improving adoption across enterprises and SMEs. Firms also invest in AI-driven threat analytics, hardware-based key vaults, and compliance management to address complex regulations. Mergers, acquisitions, and regional data center expansion strengthen market positioning, while subscription-based offerings increase accessibility for smaller businesses. As cyberattacks grow more sophisticated, vendors continue to differentiate through lightweight encryption, faster processing, and interoperability across multi-cloud environments, creating a highly dynamic and innovation-driven competitive landscape.

Key Player Analysis

- Hitachi Ltd.

- Hewlett Packard Enterprise Co.

- Cisco Systems Inc.

- Dell Technologies Inc.

- Check Point Software Technologies Ltd.

- Alphabet Inc.

- Forcepoint LLC

- Intel Corp.

- International Business Machines Corp.

- F Secure Corp.

Recent Developments

- In March 2025, NIST selected HQC as its fifth post-quantum encryption candidate, broadening cryptographic diversity.

- In February 2025, Google Cloud introduced quantum-safe digital signatures in Cloud KMS, implementing ML-DSA-65 and SLH-DSA-SHA2-128S.

- In January 2025, Amazon Web Services and Booz Allen Hamilton expanded cooperation to offer end-to-end encryption for U.S. federal agencies.

- In January 2025, Broadcom delivered the first quantum-resistant network encryption through Emulex Secure Fibre Channel HBAs, adding real-time ransomware detection.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Software, Enterprise, Component and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Enterprises will increase adoption of cloud-native encryption to secure multi-cloud workloads.

- Demand for automated key lifecycle management will rise as data volumes grow.

- AI-driven encryption tools will strengthen threat detection and reduce manual security gaps.

- Subscription-based encryption services will expand among SMEs seeking low-cost security.

- Integration of encryption with zero-trust frameworks will become standard in regulated industries.

- Cloud providers will embed stronger built-in encryption to support compliance and cross-border data transfer.

- Growth in remote work will boost demand for endpoint and communication encryption.

- Data localization laws will drive regional deployment of encrypted cloud storage and key vault services.

- Lightweight encryption algorithms will gain prominence to reduce performance impact on cloud systems.

- Partnerships between cybersecurity vendors and cloud platforms will accelerate global market penetration.