Market Overview

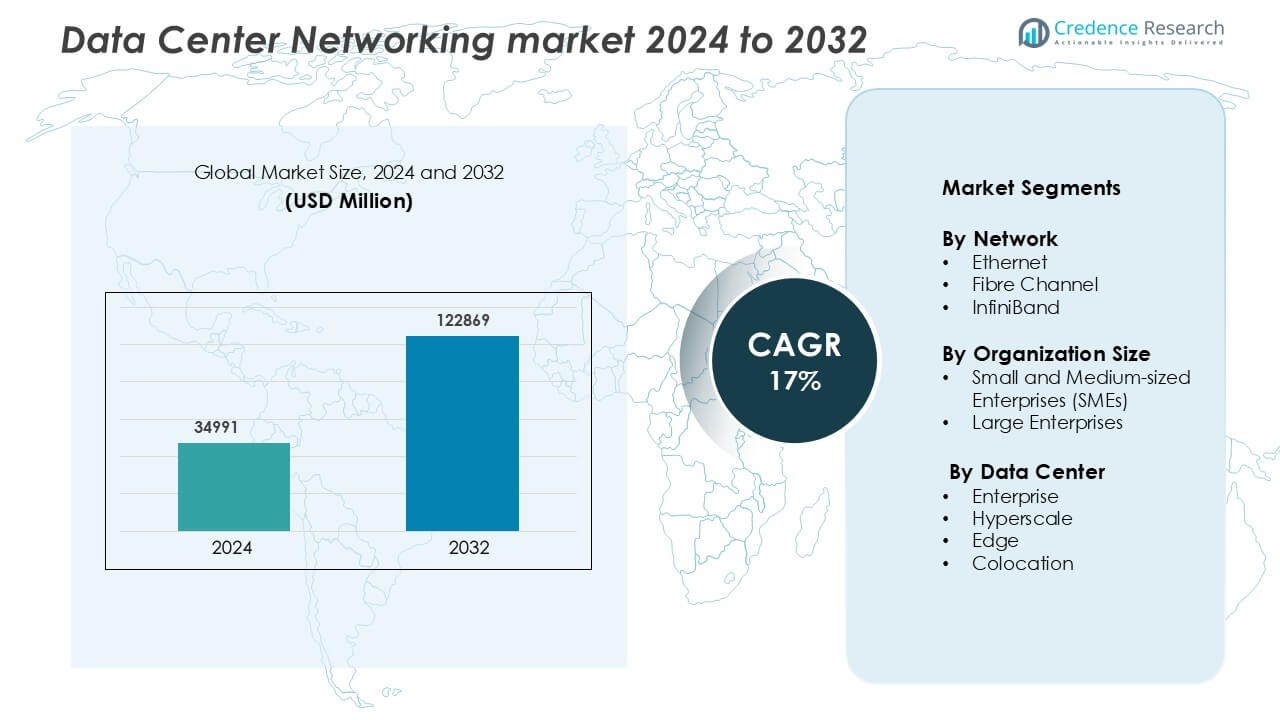

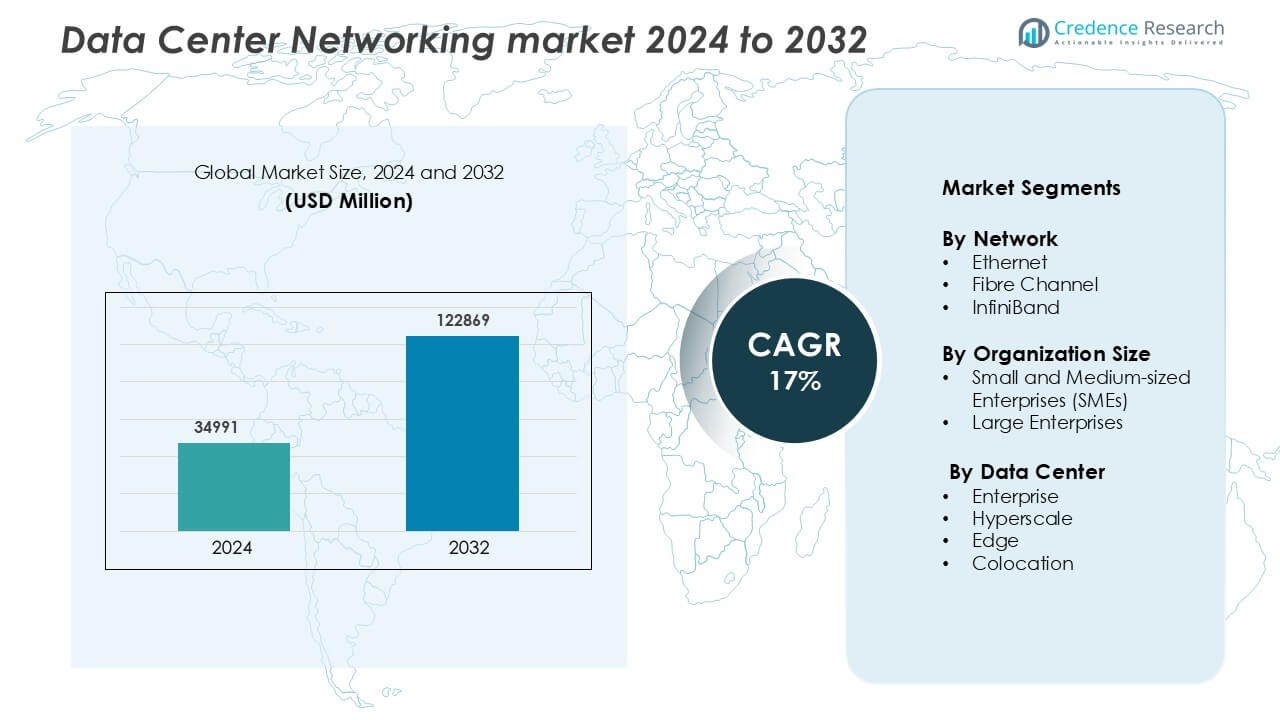

Data Center Networking Market was valued at USD 34991 million in 2024 and is anticipated to reach USD 122869 million by 2032, growing at a CAGR of 17% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Data Center Networking Market Size 2024 |

USD 34991 Million |

| Data Center Networking Market, CAGR |

17% |

| Data Center Networking Market Size 2032 |

USD 122869 Million |

The data center networking market is led by major players including Huawei Technologies, Dell, Juniper Networks, ZF Friedrichshafen, Hewlett Packard Enterprise (HPE), Cisco, Bosch, Arista Networks, Continental, and Extreme Networks. These companies compete through innovation in high-speed Ethernet, network automation, and software-defined networking (SDN) to enhance scalability and operational efficiency. Strategic collaborations with cloud providers and investments in AI-based network management are shaping the industry’s evolution. North America dominates the global market with a 38% share in 2024, driven by strong hyperscale data center expansion, advanced digital infrastructure, and significant cloud service penetration across enterprise and government sectors.

Market Insights

- The Data Center Networking Market was valued at USD 34991 million in 2024 and is projected to reach USD 122869 million by 2032, growing at a CAGR of 17%.

- Rising cloud adoption, virtualization, and the expansion of hyperscale facilities are driving market growth globally.

- Key trends include increased adoption of SDN, network automation, and integration of AI-driven network optimization tools.

- The market is competitive, with major players like Huawei, Cisco, Dell, and HPE focusing on high-speed Ethernet, automation, and energy-efficient designs.

- North America leads with a 38% share, followed by Asia-Pacific at 28%, while Ethernet remains the dominant segment with a 59% share, supported by strong enterprise and hyperscale data center deployments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Network

Ethernet dominates the data center networking market with a 59% share in 2024. Its strong position stems from scalability, cost-effectiveness, and support for high-speed connectivity across enterprise and hyperscale facilities. Ethernet’s continuous evolution to 400 GbE and 800 GbE technologies enhances network throughput and minimizes latency in cloud and AI workloads. Organizations favor Ethernet for its interoperability and mature ecosystem, making it ideal for large-scale data centers that demand efficient communication infrastructure and simplified network management.

- For instance, Arista Networks’ 7060X6-64PE platform offers 64 ports of 800 GbE in a 2RU system with 51.2 Tbps throughput.

By Organization Size

Large enterprises lead the market with a 66% share due to their extensive IT infrastructure and higher adoption of advanced networking technologies. These organizations prioritize data security, virtualization, and automation to improve operational agility and network visibility. Increased deployment of software-defined networking (SDN) and network function virtualization (NFV) drives scalability and cost efficiency. The growing digital transformation initiatives in financial services, telecom, and e-commerce sectors further strengthen the dominance of large enterprises in global data center networking adoption.

- For instance, Cisco helped a major enterprise transform its network infrastructure by reducing provisioning time from months to minutes through SDN and NFV deployment.

By Data Center

Hyperscale data centers hold the largest market share of 48% in 2024, driven by massive cloud service providers and high-performance computing needs. Their dominance is supported by continuous investment from companies like Amazon, Microsoft, and Google in expanding global data center capacity. Hyperscale facilities rely on automated, high-bandwidth, and energy-efficient network solutions to manage large-scale data traffic. Rising demand for AI workloads, data analytics, and edge computing continues to drive innovation and infrastructure expansion within the hyperscale segment.

Key Growth Drivers

Rising Adoption of Cloud Computing and Virtualization

The rapid expansion of cloud computing and virtualization remains a primary growth driver in the data center networking market. Enterprises are shifting from traditional on-premises IT to cloud-based models, increasing demand for scalable and high-performance network infrastructure. Virtualized environments require flexible, software-defined networking (SDN) solutions to handle dynamic workloads efficiently. This transition enhances resource utilization and reduces operational costs while improving data flow between distributed servers. The proliferation of hybrid and multi-cloud architectures further drives investment in high-bandwidth, low-latency networks. Companies are deploying advanced Ethernet and optical solutions to support massive data movement between private and public cloud infrastructures.

- For instance, Huawei Technologies deployed its CloudEngine CE12800 switch series which can provide up to 10 Tbit/s of bidirectional bandwidth per slot (or 5 Tbit/s forwarding capacity in a single direction) and a maximum total switching capacity of 160 Tbit/s (scalable up to 1032 Tbit/s with newer line cards and fabric modules) in large cloud data center deployments.

Surge in Data Traffic and IoT Connectivity

Exponential growth in data generation and Internet of Things (IoT) adoption fuels the need for advanced data center networks. Connected devices, sensors, and real-time analytics applications generate continuous data streams that require robust network performance. Enterprises rely on high-speed fiber connections, intelligent routing, and edge networking to manage this surge effectively. Increased demand for streaming, remote work solutions, and AI-driven workloads amplifies network strain, leading organizations to upgrade infrastructure. Data center operators are investing in automation and network optimization technologies to ensure seamless data transmission, scalability, and fault tolerance. This trend accelerates modernization efforts, making high-throughput, energy-efficient networks a strategic necessity.

- For instance, Juniper Networks’ QFX5220-32CD switch offers up to 25.6 Tbps bidirectional throughput, enabling substantial data-flow handling in dense environments.

Expansion of Hyperscale Data Centers

The rapid rise of hyperscale facilities drives significant market growth as global cloud and technology giants expand capacity to meet soaring data demands. Companies like Amazon Web Services, Microsoft Azure, and Google Cloud are investing in next-generation networking hardware to enhance throughput and reliability. Hyperscale data centers require ultra-low-latency connections and automation to manage vast workloads efficiently. The growing use of AI, big data analytics, and cloud-native applications further boosts infrastructure investment. Adoption of 400G and 800G Ethernet technologies enhances bandwidth and supports future scalability. These deployments also emphasize energy efficiency and modular architectures to sustain long-term operations and reduce total ownership costs.

Key Trend & Opportunity

Integration of Software-Defined Networking (SDN) and Network Automation

The growing integration of SDN and network automation represents a major trend reshaping data center operations. SDN decouples control from the hardware layer, allowing centralized network management and improved agility. Automated provisioning reduces manual errors, enhances security, and accelerates deployment cycles. Enterprises are adopting intent-based networking and AI-driven analytics for predictive maintenance and real-time optimization. This transformation supports scalability as organizations handle expanding digital workloads. The combination of SDN and automation reduces operational complexity and supports multi-cloud orchestration, making it a crucial enabler for agile and cost-effective data center management.

- For instance, Cisco often highlights the potential of its ACI controller for rapid deployment, with internal metrics and partner case studies suggesting that clients can provision new network services in under 30 minutes, a process that typically takes days with traditional methods.

Growth of Edge Data Centers and 5G Infrastructure

Edge data centers are emerging as a crucial opportunity driven by 5G deployment and demand for low-latency computing. As real-time processing gains importance in IoT, autonomous vehicles, and industrial automation, edge facilities complement hyperscale centers by handling localized data traffic. The combination of edge computing and 5G enhances responsiveness and supports new digital services. Network providers are investing in high-capacity fiber and routing technologies to connect distributed edge nodes efficiently. This expansion fosters collaboration between telecom operators and data center vendors, unlocking new business models and improving service delivery for latency-sensitive applications.

- For instance, the Cisco Catalyst 8200 Series Edge Platforms are designed for small to medium-sized branch and edge use cases, with the higher-end model, the C8200-1N-4T, supporting up to 4,000 VRF instances.

Key Challenge

High Capital and Operational Expenditure

Building and maintaining advanced data center networking infrastructure requires substantial financial investment, posing a key challenge for both enterprises and service providers. The deployment of high-speed Ethernet, optical switches, and automation tools involves significant upfront costs. Operational expenses also rise due to power consumption, cooling, and continuous equipment upgrades. Smaller organizations often struggle to compete with hyperscale players that benefit from economies of scale. Moreover, fluctuating energy prices and sustainability pressures drive the need for greener, yet more expensive technologies. Addressing these financial constraints requires adopting modular architectures, energy-efficient designs, and cloud-based management models to balance performance with cost efficiency.

Growing Cybersecurity and Data Privacy Concerns

Increasing digital connectivity in data centers heightens vulnerability to cyberattacks and data breaches. The integration of multi-cloud and hybrid environments creates complex security challenges that traditional perimeter defenses cannot manage effectively. Threats such as DDoS attacks, ransomware, and unauthorized access compromise sensitive enterprise data. Companies must adopt zero-trust frameworks, AI-based threat detection, and encryption protocols to safeguard information across distributed networks. However, implementing these solutions demands skilled professionals and additional investment, increasing operational complexity. Maintaining compliance with evolving data protection regulations, such as GDPR and CCPA, remains a significant hurdle for global data center operators.

Regional Analysis

North America

North America leads the global data center networking market with a 38% share in 2024. The region’s dominance stems from the strong presence of major cloud service providers such as Amazon Web Services, Google, and Microsoft. Rapid adoption of AI, big data, and 5G technologies continues to drive demand for high-speed, low-latency networking infrastructure. The U.S. government’s focus on digital transformation and cybersecurity investments further supports market expansion. Additionally, growing hyperscale and colocation data center deployments enhance regional capacity, ensuring scalability and reliability for enterprises and service providers.

Europe

Europe accounts for a 26% share of the global data center networking market, driven by regulatory compliance, sustainability goals, and data sovereignty initiatives. Countries such as Germany, the UK, and the Netherlands are major hubs for hyperscale and colocation facilities. Increased focus on green data centers and renewable energy integration is promoting network efficiency. The expansion of the European Data Strategy and GDPR enforcement continues to influence infrastructure modernization. Rising enterprise digitalization and investments in fiber connectivity across the region are strengthening Europe’s role in global network development.

Asia-Pacific

Asia-Pacific holds a 28% market share and is the fastest-growing region due to large-scale investments in data infrastructure. Countries like China, India, Japan, and Singapore are witnessing rapid cloud adoption and data localization initiatives. The surge in e-commerce, fintech, and streaming platforms fuels the need for advanced network solutions. Government-led smart city projects and the rollout of 5G networks further accelerate market growth. Regional players are investing in hyperscale and edge data centers to meet rising demand for digital services, reinforcing Asia-Pacific’s leadership in data-driven innovation and capacity expansion.

Latin America

Latin America represents an 5% share of the data center networking market, supported by increasing digital transformation and cloud service adoption. Brazil and Mexico serve as primary growth centers, with rising investments in colocation and hyperscale data centers. The growing penetration of e-commerce and digital banking is creating strong demand for reliable and secure connectivity. Regional governments are improving data infrastructure and regulatory environments to attract global operators. However, challenges such as high energy costs and limited local manufacturing capabilities moderately affect the market’s expansion potential across the region.

Middle East & Africa

The Middle East and Africa account for a 3% share, showing steady growth driven by digital economy initiatives and smart infrastructure development. The UAE, Saudi Arabia, and South Africa are leading data center investment destinations in the region. Expansion of 5G networks, government cloud adoption, and international partnerships with hyperscale providers are fueling network modernization. Increased focus on diversifying economies and promoting digital hubs is fostering local data hosting capabilities. Despite challenges related to energy efficiency and skilled labor shortages, the region’s long-term prospects remain positive due to continuous infrastructure development.

Market Segmentations:

By Network

- Ethernet

- Fibre Channel

- InfiniBand

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

By Data Center

- Enterprise

- Hyperscale

- Edge

- Colocation

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The data center networking market is highly competitive, characterized by innovation, strategic alliances, and rapid technological evolution. Leading players such as Huawei Technologies, Dell, Juniper Networks, ZF Friedrichshafen, Hewlett Packard Enterprise (HPE), Cisco, Bosch, Arista Networks, Continental, and Extreme Networks focus on expanding their product portfolios and global presence. These companies are investing heavily in high-speed Ethernet, SDN, and automation solutions to enhance network efficiency and scalability. Partnerships with cloud service providers and hyperscale operators strengthen market positioning. For instance, Cisco and HPE emphasize AI-driven network management, while Huawei and Dell lead in modular data center solutions. Continuous R&D investments, sustainability-focused infrastructure, and regional data compliance drive competitive differentiation. The market’s intense rivalry encourages innovation in areas like network virtualization, cybersecurity integration, and edge connectivity, ensuring sustained technological advancement and service optimization across industries.

Key Player Analysis

Recent Developments

- In June 2024, Hewlett Packard Enterprise and Danfoss collaborated to deliver HPE’s IT Sustainability Services Data Center Heat Recovery, an off-the-shelf heat recovery module that will help organizations to manage and value excess heat as they transition towards more sustainable IT facilities.

- In 2024, Arista Networks launched Arista Etherlink, a standards-based Ethernet solution designed for AI workloads. Powered by AI-optimized Arista EOS, Etherlink delivers scalable infrastructure supporting deployments from a few thousand up to hundreds of thousands of XPUs across both one- and two-tier network topologies.

- In March 2024, NVIDIA introduced the X800 series of switches, including the Quantum-X800 InfiniBand and Spectrum-X800 Ethernet models. These next-generation switches deliver speeds of 800Gb/s, setting a new benchmark for AI and GPU computing. Widely adopted by enterprises, they enhance AI, cloud, and high-performance computing (HPC) capabilities with unmatched speed and efficiency

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Network, Organization size, Data Center and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with increasing adoption of cloud computing and virtualization technologies.

- AI-driven network automation will enhance performance monitoring and predictive maintenance.

- The rollout of 5G and edge computing will create new opportunities for low-latency networking.

- Hyperscale data centers will continue to dominate due to growing cloud service demand.

- Adoption of software-defined networking (SDN) will accelerate to support agile infrastructure management.

- Energy-efficient and sustainable network solutions will gain prominence across global facilities.

- Integration of cybersecurity and zero-trust frameworks will become a key priority.

- Enterprises will invest more in hybrid and multi-cloud connectivity solutions.

- Advances in 400G and 800G Ethernet technologies will improve bandwidth and scalability.

- Asia-Pacific will emerge as the fastest-growing region, supported by digital transformation and government-led infrastructure initiatives.