Market Overview:

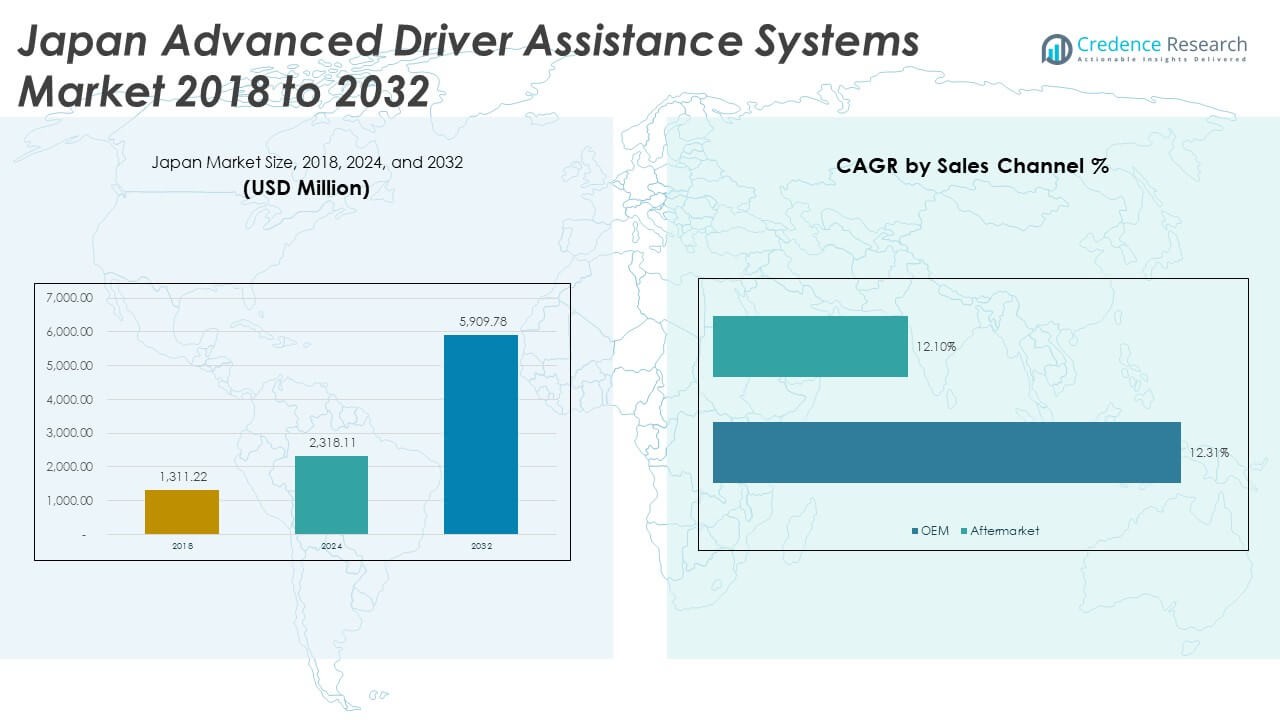

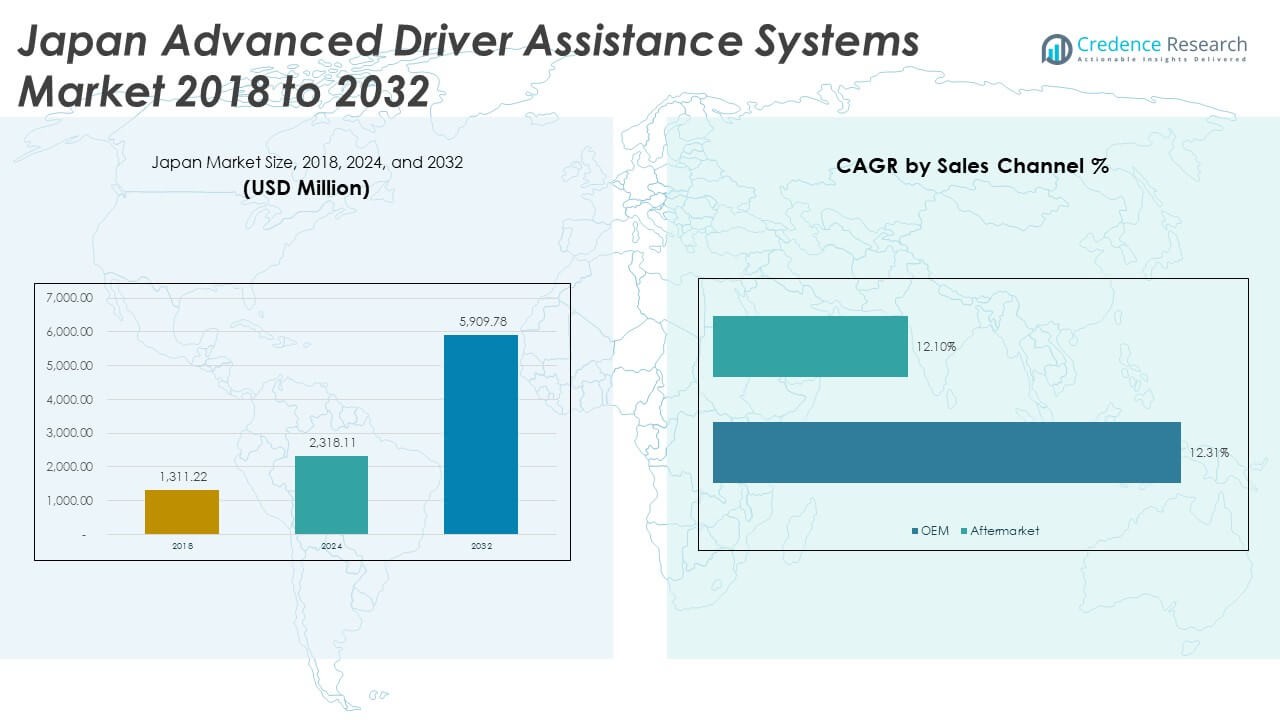

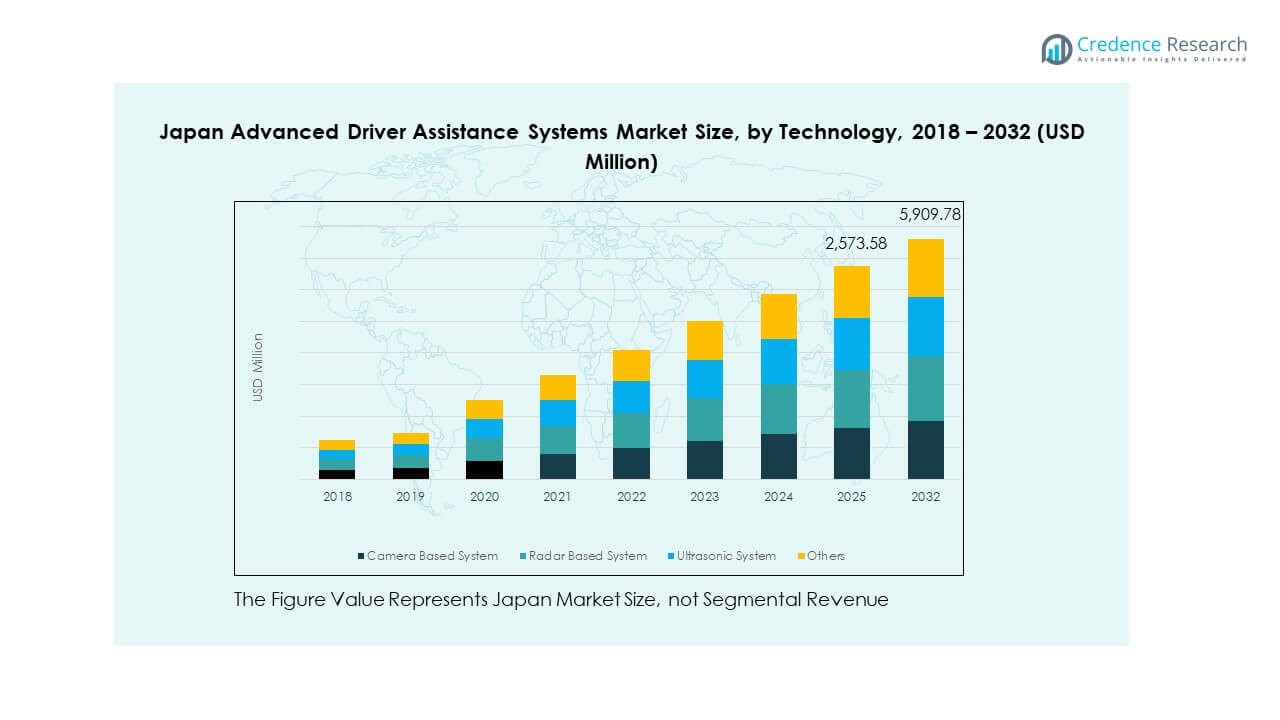

The Japan Advanced Driver Assistance Systems Market size was valued at USD 1,311.22 million in 2018, reaching USD 2,318.11 million in 2024, and is anticipated to reach USD 5,909.78 million by 2032, growing at a CAGR of 12.41% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Advanced Driver Assistance Systems Market Size 2024 |

USD 2,318.11 Million |

| Japan Advanced Driver Assistance Systems Market, CAGR |

12.41% |

| Japan Advanced Driver Assistance Systems Market Size 2032 |

USD 5,909.78 Million |

Japan’s market expansion is driven by strong regulatory support, consumer demand for safety, and the rapid integration of advanced sensing technologies. Automakers like Toyota, Nissan, and Honda are embedding adaptive cruise control, automatic emergency braking, and lane-keeping assist systems in both premium and mid-range models. The government’s focus on traffic accident reduction through ADAS incentives encourages automakers to accelerate technology deployment. Increasing urbanization and the growing number of electric and autonomous vehicles further strengthen the demand for intelligent driver-assistance features.

The Kanto region remains the leading hub for ADAS production and deployment due to its concentration of top automotive and electronics manufacturers. Kansai and Chubu regions are emerging as significant contributors, supported by their semiconductor and sensor manufacturing bases. It benefits from advanced testing infrastructure, smart city projects, and collaborative R&D initiatives between government and private sectors. The ongoing evolution toward autonomous mobility ensures that Japan stays at the forefront of ADAS innovation across Asia-Pacific markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Japan Advanced Driver Assistance Systems Market was valued at USD 1,311.22 million in 2018, reached USD 2,318.11 million in 2024, and is projected to reach USD 5,909.78 million by 2032, expanding at a CAGR of 12.41% during the forecast period.

- The Kanto region leads with 39% share, driven by Tokyo’s concentration of automakers and R&D facilities. Kansai follows with 27%, supported by semiconductor production, while Chubu and Kyushu hold 34% combined due to strong automotive and electronics clusters.

- The Kyushu region is the fastest-growing, supported by electric vehicle manufacturing expansion and government-backed smart mobility initiatives that encourage ADAS deployment in commercial fleets.

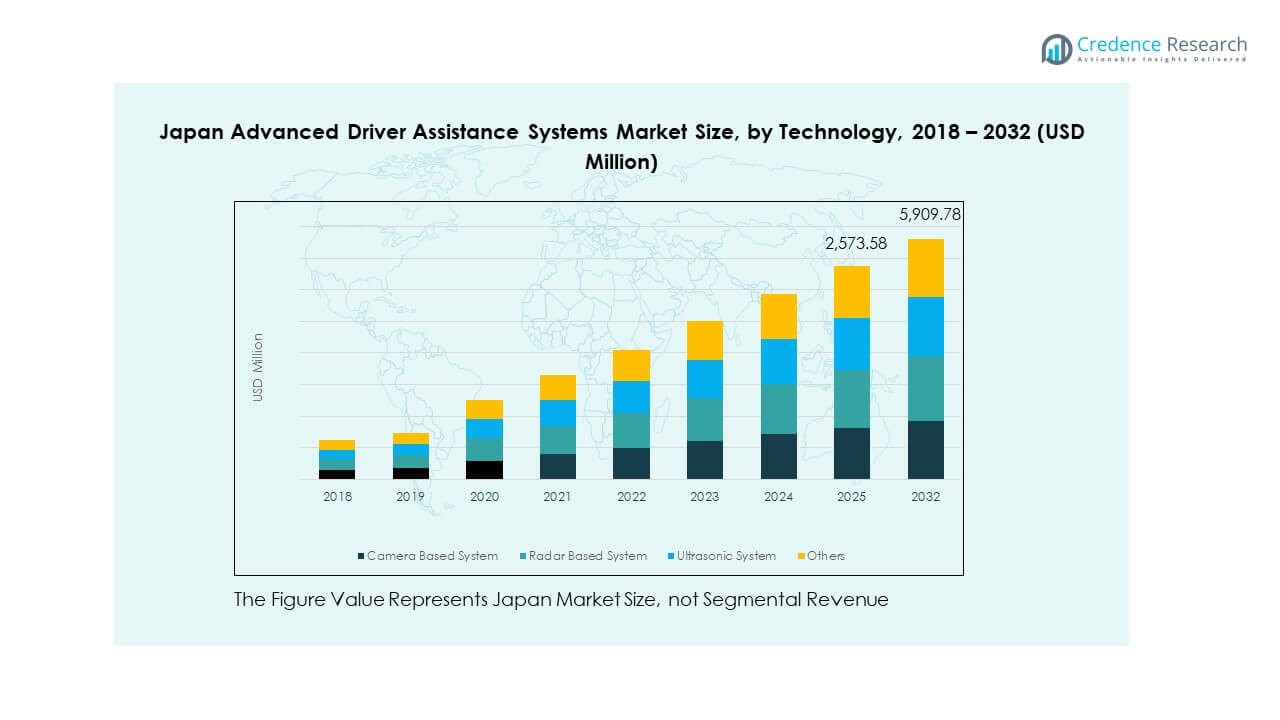

- Based on technology segmentation, camera-based systems account for roughly 37% share, supported by growing adoption in passenger vehicles for lane and pedestrian detection.

- Radar-based systems represent around 33% share, gaining traction for adaptive cruise control and collision-avoidance features across both luxury and mid-range models.

Market Drivers

Growing Government Mandates on Vehicle Safety Standards and Regulations

The Japan Advanced Driver Assistance Systems Market experiences strong growth due to strict safety regulations by the Japanese government. Authorities encourage automakers to equip vehicles with essential ADAS features such as lane departure warning and automatic emergency braking. The Ministry of Land, Infrastructure, Transport, and Tourism promotes safety initiatives aligning with global standards. It supports vehicle testing frameworks to ensure ADAS reliability. These policies drive innovation and adoption among domestic carmakers. Consumers increasingly value vehicles offering enhanced protection. The regulation-led environment ensures consistent technology integration. This creates a reliable growth base for Japan’s ADAS industry.

- For instance, Toyota confirmed that Toyota Safety Sense is installed in about 90% of its new passenger vehicles across Japan, North America, and Europe. The suite includes pre-collision systems and lane departure alerts compliant with MLIT safety standards, as verified through Toyota’s 2024 technical releases.

Rising Consumer Awareness Toward Accident Prevention and Road Safety

Growing public concern over traffic fatalities fuels adoption of safety technologies. Japanese drivers prefer advanced vehicles that minimize human errors. Automakers respond with intelligent systems that improve reaction time and driving comfort. It helps reduce fatigue-related accidents, particularly in congested urban regions. Insurance firms also promote ADAS-enabled cars through lower premiums. This trend strengthens the demand for advanced sensors and monitoring systems. Public campaigns emphasize the benefits of ADAS adoption. The combined effect of awareness and incentives fosters continuous market expansion.

- For instance, the Japan Automobile Manufacturers Association (JAMA) reports that human error contributes to nearly 90% of traffic accidents in Japan, underscoring the nation’s push toward advanced ADAS integration. This statistic is consistently referenced in JAMA’s traffic safety reports and industry publications.

Accelerated Adoption of Electric and Autonomous Vehicles Supporting ADAS Integration

Japan’s rapid shift toward electric and autonomous vehicles boosts ADAS deployment. EV manufacturers embed driver-assistance features to enhance navigation and safety. It allows smoother human-machine interaction during semi-autonomous driving. Companies integrate radar, cameras, and ultrasonic sensors for precision. Leading automakers invest in Level 2 and Level 3 autonomous capabilities. The transition supports multi-modal ADAS development across vehicle categories. The convergence of automation and electrification strengthens system efficiency. This synergy reinforces the country’s leadership in next-generation vehicle technology.

Technological Advancements in Sensor Fusion and Real-Time Data Processing Capabilities

Continuous R&D in sensor fusion improves ADAS performance in complex traffic conditions. Japanese firms focus on combining radar, LiDAR, and vision-based systems for accuracy. It ensures consistent obstacle detection and situational awareness. AI algorithms enable predictive decision-making and adaptive response. Manufacturers like Denso and Hitachi develop compact, low-latency modules for real-time analysis. This enhances object tracking, even in adverse weather. The integration of 5G networks further refines responsiveness. The technology-driven evolution maintains Japan’s competitive edge in ADAS innovation.

Market Trends

Expansion of Level 2 and Level 3 Semi-Autonomous Driving Capabilities

The Japan Advanced Driver Assistance Systems Market witnesses growth through expanding semi-autonomous features. Automakers are embedding Level 2 and Level 3 functionalities into premium and mid-range models. It allows partial automation for highway driving and congestion management. Brands such as Toyota and Nissan develop proprietary autopilot systems for urban use. Software updates are becoming crucial for system upgrades. The increased trust in autonomous technology accelerates adoption. Consumers value the combination of safety and convenience. This evolution marks a key step toward fully autonomous mobility.

- For instance, Toyota’s Teammate Advanced Drive system, available in the Lexus LS 500h and Mirai, delivers SAE Level 2 automated steering, acceleration, and braking on highways. It enhances comfort and safety by supporting vehicle control over extended distances.

Integration of AI and Machine Learning for Adaptive Decision-Making

AI and machine learning significantly enhance ADAS functions in Japanese vehicles. Systems now analyze driver habits and adjust control parameters accordingly. It supports proactive risk detection and dynamic route optimization. Automakers employ deep learning for continuous system improvement. Predictive algorithms identify hazards before driver reaction time. Such precision improves both passenger safety and driving comfort. The collaboration between AI firms and automotive giants expands innovation potential. This integration strengthens Japan’s position in intelligent mobility ecosystems.

- For instance, Honda’s SENSING Elite with Traffic Jam Pilot uses 3D high-definition maps, GNSS, and sensor fusion to control acceleration, braking, and steering in congested expressway conditions. Honda validated system performance through over 10 million simulations and 1.3 million kilometers of test driving to ensure reliability.

Increased Adoption of High-Performance Sensors and Compact Modules

High-precision sensors and compact modules dominate Japan’s ADAS component market. Manufacturers focus on miniaturized radars and cameras with higher resolution. It helps vehicles detect pedestrians and objects across varying distances. Suppliers like Panasonic and Murata enhance sensor durability for all-weather use. The integration of MEMS technology supports cost-effective production. Continuous improvements in thermal resistance and energy efficiency drive demand. The growing sophistication of sensors enhances overall ADAS accuracy. This trend defines Japan’s shift toward reliable, high-performance driver-assistance systems.

Connected Vehicle Ecosystem and Data-Sharing Infrastructure Development

Connectivity advancements strengthen the foundation for collaborative driving systems. Automakers and telecom operators work to synchronize vehicles with smart traffic grids. It enables real-time communication between vehicles and infrastructure. Japan’s 5G rollout supports faster data exchange and decision processing. The integration improves predictive navigation and situational awareness. It reduces congestion and enhances driver confidence in automated systems. The ecosystem supports cloud-based updates for ADAS software. This transformation reinforces the nation’s transition toward intelligent transportation networks.

Market Challenges Analysis

High Production Cost and Complex Integration Across Vehicle Platforms

The Japan Advanced Driver Assistance Systems Market faces cost pressures due to intricate sensor and software requirements. Developing and calibrating systems like radar and LiDAR increases production expenses. It affects affordability in compact vehicle categories. Manufacturers struggle to balance cost and safety standards. Integration with legacy vehicle architectures poses engineering hurdles. Automakers need specialized calibration tools and advanced testing environments. Smaller suppliers face difficulties adapting to evolving technology frameworks. The high investment requirement slows penetration across budget vehicle segments.

Regulatory Compliance, Data Privacy Concerns, and System Reliability Issues

Regulatory alignment across international markets remains challenging for Japanese producers. ADAS functions must comply with domestic safety codes and global certification standards. It creates delays in large-scale rollout. Data protection laws complicate vehicle-to-infrastructure communication. Privacy concerns limit the use of cloud-based analytics. System malfunctions or sensor misreads during adverse weather impact consumer trust. Ensuring software reliability through frequent updates adds operational burden. It also raises liability concerns for both automakers and component suppliers. These challenges demand consistent innovation and regulatory clarity.

Market Opportunities

Expansion of Smart Mobility Ecosystem Through Strategic Collaborations and R&D Investments

Growing partnerships between automakers, tech firms, and government bodies enhance innovation potential. The Japan Advanced Driver Assistance Systems Market benefits from investments in 5G, edge computing, and AI-based platforms. It enables the development of intelligent traffic management and cooperative driving features. Companies collaborate on shared databases for safety improvement. The integration of smart city initiatives creates long-term ADAS growth prospects. Expanding test zones and innovation hubs accelerates technology validation. These initiatives prepare Japan for next-generation autonomous mobility.

Emergence of Aftermarket and Export Potential in Regional Automotive Networks

Rising demand for retrofitted ADAS kits opens opportunities for aftermarket suppliers. Japanese firms expand exports to Southeast Asia and Europe, supported by reliability reputation. It helps address growing regional safety demands. The domestic market’s technical expertise supports cost-efficient module production. Collaboration with local distributors accelerates aftermarket penetration. Export diversification enhances revenue resilience for component manufacturers. The strong logistics network aids timely global supply. These opportunities sustain Japan’s leadership in safety and automation technologies.

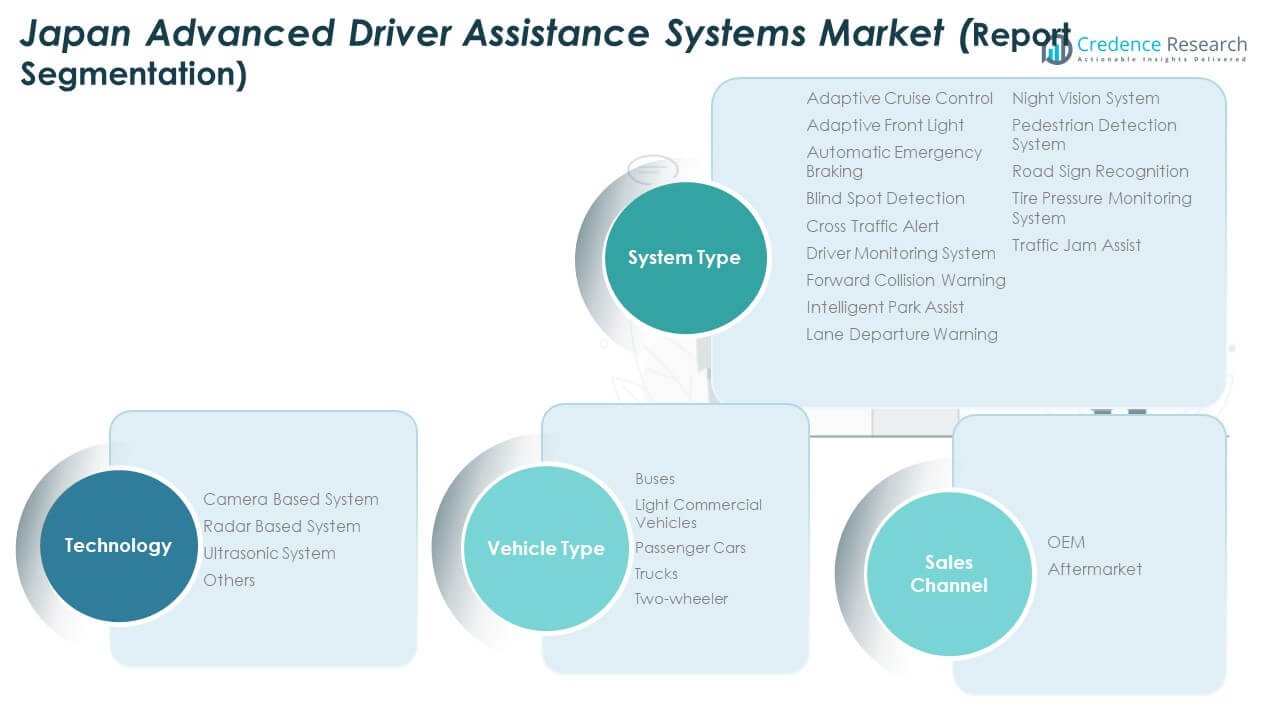

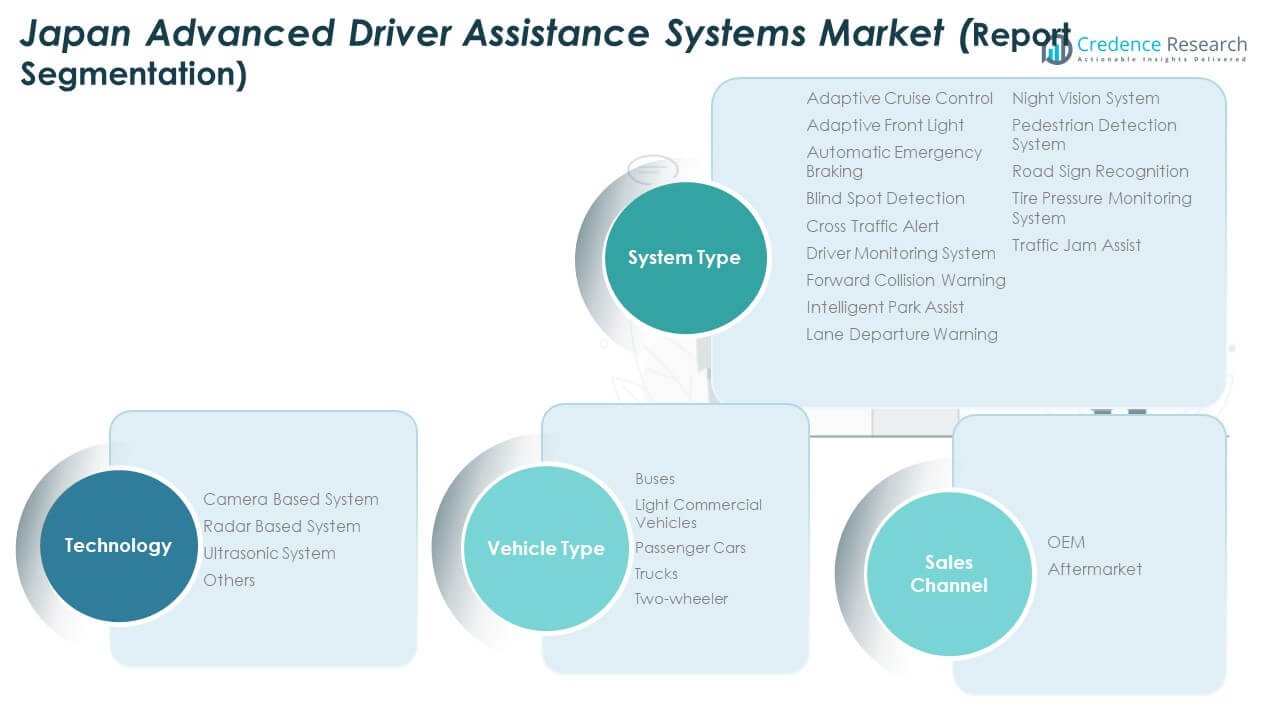

Market Segmentation Analysis

By System Type

The Japan Advanced Driver Assistance Systems Market includes adaptive cruise control, lane departure warning, and automatic emergency braking as key systems. These dominate due to their proven role in collision prevention and compliance with safety mandates. Advanced categories such as pedestrian detection, traffic jam assist, and driver monitoring systems gain traction in urban mobility. Integration of intelligent park assist and road sign recognition improves user convenience. Automakers focus on balancing automation and human control for optimal performance.

- For instance, Mazda’s latest CX-70 model features advanced Cruising & Traffic Support (CTS) with Unresponsive Driver Support, capable of calibrating as quickly as two minutes after starting, with camera monitoring and emergency response capabilities.

By Technology

Camera-based systems hold significant demand due to their affordability and versatility. Radar-based systems lead in performance-critical environments such as highways. It supports detection of multiple moving objects under varied visibility conditions. Ultrasonic systems enhance low-speed maneuvering and parking operations. Emerging hybrid models combine multiple technologies for redundancy. Japanese OEMs invest in sensor fusion to enhance accuracy. This balance between cost and capability drives widespread adoption.

- For instance, Nissan announced a collaboration with UK-based Wayve in September 2025 to develop next-generation autonomous driving technology. The partnership focuses on integrating Wayve’s AI Driver software into Nissan’s future ProPILOT systems, which have undergone successful urban testing in Tokyo to enhance safe and intelligent navigation.

By Vehicle Type

Passenger cars dominate due to their large production volume and premium safety demand. Light commercial vehicles follow as fleet operators prioritize operational safety. Trucks and buses adopt ADAS to reduce driver fatigue during long-distance operations. It enhances logistics efficiency and reduces accident frequency. Two-wheelers gradually integrate collision alerts and blind spot systems. The trend expands ADAS coverage across vehicle classes. Japan’s automotive diversity supports steady cross-segment adoption.

By Sales Channel

OEM installations remain the primary distribution channel for ADAS features in Japan. Automakers integrate advanced systems at factory level to meet regulation and consumer demand. The aftermarket segment grows with retrofitted modules for older models. It provides cost-effective safety upgrades for small operators. Increasing digital retailing supports aftermarket expansion. OEM partnerships with tech suppliers ensure continuous software updates. This structure sustains consistent system performance across vehicle lifecycles.

Segmentation

By System Type

- Adaptive Cruise Control

- Adaptive Front Light

- Automatic Emergency Braking

- Blind Spot Detection

- Cross Traffic Alert

- Driver Monitoring System

- Forward Collision Warning

- Intelligent Park Assist

- Lane Departure Warning

- Night Vision System

- Pedestrian Detection System

- Road Sign Recognition

- Tire Pressure Monitoring System

- Traffic Jam Assist

By Technology

- Camera-Based System

- Radar-Based System

- Ultrasonic System

- Others

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Trucks

- Buses

- Two-Wheeler

By Sales Channel

- OEM (Original Equipment Manufacturer)

- Aftermarket

Regional Analysis

Kanto Region

The Kanto region holds the largest share of the Japan Advanced Driver Assistance Systems Market with 39% in 2024. The area, including Tokyo and Yokohama, benefits from advanced infrastructure and high consumer adoption of premium vehicles. Automakers such as Nissan and Honda maintain strong manufacturing and R&D presence, supporting early integration of Level 2 and Level 3 systems. The concentration of technology companies and testing facilities drives continuous innovation. It benefits from public-private partnerships for smart city development and connected vehicle testing. The growing fleet of electric and hybrid vehicles further supports ADAS adoption across passenger and commercial categories.

Kansai Region

The Kansai region accounts for 27% of the market share and serves as a major automotive component production hub. Osaka and Kyoto host several sensor and semiconductor manufacturers that supply critical ADAS components such as radar and camera modules. It demonstrates growing investments in research clusters focusing on AI-assisted driving and human-machine interfaces. Regional universities collaborate with OEMs to enhance perception algorithms and control systems. High vehicle density in urban areas accelerates adoption of collision-avoidance and parking-assist features. The Kansai region’s balanced mix of industrial expertise and urban deployment ensures strong future growth for ADAS solutions.

Chubu and Kyushu Regions

The Chubu and Kyushu regions collectively hold 34% of the market share, with Nagoya serving as a major automotive production center. Toyota’s innovation ecosystem drives early adoption of adaptive cruise control, blind spot monitoring, and automatic emergency braking. Kyushu’s expanding EV and electronics clusters enhance supply chain resilience for ADAS manufacturing. It benefits from government-supported pilot projects in connected mobility and autonomous public transport. Rising logistics activity in industrial zones increases demand for ADAS-equipped commercial vehicles. Strong collaboration between automotive and electronics firms keeps these regions competitive in Japan’s evolving safety technology landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hitachi Automotive Systems

- Robert Bosch GmbH

- Continental AG

- DENSO Corporation

- JLR Corporate

- ZF Friedrichshafen AG

- Kopernikus Automotive

- Valeo SA

- Mobileye

- Fujitsu Ten

- Safety Tech

- Other Key Players

Competitive Analysis

The Japan Advanced Driver Assistance Systems Market is dominated by global and domestic players focusing on innovation and integration. DENSO Corporation, Hitachi Automotive Systems, and Robert Bosch GmbH lead with advanced radar and camera solutions tailored for Japanese driving environments. Continental AG and ZF Friedrichshafen AG emphasize scalable software architectures compatible with multiple vehicle platforms. It shows intensified competition in perception systems and control algorithms supporting higher automation levels. Valeo SA and Mobileye expand partnerships with local OEMs to enhance vision-based safety features. Fujitsu Ten and Safety Tech focus on low-cost, high-efficiency solutions for compact vehicles. Continuous R&D and partnerships with AI and telecom firms strengthen Japan’s position as a global leader in ADAS technology.

Recent Developments

- In September 2025, Valeo SA entered into a strategic global partnership with Momenta, a leading autonomous driving technology firm. Together, they will co-develop advanced intelligent assisted driving and autonomous systems, combining their strengths to deliver full-lifecycle support and accelerate the deployment of ADAS for automakers worldwide.

- In July 2025, Microchip Technology announced a partnership with Nippon Chemi-Con Corporation and NetVision Co. Ltd. to launch the first Automotive Serdes Alliance Motion Link (ASA-ML) camera development platform specifically for the Japanese automotive market.

- In June 2025, ZF announced further strengthening of its ADAS capabilities, focusing on turnkey solutions including smart cameras and software for both standalone and integrated driving functions. Their approach leverages AI-based validation tools to accelerate development cycles and support flexible software-defined vehicle architectures.

Report Coverage

The research report offers an in-depth analysis based on System Type, Technology, Vehicle Type and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Government mandates on safety technology will continue to strengthen ADAS adoption across all vehicle classes.

- Integration of AI and sensor fusion will enhance decision accuracy and response times in real driving conditions.

- Growing collaboration between automotive, electronics, and telecom sectors will accelerate connected vehicle development.

- Expansion of 5G infrastructure will enable faster data exchange, improving real-time system performance.

- Demand for electric and hybrid vehicles will increase the use of adaptive cruise and lane-keeping systems.

- Advances in vision-based algorithms will support improved pedestrian detection and traffic sign recognition.

- Aftermarket upgrades for older vehicles will emerge as a new revenue stream for domestic suppliers.

- Investments in R&D will focus on miniaturized, cost-efficient modules to improve affordability.

- Rising cross-border exports of Japanese ADAS technologies will expand the country’s global market footprint.

- Continuous consumer awareness campaigns will sustain demand for safer and semi-autonomous driving solutions.