Market Overview

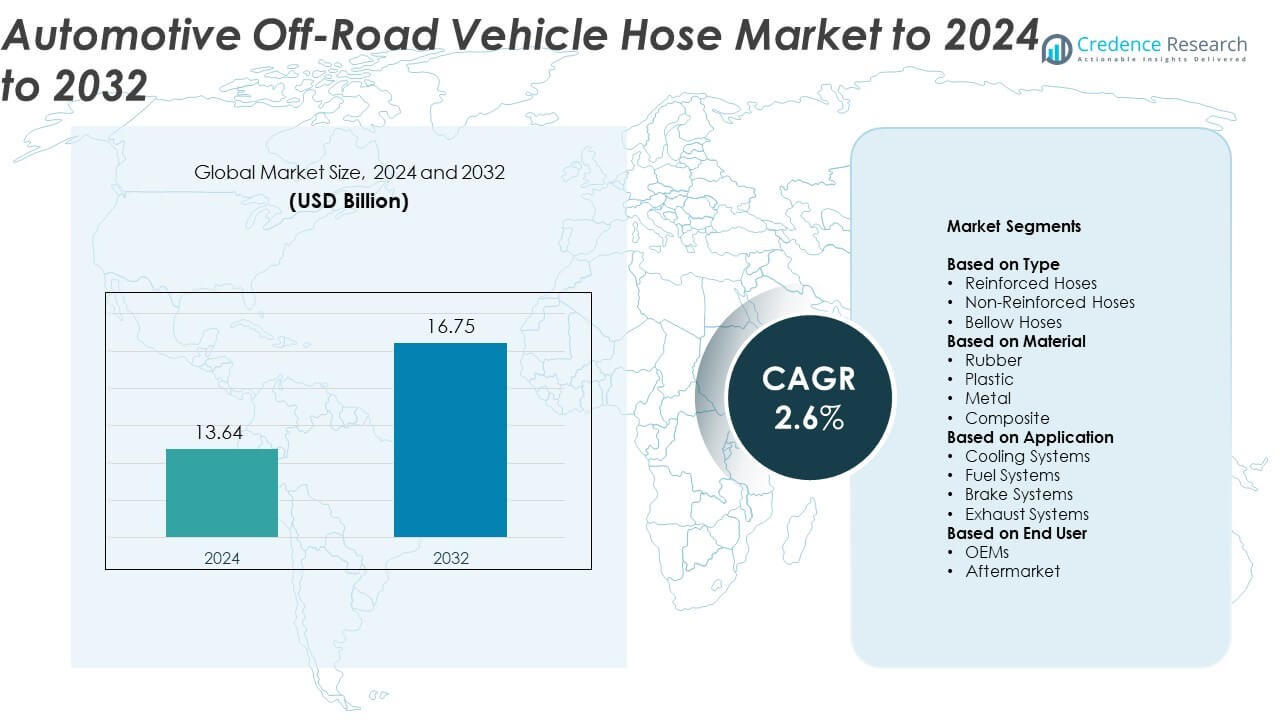

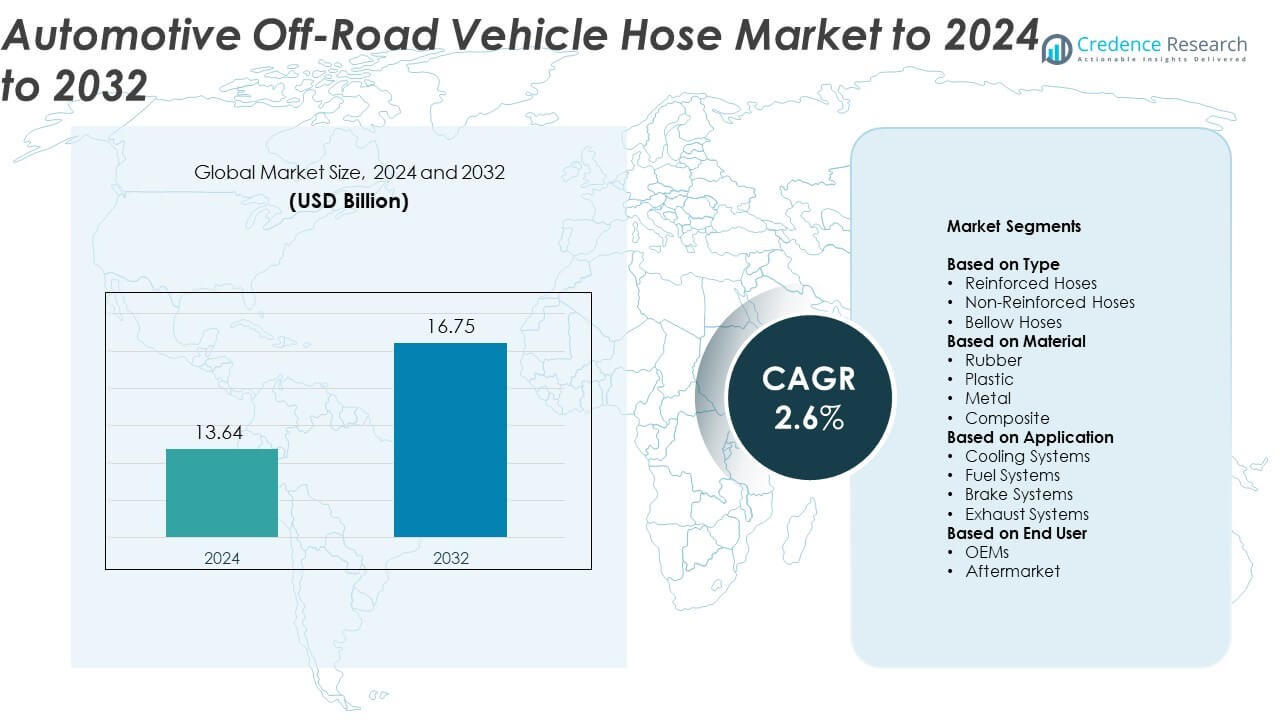

The Automotive Off-Road Vehicle Hose Market size was valued at USD 13.64 billion in 2024 and is anticipated to reach USD 16.75 billion by 2032, at a CAGR of 2.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Off-Road Vehicle Hose Market Size 2024 |

USD 13.64 Billion |

| Automotive Off-Road Vehicle Hose Market, CAGR |

2.6% |

| Automotive Off-Road Vehicle Hose Market Size 2032 |

USD 16.75 Billion |

The automotive off-road vehicle hose market is led by key players including Continental, Gates, Eaton, Bosch, Parker Hannifin, Raven Industries, HBD Industries, Flexaust, Mako Group, Ohlheiser, Deboer, Automotive Products of India, Saeed Al Saadi, Hoses Direct, and Ningbo Wuxing. These companies focus on developing durable, high-performance hose systems designed for demanding environments in agriculture, construction, and mining vehicles. North America leads the global market with a 37.4% share in 2024, supported by strong manufacturing capabilities and a robust aftermarket network. Europe follows with 28.6%, driven by advanced engineering standards and strict emission regulations, while Asia Pacific, holding 24.1%, is rapidly expanding due to industrial growth and rising off-road vehicle production.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The automotive off-road vehicle hose market was valued at USD 13.64 billion in 2024 and is expected to reach USD 16.75 billion by 2032, growing at a CAGR of 2.6%.

- Demand for heavy-duty hoses is increasing due to the rising production of off-road vehicles used in mining, construction, and agriculture.

- Growing use of advanced rubber, composite, and thermoplastic materials is driving innovation and improving hose durability and performance.

- The market is moderately consolidated, with major players focusing on product efficiency, sustainability, and long-term OEM collaborations.

- North America leads the market with 37.4% share, followed by Europe at 28.6% and Asia Pacific at 24.1%, reflecting strong regional industrial and construction activities.

Market Segmentation Analysis:

By Type

The reinforced hoses segment dominates the automotive off-road vehicle hose market with nearly 47.8% share in 2024. Their high strength, flexibility, and resistance to abrasion make them ideal for demanding off-road environments. These hoses handle extreme pressure variations in hydraulic and fuel systems, enhancing vehicle performance and safety. Manufacturers increasingly use multi-layer reinforcement technologies to improve durability and reduce leakage risks, meeting the rising demand for heavy-duty applications in agricultural and construction vehicles. Growing adoption of reinforced hoses in advanced cooling and braking systems supports this segment’s continued leadership.

- For instance, Parker’s 701 multispiral hydraulic hose lists a maximum operating pressure of 6500 psi (≈ 448 bar) for heavy-duty mobile hydraulics.

By Material

The rubber segment leads the market with approximately 42.6% share in 2024. Rubber hoses remain the preferred choice due to their excellent flexibility, heat resistance, and vibration absorption. They are widely used in cooling and fuel systems for off-road vehicles operating in harsh terrain conditions. Increasing demand for synthetic rubber compounds, such as EPDM and NBR, further strengthens their dominance. The material’s compatibility with various fluids and cost-effectiveness continue to drive usage across OEM and aftermarket applications, ensuring long-term reliability and operational stability.

- For instance, Gates Green Stripe™ coolant hose operates from −40 °C to +125 °C with a two-ply EPDM construction for heavy-duty service.

By Application

The cooling systems segment holds the largest share of around 38.2% in 2024. These hoses play a vital role in maintaining optimal engine temperatures, preventing overheating in off-road vehicles used in mining, forestry, and agriculture. Growing preference for high-temperature resistant hoses and advancements in coolant formulations drive this segment’s expansion. Manufacturers are focusing on developing lightweight and flexible hose assemblies that improve fluid flow and energy efficiency. Rising production of heavy-duty off-road vehicles with enhanced thermal management systems continues to strengthen demand for advanced cooling system hoses.

Key Growth Drivers

Rising Demand for Heavy-Duty Off-Road Vehicles

The growing production of heavy-duty off-road vehicles for agriculture, mining, and construction is a major growth driver. These vehicles require durable and high-performance hoses for fuel, cooling, and hydraulic systems. Increasing mechanization in developing economies and the expansion of large-scale infrastructure projects are accelerating demand. Manufacturers are enhancing hose materials to handle extreme temperatures and pressures, ensuring reliability in rugged environments. This rising adoption of robust hose solutions directly supports market expansion across OEM and aftermarket channels.

- For instance, Eaton mobile hydraulics components are specified up to 420 bar pressure and 560 L/min flow for construction and forestry equipment.

Technological Advancements in Hose Materials

Advances in material science have led to the development of lightweight, heat-resistant, and abrasion-proof hoses. The integration of reinforced synthetic rubbers and composites enhances flexibility and longevity under high-pressure operations. Such innovations reduce maintenance frequency and improve system efficiency in off-road vehicles. Growing preference for eco-friendly and recyclable materials aligns with sustainability goals, encouraging broader adoption. These technological improvements are enabling manufacturers to offer performance-driven hose systems that meet modern emission and durability standards.

- For instance, RYCO’s H6000 series is tested to 1 million impulse cycles at constant 420 bar (6100 psi), including a world-first 2-inch hose test at a 400 mm bend radius.

Expansion of the Aftermarket Segment

The rapid growth of the off-road vehicle aftermarket is driving steady revenue generation for hose manufacturers. Frequent wear and tear in harsh terrain increases the need for regular hose replacement and maintenance. The availability of customized, cost-effective, and performance-oriented hose solutions has strengthened the aftermarket’s role. Additionally, digital distribution channels and e-commerce platforms are improving accessibility for replacement parts. This trend supports long-term demand, especially in regions with aging vehicle fleets and high off-road equipment utilization rates.

Key Trends & Opportunities

Shift Toward Electrification and Hybrid Systems

Electrification in off-road vehicles is creating new opportunities for advanced hose designs. Electric and hybrid systems require specialized thermal management hoses to maintain battery and motor efficiency. Manufacturers are developing low-permeation and high-temperature hoses suitable for these new energy platforms. The transition toward cleaner propulsion technologies is driving innovation in lightweight and compact hose assemblies. This shift aligns with global emission reduction goals, creating a fresh growth avenue for hose suppliers focused on sustainable mobility solutions.

- For instance, TI Fluid Systems was acquired by ABC Technologies in April 2025 and is now a combined entity. After the acquisition, the combined entity operates across 26 countries. The company has also expanded its EV offerings, having opened multiple e-Mobility Innovation Centers (eMICs) and developed thermal modules for EV platforms, such as for the Volkswagen ID.3 and ID.4 battery electric vehicles.

Adoption of Smart and Sensor-Integrated Hoses

The integration of sensors in hose assemblies is emerging as a key market trend. Smart hoses enable real-time monitoring of pressure, temperature, and fluid flow, improving vehicle safety and predictive maintenance. Advanced data analytics enhance system diagnostics and reduce downtime for off-road operations. As Industry 4.0 technologies expand, sensor-equipped hoses are gaining attention in modern vehicle platforms. This digital transformation offers a strong opportunity for manufacturers to deliver intelligent hose systems for precision-driven applications.

- For instance, Continental’s 3-year “sensIC” program equips battery-thermal hoses with integrated temperature sensors using printed electronics.

Increasing Use of Composite and Thermoplastic Materials

Composite and thermoplastic hoses are gaining traction due to their lightweight structure and chemical resistance. These materials offer superior flexibility and durability compared to conventional rubber hoses. Their growing application in fuel and cooling systems reduces overall vehicle weight, improving energy efficiency. The shift toward recyclable and cost-efficient materials also supports sustainability efforts in manufacturing. As regulations tighten around emissions and waste management, composite hoses present a key opportunity for product differentiation and compliance.

Key Challenges

Fluctuating Raw Material Prices

Volatility in raw material prices, especially for rubber and metal, poses a major challenge for hose manufacturers. Frequent cost fluctuations affect production planning and profit margins, particularly for small-scale suppliers. The dependency on petroleum-based materials further exposes manufacturers to supply chain disruptions. To counter this, companies are exploring alternative materials and regional sourcing strategies. However, achieving consistent quality and performance across substitutes remains a complex and costly process for the industry.

Stringent Environmental and Safety Regulations

Tightening global emission and safety regulations create compliance challenges for hose producers. Meeting standards for fluid leakage, chemical resistance, and recyclability demands continuous R&D investments. Manufacturers must also adapt to regional differences in testing and certification norms, adding complexity to global supply chains. Failure to meet these standards can result in product recalls or limited market access. Balancing innovation with cost efficiency while maintaining compliance remains a persistent obstacle in the automotive hose market.

Regional Analysis

North America

North America dominates the automotive off-road vehicle hose market with nearly 37.4% share in 2024. Strong demand from agriculture, mining, and construction sectors drives regional growth. The United States leads due to its high production of utility terrain vehicles and heavy machinery. Manufacturers focus on durable hose materials capable of withstanding high pressure and temperature variations. Investments in advanced hydraulic and thermal management systems further enhance market expansion. The growing aftermarket for hose replacements and upgrades in off-road vehicles strengthens long-term regional prospects.

Europe

Europe accounts for around 28.6% share of the global automotive off-road vehicle hose market in 2024. The region benefits from the strong presence of established OEMs and component suppliers emphasizing safety and emission compliance. Germany, France, and Italy are major contributors with their expanding industrial and construction vehicle fleets. Rising adoption of lightweight and high-performance hose materials aligns with the EU’s sustainability goals. Increased demand for durable hoses in cold climates and harsh terrains supports steady market growth. Continuous innovation in composite hose designs enhances product efficiency and longevity across off-road applications.

Asia Pacific

Asia Pacific holds nearly 24.1% share in 2024, emerging as one of the fastest-growing regions. The expansion of construction, mining, and agriculture industries in China, India, and Japan drives high product demand. Rapid urbanization and infrastructure projects continue to boost off-road vehicle sales. Local manufacturers are adopting cost-effective rubber and thermoplastic hoses to meet rising domestic needs. Increasing investments in vehicle durability and emission reduction technologies strengthen market performance. The region’s large aftermarket base and strong export potential are expected to accelerate future growth in hose manufacturing.

Latin America

Latin America captures about 6.3% share of the automotive off-road vehicle hose market in 2024. The region’s growth is supported by the expansion of mining and agricultural sectors in Brazil, Mexico, and Chile. Demand for high-strength, heat-resistant hoses is increasing due to heavy equipment use in rugged environments. Manufacturers are focusing on localized production to reduce import dependency and improve cost competitiveness. The growing adoption of advanced hose assemblies for hydraulic and cooling applications is improving performance reliability. Rising awareness about preventive maintenance and aftermarket support also boosts regional market development.

Middle East & Africa

The Middle East & Africa region accounts for nearly 3.6% share in 2024. Mining, oil extraction, and infrastructure projects are key drivers of off-road vehicle demand. Countries such as South Africa, Saudi Arabia, and the UAE are investing in heavy equipment modernization. Hoses designed for high temperature and chemical resistance are increasingly used in hydraulic and fuel systems. Limited local production capacity encourages imports from Asia and Europe. However, growing investments in regional manufacturing and service networks are gradually improving supply availability and strengthening long-term market potential.

Market Segmentations:

By Type

- Reinforced Hoses

- Non-Reinforced Hoses

- Bellow Hoses

By Material

- Rubber

- Plastic

- Metal

- Composite

By Application

- Cooling Systems

- Fuel Systems

- Brake Systems

- Exhaust Systems

By End User

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the automotive off-road vehicle hose market includes major players such as Continental, Gates, Eaton, Bosch, Parker Hannifin, Raven Industries, HBD Industries, Flexaust, Mako Group, Ohlheiser, Deboer, Automotive Products of India, Saeed Al Saadi, Hoses Direct, and Ningbo Wuxing. The market remains moderately consolidated, with leading manufacturers focusing on expanding their global footprint through product innovation and regional partnerships. Companies are investing in lightweight, high-pressure, and temperature-resistant hose technologies to enhance vehicle efficiency and durability. Increasing collaboration with OEMs supports the integration of advanced hose assemblies in next-generation off-road vehicles. Strategic moves such as capacity expansion, mergers, and sustainable product development are helping players strengthen supply chains and cost competitiveness. Continuous R&D toward eco-friendly and recyclable hose materials is also shaping market differentiation. As demand for durable and efficient off-road components rises, manufacturers are emphasizing performance reliability and compliance with international quality standards.

Key Player Analysis

- Continental

- Gates

- Eaton

- Bosch

- Parker Hannifin

- Raven Industries

- HBD Industries

- Flexaust

- Mako Group

- Ohlheiser

- Deboer

- Automotive Products of India

- Saeed Al Saadi

- Hoses Direct

- Ningbo Wuxing

Recent Developments

- In 2025, Gates announced the availability of its Data Master MegaFlex cooling hose, targeting data center application.

- In 2025, Eaton continues to focus on power management solutions for off-highway vehicles, including construction and agriculture machinery, emphasizing hybrid and electric propulsion systems.

- In 2025, Bosch showcased multiple innovations for off-highway vehicles focusing on electrification, digitalization, automation, and smart hydraulics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increasing production of off-road vehicles will continue to drive steady demand for durable hoses.

- Advancements in rubber and composite materials will improve hose flexibility and service life.

- Rising focus on lightweight components will encourage adoption of thermoplastic and hybrid hoses.

- Electrification of off-road vehicles will create new opportunities for thermal management hose systems.

- Expanding infrastructure and mining projects will sustain high usage of hydraulic and fuel hoses.

- Smart and sensor-integrated hose technologies will enhance vehicle performance monitoring.

- Growing aftermarket demand will strengthen replacement and maintenance-driven revenue streams.

- Manufacturers will prioritize eco-friendly and recyclable hose materials to meet sustainability targets.

- Strategic partnerships between OEMs and suppliers will accelerate innovation in hose design.

- Asia Pacific will emerge as the fastest-growing regional market due to rapid industrial expansion.