Market Overview:

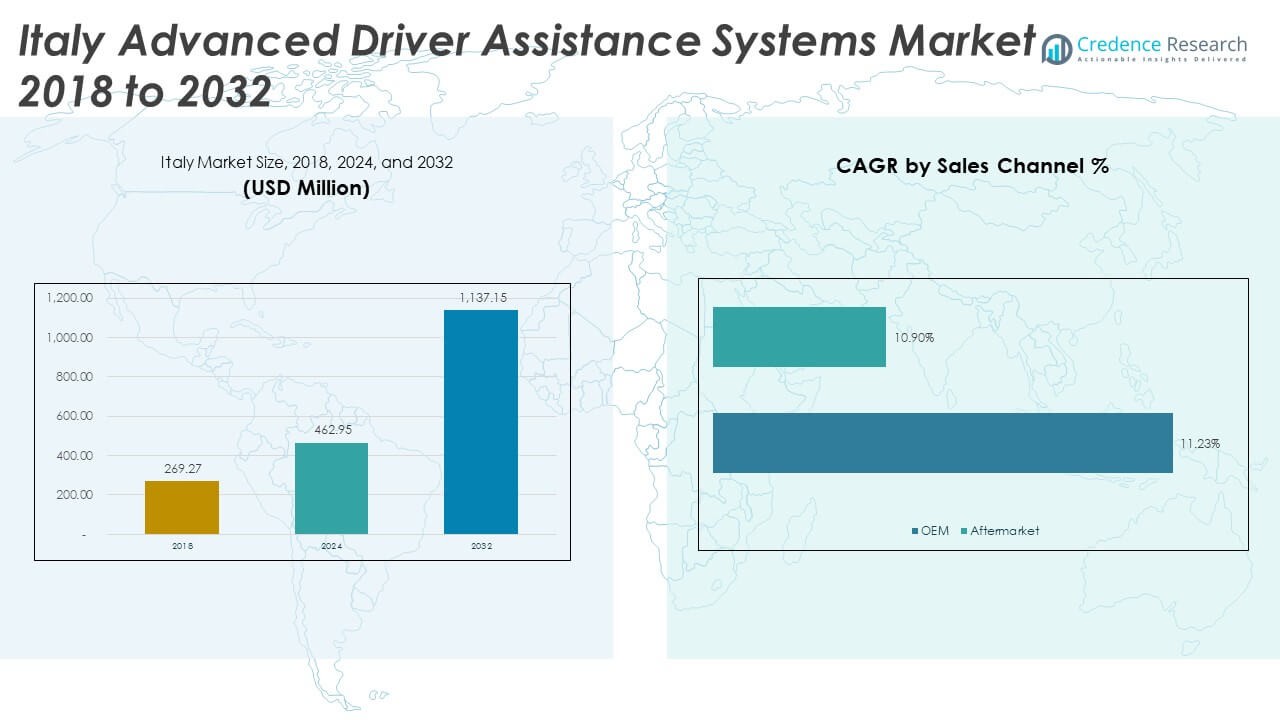

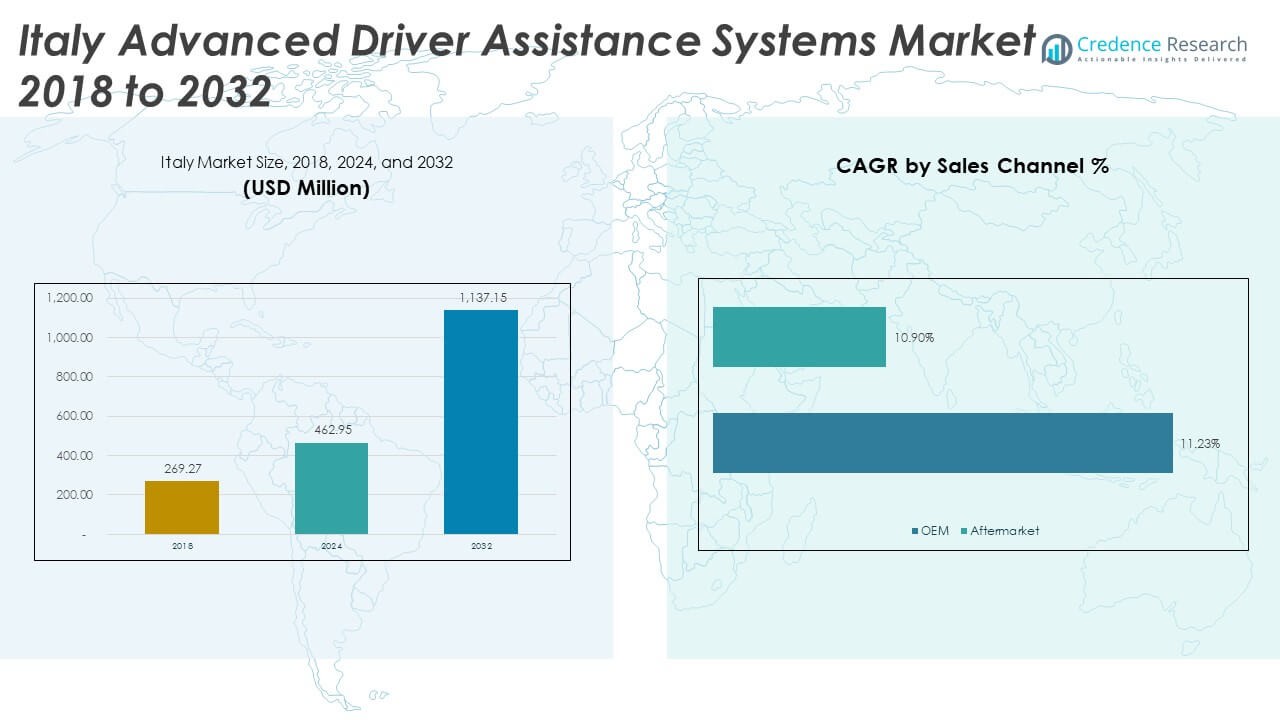

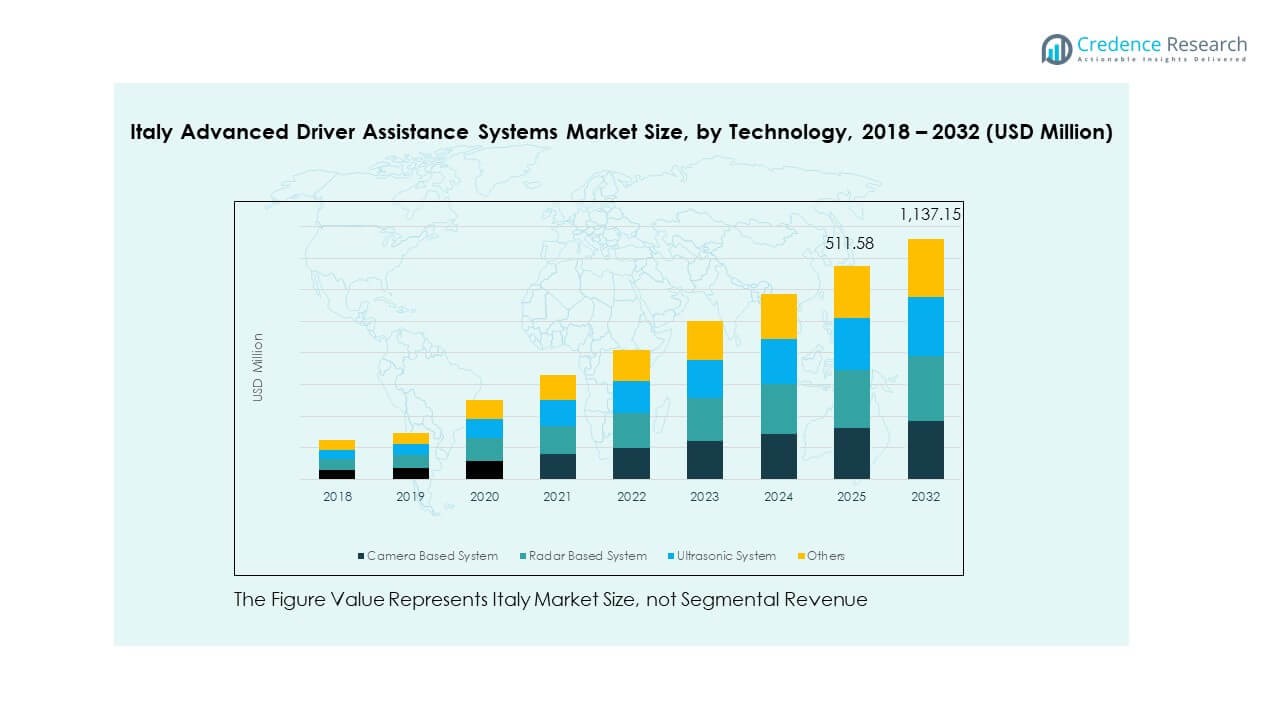

The Italy Advanced Driver Assistance Systems Market size was valued at USD 269.27 million in 2018 to USD 462.95 million in 2024 and is anticipated to reach USD 1,137.15 million by 2032, at a CAGR of 11.89% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Advanced Driver Assistance Systems Market Size 2024 |

USD 462.95 Million |

| Italy Advanced Driver Assistance Systems Market, CAGR |

11.89% |

| Italy Advanced Driver Assistance Systems Market Size 2032 |

USD 1,137.15 Million |

The market growth is driven by rising adoption of safety technologies and stricter regulatory standards for vehicle safety compliance. Automakers are increasingly integrating adaptive cruise control, blind spot detection, and lane departure warning in both premium and mid-range vehicles. Advances in radar, LiDAR, and camera technologies enhance system performance and reliability, encouraging higher consumer acceptance. Growing demand for connected and electric vehicles also accelerates the integration of intelligent driver-assistance systems across the country.

Regionally, Northern Italy leads the market due to the presence of major automotive manufacturers and strong R&D infrastructure in regions like Lombardy, Piedmont, and Emilia-Romagna. Central Italy shows steady expansion driven by software innovation and ADAS testing centers, while Southern Italy is emerging as a developing hub supported by new industrial projects and supply chain diversification. Collaborative research, industrial policy support, and smart city initiatives further strengthen regional adoption of ADAS technologies across Italy.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Italy Advanced Driver Assistance Systems Market was valued at USD 269.27 million in 2018, reached USD 462.95 million in 2024, and is projected to attain USD 1,137.15 million by 2032, growing at a CAGR of 11.89%.

- Northern Italy holds the largest share at 45%, driven by strong OEM presence, advanced R&D facilities, and high adoption of automation technologies in Lombardy and Emilia-Romagna.

- Central Italy accounts for 30% share, supported by growing software integration, sensor calibration centers, and active university–industry collaboration in Tuscany and Lazio.

- Southern Italy, with a 25% share, is the fastest-growing region due to rising industrial investments, infrastructure upgrades, and establishment of new ADAS manufacturing clusters.

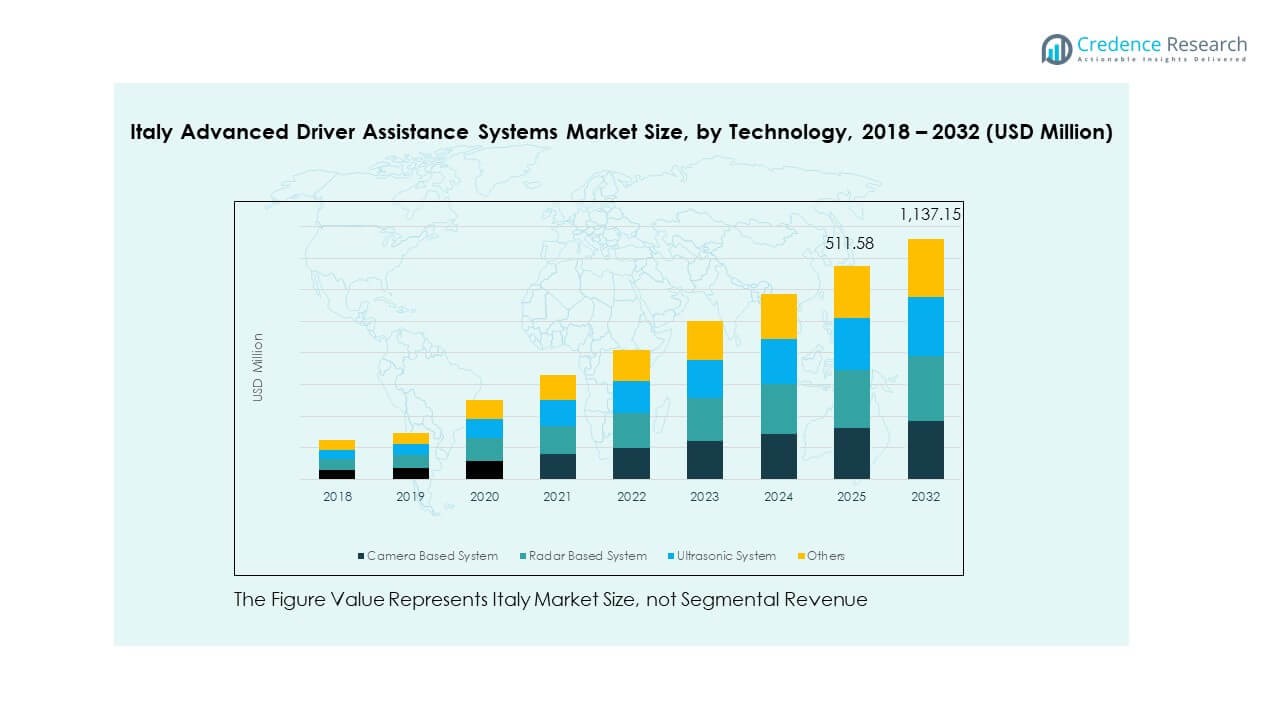

- By technology, radar-based systems lead with around 40% share, followed by camera-based systems at 35%, supported by increasing integration in mid-range vehicles and advancements in real-time perception and sensor fusion technologies.

Market Drivers

Growing Focus on Vehicle Safety and Regulatory Compliance

The Italy Advanced Driver Assistance Systems Market is witnessing strong growth due to increasing safety regulations from both national and EU authorities. Strict mandates by the European Union requiring technologies like Automatic Emergency Braking (AEB) and Lane Departure Warning (LDW) have accelerated adoption across vehicle categories. Consumers prefer vehicles that meet the latest safety ratings under Euro NCAP standards. Manufacturers integrate ADAS components in new models to ensure compliance. This regulatory drive pushes OEMs to innovate safety features. Enhanced consumer awareness also reinforces the demand for safer mobility. It creates sustained growth across both passenger and commercial vehicle segments.

Rising Integration of ADAS in Mid-Range Vehicle Models

Automakers in Italy now focus on deploying ADAS features in mid-range vehicles to meet rising expectations for safety and comfort. Systems such as adaptive cruise control and blind spot detection are becoming standard offerings beyond luxury segments. Growing competition among brands encourages wider feature inclusion at affordable price levels. The trend supports broader market penetration and increased consumer accessibility. Government incentives and insurance discounts for ADAS-equipped cars further strengthen market growth. Automakers see this as a strategy to differentiate their models in a saturated market. It also builds brand reliability among safety-conscious buyers.

- For instance, as of 2025, Volkswagen confirmed the integration of Level 2+ “enhanced partially automated driving” systems, previously reserved for high-end models, into mainstream models like the Golf and Tiguan sold in Italy.

Technological Advancements in Sensor and Processing Capabilities

Innovation in radar, LiDAR, and camera-based systems has enhanced ADAS precision and reliability. The Italy Advanced Driver Assistance Systems Market benefits from developments in real-time image processing and machine learning. These technologies improve hazard detection accuracy under various road conditions. Suppliers invest heavily in compact sensor modules to support vehicle design flexibility. Integration with AI-enabled software ensures faster decision-making and smoother automation. Collaboration between semiconductor companies and automotive OEMs continues to drive performance gains. It helps create scalable, energy-efficient systems suited for diverse vehicle architectures.

- For instance, Bosch introduced its SX600 and SX601 radar SoCs in 2025, developed using 22 nm RF-CMOS technology and a digital phase-locked loop, offering a 30% improvement in sensing range and enhanced object detection under challenging weather conditions to support advanced ADAS functions such as adaptive cruise control and lane change assist.

Expansion of Electric and Connected Vehicle Ecosystem

Italy’s growing electric mobility network supports broader integration of ADAS technologies. Electric vehicles rely on advanced control systems, making them ideal for automation features. The rollout of connected vehicle infrastructure enables continuous software updates and enhanced situational awareness. OEMs use over-the-air (OTA) technology to update ADAS algorithms and improve functionality. Government plans promoting e-mobility align with safer, smarter vehicle ecosystems. Fleet operators and logistics providers adopt ADAS to reduce downtime and accident-related costs. It supports the transition toward intelligent transportation systems with improved driver assistance reliability.

Market Trends

Shift Toward Semi-Autonomous Driving Capabilities

The Italy Advanced Driver Assistance Systems Market is moving toward higher levels of automation, where vehicles can perform partial driving tasks independently. The demand for semi-autonomous driving features grows with consumer trust in ADAS technology. Manufacturers integrate multi-sensor fusion systems that combine radar, LiDAR, and cameras for superior situational awareness. Enhanced computing power enables smoother decision-making during lane changes or traffic congestion. Automakers also test advanced driver monitoring systems to maintain user engagement. Regulatory bodies are preparing for autonomous certification frameworks, pushing further innovation. It creates a foundation for the next generation of smart mobility.

- For instance, Stellantis launched a pilot project for Level 4 robotaxi technology in partnership with Pony.ai in October 2025, upgrading its AV-Ready Platform to support fully hands-off, eyes-off autonomous driving via advanced sensor suites and system redundancies; the collaboration includes real-world test deployment in Europe.

Increasing Use of Artificial Intelligence in ADAS Algorithms

Artificial intelligence plays a growing role in optimizing ADAS decision-making. AI models analyze large volumes of real-world driving data to improve prediction accuracy. Automakers and technology firms train systems to detect and classify road hazards with high precision. This trend enhances pedestrian and cyclist recognition, supporting safer city driving. It also improves adaptive cruise control by learning individual driving styles. AI integration reduces false alerts and increases driver confidence. The Italy Advanced Driver Assistance Systems Market continues investing in AI-driven control units for faster and smarter reactions. It positions Italy as a participant in Europe’s autonomous vehicle advancements.

Adoption of High-Definition Mapping and V2X Communication

Advanced navigation systems now integrate high-definition mapping to support ADAS functions like traffic jam assist and intelligent parking. Vehicle-to-everything (V2X) communication enables cars to exchange data with nearby infrastructure and vehicles. It improves response times to hazards and reduces congestion. Italian automotive suppliers partner with European telecom providers to expand 5G-based V2X testing. Integration of map-based ADAS supports smoother highway merging and route optimization. The technology also helps in enhancing driver comfort during long-distance travel. It represents a key enabler of connected, cooperative mobility systems in Italy’s transport network.

Increased Emphasis on In-Vehicle User Experience and Interface Design

Automakers focus on simplifying ADAS interfaces to reduce driver distraction. Touchscreen dashboards and voice-controlled systems present alerts and guidance more intuitively. Italian consumers value systems that balance automation with manual control flexibility. Advanced display clusters now integrate real-time sensor data in dynamic visual formats. Enhanced human–machine interfaces promote better driver understanding of ADAS actions. The Italy Advanced Driver Assistance Systems Market benefits from these user-focused design upgrades that encourage adoption. It fosters consumer trust and comfort with automation features while supporting safer driving habits.

- For instance, Lamborghini’s Huracán features a 12.3-inch TFT digital display cluster that delivers dynamic navigation and ADAS information in real time, exemplifying user-focused interface design in Italian vehicles and supporting safer, more intuitive in-cabin experiences.

Market Challenges Analysis

High Cost of Advanced Sensors and Integration Complexity

The Italy Advanced Driver Assistance Systems Market faces cost barriers that limit mass adoption. High-end radar, LiDAR, and infrared sensors raise vehicle prices significantly. Smaller OEMs struggle to balance performance with affordability in entry-level models. Integration of multi-sensor networks requires precise calibration and complex software alignment. Limited availability of skilled technicians adds to deployment delays. Supply chain disruptions in semiconductor components also raise production costs. The cost issue affects aftermarket adoption, where customers hesitate to retrofit systems. It continues to challenge market scalability in cost-sensitive vehicle categories.

Lack of Infrastructure and Consumer Awareness for Autonomous Features

Limited infrastructure readiness restricts ADAS performance across Italian cities and highways. Poor lane markings, inconsistent road signage, and outdated traffic systems hinder camera and radar detection. Consumers remain skeptical about automation reliability in complex urban environments. Lack of awareness about ADAS functions often leads to misuse or underutilization. Training initiatives for drivers and service centers are insufficient to support technology understanding. Insurers also show limited alignment with ADAS-based premium adjustments. The Italy Advanced Driver Assistance Systems Market must address these challenges to ensure broader acceptance and operational efficiency.

Market Opportunities

Rising Government Support for Smart Mobility and Digital Infrastructure

Government initiatives promoting smart mobility open major growth avenues for the Italy Advanced Driver Assistance Systems Market. Investment in digital traffic management systems and intelligent transport networks improves ADAS compatibility. The European Union’s mobility strategy encourages harmonized standards for connected and automated driving. Partnerships between technology providers and infrastructure authorities enhance cross-border data sharing. Municipal authorities in cities like Milan and Turin implement pilot programs for automated transport. It supports the gradual scaling of semi-autonomous and cooperative driving ecosystems across Italy.

Expansion of Aftermarket and Retrofit ADAS Solutions

The aftermarket sector offers strong opportunities for system retrofitting across older vehicle models. Italian consumers increasingly demand safety upgrades compatible with existing cars. Local installers collaborate with technology suppliers to deliver cost-efficient radar and camera modules. Fleet operators view retrofitting as a strategic move to reduce accident risks. Growing demand for modular kits simplifies installation and broadens market access. It drives a new revenue channel for suppliers seeking volume expansion beyond OEM contracts.

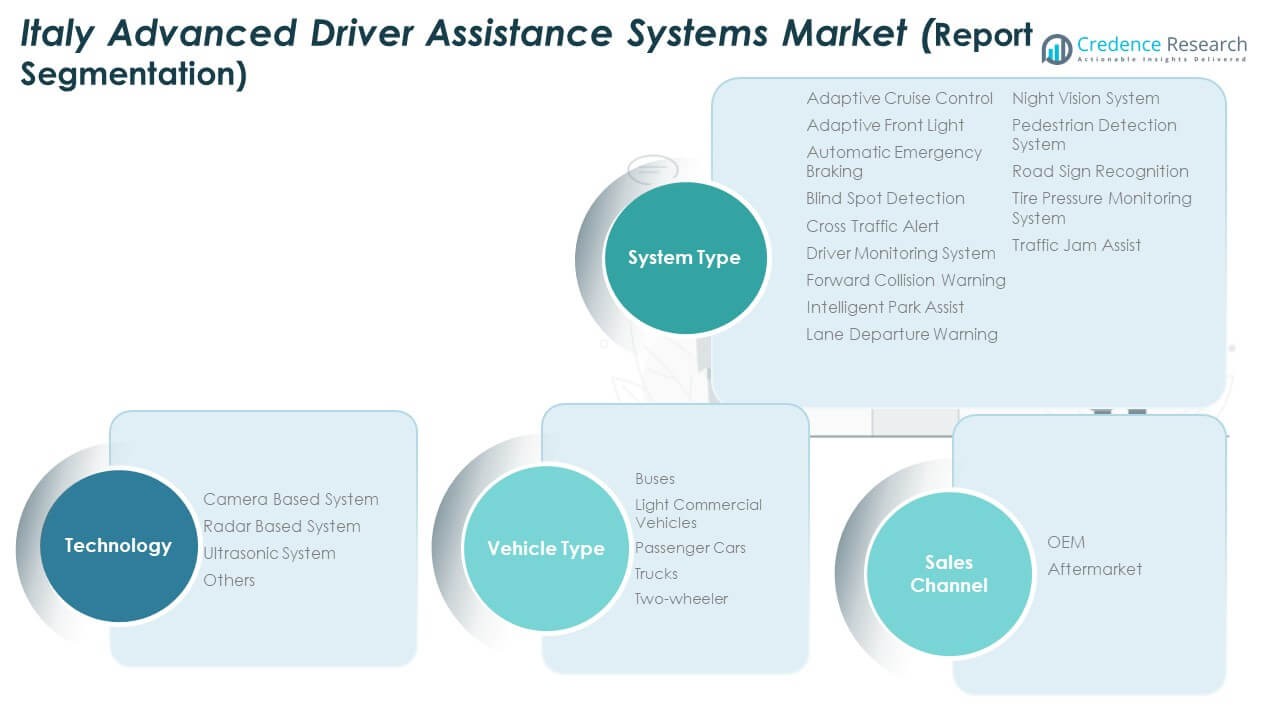

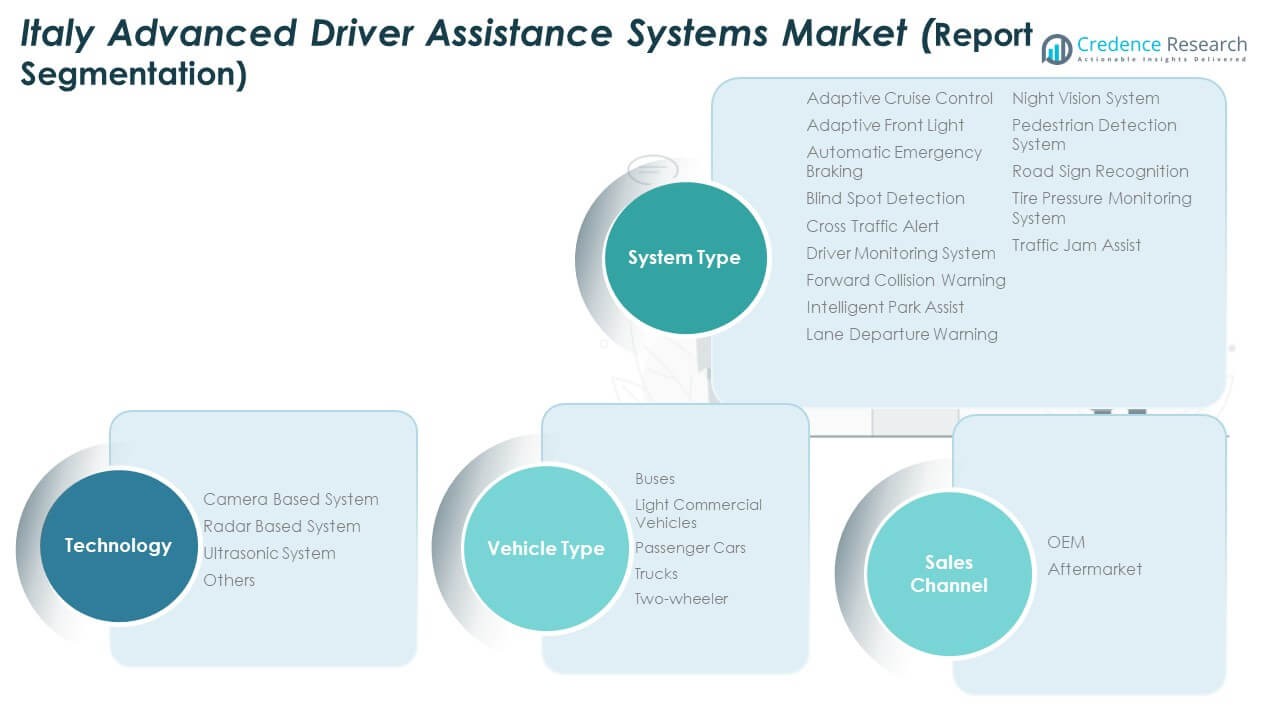

Market Segmentation Analysis

By System Type

Adaptive cruise control, lane departure warning, and automatic emergency braking lead adoption among system types. These systems deliver measurable safety benefits and align with EU regulations. Blind spot detection and driver monitoring systems show rising demand due to urban congestion. Intelligent park assist and night vision systems gain traction in premium vehicle categories. Pedestrian detection and road sign recognition strengthen safety standards in smart city zones. The Italy Advanced Driver Assistance Systems Market benefits from increased adoption of multi-functional ADAS suites. It highlights how safety compliance and driving comfort drive segmentation growth.

By Technology

Radar-based systems dominate the market due to their reliability in adverse weather. Camera-based systems follow closely, offering strong visual detection for lane and pedestrian recognition. Ultrasonic systems find use in close-range applications like parking assistance. Hybrid configurations that combine radar and camera systems improve detection precision. It supports flexible adoption across passenger and commercial vehicles. Software updates enhance performance through AI-driven interpretation of road conditions. The Italy Advanced Driver Assistance Systems Market continues advancing through technological diversification and integration efficiency.

- For instance, Bosch’s 77 GHz long-range radar sensors operate within the 76–81 GHz band and detect objects up to 530 meters ahead, supporting adaptive cruise control and automatic emergency braking functions in production vehicles, as confirmed by Bosch technical specifications.

By Vehicle Type

Passenger cars represent the largest segment with ADAS integration becoming standard in newer models. Light commercial vehicles adopt ADAS to improve driver safety and reduce operational risks. Trucks and buses integrate collision avoidance and fatigue monitoring systems to support logistics safety. Two-wheelers show early-stage integration of adaptive braking and alert systems. The trend highlights growing interest in comprehensive mobility safety. It supports Italy’s national goals for accident reduction and intelligent transport. The Italy Advanced Driver Assistance Systems Market shows balanced growth across multiple mobility classes.

- For instance, Euro NCAP’s 2024 evaluation of the Iveco Daily highlights its standard Lane Support System, which provides corrective steering during lane drift and stronger intervention when needed, earning a “good” performance rating for ADAS effectiveness in light commercial vehicles.

By Sales Channel

OEMs lead in ADAS deployment through factory-installed solutions that meet Euro NCAP criteria. Automakers invest in technology partnerships to enhance reliability and integration quality. The aftermarket segment expands rapidly, offering cost-effective installation options. Local service providers develop calibration tools for retrofitting radar and camera modules. Demand for sensor replacement and maintenance services supports recurring business. It widens accessibility of ADAS technology among older vehicle owners. The Italy Advanced Driver Assistance Systems Market benefits from dual-channel growth driven by OEM innovation and aftermarket expansion.

Segmentation

By System Type

- Adaptive Cruise Control

- Adaptive Front Light

- Automatic Emergency Braking

- Blind Spot Detection

- Cross Traffic Alert

- Driver Monitoring System

- Forward Collision Warning

- Intelligent Park Assist

- Lane Departure Warning

- Night Vision System

- Pedestrian Detection System

- Road Sign Recognition

- Tire Pressure Monitoring System

- Traffic Jam Assist

By Technology

- Camera-Based System

- Radar-Based System

- Ultrasonic System

- Others

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Trucks

- Buses

- Two-Wheeler

By Sales Channel

- OEM (Original Equipment Manufacturer)

- Aftermarket

Regional Analysis

Northern Italy – Industrial Core and Innovation Hub (45% Market Share)

Northern Italy dominates the Italy Advanced Driver Assistance Systems Market with a 45% market share. Lombardy, Piedmont, and Emilia-Romagna serve as the country’s automotive and manufacturing epicenters. These regions host major OEMs, component manufacturers, and technology firms focused on ADAS integration and testing. High production capacity and the presence of R&D centers enable rapid deployment of safety and automation technologies. Government-backed industrial policies and access to skilled engineering talent further strengthen their leadership. It benefits from advanced infrastructure and cross-border supply chain networks that link to Central Europe. Northern Italy continues to anchor the country’s innovation in vehicle automation and mobility solutions.

Central Italy – Growing Automotive Ecosystem and Software Integration (30% Market Share)

Central Italy accounts for 30% of the Italy Advanced Driver Assistance Systems Market and is recognized for its evolving automotive software and component ecosystem. Regions such as Tuscany and Lazio are becoming hubs for embedded electronics, ADAS calibration centers, and data analytics solutions. Strong university–industry collaboration fosters development of driver monitoring and perception technologies. Software engineering capabilities are improving integration between ADAS modules and vehicle control systems. Medium-sized suppliers collaborate with global Tier 1 firms to develop radar and vision-based components. Government incentives for smart city development and digital innovation encourage further growth. It leverages its geographic advantage to connect innovation from the north with expanding markets in the south.

Southern Italy – Emerging Market with Expanding Manufacturing Capabilities (25% Market Share)

Southern Italy holds 25% of the market and is emerging as a new hub for ADAS assembly and testing facilities. Regions including Campania, Apulia, and Sicily are experiencing growth driven by regional development programs. The establishment of new automotive clusters supports sensor production and supply chain diversification. Public–private partnerships focus on infrastructure modernization to support ADAS-equipped fleets. Increasing consumer demand for connected vehicles and EVs accelerates technology adoption in the region. It benefits from logistics accessibility through key ports and highway connectivity. Southern Italy’s transformation from a low-tech base to a growing automation center strengthens national ADAS integration efforts.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Italy Advanced Driver Assistance Systems Market features a strong competitive landscape dominated by multinational and domestic players. Global firms such as Bosch, Continental, DENSO, and ZF Friedrichshafen lead with robust portfolios in radar, camera, and LiDAR-based systems. European suppliers including Valeo, Mobileye, and Hella expand local partnerships with Italian OEMs to develop tailored ADAS modules. Domestic innovators like Kopernikus Automotive and regional software firms contribute advanced sensor fusion and AI-based control systems. Continuous R&D in perception algorithms, edge computing, and safety software enhances product differentiation. Companies prioritize mergers, alliances, and technology licensing to improve regional presence. It remains highly competitive with increasing emphasis on cost optimization, system miniaturization, and compliance with Euro NCAP safety standards, positioning Italy as a key player in Europe’s automotive safety innovation landscape.

Recent Developments

- In October 2025, AVL Italia initiated a partnership focused on the industrialization of the “Driving Coach” system. This solution, tailored specifically for the Italian market, is designed to enhance road safety and driver performance by leveraging advanced ADAS functions and real-time feedback technology.

- In September 2025, Valeo, a global leader in ADAS, announced a strategic partnership with Momenta, an autonomous driving technology company. This partnership aims to jointly develop advanced mid- to high-level Intelligent Assisted Driving and Autonomous Driving products, systems, and solutions, targeting both the Chinese and international markets, with tangible effects in Europe including Italy.

- In April 2024, Mobileye introduced its EyeQ6 Lite system-on-chip hardware and software to customers, enabling new generation ADAS functions in vehicles launching from 2024 onward. The EyeQ6 family, already committed for installation in tens of millions of vehicles regionally, is expected to power advanced features in new models entering the Italian market over the next several years.

Report Coverage

The research report offers an in-depth analysis based on System Type, Technology, Vehicle Type and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increasing integration of semi-autonomous driving technologies will expand adoption across premium and mid-range vehicles.

- Rising government regulations on vehicle safety standards will accelerate OEM investments in ADAS features.

- AI-based perception and decision-making systems will enhance detection accuracy and reduce system errors.

- Electric and connected vehicles will create higher demand for sensor-rich ADAS architectures.

- Partnerships between technology providers and automakers will drive software-defined vehicle development.

- Continuous innovation in radar and camera modules will improve reliability under complex driving conditions.

- Aftermarket expansion will make ADAS retrofitting more accessible for existing vehicle fleets.

- Growth of 5G-enabled V2X infrastructure will enable advanced cooperative driving and traffic management.

- Local production and calibration facilities will strengthen Italy’s position in the European ADAS supply chain.

- Increasing consumer preference for safety and comfort will sustain steady long-term growth in the market.