Market Overview

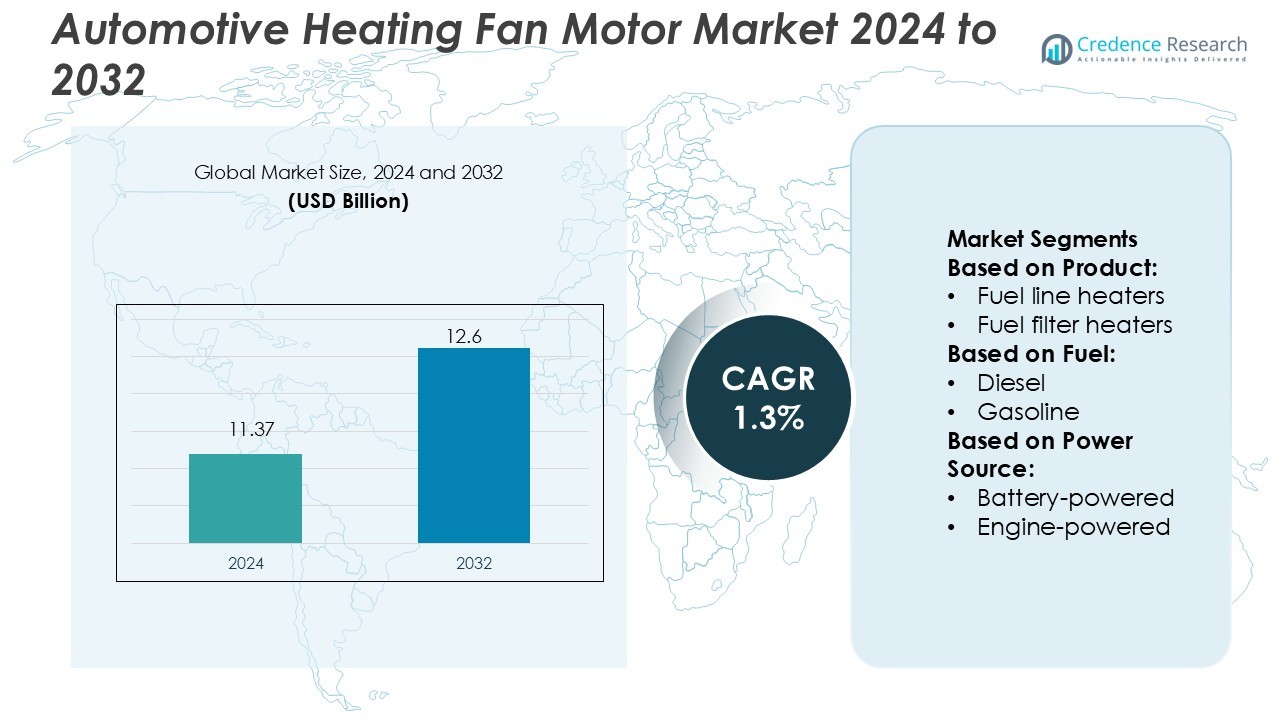

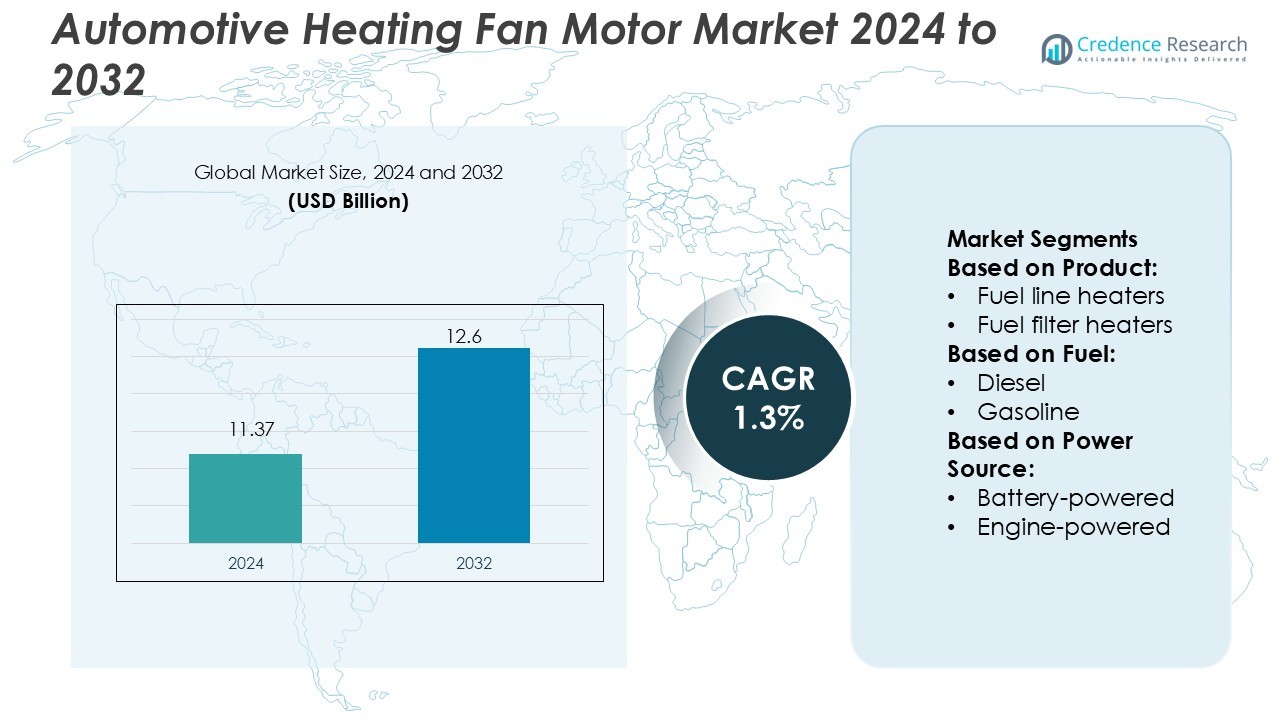

Automotive Heating Fan Motor Market size was valued USD 11.37 billion in 2024 and is anticipated to reach USD 12.6 billion by 2032, at a CAGR of 1.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Heating Fan Motor Market Size 2024 |

USD 11.37 Billion |

| Automotive Heating Fan Motor Market, CAGR |

1.3% |

| Automotive Heating Fan Motor Market Size 2032 |

USD 12.6 Billion |

The market is headed by major players such as Daikin Industries Ltd, Hitachi Ltd., Lennox International, Mitsubishi Electric Corporation, Rheem Manufacturing Company, Johnson Controls Inc., Emerson Electric Co., Midea Group, Robert Bosch GmbH, and Trane, each leveraging advanced technology, strong OEM ties, and global service networks to shape the landscape. In regional terms, North America leads the Automotive Heating Fan Motor Market with exactly 31.2% market share, driven by its mature automotive ecosystem, high penetration of electric vehicles, and demand for premium cabin comfort systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Automotive Heating Fan Motor Market was valued at USD 11.37 billion in 2024 and is projected to reach USD 12.6 billion by 2032, growing at a CAGR of 1.3%.

- Rising adoption of electric and hybrid vehicles drives demand for energy-efficient and battery-powered heating fan motors.

- Trends such as miniaturization, brushless DC motors, and integration with advanced HVAC systems enhance performance and passenger comfort.

- The market is moderately consolidated, with key players focusing on OEM partnerships, technological innovation, and global service networks to maintain competitive positioning.

- North America leads with 31.2% market share, followed by Asia-Pacific with growing adoption in electric and hybrid vehicles, Europe with strong regulatory standards, and emerging markets in Latin America and the Middle East & Africa contributing to aftermarket and fleet expansion.

Market Segmentation Analysis:

By Product

The Automotive Heating Fan Motor Market is segmented into fuel line heaters, fuel filter heaters, tank heaters, and fuel pump heaters. Fuel line heaters dominate with a 37% market share due to their critical role in preventing fuel thickening and maintaining flow efficiency in cold environments. These heaters are widely adopted in commercial and passenger vehicles operating in low-temperature regions. Their effectiveness in improving cold-start performance and reducing engine wear drives steady demand. Advancements in electric heating elements and compact designs further enhance efficiency, supporting growth in hybrid and diesel-powered vehicles.

- For instance, Daikin Industries, Ltd. has developed a fluoro‑polymer‑based fuel‑line hose material that supports continuous operation at temperatures down to −40 °C and withstands 100 000 cycles of flexing while maintaining less than 0.1 g/day fuel permeation.

By Fuel

Diesel-based systems lead the market with a 54% share, supported by their extensive use in commercial trucks, buses, and off-highway vehicles. Diesel engines are more susceptible to fuel gelling and viscosity changes at low temperatures, making heating solutions essential for reliability. The growing adoption of diesel vehicles in logistics and construction sectors reinforces this dominance. Gasoline and alternative fuel categories also witness gradual adoption, driven by innovations in biofuel compatibility and energy-efficient heating mechanisms designed for emerging hybrid powertrains.

- For instance, Mitsubishi Electric offers fan-blower motors for HVAC applications with a 30 W power rating and 5/16″ shaft diameter and 1½” shaft length. Search results confirm a specific model, the E22C30300 Indoor Fan Motor, matches these output and bracket dimensions.

By Power Source

Engine-powered systems account for a 61% share in the Automotive Heating Fan Motor Market, primarily due to their established use in conventional vehicles. These systems utilize engine waste heat for fuel warming, offering reliable performance and low maintenance. However, the battery-powered segment is expanding rapidly with the rise of electric and hybrid vehicles. Growing demand for energy-efficient, electronically controlled heating systems accelerates innovation in compact, low-voltage designs. The transition toward electrified mobility is expected to shift market preference gradually toward battery-powered heating fan motors for enhanced efficiency and sustainability.

Key Growth Drivers

Increasing Vehicle Comfort and Climate Control Expectations

Consumers now expect enhanced thermal comfort and sophisticated climate control systems in vehicles. Heating fan motors have become integral to delivering rapid cabin heating and defrost functions, especially in cold climates. OEMs are responding by integrating variable‑speed brushless motors and electronically controlled modules in HVAC systems to improve response times and durability. As vehicle listings include multi‑zone heating and remote pre‑conditioning features, demand for more advanced and reliable heating fan motors increases further.

- For instance, Bosch’s EC motor for electric cooling fans supports a power range of 500 W to 850 W, offers a service life exceeding 8,000 h and retains high efficiency in harsh ambient conditions.

Rise of Electric and Hybrid Vehicles Requiring Dedicated Heating Systems

Electrified vehicles often lack the waste‑heat resources of internal combustion engines, which drives the need for electrically powered heating fan motors. Manufacturers are developing compact, high‑efficiency motors capable of low‑voltage operation and rapid airflow generation for cabin climate control. These motors help preserve driving range by optimizing energy consumption. Automakers offering EV and PHEV models are accelerating adoption of such dedicated heating fan solutions.

- For instance, Lochinvar’s CENTRUS™ Residential Hydronic Heat Pump delivers up to 41,000 Btu/hr (approximately 12.0 kW). It delivers up to 34,800 Btu/hr (approximately 10.2 kW). The unit has a peak Coefficient of Performance (COP) of up to 6.0 at a 95°F leaving-water temperature.

Expansion of Vehicle Production and After‑Replacement Markets in Emerging Regions

Emerging markets are experiencing rising vehicle ownership alongside growing environmental and regulatory pressures. This trend catalyzes demand for heating fan motors that support varied powertrains (diesel, gasoline, electric) and cabin climate systems. In addition, as fleets age in these regions, aftermarket demand for heating fan motor replacements grows significantly. Manufacturers and suppliers are expanding production capacity and localization to address these growth opportunities.

Key Trends & Opportunities

Adoption of Brushless DC (BLDC) and Variable‑Speed Motor Technologies

Automotive heating fan motors are increasingly shifting from traditional brushed designs to brushless DC and variable‑speed configurations. These offer quieter operation, longer life, and fine motor speed control for optimized airflow and energy efficiency. Suppliers are leveraging these motor innovations to target premium vehicle segments and enhance passenger comfort without compromising powertrain efficiency.

- For instance, Daikin’s FIT heat pump model DH6VS features a variable-speed swing compressor and inverter technology, with rated performance of up to 19.0 SEER2, up to 12 EER2 and up to 8.8 HSPF2 for capacities from 1.5 to 5 tons.

Integration with Smart HVAC Systems and IoT Connectivity

Heating fan motors are now being integrated into connected HVAC systems that monitor cabin conditions, user preferences, and vehicle data. Real‑time control enables dynamic motor speed adjustment and predictive maintenance alerts. This digitalization presents an opportunity for suppliers to offer motors with telemetry, diagnostics, and adaptive control capabilities—especially relevant in connected vehicles and upcoming autonomous platforms.

- For instance, Bosch has released new inverter-driven mini-split and ducted heat pump systems that use the low-GWP refrigerant R-454B (GWP: 470). These include the Climate 5000 Ductless Systems and IDS Family heat pumps.

Key Challenges

Balancing Motor Efficiency, Size, and Cost for Diverse Powertrains

Designing heating fan motors that meet efficiency, compactness, and affordability requirements across gasoline, diesel, hybrid, and electric platforms is complex. Motors must perform reliably in harsh automotive environments while minimizing energy draw and cost. Suppliers face the challenge of aligning design innovation with stringent cost and packaging constraints to achieve broad market applicability.

Supply Chain and Material Pressure Amid Increasing Electrification

As electrification accelerates, demand for precise motor components such as rare earth magnets and high‑grade copper wire rises sharply. Supply chain constraints and fluctuating raw material prices can impact motor cost, production timelines, and scalability. Suppliers need to secure resilient sourcing strategies and adapt manufacturing processes to maintain competitiveness and meet growing global vehicle production.

Regional Analysis

North America

North America holds approximately 31% of the Automotive Heating Fan Motor Market, supported by strong vehicle production, advanced comfort features, and harsh winter climates that demand efficient heating solutions. The region benefits from early adoption of electric vehicle technologies and deep aftermarket penetration. Automated climate control systems in the U.S. and Canada fuel replacement demand while OEMs integrate advanced fan motors for enhanced cabin comfort. Manufacturers are expanding localized manufacturing and service networks to support rapid growth in this market.

Europe

Europe captures an estimated 27% market share in the Automotive Heating Fan Motor sector, driven by stringent emission and energy‑efficiency regulations and high consumer expectations for vehicle comfort. Sales in Germany, France, and the U.K. lead due to large premium vehicle markets and cold‑weather conditions. The region sees growth from both OEM‑fit and aftermarket heating fan motors as fleets age and climate demands rise. Local suppliers are investing in green manufacturing and lightweight motor solutions to align with regional sustainability goals.

Asia‑Pacific

Asia‑Pacific accounts for around 35% of the Automotive Heating Fan Motor Market. Rapid growth in China, India, Japan, and South Korea drives demand through rising vehicle production and adoption of premium features. Emerging markets within the region also present strong aftermarket potential as vehicle ownership expands. Local OEMs and suppliers focus on cost‑efficient heater‑fan systems adapted for varied fuel types and powertrains. The region’s growing EV and hybrid fleet further underscores the need for electrically‑powered heating fan motors.

Latin America

Latin America holds roughly 5% of the global Automotive Heating Fan Motor Market, with Brazil and Mexico leading demand. The region’s growth stems from rising vehicle production, improving wealth levels, and increasing aftermarket replacement needs. Harsh seasonal conditions in certain areas boost demand for robust heating fan motors in commercial and passenger vehicles. Infrastructure improvements and expansion of vehicle fleets create opportunities for suppliers to enter localized markets and develop region‑specific heating solutions.

Middle East & Africa

The Middle East & Africa region commands about 2% of the market share for automotive heating fan motors. Growth is influenced by fleet expansion in GCC countries and increased demand for vehicle comfort systems under extreme ambient conditions. Local vehicle manufacturers and regional service providers are beginning to offer upgraded HVAC components, including heating fan motors. While the region’s manufacturing base is limited, ongoing infrastructure development and rising mobility demand signal future growth opportunities for heating fan motor suppliers.

Market Segmentations:

By Product:

- Fuel line heaters

- Fuel filter heaters

By Fuel:

By Power Source:

- Battery-powered

- Engine-powered

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Automotive Heating Fan Motor Market players such as Daikin Industries, Ltd, Hitachi, Ltd., Lennox International, Mitsubishi Electric Corporation, Rheem Manufacturing Company, Johnson Controls, Inc., Emerson Electric Co., Midea Group, Robert Bosch GmbH, and Trane. The Automotive Heating Fan Motor Market features moderate consolidation, driven by technological innovation and efficiency improvements. Manufacturers focus on developing compact, durable, and energy-efficient motors suitable for passenger cars, commercial vehicles, and electric mobility platforms. The market emphasizes advanced brushless DC motors for high airflow with minimal noise, integrated climate control modules, and high-temperature-resistant components for harsh operating conditions. Continuous R&D and adoption of battery-powered and engine-powered designs enhance performance and reliability. Growing OEM integration, aftermarket replacement demand, and the expansion of electric and hybrid vehicle fleets further strengthen market growth and competitive dynamics across global regions.

Key Player Analysis

Recent Developments

- In January 2025, Midea introduced its Energy-Efficient Heat Pump Water Heater (HPWH) in North America. This innovative product highlights transitioning from conventional water heating methods to more sustainable, energy-efficient air-source technology.

- In December 2024, Daikin launched a new line of residential air-to-water heat pumps for single-family homes, utilizing propane (R290) as the refrigerant. This environmentally friendly solution offers efficient heating and hot water, supporting the growing demand for sustainable and energy-efficient heating technologies in residential markets.

- In September 2024, Mitsubishi Electric Corporation launched a new series of water-to-water heat pumps, branded Climaveneta EW-HT-G05, for commercial and industrial use, capable of producing high-temperature water.

- In August 2024, Carrier collaborated with Sibi, a technology platform for supply chains. Through this collaboration, Carrier aims to change the HVAC industry through improved data-driven efficiency and develop a new, enhanced supply chain management system.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Fuel, Power Source and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow with increasing adoption of electric and hybrid vehicles.

- Demand will rise for energy-efficient, low-noise heating fan motors.

- OEM integration of advanced HVAC systems will drive motor adoption.

- Expansion of aftermarket replacement services will boost regional sales.

- Miniaturization and lightweight motor designs will support compact vehicle applications.

- Battery-powered motors will gain traction with electrification trends.

- Increasing focus on cabin comfort and climate control will stimulate demand.

- Technological innovations in brushless DC and variable-speed motors will enhance performance.

- Regional manufacturing and localized supply chains will improve market resilience.

- Government regulations on energy efficiency and emissions will encourage high-performance motor development.