Market Overview

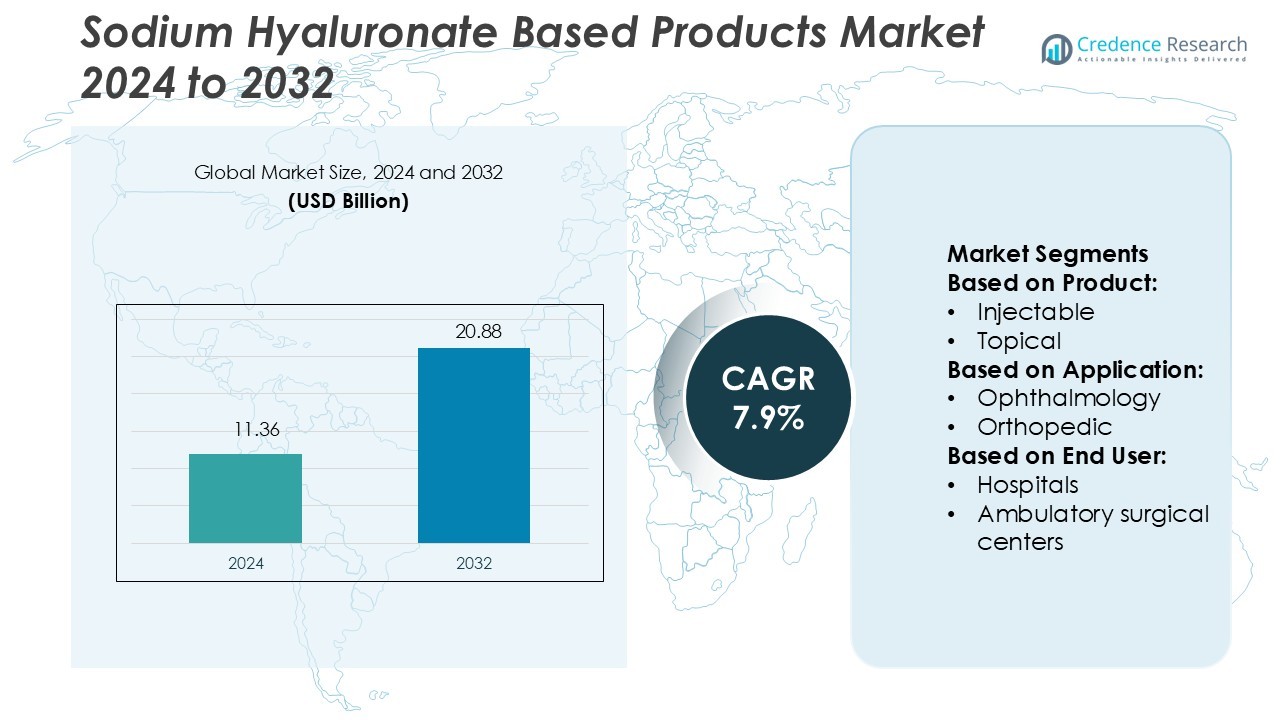

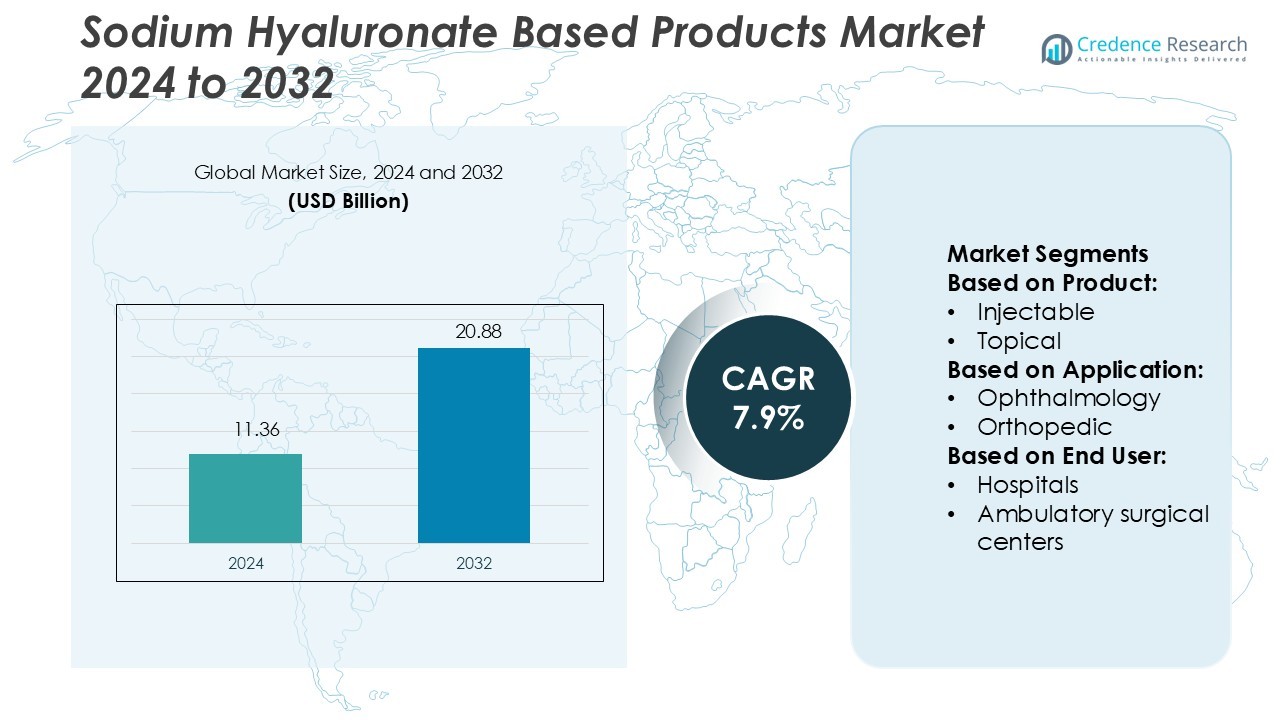

Sodium Hyaluronate Based Products Market size was valued USD 11.36 billion in 2024 and is anticipated to reach USD 20.88 billion by 2032, at a CAGR of 7.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sodium Hyaluronate Based Products Market Size 2024 |

USD 11.36 Billion |

| Sodium Hyaluronate Based Products Market, CAGR |

7.9% |

| Sodium Hyaluronate Based Products Market Size 2032 |

USD 20.88 Billion |

The sodium hyaluronate-based products market is driven by prominent companies such as GALDERMA, LG Chem, Ltd., Cadila Pharmaceuticals, Syner-Med (Pharmaceutical Products) Ltd., Ferring B.V., Ashland Inc., Bohus BioTech AB, Fidia Farmaceutici S.p.A., Anika Therapeutics, Inc., and Allergan, Inc. These players focus on expanding product portfolios through innovation in injectable, topical, and ophthalmic formulations. Strategic collaborations, R&D investments, and sustainable manufacturing practices enhance their global competitiveness. North America leads the market with a 36% share, supported by advanced healthcare infrastructure, high aesthetic procedure rates, and early adoption of next-generation hyaluronic acid-based medical and cosmetic solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Sodium Hyaluronate Based Products Market was valued at USD 11.36 billion in 2024 and is projected to reach USD 20.88 billion by 2032, registering a CAGR of 7.9% during the forecast period.

- Rising demand for injectable and ophthalmic formulations drives market growth, supported by expanding applications in orthopedics and dermatology.

- Trends highlight growing adoption of biofermented and vegan hyaluronic acid products and increasing innovation in cross-linking technologies for improved durability.

- The market is moderately consolidated, with leading companies such as GALDERMA, LG Chem, Ltd., and Allergan focusing on R&D, product diversification, and sustainable production.

- North America dominates with a 36% share, followed by Europe with 28% and Asia Pacific with 24%, while the injectable segment holds the largest share driven by high usage in aesthetics and regenerative therapies.

Market Segmentation Analysis:

By Product

The injectable segment dominates the sodium hyaluronate-based products market, accounting for the largest market share. Its widespread use in aesthetic treatments, osteoarthritis therapy, and ophthalmic surgeries drives growth. Injectable formulations deliver targeted therapeutic effects and long-lasting results, enhancing patient satisfaction. Demand is further supported by the expanding cosmetic procedures market and advancements in minimally invasive techniques. The segment benefits from product innovations offering controlled release and improved biocompatibility, strengthening its dominance across medical and aesthetic applications.

- For instance, GALDERMA’s Restylane® Lyft with Lidocaine incorporates NASHA™ cross-linking technology, which provides a particle size of approximately 750–1000 microns for deep dermal injections.

By Application

The pharmaceuticals segment holds the dominant share in the sodium hyaluronate-based products market, driven by its extensive use in ophthalmology, orthopedics, and dermatology. It is primarily utilized in eye drops, viscoelastic agents, and joint lubricants for osteoarthritis management. High adoption in wound healing and tissue repair further contributes to growth. Increasing investment in drug formulation R&D and regulatory approvals for hyaluronic acid-based drugs reinforce the segment’s leadership. Expanding clinical applications across urology and cosmetic medicine continue to widen its market scope.

- For instance, LG Chem Ltd. the product Hyruan ONE® Inj. uses a BDDE cross-linked sodium hyaluronate gel at a dose of 60 mg in 3.0 mL per syringe, intended for a one-time intra-articular injection into the knee.

By End-user

Hospitals lead the sodium hyaluronate-based products market, holding the largest market share among end users. The dominance results from the high patient inflow for ophthalmic, orthopedic, and dermatological procedures. Hospitals prefer these products for their efficacy, safety, and versatility in both surgical and non-surgical applications. Strong partnerships between healthcare facilities and pharmaceutical manufacturers ensure reliable product supply and adoption. The rising prevalence of chronic joint and eye disorders further increases hospital-based demand, solidifying their position as key end users in the global market.

Key Growth Drivers

Rising Demand in Aesthetic and Anti-Aging Treatments

The increasing use of sodium hyaluronate in dermal fillers and cosmetic formulations drives market growth. Its moisture retention, biocompatibility, and rejuvenation properties make it a preferred ingredient for anti-aging applications. The growing acceptance of minimally invasive aesthetic procedures enhances demand among dermatologists and clinics. Expanding product portfolios featuring high-purity, cross-linked hyaluronic acid further strengthen its market position. The rising global focus on personal care and appearance significantly fuels the growth of sodium hyaluronate-based products.

- For instance, Hyacyst® is a medical device containing a sterile solution of sodium hyaluronate. Hyacyst® (sodium hyaluronate), which is offered in pre-filled syringes of 40 mg in 50 mL and 120 mg in 50 mL.

Expanding Use in Orthopedic and Ophthalmic Applications

Sodium hyaluronate plays a crucial role in joint lubrication and ocular surgeries, supporting its expanding use in orthopedics and ophthalmology. Increasing incidences of osteoarthritis and age-related eye conditions drive adoption in viscoelastic and injection-based therapies. The material’s ability to reduce friction and promote tissue healing enhances treatment outcomes. Rising approvals for intra-articular and ophthalmic formulations boost the clinical acceptance of sodium hyaluronate products, particularly in developed healthcare systems.

- For instance, Ferring B.V.’s product EUFLEXXA® is formulated at 1% sodium hyaluronate (i.e., 10 mg per mL) for intra-articular knee injection.The material’s ability to reduce friction and promote tissue healing enhances treatment outcomes.

Technological Advancements in Formulation and Delivery Systems

Continuous innovation in formulation technologies strengthens sodium hyaluronate’s therapeutic performance and application range. Advancements in cross-linking methods, nanoparticle delivery, and biofermentation have improved stability, absorption, and efficacy. Pharmaceutical companies are investing in next-generation products offering extended release and superior biocompatibility. These improvements enhance patient compliance and treatment efficiency, driving demand across medical and cosmetic sectors. The integration of advanced biotechnology in production processes supports scalability and consistent quality, further propelling market expansion.

Key Trends & Opportunities

Shift Toward Sustainable and Biofermented Hyaluronic Acid

Growing environmental awareness and consumer preference for natural ingredients are fostering the adoption of biofermented sodium hyaluronate. Companies are increasingly using microbial fermentation techniques to produce vegan and eco-friendly variants. This approach reduces dependency on animal-derived sources and ensures high product purity. The trend supports ethical manufacturing while aligning with global sustainability goals. Expanding applications of bio-based sodium hyaluronate in skincare and pharmaceuticals create significant opportunities for long-term market growth.

- For instance, Ashland’s hyalurotech™ portfolio includes grades such as “Hyalurotech™ 1000/1800” which denote molecular-weight variants (1000 kDa / 1800 kDa) used in skin-care applications.

Integration of Sodium Hyaluronate in Multi-Functional Formulations

Manufacturers are combining sodium hyaluronate with peptides, ceramides, and antioxidants to develop advanced skincare and therapeutic products. These multi-functional formulations enhance hydration, repair, and anti-inflammatory effects. The trend appeals to both cosmetic and medical markets seeking efficient, versatile solutions. Growing consumer awareness of ingredient transparency and performance further boosts adoption. The expanding range of multifunctional sodium hyaluronate products creates new opportunities for product diversification and premium market positioning.

- For instance, ophthalmic product line (e.g., Ophteis®/OphteisMax®), each mL contains 10.0 mg, 14.0 mg or 25.0 mg sodium hyaluronate at concentrations of 1.0 %, 1.4 % or 2.5 % respectively.

Key Challenges

High Production Costs and Complex Manufacturing Process

The production of high-grade sodium hyaluronate involves complex purification, stabilization, and fermentation processes. Maintaining product consistency and sterility significantly increases manufacturing costs. Limited access to cost-effective raw materials further adds pressure on small and medium manufacturers. These factors can restrain price competitiveness, especially in price-sensitive markets. Continuous technological optimization and process automation are essential to address cost barriers and improve overall production efficiency.

Regulatory Constraints and Quality Compliance

Strict regulatory frameworks governing pharmaceutical and cosmetic-grade sodium hyaluronate pose challenges for market players. Compliance with regional standards for purity, biocompatibility, and safety requires extensive testing and documentation. Any deviation can delay product approvals and market entry. Differences in global regulatory norms also complicate cross-border commercialization. Companies must invest heavily in R&D and quality assurance to maintain compliance and sustain credibility in competitive markets.

Regional Analysis

North America

North America dominates the sodium hyaluronate-based products market with a 36% share. The region’s leadership is driven by strong demand in aesthetics, orthopedics, and ophthalmology. High consumer spending on anti-aging and skincare products supports continuous market expansion. The presence of key players such as Allergan and AbbVie enhances innovation and product availability. Advanced healthcare infrastructure and favorable FDA approvals for hyaluronic acid-based injectables strengthen regional growth. Rising awareness of non-invasive treatments and growing use in regenerative medicine continue to boost adoption across the United States and Canada.

Europe

Europe holds a 28% share of the global sodium hyaluronate-based products market, supported by strong pharmaceutical manufacturing and dermatology sectors. The region benefits from increasing geriatric populations and rising demand for aesthetic procedures. Strict EU regulatory standards ensure high product quality and safety, promoting consumer trust. Countries like Germany, France, and Italy lead in dermal filler and ophthalmic solution usage. Continuous R&D investment in bio-based hyaluronic acid production enhances sustainability. Growing preference for natural and certified cosmetic ingredients continues to drive product adoption across both medical and personal care applications.

Asia Pacific

Asia Pacific accounts for 24% of the global sodium hyaluronate-based products market and is the fastest-growing region. Rising disposable incomes, expanding healthcare infrastructure, and increasing beauty consciousness drive market growth. Countries such as China, Japan, and South Korea dominate due to strong cosmetic and pharmaceutical industries. Government initiatives supporting healthcare modernization and cosmetic safety standards further enhance adoption. Local manufacturers focus on affordable and biofermented formulations, boosting regional competitiveness. The rising popularity of injectable beauty treatments and ophthalmic care supports sustained market expansion across the region.

Latin America

Latin America represents a 7% share of the sodium hyaluronate-based products market, driven by increasing awareness of aesthetic and therapeutic applications. Countries such as Brazil and Mexico are witnessing higher demand for dermal fillers and orthopedic treatments. Growth is supported by expanding healthcare access and rising urbanization. Local cosmetic brands are incorporating sodium hyaluronate in skincare lines to cater to evolving consumer preferences. However, limited production capacity and dependency on imports constrain faster adoption. Strategic partnerships with global manufacturers are helping regional players strengthen market presence and expand product portfolios.

Middle East & Africa

The Middle East & Africa region holds a 5% market share in the sodium hyaluronate-based products market. The market is gaining traction due to rising demand for cosmetic enhancements and orthopedic treatments in countries like the UAE, Saudi Arabia, and South Africa. Expanding medical tourism and growing investments in advanced healthcare facilities contribute to regional development. Increasing consumer focus on skincare and regenerative therapies supports gradual adoption. However, higher product costs and limited local manufacturing present challenges. Global players are entering the region through distribution partnerships to capitalize on its emerging opportunities.

Market Segmentations:

By Product:

By Application:

By End User:

- Hospitals

- Ambulatory surgical centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The sodium hyaluronate-based products market is characterized by strong competition among key players including GALDERMA, LG Chem, Ltd., Cadila Pharmaceuticals, Syner-Med (Pharmaceutical Products) Ltd., Ferring B.V., Ashland Inc., Bohus BioTech AB, Fidia Farmaceutici S.p.A., Anika Therapeutics, Inc., and Allergan, Inc. The sodium hyaluronate-based products market is highly competitive, driven by continuous innovation and diversification across medical and cosmetic applications. Companies are focusing on developing advanced formulations with improved biocompatibility, stability, and prolonged therapeutic effects. Investments in R&D are directed toward biofermentation technologies and cross-linked hyaluronic acid to enhance product performance. Strategic alliances, mergers, and licensing partnerships are common strategies to strengthen global distribution and expand regional reach. The growing demand for injectable treatments, ophthalmic solutions, and anti-aging skincare products continues to push manufacturers toward sustainable production methods and high-quality, clinically tested formulations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- GALDERMA

- LG Chem, Ltd.

- Cadila Pharmaceuticals

- Syner-Med (Pharmaceutical Products) Ltd.

- Ferring B.V.

- Ashland Inc.

- Bohus BioTech AB

- Fidia Farmaceutici S.p.A.

- Anika Therapeutics, Inc.

- Allergan, Inc.

Recent Developments

- In December 2024, Goyal Salt Limited announced an investment of INR 80 crore to establish a new manufacturing plant in India, aimed at enhancing its production capacity and market reach. This strategic expansion aligns with the company’s growth plans to meet the rising demand for high-quality salt across various industries, including food processing, pharmaceuticals, and industrial applications.

- In September 2024, QatarEnergy announced a joint venture to develop a industrial salt production plant with a planned capacity of tons per annum in Qatar. The facility will produce table and industrial salts, catering to various sectors. This initiative aims to strengthen Qatar’s domestic production capabilities and reduce reliance on imports.

- In May 2024, Altris and Clarios signed a Joint Development Agreement to enhance SIB technology for low-voltage mobility applications. Altris will develop the sodium-ion cells, while Clarios will apply its expertise in Battery Management Systems, software, and system integration to design the complete battery system.

- In June 2023, Galderma announced that the U.S. Food and Drug Administration (FDA) granted approval for Restylane Eyelight for the treatment of undereye hollows, commonly known as dark shadows, in individuals over the age of 21. It is an undereye hyaluronic acid (HA) dermal filler that treats volume loss under the eyes and provides patients with natural-looking results.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for injectable formulations will rise due to growing aesthetic and orthopedic applications.

- Biofermented and vegan sodium hyaluronate will gain higher preference among consumers.

- Expansion in regenerative medicine will enhance the therapeutic potential of sodium hyaluronate.

- Technological advancements in cross-linking will improve product durability and performance.

- Emerging economies will witness increased adoption through affordable and localized manufacturing.

- Collaboration between pharmaceutical and cosmetic firms will drive product innovation.

- Online distribution channels will strengthen market accessibility and brand visibility.

- Sustainability-focused production practices will become a key industry standard.

- Rising healthcare spending will support higher utilization in ophthalmic and orthopedic care.

- Continued clinical research will expand applications in wound healing and tissue engineering.