Market Overview

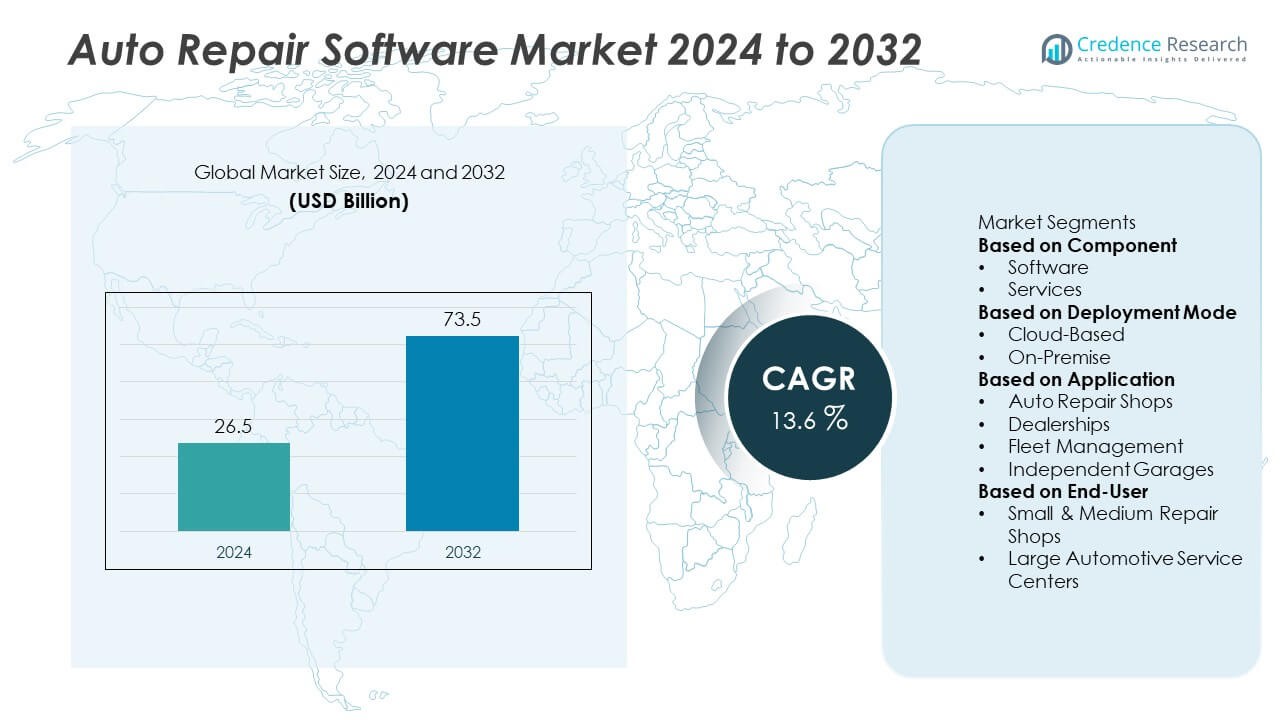

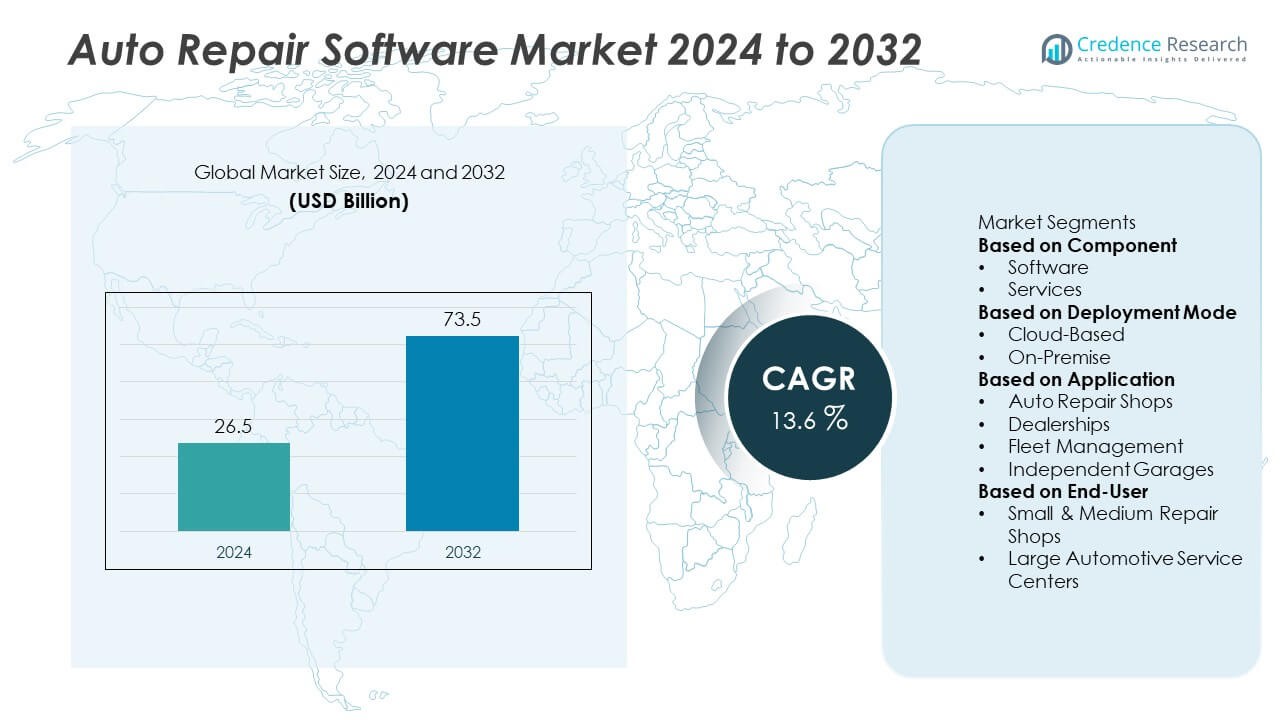

The Auto Repair Software market reached USD 26.5 billion in 2024 and is projected to hit USD 73.5 billion by 2032, registering a CAGR of 13.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Auto Repair Software Market Size 2024 |

USD 26.5 Billion |

| Auto Repair Software Market, CAGR |

13.6% |

| Auto Repair Software Market Size 2032 |

USD 73.5 Billion |

Top players in the Auto Repair Software market include Mitchell International, AutoLeap, Shopmonkey, CCC Intelligent Solutions, ALLDATA, Tekmetric, Identifix, GaragePlug, RepairPal, and Karmak. These companies strengthen market growth through cloud-based platforms, advanced diagnostics, integrated CRM tools, and mobile-enabled workflow solutions. North America leads the market with a 38% share, supported by strong digital adoption and a dense service network. Europe follows with a 29% share, driven by regulated maintenance standards and rapid digitalization across repair ecosystems. Asia-Pacific holds a 24% share, expanding through rising vehicle ownership, organized service chains, and increased demand for connected repair solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Auto Repair Software market reached USD 26.5 billion in 2024 and will grow to USD 73.5 billion by 2032 at a 13.6% CAGR, driven by high adoption of digital repair platforms.

- Strong demand for workflow automation, advanced diagnostics, and cloud-based service tools drives market expansion, with software holding a 63% segment share due to its wide integration across repair operations.

- Key trends include rising use of AI-enabled diagnostics, predictive maintenance, telematics-based service planning, and mobile-based repair workflow systems across both dealerships and independent garages.

- Intense competition continues as leading players invest in cloud platforms, CRM integration, digital inspection tools, and secure data management to strengthen market presence and support modern vehicle technologies.

- North America leads with a 38% share, followed by Europe at 29%, Asia-Pacific at 24%, Latin America at 6%, and the Middle East & Africa at 3%, supported by rising digital adoption across repair shops and fleet operators.

Market Segmentation Analysis:

By Component

Software leads this segment with a 63% market share due to strong adoption of integrated diagnostic tools, digital invoicing systems, and automated workflow platforms. Auto repair shops prefer software solutions that streamline appointment scheduling, parts ordering, and customer communication. Demand grows as service centers shift toward digital record-keeping and real-time repair status updates. Cloud-based software with analytics and reporting also supports improved operational visibility. The services segment grows as shops seek training, system integration, and technical support to manage advanced digital tools.

- For instance, Mitchell 1’s ProDemand platform uses a database of over 850 million repair records and delivers OEM-accurate procedures that cut diagnostic steps by up to 30%.

By Deployment Mode

Cloud-based platforms dominate with a 71% market share, driven by low upfront costs and easy scalability for repair shops of all sizes. Businesses choose cloud deployment for real-time updates, remote access, and reduced maintenance needs. Growing use of mobile devices in service bays supports cloud expansion, allowing technicians to access repair histories and diagnostics instantly. Cloud models also enable seamless integration with CRM, inventory, and payment systems. On-premise solutions maintain demand among large dealerships with strict data-control requirements.

- For instance, Shopmonkey’s cloud suite supports over 7,000 service centers through real-time synchronization across all devices, with annual revenue reaching $29.7 million in 2024.

By Application

Auto repair shops hold a 54% market share, making them the largest application segment due to high demand for workflow automation, diagnostics integration, and customer management tools. These shops adopt digital systems to speed repairs, reduce errors, and manage high service volumes. Dealerships also show strong uptake as they integrate repair software with OEM databases and warranty systems. Fleet management platforms gain traction as logistics companies track maintenance schedules and reduce downtime. Independent garages adopt affordable cloud-based systems to improve service quality and competitiveness.

Key Growth Drivers

Rising Demand for Digital Workflow Automation

Digital workflow automation drives major growth in the Auto Repair Software market as repair shops seek faster service delivery and improved accuracy. Shops adopt automated scheduling, digital inspection tools, and integrated invoicing systems to reduce manual errors. These platforms support real-time technician updates, streamline parts availability checks, and improve customer communication. Growing adoption across independent garages and large service centers strengthens market expansion. The shift toward connected repair bays and paperless operations further accelerates software uptake across developed and emerging regions.

- For instance, AutoLeap reports that its platform helps repair shops increase revenue by approximately 30% and reduce time spent on administrative tasks by 50% to 60% through integrated scheduling and digital inspections, with some users noting the platform helps cut the approval process from hours to minutes.

Increasing Vehicle Complexity and Advanced Diagnostics Use

Modern vehicles require advanced diagnostic tools due to complex electronic systems, sensors, and ADAS features. Auto repair software plays a key role by enabling faster fault detection, guided repair processes, and integration with OEM databases. Repair shops rely on digital diagnostic platforms to handle hybrid, electric, and intelligent vehicles. Rising adoption of scan tools and cloud-based vehicle history data supports more accurate service decisions. This trend boosts demand for diagnostic-integrated software solutions across workshops and dealerships handling diverse vehicle models.

- For instance, ALLDATA maintains a library of more than 40 million OEM procedures and supports over 400,000 technicians worldwide, enabling precise ADAS calibration and cutting diagnostic time by up to 22%.

Growing Adoption of Cloud-Based and Mobile Platforms

Cloud-based and mobile-enabled repair platforms support remote access, faster updates, and seamless integration with multiple business systems. These solutions appeal to small and mid-sized garages due to lower upfront costs and easy deployment. Mobility features allow technicians to access repair records, inspections, and checklists from tablets or smartphones. Cloud platforms also enhance customer engagement through digital approvals and automated reminders. As repair networks expand geographically, cloud systems help maintain consistent operations and improve performance visibility across locations.

Key Trends & Opportunities

Expansion of AI, Telematics, and Predictive Maintenance Tools

AI-enabled repair platforms and telematics-based diagnostics create major opportunities for predictive maintenance and faster repair decision-making. These tools analyze vehicle health data, past service patterns, and real-time alerts to guide technicians. Predictive workflows help reduce breakdowns, improve parts planning, and increase customer retention. Fleet operators increasingly prefer AI-driven service tools to manage large vehicle groups. Software vendors expand capabilities by integrating machine learning and remote diagnostics, opening new revenue streams across commercial and passenger vehicle ecosystems.

- For instance, RepairPal’s price estimation system uses data from various sources, including proprietary part price sources, industry-agreed-upon labor times from sources like MOTOR, and local labor rates, which are manually assembled by expert technicians to provide fair and transparent repair price estimates for consumers.

Growth of Integrated Payment, CRM, and Inventory Solutions

The market sees strong growth in all-in-one platforms that combine repair management with CRM, payments, and inventory systems. This trend helps repair shops consolidate operations into a single interface and reduce dependency on multiple tools. Integrated systems support faster billing, automated reminders, and streamlined supplier coordination. Shops gain end-to-end visibility of customers, parts, and service records, improving efficiency and profitability. Adoption grows among multi-location service centers and independent garages seeking improved workflow control and customer loyalty.

- For instance, the cloud-based Tekmetric platform is trusted by over 12,000 shops nationwide and provides solutions for managing the entire business, from customer service to workflow and parts ordering, giving shops unified control of invoicing, parts flow, and customer engagement.

Key Challenges

High Implementation Costs for Small and Independent Workshops

Small and independent garages face difficulty adopting advanced auto repair software due to high setup costs, subscription fees, and training requirements. Limited budgets restrict investment in premium diagnostic add-ons or integrated modules. Many workshops continue using manual or basic tools, slowing digital transformation. The cost of upgrading hardware and maintaining internet connectivity also adds pressure. Vendors must introduce flexible pricing, modular solutions, and support programs to improve adoption among smaller service providers across developing markets.

Data Security Risks and Integration Difficulties

Data security concerns remain a major challenge as repair shops manage sensitive customer information, vehicle histories, and payment records. Cloud-based systems require strong encryption and strict access controls to prevent breaches. Integrating new software with legacy tools, OEM systems, and diagnostic devices can also create operational hurdles. Poor compatibility leads to workflow disruption and longer onboarding times. Vendors must prioritize secure architectures, standardized APIs, and seamless integration capabilities to address these challenges and improve user confidence in digital repair solutions.

Regional Analysis

North America

North America leads the Auto Repair Software market with a 38% market share, driven by strong digital adoption and a dense network of professional repair centers. Service providers invest in cloud-based tools, advanced diagnostics, and integrated workflow platforms to handle growing vehicle complexity. High EV penetration also increases demand for software-supported repair processes. Dealerships and independent garages rely on real-time data, automated scheduling, and digital inspections to improve service accuracy. Strong consumer expectations for fast and transparent repair services continue to push software upgrades across the region.

Europe

Europe holds a 29% market share, supported by strict vehicle safety regulations and increasing adoption of digital service models. Repair shops adopt advanced diagnostic platforms to manage modern vehicle architectures, including hybrid and electric powertrains. Demand rises for paperless workflows, connected garage solutions, and predictive maintenance tools. Large dealership networks integrate software with OEM systems to streamline warranty claims and technical updates. Independent garages also expand digital capabilities to stay competitive in a regulated and service-driven automotive ecosystem, strengthening regional software growth.

Asia-Pacific

Asia-Pacific captures a 24% market share, driven by a large vehicle population, expanding urban mobility, and a rise in organized repair chains. Rapid adoption of cloud-based systems supports small and mid-sized garages seeking cost-effective digital tools. Growing sales of connected and electric vehicles increase demand for advanced diagnostics and workflow automation. The region benefits from strong investment by global and regional software vendors. Fleet operators adopt telematics-integrated repair platforms to manage maintenance cycles and reduce operational downtime, boosting overall market expansion.

Latin America

Latin America accounts for a 6% market share, influenced by rising digital transformation across automotive workshops. Repair shops adopt management software to handle increasing service volumes and to improve billing accuracy. Cloud-based solutions gain traction among small garages due to lower upfront investment. Growing vehicle ownership and heightened demand for reliable service tracking support adoption. Regional dealerships integrate diagnostics, CRM, and inventory tools to strengthen customer engagement. Economic challenges slow large-scale modernization, yet steady digital adoption continues across major markets like Brazil and Mexico.

Middle East & Africa

The Middle East & Africa holds a 3% market share, with growth driven by expanding automotive service networks and rising consumer expectations for professionalized repair services. Larger workshops and dealership groups adopt digital scheduling, parts management, and repair tracking tools to improve operational control. Increasing imports of modern vehicles with complex electronic systems accelerates the need for advanced diagnostics. Cloud-based platforms gain momentum across the region due to better accessibility and scalability. Although digital penetration remains uneven, investments in service infrastructure support long-term market development.

Market Segmentations:

By Component

By Deployment Mode

By Application

- Auto Repair Shops

- Dealerships

- Fleet Management

- Independent Garages

By End-User

- Small & Medium Repair Shops

- Large Automotive Service Centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Auto Repair Software market features leading players such as Mitchell International, AutoLeap, Shopmonkey, CCC Intelligent Solutions, ALLDATA, Tekmetric, Identifix, GaragePlug, RepairPal, and Karmak. These companies compete by offering advanced digital tools that improve diagnostics, workflow automation, customer engagement, and parts management. Vendors focus on user-friendly interfaces, integrated payment solutions, and strong mobile capabilities to support technicians and service advisors. Cloud-based models gain priority as shops seek scalable and cost-efficient platforms. Providers also enhance AI-driven diagnostics, telematics integration, and predictive maintenance features to address evolving vehicle technologies. Strategic partnerships with OEMs and parts distributors strengthen software ecosystems, while regular updates ensure compatibility with modern vehicle systems. Competitive pressure pushes companies to deliver faster onboarding, customized dashboards, and strong data security to support diverse repair environments across dealerships, independent garages, and fleet operators.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mitchell International

- AutoLeap

- Shopmonkey

- CCC Intelligent Solutions

- ALLDATA

- Tekmetric

- Identifix

- GaragePlug

- RepairPal

- Karmak

Recent Developments

- In November 2025, Mitchell expanded a collaboration with Crash Champions to deploy Mitchell’s end-to-end workflow optimization software across more than 650 locations.

- In October 2025, Mitchell International introduced Mitchell Diagnostics Sync, which allows third-party ADAS calibration and diagnostic reports to automatically populate estimate lines in Mitchell Cloud Estimating.

- In June 2024, AutoLeap achieved recognition from Gartner Digital Markets’ GetApp by securing four badges (Leaders in Auto Repair; Best Functionality & Features; Best Ease of Use; Best Customer Support).

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment Mode, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Cloud-based repair platforms will see wider adoption due to easy scalability.

- AI-driven diagnostics will enhance accuracy and reduce repair turnaround times.

- Mobile-enabled tools will support real-time technician workflows in service bays.

- Predictive maintenance solutions will gain traction among fleet operators.

- Integrated CRM and payment systems will strengthen customer engagement.

- EV and hybrid vehicle growth will increase demand for advanced diagnostic software.

- Multi-location service centers will expand use of centralized management platforms.

- Data security and encrypted systems will become priority features for vendors.

- OEM partnerships will drive deeper integration with repair and warranty systems.

- Digital inspections and remote approvals will improve transparency and service speed.